Professional Documents

Culture Documents

MS Corporation financial data analysis 2018-2019

Uploaded by

Princess Edelyn CastorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MS Corporation financial data analysis 2018-2019

Uploaded by

Princess Edelyn CastorCopyright:

Available Formats

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 6 REQUIREMENTS: )

The following data were provided by MS Corporation for the year 2018 and 2019:

2018 2019

Gross sales 10,000,000 12,000,000

Cost of sales 5,000,000 6,000,000

Salaries expense 800,000 800,000

Depreciation expense 300,000 400,000

Rent paid for the year, net of withholding tax 475,000 475,000

Bad debts provision 100,000 120,000

Written off bad debts 50,000 60,000

Recovery of bad debs written off - 20,000

Interest expense 150,000 200,000

Interest income from savings deposit 200,000 250,000

Royalty income 100,000 100,000

Representation expense 55,000 55,000

Capital gain on sale of a company car held for 8 months (costing P700,000) 200,000 -

Capital gain on sale of a used truck held for 2 years (costing P1, 850,000) - 150,000

Capital gain on sale of land held as capital asset for 10 mos. (costing P750,00) - 500,000

Capital loss on sale of a van, held for 18 months (costing P3,500,000) 150,000 -

Donation to government for public purpose 150,000 200,000

Donation to government for economic development activities 200,000 250,000

Gross income earned in foreign country (expressed in Phil. functional currency) 1,500,000 1,800,000

Tax paid in foreign country (expressed in Phil. functional currency) 300,000 320,000

Tax paid in the first 3 quarters on the year 200,000 250,000

Compute for the following

1. Taxable income, 2018 4,432,500 3. Tax payable, 2018 829,750.00 5. Tax due, 2019 1,682,437.50

2. Tax due, 2018 1,329,750.00 4. Taxable income, 2019 5,608,125 6. Tax payable, 2019 1,112,437.50

(USE THE FOLLOWING DATA TO ANSWER THE NEXT THREE REQUIREMENTS: )

Mr. Allen, an individual taxpayer, purchased a real property classified as capital assets for P2,000,000 five year ago. During the taxable

year, he sold the said property for P7,000,000. The prevailing fair market value on the date of sale was P6,500,000. The buyer, Mr. Maikie

will assume the mortgage of P3,000,000 and will make the following payments: down payment on January 1, P500,000; yearly installment

of P500,000 every end of the year commencing this year.

Compute the following:

7. Initial payment 2,000,000

8. Capital gains tax payment for the current year. 420,000

9. Capital gains tax payment for the year following the current year. 0

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 7 REQUIREMENTS: )

Ms. Aeley sold real property appropriately classified as capital asset on July 1, of the current taxable year for P6,000,000. The zonal value

at the time of sale was P5,000,000. The property was acquired by Aeley 5 years ago at a total cost of P1,000,000.

Required: Provide what is being asked from each case below:

Case I:

Mr. A will pay a down payment of P1,200,000 on July 1, and the balance is payable in 4 annual installments beginning December 31, of

the following year.

10. The capital gains tax on the property dealing transaction is 360,000

11. Capital gains tax due for the current taxable year. 72,000

Case II:

Mr. A will make a down payment of P600,000 on July 1, and another payment of P800,000 on October 1 of the same taxable year. The

buyer will assume the mortgage of P600,000 and the balance is payable in 4 annual installments starting December 31, of the following

year.

12. Capital gains tax due for the current taxable year. 93,333

13. Capital gains tax due for the following taxable year. 66,667

Case 3:

Mr. Mr. A will make a down payment of P500,000 on July 1 and another payment of P500,000 on October 1 of the same taxable year.

The property is mortgaged for P1,200,000 which the buyer will assume, and the balance is payable in 4 annual installments beginning

December 31, of the following year.

