Professional Documents

Culture Documents

No PE in India Declaration

Uploaded by

parthi200 ratings0% found this document useful (0 votes)

1K views1 pageThis document contains a declaration from the CEO/Director/Partner of a company stating that:

1) The company is validly incorporated in [Country Name] and is the legal owner of any advertising payments received.

2) The company does not carry out any business in India through a permanent establishment as defined by the applicable tax treaty.

3) The company does not have a business connection in India as defined by Section 9(1)(i) of the Indian Income Tax Act of 1961.

The declaration is signed and dated by an authorized representative of the company.

Original Description:

No PE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a declaration from the CEO/Director/Partner of a company stating that:

1) The company is validly incorporated in [Country Name] and is the legal owner of any advertising payments received.

2) The company does not carry out any business in India through a permanent establishment as defined by the applicable tax treaty.

3) The company does not have a business connection in India as defined by Section 9(1)(i) of the Indian Income Tax Act of 1961.

The declaration is signed and dated by an authorized representative of the company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views1 pageNo PE in India Declaration

Uploaded by

parthi20This document contains a declaration from the CEO/Director/Partner of a company stating that:

1) The company is validly incorporated in [Country Name] and is the legal owner of any advertising payments received.

2) The company does not carry out any business in India through a permanent establishment as defined by the applicable tax treaty.

3) The company does not have a business connection in India as defined by Section 9(1)(i) of the Indian Income Tax Act of 1961.

The declaration is signed and dated by an authorized representative of the company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

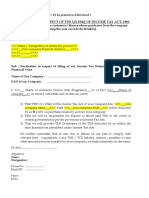

(Print this on your letter head)

No Permanent Establishment in India Declaration

I_________________CEO/Director/Partner of __________________________having it’s national office

at:

(Mention your companies registered address below)

Hereby State that:

a. ________________(You company Name)is a valid and subsisting company incorporated under

the laws of _________________( Country Name)

b. ________________ (You company Name) is the legal beneficial owner of the payment towards

advertising services and do not involve any transmission of technical knowledge.

c. We do not, wholly or partly carry on business in the Republic of India through a permanent

establishment situated there in, as defined under the DTAA entered into between India and

____________________(Your country Name)

d. We do not have a Business connection in the Republic of India, as defined in Explanation (a) of

Section 9(1)(i) of the Indian Income Tax Act, 1961

Reference to the legal provisions of the Indian Income Tax Act 1961, Section 9(1)(i), Explanation

(a) and __________________________________(Legal provision of your country).

For ____________(Your company)

(Authorized Person signature with Seal)

Name :

Designation:

Date :

You might also like

- Declaration No PE in India.175145431Document3 pagesDeclaration No PE in India.175145431Pallavi MaggonNo ratings yet

- Form 10FDocument2 pagesForm 10FRajeev AttriNo ratings yet

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- Motor Claim Form National Insurance Co. Ltd.Document3 pagesMotor Claim Form National Insurance Co. Ltd.rajiv.surveyor7145No ratings yet

- Artifact 5 PF Withdrawal Application PDFDocument1 pageArtifact 5 PF Withdrawal Application PDFRamesh BabuNo ratings yet

- IOCL Application Form PDFDocument11 pagesIOCL Application Form PDFअसीम मेहता100% (1)

- Form For House Loan in Joint NameDocument1 pageForm For House Loan in Joint Namemk_valiantNo ratings yet

- SH 1 Share CertificateDocument1 pageSH 1 Share CertificateARVINDNo ratings yet

- Deed of Admission Cum RetirementDocument3 pagesDeed of Admission Cum RetirementgulshanNo ratings yet

- Template Emudhra Authorization Letter PDFDocument1 pageTemplate Emudhra Authorization Letter PDFnishi vatsNo ratings yet

- Pensioner Signature/Thumb ImpressionDocument1 pagePensioner Signature/Thumb ImpressionSalaar AnsarNo ratings yet

- Annexure-"D" Specimen of Affidavit (In Case of Death)Document2 pagesAnnexure-"D" Specimen of Affidavit (In Case of Death)Rahul KumarNo ratings yet

- Declaration No PE in India.175145431Document2 pagesDeclaration No PE in India.175145431Steven LeachNo ratings yet

- Ipa-Business Name Renewal & RegisDocument2 pagesIpa-Business Name Renewal & RegisSkyview Travel LTD ManagementNo ratings yet

- Form COS 539: Annexure - BDocument1 pageForm COS 539: Annexure - BbigeorNo ratings yet

- ESIC-32 Wage-Contributory Record For DBDocument2 pagesESIC-32 Wage-Contributory Record For DBsugumar100% (1)

- Form CHG-1-16032017 Signe Cfil CDocument6 pagesForm CHG-1-16032017 Signe Cfil CsunjuNo ratings yet

- CCD IssuingDocument4 pagesCCD Issuingvandana guptaNo ratings yet

- Non MarriageDocument1 pageNon Marriagemariamajeed9090100% (1)

- Indemnity Bond - FormatDocument2 pagesIndemnity Bond - FormatdrakshayambaNo ratings yet

- Meezan Roshan SscardDocument1 pageMeezan Roshan SscardhassanNo ratings yet

- Society Mortgage NOC FormatDocument2 pagesSociety Mortgage NOC Formatsharmil_jain100% (1)

