Professional Documents

Culture Documents

IDirect AstralPoly IC

Uploaded by

Bala MuruganCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect AstralPoly IC

Uploaded by

Bala MuruganCopyright:

Available Formats

Initiating Coverage

June 5, 2017

Rating Matrix Astral Poly Technik Ltd (ASTPOL)

Rating : Buy

Target : | 685 | 606

Target Period

Potential Upside

:

:

12 months

13%

Gearing up for future...

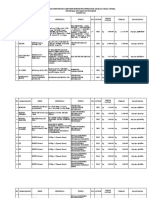

YoY Growth (%) Astral Poly Technik (APTL), a leader in CPVC piping, has 25% market share

FY16 FY17 FY18E FY19E with total pipe manufacturing capacity of ~1.4 lakh tonnes. Over the years,

Net Sales 17.3 12.6 21.8 21.0 APTL created a strong brand in Indian plumbing market registering healthy

EBITDA 23.3 27.1 23.8 27.0 piping volume CAGR of 32% in FY09-16. We believe it will continue

EBIT 25.7 28.9 22.8 28.5 recording strong piping volume CAGR of 17% in FY17-19E supported by

Net Profit 34.3 41.8 19.6 36.1 demand staying intact from various government social schemes &

implementation of GST. Further, addition of adhesive business in the kitty is

Current & target multiple a step to de-risk business from concentration of one product. We expect

FY16 FY17 FY18E FY19E doubling of capacity of adhesive business to drive segment revenue CAGR

P/E 71.7 50.5 42.2 31.0 of 22% in FY17-19E. Strong volume growth, saving in raw material cost and

Target P/E 80.9 57.1 47.7 35.1

higher credit limit from new outsourcing partner (Sekesui) would translate

EV / EBITDA 35.6 28.2 22.6 17.6

P/BV 10.3 8.6 6.8 5.6

to higher EBITDA margin and efficient working capital management. We

RoNW 14.5 17.2 16.0 18.0 expect consolidated sales, earnings CAGR of ~21%, ~28%, respectively, in

RoCE 19.2 21.3 21.7 23.8 FY17-19E. We initiate coverage on APTL with BUY rating.

Aggressive capacity addition to drive piping and adhesive revenue

Stock Data

Particulars

APTL has expanded pipe manufacturing capacity by ~3x in FY09-16 mainly

Bloomberg/Reuters code ASTRA:IN/ASPT.NS to serve rising demand for plastic piping/plumbing products from housing

Nifty 9661.2 and agriculture. The plants at Gujarat and Tamil Nadu are strategically

Average Volume (Year) 48715 located near its selling markets. Looking at the upcoming demand, APTL

Market Capitalization | 7305 Crore plans to increase its piping capacity to 1.7 Lakh tonnes by FY19E. This

Total Debt (FY17) | 156.9 Crore would lead strong piping revenue CAGR of 21% (led by volume CAGR of

Cash and Investments (FY17) | 16.4 Crore 17%) in FY17-19E while doubling the capacity of adhesive segment would

EV | 7445 Crore lead to strong segment revenue CAGR of 22% in FY17-19E.

52 week H/L (|) 625/367

Equity capital | 12.0 Crore

Backward integration to drive profitability and cashflow

Face value |1 APTL has set up a CPVC compounding plant in Gujarat with an investment

MF Holding (%) 6.2 of | 50 crore. It has signed an agreement with Japan’s Sekisui for supply of

FII Holding (%) 17.2 CPVC resin. This move helped Astral launch its own CPVC brand with an

Comparative return matrix (%) EBITDA margin expansion to tune of 100 bps. We model EBITDA margin

Return % 1M 3M 6M 12M expansion of 100 bps in FY17-19E, which would drive PAT CAGR of 28% in

Supreme Ind 6.5 17.0 30.1 24.7 FY17-19E. Further, extended credit days from outsourcing partner would

Astral Polytec 12.0 38.7 56.8 37.4 translate into lower working capital requirement. Going forward, that would

Finolex Ind 9.6 15.9 43.7 59.9 help bring back the return ratios to elevated level.

Price movement Strong fundamentals justify premium valuations

We reckon that a revival of the plastic piping industry is on the cards. Major

700 12000 government infrastructure push, implementation of GST as well as

600 10000 continued replacement demand from tier II and tier III cities will be key

500

400

8000 catalysts. Moreover, strong PAT CAGR (~28% FY17-19E) and improving

6000 return ratios would lead to a further re-rating of the stock. We value the

300

200 4000 company on a PE basis by ascribing PE multiple of 35x FY19E earnings with

100 2000 a target price of | 685 and BUY recommendation.

0 0

Exhibit 1: Financial summery

Jun-14

Oct-14

Feb-15

Jun-15

Oct-15

Feb-16

Jun-16

Oct-16

Feb-17

(| Crore) FY15 FY16 FY17 FY18E FY19E

Net Sales 1,429.9 1,677.8 1,888.8 2,301.2 2,785.5

ASTPOL Nifty

EBITDA 168.3 207.6 263.8 326.7 415.0

Net Profit 75.9 101.9 144.6 172.9 235.3

P/E (x) 96.2 71.7 50.5 42.2 31.0

Research Analyst

Price / Book (x) 11.8 10.3 8.6 6.8 5.6

Sanjay Manyal EPS (|) 6.3 8.5 12.1 14.4 19.7

sanjay.manayal@icicisecurites.com EV/EBITDA (x) 44.2 35.6 28.2 22.6 17.6

RoCE (%) 17.0 19.2 21.3 21.7 23.8

Hitesh Taunk RoE (%) 12.3 14.5 17.2 16.0 18.0

hitesh.taunk@icicisecurites.com Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research

Shareholding pattern (Q4FY17) Company background

Shareholding Pattern Holdings (%) Astral Poly Technik (APTL) was established in 1996 to manufacture

Promoters 59.3

plumbing and drainage systems in India. It was the first company to receive

Institutional investors 24.3

a license for manufacturing a chlorinated polyvinyl chloride (CPVC) piping

Others 16.4

system in India. APTL’s plumbing & drainage systems include both

residential and commercial applications, CPVC piping systems for industrial

applications, column and pressure piping system for agriculture

applications and also conduit pipes for residential and commercial

Institutional holding trend (%)

applications. The company has a presence in both CPVC (compatible with

both hot & cold water) and PVC (used for cold water flow) product

segments with topline contribution of 41% and 33%, respectively.

