Professional Documents

Culture Documents

Sdtol: Aountancy

Uploaded by

KyohyunOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sdtol: Aountancy

Uploaded by

KyohyunCopyright:

Available Formats

RgSA: The Review Sdtol of Aountancy Page 3 of Ut

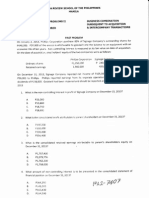

On December 31, 2015, records show that 925 days vacation and sick leaves carried over from the last

operating period were exercised and paid in 2015. In addition, there are 30 employees who have 6

weeks jccumulated unused sick leaves and vacation leaves combined; 25 employees who have

accumulated 3 weeks unused sick leaves and 2 weeks unused vacation leaves ; 30 employees who have

accumulated 3 weeks unused sick leaves and vacation leaves combined; 10 employees who have

accumulated 1 week unused sick leaves and 1 week unused vacation leaves. Employees had an average

daily wage rate of P275 for a 5-day weekly operation in 2015'

7. How much liability for compt:nsated absences should be included as current liabilities as of

December 31, 2014?

a. 57A,625. b. 453,750 c. 412,500 d. 337,500

B. How much liability for compensated absences should be included as current liabilities as of

December 31, 2015?

a. 570,625 b. 453,750 c. 412,500 d. 337,500

eBAELEUS CUMMINGS INC. manufactures and sells air conditioning units with a 12 month warranty

under which defective air conditioning units will be replaced free of any charges.

The company started out in 2014 expecting 10o/o of the sales to be returned, However, due to the

innovations and improvements made to the products during the year, the estimated percentage of

returns increased to 15o,/o on July :1. It is assumed that no units sold during a given quarter are returned

in that quarter. Each unit is stamped with a date at tirne of sale so that the warranty may be properly

administered. The following table of percentages indicates the pattem of sales return during the 12-

month period of warranty, starting with the guarter following the sale of air conditioning units.

Quertg.. rqllowino quarter of sale

o,/o of total returns exoected

Fr rs: e iia !'ter 4OYo

SeccnC cuatter 30%

Thrrd cua,.ter 2C'%

Fcu-r cJa.te- 104

Gross -les of arr condthonrng unrts rn X)14 are iis follows:

Quarter Sales in Peso

First P16,2OO,OOO

Second 14,850,000

j

Tl', r '! , nnn a.,n

FoL(t 8 lti ?!c

i-he company alsc pays for tfie fre ght c.sts of tl: e return and trre de{rverY :i tre defe€ve Llts 'etdrTEO

and the ner.v replacement units, respe(trvely. The frelght cost were approx,mateiy 1C:t of ttre sats gnce

of the air conctitioning units returned. The manufactunng cost of the arr condrtronr:rg unris are roughtY

80o/o of the sales price. The retumed units can be salvaged at an estimated value of 159t of their sales

price. Returned units on hand at December 3L,2074, were thus valued in the inventory at 15 6 of their

orlginal sales price.

Requirements:

9. What is the total estimated returns for the year ended December 31, 2014?

a.5,115,000 b. 6,120,000 c. 6,300,000 d. 7,672,500

10. What is the warranty expense for the year ended December 3L, 2OL4?

a. 4,590,000 b. 4.896,000 c. 5,508,000 d. 6,120,000

11. What is the estimated warranties payable as of December 31, 2AL4?

a. 2,1.76,875 b. 2,205,900 c. 2,3.22,0OO d. 2,612,250

pROBLEM 6: Mountain Province Home Depot carries a wide variety of promotion techniques to attract

customers.

Kitchen and home appliances are sold in a one-year warranty for replacement of parts and labor. The

estimated warranty cost, based on past experience, is 5olo of sales.

The premium is offered on the home furniture. Customer receive a coupon for each peso spent on home

furniture. Customers may exchange 2,000 coupons and P50 for a rice cooker which the company

purchased at P340 for each rice cooker and estimates that 6o0/o of the coupons given to customers will be

redeemed.

The company's total sales for 2014 were P775.2M - P86.4M from kitchen and home appliances and

P28.8t4 from home furniture. Replacement pafts and labor for warranty work totaled P2.624M during

A D I rn EtTI TTTtr< Itrtrtnh ?d\ A EIfI2

You might also like

- Building Wealth Like A Billionaire by Christopher HowardDocument25 pagesBuilding Wealth Like A Billionaire by Christopher HowardNadeem Bedar100% (6)

- PhiLSAT Practice BookletDocument61 pagesPhiLSAT Practice Bookletlckdscl100% (7)

- Advance Accounting 2 by GuerreroDocument15 pagesAdvance Accounting 2 by Guerreromarycayton77% (13)

- 2007-2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals&Ladot)Document125 pages2007-2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals&Ladot)Jay-Arh93% (98)

- Sports Bar Business PlanDocument33 pagesSports Bar Business PlanNathaniel MadugaNo ratings yet

- Non-Profit Organizations: Learning ObjectivesDocument12 pagesNon-Profit Organizations: Learning Objectivesbobo kaNo ratings yet

- Auditing Theory Audit of The Inventory and Warehousing CycleDocument15 pagesAuditing Theory Audit of The Inventory and Warehousing CycleMark Anthony Tibule100% (2)

- Nfjpia Nmbe Auditing 2017 AnsDocument9 pagesNfjpia Nmbe Auditing 2017 AnsBriana DizonNo ratings yet

- CPAR - P2 - 7407 - Business Combination Subsequent To Acquisition PDFDocument5 pagesCPAR - P2 - 7407 - Business Combination Subsequent To Acquisition PDFAngelo Villadores100% (3)

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- Advance Accounting 2 by GuerreroDocument14 pagesAdvance Accounting 2 by Guerreromarycayton83% (6)

- Conso FS2Document4 pagesConso FS2Analyn0% (1)

- Ichapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresDocument14 pagesIchapter 6-The Expenditure Cycle Part Ii: Payroll Processing and Fixed Asset ProceduresJessalyn DaneNo ratings yet

- Final Powerpoint2Document35 pagesFinal Powerpoint2Kyohyun100% (1)

- AnswerQuiz - Module 10Document4 pagesAnswerQuiz - Module 10Alyanna Alcantara100% (1)

- Pre-Week Auditing Problems 2014Document41 pagesPre-Week Auditing Problems 2014Pat Closa80% (15)

- Equilibrium of Force SystemDocument89 pagesEquilibrium of Force SystemKimberly TerogoNo ratings yet

- AP 5902 LiabilitiesDocument11 pagesAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet

- Eda Group5 Hypothesis TestingDocument32 pagesEda Group5 Hypothesis TestingKyohyunNo ratings yet

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Document8 pagesCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoNo ratings yet

- Liabilities QuizDocument13 pagesLiabilities QuizRizia Feh Eustaquio100% (1)

- CAT Challenge - Answers PDFDocument6 pagesCAT Challenge - Answers PDFnivea gumayagayNo ratings yet

- Assement Exam-Dysas 1st Quarter-P1Document5 pagesAssement Exam-Dysas 1st Quarter-P1JohnAllenMarillaNo ratings yet

- Auditing Problems: Problem No. 1 (Intermediate Accounting 17 Edition - Stice)Document22 pagesAuditing Problems: Problem No. 1 (Intermediate Accounting 17 Edition - Stice)Joanna GarciaNo ratings yet

- Practical Accounting 1 Mockboard 2014Document8 pagesPractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- Liabilities Part 2Document4 pagesLiabilities Part 2Jay LloydNo ratings yet

- Tutorial 2 - Accruals and PPEDocument7 pagesTutorial 2 - Accruals and PPEFanboy100% (1)

- Practical Accounting 2: 2011 National Cpa Mock Board ExaminationDocument6 pagesPractical Accounting 2: 2011 National Cpa Mock Board ExaminationMary Queen Ramos-UmoquitNo ratings yet

- Preweek Drill2Document7 pagesPreweek Drill2Grave KnightNo ratings yet

- Audit Rev 1Document1 pageAudit Rev 1julie anne mae mendozaNo ratings yet

- P2 RemovalsDocument10 pagesP2 RemovalsCarolineNo ratings yet

- 7wbva-: First Examination A.MDocument1 page7wbva-: First Examination A.MJims Leñar CezarNo ratings yet

- Dumandan, Kenneth R BSA 302-A Financial Markets P15-1Document8 pagesDumandan, Kenneth R BSA 302-A Financial Markets P15-1Lorielyn AgoncilloNo ratings yet

- Cpar - P2 09.15.13Document22 pagesCpar - P2 09.15.13Leo Mark Ramos100% (1)

- Sraw Finals QaDocument10 pagesSraw Finals QaVinluan JeromeNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- The Trial Balance of Capaldo Dry Cleaners On June 30Document1 pageThe Trial Balance of Capaldo Dry Cleaners On June 30M Bilal SaleemNo ratings yet

- Tut 9-11Document3 pagesTut 9-11Riya khungerNo ratings yet

- Nfjpia Nmbe Auditing 2017 AnsDocument10 pagesNfjpia Nmbe Auditing 2017 AnsSamieeNo ratings yet

- CRC Ace Far 1ST PBDocument9 pagesCRC Ace Far 1ST PBJohn Philip Castro100% (1)

- Quiz 6 Accounting For MaterialsDocument2 pagesQuiz 6 Accounting For MaterialsVanessa AbellaNo ratings yet

- MAA Past Exam Paper 2019Document9 pagesMAA Past Exam Paper 2019Boineelo MasupeNo ratings yet

- Cpar - Ap 07.28.13Document12 pagesCpar - Ap 07.28.13KwonyoongmaoNo ratings yet

- Preweek Auditing Problems 2014 PDFDocument41 pagesPreweek Auditing Problems 2014 PDFalellieNo ratings yet

- Chapter 6-Exercise 9Document5 pagesChapter 6-Exercise 9jayjay storageNo ratings yet

- 3415 Corporate Finance Assignment 2: Dean CulliganDocument13 pages3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersNo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- Removal JulyDocument8 pagesRemoval JulyRosanna RomancaNo ratings yet

- Financial Lislrorting The of Bcfore For Realized: Gross ..,.... ,... '.......... 'P 2,040 37'800Document1 pageFinancial Lislrorting The of Bcfore For Realized: Gross ..,.... ,... '.......... 'P 2,040 37'800John Francis Raspado AnchetaNo ratings yet

- Resignations: EstinratedDocument1 pageResignations: EstinratedKyohyunNo ratings yet

- Math3 sf.q1Document2 pagesMath3 sf.q1ExequielCamisaCrusperoNo ratings yet

- New Microsoft Office Word DocumentDocument5 pagesNew Microsoft Office Word DocumentTariq RahimNo ratings yet

- Problems On PPEDocument8 pagesProblems On PPEDibyansu KumarNo ratings yet

- Chap 10Document43 pagesChap 10Boo LeNo ratings yet

- National Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentDocument13 pagesNational Mock Board Examination 2017 Auditing: A. Consolidated Net Profit After Tax Attributable To ParentKez MaxNo ratings yet

- Latihan MatrikulasiDocument4 pagesLatihan MatrikulasiD Ayu Hamama PitraNo ratings yet

- Bachelor'S Degree Programme C/1 M Term-End Examination (3) December, 2017 Elective Course: Commerce Eco-002: Accountancy-IDocument8 pagesBachelor'S Degree Programme C/1 M Term-End Examination (3) December, 2017 Elective Course: Commerce Eco-002: Accountancy-ISaurav JhaNo ratings yet

- Quiz Audit of Shareholders Equity-2Document10 pagesQuiz Audit of Shareholders Equity-2Moi Escalante100% (1)

- Engineering EconomicsDocument17 pagesEngineering EconomicsIan BondocNo ratings yet

- AP - PrelimDocument7 pagesAP - PrelimJohn Aries Reyes100% (1)

- NFJPIA Mockboard 2011 P2Document13 pagesNFJPIA Mockboard 2011 P2Regie Sharry Alutang PanisNo ratings yet

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Document16 pagesCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupNo ratings yet

- Bachelor'S Degree Programme Term-End Examination June, 2016Document11 pagesBachelor'S Degree Programme Term-End Examination June, 2016sahithi rudrarajuNo ratings yet

- Practical Accounting QuizzesDocument3 pagesPractical Accounting QuizzesMichelle ValeNo ratings yet

- AP AnswerKeyDocument6 pagesAP AnswerKeyRosalie E. Balhag100% (2)

- 9.liability Questionnaire QUIZDocument10 pages9.liability Questionnaire QUIZMark GaerlanNo ratings yet

- ExerciseDocument2 pagesExercisePhuong DungNo ratings yet

- Pre-Finals ExaminationDocument2 pagesPre-Finals ExaminationShane KimNo ratings yet

- Laplace Table PDFDocument2 pagesLaplace Table PDFKyohyunNo ratings yet

- Column FootingDocument1 pageColumn FootingCarmela CerflenNo ratings yet

- Differential EquationsDocument1 pageDifferential EquationsGlenda GragedaNo ratings yet

- Lecture Sept 3 2019Document12 pagesLecture Sept 3 2019KyohyunNo ratings yet

- Lecture Sept 3 2019Document12 pagesLecture Sept 3 2019KyohyunNo ratings yet

- Problem 001 MJ Method of JointsDocument6 pagesProblem 001 MJ Method of JointsKyohyunNo ratings yet

- Problem Sheet III - Testing of HypothesisDocument3 pagesProblem Sheet III - Testing of HypothesisAbhishek SinghNo ratings yet

- 16 Comparison and ContrastDocument19 pages16 Comparison and ContrastKyohyunNo ratings yet

- Laplace Table PDFDocument2 pagesLaplace Table PDFKyohyunNo ratings yet

- Common Derivatives IntegralsDocument4 pagesCommon Derivatives Integralsapi-243574449No ratings yet

- Differential EquationsDocument1 pageDifferential EquationsGlenda GragedaNo ratings yet

- 6 Simple Interest Discounted Loan1Document3 pages6 Simple Interest Discounted Loan1KyohyunNo ratings yet

- Masculinity, Femininity, & Androgyny: The Interaction of College Students With PreschoolersDocument32 pagesMasculinity, Femininity, & Androgyny: The Interaction of College Students With PreschoolersKyohyunNo ratings yet

- 2nd Summative Test in English 10Document1 page2nd Summative Test in English 10KyohyunNo ratings yet

- Chapter 1 Advanced Acctg. SolmanDocument20 pagesChapter 1 Advanced Acctg. SolmanLaraNo ratings yet

- Test I. Multiple ChoiceDocument2 pagesTest I. Multiple ChoiceKyohyunNo ratings yet

- RFBTDocument1 pageRFBTKyohyunNo ratings yet

- 2nd Summative Test in English 10Document1 page2nd Summative Test in English 10KyohyunNo ratings yet

- False True True ., False L:rue B-Ue D I True False Fue ' False True True ' False True False TDocument1 pageFalse True True ., False L:rue B-Ue D I True False Fue ' False True True ' False True False TKyohyunNo ratings yet

- Midterm - Introduction To and History of PhilosophyDocument31 pagesMidterm - Introduction To and History of PhilosophyKyohyunNo ratings yet

- "Kodak": Strategic ManagementDocument9 pages"Kodak": Strategic ManagementKyohyunNo ratings yet

- Sesbreno vs. Court of AppealsDocument12 pagesSesbreno vs. Court of AppealsKyohyunNo ratings yet

- Bob Livingston: ManagementDocument3 pagesBob Livingston: Managementapi-103906346No ratings yet

- Application: The Costs of Taxation: Marwa HeggyDocument42 pagesApplication: The Costs of Taxation: Marwa HeggyAnonymous cioChTZoVNo ratings yet

- Materials From HBS and Text Book - Summary of Management AccountingDocument145 pagesMaterials From HBS and Text Book - Summary of Management AccountingMuhammad Helmi FaisalNo ratings yet

- Tactics & Strategic AllianceDocument43 pagesTactics & Strategic AllianceVishwesh KoundilyaNo ratings yet

- Googles Success Ben Morrow Thesis 2008 PDFDocument31 pagesGoogles Success Ben Morrow Thesis 2008 PDFAzim MohammedNo ratings yet

- The BIG Partnership Has Decided To Liquidate at December 31Document6 pagesThe BIG Partnership Has Decided To Liquidate at December 31deepak_baidNo ratings yet

- Financial ManagementDocument44 pagesFinancial ManagementNitish SinhaNo ratings yet

- IHRM-Compensation & BenefitsDocument20 pagesIHRM-Compensation & Benefitsapi-377191787% (15)

- Calculation PracticeDocument5 pagesCalculation Practicenguyenductai2006No ratings yet

- Nust Seecs Aa SP Form V 0.3Document10 pagesNust Seecs Aa SP Form V 0.3Nadeem AhmedNo ratings yet

- Acc414 Fin43 mgt45 Midterm-ExamDocument11 pagesAcc414 Fin43 mgt45 Midterm-ExamNicole Athena CruzNo ratings yet

- Wood FSDocument117 pagesWood FSAnton SocoNo ratings yet

- Module #03 - Financial Statements, Cash Flow, and TaxesDocument19 pagesModule #03 - Financial Statements, Cash Flow, and TaxesRhesus UrbanoNo ratings yet

- HRM 430 Final ExamDocument5 pagesHRM 430 Final ExamDeVryHelpNo ratings yet

- 183531Document11 pages183531artemis42No ratings yet

- Unit IvDocument26 pagesUnit Ivthella deva prasadNo ratings yet

- Stie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDocument13 pagesStie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDwi Merry WijayantiNo ratings yet

- Product Summary:: Jeevan Shree-IDocument4 pagesProduct Summary:: Jeevan Shree-IPinakin PatelNo ratings yet

- 119 Foster v. Bowen (Consing)Document1 page119 Foster v. Bowen (Consing)ASGarcia24No ratings yet

- Jam Jelly Murabba Manufacturing ProjectDocument2 pagesJam Jelly Murabba Manufacturing ProjectcasagarteliNo ratings yet

- Internal ControlDocument14 pagesInternal ControlHemangNo ratings yet

- Appendix D - Answers To Self-Test Problems PDFDocument32 pagesAppendix D - Answers To Self-Test Problems PDFgmcrinaNo ratings yet

- Corporate Tax HW SolutionsDocument12 pagesCorporate Tax HW SolutionsbiziakmNo ratings yet

- Class Participation-2: Reflection - 1: (10 Marks) : List The Following Items in Appropriate Category and OrderDocument4 pagesClass Participation-2: Reflection - 1: (10 Marks) : List The Following Items in Appropriate Category and Orderaj singhNo ratings yet

- Debonair-Strategic Analysis of No Frills AirlineDocument8 pagesDebonair-Strategic Analysis of No Frills AirlineHarry LondonNo ratings yet