Professional Documents

Culture Documents

Topic 2 - Cost-Volume-Profit (CVP) Analysis

Uploaded by

Janus Aries SimbilloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 2 - Cost-Volume-Profit (CVP) Analysis

Uploaded by

Janus Aries SimbilloCopyright:

Available Formats

MANAGEMENT ADVISORY SERVICES

COST-VOLUME-PROFIT (CVP) ANALYSIS

OCTOBER 2019 BATCH

J.A. SIMBILLO

INTRODUCTION

Cost-Volume-Profit (CVP) Analysis examines the interaction of a firm’s sales volume, selling price, cost structure,

and profitability. It is a powerful tool in making managerial decisions including marketing, production, investment,

and financing decisions.

How many units of its products must a firm sell to break even?

How many units of its products must a firm sell to earn a certain amount of profit?

Should a firm invest in highly automated machinery and reduce its labor force?

Should a firm advertise more to improve its sales?

Key Assumptions of CVP Analysis

1. Selling price is constant.

2. Costs are linear and can be accurately divided into variable (constant per unit) and fixed (constant in total)

elements.

3. In multiproduct companies, the sales mix is constant.

4. In manufacturing companies, inventories do not change (units produced = units sold).

CONTRIBUTION MARGIN (CM)

- is the amount remaining from sales revenue after variable expenses have been deducted.

In using and understanding the Contribution Margin Income Statement, it is prerequisite to understand the

behavior of costs.

Variable Costs - are costs whose total peso amount varies in direct proportion to changes in the activity

level.

Fixed Costs - are costs whose total dollar amount remains constant as the activity level changes.

Summary of Variable and Fixed Cost Behavior

Cost In Total Per Unit

Variable Total variable cost is Variable cost per unit remains

proportional to the activity the same over wide ranges

level within the relevant range. of activity.

Total fixed cost remains the

same even when the activity Fixed cost per unit goes

Fixed level changes within the down as activity level goes up.

relevant range.

CONTRIBUTION MARGIN INCOME STATEMENT

- is helpful to managers in judging the impact on profits of changes in selling price, cost, or volume.

1|Page MAS - JAQS

Format:

X COMPANY

CONTRIBUTION INCOME STATEMENT

FOR THE MONTH OF JULY 2019

TOTAL PER UNIT

Sales ₱ xxxxxx.xx ₱ xx.xx

Less: Variable Costs and Expenses (xxxxxx.xx) (xx.xx)

Contribution Margin ₱ xxxxxx.xx ₱ xx.xx

Less: Fixed Costs and Expenses (xxxxxx.xx)

Net Operating Income ₱ xxxxxx.xx

CONTRIBUTION MARGIN RATIO

Formula:

Total Contribution Margin

CONTRIBUTION MARGIN RATIO =

Total Sales

or

Contribution Margin per unit

CONTRIBUTION MARGIN RATIO =

Total Sales

CONTRIBUTION MARGIN PER Total Contribution Margin

=

UNIT Total Sales in units

BREAK-EVEN POINT

- is the point where total revenue equals total cost (i.e., the point of zero profit).

- Also, the level of sales at which contribution margin just covers fixed costs and when operating income is

equal to zero.

BREAK-EVEN POINT ANALYSIS

- is a measurement system that calculates the margin of safety by comparing the amount of revenues or units

that must be sold to cover fixed and variable costs associated with making the sales.

- is a way to calculate when a project will be profitable by equating its total revenues with its total expenses.

There are several different uses for the equation.

The purpose of the break-even analysis formula is to calculate the amount of sales that equates revenues to

expenses and the amount of excess revenues, also known as profits, after the fixed and variable costs are met.

Formula:

Total Fixed Cost

BREAK-EVEN POINT =

Contribution Margin per unit

TARGET INCOME

While the break-even point is useful information and an important benchmark for relatively young

companies, most companies would like to earn operating income greater than $0.

CVP allows us to do this by adding the target income amount to the fixed cost.