17.8 18.6 18

20.0 17.5 APTL operates with three pipe manufacturing plants (total capacity of

1,37,000 TPA) and over 25,000 strong dealer network across India. As part

15.0

of diversification, APTL also entered the adhesives and sealants segments

10.0

(~26% of topline) with the acquisition of Resinova Chemie (India) and Seal

(%)

5.6 5.0 5.3 6.2 IT Services (UK). With this acquisition, APTL now has a presence in

5.0 construction chemicals, sealants, industrial maintenance products,

hardware & sanitary adhesives, electrical insulators, automobile adhesives

0.0 etc. It also formed a subsidiary in the US and acquired the silicone tape

Q1FY17 Q2FY17 Q3FY17 Q4FY17 business of Rowe Industries Inc during FY16. The company’s adhesive

FII DII products are available at 4.5 lakh outlets in India. APTL’s piping division

recorded strong sales CAGR of ~32% in FY09-16 entirely driven by volume

growth. This was led by addition of piping capacity (~1,00,000 TPA during

FY09-16) to serve rising demand from housing segments. Despite

substantial capex (average annual capex of ~| 100 crore in last seven

years), debt/equity ratio has improved from 0.7x to 0.2x in FY09-16 as APTL

generated strong cash flow from operations during the same period.

Exhibit 2: Corporate Structure Exhibit 3: Revenue break-up of Astral Poly Technik

ASTRAL POLY

TECHNIK

Adhesive

PVC 26%

33%

RESINOVA SEAL IT - UK APL - KENYA

ABPL (100%)

(97.45%) (80%) (37.5%)

SEAL IT - USA

CPVC

(100%)

41%

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com Research, FY16

Exhibit 4: Global partnership to build competent products for global market under piping and adhesive segment

Commencing business in 1947, Sekisui group is one of the largest chemical groups based in Japan. As on March 31, 2016 Sekisui group has a

turnover of over US$ 10 billion with global presence in Europe, Asia and America. Astral Poly joined hands with Sekisui to source Cholinated Poly

Vinyl Chloride (CPVC) resin for hot and cold water plumbing system

US based 'Spears’ product line inlcudes selection of 1/8” through 12” injection molded fittings and fabricated fittings through 48”, specialty

products, and manual and mechanically actuated thermoplastic valves in a variety of types, sizes and configurations

Established in 1954 as the original inventor of solvent cement for PVC pipe applications, IPS® Corporation has operations throughout the US,

Europe, and Asia. Astral Poly entered into a JV with IPS® Corporation to manufacture solvent cement, which is used as glue in PVC/CPVC pipes in

FY12

Italy based 'First Plast' is skilled in manufacturing building plastics and produces drainage systems such as drainage channels, ground accessories,

rainwater gutter and solvent cement fittings made of PVC

AlcaPlast is one of the largest manufacturers of sanitary ware in Central and Eastern Europe. Besides its traditional product range of fill and flush

valves, it also produces concealed WC installation systems, plastic cisterns, bath siphons and shower-basin siphons

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 2

Exhibit 5: Company’s milestone

1. Acquired 80% stake in UK based 1. Purchases land in Rajasthan to start

Enters into secondary market Seal It Services Ltd

and raises | 34 crore manufacturing of pipe

2. Acquired 76% Stake in Resinova 2. Enters US market by acquiring Silicone

through IPO route Chemie Ltd (India) Tape business of Row Industries

Established with aim of Signs agreement with IPS (US)

manufacturing plumbing for manufacturing Solvent Acquired balance 24% stake

and drainage system Cement in India in Resinova Chemie Limited

1996 1999 2007 2008 2011 2014 2015 2016

First to receive license for 3. Commences operations at 3.Discontinues raw material sourcing tie up

CPVC piping system Enters into Kenya plumbing agreement with Lubrizol and joins hands

Hosur (Tamil Nadu) with initial

for India market by forming a JV with with Skisui Chemical Co Ltd. Launches its

capacity of 7000 TPA

Kenya based group own brand Astral CPVC PRO

Source: ICICIdirect.com Research

Exhibit 6: Presence across plumbing and drainage system through various product categories

Category Product Specification Target Customer Segment

Compatible with both hot and cold water, corrosion resistant, lower bacterial

Astral CPVC Pro

Plumbing System growth, tough, rigid material, unaffected by chlorine in water, chemical Residential, Hotels, Hospitals

(Plumbing for Hot and cold water)

resistance, low thermal expansion

Manufactured using un-plasticised PVC (uPVC), which is non-toxic and,

hence, favoured for applications including potable water (cold/normal) pipes.

Plumbing System Astral Aquarius (PVC) Residential, Hotels, Hospitals

The product is light weight and very strong for use in building and

construction property

Sewerage, Waste & Rain Recommended for use in ventilation and rain water, soil and waste discharge

Astral Drainmaster, Ultradrain, DMV Residential, industrials

water (SWR) applications

Astral Silencio is low noise piping system with temparature resistance from -

Multistorey apartment, commercial,

Low noise SWR (Sewerage, 20 °C to 90° C.

