Professional Documents

Culture Documents

South American Oil and Gas Investment Shaped by Years of Lower Prices

Uploaded by

mkpai-1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

South American Oil and Gas Investment Shaped by Years of Lower Prices

Uploaded by

mkpai-1Copyright:

Available Formats

THE NEW GEOPOLITICS JULY 2018

LATIN AMERICA

LOWER FOR LONGER:

YEARS OF LOW PRICES

REWRITE FOREIGN

INVESTMENT IN SOUTH

AMERICAN OIL AND GAS

SAMANTHA GROSS

LOWER FOR LONGER: YEARS OF LOW

PRICES REWRITE FOREIGN INVESTMENT

IN SOUTH AMERICAN OIL AND GAS

SAMANTHA GROSS

EXECUTIVE SUMMARY

Oil prices have been on a wild ride for the last decade—very high from 2008 through

2014, followed by a crash from 2015 to 2017. One might think that very high oil prices

are always a boon for the industry. However, high oil prices increase the competition for

resources and can bring about unproductive behavior on the part of resource holders.

Resource nationalism is a particular challenge—the desire to maximize government take

from oil and gas development can stifle foreign investment and reduce governments’

overall oil and gas income.

Several countries in South America demonstrate how government policy and foreign

investment can interact with an extreme price environment. Argentina and Brazil

largely missed the boat during the price boom, with resource nationalism and political

uncertainty primarily to blame. The political winds have shifted along with falling prices,

and policies more favorable to foreign investment are bringing greater development

of the world-class oil and gas resources in these two countries. Colombia followed a

different path. Its business-friendly policies made it a darling of the industry during the

boom years, but its smaller resource base has made it less attractive when prices are

lower. Additionally, community resistance to oil and gas development grew during the

boom years and laws governing community engagement have been strengthened.

Guyana represents a special case: Significant oil and gas resources were recently

discovered off the shore of one of the smallest and poorest countries in South America.

Guyana signed the original contract for development at a time of relatively low oil prices,

when its resource potential was completely unknown. This contract is therefore quite

generous to the developer. Now that the resource base is better understood, exploration

is less risky, and oil prices are relatively higher, Guyana will be able to drive a harder

bargain in future contracts. The key is to find a happy medium between reaping maximum

benefit for the Guyanese people and attracting sufficient investment. A moderate oil

price environment makes this balance easier.

Foreign Policy at Brookings | 1

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

INTRODUCTION

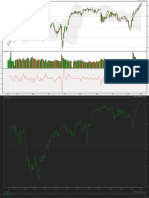

Oil prices have been on a wild ride for the past decade. Prices were mostly above $100 per

barrel from 2008 through 2014, only to crash to less than $50 per barrel from late 2014

through late 2017 as abundant new supply, especially from the United States, came online.

Prices have been rising again since then, as production cuts from the Organization of the

Petroleum Exporting Countries (OPEC) and Russia have tightened supply and reduced

global oil inventories.

One might think that a very high oil price is always a boon for the industry. However, high oil

prices can increase the competition for resources and bring about unproductive behavior

on the part of resource holders. Counterintuitively, moderate prices can be better for the

overall health of the oil and gas industry and bring more rational decisionmaking. Despite

the recent rise in prices, oil exploration has not recovered from the exuberance of 2008

through 2014.

This paper explores how today’s moderate oil price environment is playing out in four South

American countries: Argentina, Brazil, Colombia, and Guyana. The oil industry is expanding,

for now, in Argentina and Brazil. Both countries have implemented policies that have

greatly improved the environment for oil and gas investment, but these policies are facing

economic headwinds in Argentina and political headwinds in Brazil. The oil price drop was

less kind to Colombia. Its welcoming investment environment made it a darling of the oil

industry while prices were high, but its modest reserve base is now reducing investment in

a time of moderate prices. Guyana provides an example where a recent very large discovery

is creating an oil and gas industry and infrastructure from scratch. Guyana can learn about

how to attract (and discourage) investment from the other countries in the region.

Regardless of the price level, the oil and gas industry focuses on the fundamentals when

making investment decisions: resource quality and above-ground conditions. The size and

development cost of the resource are always the most important considerations in oil and

gas development, although companies favor larger and less expensive resources during

times of lower prices. The above-ground political and investment environment are also

crucial. Good macroeconomic management, a lack of corruption, sanctity of contracts, and

a steady regulatory environment encourage investment.

On the other hand, times of very high oil prices can bring political challenges to resource-

dependent countries. The potential benefits of high oil prices are clear, but resource

nationalism took hold in a number of countries during the price boom, with a desire to

maximize governments’ profits from oil and gas development and to keep as much revenue

as possible within each country. This impulse makes sense, but taken too far, such policies

can stifle needed foreign direct investment (FDI) and reduce governments’ overall income

from oil and gas.

Resource nationalism was particularly evident in several South American countries during

the oil price boom. High commodity prices, including for oil, contributed to a populist

political wave that swept through the region in the 2000s. Argentina and Brazil both

experienced this phenomenon, as nationalist policies nearly eliminated FDI in the oil and

gas sector. Brazil focused on maximizing control over its own oil and gas resources, while

Argentina’s economic policies discouraged outside investment in general, not only in oil

and gas. Venezuela provides a sad example of populism and resource nationalism at its

worst, where the government plundered the oil and gas industry to fund other parts of the

economy.

2 | Foreign Policy at Brookings

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

What goes up must come down, and the oil price crash from 2014 to 2017 brought

about important changes in South America’s oil and gas sector. Today’s moderate oil

prices have tempered resource nationalism and brought more long-term thinking to

government and corporate decisionmaking.

NATIONS IN REBOUND—ARGENTINA AND BRAZIL

Argentina and Brazil are both experiencing a rebound in their oil and gas sectors,

encouraged by policy changes that boosted FDI. However, the resource bases of these

two nations are very different, resulting in very different kinds of investments. Argentina’s

new production is occurring in a shale formation, where shorter development cycles

and payback times allow a step-by-step approach to development. Conversely, Brazil’s

resurgence is taking place in the deep-water offshore, requiring companies to make very

large, long-term investments to get in the game. In both of these areas, international

oil and gas companies are hoping that the move away from populism toward a more

investment-friendly environment will persist.

Argentina reaping the benefits of a new resource

Optimism is spreading around the oil and gas sector in Argentina. Changes in government

policy are attracting investment to its world-class unconventional oil and gas resources.

However, challenges remain in developing a new type of resource at competitive cost.

Without foreign capital and expertise, such development would be nearly impossible.

During the Kirchner presidencies, the oil and gas industry suffered along with the larger

economy (Néstor Kirchner was president from 2003 to 2007, succeeded by his wife

Cristina Fernández de Kirchner from 2007 to 2015). Difficulty in obtaining financing,

exchange rate controls, and challenges in repatriating earnings greatly reduced outside

investment in Argentina’s oil and gas sector.

YPF (in Spanish, Yacimientos Petrolíferos Fiscales) is the leading oil and gas company

in Argentina and its history helps to tell the story of oil and gas development there. The

government of Argentina created YPF in 1922, as the world’s first state-owned oil and

gas company. The government privatized YPF in 1993 and the Spanish company Repsol

purchased it in 1999. The Argentine government expropriated YPF in 2012, adding fear

of expropriation to an already challenging investment environment.1 YPF and Repsol

resolved their legal disputes in early 2014, with the Argentine government agreeing to

pay Repsol $5 billion.2

President Mauricio Macri took office in 2015, paving the way for reforms and a more

positive attitude toward foreign investment. Macri’s party consolidated its power with

key electoral wins in the October 2017 midterm elections, encouraging investors that

his economic reforms will continue. Removing capital controls made Argentina a much

better environment for foreign investment. The government removed the last of the

controls, a 120-day delay in repatriating funds from Argentina, in early 2017.3

1 Simon Romero and Raphael Minder, “Argentina to Seize Control of Oil Company,” The New York Times, April 16,

2012, https://www.nytimes.com/2012/04/17/business/global/argentine-president-to-nationalize-oil-company.html.

2 Tracy Rucinski, Andrés González, and Kevin Gray, “Spain’s Repsol agrees to $5 billion settlement with Argentina over

YPF,” Reuters, April 25, 2014, https://www.reuters.com/article/us-repsol-argentina/spains-repsol-agrees-to-5-billion-

settlement-with-argentina-over-ypf-idUSBREA1O1LJ20140225.

3 Reuters Staff, “Argentina ends holding period for foreign capital,” Reuters, January 5, 2017, https://www.reuters.

com/article/us-argentina-economy/argentina-ends-holding-period-for-foreign-capital-idUSKBN14P2E1.

Foreign Policy at Brookings | 3

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

Argentina has some of the world’s largest unconventional oil and gas resources. The

Vaca Muerta shale formation (see Figure 1), located in Neuquén Province, holds an

estimated 21.2 billion barrels of oil equivalent.4 The formation is in an area of existing

conventional oil and gas production—57 percent of Argentina’s natural gas production

and 40 percent of its oil production come from the area today—so some of the

necessary infrastructure is already in place.5 The challenge is establishing the overall

ecosystem for tight oil and gas development in a new area, including such services

as fracking and wastewater management. Economies of scale are important for these

services, meaning that costs are likely to drop as production grows. Drilling costs are

falling rapidly as development proceeds—cut in half from 2015 to 2017.6 The central

government is also planning rail and road infrastructure to reduce logistics costs, with

significant investment from China.7

FIGURE 1: ARGENTINA’S VACA MUERTA SHALE DISCOVERY

Argentina’s shale resources

Vaca Muerta has caught the attention of international investors because it holds one of the

world's biggest deposits of shale resources, with an estimated 23 billion barrels of oil

equivalent. Argentina's state-run energy company YPF has concessions on 40 percent of the site.

Vaca Muerta

MENDOZA shale

CHILE formation

LA Blocks

ARGENTINA PAMPA YPF operated

With YPF’s

Chos Malal participation

NEUQUEN Colorado

river

50 miles

50 km Neuquen

Zapala Neuquen river

"El Orejano"

YPF signed on

RIO NEGRO

Tuesday a preliminary

agreement with Dow

Oil Wet gas Dry gas Chemical to jointly

9,311 fields fields develop shale gas in

sq km 670 sq km 2,019 sq km this block

Sources: Reuters; Non-conventional oil exploration plan for the Neuquen district, YPF

Estudio R. Carrera 28/03/2013

4 BMI Research, Argentina Oil and Gas Report Q1 2018, December 2017.

5 Schlumberger, “Vaca Muerta Shale—Taming a Giant,” Schlumberger Oilfield Review 28 No. 1, January 2016, https://

www.slb.com/~/media/Files/resources/oilfield_review/ors16/Jan2016/04_Vaca_Muerta_Shale.pdf.

6 Paola Carvajal, Consulting Principal, Arthur D. Little. Speaking at the Inter-American Dialogue, March 27, 2018.

7 Canning House, “Newsbase—Latam top story: Macri’s midterm win a boost for oil investment in Argentina,” Canning

House, October 24. 2017, https://www.canninghouse.org/newsbase-latam-top-story-macri-win-boost-oil-investment-

arg/.

4 | Foreign Policy at Brookings

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

To attract investment, the Macri government struck a grand bargain with the oil and gas

sector. The government is offering a price of $7.50 per one million British Thermal Units

(mmBTU) of natural gas produced from new wells in the Vaca Muerta and Austral basins,

declining by $0.50 per mmBTU per year until 2021.8 This price is greater than recent

prices for liquefied natural gas (LNG) delivered to Argentina. However, questions remain

about how politically durable this subsidy is at a time when the central government is

focused on fiscal discipline, particularly as production grows and the subsidy becomes

a greater budgetary strain.

Energy prices and subsidies are becoming an even larger issue as the value of the

peso has declined, losing one-quarter of its value in the past year.9 Energy Minister

Juan José Aranguren was ousted during a cabinet shake-up in June 2018. He was

popular with energy companies, but unpopular with the public for raising consumer

prices for electricity and natural gas. The Macri administration is under strong political

pressure to control energy prices amid rising inflation, but at the risk of stifling oil and

gas investment.

Additionally, high labor costs continue to be a challenge. As part of the subsidy

deal, labor unions in the Neuquén Province signed more flexible contracts, trading a

reduction in labor cost for the promise of additional oil and gas development.10 Strikes

had been common in the area, as high inflation strained the relationship between labor

and management. The province also agreed to stabilize its tax regime for oil and gas

production.11

The development of the Vaca Muerta play also depends on energy cooperation with

Chile. Argentina became a net gas exporter in 2016, but gas demand is highly seasonal.

Today Argentina relies on LNG and imports from Bolivia during the high-demand winter

months.12 In the future, Argentina is likely to export gas to Chile via pipeline in the

summer and import regasified LNG from Chile during the winter months when demand

is higher.

The industry understands Argentina’s past and present fiscal challenges, but the

oil and gas resources in the Vaca Muerta are attractive enough to draw investment

nonetheless. Unconventional investments recover their costs faster than conventional

oil and gas production, meaning that they may be a more palatable investment in an

uncertain environment. Additionally, economies of scale in infrastructure and service

industry capacity will bring cost reductions over time, potentially bringing both oil and

gas from the Vaca Muerta into the cost range of U.S. unconventional resources.13

8 Reuters Staff, “Argentina clinches deal to attract investment in Vaca Muerta shale,” Reuters, January 10, 2017,

https://www.reuters.com/article/us-argentina-gas/argentina-clinches-deal-to-attract-investment-in-vaca-muerta-shale-

idUSKBN14V03N.

9 Benedict Mander, “Macri’s energy reverse unnerves Argentina’s shale investors,” The Financial Times, June 28,

2018, https://www.ft.com/content/3158be92-78b3-11e8-bc55-50daf11b720d.

10 “Macri anunció el plan de explotación de Vaca Muerta: ‘Esto va a ser una revolución del trabajo,’” La Nacion,

January 10, 2017, https://www.lanacion.com.ar/1974553-macri-anuncio-el-plan-de-explotacion-de-vaca-muerta-esto-

va-a-ser-una-revolucion-del-trabajo.

11 Reuters Staff, “Argentina clinches labor/subsidy deal to attract energy investment,” Reuters, January 10,2017,

https://www.reuters.com/article/argentina-gas/argentina-clinches-labor-subsidy-deal-to-attract-energy-investment-

idUSL1N1F00IV.

12 BMI Research, Argentina Oil and Gas Report Q1 2018, December 2017.

13 Javier Iguacel, “The Role for Gas in an Integrated Americas,” Ministry of Energy of Argentina, June 2018, https://

www.argentina.gob.ar/sites/default/files/20180627_-_presentacion_ji_og_world_gas_day.pdf.

Foreign Policy at Brookings | 5

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

BRAZILIAN RESURGENCE, BUT WILL IT CONTINUE?

From 2005 to 2007, Brazil’s national oil company, Petrobras, discovered significant

oil resources in the offshore deep-water pre-salt formation—estimated at 5 to 8 billion

barrels of oil equivalent—one of the world’s largest oil discoveries in recent years.14 (See

Figure 2.) Pre-salt refers to the location of the oil reservoir, below a layer of salt more

than 6,000 feet thick.

FIGURE 2: MAP OF BRAZILIAN PRE-SALT DEEP-WATER OFFSHORE OIL FORMATION

Source: U.S. Energy Information Administration, IHS EDIN.

After the pre-salt discovery, Brazil enacted a number of policies focused on controlling

resource development and keeping as much oil and gas revenue as possible within the

Brazilian economy. In 2010, the Brazilian government set new rules for development of

the pre-salt resource. It took a larger stake in Petrobras, granting it 5 billion barrels of oil

from the pre-salt formation in exchange for the greater ownership share.15 It also required

that Petrobras be the operator in all pre-salt development and that it hold a minimum 30

percent stake in all projects.16 Then-president Luiz Inácio Lula da Silva said these changes

were appropriate because operators in the pre-salt would not be taking on exploration risk,

14 “Country Analysis Brazil: Beta Version,” The U.S. Energy Information Agency, November 21,2017, https://www.eia.

gov/beta/international/analysis.cfm?iso=BRA.

15 “Petrobras’s record share issue—Now comes the hard bit,” The Economist, September 24, 2010, https://www.

economist.com/americas-view/2010/09/24/now-comes-the-hard-bit.

16 “Country Analysis Brazil: Beta Version,” The U.S. Energy Information Agency, November 21,2017, https://www.eia.

gov/beta/international/analysis.cfm?iso=BRA.

6 | Foreign Policy at Brookings

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

stating: “You offer risk-sharing contracts when there is risk. In the case of the pre-salt, we are

sure.”17 Nonetheless, companies developing the pre-salt would still be accepting substantial

operational risk, since accessing the resource requires very deep wells in deep water located

far from shore.

Despite the huge resource base and initial optimism, production in Brazil did not take off

as planned. Although Petrobras has world-class expertise in deep-water production, it was

financially and technically overextended, unable to manage the costly development of the

complicated pre-salt resource. In 2016, Petrobras was the world’s most indebted company,

with total debt of $123 billion.18 The share of natural resources in FDI in Brazil decreased

from its peak in 2010 of 31 percent to 16 percent in 2016—not what one would expect from

a country with one of the world’s largest oil finds.19

Corruption at Petrobras contributed to its financial challenges. Under an investigation that

began in 2014, Petrobras executives were charged with bribery and money laundering.

Petrobras overpaid for contracts for various services, with the extra money used to finance

political campaigns and grease the palms of those involved. Graft and poor management

brought extraordinary cost overruns—for example, construction of the Abrue e Lima refinery

(also known as the Refinaria do Nordeste, or RNEST) exceeded its original budget by a factor

of five. The project is also years behind schedule and only one of its two process trains is

operating today, with the other half 80 percent complete.20 Overall, corruption resulted in

more than $8 billion in losses at Petrobras—money not available for oil and gas development.

The corruption reached the highest level of the company, with former CEO Aldemir Bendine

arrested in July 2017 for requesting bribes from a construction firm.21

Brazil also established strict local content rules, with the goal of maximizing the participation

of Brazilian businesses in the oil and gas supply chain. These local content laws slowed

development and increased development costs, as there was not enough local industry

capacity to meet them.

Despite these challenges, a number of recent developments have brought about a

resurgence in the Brazilian oil and gas industry, many of them undoing the policies that

limited development in the first place. In November 2016, the Brazilian government, under

the more pro-business administration of Michel Temer, removed the requirement that

Petrobras be the operator in all pre-salt development, as a way to attract outside investment.22

17 “Brazil’s oil boom Filling up the future,” The Economist, November 5, 2011, https://www.economist.com/

briefing/2011/11/05/filling-up-the-future.

18 “Country Analysis Brazil: Beta Version,” The U.S. Energy Information Agency, November 21,2017, https://www.eia.

gov/beta/international/analysis.cfm?iso=BRA.

19 Economic Commission for Latin America and the Caribbean (ECLAC), Foreign Direct Investment in Latin

America and the Caribbean, 2017 (LC/PUB.2017/18-P), Santiago, 2017, https://repositorio.cepal.org/bitstream/

handle/11362/42024/4/S1700815_en.pdf.

20 Simon West, “Brazil Petrobras cancels second refinery train at Comperj,” ICIS, July 25, 2016, https://www.icis.

com/resources/news/2016/07/25/10019369/brazil-petrobras-cancels-second-refinery-train-at-comperj/; Jeff Fick,

“Brazil’s Petrobras puts four oil refineries, related infrastructure on sales block,” S&P Global Platts, April 30, 2018,

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/043018-brazils-petrobras-puts-four-oil-refineries-

related-infrastructure-on-sales-block.

21 Luciana Magalhaes, “Former Petrobras CEO Aldemir Bendine Arrested in Corruption Probe,” The Wall Street

Journal, July 17, 2017, https://www.wsj.com/articles/former-petrobras-ceo-aldemir-bendine-arrested-in-corruption-

probe-1501167139.

22 Ted Rhodes, “Brazil’s pre-salt oil reserves: opening up to new operators,” CMS Law Now, November 18,

2016, http://www.cms-lawnow.com/ealerts/2016/11/brazils-presalt-oil-reserves-opening-up-to-new-operators?_

ga=2.71092119.660546157.1493908900-582299354.1481804950.