- 73.NOC Application Form PDFDocument1 page73.NOC Application Form PDFSneha AdepuNo ratings yet

- Declaration For List of PartnersDocument1 pageDeclaration For List of PartnersAmar Stunts ManNo ratings yet

- App Form Apna Office IndividualDocument6 pagesApp Form Apna Office IndividualKadhar AnwarNo ratings yet

- Postal Id FormDocument2 pagesPostal Id FormArturo ReyesNo ratings yet

- Form 1 Application For Registration of Firms Under Partnership Act 1932Document3 pagesForm 1 Application For Registration of Firms Under Partnership Act 1932bilal0% (1)

- Amendments Notes by Darshan KhareDocument15 pagesAmendments Notes by Darshan KhareVidyadhar ReddyNo ratings yet

- CA Inter Law MCQs by Darshan KhareDocument146 pagesCA Inter Law MCQs by Darshan KhareSiva KumarNo ratings yet

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument9 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaNo ratings yet

- Non Availability of Birth Certificate (Sample)Document1 pageNon Availability of Birth Certificate (Sample)Saravana PuttarNo ratings yet

- Draft of Indemnity BondDocument2 pagesDraft of Indemnity BondPrashant SheteNo ratings yet

- Declaration For Joint House Property (If Applicable) : Magic Software Private Limites Magic Software Private LimitesDocument1 pageDeclaration For Joint House Property (If Applicable) : Magic Software Private Limites Magic Software Private LimitesZafarNo ratings yet

- Life CertificateDocument1 pageLife CertificateMalikNo ratings yet

- NRI Questionnaire Form Max LifeDocument2 pagesNRI Questionnaire Form Max LifeprakashNo ratings yet

- Joint Declaration LetterDocument1 pageJoint Declaration LetterST COMMNICATIONNo ratings yet

- Affidavit - Leave EncashmentDocument1 pageAffidavit - Leave EncashmentSAI ASSOCIATENo ratings yet

- Penalites Chart by Darshan Khare 1.pdf 1Document5 pagesPenalites Chart by Darshan Khare 1.pdf 1Pankaj PathakNo ratings yet

- Lalit Goyal-UP-New GST (Rent-Agreement)Document2 pagesLalit Goyal-UP-New GST (Rent-Agreement)SAKET TYAGINo ratings yet

- El Subsidy LetDocument1 pageEl Subsidy Letscribdaashish0% (1)

- Declaration TRLP PDFDocument1 pageDeclaration TRLP PDFvishnu5b8No ratings yet

- Variation Deed (To Amend An Initial Agreement) - Template SampleDocument5 pagesVariation Deed (To Amend An Initial Agreement) - Template SampleLegal ZebraNo ratings yet

- Msme Declaration FormDocument1 pageMsme Declaration Formshrinath corporationNo ratings yet

- Model Proforma For Income CertificateDocument1 pageModel Proforma For Income Certificatevoltax1100% (1)

- Indemnity Cum Affidavit BondDocument1 pageIndemnity Cum Affidavit BondKrishna Reddy100% (2)

- CERTIFICATE of The Guide in English, Marathi and HindiDocument5 pagesCERTIFICATE of The Guide in English, Marathi and HindimukulNo ratings yet

- PPF Form B Deposit SlipDocument1 pagePPF Form B Deposit SlipSangeeta SinghNo ratings yet

- No Objection Certificate Given by CorporateDocument2 pagesNo Objection Certificate Given by CorporateJayanti Pal choudhuryNo ratings yet

- Comfort Letter - TemplateDocument1 pageComfort Letter - TemplateHicham fares100% (1)

- Power of Attorney Sample SBIDocument3 pagesPower of Attorney Sample SBIShreyas Kamath50% (2)

- CCMT - 2020 Affidavit of EWS CategoryDocument1 pageCCMT - 2020 Affidavit of EWS CategoryKalyan valisetty100% (2)

- Share Application FormDocument2 pagesShare Application FormKrishna Chaitanya SamudralaNo ratings yet

- F No - 135Document3 pagesF No - 135Treena Majumder SarkarNo ratings yet

- 2023 No Permanent Establishment CertificateDocument1 page2023 No Permanent Establishment CertificateAnrica FerdiantiNo ratings yet

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- Self Declaration From ShareholderDocument2 pagesSelf Declaration From ShareholderSimul MondalNo ratings yet

- Adtoi Membership FormDocument9 pagesAdtoi Membership FormMit MotaNo ratings yet

- Undertaking From Non Resident IndividualsDocument1 pageUndertaking From Non Resident IndividualstajmussaratNo ratings yet

- 19 Performa 2 For No Pe CertificateDocument6 pages19 Performa 2 For No Pe CertificateromysugandhNo ratings yet

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (98)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseFrom EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- Law of Leverage: The Key to Exponential WealthFrom EverandLaw of Leverage: The Key to Exponential WealthRating: 4.5 out of 5 stars4.5/5 (6)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (228)

- Contract Law in America: A Social and Economic Case StudyFrom EverandContract Law in America: A Social and Economic Case StudyNo ratings yet

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- Nolo's Quick LLC: All You Need to Know About Limited Liability CompaniesFrom EverandNolo's Quick LLC: All You Need to Know About Limited Liability CompaniesRating: 4.5 out of 5 stars4.5/5 (7)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet