Professional Documents

Culture Documents

Accenture How Blockchain Can Bring Greater Value Procure To Pay PDF

Uploaded by

Pavi DiviOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accenture How Blockchain Can Bring Greater Value Procure To Pay PDF

Uploaded by

Pavi DiviCopyright:

Available Formats

How Blockchain can

bring Greater Value to

Procure-to-Pay Processes

Blockchain as a technology and concept continues to be hyped in the

financial services industry. Experimental approaches and innovations like

Accenture’s redactable blockchain are emerging and are of great interest and

appeal to the financial sector. As a disruptive technology platform, blockchain

is impactful with the potential to redefine the operations and economics of

the financial services industry.

Its purpose is to deliver transparency, Improved validation and Streamlined enquiries

security and efficiency in transactions.

In our view, blockchain technology’s

authentication management

strengths are well-demonstrated in These would benefit from blockchain Blockchain’s greater transparency

supporting objective, distributed, technology. A blockchain would support would diminish the need for enquiries

evenly-balanced control in situations swift distribution of authentication and process status follow-ups, thus

where this is difficult to secure, such as rights along the PTP chain, thereby streamlining current enquiry management

international payments. The technology helping to prevent fraud and improve and control processes.

also provides transparency in vital areas security across the PTP process.

like anti-money laundering (AML) and Reduced money laundering risk

can add efficiency, trust and reach Accelerated purchase order By permanently retaining historical

to global financial markets where

current processes are challenged in

management payment information, suspicious

their ability to handle the volume Purchase order and good receipt data transactions can be more easily identified.

and velocity of data that needs to be would be exchanged on the blockchain at

assessed in day-to-day operations. an accelerated pace when compared to Greater trust among

Procure-to-Pay (PTP) is the multi-step

current performance levels. As well, the stakeholders

blockchain could help identify the nearest

process connecting a client with one and most cost effective vendor within the Blockchain technology would help

or more service/product providers. network. This would help decrease lead increase trust among clients and vendors

Among other activities, it allows for time and workload associated with vendor through shared public IDs, simple and fair

the identification and authentication of searches, the processing of purchase referral mechanisms and ratings/scores

stakeholders, budgeting, service provision, orders and goods/services receipts. assigned to all market players based on

invoicing and payment settlement. Among the quality of the goods, reliability in

the current challenges faced by PTP delivery and timely payment of invoices.

programs are generating sustainable cost

Reshaped invoice processing The accumulated and stored history of

reductions through disintermediation, Invoice scanning would no longer be transactions would also help build trust

efficiency improvement, fraud control required thanks to shared access to the and transparency.

and transparency enhancement. database, with the exchange of invoices

Blockchain technology can disrupt

supported by the blockchain. This would Strong audit trail

also help render the reconciliation process

PTP processes and more importantly far less cumbersome as all authorized As all parties are registered in the

provide huge operational benefits in parties could review the same transaction, ledger, transactions are stored and a

terms of speed, greater security and eliminating the need for reconciliations. tamper‑proof audit trail is maintained.

decreased workload by facilitating the Blockchain hosted transactions would This type of end-to-end visibility into

exchange of information. The following feed into the company’s general ledger procurement is a well-established practice

outlines how blockchain technology for general accounting and financial in the tracking of physical goods.

can bring value to key PTP processes. reporting purposes.

Greater security of transactions

Front-end system Accelerated settlements This can be attained through cloud-based

A front-end interface is recommended to These would be accelerated as contract repository and an integrated

authorize vendors, define new catalogs, reconciliations and vendor/end user e-sign feature that verifies signer identity

place purchase orders or sign contracts. enquiries would not be required due to and authorization.

This application can be an add-on to the complete transparency and real-time

blockchain or could be leveraged through access to shared database. This could

existing procurement systems, if vendors potentially disrupt in a positive sense

decide to adopt this technology. business practices such as the standard

D+30 days settlement deadline.

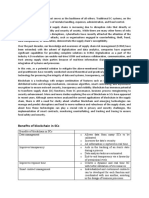

Blockchain PTP Process

Sensitive to

baseline situation

Medium impact

Allow vendor or Allow for/update Load contract into Allow vendor to Create and approve

update vendor catalog in contract repository submit e-invoices requisition or spot buy

master data purchasing system

Issue purchase

order (PO)

Low cost

Low benefits

Investigate and resolve Process invoices Scanning no Certification Fulfill PO and track order

invoice exceptions Low cost longer required of reception High sensitivity to

Low cost Low benefits Low impact the client situation

Medium to high benefits

Blockchain impact Process payment Validate accuracy of Issue payment Diminished need to

Baseline cost Low cost payment, payment and remittance handle vendor/end

run and perform to vendor user inquiries through

Medium to

reconciliations Low cost support center

high benefits

Low cost Medium to

Medium to high benefits

high benefits

Source: Accenture, September 2016

Use of digital age procurement assets such as PTP As in all its current blockchain

cloud, enterprise resource planning, engagements, Accenture can work

cryptocurrencies business process outsourcing (BPO) with clients from ideation to design

Blockchain technology allows firms to use and people deployed to the PTP. It and through the prototyping steps in

this digital-based medium of exchange should also balance the benefits of order to demonstrate blockchain’s real

which is based on financial institution adopting blockchain with the cost world benefits in a PTP application.

generated currency. It also offers users of integrating this technology to

instantaneous transactions, near real‑time existing systems such as validation

logging and audit capabilities, thus workflows, accounting system and

providing borderless transfer of ownership. the cost to address cyber security.

• Adoption of a private or a public

Speed of execution blockchain? A public blockchain would

Blockchain technology provides a help reduce complexity and entry costs

secured transaction ledger database, but would require a new certification

shared between vendors and client for process for all parties. Challenges to

additional efficiency gains. The database doing so include the fact that there are

is immediately updated to reflect any new no global authorities entitled to perform

transaction, thus accelerating the consent this certification, and such actions

and validation of work orders and invoices. might be considered infringements on

transnational free trade agreements.

Before applying blockchain to a PTP As for a private blockchain, it could

business, there are a few decisions help increase security issues as

and actions that should be taken. well as disadvantaging the weaker

• A business case for adopting the PTP participant(s) in the transaction (e.g. a

blockchain should be performed. It vendor would have to handle multiple

should encompass all pre-existing private blockchains).

For more information, Disclaimer

please contact This document is intended for general

informational purposes only and does not

take into account the reader’s specific

Philippe Guyonnet

circumstances, and may not reflect the

Managing Director,

most current developments. Accenture

Accenture Finance & Risk

disclaims, to the fullest extent permitted

philippe.guyonnet@accenture.com

by applicable law, any and all liability for

+33 1-5323 4713

the accuracy and completeness of the

information in this presentation and for

Hamdi Mohammed any acts or omissions made based on such

Managing Director, information. Accenture does not provide

Accenture Finance & Risk legal, regulatory, audit, or tax advice.

hamdi.mohammed@accenture.com Readers are responsible for obtaining

+33 1-5323 4755 such advice from their own legal counsel

or other licensed professionals.

About Accenture

Accenture is a leading global professional

services company, providing a broad

range of services and solutions in

strategy, consulting, digital, technology

and operations. Combining unmatched

experience and specialized skills across

more than 40 industries and all business

functions—underpinned by the world’s

largest delivery network—Accenture

works at the intersection of business and

technology to help clients improve their

performance and create sustainable value

for their stakeholders. With approximately

384,000 people serving clients in more

than 120 countries, Accenture drives

innovation to improve the way the world

works and lives. Visit us at

www.accenture.com.

Copyright © 2016 Accenture

All rights reserved.

Accenture, its logo, and

High Performance Delivered

are trademarks of Accenture. 16-3585

You might also like

- WEB 17.8 TTH GLOB Top Use Cases For Blockchain in Hospitality Thoughtpost - 1Document4 pagesWEB 17.8 TTH GLOB Top Use Cases For Blockchain in Hospitality Thoughtpost - 1Keith WongNo ratings yet

- 03 PwCGlobalBlockchainSurvey - InfographicDocument2 pages03 PwCGlobalBlockchainSurvey - InfographicStephen TanNo ratings yet

- Blockchain Benefit: Driving Freight Bill Audit and Pay Savings in Oil and GasDocument2 pagesBlockchain Benefit: Driving Freight Bill Audit and Pay Savings in Oil and Gaschrystian_afikoNo ratings yet

- FYBBI-01-A The Impact of Blockchain On Financial TransactionsDocument13 pagesFYBBI-01-A The Impact of Blockchain On Financial TransactionswattpadNo ratings yet

- Blockchain in Fin-Tech Sector.Document9 pagesBlockchain in Fin-Tech Sector.Himanshu SinghNo ratings yet

- KYC VERIFICATION USING BLOCKCHAIN TECHNOLOGYDocument5 pagesKYC VERIFICATION USING BLOCKCHAIN TECHNOLOGYPrashant A UNo ratings yet

- Blockchain in FinanceDocument4 pagesBlockchain in FinanceVNo ratings yet

- 9 Analytics FramworksDocument5 pages9 Analytics FramworksmittleNo ratings yet

- Blockchain's Role in Supply Chain TransparencyDocument6 pagesBlockchain's Role in Supply Chain TransparencyKoushik gangipellyNo ratings yet

- Blockchain 3Document6 pagesBlockchain 3tatiamamrikishviliNo ratings yet

- 34 SubmissionDocument6 pages34 Submissionpradeep kumarNo ratings yet

- Blockchain Slide Deck 0Document25 pagesBlockchain Slide Deck 0johnkwashanaiNo ratings yet

- Blockchain:: A Revolutionary Change or Not?Document6 pagesBlockchain:: A Revolutionary Change or Not?sgjatharNo ratings yet

- 03 Blockchain-DSDocument17 pages03 Blockchain-DSJefery SungNo ratings yet

- The Essential Eight Technologies: Board Byte: BlockchainDocument12 pagesThe Essential Eight Technologies: Board Byte: BlockchainsilvofNo ratings yet

- HSBC cm2559 DC Factsheet Egypt EngDocument2 pagesHSBC cm2559 DC Factsheet Egypt EngAsem Youssef Abdel SalamNo ratings yet

- Swift Gpi Business Case EbookDocument14 pagesSwift Gpi Business Case EbookBeniamin KohanNo ratings yet

- DocuTrade Deck For CarriersDocument10 pagesDocuTrade Deck For CarriersamitpNo ratings yet

- Blockchain A True Disruptor For The Energy IndustryDocument8 pagesBlockchain A True Disruptor For The Energy IndustryAnonymous IPF3W1FczNo ratings yet

- CFO Insights: Getting Smart About Smart ContractsDocument5 pagesCFO Insights: Getting Smart About Smart ContractsPhuong Thanh TranNo ratings yet

- Blockchain PART 5Document3 pagesBlockchain PART 5Dipika SinghNo ratings yet

- Blockchain: A Potential Game-Changer For Life InsuranceDocument20 pagesBlockchain: A Potential Game-Changer For Life InsuranceCognizantNo ratings yet

- Blockchain Document Storage System for Secure KYC VerificationDocument3 pagesBlockchain Document Storage System for Secure KYC VerificationSaish KaranjekarNo ratings yet

- Survey PaperDocument4 pagesSurvey PaperSaish KaranjekarNo ratings yet

- CPD Skills: The Impact of Blockchain and Cryptocurrencies On The Accounting ProfessionDocument28 pagesCPD Skills: The Impact of Blockchain and Cryptocurrencies On The Accounting ProfessionOmer SabirNo ratings yet

- How Can Blockchain Power Industrial Manufacturing?Document10 pagesHow Can Blockchain Power Industrial Manufacturing?ABHINAV SAURAVNo ratings yet

- Value Proposition: For Real Estate TokenizationDocument5 pagesValue Proposition: For Real Estate TokenizationNoamNo ratings yet

- 17fin8599 C NCR Reconciliation BR FNLDocument8 pages17fin8599 C NCR Reconciliation BR FNLRoeddy ZengNo ratings yet

- Using Blockchain To Drive Supply Chain InnovationDocument12 pagesUsing Blockchain To Drive Supply Chain InnovationAhmed ZohairNo ratings yet

- Week2 Kyc Blockchain White PaperDocument14 pagesWeek2 Kyc Blockchain White Paperkv55ggnhxvNo ratings yet

- Blockchain - Curs 1Document36 pagesBlockchain - Curs 1Farmacie Baia de AramaNo ratings yet

