Professional Documents

Culture Documents

Greek Finance

Uploaded by

Aabiskar BasyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Greek Finance

Uploaded by

Aabiskar BasyalCopyright:

Available Formats

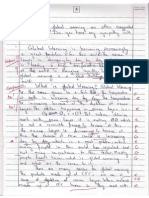

The Greeks are vital tools in risk management.

Each Greek measures the sensitivity of the value of a

portfolio to a small change in a given underlying parameter, so that component risks may be treated

in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example

delta hedging.

The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of

financial models, and are very useful for derivatives traders, especially those who seek to hedge

their portfolios from adverse changes in market conditions. For this reason, those Greeks which are

particularly useful for hedging—such as delta, theta, and vega—are well-defined for measuring

changes in Price, Time and Volatility. Although rho is a primary input into the Black–Scholes model,

the overall impact on the value of an option corresponding to changes in the risk-free interest rate is

generally insignificant and therefore higher-order derivatives involving the risk-free interest rate are

not common.

The most common of the Greeks are the first order derivatives: delta, vega, theta and rho as well as

gamma, a second-order derivative of the value function. The remaining sensitivities in this list are

common enough that they have common names, but this list is by no means exhaustive.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EtymologyDocument2 pagesEtymologyAabiskar BasyalNo ratings yet

- AMGC - Industry 4.0 An Opportunity For Every Australian ManufacturerDocument28 pagesAMGC - Industry 4.0 An Opportunity For Every Australian ManufacturerAabiskar BasyalNo ratings yet

- VannaDocument1 pageVannaAabiskar BasyalNo ratings yet

- Introduction To Robotstudio An Offline Robot Programming ToolDocument28 pagesIntroduction To Robotstudio An Offline Robot Programming TooljeraffitiNo ratings yet

- Ender-3 Assembly Instruction - EN V.4.1Document16 pagesEnder-3 Assembly Instruction - EN V.4.1ARM ZI4D3No ratings yet

- Greek FinanceDocument1 pageGreek FinanceAabiskar BasyalNo ratings yet

- For A Vanilla OptionDocument4 pagesFor A Vanilla OptionAabiskar BasyalNo ratings yet

- Meaning of HistoryDocument2 pagesMeaning of HistoryAravind RajNo ratings yet

- Football Is A Family ofDocument8 pagesFootball Is A Family ofAabiskar BasyalNo ratings yet

- Inclusion of in The Article: Bhimsen ThapaDocument1 pageInclusion of in The Article: Bhimsen ThapaAabiskar BasyalNo ratings yet

- Football Is A Family ofDocument8 pagesFootball Is A Family ofAabiskar BasyalNo ratings yet

- Wiki Loves MonumentsDocument8 pagesWiki Loves MonumentsAabiskar BasyalNo ratings yet

- NepalDocument4 pagesNepalAabiskar BasyalNo ratings yet

- Loading The Truss ExperimentDocument2 pagesLoading The Truss ExperimentAabiskar BasyalNo ratings yet

- General Paper EssayDocument2 pagesGeneral Paper EssayAabiskar BasyalNo ratings yet

- Wiki Loves MonumentsDocument8 pagesWiki Loves MonumentsAabiskar BasyalNo ratings yet

- Essay 4Document3 pagesEssay 4Aabiskar BasyalNo ratings yet

- Example Candidate Response - Grade A: Paper 1Document4 pagesExample Candidate Response - Grade A: Paper 1Aabiskar BasyalNo ratings yet

- ReductionDocument42 pagesReductionAabiskar BasyalNo ratings yet