Foreign Policy at Brookings | 7

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

This change coincided with an agreement among OPEC countries and Russia to pull back

production in an attempt to increase oil prices, a good combination to increase confidence

in Brazilian development. Additionally, Petrobras is undertaking a divestment plan to allow

it to focus on its core competency in offshore oil and gas, leaving it in a better position to

participate in development of the pre-salt resource. From 2017 through 2021, Petrobras

plans to leave the petrochemicals, fertilizer, and biofuels businesses, which total $45 billion

in investment today.23 Finally, for the bid round conducted in October 2017, Brazil relaxed its

local content requirements, by nearly 50 percent in some areas.24

In the first bid round that allowed foreign operators, six of eight blocks attracted bids,

with winning operators including ExxonMobil, Shell, and Statoil. The winning bidders are

those that set aside the maximum amount of production for the Brazilian government.

The winners paid signing bonuses totaling $1.9 billion and will pay as much as 80

percent of their oil revenues to the government after they recover their costs.25 The

second auction in June 2018 was similarly successful, with three of four blocks offered

attracting bids and as much of 75 percent of revenues pledged to the government.26 The

success of these auctions speaks to the quality of the pre-salt resource, with breakeven

costs below $40 per barrel.27

Despite these positive developments, the political situation for oil and gas development

in Brazil is still tenuous. Petrobras CEO Pedro Parente took the job in May 2016 with

a goal of cleaning up corruption and making Petrobras more business-oriented. Under

his watch, the government removed fuel subsidies that had kept Brazilian gasoline

and diesel prices below international levels. This was relatively easy during the low

oil prices of 2016 and 2017, but public discontent rose along with global oil prices

in 2018, culminating in an 11-day truckers strike in May 2018. To end the strike, the

government subsidized diesel sales and Parente resigned. However, the incident brought

the economy to a standstill and demonstrated the Brazilian public’s displeasure with

Temer’s business-friendly reforms.

The policies allowing greater foreign participation in the industry are beginning to deliver

benefits, in terms of current and promised government revenue. Brazil’s October 2018

presidential election could raise serious challenges to FDI in the oil and gas sector.

Former president Lula was a frontrunner in the race until an appeals court in January

2018 upheld his conviction for corruption. He has now begun serving his 12-year

sentence. Lula was the author of the nationalist policies that constrained oil and gas

development in Brazil and favored bringing them back if he regained power.

23 Pedro Parente, Chief Executive Officer, Petrobras. Speech at CERA Week, Houston TX, March 5 2018.

24 Rafael Baptista Baleroni, “Recent developments in the oil and gas industry in Brazil,” Oil and Gas Law News, June

2017, http://www.cesconbarrieu.com.br/arquivos/15030717330.pdf.

25 Marta Nogueira and Alexandra Alper, “Shell bets big on Brazil as oil majors snap up offshore blocks,” Reuters,

October 27, 2017, https://www.reuters.com/article/us-brazil-oil-auction/shell-bets-big-on-brazil-as-oil-majors-snap-up-

offshore-blocks-idUSKBN1CW12W; “Factbox: Winners of Brazil’s pre-salt oil round, Reuters, October 27, 2017, https://

www.reuters.com/article/us-brazil-oil-auction-factbox/factbox-winners-of-brazils-pre-salt-oil-round-idUSKBN1CW2RA.

26 Louis Genot, “Auction of Brazil’s pre-salt oil fields earns $807 million,” Phys.org, June 7, 2018, https://phys.org/

news/2018-06-auction-brazil-pre-salt-oil-fields.html.

27 Sabrina Valle and Peter Millard, “Petrobras Says Deep-Water Opening Luring Big Oil to Brazil,” Bloomberg, October

10, 2016, https://www.bloomberg.com/news/articles/2016-10-10/petrobras-says-deep-water-opening-luring-big-oil-to-

brazil.

8 | Foreign Policy at Brookings

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

The two front-runners for the Brazilian presidency oppose the energy reforms. The

leader at the time of writing is Jair Bolsonaro, a far-right populist and provocateur who

has expressed nostalgia for the Brazilian dictatorship of 1964-85. He has opposed the

privatization of state companies during his time in Congress. On the left, Ciro Gomes

said in an interview recently that he would expropriate all oil and gas assets that have

been sold to foreign companies, “with due compensation.”28 The leading market-

friendly candidate, Geraldo Alckmin, has poll numbers in the single digits. He has

called for privatizing Petrobras to pay down public debt.29 The race increasingly looks

like one between the far-left and far-right, with neither alternative good for continued

development of Brazil’s vast oil and gas resources.

FUNDAMENTALS CATCH UP WITH COLOMBIA

Colombia opened its oil and gas sector to outside investment in 2003. During this low oil

price period, President Álvaro Uribe enacted a number of reforms to attract oil and gas

FDI, including cutting the government’s take of oil revenues and creating the National

Hydrocarbons Agency (Agencia Nacional de Hidrocarburos, or ANH) to streamline

regulation. Colombia also partially privatized its national oil company, Ecopetrol, in

2007. 30

Unlike its South American neighbors, Colombia did not change its terms during the

2008 to 2014 oil price boom, and it was a darling of the oil industry during that time.

Oil production grew rapidly from 2008 through 2013. (See Figure 4.) Yet, since the

oil price decline in 2014, there has been a drop off in new exploration and drilling. In

2012, FDI in the oil sector totaled $5.4 billion, 35 percent of Colombia’s total FDI. By

2016, that total was down to $2.2 billion and 16 percent of FDI. (See Figure 3.)31 In

contrast with Argentina and Brazil, Colombia’s investment environment has become

more challenging after the price decline.

28 Matt Sandy, “AQ INTERVIEW: Ciro Gomes: ‘Brazil Cannot Endure a Leftist Government,’” Americas Quarterly, June

2018, http://americasquarterly.org/content/aq-interview-ciro-gomes.

29 Reuters Staff, “Likely centrist Brazil presidential contender says he would sell Petrobras,” Reuters, February 26,

2018, https://www.reuters.com/article/us-brazil-politics-petrobras/likely-centrist-brazil-presidential-contender-says-he-

would-sell-petrobras-idUSKCN1GA2SB.

30 Lisa Viscidi, “Colombia’s Energy Renaissance,” A Working Paper of the Americas Society and Council of the

Americas, December 2010, http://www.as-coa.org/sites/default/files/ColombiasEnergyRenaissance.pdf.

31 “Colombia FDI Statistics,” Colombia Reports, March 27, 2017, https://colombiareports.com/colombia-fdi-

statistics/.

Foreign Policy at Brookings | 9

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

FIGURE 3: FOREIGN DIRECT INVESTMENTS IN THE COLOMBIAN OIL SECTOR

20

15

Foreign Oil Investments

(in billion dollars)

10

0

03 004 005 006 007 008 009 010 011 012 013 014 015 016 017

20 2 2 2 2 2 2 2 2 2 2 2 2 2 2

Year

Source: https://colombiareports.com/colombia-fdi-statistics/

The boom during the high-price period was largely due to Colombia’s favorable

investment environment, rather than its resource base. Today, discoveries, reserves,

and production are all decreasing. Colombia was still the fifth-largest crude oil

exporter to the United States in 2015.32 But today it only has four and a half years of

reserves remaining at the current rate of production.33 In today’s more modest oil price

environment, Colombia’s modest resource base means it is being left behind in the

competition for investment.

32 “Country Analysis Colombia Beta Version,” The U.S. Energy Information Agency, June 29, 2016, https://www.eia.

gov/beta/international/analysis.cfm?iso=COL.

33 Lorenzo Morales, “Industrias extractivas y Regulaciones Ambientales en el Posconflicto: Preguntas clave para el

nuevo gobierno colombiano,” El Dialogo Interamericano, February 2018, https://www.thedialogue.org/wp-content/

uploads/2018/02/Colombia-Report-FINAL.pdf (page 4).

10 | Foreign Policy at Brookings

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

FIGURE 4: COLOMBIAN OIL PRODUCTION

60

50

(in million tonnes)

40

Oil Production

30

20

10

0

03 004 005 006 007 008 009 010 011 012 013 014 015 016 017

20 2 2 2 2 2 2 2 2 2 2 2 2 2 2

Year

Source: BP Statistical Review of World Energy

An additional challenge to furthering oil and gas development in Colombia is growing

community resistance. A judicial decision in 2016 gave local communities the right

to veto extraction projects. As of December 2017, there were 45 such petitions in

progress.34 Voters overwhelmingly rejected oil and gas and mining in their communities

in the five popular consultations that took place in 2017.35 This community power and

the accompanying bureaucratic processes bring uncertainty to Colombia’s investment

environment. Lower oil prices exacerbated the community-relations challenge. When

there was lots of money to go around, community leaders had more incentive to accept

and smooth the way for projects. The drop in oil prices, plus a change in 2011 in the

way oil and gas royalties were distributed to communities, left some feeling that they

are not being adequately compensated for the disruption these projects bring.

The government of President Juan Manuel Santos has primarily focused on the peace

process with the Fuerzas Armadas Revolucionarias de Colombia (FARC) rebels. This

process could open largely unexplored former conflict areas to development, with

the potential to expand Colombia’s resource base. However, the concerns of local

citizens will have to be considered, and efforts are underway to establish procedures

for consultation. In addition, militant groups have waged persistent attacks on oil and

34 Patrick Gillespie, “Venezuelan refugee crisis adds to Colombia’s growing challenges,” CNN Money, February 22,

2018, http://money.cnn.com/2018/02/22/news/economy/colombia-venezuela/index.html.

35 Matthew Bristow, “Colombia Has Oil, but Voters Want to Keep It Underground,” Bloomberg, September 7, 2017,

https://www.bloomberg.com/news/articles/2017-09-07/colombia-needs-oil-colombians-say-no.

Foreign Policy at Brookings | 11

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

natural gas pipelines, leading to supply disruptions. In 2015, the attacks disrupted

about 41,000 barrels per day of oil supply.36 Companies would need assurances that

such attacks will not continue.

GUYANA’S RESOURCE BASE BRINGS SIGNIFICANT INVESTMENT

Guyana is one of the poorest and smallest countries in South America, with only 800,000

residents. However, significant oil and gas resources were recently discovered in its

deep water offshore. Beginning in 2015 and continuing to the present, an estimated

2 to 3 billion barrels of oil equivalent have been discovered—with the potential to

make Guyana one of South America’s largest oil producers. Production is planned

to begin in 2020 with a floating offshore, production, storage, and offloading facility

with capacity of 120,000 barrels per day.37 To put the discovery into perspective, this

level of production would more than double Guyana’s export revenues. FDI is critical to

developing this new resource.

This discovery represents the beginning of the Guyanese oil and gas industry. The

country is starting from scratch in building the infrastructure, regulatory frameworks,

and institutions to support oil and gas production. Getting the regulatory frameworks

in place while the industry is ramping up is a particular challenge, akin to building an

airplane while flying it. The Guyanese government and the oil and gas industry will

have slightly different goals—establishing a regulatory structure that maximizes benefit

to the Guyanese people (rather than oil company profits) will be crucial as the industry

makes investment decisions.

The International Monetary Fund (IMF) has been working with the Guyanese

government to improve its legal, fiscal, and regulatory frameworks for oil development.

The IMF has raised concerns that the initial deal that Guyana struck with ExxonMobil is

too generous by international standards.38 But ExxonMobil began exploration in 1999

when oil prices were relatively low, and Guyana’s resource potential was completely

unknown. Now that the resource base is better understood, exploration is less risky,

and oil prices are relatively higher, Guyana can and should demand more favorable

terms from future contracts.

The discovery of oil and gas resources has the potential to transform the Guyanese

economy, but this development is not without challenges. In some ways, these

challenges more closely resemble those of less developed countries in Africa and other

parts of the world, more than Guyana’s South American neighbors. Guyana will face

significant challenges in using the oil and gas industry to bring development without

the “resource curse,” where oil and gas revenues bring concentrated wealth and harm

the competitiveness of other industries within the country. Policies that encourage

investments in parallel industries can spread the oil and gas wealth and help prevent

the resource curse. Local content policies can encourage local development and help

local businesses overcome the barriers to entry—such as complicated procurement

36 “Country Analysis Colombia Beta Version,” The U.S. Energy Information Agency, June 29, 2016, https://www.eia.

gov/beta/international/analysis.cfm?iso=COL.

37 “What Lies Beneath Guyana’s Petroleum Future,” Stratfor Worldview, October 30, 2017, https://worldview.

stratfor.com/article/what-lies-beneath-guyanas-petroleum-future.

38 Kevin Crowley, “Exxon Sparks IMF Concern With Weighty Returns in Tiny Guyana,” Bloomberg, April 9, 2018,

https://www.bloomberg.com/news/articles/2018-04-09/exxon-sparks-imf-concern-with-weighty-returns-in-tiny-

guyana.

12 | Foreign Policy at Brookings

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

programs—of working with the large multinational oil and gas companies. Additionally,

gas from the project may be used to produce power onshore, replacing diesel generation

and providing cleaner and less expensive power for development of other industries.

In other areas, Guyana can learn from the experiences of its neighbors. Brazil and

Argentina demonstrate the importance of the policy and investment environment,

including sanctity of contracts and a lack of corruption. Expropriation risk and capital

controls can quickly scare off investors in even the most prospective reserves.

Investors like policy and fiscal certainty when making long-term decisions. Colombia

demonstrates the importance of community support for natural resource development.

Managing the environmental and economic concerns of local communities will be

important as Guyana writes the rules for its development. These constituencies need

to feel that they are reaping enough rewards from development to overcome the

inconveniences it brings. This issue will be somewhat less pressing in Guyana, where

production will be located offshore. Nevertheless, environmental concerns about

offshore development and community concerns about the footprint and operations of

related onshore facilities must be addressed.

CONCLUSION

Resource quality is the most important determinant of oil and gas investment. But great

resources alone are not enough—a favorable political environment is also necessary.

Argentina and Brazil have both enacted policy reforms recently to make their significant

oil and gas resources more attractive for FDI. Both countries are beginning to reap the

benefits of these policies. However, such reforms are politically tricky when they are up

against populist urges to keep local control over natural resource development. Mexico

is also facing such challenges, a topic my colleagues have studied in depth.39

Public pressure to enact populist, rent-seeking policies that ultimately limit oil and

gas investment is especially strong during times of high resource prices. However,

going along with such pressure means that countries can be shut out of investment at

exactly the times when they could reap the most benefits. Argentina and Brazil missed

the boat during the oil price boom of 2008 through 2014. Even if new investment

would not have yielded much production during the price boom, owing to long lead

times, governments could have locked in favorable fiscal terms on investment during

that time. Instead, they demanded everything and got nothing.

Corruption is a central issue in Brazil’s political situation. Widespread corruption in

government and Petrobras has destroyed public trust in institutions. With public trust

that low, citizens do not believe that allowing oil and gas FDI is to their benefit—it looks

like another opportunity for graft.

Guyana must walk a tightrope to develop its significant resources. Guyana needs

foreign investment to develop its oil and gas, but must develop a governance and

regulatory structure that reassures the public that such development is in their interest.

Guyana’s original exploration contracts were signed during a low-price period and

are quite generous to the oil companies. Now that the resource is better understood

and oil prices are a bit higher, Guyana will be able to drive a harder bargain in future

39 Carlos Pascual, David G. Victor, and Rafael Fernandez de Castro, “Will Mexican Energy Reform Survive Political

Transition: What Mexicans Think,” The Brookings Institution, June 2018, https://www.brookings.edu/research/will-

mexican-energy-reform-survive-political-transition/.

Foreign Policy at Brookings | 13

LOWER FOR LONGER: YEARS OF LOW PRICES REWRITE FOREIGN INVESTMENT IN SOUTH AMERICAN OIL AND GAS

contracts. The key is to find a happy medium between reaping maximum benefit for the

Guyanese people and attracting investment. A moderate oil price environment makes

this balance easier.

Additionally, avoiding corruption and regulatory capture, where the industry has too

much say in its own regulation, will be crucial to success. The public must see the

benefits of development spread broadly across the population. The history and present

situation of Guyana’s neighbors provide valuable lessons.

14 | Foreign Policy at Brookings

ABOUT THE AUTHOR

Samantha Gross is a fellow in the Cross-Brookings Initiative on Energy and Climate.

Her work is focused on the intersection of energy, environment, and policy, including

climate policy and international cooperation, energy efficiency, unconventional oil and

gas development, regional and global natural gas trade, and the energy-water nexus.

Gross has more than 20 years of experience in energy and environmental affairs. She

has been a visiting fellow at the King Abdullah Petroleum Studies and Research Center,

where she authored work on clean energy cooperation and on post-Paris climate

policy. She was director of the Office of International Climate and Clean Energy at the

U.S. Department of Energy. In that role, she directed U.S. activities under the Clean

Energy Ministerial, including the secretariat and initiatives focusing on clean energy

implementation and access and energy efficiency. Prior to her time at the Department

of Energy, Gross was director of integrated research at IHS CERA. She managed the IHS

CERA Climate Change and Clean Energy forum and the IHS relationship with the World

Economic Forum. She also authored numerous papers on energy and environment

topics and was a frequent speaker on these topics. She has also worked at the

Government Accountability Office on the Natural Resources and Environment team

and as an engineer directing environmental assessment and remediation projects.

Gross holds a Bachelor of Science in chemical engineering from the University of

Illinois, a Master of Science in environmental engineering from Stanford, and a Master

of Business Administration from the University of California at Berkeley.

ACKNOWLEDGEMENTS

The author would like to thank the following individuals for their assistance and

comments on drafts: Jennifer Perron, Ted Piccone, and an anonymous reviewer.

The Brookings Institution is a nonprofit organization devoted to independent research and

policy solutions. Its mission is to conduct high-quality, independent research and, based

on that research, to provide innovative, practical recommendations for policymakers and

the public. The conclusions and recommendations of any Brookings publication are solely

those of its author(s), and do not reflect the views of the Institution, its management, or

its other scholars.

The Brookings Institution

1775 Massachusetts Ave., NW

Washington, D.C. 20036

brookings.edu

You might also like

- Gas Prices Research PaperDocument5 pagesGas Prices Research Paperafeaynwqz100% (1)

- Oilprice ArticleDocument4 pagesOilprice ArticleGeorge OnyewuchiNo ratings yet

- Working Paper in The Role of Foreign Direct Investment in Resource-Rich RegionsDocument73 pagesWorking Paper in The Role of Foreign Direct Investment in Resource-Rich RegionsFederico PachecoNo ratings yet

- Oil and Gas: A Blessing or A Curse?Document4 pagesOil and Gas: A Blessing or A Curse?Sameer YounusNo ratings yet

- Deloitte Oil Gas and Chemicals Industry OutlookDocument8 pagesDeloitte Oil Gas and Chemicals Industry OutlookNasrul SalmanNo ratings yet

- Ups and downs of oil prices: Will prices continue to fallDocument18 pagesUps and downs of oil prices: Will prices continue to fallmuki10No ratings yet

- Curse or Blessing? How Institutions Determine Success in Resource-Rich EconomiesDocument48 pagesCurse or Blessing? How Institutions Determine Success in Resource-Rich EconomiesCato InstituteNo ratings yet

- Research Paper Oil PricesDocument5 pagesResearch Paper Oil Pricesfvfr9cg8100% (1)

- Written by Nwala Vincent Nkem 20141922873: A Term Paper OnDocument5 pagesWritten by Nwala Vincent Nkem 20141922873: A Term Paper OndanoskiNo ratings yet

- Us Oil and Gas Outlook 2018Document8 pagesUs Oil and Gas Outlook 2018DebasishNo ratings yet

- Negative AssignmentDocument6 pagesNegative Assignmentyoungmoney6996No ratings yet

- Challenges in the Oil & Gas Industry: An OverviewDocument22 pagesChallenges in the Oil & Gas Industry: An OverviewWesam Salah AlooloNo ratings yet

- REGNAULT Oil Rent Ven Econ Crisis For BLISSDocument3 pagesREGNAULT Oil Rent Ven Econ Crisis For BLISSBlasNo ratings yet

- Demand of Petrolium ProductDocument18 pagesDemand of Petrolium ProductSwapnil MurudkarNo ratings yet

- IELR - Resource Nationalism - A Gathering Storm - Mark Clarke Tom CumminsDocument7 pagesIELR - Resource Nationalism - A Gathering Storm - Mark Clarke Tom CumminsdumbledoreaaaaNo ratings yet

- Low Oil PricesDocument6 pagesLow Oil Pricessamira2702No ratings yet

- Microsoft Word - Van de Graaf and Bradshaw - Pre-Print VersionDocument27 pagesMicrosoft Word - Van de Graaf and Bradshaw - Pre-Print VersiondanielaNo ratings yet

- Impact of Crude Oil Price On Indian EconomyDocument5 pagesImpact of Crude Oil Price On Indian EconomySri LakshmiNo ratings yet

- CERI Crude Oil Report - January 2023Document6 pagesCERI Crude Oil Report - January 2023avinash mohantyNo ratings yet

- GenesisDocument12 pagesGenesisGaurav SinghNo ratings yet

- Oil Prices Term PaperDocument5 pagesOil Prices Term Papereeyjzkwgf100% (1)

- Effects of Decreasing in Oil Prices On Global and Saudia Arab EconomyDocument48 pagesEffects of Decreasing in Oil Prices On Global and Saudia Arab EconomyMomal TanveerNo ratings yet

- Oil Glut Illusion: Prices Likely to Rise Again Due to Supply and Demand FactorsDocument9 pagesOil Glut Illusion: Prices Likely to Rise Again Due to Supply and Demand Factorssaisridhar99No ratings yet

- Research Paper Over Gas PricesDocument8 pagesResearch Paper Over Gas Pricesegwv92v7100% (1)

- Advantages and Economic Benefits of Crude Oil TransportationDocument12 pagesAdvantages and Economic Benefits of Crude Oil TransportationRüstəm Emrah QədirovNo ratings yet

- Financing Oil and Gas Projects in Developing Countries: Hossein RazaviDocument4 pagesFinancing Oil and Gas Projects in Developing Countries: Hossein RazaviOmeruo EmekaNo ratings yet

- SPE-191766-MS Assessment of Petroleum Sensitive Countries Economic Reforms in Reaction To Fluctuating Oil PricesDocument13 pagesSPE-191766-MS Assessment of Petroleum Sensitive Countries Economic Reforms in Reaction To Fluctuating Oil PricesGabriel SNo ratings yet

- Cause and Effect - US Gasoline Prices 2013Document7 pagesCause and Effect - US Gasoline Prices 2013The American Security ProjectNo ratings yet

- Report 29-2006Document7 pagesReport 29-2006Kien LeNo ratings yet

- 2015 Outlook On Oil and Gas:: My Take: by John EnglandDocument4 pages2015 Outlook On Oil and Gas:: My Take: by John EnglandsendarnabNo ratings yet

- Delloite Oil and Gas Reality Check 2015 PDFDocument32 pagesDelloite Oil and Gas Reality Check 2015 PDFAzik KunouNo ratings yet

- Oil Price Hike Research PaperDocument7 pagesOil Price Hike Research Paperzwyzywzjf100% (1)

- How oil and gas resources impact economiesDocument4 pagesHow oil and gas resources impact economiesrsjavkhedkar09No ratings yet

- Essay: The Determinants of Oil PricesDocument2 pagesEssay: The Determinants of Oil PricesJennyNo ratings yet

- Paper-Acquistion of Assets WorldwideDocument9 pagesPaper-Acquistion of Assets Worldwidesurbhi0703No ratings yet

- With Fortunes To Be Made or Lost - Will Natural Gas Find Its FootingDocument7 pagesWith Fortunes To Be Made or Lost - Will Natural Gas Find Its FootingdiponogoroNo ratings yet

- Rise of Resource NationalismDocument11 pagesRise of Resource NationalismTuğba YürükNo ratings yet

- Economic Theories AnalysisDocument6 pagesEconomic Theories AnalysisKennethNo ratings yet

- Building An Industry:: Can The United States Sustainably Export LNG at Competitive Prices?Document18 pagesBuilding An Industry:: Can The United States Sustainably Export LNG at Competitive Prices?maiNo ratings yet

- Academic Research Essay On Oil Prices: Prakhar GuptaDocument13 pagesAcademic Research Essay On Oil Prices: Prakhar GuptaPrakhar GuptaNo ratings yet

- What Negative Oil Prices Mean and How The Impact Could Last - The New York TimesDocument3 pagesWhat Negative Oil Prices Mean and How The Impact Could Last - The New York TimesRashed Bin IbrahimNo ratings yet

- Controls On PricesDocument18 pagesControls On PricesSam SaNo ratings yet

- The Increase in Gasoline PriceDocument4 pagesThe Increase in Gasoline PriceKris TineNo ratings yet

- Oil Glut and The New EquationDocument4 pagesOil Glut and The New EquationRothindra Nath GoswamiNo ratings yet

- 2020 Oil, Gas, and Chemical Industry OutlookDocument16 pages2020 Oil, Gas, and Chemical Industry OutlookmapstonegardensNo ratings yet

- Venezuela Negative - UNT 2013Document74 pagesVenezuela Negative - UNT 2013kellybye10No ratings yet

- Oil Price Research PaperDocument7 pagesOil Price Research Paperlrqylwznd100% (1)

- Venezuela Neg - SCDI 2013Document37 pagesVenezuela Neg - SCDI 2013kellybye10No ratings yet

- Root,+journal+manager,+24 IJEEP+6010+mahmood+okey 20180308 V1Document6 pagesRoot,+journal+manager,+24 IJEEP+6010+mahmood+okey 20180308 V1Amit-DuccerNo ratings yet

- DF Unit 2Document2 pagesDF Unit 2Ben ObiNo ratings yet

- Steep Slide in Oil Prices Is Blessing For MostDocument7 pagesSteep Slide in Oil Prices Is Blessing For MostAlvaro Villanueva CastroNo ratings yet

- Because When The Price of Crude Oil Fell in 2014, The Land Rose SignificantlyDocument3 pagesBecause When The Price of Crude Oil Fell in 2014, The Land Rose SignificantlyJulianaNo ratings yet

- Us MA Report Midyear 2014Document20 pagesUs MA Report Midyear 2014xpac_53No ratings yet

- Economics and Energy - IDocument3 pagesEconomics and Energy - IsushiiNo ratings yet

- Lower Oil Prices and The U.S. Economy: Is This Time Different?Document57 pagesLower Oil Prices and The U.S. Economy: Is This Time Different?Valentina RodriguezNo ratings yet

- Oil Crisis - 2023Document4 pagesOil Crisis - 2023imymeweourusyouNo ratings yet

- Financial Performance of The Major Oil Companies, 2007-2011: Robert PirogDocument12 pagesFinancial Performance of The Major Oil Companies, 2007-2011: Robert PirogFederovici Adrian GabrielNo ratings yet

- Oil Prices Core GeorgetownDocument196 pagesOil Prices Core GeorgetownMichael LiNo ratings yet

- Comparing pricing strategies of two gasoline stationsDocument2 pagesComparing pricing strategies of two gasoline stationsVanessa GabroninoNo ratings yet

- Simplicost A Cost Partha System For MsmesDocument3 pagesSimplicost A Cost Partha System For Msmesmkpai-1No ratings yet