- Blockchain Technology and AuditDocument4 pagesBlockchain Technology and AuditOgechukwu JulianaNo ratings yet

- Blockchain Can Transform Pharma and HealthcareDocument9 pagesBlockchain Can Transform Pharma and HealthcareBeate IgemannNo ratings yet

- Block ChainDocument4 pagesBlock ChainAnoopNo ratings yet

- SCR in Procure To Pay Analytics v2Document12 pagesSCR in Procure To Pay Analytics v2shuklaniranjan320No ratings yet

- Swift Payments Whitepaper GuidelinesforthenextgenerationDocument8 pagesSwift Payments Whitepaper Guidelinesforthenextgenerationj-oneillNo ratings yet

- UntitledDocument10 pagesUntitledMortal Eyes GamingNo ratings yet

- The Internet of Value-Exchange: How Does A Blockchain Deliver Value?Document2 pagesThe Internet of Value-Exchange: How Does A Blockchain Deliver Value?magnux intelcomNo ratings yet

- Block ChainDocument12 pagesBlock ChainHarsh TyagiNo ratings yet

- Blockchain in Aerospace & DefenseDocument5 pagesBlockchain in Aerospace & DefenserubenarisNo ratings yet

- Unit 4 BlockchainDocument71 pagesUnit 4 BlockchainNiNjA KaPpA'SNo ratings yet

- EY Blockchain How This Technology Could Impact The CfoDocument12 pagesEY Blockchain How This Technology Could Impact The CfoAndreea GeorgianaNo ratings yet

- Payments Hub Redefining Payments InfrastructureDocument10 pagesPayments Hub Redefining Payments InfrastructureRishi SrivastavaNo ratings yet

- 5 - Accenutre Outlook Blockchain POVDocument6 pages5 - Accenutre Outlook Blockchain POVselcukNo ratings yet

- Training Material - Blockchain Concepts and Its ApplicationsDocument14 pagesTraining Material - Blockchain Concepts and Its ApplicationsSantosh Kumar PathakNo ratings yet

- Blockchain InfosysDocument12 pagesBlockchain InfosysnikhilNo ratings yet

- Blockchain Technology SummaryDocument8 pagesBlockchain Technology SummaryHumza ZahidNo ratings yet

- 3 - IBM Blockchain PDFDocument15 pages3 - IBM Blockchain PDFMayank AgrawalNo ratings yet

- Bank Record Storage Using BlockchainDocument5 pagesBank Record Storage Using BlockchaingeethakaniNo ratings yet

- Block Chain Technology: Sampath KumarDocument7 pagesBlock Chain Technology: Sampath KumarSampath Kumar MakaNo ratings yet

- 4 Cloud CapabilitiesDocument5 pages4 Cloud CapabilitiesmittleNo ratings yet

- Blockchain and FutureDocument8 pagesBlockchain and FutureApurvAdarshNo ratings yet

- The P2P Automation Playbook For Successful EProcurement Compressed MinDocument24 pagesThe P2P Automation Playbook For Successful EProcurement Compressed Mina2lusiNo ratings yet

- Blockchain Revolutionizing Finance ProcessesDocument4 pagesBlockchain Revolutionizing Finance ProcessesRaj KrishnaNo ratings yet

- Document Storage System Using BlockchainDocument3 pagesDocument Storage System Using BlockchainSaish KaranjekarNo ratings yet

- Digital Oil and Gas Vol 5 BlockchainDocument17 pagesDigital Oil and Gas Vol 5 BlockchainArunDhamD100% (1)

- Blockchain in LogisticsDocument16 pagesBlockchain in Logisticsshobana.ravisankar3506No ratings yet

- DL Freight SolutionsDocument6 pagesDL Freight SolutionsYashwant KakiNo ratings yet

- Cards Payments UKDocument4 pagesCards Payments UKomkar.in.sgNo ratings yet

- Tutorial 1 SolutionsDocument2 pagesTutorial 1 SolutionsrayenNo ratings yet

- White Paper On E Business Tax Implementation in R 12 Presented atDocument31 pagesWhite Paper On E Business Tax Implementation in R 12 Presented atyasserlionNo ratings yet