Astral Silencio hotel, sport stadium, education

waste & rain water)

institutes, hospitals, entertainments

Multiplayer pipes with outer and inner layers of conventional PVC and middle Residential complexes,

Astral Foamcore, Underground,

Underground Application layer of foamed PVC. Used primarily for underground applications commercial/office space, resorts,

Drain Hulk

hospitals

Chemical and corrosion resistant, odourless & hygienic with a smooth bore

Use in agriculture for water supply,

Agriculture pressure pipe Astral Aquasafe (PVC) giving a high flow rate, light welded & economical, with low maintenance

drip irrigation and sprinkler lines

requirements

Use in chemical manufacturing plants, pulp and paper plants, waste water

treatment plants, metal treating/electroplating plants, water purification

Industrial Application Astral Chem Pro Industrial

plants, and food processing plants where excellent resistance to corrosion

from a wide range of chemical

Piping systems for submersible pumps with fast and easy installation, Heavy Residential, agriculture, commercial,

Submersible Pump Astral Bore-well (Column Pipe) metal & lead free and hence, absolutely safe for drinking water industrial

Smooth interior walls helping in easy wiring, Fire resistance, Light weight &

Astral Wire guard (Conduit pipes &

Electrical Pipes high mechanical strength, Corrosion resistance, No maintenance & last for a Residential, commercial, industrial

Fittings) (PVC)

lifetime

Accessories Alcaplast Channel drains used for indoor and outdoor bathroom fittings Residential, commercial, industrial

Solvent cements, ceramic tile adhesives, construction adhesives, tapes,

Adhesive & Sealants Weld-On, BONDSET super glues, silicone, automobile adhesives, brushmaking industry, hardware Retail and institutional clients

& sanitary adhesives, rust removers, etc

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 3

Exhibit 7: Geographical spreads - Pipes Exhibit 8: Geographical spreads - Adhesives

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research

Overseas manufacturing facilities

Exhibit 9: Plant location & product specifications

Plant Location Products

Piping plant

CPVC piping system for plumbing, industrial & fire protection, UPVC

Santej (Gujarat)

piping system for plumbing, UPVC column pipes, manholes/chambers

PVC piping system for drainage, UPVC agriculture pressure pipes,

Dholka (Gujarat)

electrical conduit pipes

CPVC piping system for plumbing, PVC piping system for drainage,

Hosur (Tamil Nadu)

UPVC agriculture pressure pipes

Nairobi (Kenya)* Plumbing & drainage systems

Adhesive manfucturing facilities

Cyanoacrylate, solvent cements, tile adhesives, silicone sealant, tapes,

Rania(Kanpur, Uttar Pradesh)

putty

Unnao (Kanpur, Uttar Pradesh) Epoxy, PVA, construction chemicals

Solvent cement, cyno, putty, silicone sealants, Epoxy, PVA,

Santej (Gujarat)

construction chemicals, tile adhesive

Seal IT Services Ltd

Bitumen, hybrid MS polymer, Polyurethane, acrylics, silicone sealants,

U.K.

PVA, tile adhesives, waterproofing solutions

U.S. Silicone tapes

Source: Company, ICICIdirect.com Research

Source: Company, ICICIdirect.com, Research *APTL has a stake of 37.5% in the JV Company while 37.5% is held by the local partners RAMCO Group and balance

25% is held by Allied Plumbers Ltd

ICICI Securities Ltd | Retail Equity Research Page 4

Investment Rationale

Pioneer in product launches Strengthening presence in building material category

Year Pioneered

1999 First to receive license for CPVC piping system APTL, a pioneer in CPVC piping industry, had put up a strong historical

2004 First to launch lead free uPVC piping system performance with revenue, earnings CAGR of 37%, 33%, respectively, in

2012 First to launch lead free uPVC column pipes FY09-16. Over the years, it has launched various new products in the CPVC

2013 First to launch CPVC - AL - CPVC bendable pipes piping segment and gradually added PVC products in the portfolio, as part

Source: Company, ICICIdirect.com, Research of diversification. Strong demand for plastic piping products was driven by

replacement of metal/cement pipes and pent up demand from housing,

agriculture and industrial segments. This coupled with addition of new

capacity helped APTL drive piping division revenue CAGR of 32% in FY09-

16. Further, addition of adhesive business in the kitty with two back-to-back

acquisitions in UK (Seal IT) and India (Resinova Chemie) in FY15 was a step

to de-risk business from concentration of one product.

Acquisitions to foray into the adhesive business coupled with global

partnership helped APL achieve 1) scalability, 2) strong R&D, 3) launch of

quality/premium products, 4) opportunity of cross-selling various products

and 5) addition of a dealer network. We believe APL’s strong branding

(~4% of sales) coupled with deep rooted dealer networks (piping division:

~25,000 touch points, adhesive division: ~5,00,000 touch points) helped

APTL increase its retail contribution in sales to 50% from 30% a few years

back. This, in turn, helped the company improve its EBITDA margin. We

believe APTL will post revenue earning CAGR of 21%, 28%, respectively, in

FY17-19E supported by 1) capacity addition (in both piping and adhesive

and sealant) 2) replacement demand (of metal pipe), 3) implementation of

GST to increase the pie of organised players and 4) rising government

expenditure towards industrial, agriculture and housing segment.

Exhibit 10: Revenue growth largely to be driven by volume growth Exhibit 11: Strong PAT growth supported by higher margin and sales

3000.0 250.0

235.3

2785.5

2500.0 CAGR 21% 200.0

CAGR 28%

2301.2

2000.0

172.9

150.0

(| crore)

(| crore)

1888.8

1500.0 CAGR 37%

144.6

1677.8

100.0 CAGR 32.5%

1429.9

1000.0

101.9

1079.6

78.9

75.9

50.0

825.4

500.0

411.3

582.7

60.6

32.8

39.5

0.0 0.0

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18E

FY19E

FY18E

FY19E

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research

Exhibit 12: Concentration on single product: Revenue break-up FY14 Exhibit 13: De-risk business by diversifying: Revenue break-up FY16

1%

26%

74%

99%

Piping Adhesive & Sealants Piping Adhesive & Sealants

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research,

ICICI Securities Ltd | Retail Equity Research Page 5

Aggressive capacity addition to drive piping revenue FY17-19E

In the last six years, the company has expanded its pipe manufacturing

capacity by ~3x to 1.4 lakh MT mainly to serve the rising demand for plastic

piping/plumbing products from housing and agriculture. The plants at

Gujarat (Santej, Dholka) and Tamil Nadu (Hosur) are strategically located

near its selling markets. According to Ficci, strong pent up demand from

the housing and agriculture segment would drive demand for plastic piping

and plumbing products the industry at a CAGR of 12-15% in FY17-19E.

Eyeing the upcoming demand, APTL plans to increase its Hosur plant

capacity by 57% in the next two years (largely to serve agriculture product).

New pipe and fittings plant at Rajasthan is expected to In addition to this, the company’s new pipe and fittings plant at Rajasthan is

commence production by H2FY18. We believe the also expected to commence production by H2FY18. We believe the

company’s pipe manufacturing capacity will record a CAGR company’s pipe manufacturing capacity will record a CAGR of 12% in FY17-

of 12% in FY17-19E, which will drive the volume CAGR by 19E, which will drive the volume CAGR by 17% in FY17-19E.

17% during FY17-19E Exhibit 14: Addition of new capacity to drive piping revenue at CAGR of 21% in FY17-19E

180000 80

160000 70

140000 60

120000

50

100000

40

MT

(%)

80000

30

60000

40000 20

20000 10

0 0

FY11 FY12 FY13 FY14 FY15 FY16 FY17E FY18E FY19E

Capacity Utilisation

Source: Company, ICICIdirect.com Research

Exhibit 15: Range of products introduced by APTL in piping & fitting segments

Hot and Cold Water Multilayer Composite Lead Free uPVC Piping Conventional Drainage Leak-proof Drain Waste

Plumbing System Pipes System System and Vent System

Superior Push-Fit Drainage Strong and Light Weight Ultra-Modern Underground uPVC Pipes for Protection of

Lead Free uPVC Column Pipes for

System Drainage System Drainage System Concealed Wiring

Submersible Pumps

uPVC Pipes For Agriculture and CPVC Fire Sprinkler System Support System for Pipes and Industrial Piping System

Water Transportation Fittings :Clamps & Hangers

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 6

Global PVC Industry: Developing nations to drive growth

Globally, PVC resins are generally the main raw material to manufacture

PVC pipes and fittings. Fundamentally, PVC is a synthetic resin derived from

Global PVC industry is pegged at US$56 billion (bn) and is

the polymerisation of vinyl chloride. The key feature of PVC is that it can be

expected to cross US$65 bn by 2019 at a CAGR of 3.9%

combined with various additives to form a variety of products such as pipes

supported by continuous demand from developing nations

and fittings, profiles and tubes, windows and doors, sidings, wire and

cables, film and sheets, toys and other moulded products and floorings.

This coupled with features such as durability, self extinguishing property,

resistance to most chemicals and oils, mechanical strength and ease of

processing made PVC an attractive option for many end uses (for

construction and infrastructure, agriculture, electrical products and

healthcare). As a result, global PVC demand recorded notable growth with

an increase in production capacity from a few thousand tonnes in the 1930s

to ~50 million tonne today. Today, the global PVC industry is pegged at

US$56 billion (bn) and is expected to cross US$65 bn by 2019 at a CAGR of

3.9% supported by continuous demand from developing nations.

Exhibit 16: Global PVC capacity break-up Exhibit 17: Global PVC demand break-up

India India Others NE Asia

subcontinent subcontinent 46%

Middle East 4% NE Asia 7%

2% Africa 54% Middle East

1% 6%

Africa

Central Europe 3%

4%

Western

Central Europe

Europe Western

2% SE Asia

12% Europe

5%

10% South America North America

South America North America SE Asia

5% 13%

3% 16% 4%

Source: Ficci, Industry report, ICICIdirect.com, Research Source: Ficci, Industry report, ICICIdirect.com, Research, global PVC in 2014 was

estimated at 40 mn tones.

According to Ficci, growth in demand for PVC is expected to be

concentrated in developing countries in Asia, Africa and Latin America

mainly due to rising expenditure in construction, agriculture and healthcare

industries. In the last 10 years, the use of PVC has increased notably in

various industries due to its unique and diverse blending properties.

Despite PVC increasingly becoming a material of choice of widespread

consumption, the current per capita consumption in India (in kg/person) is

still relatively low (2 kg) vs. other nations like the US, China and Brazil.

In the last 10 years, the use of PVC has increased notably Exhibit 18: India per capita consumption of PVC much lower than global peers

in various industries due to its unique and diverse blending

properties 14 12.7

12

10.3

10 8.8

7.6

(kg/person)

8

5.6

6

4

2

2

0

India Brazil Malaysia Thailand China USA

Source: Ficci, Industry report, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 7

India: Rising infrastructure expenditure to drive future demand

The PVC industry in India (valued at | 20,000 crore) has historically been

driven by the agriculture sector. However, post 2000, heavy infra spending

pushed demand for PVC to a new high. According to Ficci, total demand for

PVC in India recorded a CAGR of 8.7% in 2002-15. However, lack of PVC

manufacturing capacity pushed India’s dependency more towards import.

As a result, import of PVC that was less than 5% of the country’s demand

10 year ago, is now ~50%. During 2002-15, domestic PVC production

recorded a CAGR of 3.7% whereas import grew at a CAGR of 32.5%.

Housing and agriculture remained key drivers of PVC consumption in India.

India’s PVC demand is likely to record a CAGR of 13% in

Currently in India, nearly 73% of PVC is consumed by the pipes & fittings

2015-20 to post a whopping demand of over 5 MT of PVC

industries while other sectors comprise only 27%. Globally, the

from the current 2.5 MT

consumption pattern appears to be the same with a larger pie of PVC

consumption driven by pipes & fittings industries (account for 43% of PVC).

According to an estimate, India’s PVC demand is likely to record 13% CAGR

in FY15-21 to give rise to whopping demand of over 5 MT of PVC from the

current 2.5 MT. Demand for PVC will be largely supported by rising

investment in construction, changing life style and rising urbanisation.

Exhibit 19: Global: break-up of PVC application Exhibit 20: India: break-up of PVC application

Others

Floorings 10% Others

3% 6%

Wires &

Floorings

Cables Pipes &

8%

8% Fittings

43% Wires & Pipes &

Cables Fittings

Films & Sheets 5% 73%

17% Films & Sheets

5%

Profiles Profiles

19% 3%

Source: Ficci, Industry report, ICICIdirect.com Research Source: Ficci, Industry report, ICICIdirect.com Research

Exhibit 21: India’s PVC supply-demand mismatch Exhibit 22: PVC demand to record 13% CAGR in FY15-21E

3000000 6000000

2500000 CAGR 5000000

CAGR 13% 5335000

4722000

2000000 8.7% 4000000

4178000

CAGR

(tpa)

1500000

3698000

(tpa)

3000000

3272000

3.7% CAGR

2896000

1000000

2563000

32.3% 2000000

500000

1000000

0

0

PVC demand PVC supply PVC import

2014- 2015- 2016- 2017- 2018- 2019- 2020-

2002 2015

15 16E 17E 18E 19E 20E 21E

Source: Ficci, Industry report, ICICIdirect.com Research Source: Ficci, Industry report, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 8

Plastic piping industry: Structural reform to drive demand

The plastic piping industry (largely PVC), growing at ~12-15% CAGR in

The total piping industry size in India is ~| 27,500 crore

2009-14 in India, has been passing through a volatile phase in pricing terms

largely dominated by the plastic piping industry, which is

due to heavy crude price fluctuations. However, in volume terms, industry

considered to be ~| 21,500 crore while the metal piping

recorded growth of over 10% in FY14-16 (top three players) largely due to

industry is at about | 6000 crore

growth in construction activity in tier-II, tier-III cities, replacement of

conventional piping systems like galvanised iron & cast iron piping systems

and rise in demand for branded agriculture & plumbing piping. Agriculture

accounts for the largest share in terms of application of PVC pipes and

fittings industry in India with share of ~74% of total revenue in India.

The piping industry consists of two segments viz. 1) plastic piping and

2) metal piping. The size of the total piping industry in India is ~| 27,500

crore largely dominated by the plastic piping industry, which is considered

to be ~| 21,500 crore while the metal piping industry is about | 6000 crore.

Since replacement of metal by plastic has been happening rapidly, the

plastic piping industry is expected to grow at an accelerated pace in the

coming years (we believe at the same historical rate of ~12%). Of this, the

organised category would record ~14% CAGR led by market share gain

from the unorganised category (due to implementation of GST) and gradual

replacement of metal pipes, in the construction and agriculture segment,

going forward.

Exhibit 23: Structure of Indian piping industry

Domestic piping industry

Value: | 27500 crore

Metal pip

Capacity

Plastic piping Metal piping

Finolex

Value: | 21500 crore Value | 6000 crore

Astral

Total

Sales Vol

Organised segment (65%-70%) Unorganised segment (30-35%)

Value: | 13900 crore Value: | 7500 crore Finolex

Astral

Total

Source: Company, ICICIdirect.com Research

Source: ICICIdirect.com Research

Exhibit 24: PVC piping industry (market share of organised players FY16)

Growing brand and quality consciousness – share of

PVC piping industry

organised players to rise further

Cap: ~18,00,000 MT

Organised market Unorganised market

(60%) (40%)

~10,80,000 MT ~7,20,000 MT

Finolex Industries Supreme Industries Astral Poly Others

Cap: 280000 MT Cap: 336000MT Cap: 127760 MT Cap: 336240 MT

Source: Company, ICICIdirect.com Research,

Rising popularity of CPVC pipes

CPVC pipes are expected to register fastest CAGR in terms of production

capacity in FY15-19. The share of CPVC pipes in the market is estimated at

6% (of total volume), which is expected to increase up to 9.7% by FY19.

Rising acceptance of CPVC pipes over galvanised or PVC pipes is expected

ICICI Securities Ltd | Retail Equity Research Page 9

to lead to the growth going ahead. Installing CPVC pipes through large

structures is easy and does not require advanced equipments, thus

Rising acceptance of CPVC pipes over galvanised or PVC

facilitating their usage in the plumbing and other industries.

pipes will lead to the growth in the future. Installing CPVC

pipes through large structures is easy and does not require In addition to this, cumulative residential demand in India will be largely

advanced equipment, thus facilitating their usage in the driven by government’s flagship housing programmes such as: 1) “Housing

plumbing and other industries for All” 2) “Real Estate Act” (to protect consumer interest, ensure efficiency

in all property related transactions, improve accountability of developers,

boost transparency and attract more investments to the sector), 3) Smart

Cities, and 4) Atal Mission for Rejuvenation and Urban Transformation

Mission (AMRUT).

Thus, swift growth in the construction sector will eventually create constant

and growing demand for plumbing products like CPVC, PVC, bendable and

other products, thus supporting overall market growth. In the past few

years, a shifting trend towards CPVC pipes has been witnessed in India.

CPVC is obtained by chlorination of polyvinyl chloride. It has better physical

and mechanical properties than PVC, which make it ideal for making pipes

and pipe fittings. CPVC gives pipes unbeatable strength and high corrosive

water and heat resistance. They are widely used in the industries for

transportation of hazardous and highly corrosive chemicals. The CPVC

pipes business has high entry barriers on account of limited number of

quality raw material suppliers like Lubrizol, Sekisui and Kaneka. In India,

after completion of CPVC compounding plant at Gujarat, APTL is a leading

manufacturer of CPVC pipes with integrated facility. It will outsource CPVC

resins from Japan’s Sekisui. APTL has three product lines (one is under

development) in India, which is for CPVC plumbing pipes and fittings, i.e.

CPVC Pro (domestic plumbing for hot & cold water), Chem pro (industrial

pipes), fire pro (sprinkler system). Since CPVC manufacturing requires

quality raw material (that is largely imported), strong R&D and requirement

of high technology, it is difficult for new entrants in the CPVC pipes market

to garner significant market share in the presence of existing players.

Exhibit 25: CPVC/PVC possesses better quality than conventional GI pipes

Properties Galvanized Iron (GI) CPVC PVC

Life (Years) 15-20 30-35 20-25

CPVC gives pipes an unbeatable strength and high 25% cheaper than GI and 15% costlier Cheaper than galvanized iron

corrosive water and heat resistance Cost Costlier than CPVC

than PVC and CPVC

Corrodes faster and No effect due to

Corrosion Have Anti Corrosive properties

deteriorates chemical resistance

Easily catches fire and Does not catch fire or sustain Less resistance (45°C)

Fire Resistant

sustains burning burning, resistance up to 95°C than CPVC

Leakage Vulnerable to leakage Leakage free for lifetime Leakage free

Special Tools Heavy tools to cut Simple cutter Hex Saw Blade

Higher than Copper and

Bacterial Growth Extremely Low Relatively Low

CPVC

Requires more time and No electric or heat source required, Done through cold

Installation

energy done through cold welding welding

Very High thermal

Thermal conductivity Low thermal conductivity reduces

Low thermal

Conductivity and increases heat loss and heat loss and requires reduced

conductivity

Insulation requires high insulation levels

insulation levels

Source: Company, ICICIdirect.com Research

We believe future demand for piping products would largely be driven by

various factors such as:

1. Government’s flagship programme of ‘Housing for all by 2022’

According to Census 2011, India had a population of ~121 crore, out of

Government’s focus on increasing irrigation and housing

which ~38 crore (~31.2%) lived in urban areas. During 2001-11, the urban

will help to keep the industry growth strong over the next

population of India grew at a CAGR of 3.1%, resulting in an increase in the

three to five years

level of urbanisation from 27.8% to 31.2%. This growing urbanisation has

ICICI Securities Ltd | Retail Equity Research Page 10

led to problems of land shortage, housing shortfall and congested transit

and also severely stressed existing basic amenities like water, power and

open spaces of the towns and cities. According to Census 2011, the

housing stock in urban India is ~7.8 crore for ~7.9 crore urban households.

Though the gap between household and housing stock is narrowing, the

Technical Group on Urban & Rural Housing Shortage came out with a report

in 2012 saying there was an overall shortage of ~6 crore houses in India

(certain portion of housing stock in Census was not in living condition). It

includes a shortage of 1.9 crore houses in urban areas and ~4 crore houses

in rural areas. To overcome the housing shortage, the government aims to

build 6 crore houses under its twin schemes:-‘Pradhan Mantri Gram Awas

Yojana’ for rural areas – 4 crore houses & ‘Pradhan Mantri Awas Yojana’ for

urban areas – 2 crore houses. According to KPMG, a demographic trend

suggests India is on the verge of large scale urbanisation over the next few

decades. With more than 1 crore people getting added to urban areas,

India’s urban population is expected to reach about 81 crore by 2050.

Exhibit 26: Technical group estimates show housing shortage of 1.9 crore Exhibit 27: Increment in housing stocks

in 2012

30

Rest of UP, 3.07 24.7 24.5

states/Uts, 25

19.2 18.7

4.47 20

15.1 14.7

( crore)

Maharashtra, 15

1.94

10

Gujarat, 0.99 5

West Bengal,

Karnataka, 1.02 1.33 0

MP, 1.1 1991 2001 2011

AP, 1.27

Rajasthan, 1.15 Tamilnadu, 1.25 Households Housing Stocks

Bihar, 1.19

Source: Company, ICICIdirect.com, Research

Source: Company, ICICIdirect.com, Research

Furthermore, a KPMG Naredco study points out shortage even beyond 6

crore houses. As per the study, “Housing for all” vision would require

development of ~11 crore houses and outlay of over US$2 trillion (or about

As per KPMG estimate, the vision would require development US$250-260 billion annual investment until 2022). Most housing

of ~11 crore houses with investment of over US$ 2 trillion (or development would be expected for the economically weak section/low

about US$ 250 to 260 billion annual investment until 2022) income group households (in both rural and urban areas) whose income is

less than | 2 lakh per annum. This also indicates there could be another

phase of Housing for all, which can take this scheme beyond 2022.

Exhibit 28: Number of housing units required under ‘Housing for all by 2022’ programme

Particulars Urban (crore unit) Rural (crore unit) Total (crore unit)

Current housing shortage 1.9 4 5.9

Required housing units by 2022 2.6-2.9 2.3-2.5 4.9-5.4

Total Need 4.4-4.8 6.3-6.5 10.7-11.3

Source: KPMG, ICICIdirect.com Research

We believe the housing shortage coupled with lack of proper water

management system (sewage/drainage) in slums creates ample opportunity

for the piping industry in India. The major application of PVC pipes is in

water management for the housing and agriculture sectors. Since APTL

earns nearly 76% of its piping revenue from the housing segment, we

believe the company would be a direct beneficiary of various government

Source: ICICIdirect.com Research initiatives such as ‘Housing for All by 2022’, 100 smart cities, etc, where

PVC pipes & fittings are used for supply of water in households, removal of

waste water, linking of drainage systems, pipes for micro irrigations, etc.

ICICI Securities Ltd | Retail Equity Research Page 11

2. Swachh Bharat Mission: Boost for plastic products

Swachh Bharat Mission (SBM) is another flagship programme of the

government aimed to stop open defecation through construction of

According to Census 2011, over 67% of rural households in individual household latrines (IHHL), cluster toilets and community toilets

India lack access to toilets. In other words, more than 11 (especially via PPP mode). Solid and liquid waste management is also an

crore rural households do not have access to a toilet important component of the programme. According to Census 2011, there

were 16.8 crore household in rural areas, among which ~11 crore (~65%)

rural households do not have access to a toilet. The government’s budget

allocation to SBM recorded a CAGR of 48% in the last three years. Under

the scheme, the government has mandated to provide sanitation and

household (urban) toilet facilities in all 4041 towns with total population of

~38 crore. The estimated cost is | 62,009 crore over five years. Further,

SBM Gramin (rural mission) aims to make village Panchayats free of open

defecation by 2019. Under the scheme, the government plans to build ~11

crore toilets at a cost of ~| 1,34,000 crore. We believe lack of sanitation and

drinking water facility at rural and urban households creates a huge

opportunity for PVC pipe manufacturers like Supreme Industries, Astral

Poly, Ashirvad and Finolex Pipes.

Exhibit 29: Central government Swachh Bharat Mission budget allocation

18000

16000 CAGR ~48%

16248

14000

12000

12800

(| crore)

10000

8000

7469

6000

4000

2000

0

2015-16 2016-17 2017-18E

Source: Budget document, ICICIdirect.com Research

Exhibit 30: Households without sanitation and drinking water facility (in crore)

We believe lack of sanitation and drinking water facility at

Total Households 25

rural and urban households creates a huge opportunity for

Households sources water outside the premises 13

PVC pipe manufacturers like Supreme industries, Astral

Poly, Ashirvad and Finolex Pipes Households have to fetch water from a source located within 500 m in rural areas/100 m in urban areas 9

Fetch drinking water from a source located more than 500 m away in rural areas or 100 m in urban areas 4

Households have no drainage facility (rural + urban) 12

Household without toilets (rural + urban) 12

Source: Census 2011, ICICIdirect.com Research

Exhibit 31: Number of toilets constructed each year for individual rural households

1113

1200

1000

800

(Lakhs)

600

400

200 88.0 45.6 49.8 40.1 57.2

0

2011-12 2012-13 2013-14 2014-15* 4 yr avg Target by 2019

Source: Census 2011, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 12

3. AMRUT: Targets 500 cities to raise water supply, sewerage, urban

transport system

The government has also launched its programme Atal Mission for

AMRUT can be considered a remodelled version of Rejuvenation and Urban Transformation (AMRUT) to provide basic services

JNNURM wherein the government has worked on many to household and build amenities in cities. Under the scheme, ~500 cities

flaws present in the earlier programme and towns have been selected on the basis of population i.e. one lakh and

above. The project would help improve existing basic infrastructure

services like extending clean drinking water supply, improve sewerage

networks, develop seepage management, lay storm water drains, improve

public transport services and create green public spaces like parks, etc. The

total project outlay of funds for five years (FY16-20) will be | 50,000 crore

which will be provided by the central government in instalments of

20:40:40. AMRUT, a flagship programme to improve the infrastructure of

the country would be the future growth driver of the plastic piping industry.

Agriculture: Focus to increase irrigated land to piping industry growth

The Government of India has launched various programmes in the

agriculture sector focusing on increasing irrigation, farmer’s income and

production. These schemes and programmes will give an impetus to

demand for pipes & fittings. The Union Budget 17-18 was focused on

boosting the rural economy, by announcing higher spend on the agri sector

to support farmers. In a bid to double farmers’ income in the next five

years, the government has made a total allocation of | 1,87,233 crore. The

government has increased the allocation for irrigation corpus to | 40,000

crore coupled with dedicated micro irrigation fund worth | 5000 crore (to be

set up by Nabard). ‘Pradhan Mantri Krishi Sinchayee Yojana’ will be

implemented in mission mode and 28.5 lakh hectares of land will be

brought under irrigation. This will boost the growth of pipe and fittings for

the next few years.

Exhibit 32: Low irrigation coverage to be bigger opportunity for PVC piping industry

Gross Cropped area (198 mn ha)

Source: ICICIdirect.com Research

Net Cropped area (142 mn ha)

*Uneven distribution of rain

makes irrigation paramount

Net irrigated area (65.3 *Only 46% of net cropped area is

mn ha) under irrigation

Source: Company, ICICIdirect.com Research

Of the 1.8 mn piping industry, operating @65% utilisation Agriculture constitutes a significant ~70% of total PVC pipe demand in

1.2 volume we assume 90% represents PVC pipes (which India. It is pegged at | 7000 crore. Finolex Industries, Jain Irrigation and

is 1.1 MT). Of this 1.1 MT agriculture contributes 70% of Supreme Industries are major players in the agriculture piping segment.

total demand (comes ~0.7 MT). The agri opportunity is Rising government expenditure towards irrigation (only 46% of net cropped

pegged at | 7000 crore (realisation is | 100000/tonne) area is under irrigation) opens up a huge opportunity for PVC pipe

manufacturer in India. APTL, earlier being the largest supplier to CPVC

piping to housing industry, has gradually been increasing its focus towards

the agriculture PVC pipe business. This is clearly evident from the

company’s revenue mix wherein contribution of PVC pipe in the revenue

increased from 37.5% in 2012 to ~48% currently. Focusing on the

agriculture segment would not only benefit the company in terms of

ICICI Securities Ltd | Retail Equity Research Page 13

diversifying business, it would also help APTL to achieve notable volume

growth (17% CAGR in FY17-19E).

