Professional Documents

Culture Documents

BUY: TP 1,899.00 GLO: Globe Telecommunications, Inc

Uploaded by

Alyssa ArenilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BUY: TP 1,899.00 GLO: Globe Telecommunications, Inc

Uploaded by

Alyssa ArenilloCopyright:

Available Formats

BUY: TP ₱1,899.

00

ARENILLO, ALYSSA MARIE A.

SISON, MA. AIRA JOY F.

FMGT2A

GLO

I. ECONOMIC, INDUSTRY, AND STRUCTURAL LINKS

According to PSA, the country's GDP grew year-on-year by 5.5% in the second quarter of 2019. Aside from factors like Fishing,

Mining, Manufacturing, one of the drivers of this growth is the Communication services and Globe Telecommunications, Inc. is

considered as one of the biggest companies under that industry. Due to that positive GDP rate, Globe posted favourable results with

consolidated revenues climbing to ₱158.45B because as the infrastructure program continues here in the Philippines, the need for

telecommunication resources also increases. Additionally, all of the business here in the Philippines tends to use the internet and

mobile phones for marketing and other purposes that is why their company has a good performance for the past years.

II. COMPANY ANALYSIS

Globe Telecom, Inc. is a provider of telecommunications services to individuals, small and medium-sized businesses, and

corporates and enterprises in the Philippines. The company operates the mobile, fixed- line and broadband networks in the country.

Under the mobile business segment, its well-known brands are Globe Postpaid as well as Globe and TM prepaid brands.

Additionally, it also provides its subscribers with mobile payment and remittance services under the GCash brand. While on its

fixed-line and broadband business segment, it offers a large of fixed-line communication services, wired and wireless broadband

access and an end to end connectivity solutions. The company’s principal shareholders are Ayala Corporation and Singapore

Telecommunications and has market capitalization of ₱253,081,263,500.00 as of Aug. 23, 2019.

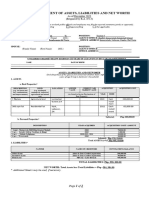

The figure below shows the fundamental and technical analysis of the company. It indicates the earnings per share, support and

resistance level, as well as the downtrend movement of the GLO.

FUNDAMENTAL ANALYSIS (AS OF AUGUST 23, 2019)

Earnings per Share TTM (EPS): ₱151.40

52- Week high: ₱2,380.00 Price to Book Value (P/VP): 3.71

(22.86%)

52- Week low: ₱1,690.00 Price-Earnings Ratio TTM (P/E): ₱12.55 Return on Equity (ROE): 24.79%

Fair Value: - Dividends Per Share (DPS):

TECHNICAL ANALYSIS (AS OF AUGUST 23, 2019)

Support 1: ₱1,890.00 Resistance 1: ₱1,980.00 Short-Term Trend: ↓Downtrend

Support 2: ₱1,794.50 Resistance 2: ₱2,260.00 Medium-Term Trend: ↓Downtrend

Week to Date %: -0.84% Year to Date %: -0.05% Month to Date %: -11.59%

III. INTRINSIC VALUE ( AS OF JANUARY 2019- AUGUST 2019)

DATE LAST % NET

CHANGE OPEN LOW HIGH VOLUME

(2019) PRICE CHANGE FOREIGN

Aug. 23, 2019 ₱1,899.00 -1.00 -0.05% ₱1,890.00 ₱1,890.00 ₱1,900.00 47.53K 1.51B

Jul. 23, 2019 ₱2,180.00 -36.00 -1.62% ₱2,180.00 ₱2,180.00 ₱2,214.00 17.36K -10.67B

Jun. 24, 2019 ₱2,208.00 -22.00 -0.99% ₱2,218.00 ₱2,182.00 ₱2,230.00 37.32K -6.41M

May 23, 2019 ₱2,100.00 -50.00 -2.33% ₱2,100.00 ₱2,090.00 ₱2,150.00 94.2K 28.62M

April 23, 2019 ₱1,830.00 -48.00 -2.56% ₱1,860.00 ₱1,830.00 ₱1,864.00 51.43K 14.55M

Mar. 22, 2019 ₱1,996.00 24.00 1.22% ₱1,972.00 ₱1,951.00 ₱1,996.00 23.97K 23.9M

Feb. 22, 2019 ₱1,901.00 11.00 0.58% ₱1,899.00 ₱1,899.00 ₱1,907.00 19.35K 2.92M

Jan. 23, 2019 ₱2,100.00 14.00 0.67% ₱2,080.00 ₱2,052.00 ₱2,094.00 21.86K 21.05M

(Historical data from Aug. 2018- July 2019)

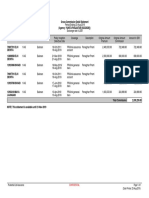

(Graphical representation of Globe

Telecommunications, Inc. from

January 2019- August 2019)

This graph shows the price movement

of GLO with the last trading price of

₱1,899.00. Bollinger Bands and

Stochastic are the indicators that were

used. As you can see, starting in the

last week of July up to August, the

stock price results in fall.

GLOBE TELECOMMUNICATIONS, INC.

BUY: TP ₱1,899.00

ARENILLO, ALYSSA MARIE A.

SISON, MA. AIRA JOY F.

FMGT2A

GLO

IV. COMPETITIVE SRATEGIES

SWOT ANALYSIS

STRENGTHS WEAKNESSES

Wider coverage of internet connection Have a poor quality of signal reception provided to its

Profitability customers.

Strong brand identity Poor customer service

Late adaption of latest technology

OPPORTUNITIES THREATS

Acquisition of high-quality technology equips Globe Intense Competition

Telecom to provide better internet service. Government Regulations

Increasing demand for internet services and network

expansion.

Improving its broadband net services on rural areas.

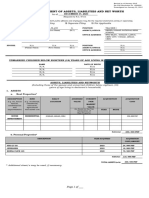

V. COMPANY EARNINGS

The figure below shows the 3 Year estimated Annual Income of Globe Telecommunications, Inc.

Fiscal Period Actuals in M PHP Estimates in M PHP

December 2016 2017 2018 2019 (e) 2020 (e) 2021 (e)

Sales 119 990 127 906 132 875 163 216 171 547 178 903

EBITDA 49 978 53 326 65 127 74 898 77 021 78 315

Operating Profit (EBIT) 26 129 25 813 34 705 41 101 39 821 37 948

Pre-Tax Profit ( EBT) 21 937 21 542 27 613 32 590 32 621 30 380

Net Income 15 878 15 084 18 626 22 091 22 173 20 647

P/E Ratio - - - 11, 3x 11, 2x 11, 5x

EPS (PHP) 115 109 135 168 170 165

Dividend Per Share (PHP) 88,0 91,0 91,0 94,3 100 102

Yield - - - 4,96% 5, 29% 5, 39%

Reference Price (PHP) - - - 1 900,000 1 900,000 1 900,000

Announcement Date 02/08/2017 02/05/2018 02/11/2019

- - -

07:41 am 12:00 am 11:25 pm

VI. GROWTH ANALYSIS

Globe Telecom is still growing because of its strong consolidated service revenue and now a leading mobile provider in terms of

overall subscribers. For the first three months of 2019, Globe spends around 68% of the total expenditures for data-related services. It is

now reaping the benefits of its modernized 4G/LTE network that allows more of its customers to experience faster internet connection,

thus the mobile data traffic growth from 180 petabytes in the same period of 2018 to 370 petabytes this period. Yearly, Globe Telecom has

increased the revenue of P2.7 billion last year up to this year. Additionally, Globe signs MOU with ISOC Infrastracture, Inc. and Malaysia-

based tower giant edotco Group Sdn. Bhd., becoming the first telco to support the common tower initiative of the Department of

Information and Communications Technology (DICT).

VII. WHEN TO SELL OR BUY

Globe Telecom has been downtrend since the beginning of August 2019 and based on the RSI and other indicators, it was believed

that the stock price will continuously fall (bearish) so if someone would like to buy, the researchers suggest that they should wait for GLO

to reach a stable base first and has stopped from dropping because there is a risk since we are not sure yet if the stock will still go down

further. It is good to buy a stock at a cheaper price but not while they are dropping. On the other hand, if someone wants to sell the stock,

it should be based on data and analysis rather than emotion. It is a good sale if it will result in profit and it does not necessarily mean that

you will wait for the absolute price before selling it because it can be seen in the graph that the stock price changes dramatically in a short

period of time.

VIII. INFLUENCE ANALYST

The researchers recommend aspiring investors to put up their money on investing to Globe Telecommunications, Inc. for the reasons:

GLO has been generating positive cash flows for the last 20 years. Its operating cash flows represent about 37 percent of its

annual revenues. Its operating cash flows have been growing by nine percent every year since 2010.

GLO has one of the highest returns on equity in the market, averaging 23 percent for the past ten years.

The total number of mobile subscribers of GLO has increased by 9 percent to 65 million to date, where 54 percent are mobile

data users. Improving revenue growth from data-related businesses in the next twelve months should sustain GLO’s earnings

growth recovery.

GLOBE TELECOMMUNICATIONS, INC.

You might also like

- Exotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsFrom EverandExotic Alternative Investments: Standalone Characteristics, Unique Risks and Portfolio EffectsNo ratings yet

- JM Tuason & Co. Inc. v. Javier and Legal TenderDocument3 pagesJM Tuason & Co. Inc. v. Javier and Legal TenderKê MilanNo ratings yet

- Toast-How To Manage A Restaurant in Todays Competitive EnvironmentDocument28 pagesToast-How To Manage A Restaurant in Todays Competitive Environmentsinghishpal24374No ratings yet

- SMRP Metric - Guideline RAVDocument2 pagesSMRP Metric - Guideline RAVjimeneajNo ratings yet

- BOM Statement xxxxxxxx1774 20190122 20190626 20190626124832 PDFDocument6 pagesBOM Statement xxxxxxxx1774 20190122 20190626 20190626124832 PDFAnuj GoyalNo ratings yet

- Reaction Paper On Corruption in The PhilippinesDocument1 pageReaction Paper On Corruption in The PhilippinesJalalodin AminolaNo ratings yet

- FABM 2 Module 5 FS AnalysisDocument9 pagesFABM 2 Module 5 FS AnalysisJOHN PAUL LAGAO100% (4)

- Introduction To Globalization-Contemporary WorldDocument29 pagesIntroduction To Globalization-Contemporary WorldBRILIAN TOMAS0% (1)

- Pls Cadd ManualDocument4 pagesPls Cadd Manualelmapa040% (1)

- PR 0224 BTL Mix 02 2019Document4 pagesPR 0224 BTL Mix 02 2019SafiuddinNo ratings yet

- Atomy CompanyDocument28 pagesAtomy CompanyAmabel Jamero100% (1)

- Bulletin - CPI December 2019Document10 pagesBulletin - CPI December 2019kingsleyNo ratings yet

- 2019 Q3 CushWake Jakarta IndustrialDocument2 pages2019 Q3 CushWake Jakarta IndustrialCookiesNo ratings yet

- 2019 Q1 CushWake Jakarta IndustrialDocument2 pages2019 Q1 CushWake Jakarta IndustrialCookiesNo ratings yet

- Position Analysis: High PriceDocument10 pagesPosition Analysis: High PriceErishvida MadrazoNo ratings yet

- Private Consumption Nominal Gross Domestic Product Government ConsumptionDocument3 pagesPrivate Consumption Nominal Gross Domestic Product Government ConsumptionPrithviraj PadgalwarNo ratings yet

- Fs Energy Select Sector IndexDocument7 pagesFs Energy Select Sector IndexdanieldebestNo ratings yet

- Mexico City: Industrial Q4 2019Document2 pagesMexico City: Industrial Q4 2019PepitofanNo ratings yet

- Ho Chi Minh City: Retail Q4 2019Document2 pagesHo Chi Minh City: Retail Q4 2019Athira ThampyNo ratings yet

- ABYIP of San Juan 2019 NewestDocument43 pagesABYIP of San Juan 2019 Newestbrilney r. santosNo ratings yet

- 2019 Q2 CushWake Jakarta IndustrialDocument2 pages2019 Q2 CushWake Jakarta IndustrialCookiesNo ratings yet

- AAPL Equity Research - JPM (2019.01.30)Document12 pagesAAPL Equity Research - JPM (2019.01.30)Joe SantoroNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthjunNo ratings yet

- Digi PDFDocument2 pagesDigi PDFdhannu yogaNo ratings yet

- LBS February 2020Document114 pagesLBS February 2020Adebowale OyedejiNo ratings yet

- My Mofr Invoice 20190720Document6 pagesMy Mofr Invoice 20190720Min Chan MoonNo ratings yet

- Saln 2023Document3 pagesSaln 2023Osman G. Lumbos LptNo ratings yet

- TAQWATIMES-vol0 1Document3 pagesTAQWATIMES-vol0 1Ridzwan OsmanNo ratings yet

- Quarterly Market Report: Houston Retail - Q2 2020Document5 pagesQuarterly Market Report: Houston Retail - Q2 2020Kevin ParkerNo ratings yet

- Dappie Saln-2023Document3 pagesDappie Saln-2023Shrun ShrunNo ratings yet

- Essay On Economic-Commercial Reality of The Country Considering Trends and Changes in Cultural RealityDocument10 pagesEssay On Economic-Commercial Reality of The Country Considering Trends and Changes in Cultural RealityCris Trujillo AranaNo ratings yet

- Ho Chi Minh City: Industrial Q4 2020Document2 pagesHo Chi Minh City: Industrial Q4 2020Athira ThampyNo ratings yet

- China Suzhou Retail Q4 2019 ENGDocument2 pagesChina Suzhou Retail Q4 2019 ENGAprizal PratamaNo ratings yet

- Oaa Active Instruments Summary As of 02.27.2020Document3 pagesOaa Active Instruments Summary As of 02.27.2020Diego OchoaNo ratings yet

- Prudential Life Assurance Page 1 of 1 (Date Printed: 25-Aug-2019)Document1 pagePrudential Life Assurance Page 1 of 1 (Date Printed: 25-Aug-2019)YunitaNo ratings yet

- Fuel Prices - September 2 2019Document1 pageFuel Prices - September 2 2019Tiso Blackstar GroupNo ratings yet

- Summary of 2Nd Quarter Commission 2019: Month Total Gross Sale Total Expenses Net IncomeDocument1 pageSummary of 2Nd Quarter Commission 2019: Month Total Gross Sale Total Expenses Net IncomeJinky DeypalubosNo ratings yet

- APL Apollo Tubes - Q1FY20 - Result Update - 16!09!2019 - 16Document6 pagesAPL Apollo Tubes - Q1FY20 - Result Update - 16!09!2019 - 16Akshat MehtaNo ratings yet

- SalnDocument2 pagesSalnje-ann montejoNo ratings yet

- Fuel Prices - January 29 2019Document1 pageFuel Prices - January 29 2019Tiso Blackstar GroupNo ratings yet

- Singapore Retail Market q3 2018 5992Document5 pagesSingapore Retail Market q3 2018 5992AlexNo ratings yet

- Fuel Prices - October 22 2019Document1 pageFuel Prices - October 22 2019Lisle Daverin BlythNo ratings yet

- Grade 3 ModuleDocument2 pagesGrade 3 Modulericomicah297No ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22018Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q22018Anonymous Feglbx5No ratings yet

- Sample SLP 2019Document2 pagesSample SLP 2019ChaNo ratings yet

- Fuel Prices - October 3 2019Document1 pageFuel Prices - October 3 2019Tiso Blackstar GroupNo ratings yet

- Cy 2018 Annual Investment PlanDocument10 pagesCy 2018 Annual Investment PlanRenalie Bala-an BinosaNo ratings yet

- Fuel Prices - October 23 2019Document1 pageFuel Prices - October 23 2019Anonymous fKUgvuNo ratings yet

- Financial Analysis of ASTRO Malaysia Holdings Berhad: November 2019Document17 pagesFinancial Analysis of ASTRO Malaysia Holdings Berhad: November 2019Ahmad AimanNo ratings yet

- Cfra - TmusDocument9 pagesCfra - TmusJeff SturgeonNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- Fuel Prices - November 1 2019Document1 pageFuel Prices - November 1 2019Anonymous jP4lPgNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- CY 2018 Annual Investment ProgramDocument3 pagesCY 2018 Annual Investment Programbarangay kainginNo ratings yet

- Greater Jakarta: Industrial Q1 2020Document2 pagesGreater Jakarta: Industrial Q1 2020CookiesNo ratings yet

- Investor Digest 03 Mei 2019Document13 pagesInvestor Digest 03 Mei 2019Rising PKN STANNo ratings yet

- Fuel Prices - March 21 2019Document1 pageFuel Prices - March 21 2019Tiso Blackstar GroupNo ratings yet

- Fuel Prices - October 29 2019Document1 pageFuel Prices - October 29 2019Tiso Blackstar GroupNo ratings yet

- 2015 SALN FormDocument2 pages2015 SALN FormAriel BarcelonaNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument4 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableI-pugo PrinceNo ratings yet

- Fuel Prices - October 24 2019Document1 pageFuel Prices - October 24 2019Lisle Daverin BlythNo ratings yet

- Saln 2020Document2 pagesSaln 2020Jhonalyn Toren-Tizon LongosNo ratings yet

- Nvestment Portfolio: Jorge Paternina Luis Venegas Sharon ZuñigaDocument12 pagesNvestment Portfolio: Jorge Paternina Luis Venegas Sharon ZuñigaMarcela Caro ArmestoNo ratings yet

- Fuel Prices - August 21 2019Document1 pageFuel Prices - August 21 2019Lisle Daverin BlythNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Imrad-Ncp Tracer Study (Critiqued)Document56 pagesImrad-Ncp Tracer Study (Critiqued)Alyssa ArenilloNo ratings yet

- Reflection PapersDocument3 pagesReflection PapersAlyssa ArenilloNo ratings yet

- Bahay Tsinoy Reflection PaperDocument4 pagesBahay Tsinoy Reflection PaperAlyssa ArenilloNo ratings yet

- Globe Telecom, Incorporated I. Company ProfileDocument3 pagesGlobe Telecom, Incorporated I. Company ProfileAlyssa ArenilloNo ratings yet

- Finman ReviewerDocument6 pagesFinman ReviewerAlyssa ArenilloNo ratings yet

- Punjab National Bank Financial Inclusion: Experience SharingDocument18 pagesPunjab National Bank Financial Inclusion: Experience SharingShreya DubeyNo ratings yet

- Chapter 1 Risk and Its TreatmentDocument30 pagesChapter 1 Risk and Its Treatmentrithy pichchornayNo ratings yet

- Law of Partnership PresentationDocument12 pagesLaw of Partnership PresentationFaizan Ahmed KiyaniNo ratings yet

- CV Demarchi Nov23Document2 pagesCV Demarchi Nov23api-613799982No ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingSirshajit SanfuiNo ratings yet

- Chapter 06 Test BankDocument61 pagesChapter 06 Test BankMariamNo ratings yet

- Syed Zaveer Naqvi Internship Viva ReportDocument42 pagesSyed Zaveer Naqvi Internship Viva ReportMuhammad HasnatNo ratings yet

- Job Application Accounts Payable Assistant Tupperware Brands Malaysia SDN BHD - JobDocument4 pagesJob Application Accounts Payable Assistant Tupperware Brands Malaysia SDN BHD - Jobapi-284701992No ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument38 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont Collegee s tNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument3 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceNishi GuptaNo ratings yet

- Pip (Lot) Cost Breakdown SheetDocument12 pagesPip (Lot) Cost Breakdown SheetHicham HasnaouiNo ratings yet

- Answer Key On Comprehensive ExerciseDocument13 pagesAnswer Key On Comprehensive ExerciseErickaNo ratings yet

- School of Social Work, Roshni Nilaya, Mangalore - 575002 Post Graduate Diploma in Human Resource Management (PGDHRM)Document4 pagesSchool of Social Work, Roshni Nilaya, Mangalore - 575002 Post Graduate Diploma in Human Resource Management (PGDHRM)Agam MridaNo ratings yet

- Apple-iPhone in KoreaDocument31 pagesApple-iPhone in KoreatunggaltriNo ratings yet

- Bok SPP Spa Level I 2010Document47 pagesBok SPP Spa Level I 2010FFNo ratings yet

- Audit Report - Deepali ShekhawatDocument29 pagesAudit Report - Deepali ShekhawatDeepali ShekhawatNo ratings yet

- Ch4 641Document35 pagesCh4 641MubeenNo ratings yet

- Quiz 1 Keys PGDM 2014-16Document4 pagesQuiz 1 Keys PGDM 2014-16Pranav Patil100% (1)

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNo ratings yet

- Chapter 1-The Scope of Corporate Finance: Multiple ChoiceDocument13 pagesChapter 1-The Scope of Corporate Finance: Multiple ChoiceFarhanie NordinNo ratings yet

- Shivananda - World Class Maintenance Management-MC GRAW HILL INDIA (2015)Document373 pagesShivananda - World Class Maintenance Management-MC GRAW HILL INDIA (2015)Fabricio HidalgoNo ratings yet

- Unit 6 Learning Aim D Assessment MatDocument2 pagesUnit 6 Learning Aim D Assessment Mathello'iNo ratings yet

- IFRS BasicsDocument8 pagesIFRS BasicsgeorgebabycNo ratings yet

- E-Magazine of The Department of MHRM, IISWBM - November 09Document21 pagesE-Magazine of The Department of MHRM, IISWBM - November 09E magazine of department of MHRM,IISWBM100% (1)