- Abba (Nber WP 26744)Document73 pagesAbba (Nber WP 26744)mkpai-1No ratings yet

- Gold Time & Price Predictions For Year 2021: Jan/Feb/Mar 2021 Issue #79Document134 pagesGold Time & Price Predictions For Year 2021: Jan/Feb/Mar 2021 Issue #79mkpai-1100% (1)

- Eliades CyclesDocument17 pagesEliades Cyclesquan lyhongNo ratings yet

- Opalesque European PE & VC Roundtable 2019Document32 pagesOpalesque European PE & VC Roundtable 2019mkpai-1No ratings yet

- Matbel 1 PDFDocument374 pagesMatbel 1 PDFMuhammad Shahzad KhanNo ratings yet

- Vontobel Wealth Management Fees and Conditions ENDocument20 pagesVontobel Wealth Management Fees and Conditions ENmkpai-1No ratings yet

- Vontobel Wealth Management Fees and Conditions ENDocument20 pagesVontobel Wealth Management Fees and Conditions ENmkpai-1No ratings yet

- Model ThinkingDocument103 pagesModel Thinkingairbuk doeing100% (1)

- Opalesque 2019 Diversity RoundtableDocument39 pagesOpalesque 2019 Diversity Roundtablemkpai-1No ratings yet

- EAM Presentation enDocument23 pagesEAM Presentation enmkpai-1No ratings yet

- 2020 Gips Standards FirmsDocument146 pages2020 Gips Standards Firmsmkpai-1No ratings yet

- Ta Course OutlineDocument1 pageTa Course Outlinemkpai-1No ratings yet

- Bearish Ebook enDocument30 pagesBearish Ebook enSumeet GuptaNo ratings yet

- 50 Successful Habits Ebook OnlineDocument60 pages50 Successful Habits Ebook Onlinemkpai-10% (1)

- Personas HKBDocument1 pagePersonas HKBmkpai-1No ratings yet

- Vsta README PDFDocument3 pagesVsta README PDFmkpai-1No ratings yet

- OTA PatentDocument21 pagesOTA Patentmkpai-1No ratings yet

- Mash Req Terms and Conditions Feb 2016Document44 pagesMash Req Terms and Conditions Feb 2016mkpai-1No ratings yet

- A Study of Adjacent 5-Wave FormationsDocument7 pagesA Study of Adjacent 5-Wave Formationsmkpai-1No ratings yet

- HawalaDocument27 pagesHawalaAnonymous WpMUZCb935No ratings yet

- ArcDocument1 pageArcmkpai-1No ratings yet

- Us 5640549Document86 pagesUs 5640549mkpai-1No ratings yet

- Red Hat Enterprise Linux-7-Desktop Migration and Administration Guide-En-USDocument88 pagesRed Hat Enterprise Linux-7-Desktop Migration and Administration Guide-En-USmkpai-1No ratings yet

- Bollinger Bands (20,2) (Upper/Lower) : 2228.316/2080.067: Last 2213.35Document22 pagesBollinger Bands (20,2) (Upper/Lower) : 2228.316/2080.067: Last 2213.35mkpai-1No ratings yet

- Rice PlumbingDocument2 pagesRice PlumbingDigital MediaNo ratings yet

- Introduction To AccutechDocument5 pagesIntroduction To AccutechSaravanramanKoNo ratings yet

- Solar Electric (Photovoltaic) System Cash-Back Reward Pre-Approval ApplicationDocument4 pagesSolar Electric (Photovoltaic) System Cash-Back Reward Pre-Approval ApplicationsandyolkowskiNo ratings yet

- RCEDocument689 pagesRCEHima Consultants EngineersNo ratings yet

- Assumptions and Process Descriptions for LPG Recovery Using Conventional and Petlyuk ColumnsDocument5 pagesAssumptions and Process Descriptions for LPG Recovery Using Conventional and Petlyuk ColumnsmusaveerNo ratings yet

- Conversation QuestionsDocument14 pagesConversation QuestionsMariaNo ratings yet

- Influence of Excitation System Control Modes OnDocument7 pagesInfluence of Excitation System Control Modes OnailsonmouraNo ratings yet

- Errampalli 2018Document19 pagesErrampalli 2018Danang Desfri ANo ratings yet

- Contact Inform 2002 PDFDocument24 pagesContact Inform 2002 PDFFrank AlmeidaNo ratings yet

- Rule 21 Generator Interconnection Basics PDFDocument7 pagesRule 21 Generator Interconnection Basics PDFSe SamnangNo ratings yet

- Tourism Marketing: Presented byDocument36 pagesTourism Marketing: Presented byabimithuNo ratings yet

- RRLDocument4 pagesRRLPatrick John PoNo ratings yet

- Perhitungan Tingkat Diskonto Per Tanggal 26 April 2016: Boim (Ke We) + (KD WD) Ke KRF + Beta KM + SPDocument34 pagesPerhitungan Tingkat Diskonto Per Tanggal 26 April 2016: Boim (Ke We) + (KD WD) Ke KRF + Beta KM + SPIndra GunawanstNo ratings yet

- WCE Files For Deregistration - News ReleaseDocument2 pagesWCE Files For Deregistration - News ReleaseRob NikolewskiNo ratings yet

- An 5232Document17 pagesAn 5232chatty85No ratings yet

- SGS (Elgiznur Cebi)Document2 pagesSGS (Elgiznur Cebi)AamirMalik100% (1)

- 84 A 226035Document6 pages84 A 226035Herman50% (2)

- CNP Company ProfileDocument52 pagesCNP Company ProfileMemory CrushNo ratings yet

- TankTerminals - KnowledgeDocument90 pagesTankTerminals - Knowledgesmartleo_waloNo ratings yet

- TNB GuidelinesDocument132 pagesTNB GuidelinesDaecan Tee83% (6)

- BFPDocument19 pagesBFPpothanNo ratings yet

- Fresh Fruit ReceptionDocument2 pagesFresh Fruit ReceptionhaysnamripNo ratings yet

- Mini Industrial Relay Specs and ApplicationsDocument3 pagesMini Industrial Relay Specs and ApplicationsSami SaadNo ratings yet

- January 2017 - InternationalDocument68 pagesJanuary 2017 - InternationalAlexander Reategui GarciaNo ratings yet

- LT E-Bill PDFDocument2 pagesLT E-Bill PDFAnkita SharmaNo ratings yet

- UL India Laboratory CapabilitiesDocument74 pagesUL India Laboratory CapabilitiesSudeep Karmakar100% (1)

- Ferraz PDFDocument2 pagesFerraz PDFRaymondNo ratings yet

- Flexibilit T Ist Trumpf GB WebDocument8 pagesFlexibilit T Ist Trumpf GB Webzubair1950No ratings yet

- Trane PDFDocument8 pagesTrane PDFRigeNo ratings yet

- Det 773Document90 pagesDet 773Ali AhmadNo ratings yet