Formula:

NUMBER OF UNITS TO Total Fixed Cost + Target Income

=

EARN TARGET INCOME Contribution Margin per unit

2|Page MAS - JAQS

SALES PESO TO EARN Total Fixed Cost + Target Income

=

TARGET INCOME Contribution Margin Ratio

IMPACT OF CHANGE IN REVENUE ON CHANGE IN PROFIT

If fixed costs remain unchanged, the contribution margin ratio can find the profit impact of a change in

sales revenue.

To obtain the total change in profits from a change in revenues, multiply the contribution margin ratio

times the change in sales:

Formula:

CHANGE IN PROFITS = CONTRIBUTION MARGIN RATIO x CHANGE IN SALES

MARGIN OF SAFETY

- is the difference between the amount of expected profitability and the break-even point.

- This is the revenue earned after the company or department pays all of its fixed and variable costs

associated with producing the goods or services.

- the amount of sales a company can afford to lose before it stops being profitable.

Management uses this calculation to judge the risk of a department, operation, or product. The smaller the

percentage or number of units, the riskier the operation is because there’s less room between profitability and loss.

For instance, a department with a small buffer could have a loss for the period if it experienced a slight decrease in

sales. Meanwhile a department with a large buffer can absorb slight sales fluctuations without creating losses for

the company.

Formula:

MARGIN OF SAFETY IN PESOS = ACTUAL/BUDGETED SALES – BREAK-EVEN SALES

MARGIN OF SAFETY IN UNITS = ACTUAL/BUDGETED SALES IN UNITS – BREAK-EVEN SALES IN UNITS

Actual/Budgeted Sales – Break-even Sales

MARGIN OF SAFETY RATIO =

Actual/Budgeted Sales

OPERATING LEVERAGE

- is the use of fixed costs to extract higher percentage changes in profits as sales activity changes.

- Measure of the proportion of fixed costs in a company’s cost structure.

- Used as an indicator of how sensitive profit is to changes in sales volume.

Formula:

DEGREE OF OPERATING Contribution Margin

=

LEVERAGE (DOL) Operating Income

Summary of Operating Leverage

Operating

Leverage

HIGH LOW

% profit increase with sales increase Large Small

% loss increase with sales decrease Large Small

3|Page MAS - JAQS

MULTIPLE PRODUCT/SEGMENT CVP ANALYSIS

When a company sells more than one product, break-even analysis becomes more complex since different

products have different selling prices, cost structures and contribution margin. Thus it is important to

understand the concept of sales mix and apply this concept to the CVP Analysis.

Sales Mix

- is the relative proportion in which a company’s products are sold.

Formula:

If the sales mix is constant, CVP problems with multiple products can be solved using the following equations:

OVERALL CONTRIBUTION Overall Contribution Margin

=

MARGIN RATIO Total Sales

BREAK-EVEN SALES (FOR Total Fixed Cost

=

MULTIPLE PRODUCTS) Overall CM Ratio

SALES PESO TO EARN TARGET Total Fixed Costs + Target Profit

=

INCOME Overall CM Ratio

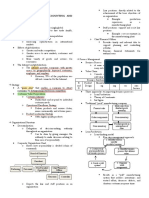

CVP GRAPH

4|Page MAS - JAQS

You might also like

- Finance Policies and Procedures Manual - TEMPLATE PDFDocument60 pagesFinance Policies and Procedures Manual - TEMPLATE PDFIPFC CochinNo ratings yet

- Mas Ho No. 2 Relevant CostingDocument7 pagesMas Ho No. 2 Relevant CostingRenz Francis LimNo ratings yet

- CVP Analysis Review Problem SolutionDocument3 pagesCVP Analysis Review Problem SolutionSUNNY BHUSHANNo ratings yet

- Cost Accounting Reviewer Chapter 1-4Document10 pagesCost Accounting Reviewer Chapter 1-4hanaNo ratings yet

- LECTURE NOTES FOR Revaluation Model PDFDocument10 pagesLECTURE NOTES FOR Revaluation Model PDFFilip SlavchevNo ratings yet

- Unit 12 Responsibility Accounting and Performance MeasuresDocument16 pagesUnit 12 Responsibility Accounting and Performance Measuresestihdaf استهدافNo ratings yet

- Chapter Iii. Master Budget: An Overall PlanDocument16 pagesChapter Iii. Master Budget: An Overall PlanAsteway MesfinNo ratings yet

- Module 4 Absorption and Variable Costing NotesDocument3 pagesModule 4 Absorption and Variable Costing NotesMadielyn Santarin Miranda100% (3)

- Process Costing ModuleDocument6 pagesProcess Costing ModuleClaire BarbaNo ratings yet

- Solution Manual For College Accounting 14th Edition Price, Haddock, FarinaDocument18 pagesSolution Manual For College Accounting 14th Edition Price, Haddock, Farinaa289899847No ratings yet

- Tender No. SH/001/2017-2019 For Supply of General Hardware & ElectricalsDocument75 pagesTender No. SH/001/2017-2019 For Supply of General Hardware & ElectricalsState House KenyaNo ratings yet

- Auditing ReviewerDocument26 pagesAuditing ReviewerCynthia PenoliarNo ratings yet

- KF Cost Volume Profit AnalysisDocument43 pagesKF Cost Volume Profit AnalysisNCTNo ratings yet

- Mas 3 Module 1 Fs AnalysisDocument19 pagesMas 3 Module 1 Fs AnalysisHazel Jane EsclamadaNo ratings yet

- Differential Cost Analysis Relevant CostingDocument10 pagesDifferential Cost Analysis Relevant CostingBSIT 1A Yancy CaliganNo ratings yet

- CVP Analysis Lecture Notes PDFDocument32 pagesCVP Analysis Lecture Notes PDFReverie Sevilla100% (1)

- Variable Costing and Absorption CostingDocument15 pagesVariable Costing and Absorption CostingRomilCledoro100% (1)

- Management Accounting ReviewerDocument17 pagesManagement Accounting ReviewerAina Marie GullabNo ratings yet

- Chapter 12 - Events After The Reporting PeriodDocument10 pagesChapter 12 - Events After The Reporting PeriodMarriel Fate CullanoNo ratings yet

- Chapter 3 Cost Behavior Analysis and UseDocument45 pagesChapter 3 Cost Behavior Analysis and UseMarriel Fate Cullano100% (1)

- University of Caloocan City Cost Accounting & Control Midterm ExaminationDocument8 pagesUniversity of Caloocan City Cost Accounting & Control Midterm ExaminationAlexandra Nicole IsaacNo ratings yet

- Cost Concept and Classification of CostDocument31 pagesCost Concept and Classification of CostRujean Salar AltejarNo ratings yet

- Lesson 3 Cost Volume Profit AnalysisDocument7 pagesLesson 3 Cost Volume Profit AnalysisklipordNo ratings yet

- Allocation of Joint Costs and Accounting For By-Product/ScrapDocument31 pagesAllocation of Joint Costs and Accounting For By-Product/ScrapMichelle Rotairo100% (1)

- Internal Controls ChecklistDocument32 pagesInternal Controls ChecklistBob Forever100% (1)

- MANACC Lesson 1 Introduction To Managerial Accounting Reviewer 1Document13 pagesMANACC Lesson 1 Introduction To Managerial Accounting Reviewer 1Rodolfo ManalacNo ratings yet

- ISO27001 2022 Self-Assessment Checklist - (9p)Document9 pagesISO27001 2022 Self-Assessment Checklist - (9p)Rodrigo Benavente100% (1)

- Topic 5 Financial Forecasting For Strategic GrowthDocument20 pagesTopic 5 Financial Forecasting For Strategic GrowthIrene KimNo ratings yet

- Job Order CostingDocument5 pagesJob Order CostingDrNadia ZubairNo ratings yet

- #4 Pas 8Document3 pages#4 Pas 8jaysonNo ratings yet

- ABC Costing Lecture NotesDocument12 pagesABC Costing Lecture NotesMickel AlexanderNo ratings yet

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- Share 'Standard Costing and Variance Analysis - PPT'Document67 pagesShare 'Standard Costing and Variance Analysis - PPT'Afrina AfsarNo ratings yet

- Lesson 1-4 Cost - Volume-Profit AnalysisDocument13 pagesLesson 1-4 Cost - Volume-Profit AnalysisClaire BarbaNo ratings yet

- MAS Reviewer - Overview of MAS PracticeDocument5 pagesMAS Reviewer - Overview of MAS PracticeJanus Aries SimbilloNo ratings yet

- CH 2 Cost Concepts and BehaviorDocument36 pagesCH 2 Cost Concepts and BehaviorYunita LalaNo ratings yet

- Chapter 2 Cost Terms, Concepts, and Classifications PDFDocument2 pagesChapter 2 Cost Terms, Concepts, and Classifications PDFsolomonaauNo ratings yet

- ACC1701 Mock Test - Sep 2018Document9 pagesACC1701 Mock Test - Sep 2018kik leeNo ratings yet

- Ch3 Raiborn SMDocument34 pagesCh3 Raiborn SMOwdray Cia100% (1)

- Chapter 1 Introduction To Cost AccountingDocument42 pagesChapter 1 Introduction To Cost AccountingPotato FriesNo ratings yet

- Responsibility Accounting and Transfer PricingDocument23 pagesResponsibility Accounting and Transfer PricingNekibur DeepNo ratings yet

- Overhead Variances FinalDocument12 pagesOverhead Variances FinalKella PradeepNo ratings yet

- Appellant Rebuttal Document PDFDocument26 pagesAppellant Rebuttal Document PDFsaul campbellNo ratings yet

- Narayana Murthy Committee Report, 2003Document5 pagesNarayana Murthy Committee Report, 2003shanky017275% (4)

- I Introduction To Cost AccountingDocument8 pagesI Introduction To Cost AccountingJoshuaGuerreroNo ratings yet

- Differential Cost AnalysisDocument7 pagesDifferential Cost AnalysisSalman AzeemNo ratings yet

- Garrison ABCDocument18 pagesGarrison ABCAshley Levy San PedroNo ratings yet

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDocument30 pagesCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanNo ratings yet

- Short Run Decision Making: Relevant CostingDocument47 pagesShort Run Decision Making: Relevant CostingSuptoNo ratings yet

- Variable Costing - Cost Accounting QuizDocument2 pagesVariable Costing - Cost Accounting QuizRizza Mae RodriguezNo ratings yet

- Module 4 Absorption Variable Throughput CostingDocument3 pagesModule 4 Absorption Variable Throughput CostingSky Soronoi100% (1)

- Joint and by - Product CostingDocument22 pagesJoint and by - Product CostingTamanna ThomasNo ratings yet

- Cost Accounting CycleDocument8 pagesCost Accounting CycleRosiel Mae CadungogNo ratings yet

- Chapter 7 AbcDocument5 pagesChapter 7 AbcAyu FaridYaNo ratings yet

- JOB Order CostingDocument4 pagesJOB Order CostingWag NasabiNo ratings yet

- Level Up - Conceptual Framework ReviewerDocument15 pagesLevel Up - Conceptual Framework Reviewerazithethird100% (1)

- SCM-4-Master BudgetDocument21 pagesSCM-4-Master BudgetChin FiguraNo ratings yet

- Cost Segregation and Estimation (Final)Document4 pagesCost Segregation and Estimation (Final)Laut Bantuas IINo ratings yet

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Strategic Cost Management Midterm ExaminationDocument9 pagesStrategic Cost Management Midterm ExaminationJohn FloresNo ratings yet

- Lesson 3 Sales Budget and Schedule of Expected Cash CollectionDocument18 pagesLesson 3 Sales Budget and Schedule of Expected Cash CollectionZybel RosalesNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- Cost Volume Profit AnalysisDocument6 pagesCost Volume Profit AnalysisCindy CrausNo ratings yet

- Syllabus Management Advisory ServicesDocument5 pagesSyllabus Management Advisory ServicesUy SamuelNo ratings yet

- IA2 02 - Handout - 1 PDFDocument10 pagesIA2 02 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Chapter 15 - Pas 16 PpeDocument36 pagesChapter 15 - Pas 16 PpeMarriel Fate CullanoNo ratings yet

- Chapter 5 Spoilage, Rework, and ScrapDocument21 pagesChapter 5 Spoilage, Rework, and ScrapMulugeta Girma100% (1)

- 1.3 CVP AnalysisDocument2 pages1.3 CVP AnalysisLea GerodiazNo ratings yet

- Costram - Midterm Reviewer PDFDocument8 pagesCostram - Midterm Reviewer PDFliliNo ratings yet

- Chapter 9 Marginal Costing and Absorption CostingDocument7 pagesChapter 9 Marginal Costing and Absorption CostingLinyVatNo ratings yet

- Topic 16 - Investment Analysis and Portfolio ManagementDocument4 pagesTopic 16 - Investment Analysis and Portfolio ManagementJanus Aries SimbilloNo ratings yet

- Topic 20 - Project FeasibilityDocument3 pagesTopic 20 - Project FeasibilityJanus Aries SimbilloNo ratings yet

- Topic 20 - Project FeasibilityDocument3 pagesTopic 20 - Project FeasibilityJanus Aries SimbilloNo ratings yet

- Volume I (Operating Procedures)Document70 pagesVolume I (Operating Procedures)Warren JaraboNo ratings yet

- Chapter 10 Solman Aud TheoDocument8 pagesChapter 10 Solman Aud TheoRomulus AronNo ratings yet

- Course Outline PFMDocument7 pagesCourse Outline PFMmohamedNo ratings yet

- Cbcs4103-Is Audit, Security and ControlDocument9 pagesCbcs4103-Is Audit, Security and ControlSimon RajNo ratings yet

- AA02 Post October Dormant Company Accounts DcaDocument3 pagesAA02 Post October Dormant Company Accounts DcaHugo Dario Machaca CondoriNo ratings yet

- GF&AR Part-IIIDocument63 pagesGF&AR Part-IIIAbdul Rashid QureshiNo ratings yet

- Audit Checklist: Volume of Issues Makes It1Document6 pagesAudit Checklist: Volume of Issues Makes It1Vishwajit Pathare0% (1)

- State-Owned Enterprises in Georgia: Transparency, Accountability and Prevention of CorruptionDocument35 pagesState-Owned Enterprises in Georgia: Transparency, Accountability and Prevention of CorruptionTIGeorgiaNo ratings yet

- Cash and Internal Control: Financial Accounting, Alternate 4e by Porter and NortonDocument39 pagesCash and Internal Control: Financial Accounting, Alternate 4e by Porter and NortongopakumaNo ratings yet

- Prof Abdurrahim-Paper Shariah Audit & IntegrityDocument14 pagesProf Abdurrahim-Paper Shariah Audit & IntegrityDila Fadiya FarrasNo ratings yet

- Chap 1Document5 pagesChap 1Cẩm ChiNo ratings yet

- C695-19 (Sme)Document13 pagesC695-19 (Sme)Willie NgNo ratings yet

- ACCA Presentation On Ethics IIDocument25 pagesACCA Presentation On Ethics IIKingston Nkansah Kwadwo Emmanuel100% (1)

- Auditing Assignment - Jenny, Joanna, Ling PrintDocument28 pagesAuditing Assignment - Jenny, Joanna, Ling PrintJoanna EveNo ratings yet

- CSPGCLDocument87 pagesCSPGCLRobinn TiggaNo ratings yet

- Seatwork 2B ASSIGNDocument5 pagesSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- MC1Document3 pagesMC1deepalish88No ratings yet

- Revenue Bulletin No. 01-03Document4 pagesRevenue Bulletin No. 01-03MMNo ratings yet

- LDD Request List - USDocument16 pagesLDD Request List - USTubagus Syaqief HarizansyahNo ratings yet

- AuditingDocument3 pagesAuditingmuse tamiruNo ratings yet

- Kingsbury AR - 2012 PDFDocument52 pagesKingsbury AR - 2012 PDFSanath FernandoNo ratings yet