- HWAWELLTEX 2021-2022 Annual PDFDocument146 pagesHWAWELLTEX 2021-2022 Annual PDFCAL ResearchNo ratings yet

- Friedman and Freeman MaterialsDocument3 pagesFriedman and Freeman MaterialsHieu LeNo ratings yet

- Series-A Investment Opportunity: International Payments Service ProviderDocument3 pagesSeries-A Investment Opportunity: International Payments Service ProviderDhiraj KhotNo ratings yet

- All SAP Transactions Starting with MDocument26 pagesAll SAP Transactions Starting with Mhybrido jugonNo ratings yet

- Full Download Management Accounting Information For Decision Making and Strategy Execution Atkinson 6th Edition Test Bank PDF Full ChapterDocument36 pagesFull Download Management Accounting Information For Decision Making and Strategy Execution Atkinson 6th Edition Test Bank PDF Full Chaptersloppy.obsidian.v8ovu100% (18)

- Alka MedicalDocument1 pageAlka MedicalKamlesh PrajapatiNo ratings yet

- Complete Reports and Indices For UPSC Prelims 2023Document54 pagesComplete Reports and Indices For UPSC Prelims 2023AmarNo ratings yet

- SYNTHESIS (Chapter 1) - FINANCIAL MANGEMENT 1Document3 pagesSYNTHESIS (Chapter 1) - FINANCIAL MANGEMENT 1Mary Joy SameonNo ratings yet

- Ferguson v. Countrywide Credit Industries, Inc.Document2 pagesFerguson v. Countrywide Credit Industries, Inc.crlstinaaa100% (3)

- MATH4512 - Fundamentals of Mathematical Finance HomeworkDocument5 pagesMATH4512 - Fundamentals of Mathematical Finance HomeworkAnonymous pPeyKBmYNo ratings yet

- Account Statement From 20 Apr 2022 To 4 May 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 20 Apr 2022 To 4 May 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajkumar GopalanNo ratings yet

- David OgilvyDocument9 pagesDavid OgilvyDan DsouzaNo ratings yet

- Indian Textile Industry: Opportunities, Challenges and SuggestionsDocument16 pagesIndian Textile Industry: Opportunities, Challenges and SuggestionsGadha GopalNo ratings yet

- Local Tax Double Taxation CaseDocument1 pageLocal Tax Double Taxation CaseEmmanuel YrreverreNo ratings yet

- Lecture 1-Intangible Assets UpdatedDocument52 pagesLecture 1-Intangible Assets UpdatedIvan ChinNo ratings yet

- Smart Project ManagementDocument73 pagesSmart Project ManagementDr P AdhikaryNo ratings yet

- PETROJET Employment Offer in Saudi ArabiaDocument1 pagePETROJET Employment Offer in Saudi ArabiaHaleemUrRashidBangashNo ratings yet

- Unorganised Financial SystemDocument3 pagesUnorganised Financial Systemriya thakurNo ratings yet

- Frazil Bundle Agreement 2021 KentDocument4 pagesFrazil Bundle Agreement 2021 Kentazhar_qaiserNo ratings yet

- Part 1 Contract: Section 1. General Conditions of ContractDocument55 pagesPart 1 Contract: Section 1. General Conditions of ContractRun FastNo ratings yet

- Constitution of IndiaDocument7 pagesConstitution of IndiaRITIKANo ratings yet

- Maven Silicon - BPD Training Agreement 2023Document4 pagesMaven Silicon - BPD Training Agreement 2023kothapalli naveenNo ratings yet

- Note 1Document3 pagesNote 1Wedaje AlemayehuNo ratings yet

- People's Republic of Bangladesh Preparatory Survey On Renewable Energy Development Project Final ReportDocument310 pagesPeople's Republic of Bangladesh Preparatory Survey On Renewable Energy Development Project Final ReportShahin NescoNo ratings yet

- Gititi 20122Document16 pagesGititi 20122Kavita HindiNo ratings yet

- FA of SPDocument8 pagesFA of SPShivangi AggarwalNo ratings yet

- Project (Role of Commercial Bank)Document5 pagesProject (Role of Commercial Bank)souvikNo ratings yet

- The Strategic Role of Information in Sales ManagementDocument33 pagesThe Strategic Role of Information in Sales ManagementJessica BonillaNo ratings yet