14. Determine the contract price. 5,000,000

15. How much will be the annual installment collection after the current taxable year? 950,000

16. After the first annual collection and paying the corresponding capital gains tax due, how much is the balance of the capital gains

tax due to the government. 205,200

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 2 REQUIREMENTS: )

Mr. Maikie, resident citizen and married with 3 qualified dependent children, had the following data for the 2018 taxable year:

Gross business income – Philippines P5,000,000

Cost of sales and allowable business expenses – Philippines 3,500,000

Gross business income – Singapore 2,000,000

Cost of sales and allowable business expenses – Singapore 1,400,000

Income taxes paid in Singapore 180,000

Income taxes paid in the Philippines (quarterly) 250,000

Compute the tax still due under the following options:

17. The income tax expense paid in Singapore is allowable business deduction. 466,000 DUE; STILL DUE 216,000

18. The income tax paid in Singapore is tax credit deductible from tax due. DUE 522,000; STILL DUE 122, 857.14

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 6 REQUIREMENTS: )

Mr. Mike, married with 6 qualified dependent children and a resident and self-employed citizen had the following data for the 2018 taxable

year:

Gross business income – Philippines P2,500,000

Gross business income – Australia (in peso) 4,000,000

Gross business income – China (in peso) 1,000,000

Gross business income – Indonesia (in peso) 1,600,000

Business expenses – Philippines 500,000

Business expenses – Australia (in peso) 1,000,000

Business expenses – China (in peso) 200,000

Business expenses – Indonesia (in peso) 2,900,000

Taxes paid in Philippines (quarterly) 280,000

Taxes paid in Australia (in peso) 350,000

Taxes paid in China (in peso) 150,000

Compute the following

19. Net taxable income of Mr. Mike 4.5M

20. Tax due 1.29M

21. Amount of tax credit 500,000

22. Tax payable 510,000

23. With the foregoing data, except that, the taxpayer is a corporation, compute the tax due. 1,350,000

24. With the foregoing data, except that, the taxpayer is a corporation, compute the tax payable. 570,000

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 6 REQUIREMENTS: )

Mr. Del Pilar, a mixed income earner, has the following data for the current taxable year 2018:

Annual salary P1,200,000

Allowances received from the employer 250,000

Gross sales from business 5,200,000

Cost of sales 3,120,000

Itemized business allowable expenses - total 420,000

The taxpayer is married with two qualified dependent children.

Determine the tax due using the following:

25. Itemized deduction 845,200

26. Optional standard deduction 1,312,400

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 4 REQUIREMENTS: )

X formed a general professional partnership with Y, participating 45:55 in the partnership’s income and expenses. The following are the data for

the partnership and the partners in 2018: XY Partnership’s Gross Income P975,550; XY Partnership’s Operating expenses (OPEX) P327,540;

X’s Gross Receipts P600,000; X’s Cost of Services P187,550; X’s OPEX P175,450; Y’s Gross Receipts P435,000; Y’s Cost of Services Ratio

35%; Y’s OPEX P122,250. Compute the tax due of each partner using an option that is tax beneficial to both partners and partnership. GPP

withheld the tax on distributive share of each partner.

27. GPP’s net taxable income. 0

28. GPP’s tax due. 0

29. X’s tax payable 63740.675

30. Y’s Tax payable 48710.825

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 2 REQUIREMENTS: )

Gary, a resident citizen, had the following data on income and expenses for the calendar year 2018:

Gross sales P12,000,000 Inventory, beginning 300,000

Sales returns 1,000,000 Inventory, ending 100,000

Sales discounts 500,000 Interest income on notes 100,000

Purchases 5,000,000 Interest income on savings deposit 80,000

Freight in 150,000 Dividend from domestic corporation 100,000

Purchase returns 200,000 Entertainment and amusement exp. 20,000

Purchase discounts 100,000 Interest expense 30,000

31. Compute the tax due of Gary under itemized deduction. 1,618,448.00

32. Compute the tax due of Gary under optional standard deduction. 1885200

(USE THE FOLLOWING DATA TO ANSWER THE NEXT 2 REQUIREMENTS: )

On September 1, 2018, Ms Max borrowed P1,000,000 from smart commercial bank at 12% per annum as for additional working capital.

The loan ha a maturity period of 1 year and the bank discounted the interest. The taxpayer settled the loan on the date of maturity.

33. Under cash basis, the amount of deductible interest expense for 2019 is 120,000

34. Under accrual basis, the amount of deductible interest expense for 2019 is 80,000

35. X Corporation bought a truck for P2,500,000 on January 1, 2018 which was used for operations. On December 1, 2018, X

Corporation sold the truck for 2,800,000 under installment. The following terms were agreed:

Down payment, December 1, 2018 400,000

Amount paid December 15, 2018 400,000

Installment due in 2 equal annual installments.

