0% found this document useful (0 votes)

73 views4 pagesSales Value Analysis at Split-off

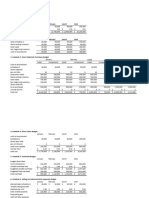

This document contains information about allocating a joint processing cost of $1,020,000 among three joint products: studs, decorative pieces, and posts.

It considers three allocation methods: the split-off method allocates costs based on the sales value of each product; the physical-measure method allocates costs based on the units produced of each product; and the net realizable value method allocates costs based on the contribution of each product after further processing costs.

The document also provides requirements to calculate the decrease in profit if decorative pieces are further processed, and potential impacts and management strategies if a plant closure is announced 6 months in advance.

Uploaded by

Kyle BacaniCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

73 views4 pagesSales Value Analysis at Split-off

This document contains information about allocating a joint processing cost of $1,020,000 among three joint products: studs, decorative pieces, and posts.

It considers three allocation methods: the split-off method allocates costs based on the sales value of each product; the physical-measure method allocates costs based on the units produced of each product; and the net realizable value method allocates costs based on the contribution of each product after further processing costs.

The document also provides requirements to calculate the decrease in profit if decorative pieces are further processed, and potential impacts and management strategies if a plant closure is announced 6 months in advance.

Uploaded by

Kyle BacaniCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd