Professional Documents

Culture Documents

Wa0023

Uploaded by

Josephe MwiniziOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wa0023

Uploaded by

Josephe MwiniziCopyright:

Available Formats

ADVANCED FINANCIAL MANAGEMENT

SECTION FIVE

Capital budgeting

1. Consider a project whose initial investment is 636,000 and the company expects

to generate annual cash flows of 240,000 p.a. for a period of 5 years. The present

cash flows can be re-invested at the rate of 16% pa and the cost of capital is 14%.

Determine the MIRR.

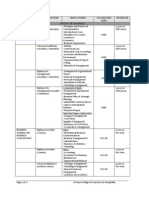

2. Consider the following projects.

Project Initial investment Annual cash flows Economic life

A 10,000 2191.2 7years

B 20,000 5427.84 6years

Required: Determine the IRR for each project.

3. Consider a one year project whose initial investment is 100M. The project is

expected to generate sh.125M at the end of the year.

Required: Compute the IRR of the project.

4. Consider a project whose initial investment is sh 250M. It is expected to generate

annual cash inflows of sh 45M until infinity

Determine the IRR of the project.

5. A company has 4 independent projects with the following features.

A B C D

PVCIF 53 63 103 80

PVCOF 35 40 65 48

NPV 18 23 38 32

The company has a capital limitation of sh 100M. The cost of capital is 10% and any

surplus fund can be invested at a rate of return of 12% pa until infinity. All the 4

projects are indivisible. Determine the optimal project combination.

RISK ANALYSIS IN CAPITAL BUDGETING

Question one

Consider a 5 year project whose initial investment is sh.120M. The annual cash flows to

be generated by the project is estimated using probabilities as follows.

Cash prob

flows

40M 0.3

50M 0.4

60M 0.3

If the cost of capital is 12%, determine the EMV and NPV of the project.

1|Page

C3 - Safaricom Confidential Internal

Question two

ABC ltd is planning advertising campaign in 3 different markets as follows

Market 1 Market 2 Market 2

Fair 10,000 0.4 5,000 0.2 16,000 0.5

Normal 18,000 0.5 8,000 0.6 20,000 0.3

Excellent 25,000 0.1 12,000 0.2 25,000 0.2

Compute the expected value and the standard deviation for the 3 markets

Rank the projects according to the coefficient of variation

Question 3

BEP analysis-sensitivity analysis

Consider the following information about project X

The initial investment is sh. 100,000

Annual revenue 200,000.

The operating expenses excluding depreciation is sh. 170,000

The economic life of the project is 5 years and it is being depreciated using straight

line method and the cost of capital is 10%.

The corporate tax rate is 30%

Required:

Carry out the sensitivity analysis in respect of each key variable in isolation. (Initial

investment revenue and operating expenses)

Question 4 (CEC)

Consider a project whose initial investment is sh. 100,000 and it’s expected to generate

the following cash flows.

Year 1 2 3 4 5

Cash flow 35,000 35,000 35,000 35,000 35,000

CEF 0.9 0.8 0.7 0.3 0.2

The cost of capital is 10% and the risk free rate is 8%.

Required; evaluate the project using the equivalent coefficient factor.

QUESTION 5

Simulation

Consider a project whose initial investment is 40M and the cost of capital is 12%. Its

economic life is 5 years and the following costs and revenues are provided.

Revenues Costs

Amount prob Amount prob

40M 0.15 25M 0.10

50M 0.40 30M 0.25

55M 0.30 35M 0.35

60M 0.15 40M 0.30

2|Page

C3 - Safaricom Confidential Internal

Random no of revenue : 37, 20, 56, 19, 47

Random no of costs : 84, 01, 89, 18, 48

Required: Evaluate the project using the simulation analysis.

REPLACEMENT ANALYSIS

Question one

Replication chain method. (LCM)

Consider the following 2 mutually exclusive projects.

Project X Project Y

Initial cost 100,000 100,000

Cost of capital 10% 10%

Economic life 2 years 3 years

Annual cash flows

1 60,500 60,000

2 60,500 44,000

3 ------ 20,000

Required

a. Determine the NPV of each project

b. Evaluate the project using the replacement chain analysis

Question two

Bond refinancing

Mac ltd issued a 100M par value 16%, 10-year bond five years ago. The bond was issued

at a 2% discount and issuing costs amount to 2M.

Due to the decline in Treasury bill rates in the recent past, interest rates in the money

market have been falling presenting favorable opportunities for the refinancing.

A financial analyst engaged by the company to assess the possibilities of refinancing the

debt reports that a new 100M par value, 12%, 5 years’ bond can be issued by the

company. Issuing cost for the new bond will be 5% of the par value and a discount of 3%

will have to be given to attract investors.

The old bond can be redeemed at 10%premium and in addition, two months’ interest

penalty will have to be paid on redemption.

All bond issue expenses (including the interest penalty) are amortization on a straight line

basis over the life of the bond and are allowable for corporate tax purposes.

The applicable tax rate is 40% and the after tax cost of the debt to the company is

approximately 7%

Required:

a. Cash investment required for the refinancing decision (9 marks)

b. Annual cash benefits (savings) of the refinancing decision (6marks)

3|Page

C3 - Safaricom Confidential Internal

c. NPV of refinancing decision (3marks)

d. Is it worthwhile to issue the new bond (2marks)

PORTFOLIO AND CAPM

Question one

Consider the following 2 securities X and Y which have the following features.

Prob Return of X% Return of Y%

0.3 25 18

0.4 20 14

0.3 15 10

Compute the standard deviation and co-variance btw security X and Y

CAPITAL MARKET LINE

QUESTION TWO

The following information is provided about securities of the company forming the

portfolio.

Portfolio ERP % Standard

deviation %

1 19 8

2 25 12

3 16 6

4 32 16

5 22.5 10

6 8 2

The Expected Return on the market portfolio is 12% and the standard deviation of the

market is 4%. The risk free rate is 5%.

Required;

(a) Using the capital market line advice the investor on which of the above portfolio

are efficient, super-efficient and inefficient

(b) In case of inefficient portfolio in 1 above, determine the standard deviation of the

portfolio for the efficiency to be achieved within the expected returns.

Question two

APM

The shares of XYZ ltd are influenced by the following micro-economic factors as follows.

Factors ER Beta

Inflation 13% 0.95

Industry 10% 1.32

Default premium risk 6% -0.8

The risk free rate is 8%, determine the return of security using APM.

4|Page

C3 - Safaricom Confidential Internal

QUESTION THREE

Performance measures.

Consider a company holding portfolio A & B, the risk free rate is 8% and the expected

return of the market (ERM) is 12% and the standard deviation of the market is 8%.

The following details are also provided.

Portfolio BP std deviation % ERP %

A 1 15 13

B 2 12 18

Required: Evaluate the portfolio using

(a) Sharpe’s measure

(b) Treynors measure

(c) Jensen’s measure

QUESTION FOUR

Leverage

The following data is available for company A

Quantity 20,000 units

Selling price sh.20

Variable cost sh.15

Fixed cost sh.40, 000

Interest sh.10, 000

Pref dividends sh.5, 000

Tax rate 30%

Required:

a. The BEP in units

b. DOL

c. DFL

d. DCL

RIGHT ISSUE.

This is a method of raising equity finance by issuing additional shares to the existing

shareholders at a price below the market price.

Advantages of right issue.

1. It involves less floatation cost since shares are issued to the existing shareholders

who already know the company.

2. It involves less formalities and administration procedures i.e. there is no need for

preparing the prospectus since the shares are sold to the existing shareholders.

3. It increases equity capital and hence reducing the gearing level of the company

4. Ownership and control of the company will not be diluted.

5. It enables the existing shareholders to enjoy the discount offered by the company.

5|Page

C3 - Safaricom Confidential Internal

6. There are minimum legal and administration measures compared to the public

issue.

Disadvantages of right issues.

1. If the shares are not correctly valued, the shareholders may end up paying

additional price.

2. If the shareholders ignores the right issue, his % of ownership will decrease.

The success of the right issue depends on the following factors.

The current market price of the share.

The offer price

Efficiency of the stock market

The number of right issue required to acquire one new share

ILLUSTRATIONS.

QUESTION 1

Laura ltd intends to raise sh.25 million to finance new project through the right issue. The

project has a 10 year economic life with no salvage value and it is expected to generate

cash inflows of sh.7, 372,280. The company has 4 million issued shares. The cost of capital

is 15% and before the announcement of the right issue. The market price per share was

sh. 18.

Required: The cum-rights market price per share.

QUESTION 2

Mhusika ltd is an all equity finance with market capitalization of sh. 720 million. The

company intends to raise sh. 120 million through the right issue to finance a new project.

The current market price per share of the company prior to the announcement of the

right issue is sh.30

The proposed offer price is sh.25. The new project is expected to generate cash-flows of

sh 16.8 million per annum to perpetuity. For the year just ended, the company paid a

dividend per share of sh. 2.83. The project’s cash flows and dividend per share have a

growth rate of 6% per annum.

Required:

(i) The cum-right market price per.

(ii) The number of right.

(iii) The theoretical ex-right MPS

(iv) The value of each right

QUESTION 3

Latex ltd has a paid up ordinary share capital of sh. 4.5 million represented by 6 million

ord shares of sh. 0.75 each. The company has no loan capital. During the last financial

year, EAT were sh. 3.6 million. The P/E ratio is 15 and the company is planning to make a

6|Page

C3 - Safaricom Confidential Internal

large investment which will cost sh.10.5 million and is considering to raise the finance

through the right issue with a price of sh. 8 per share.

Required:

(i) Current market price per share.

(ii) The number of rights

(iii) The theoretical ex-right price per share.

QUESTION FIVE [adjusted NPV)

The management of J ltd is investigating a potential 24M investment. The investment

would be a diversification away from the mainstream activities and into printing

industries.5M of the investment would come from internal funds, 10M by the right issue

and 9M through debt financing.

The project will generate before tax cash flows of 5M pa ,for the 10 years period .The

residual value at the end of the 10th year is forecasted to be 5 M after tax, as the

investment is in an area that the government wishes to develop , a subsidized loan od 4M

out of the total 9M debt is available. This will cost 2% below the normal cost of long term

debt finance which is 8%.

J ltd equity beta is 0.85 and its financial gearing is 60% equity and 40% debt by market

values.

The average equity beta in the printing industry is 1.2 and the average gearing, 50% equity

and 50% debt by market value.

The risk free rate is 5.5% per annum and the market returns 12% per annum. Issue cost

are estimated to be 1% for the debt financing (excluding the subsidized loan), and 4% for

equity financing. These costs are tax allowable. The tax rate is 30%.

Required.

a. Estimated Adjusted Present Value of the proposed investment (16 marks)

b. State the circumstances which the above method is preferred (4 marks)

COMPANY RESTRUCTURING

QUESTION ONE.

A company has the following for the last 5 years

Period 2010 2011 2012 2013 2014

Dividend per share 5 5.5 6 6.5 7.3

The co has just paid the dividend for the year 2014.The cost of equity is 16%

Required:

Using constant dividend growth model, determine the price of the share as at 31 st Dec

2014.

7|Page

C3 - Safaricom Confidential Internal

REAL OPTIONS

OPTION TO DELAY THE PROJECT

QUESTION 1

K ltd is planning to invest in the expansion of its existing production capacity. The

company has estimated 20M as an initial investment. The expansion is expected to

generate 5M after tax cash flows each year for the next 5 years. Assume cost of capital of

10%.

Required;

a. Calculate the NPV

b. Compute the value of option to delay the project assuming the risk free rate is 7%

and standard deviation of the cash flows of 30%.

Question 2

Option to withdraw

A co is considering opening a new branch which will require an initial investment of 1M.

The PV of the cash flows from the project is expected to be 4.2M and the company has

an option to withdraw the project at any time during the next 5 years. If the company

withdraws from the project it will realize 2M. Assuming the standard deviation of the cash

flows is 30% and the risk free rate is 9%, determine the value of the option to withdraw

from the project within the next 5 years.

INTERNATIONAL ARBITRAGE

Consider the following actual exchange rates.

1 Ksh =0.015 dollars

1 TSH =0.0008 dollars

1 Ksh =TSH 20

Required; Compute the gain from triangular arbitrage to an investor with 200,000 dollars

to invest.

MODIGLIANI AND MILLER (JUNE 2005 Q1)

(A)Two firms A ltd and B ltd operates in the same industry. The two firms are similar in all

aspect except for their capital structure.

The following additional information is available:

1. A ltd is financed using sh. 100 million worth of ordinary shares.

2. B ltd is financed using sh 50 million in ordinary share and sh. 50 million in 7%

debentures.

3. The annual earnings before interest and tax are sh 10 million for both firms. These

earnings are expected to remain constant indefinitely.

4. The cost of equity in A ltd is 10%.

5. The corporate tax rate is 30%.

Required:

8|Page

C3 - Safaricom Confidential Internal

Using Modigliani and miller (MM) model, determine the following:

a) The market value of A ltd and B ltd (6 marks)

b) The weighted average cost of capital of A ltd and B ltd (4 marks)

(B)

Proton ltd has a capital structure consisting of sh 250 million in 12% debentures and sh.

150 million in ordinary share capital of sh. 10 each.

The finance manager of proton ltd intends to raise an additional sh. 50 million to finance

an expansion programme and is considering three financing options.

Option one: issue an 11% debenture stock.

Option two: issue 13% cumulative preference shares.

Option three: issue additional ordinary shares of sh. 10 par value

The corporate tax rate is 30%.

Required:

Calculate the EBIT and EPS at the point of indifference between the following financing

options:

a) Option one and option three (6 marks)

b) Option two and option three (4 marks)

9|Page

C3 - Safaricom Confidential Internal

ADVANCED FINANCIAL MANAGEMENT THEORIES.

FINANCE- Is a branch of economics which deals with generating and allocation of the

company’s scarce resources amongst the competing needs of the company.

OBJECTIVE OF THE BUSINESS ENTITY

Profit maximization

Shareholders wealth maximization.

Social responsibility.

Business ethics.

growth

The function of the finance manager can be categorized into 2 categories as follows:

1. Managerial functions.

2. Routine functions.

1. Managerial function.

They are functions that require technical expertise, knowledge of a finance manager and

they include:

Liquidity and working capital management.

Financing function.

Investment or capital budgeting functions.

Dividend policy decision/ Profit allocation function.

2. Routine functions.

This functions o not requires technical skills and knowledge of the finance manager.

Agency theory

An agency relationship exist where one party known as the principal appoints other

known as the agent and gives him the authority to act on his behalf. There are various

type of agency relationship which include;

(a) Shareholders vs. management.

(b) Creditors vs. shareholders

(c) Government vs. shareholders

(d) Auditors vs. shareholders.

Shareholders VS Management/Shareholders versus Managers

A Limited Liability company is owned by the shareholders but in most cases is managed

by a board of directors appointed by the shareholders. This is because:

a) There are very many shareholders who cannot effectively manage the firm all at

the same time.

b) Shareholders may lack the skills required to manage the firm.

c) Shareholders may lack the required time.

10 | P a g e

C3 - Safaricom Confidential Internal

Conflicts of interest usually occur between managers and shareholders in the following

ways:

1. Managers may not work hard to maximize shareholders wealth if they perceive

that they will not share in the benefit of their labour.

2. Managers may award themselves huge salaries and other benefits more than what

a shareholder would consider reasonable

3. Managers may maximize leisure time at the expense of working hard.

4. Manager may undertake projects with different risks than what shareholders

would consider reasonable.

5. Manager may undertake projects that improve their image at the expense of

profitability.

6. Where management buyout is threatened. ‘Management buyout’ occurs where

management of companies buy the shares not owned by them and therefore make

the company a private one.

Solutions to this Conflict

In general, to ensure that managers act to the best interest of shareholders, the firm will:

1. Incur Agency Costs in the form of:

a. Monitoring expenses such as audit fee;

b. Expenditures to structure the organization so that the possibility of

undesirable management behavior would be limited. (This is the cost of

internal control)

c. Opportunity cost associated with loss of profitable opportunities resulting

from structure not permit manager to take action on a timely basis as would

be the case if manager were also owners. This is the cost of delaying

decision.

2. The Shareholder may offer the management profit-based remuneration. This

remuneration includes:

a. An offer of shares so that managers become owners.

b. Share options: (Option to buy shares at a fixed price at a future date).

c. Profit-based salaries e.g. bonus

3. Threat of firing: Shareholders have the power to appoint and dismiss managers

which is exercised at every Annual General Meeting (AGM). The threat offiring

therefore motivates managers to make good decisions.

4. Threat of Acquisition or Takeover: If managers do not make good decisions then

the value of the company would decrease making it easier to be acquired especially

if the predator (acquiring) company beliefs that the firm can be turned round.

ETHICAL ISSUES IN FINANCIAL MANAGEMENT

11 | P a g e

C3 - Safaricom Confidential Internal

Ethic in finance is an act of applied ethics that examines ethical principle and moral or

ethical problems. Business ethics should govern conduct of corporate policy in all

functional area.

1. Ethical objective of the firm.

These are social responsibilities of the company and they include:

Welfare of employees/workers.

Serving customers.

Welfare of the management

Relationship with the supplier

Responsibility to the society.

ETHICAL FUNDERMENTAL PRINCIPLES IN FINANCIAL MANAGEMENT

1. Integrity-a member should be honest, straight forward and sincere in his approach

to professional work.

2. Confidentiality-members should maintain top secrecy during and after

engagement regarding the client business.

3. Professional Competence and due care-member should demonstrate his skills,

knowledge and expertise.

4. Technical standards-a member should perform his work with professional skills.

5. Independence-a member should be free from any form of influence from the

management or any other party.

Independence of mind-is how the practitioner operates without any influence or

bias from any party.

Independence of appearance-relates to how the 3rd party will view the

practitioner.

6. Clients’ money-a member should not participate in misappropriation of the

clients’ money.

7. Objectivity.

8. Professional behavior.

CAPITAL BUDGETING /INVESTMENT DECISIONS.

This involves commitment of funds in long term assets/projects which will generate

benefits in the future.

Features/characteristic of capital budgeting.

They are irreversible projects-once the project is undertaken it will be difficult to

abandon.

They are long term projects.

Requires huge initial capital investments.

The benefits are realized in the future.

They are risky projects.

Types of capital budgeting projects.

12 | P a g e

C3 - Safaricom Confidential Internal

1. Mutually exclusive project-these are projects which are alternate of each other.

Ie they compete against each other and they are therefore substitutes. When one

is undertaken, the others are rejected automatically.

2. Independent projects-they are projects which serve different purpose. They do

not compete against each other.

3. Dependent project/complementary/contingent project-they are projects which

depend on each other and therefore if one project is undertaken, the other project

must also be undertaken.

4. Divisible project-is a project that can start generating inflows even before they are

complete.

5. Indivisible project-Is a project that cannot generate income before they are fully

completed.

Features of an ideal investment appraisal method.

1. It should consider all cash flows.

2. It should give a clear decision on whether to accept or reject a project.

3. It should help in ranking the projects.

4. It should take into consideration time value of money.

5. It should use cash flows rather than profits.

Advantages of using NPV/IRR as a project evaluation method.

1. It takes into account time value of money.

2. It uses cash flows in evaluating the projects.

3. It gives a decision whether to accept or reject a project.

4. It uses all cash flows of the project.

5. It is consistence with shareholders wealth maximization goal.

Disadvantages of using NPV.

1. Cash flows used in evaluating projects are usually estimates.

2. It assumes the cost capital will remain constant during the period of analysis.

DIFFERENCES BETWEEN IRR AND ARR.

IRR ARR

It is a discounting technique It is a non-discounting technique.

It uses cash flows to evaluate a project. It uses accounting profit to evaluate.

It uses all cash flows to evaluate It uses the average accounting profit.

It gives a decision for accepting or It does not give the decision of either

rejecting a single project accepting or rejecting.

Causes of conflict between NPV and IRR.

13 | P a g e

C3 - Safaricom Confidential Internal

1. In case of the difference in the timing of cash flows of mutually exclusive projects.

2. In case of the difference in the size of mutually exclusive projects

3. Difference in economic life of the projects

4. In case of non-convectional income.

CAPITAL RATIONING.

This occurs when there is scarcity of the investment fund i.e. the company has no

sufficient money to undertake all viable projects.

There are normally two types of capital rationing.

1. Soft/internally generated capital rationing.

This occurs when the shortage of the investment fund is as a result of actions of the

management i.e. the shortage is within the control of the management.it occurs due to

the following:

Where the management may refuse to raise additional funds through issues of

new shares to avoid dilution.

To avoid commitment of large payment of interest or installment of the principle

amount in case the company borrows funds.

Where the management has set a limit on the budget.

Where the project can only be financed by internally generated funds.

2. Hard/externally generated capital rationing.

This occurs due to factors not within the control of the management (external factors).it

occurs as a result of the following:

When the capital market is depressed thereby making it impossible to raise

finances.

Cost of capital of issuing new shares may be too high thereby affecting borrowing.

High demand of investment fund by well established companies.

Lack of security/collateral when borrowing funds.

Due to credit policy of the government thereby restricting financial institution to

lend money.

RISK ANALYSIS IN CAPITAL BUDGETING.

RISK-is a chance that some unfavorable event will occur in the future.

Types of risks facing the company.

1. Financial risk

This risk arises as a result of company borrowing funds.

2. Business risk

This refers to fluctuations of the companies’ earnings/declining profits. It is

grouped into 2 as follows:

14 | P a g e

C3 - Safaricom Confidential Internal

a. Systematic risk- is a type of business risk that affects all the companies in

the industry e.g. inflation, interest rate, political instability.

b. Unsystematic risk-this is a risk which affects a specific company in the

industry e.g. strikes, weather.

Sensitivity analysis.

Under this analysis the key financial variables which influence the profitability of the

project are identified and subjected to adverse changes in order to determine their

sensitivity.it is carried out into 2 perspectives:

1. Break even analysis.

2. The impact analysis.

Advantages of sensitivity analysis.

1. It identifies the key financial variables which require further analysis.

2. It improves management by exemption i.e. the finance manager will focus on the

critical key financial variables.

3. It provides more information about the risk of the project by identifying the key

factors.

4. It enables the decision maker to identify and analyses how one factor will affect

the overall profitability.

Disadvantages.

1. Each key financial variable is analyzed in isolation while all other key financial

variable are held constant, however in practice the key financial variables are inter-

related.

2. It does not indicate the profitability of a given change in the variable.

3. It’s difficult to determine and interprets the relationship between the key financial

variables

4. It ignores the risk of the cash-flows.

LEVERAGE.

This refers to the use of the debt in the company’s capital structure. There are normally

3 types of leverage:

Operating leverage.

Financial leverage

Combined/total leverage

1. OPERATING LEVERAGE.

This is the use of the operating costs in order to improve the profitability of the

company

2. FINANCIAL LEVERAGE

This is the use of the financing cost in-order to improve the EPS of the company.

3. COMBINED /TOTAL LEVERAGE.

15 | P a g e

C3 - Safaricom Confidential Internal

This is the use of both operating and financial leverage in-order to increase the

profitability of the company.

SIMULATION ANALYSIS.

Advantages.

1. It is the most suitable method for analyzing long term project where other

techniques may not be applicable.

2. It enables the decision analyst to evaluate various possible combination through

the use of random number.

3. Each key variable factor can be analyzed independently.

Disadvantages.

1. Practically simulation requires the use of computer programme therefore it may

take significant resources.

2. Simulation is not an optimizing technique because it does not give optimal results

of whether to accept or reject a project.

3. It deals with total risk.

4. The probability distribution is usually estimates.

BOND REFINANCING

Is the process of retiring the old bond and issuing a new bond at lower interest rate.

During the period of the declining interest rate, a company might find itself with a fixed

interest security which was issued some years back when the interest rate were very high.

Reasons for bond refinancing

1. Because of declining in the interest rates.

2. Because the company is in better position to repay now compared with the future.

3. Changes in the tax rate leading to change in interest tax shield.

4. Because of less restriction terms and conditions associated with new bond.

5. Because of the capital structure decisions.

Key terms.

1. CALL PREMIUM-this is the penalty for retiring tr bond before maturity period.

2. OVERLAPPING INTEREST CHARGE/EXPENSE-the interest which is paid on the

existing bond after the re-financing but before the amount is received back.is the

interest paid for both bonds.

PORTFOLIO AND CAPM

Portfolio in financial term refers to the collection of investment opportunities or securities

with an aim of minimizing risk. There are normally 2 types of risk facing the company:

1. Financial risk

16 | P a g e

C3 - Safaricom Confidential Internal

This is a risk associated with borrowing funds in the company structure of the

company.

2. Business/operating/total risk

This is the risk associated with declining company’s earnings due to the nature of

the industry. They are either systematic or unsystematic risk

(a) Systematic risk

This is fluctuations of the company’s earnings due to factors affecting all the

companies in the industry e.g. political risk, inflation.

(b) Unsystematic risk

This is fluctuations of the company’s earnings due to factors which affect

specific industry in the market e.g. strike, change in product price.

ASSUMPTIONS OF PORTFOLIO THEORY.

1. Investors prefers more wealth.

2. Investors are risk averse.

3. Returns on portfolio follows normal distribution.

4. It assumes only one existing security.

5. It assumes systematic risks.

6. It assumes there are no economies of scale.

Limitations of portfolio theory.

1. It deals with total risk as measured using standard deviation, however risk can be

minimized by holding a portfolio.

2. It uses historical data to analyze the portfolio and the probability assigned to each

outcome are subjective.

3. It assumes there is no economies of scale which is not correct.

4. It assumes investors are risk averse, however in practice they are risk takers.

5. It assumes all the projects are divisible however in practice indivisible project exist.

6. It can be used to analyze one security.

Investing concepts.

Investing-refers to the employment of funds in an investment during a given period of

time with an aim of enhancing investor’s wealth.

CAPITAL ASSET PRICING MODEL (CAPM)

Is a model used to determine the appropriate required rate of return of an asset to make

decision about adding asset to a well-diversified portfolio.

Types of investments.

1. Real investment

This is the investment in the tangible assets such as machinery, land, factories etc.

2. Financial investments

This involves contracts which are written on papers or in electronic forms e.g.

contract to purchase a stock, bond, fixed deposit account.

17 | P a g e

C3 - Safaricom Confidential Internal

3. Direct investment

This involves investor’s buys and sells financial assets and manages them

individually for themselves.

4. Indirect investing

Here investor’s buy shares in an intermediary company and the intermediary

company or the brokers invests on behalf of the shareholders.(involving financial

intermediary).

Types of investors.

There are 2 types of investors namely;

1. Individual investors-are individuals who invest on their own.

2. Institutional investors-they are entities such as investment companies,

commercial banks, pension funds, which invest on behalf of the shareholders.

Types of investment vehicles/avenues.

These are the investment instruments available to an investor.

1. Financial securities-they are investments which are freely tradable and negotiable.

They include; equity shares, debentures, bonds and money market securities.

2. Non-securitized financial securities-they investment which are not tradable,

transferable nor negotiable e.g. bank deposit, post office deposits, fixed deposits,

life insurance etc.

3. Mutual fund scheme.

4. Real assets-they are tangible assets such as building, land, machinery etc.

Factors to consider when making investment decisions/investment attributes.

1. Rate of return.

2. Risk.

3. Marketability-the higher the marketability of the financial asset, the better the

asset.an instrument is considered to be marketable if it can be transacted quickly

at a lower cost.

4. Taxes.

5. Convenience-this is the ease with which an investment can be made and managed.

Factors influencing the efficiency of a portfolio.

1. Risk exposure.

2. Economic condition.

3. Return.

4. Risk diversification.

Assumption of CAPM.

1. Investors are rational and they prefer greater returns for taking greater risk.

2. The borrowing rate is equal to the lending rate.

3. There are no transaction costs.

18 | P a g e

C3 - Safaricom Confidential Internal

4. There are no market imperfections i.e. it assumes the market is perfect.

5. The model ignores the risk of insolvency.

6. There is no inflation.

7. The return of the security has a normal distribution.

8. Assumes beta factor is constant.

Limitations of CAPM

1. It considers systematic risk alone.

2. It assumes risk free rate will remain constant.

3. CAPM is a single period method therefore cannot be extended.

4. Assumes beta will remain constant.

5. It ignores the risk of insolvency but in real sense the company can enter into

bankruptcy.

Application of CAPM

1. In evaluation of securities.

2. To determine the cost of security.

3. To determine the WACC.

4. Used in capital budgeting.

Differences between portfolio theory and CAPM.

PORTFOLIO THORY CAPM

1. It deals with total risk i.e. It deals with systematic risk i.e. diversified

undiversified portfolio portfolio

2. Risk is measured using standard Risk is measured using beta factor.

deviation.

3. It uses capital market line equation. It uses security market line equation

4. The standard deviation of the The beta factor of the market is always 1

market is not equal to 1

THE ARBITRAGE PRICING MODEL (APM).

This model was developed due to limitations of CAPM, unlike CAPM the model is a multi-

factor model i.e. the model assumes that there are several factors which will influence

the return of the security. The model is also a multi period model.it is based on the

following assumptions:

1. The capital market is perfect and efficient.

2. Investors prefer more returns.

3. Return of a security is generated through continuous buying and selling of security.

Differences between CAPM and APM

APM CAPM

1. It’s a multi factor model It’s a single factor model.

2. It’s a multi period model. Is a single period model

3. Return of the security does not The security return follows normal

follow normal distribution. distribution.

19 | P a g e

C3 - Safaricom Confidential Internal

LEASING

This is a contract between two parties where one party known as lessor (owner) gives

another party known as lessee the right to use the asset and enjoy the benefits and risk

associated with the utilization of the asset.

Types of leases.

(a) Operating lease.

(b) Finance lease.

(c) Sell and leaseback lease.

(d) Leverage lease

.

(a) Operating lease/off balance sheet lease.

This is a short term lease.it has the following characteristics:

The lease period is very short relative to the economic life of the asset.

The lease contract can be cancelled by either party any time before end of lease

period.

The owner (lessor) incurs maintenance, operating and insurance expenses of the

asset.

The lessee is not given an option to buy the asset at the end of lease period.

(b) Finance lease/capital lease.

This is long-term in nature and the lease period is almost equal to the economic life of the

asset.

Characteristics.

The lease period should be at least equal to 75% of the asset economic life.

The lease contract cannot be cancelled by either party before lease period

matures.

The lessee incurs all maintenance cost.

The lessee is given an option to buy the asset at the end of lease period.

Advantages of leases.

1. Lease do not involve strict terms and conditions associated with long term debts.

2. Leasing has lower effective cost compared to long term debts.

3. It does not require a significant initial capital investment compared with cost of

buying new asset.

4. It reduces the risk of obsolescence.

5. It provides off-balance sheet financing i.e. operating lease are shown as foot notes

to the financial statements.

FINANCIAL DISTRESS.

20 | P a g e

C3 - Safaricom Confidential Internal

This refers to the events that occur when the company is facing financial problems. They

include bankruptcy, where the company is unable to meet its financial obligations. A firm

going through financial distress may not necessarily fail but may survive or may be in

position to identify surviving strategies.

Forms of financial distress.

1. Technical insolvency.

Refers to a situation where the company is unable to meet its current financial

obligation.

2. Legal bankruptcy.

This is where the company is declared bankrupt by the company’s act, hence it will

be taking liquidation process under receivership.

3. Economic failure.

The company’s revenue is insufficient to cover all costs incurred on the capital

expenditures.

4. Business failure.

Refers to any businesses that have terminated its operations due to accumulated

losses.

5. Flow based insolvency.

It occurs when the operating cash-flows of the form are not enough to meet its

obligations.

Types of financial distress cost.

1. Direct distress cost

2. Indirect distress cost

3. Agency costs.

DIRECT DISTRESS COST.

These costs include

Sale of the company assets so s to improve the financial position of the company.

Changing the dividend policy of the company, so as to meet the financial difficulties

of the company.

Avoiding investing in profitable projects considered to be risky.

If the company is put under receivership, the bankruptcy cost will include legal fees

and the management expenses.

INDIRECT DISTRESS COST.

THEY INCLUDE:

High cost of borrowing.

High labour turnover which will affect the company’s productivity.

Lost sales due to fear or lack of trust from the customers

Mangers may take some actions to save the company which may affect the

company in the long run.

AGENCY COST.

21 | P a g e

C3 - Safaricom Confidential Internal

These are costs incurred by the company as a result of the conditions set by the debt

holders in order to protect their interest in the company. They include conditions like:

1. No payment of dividend unless the earnings of the company exceeds a particular

limit.

2. No additional loan capital that should be raised by the company unless the current

borrowed amount has been reduced to a particular amount.

3. The cost of the capital and other costs paid to the agent who are appointed to the

company’s BOD in order to protect the interest of the debt holders.

4. No investments in particular projects which are considered to be risky by debt

holders.

Indicators of financially distressed company.

1. Reduction I the dividends per share.

2. Closing down the branches of the company.

3. Retrenchment of staffs.

4. Accumulated losses

5. Top managers resigning from the company.

6. Operational inefficiencies.

7. Slow moving items leading to obsolescence.

8. Frequent losses.

9. Loss of key customer/staff/supplier.

10. Inability to meet clients demand.

OPTIONS AT THE TIME OF FINANCIAL DISTRESS

1. Disposing off some unnecessary assets

2. Mergers

3. Making special arrangement with the creditors.

4. Issuing more shares.

5. Liquidation.

6. Retrenchment.

7. Delay payments as much as possible.

8. Merging of departments.

Causes of financial distress/corporate failure

Mismanagement.

Competition

Technological innovation.

Political instability.

Government policies-tax structure, labour laws.

Operational inefficiencies.

Resignation of top management personnel.

PREDICTIONS OF THE CORPORATE FAILURE.

22 | P a g e

C3 - Safaricom Confidential Internal

Continuous decline of the share price of the company’s stock.

Delay/default in the repayment of the bank loan.

Delay/default in payment of creditors.

Legal cases pending in the court

Poor maintenance of company’s assets/facility.

MODELS OF PREDICTING CORPORATE FAILURE.

1. ALTMAN Z-SCORE MODEL.

This model combines various ratios in order to determine whether the

company is a going concern.

The decision criteria is made as follows:

A company with a Z score of less than 1.8 indicates failure.

A company with Z score of greater than 2.7 indicates success or non-

failure.

A company with Z score between 1.8-2.7 indicates equal chances of

success or failure.

Applications of Z score model.

1. To evaluate the performance of the company’s manager.

2. To predict the corporate failure in the local companies.

3. To determine whether a company is a going concern.

4. To determine whether the company can enter into strategic alliances or mergers.

Weaknesses of Z- score /limitations.

1. It does not take into account all ratios that measures the company performance ie

profitability ratios, gearing ratios, liquidity ratios etc.

2. It uses historical data which may not be accurate in predicting current and future

performance.

3. It uses financial data which are likely to be manipulated by the management in

order to reflect the favorable picture of the company.

4. The sample of the variable may not be random.

5. There is not cost function for type one error and type two error.

6. It does not consider the tax effect when evaluating the performance.

2. BEAVER’S MODEL.

This uses the ratios to identify companies which are likely to fail within the next

five years of their operation. The key ratio is.

Operating cash-flows

Long term and short term liabilities

If the ratio is less than 0.3 there is 70% chance that the company is likely to fail

in the next five years.

3. ARGENTIS’ MODEL.

23 | P a g e

C3 - Safaricom Confidential Internal

This model is based on the calculation of scores related to company defects,

management mistakes and symptoms failure. This model was developed by

Argentis .According to him, there are 3 types of classifications of firms

(a).TYPE I ERROR-

This is where the firm fails to start and it is usually encountered by small firms.

(b).TYPE II ERROR-

This is where the manager of the firm are too much ambitious or charismatic

beyond the capacity of the firm. This will cause the firm to fail.

(c).TYPE III ERROR-

In this case big companies fail because they are unable to adopt the new

technology or new environment.

4. TAFFLER’S MODEL.

This model is based on the following series of ratios.

Sales/total asset

The current ratio.

The reciprocal of the current ratio.

Earning before tax/current liabilities.

There is yet insufficient evidence to determine this model predictive qualities.

5. FULMER MODEL

6. ZETA MODEL

7. SPRINGATE MODEL

This model was developed in 1973 and the developer comes up with the

following ratios:

SP=1.03A+3.07B+0.66C+0.4D

Where: A=working capital /total assets

B=EBIT /Total asset.

C=EBT /total current liabilities

D=sales /total asset

If SP<0.862……..FAILURE

8. CONDITIONAL PROBABILITY MODELS.

Use of conditional probability model to replace discriminate analysis.

9. THE USE OF CAPITAL MARKET DATA.

Lack of relevance, reliability, timeliness and consistency in accounting variables

diversification in failure prediction models.

10. INFLATION ACCOUUNTING AND FAILURE PREDICTION.

11. THE USE OF NON-FINANCIAL INDICATORS.

MERGER AND ACQUISTION

24 | P a g e

C3 - Safaricom Confidential Internal

MERGER is a combination of 2 or more equally companies to form a new entity. The

original companies will lose their original identity after the other and none of them will

dominate the other.

ACQUISITION or TAKE OVER is the situation where one company known as Predator will

acquire the other company known as the Target. After the acquisition the target will lose

its identity but predator will maintains its identity.

TYPES OF MERGER AND ACQUISITION.

1. Horizontal merger/acquisition

This is the combination of 2 or more companies in the same line and type of

business. The main purpose of horizontal merger is to improve the market share

of the 2 companies.eg ICEA & LION were all insurance companies.

2. Vertical merger.

This is the combination of 2 or more companies which are in different level of

production but in the same industry.eg vehicle assembling company with tyre

manufacturing company.

3. Conglomerate merger

Its combination of 2 or more companies which are unrelated. They are from

different industries and different level of production. The purpose for this is for

risk diversification.eg Sameer group of companies.

REASONS FOR MERGER & ACQUISITION/ADVANTAGES OF MERGER.

1. Risk diversification

Especially for a conglomerate merger where 2 companies merge forming a

portfolio that will maximize returns and minimize risk.

2. Asset acquisition/asset backing.

Where a merger takes place or an acquisition, the assets of other companies

belongs to the same group of companies .This makes it cheaper instead of

purchasing new assets and this includes human resource.

3. Asset breakup value

This is where a predator acquires the target and starts selling the assets of the

target to realize more value.

4. Empire building.

Top management or shareholders of the company would be assumed to be having

a big impact economically when they control big companies as a result they

increase the market share and works toward monopoly.

5. Tax saving

Companies would have tax shield benefits when they acquire company with large

losses, these losses will offset the profit of the acquired thus reduce the tax

payment.

6. Management acquisition

25 | P a g e

C3 - Safaricom Confidential Internal

Companies would acquire or merge with other for the purpose of owning the top

management of the other company since some top management may not be ready

to move to other company regardless of the offer given.

7. Defensive merger.

Companies merge or acquire other in-order to avoid a hostile takeover.

8. Financing and liquidity.

Companies merge with other in-order to improve their liquidity especially when

the company to be acquired is financially stable.

9. Synergy

This is the additional benefit associated with economies of scale after the merger

and the acquisition synergy is divided into 4 as follows:

Operational synergy-this will result from the economies of scale and

complementary resources which can be shared among the two companies.

Managerial synergy-this will result from the combination of the

management teams.

Financial synergy-this will lead to a decrease in the fluctuation of the cash

flows and the cost of borrowing.

Combinations of operational, managerial and financial

Synergy is not always achieved in practice due to the following reasons.

Lack of complete information before merger and acquisition.

Inability to accurately take and measure the synergy.

Because of being too optimistic about the potential benefits of the merger and

acquisition.

Lack of motivation on the part of managers to achieve the additional benefits.

Because of the payment of the high premiums on the acquisition of the target

Integration problems such as cultural differences.

Steps used in merger and acquisition.

1. Merger and acquisition strategies

2. Merger and acquisition criteria to be used.

3. Identification or searching for a possible target.

4. Merger and acquisition planning.

5. Evaluation of a merger including identification of possible benefits.

6. Negotiation of the merger and acquisition agreements.

7. Due diligence on the target.

8. Purchase and sell of contract/assets.

9. Financing strategy planning.

10. Closing and integration of the merger and acquisition.

HOSTILE TAKEOVER

26 | P a g e

C3 - Safaricom Confidential Internal

This is where one company known as predator takes over target and in this case target

would be unwilling on the takeover strategy.

Indicators of the hostile takeover in a target company.

1. Resource mismatch hypothesis.

In this case the target company will have a potential of good performance but due

to unavailability of sufficient resources the company becomes an easy target for a

hostile takeover.

2. Size hypothesis.

In a highly competitive market, bigger company will easily take over small

companies. When a company is smaller in size ten it becomes an easy target for a

hostile takeover.

3. Price earnings ratio hypothesis

When the P/E ratio of a company is small, Then it means that the market value of

that company is also small and this makes it an easy and cheap target for a hostile

takeover.

4. Industrial disturbances hypothesis.

Companies may have frequent industrial disturbances e.g. frequent employees

strikes or gov’t disturbances.

5. Management inefficiencies hypothesis.

Top management may be unable to develop strategies to avoid a hostile takeover

or may be unable to identify the signs of a hostile takeover.

STRATEGIES TO AVOID A HOSTILE TAKEOVER.

1. Sell of crown jewel.

This is where the target company would sell the most attractive assets leaving

them a skeleton and unattractive.

2. Use of packman defense

This is where the target gives a counter offer to acquire the predator and in the

process the predator would back down because of the threat of being taken over

by the perceived small company.

3. Use of white knight/white squire.

This is where the target company would be taken over by a friendlier company to

avoid a hostile takeover or merge with a friendlier company i.e. have a defensive

merger.

4. Use of golden parachute.

In this case the target company would give attractive retirement package to top

management and employees upon retirement or resignation. This would scare the

predator since the predator would fear taking over the target and all over the

27 | P a g e

C3 - Safaricom Confidential Internal

sudden required to pay pension benefits to employee who would decide to resign

and this would leave the target company a skeleton.

5. Use of poison pills.

In this case the target would use mainly borrowing to finance its assets and this

would make the target unattractive since the capital structure mix would have

more leverage than use of equity.

6. Share repurchase option

In this case the target would repurchase shares issued to the public that the

original shareholders owns the share through a repurchase scheme. This would

protect the target from predator who held the major shareholders.

7. Use of dividend policy

The target company may set a very costly dividend policy that the predator would

be unable to maintain. This would scare away the predator.

8. Use of legal redress.

This involves seeking court protection against a hostile takeover and the court

would give the required protection.

9. Issue of frequent profit forecasts.

In this case the target company will issue profits warning which will increase their

market value of the same time and hence becomes unattractive to the predator.

10. Use of shark repellant.

This is the use of super majority where the target would amend the AOA to ensure

that a super majority or an achievable majority of vote would have to decide

whether the takeover would be necessary or not.

FORMS OF CONSIDERATION IN CASE OF MERGER OR ACQUISITION.

1. Cash payment.

This is where the predator will pay cash to acquire the shares or the assets of the

target.

2. Share for share exchange.

In this case, there is no actual cash flows but the shareholders of the target will

surrender a given number of their shares in order to acquire a given no. of the

predator’s shares. This is known as EXCHANGE RATIO. This has the following

implications:

It conserves cash on the predators company.

There will be increase in the equity capital of the predator company leading

to the decrease in the financial risk.

It will dilute the ownership and control of the predator’s company.

The shareholders of the target company will gain control in the predator’s

company.

3. Use of convertible securities.

28 | P a g e

C3 - Safaricom Confidential Internal

This is where the predator will use convertible securities such as debentures or the

convertible preference shares. This will have the following implications:

It conserves cash on the predators company.

It will not dilute the ownership and control of the predator company.

It will lead to an increase in the financial risk of the company.

VALUE GAPS

This arises from the face that the value of the company acquired is different from the true

market value.it can either be higher or lower depending on the market circumstances. If

it’s higher than the shareholders of the target will get additional benefits. It is also refers

to a situation where the amount paid for the merger/acquisition of the target is more

than its true current market value.

Causes that gives rise to value gaps in merger.

Poor parenting by headquarter.

Poor financial management.

The stock market inefficiencies.

Over-enthusiastic bidding-this normally occurs when the management accepts the

highest offer in order to acquire their businesses. This may not be the market value

of the company.

This is analyzed as follows. (JUNE 2013 Q5C)

The minimum amount to accept by target=P/E ratio ×EPS

Total value of shares (target) =P/E ratio × total earnings.

9×390=3510.

Maximum amount to pay by predator.

= (combined P/E ratio × total combined earnings) –current market value of predator

12× (390+693+125) – (13 × 693) =5487

CAUSES/REASONS WHY MERGERS FAILS.

Cultural differences after merger and acquisition.

Lack of time after merger on part of managers.

General fear-this might arise due to technological development.

Expected synergy may not occur.

Political interferences

Failure in coordination and communication

Social differences

Value gap

Poor corporate parenting.

Lack of experienced experts in mergers and acquisition.

29 | P a g e

C3 - Safaricom Confidential Internal

BUSINESS RESTRUCTURING AND REORGANIZATION.

RESTRUCTURING-is the process of changing the capital structure of the company and it’s

carried out as part of corporate restructuring.

Corporate restructuring is categorized into 3 as follows:

1. Financial restructuring.

2. Portfolio restructuring.

3. Organizational restructuring.

FINANCIAL RESTRUCTURING

This is where the capital structure of the company is changed and its normally carried out

by companies that are facing financial problem.

Reasons for financial restructuring.

a. To reduce the debt of the company to a manageable level.

b. To stabilize the company so that investors will inject more capital.

c. To enable the company to concentrate on its core business activities

d. To avoid liquidation of the company.

e. To revalue the assets of the company in order to determine whether the company

is undervalued or overvalued.

Types of financial restructuring skills.

1. Internal scheme.

2. External scheme.

3. Debt-equity swaps.

4. Equity-debt scheme.

5. Share repurchase scheme.

BUSINESS REORGANIZATION.

This is the process which involves a change in the organization of the business in order to

improve on operations of the company.it has the following importance;

a. Enhance the performance of the business.

b. Tackles competition in the market.

c. Reduces the operating costs of the business.

d. Solves the existing problems in the functioning of the organization.

Objectives of business re-organization.

1. In order to reduce the after tax cost of borrowing.

2. Improve the security of finance.

3. To clean the balance sheet of the organization.

4. Settle loan immediately.

5. Improve the financial image of the company.

Types of business reorganization.

1. Portfolio reorganization.

30 | P a g e

C3 - Safaricom Confidential Internal

This entails the change in the balance sheet and the business structure through a

change in the asset mix, business units, lines of operation in order to improve the

performance of the company.it also involves the acquisition of the new assets or

disposing off non-performing assets to enhance and improve the returns on the

assets. This process is known as unbundling.

UNBUDDLING-it’s a strategy of portfolio reconstruction where the assets of the

company, the line of production and the operating branches are disposed off or

separated from the parent company in order to improve the performance of the

existing company.

The process is divided into as follows:

(a) Voluntary unbundling

This may be undertaken for the following reasons.

Improving the performance of the existing company.

Enhance value of the existing company.

To dispose off underperforming or non-performing assets of the business.

To improve the functioning of the division.

(b) Compulsory unbundling

This is necessary in the case of hostile takeover or government policy decision. The

following are some ways of unbundling the company:

a) Divestment.

b) Mergers/demerger

c) Spin-off

d) Sell-off

e) Equity

f) Liquidation

g) Management buy out

h) Management but in.

1. DIVESTMENT.

This is the withdrawal of investment in the business. This can be achieved either by

securing the entire business or part of the business.

2. MERGER AND DEMERGER.

Demerger is where the company is now split into 2 or more separate business entities.it

aims to create a new business entry which will enhance the value of the original company.

Reasons for demerger.

Focus on the core business activity.

To create separate business entity that will specialize in the respective business.

To comply with the regulations in the industry.

To increase the total returns of each individual unit.

31 | P a g e

C3 - Safaricom Confidential Internal

3. SPIN-OFF

It involves the creation of one or more new independent business entity from the existing

company without transferring the ownership to the outsiders. Spin-off is made due to the

following reasons:

(a) To improve the efficiency in the operation of the separate business entity.

(b) Diversify business operations.

(c) To enhance business to perform better by allowing them to concentrate on core

activities.

4. SELL OFF

Is a type of divestment which involves sell-off part of assets/division of the company for

cash? It’s made due to the following reasons.

a) To realize cash to meet the current obligation when they fall due.

b) To improve the performance of the entire group by eliminating the loss making

units.

c) To make the company unattractive on the hostile takeover

5. EQUITY/CURVE OUT.

This involves creating a new company separating the existing assets of the company in

order to create new equity shares which are then issued to the public through the stock

exchange.

6. MANAGEMENT BUY-OUT

This occurs when the executive managers of the business joins the financing institutions

in order to buy the business they are currently managing.

It is also the process which takes place when the business units or the subsidiary is sold

to the executive managers of the company.

It is therefore a form of investment in the company by managers who acquires the shares

of the company.

7. MANAGEMENT BUY-IN.

This is where a group of managers outside the business acquire the business.it takes place

when a business is sold to a team of professionals outside the management team.

ORGNIZATIONAL RESTRUCTURING/RE-ORGANIZATION

It entails the change in the organizational structure of the company so as to change the

following:

I. Management hierarchy.

II. Workforce of the company.

III. Decision making process.

IV. Supply chain.

It’s normally undertaken in order to:

To make the decision making process less complicated.

32 | P a g e

C3 - Safaricom Confidential Internal

To reduce the misuse of the company’s resources.

To improve coordination between various departments.

To enhance overall performance of the company.

INTERNATIONAL FINANCIAL MARKETS AND INSTITUTIONS

International money market.

This is the market with partied located outside the country domicile.it is also known as

Euro currency market, where large companies are able to borrow.

EURO CURRENCY MARKET.

It is a market where borrowing and lending is through the bank of currencies other than

the bank of the home currency. These loans are generally short term, usually between

the banks.

The main function of this market is to finance the international trade.

The euro currencies are currencies held outside the country of origin.

INTERNATIONAL CAPITAL MARKET.

These are integrated capital market that deals with the international stock bonds and

foreign currencies which are part of their transactions. Therefore these markets assist

larger companies to raise fund to finance long-term projects. They include:

(a) Euro bond-they are bonds that are dominated in a currency, different from that of

the country in which they are issued.

(b) Foreign bonds-they are bonds that are dominated in the currency of the country

in which a foreign entity issues the bond.

(c) Euro equity-they issues securities which are exchanged in the listed companies

across the world.

Primary drivers of the international capital market.

1. Advancement of technology-the use of internet and computer to facilitate the

growth of the capital market

2. Deregulation-deregulation of the market by allowing not only domestic investors

to investing the foreign market, has facilitated the growth of the capital market.

3. Development of financial institutions-new financial institutions like the forward

market and future market have contributed to the growth of the capital market.

Motives for investing in the international capital market

1. To take advantage of favorable economic conditions.

2. To take advantages of appreciation of the foreign currency against the domestic

currency.

3. To benefit from international diversification.

4. Access to foreign commodities or product.

Aims of regulating financial market.

1. To prevent cases of market manipulation such as insider trading.

2. To ensure competence of the providence of financial services.

33 | P a g e

C3 - Safaricom Confidential Internal

3. To protect clients interest and investigate their complaints.

4. To maintain confidence in the financial system.

5. To reduce violation of the financial laws.

Benefits accruing from international trade and cross boarder investment

1. Financial integration.

2. Benefits for competition in the international market.

3. Aid in the benefits of economies of scale.

4. Benefit for the consumers-consumer has a wide access to variety of products.

Benefits of mobile money transfer.

1. Security.

2. Convenience.

3. Reduced cash in the economy.

4. Low cost

5. Financial inclusion.

6. Mobility.

MARKET SEGMENTATION.

It is a financial market imperfection caused mainly by government constraint institutional

practices and investors’ perceptions. Therefore, they are event which make the market

to be inefficient.

Causes of capital market segmentation.

1. Lack of transparency.

2. High securities transaction costs.

3. Foreign exchange risks.

4. Political risks

5. Corporate governance differences.

6. Regulation barriers

7. Asymmetrical information between the domestic and foreign based investors.

INTERNATIONAL MONETARY FUND (IMF)

Benefits of IMF

1. To promote international monetary cooperation.

2. Assisting in stabilizing the currencies.

3. To facilitate the expansion and balanced growth of the international trade.

4. To promote the exchange rate stability.

5. To shorten the duration in the international balance of payment of the members.

6. To make resources available to its member who are experiencing BOP difficulties.

Activities of IMF

1. Financial assistance-this includes the credit and loan extended to the IMF member

countries.

34 | P a g e

C3 - Safaricom Confidential Internal

2. Technical assistance-this consists of the expertise and procedure which are

extended to the members in handling the accounting transaction.

3. Training official in financial matters for member countries.

WORLD BANK

It was established as a multi-lateral lending agencies focusing on the projects with long-

term implications.

The objective was to promote economic and social progress in developing nations by

helping to raise the productivity so that their people can live better lives. The sources of

finance for the bank include:

1. Equity-this was capital contributed by member countries when joining the

association.

2. Bonds-this was the amount raised from the world financial markets.

3. Private markets-these were finances from investment banks and commercial

banks who were lending money to the institution.

Reasons for the success in raising borrowed funds in the institution.

1. Supportive conservative lending policies.

2. Strong financial backing by its members.

3. Prudent financial management.

Types of projects assisted by the bank.

Health care. .education

Family planning assistance .housing

Nutrition .infrastructure

FINANCIAL INNOVATION.

This can be defined as an act of creating and then popularizing new financial instrument

as well as new financial technologies.

Factors that have led to financial innovation/engineering

1. Increased interest rate fluctuations.

2. Frequency of tax and regulation changes.

3. Deregulation of financial service industry.

4. Increased competition within the investment banking.

5. Technological advancement.

6. Accounting benefits.

7. Changes in prices.

8. Opportunities to increase the asset liquidity.

9. Opportunity to reduce risk

10. Transaction cost

Types of financial innovation.

35 | P a g e

C3 - Safaricom Confidential Internal

1. Security innovation.

2. Financial process innovation.

3. Creative solutions to the corporate finance problems.

1. SECURITY INNOVATIONS.

It is the development of the innovation financial instrument for consumer type

applications and the corporate finance application. Examples include.

New bank accounts for customer’s e.g. personal loan, credit cards, savings

account.

Swaps using caps and floors.

2. FINANCIAL PROCESS INNOVATION

This aims at to reflect the effort in reducing the transaction costs and the steps

taken to reduce the idle cash balance and the availability of inexpensive computer

technology to facilitate transaction.

Examples of process innovation include.

Online banking.

Use of ATM’s

3. CREATIVE SOLUTIONS TO CORPORATE FINANCE PROBLEMS.

This involves corporate restructuring, which aim at managing the financial issues.it

involves tax effect cash management strategies. Examples include.

Leases.

Project finance.

Corporate restructuring.

FINANCIAL ENGINEERING.

It is defined as application of technical methods especially from mathematical finance.

FINANCIAL INTERMEDIERIES.

These are institutions which an act as mediators between two parties in a financial

transaction.it normally occurs between borrowers and lenders. Examples of financial

intermediaries will include:

Banks

Insurance companies

Pension funds

Mutual funds

Government saving department

Functions of financial intermediaries.

1. Information

2. Regulation

36 | P a g e

C3 - Safaricom Confidential Internal

3. Convenience-they are convenient.

4. Maturity transformation.

5. Risk reduction.

Benefits of financial intermediaries in the economy.

1. Facilitation of flow of funds.

2. Efficient allocation of funds.

3. Assistance in price discovery.

4. Money creation.

5. Enhanced liquidity for lenders.

6. Improve diversification for lenders.

7. Economies of scale.

8. Payment system.

9. Risk alleviation.

10. Money policy function.

THE FINANCIAL SYSTEM.

This is a system that allows the exchange of funds between lenders, borrowers and

investors.

FUNCTIONS OF THE FINANCIAL SYSTEM.

1. Saving function.

2. Wealth function-money and capital market provides an excellent way to store

wealth until fund are needed for spending.

3. Liquidity function.

4. Credit function-the financial system provides a credit supply to support both

consumption and investment spending in the economy.

5. Risk function.

6. Payment function-provides a mechanism for making payment for goods and

services e.g. debit and credit card.

7. Policy function.

FINANCIAL MARKET-this is a mechanism that allows people to buy and sell financial

securities such as bonds and stocks.

Types of financial markets.

The global financial system fulfills its various roles mainly through markets where financial

claims and financial services are traded.

The financial markets can be divided into different sub-markets as follows.

1. Primary versus secondary market.

Primary market are those financial markets in which financial instruments are

issued for the first time in the market e.g. a company being listed in the stock for

the first time.

Advantages of primary market.

Firms can raise capital in the primary market.

37 | P a g e

C3 - Safaricom Confidential Internal

Helps in mobilizing savings.

It is a vehicle for direct foreign investment.

The government can raise fund through sale of treasury bonds in primary

market

Secondary financial market is a market for subsequent selling and purchase of the

financial securities.

Advantages /role of secondary markets.

It gives investors a chance to buy or dispose their shares.

It increases the divestments of investments.

It improves corporate governance through separation of ownership and

management.

It provides investment opportunities for companies and small investors.

2. Organized exchange versus over the counter market (OTC)

Organized exchange is where trading of securities is done by brokers and the

buyers and sellers need not to be present. Trading is done electronically or via

internet.

Over the counter is where trading is usually organized by dealers or stock brokers

themselves who buys the securities themselves and then sell them.

Features of the OTC markets.

Prices are relatively low.

It usually deals with new securities of the firm.

It is composed of small and closely held firms.

3. Open versus negotiated market

An open financial market is where the instruments are sold to the highest bidder

openly in the market.

Negotiated market is where securities are sold to one entity or a few entities

under private contract i.e. private placement.

4. Money and capital market.

Money market is a market concerned with short-term financial securities.

Financial instrument in money market includes commercial papers, treasury bills,

and bill of exchange.

Functions of money market.

It provides finance to solve the liquidity problems of the company.

It offers advice to the concerned parties.

It acts as a channel through which short term investment are offered to the

general public

It acts as a source of finance to small businesses which are unable to raise

funds in the capital market.

The capital market-is a market for long term sources of finance which are used to

acquire fixed assets for company’s development purposes.

38 | P a g e

C3 - Safaricom Confidential Internal

Factors contributing to the slow growth of capital market in emerging markets.

1. Limited number of securities available for investing.

2. Lack of knowledge or lack of interest by ordinary citizen.

3. Low automation-market operation should be highly computerized and online.

4. High taxes on investment income earned in the capital market discourages investor

5. High growth of informal financial schemes as alternative investment avenues.

6. Inadequate legal framework.

7. Lack of transparency in stock exchange.