Determine the amount of reportable income in 2018 and 2019, respectively. 300,000 & 0

You might also like

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- Solution-Dissolution and LiquidationDocument8 pagesSolution-Dissolution and LiquidationRejay VillamorNo ratings yet

- Pure ProblemsDocument7 pagesPure Problemschristine anglaNo ratings yet

- CCE ReceivablesDocument5 pagesCCE ReceivablesJane TuazonNo ratings yet

- Name: - Score: - Course & Section: - DateDocument5 pagesName: - Score: - Course & Section: - DateRendyel PagariganNo ratings yet

- 85184767Document9 pages85184767Garp BarrocaNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- Business Combi CH 6 de JesusDocument9 pagesBusiness Combi CH 6 de JesusMerel Rose FloresNo ratings yet

- Cash AssignmentDocument2 pagesCash AssignmentRocelyn OrdoñezNo ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- Handout - CashDocument17 pagesHandout - CashPenelope PalconNo ratings yet

- Midterm Examination in Auditing and Assurance Concepts and Applications Part 1Document10 pagesMidterm Examination in Auditing and Assurance Concepts and Applications Part 1Maricar PinedaNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- ACC12 Midterm Exam QuestionsDocument2 pagesACC12 Midterm Exam QuestionsUn knownNo ratings yet

- Maker Date Payee AmountDocument3 pagesMaker Date Payee Amountmusic niNo ratings yet

- A R RoqueDocument73 pagesA R RoqueTwish BarriosNo ratings yet

- 1a Millan Solution Manual 2021 1Document259 pages1a Millan Solution Manual 2021 1avilastephjaneNo ratings yet

- HW 2. Problems Cash and Cash Equivalents - StudentDocument2 pagesHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroNo ratings yet

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Partnership Formation Discussion ProblemsDocument2 pagesPartnership Formation Discussion ProblemsMicca AndraeNo ratings yet

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsJenna BanganNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- CH1 HbotbDocument7 pagesCH1 HbotbJela OasinNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- Module 2 Bank Reconciliation Proof of CashDocument2 pagesModule 2 Bank Reconciliation Proof of CashziNo ratings yet

- Dakak Company Provided The Following Statement of Financial Position On December 31 PDFDocument4 pagesDakak Company Provided The Following Statement of Financial Position On December 31 PDFAbe Mayores CañasNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- Accounting for Cash, Receivables and InventoriesDocument12 pagesAccounting for Cash, Receivables and InventoriesPaupau100% (1)

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- Accounting Errors CorrectionDocument5 pagesAccounting Errors CorrectionandreaNo ratings yet

- BSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentDocument2 pagesBSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentGray JavierNo ratings yet

- BS ACCOUNTANCY TRUE OR FALSE STATEMENTSDocument1 pageBS ACCOUNTANCY TRUE OR FALSE STATEMENTSSheena ClataNo ratings yet

- Accounting for Government and Not-for-Profit OrganizationsDocument24 pagesAccounting for Government and Not-for-Profit Organizationshehehedontmind me100% (1)

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- Cash and Cash Equivalent LatestDocument54 pagesCash and Cash Equivalent LatestSafe PlaceNo ratings yet

- Intermediate Accounting 2 Quiz #3Document4 pagesIntermediate Accounting 2 Quiz #3Claire Magbunag AntidoNo ratings yet

- FINACC-Homework Exercise 2Document3 pagesFINACC-Homework Exercise 2Jomel BaptistaNo ratings yet

- Receivable Financing Qualifying Exam Review Sample QuestionsDocument4 pagesReceivable Financing Qualifying Exam Review Sample QuestionsHannah Jane Umbay0% (1)

- GovernanceDocument3 pagesGovernanceAndrea Marie CalmaNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- P1-02 Loans and ReceivablesDocument5 pagesP1-02 Loans and ReceivablesRachel LeachonNo ratings yet

- Practical Accounting 1 ReviewerDocument13 pagesPractical Accounting 1 ReviewerKimberly RamosNo ratings yet

- 2 3 2017 ReceivablesDocument4 pages2 3 2017 ReceivablesMr. CopernicusNo ratings yet

- Cash and Cash Equivalents Mock TestDocument3 pagesCash and Cash Equivalents Mock Testwednesday addamsNo ratings yet

- 02 Fundamentals of Assurance ServicesDocument5 pages02 Fundamentals of Assurance ServicesKristine TiuNo ratings yet

- AFAR 2 SyllabusDocument11 pagesAFAR 2 SyllabusLawrence YusiNo ratings yet

- Home Office & Branch Accounting Problems SolvedDocument3 pagesHome Office & Branch Accounting Problems SolvedChristianAquinoNo ratings yet

- Libyae Lustare - Audit Cash & Equivalents Under 40 CharactersDocument1 pageLibyae Lustare - Audit Cash & Equivalents Under 40 CharactersAna Mae HernandezNo ratings yet

- Capstone Theory & ProblemDocument10 pagesCapstone Theory & ProblemAia SmithNo ratings yet

- Financial Management - Part 1 For PrintingDocument13 pagesFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasNo ratings yet

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaNo ratings yet

- College of Accountancy Final Examination Acctg 206A InstructionsDocument4 pagesCollege of Accountancy Final Examination Acctg 206A InstructionsCarmela TolinganNo ratings yet

- Audit of Receivables - Notes & ReviewerDocument3 pagesAudit of Receivables - Notes & ReviewerJoshua LisingNo ratings yet

- Zurita - Summary Table For PSAsDocument2 pagesZurita - Summary Table For PSAsNove Jane ZuritaNo ratings yet

- CAE 10 CG Strategic Cost ManagementDocument23 pagesCAE 10 CG Strategic Cost ManagementAmie Jane MirandaNo ratings yet

- Quiz-Lets FARDocument5 pagesQuiz-Lets FARSherlock HolmesNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- SALES, AGENCY and PLEDGE TEST BANKDocument40 pagesSALES, AGENCY and PLEDGE TEST BANKChristian Blanza Lleva82% (17)

- Q4 - Negotiable Instruments Law and BP 22 - NADocument12 pagesQ4 - Negotiable Instruments Law and BP 22 - NAJessica Pama EstandarteNo ratings yet

- Practical Accounting 2 Test Bank QuestionsDocument1 pagePractical Accounting 2 Test Bank QuestionsVtg50% (2)

- Princess Edelyn L. CastorDocument2 pagesPrincess Edelyn L. CastorPrincess Edelyn CastorNo ratings yet

- DT1Document5 pagesDT1iris claire gamadNo ratings yet

- AP Investments Quizzer QDocument55 pagesAP Investments Quizzer QLordson Ramos75% (4)

- Audit of ReceivablesDocument32 pagesAudit of Receivablesxxxxxxxxx96% (55)

- Assign #1Document6 pagesAssign #1Princess Edelyn CastorNo ratings yet

- Tax RemediesDocument21 pagesTax RemediesPrincess Edelyn CastorNo ratings yet

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Excise Tax Updated PDFDocument10 pagesExcise Tax Updated PDFPrincess Edelyn CastorNo ratings yet

- 5negotiable InstrumentsDocument10 pages5negotiable InstrumentsPrincess Edelyn CastorNo ratings yet

- India Report WPS OfficeDocument38 pagesIndia Report WPS OfficePrincess Edelyn CastorNo ratings yet

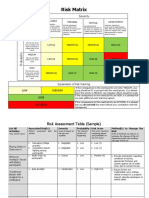

- Risk Matrix and Sample TablesDocument4 pagesRisk Matrix and Sample Tableschopra babuNo ratings yet

- Msq01 Overview of The Ms Practice by The CpaDocument9 pagesMsq01 Overview of The Ms Practice by The CpaAnna Marie75% (8)

- TB Raiborn - Responsibility Accounting and Transfer Pricing in Decentralized OrganizationDocument44 pagesTB Raiborn - Responsibility Accounting and Transfer Pricing in Decentralized OrganizationMayla Lei Pablo100% (1)

- Estate Tax Reviewer PDFDocument20 pagesEstate Tax Reviewer PDFJay DiadoraNo ratings yet

- Chapter 29. Powers Authority of The Commissioner of Internal RevenueDocument5 pagesChapter 29. Powers Authority of The Commissioner of Internal RevenuePrincess Edelyn CastorNo ratings yet

- OJT Required Documents 1Document1 pageOJT Required Documents 1Princess Edelyn CastorNo ratings yet

- Multiple choice questions on business combinationsDocument12 pagesMultiple choice questions on business combinationsHerwin Mae BoclarasNo ratings yet

- R10Document2 pagesR10Princess Edelyn CastorNo ratings yet

- Chandaria School of Business Iba and Bsc-Accounting Act3010A: Accounting Information Systems 1Document2 pagesChandaria School of Business Iba and Bsc-Accounting Act3010A: Accounting Information Systems 1Nick254No ratings yet

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocument21 pagesAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriNo ratings yet

- H. R. 6433Document3 pagesH. R. 6433ABC6/FOX28No ratings yet

- Slides Set3Document116 pagesSlides Set3Vaishnavi GnanasekaranNo ratings yet

- Group-08 Sess-05 ACMEDocument6 pagesGroup-08 Sess-05 ACMEParashar ShivNo ratings yet

- Education Loans For Higher StudiesDocument7 pagesEducation Loans For Higher StudiesSREYANo ratings yet

- Zambia: Livingstone City ProfileDocument36 pagesZambia: Livingstone City ProfileUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- Definition of PledgeDocument3 pagesDefinition of PledgeWhoopiJaneMagdozaNo ratings yet

- FINS 3635 Short Computer Assignment 2018 1 CORRECTEDDocument1 pageFINS 3635 Short Computer Assignment 2018 1 CORRECTEDRoger GuoNo ratings yet

- Questions of Business Administration - CSSDocument6 pagesQuestions of Business Administration - CSSSyed Faizan BariNo ratings yet

- UVA F 1356 EurolandDocument12 pagesUVA F 1356 EurolandPriscila MatulaitisNo ratings yet

- Assignment 2 BNP 30402 AnswerDocument7 pagesAssignment 2 BNP 30402 AnswerbndrprdnaNo ratings yet

- Jakel Capital Welcomes Datuk Ami Moris's Appointment As Director at Cypark ResourcesDocument3 pagesJakel Capital Welcomes Datuk Ami Moris's Appointment As Director at Cypark ResourcesHan JinNo ratings yet

- Philguarantee Vs VPECI and 3plexDocument1 pagePhilguarantee Vs VPECI and 3plexChaNo ratings yet

- Study Guide Topic A: European CouncilDocument9 pagesStudy Guide Topic A: European CouncilAaqib ChaturbhaiNo ratings yet

- Night Audit Report for 10/01/23Document1 pageNight Audit Report for 10/01/23Vivek BhadviyaNo ratings yet

- Tutorial 3 Questions (Chapter 2)Document4 pagesTutorial 3 Questions (Chapter 2)jiayiwang0221No ratings yet

- Philippine First Insurance CompanyDocument2 pagesPhilippine First Insurance CompanyRoda May DiñoNo ratings yet

- Cendana - CITYZEN HILLS - 291123-1Document5 pagesCendana - CITYZEN HILLS - 291123-1Oky Arnol SunjayaNo ratings yet

- Current Affairs August 2014Document7 pagesCurrent Affairs August 2014Sudheer KumarNo ratings yet

- SK Budget 2023Document68 pagesSK Budget 2023Bench Nool BermudoNo ratings yet

- Week 4 - ch16Document52 pagesWeek 4 - ch16bafsvideo4No ratings yet

- SLDB Offer Doc Aug 2011Document20 pagesSLDB Offer Doc Aug 2011puliyanamNo ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFDocument43 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFWilliamCartersafg100% (11)

- Warren Buffett 1997 BRK Annual Report To ShareholdersDocument20 pagesWarren Buffett 1997 BRK Annual Report To ShareholdersBrian McMorrisNo ratings yet

- Adv 2 ch6 Elimination of Unrealized Profit On Intercompany Sales of InventoryDocument49 pagesAdv 2 ch6 Elimination of Unrealized Profit On Intercompany Sales of InventorySella Destika0% (1)

- Opuni Sues Daily GuideDocument4 pagesOpuni Sues Daily GuideGhanaWeb EditorialNo ratings yet

- Heikin ++Document21 pagesHeikin ++BipinNo ratings yet

- Leave and License AgreementDocument4 pagesLeave and License AgreementAmitabh AbhijitNo ratings yet

- Aa) EQUIPMENT: 230 Ton Crawler CraneDocument3 pagesAa) EQUIPMENT: 230 Ton Crawler CraneAnwar SadatNo ratings yet