Backward integration: Step forward to be more competitive in CPVC

APTL was the first company in India to receive a license for outsourcing

CPVC compound from Lubrizol Corp (US) for manufacturing CPVC pipes.

Later on, APTL leveraged its tie-up with Lubrizol by launching various

plumbing products such as Flowguard, Bendable Flowguard, Corzen,

BlazeMaster, etc, which was well accepted by the plumber community.

However, APTL discontinued its tie-up with Lubrizol Corp mainly due to

issues pertaining to raw material prices. Meanwhile, APTL has also set up a

CPVC compounding plant in Gujarat at an investment of | 50 crore and

signed an agreement with Japan’s Sekisui Chemical Company (Sekisui) for

supply of CPVC resin (raw material for CPVC compound).

Benefits of APTL with new supply agreements

1. Launching own brand: New tie-up (with Sekisui) has helped APTL to

replace Astral Flowguard brand (Flowguard associated with Lubrizol)

with its own brand Astral CPVC PRO

2. Higher credit days: Lubrizol Corp reduced the credit limit for its clients

Source: ICICIdirect.com Research

(from 120 days to 60 days) once the company started its new CPVC

compounding plant at Dahej (Gujarat) in January 2016. It has

negatively impacted APTL in terms of higher working capital

requirements. However, APTL has again received credit of 120 days

after signing outsourcing deal with Sekisui (outsourcing of CPVC

resin). We believe higher credit days (from supplier) would translate

into lower working capital requirements and interest outgo

3. To turn EBITDA accretive: Starting its own CPVC compounding unit

reduced APTL’s dependency on the supplier by 70%. Backward

integration would also help the company increase its EBITDA margin

up to 100 bps over the long term by reducing the bargaining power of

limited suppliers of CPVC compound

4. Opportunity for export: APTL can now export its CPVC products to

other countries unlike when it had a tie-up with Lubrizol wherein APTL

was not allowed to export CPVC products to other countries

Exhibit 33: Lower working capital requirement, going forward Exhibit 34: Better EBITDA margin supported by backward integration

8 16

7 14 13.4 14.2 14.0 14.4 14.0 14.2 14.9

6.7 6.4

6 12 11.8 12.4

5 4.9 10

4.5 4.2

4 8

(%)

(%)

3 3.2 3.0 6

2.4 2.5

2 4

1 2

0 0

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Net working capital % sales EBITDA margin

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research

ICICI Securities Ltd | Retail Equity Research Page 14

Diversification to adhesive segments for future growth

In 2011, APTL signed a technical collaboration agreement with US based

IPS Corp to form a company Advanced Adhesive (AAL). AAL is engaged in

the cement solvent business (Weld-on), which is mainly used for joining

APTL acquired Resinova Chemie Ltd (Resinova) in two pipes for residential and industrial applications. We believe it was a start

trenches at a total consideration of ~| 286 crore. In the when APTL decided to venture into the adhesive and sealant segment

same year, APTL marked its entry into the international through the inorganic route. Later, APTL acquired a majority stake in two

market by acquiring an 80% stake in Seal IT Services Ltd at companies viz. Resinova Chemie Ltd (India) and Seal It Services Ltd (UK) in

a consideration of | 44 crore. APTL diluted equity by 6.6% FY15. APTL acquired Resinova Chemie Ltd (Resinova) in two trenches at a

during FY15-16 to fund the two acquisitions total consideration of ~| 286 crore. In the same year, APTL marked its entry

into the international market by acquiring an 80% stake in Seal IT Services

at a consideration of | 44 crore. APTL diluted equity by 6.6% in FY15-16 to

fund the two acquisitions. In Q4FY16, the company merged its two

subsidiaries AAL and Resinova Chemie with the approval of the high court.

This amalgamation resulted in consolidation of the business operations of

the two subsidiary companies, enhancing the scale of operations, reducing

its overhead and administrative expenditures resulting in better EBITDA

margin and lowering the tax incidences. Further, as part of the extension

Seal IT Services (UK), acquired the US based Silicone tape business of

Rowe Industries Inc at a consideration of US$3.25 million.

Exhibit 35: Historical performance of Resinova (includes AAL) Exhibit 36: Historical performance of Seal IT

250 10.5 160 8.0

10.2 7.4

140 7.0

234.5

150.1

200 10.0 6.5

120 5.9 6.0

132.9

195.3

9.5

117.1

150 100 5.0

(| crore)

(| crore)

152.4

9.0 80 4.0

(%)

(%)

100 8.7 8.7 60 3.0

8.5

40 2.0

50

14.1

8.0

6.6

20 1.0

8.4

4.8

4.6

10

0 7.5 0 0.0

FY13 FY14 FY15 FY13 FY14 FY15

Revenue PAT EBITDA margin Revenue PAT EBITDA margin

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research

Exhibit 37: Adhesive business performance

500.0 454.5 14.0

450.0 394.0

384.7 12.0

400.0

328.3 10.0

350.0

300.0 269.4

8.0

(| crore)

250.0

(%)

200.0 6.0

150.0 4.0

100.0

2.0

50.0

0.0 0.0

FY13 FY14 FY15 FY16 FY17

Revenue EBITDA margin

Source: Company, ICICIdirect.com Research

Resinova manufactures adhesives, sealants, construction chemicals and

Resinova manufactures adhesives, sealants, construction

industrial maintenance products under several brand names with a wide

chemicals and industrial maintenance products under

marketing network across India. RCL covers various industry segments for

several brand names

its products including the automobile sector, sanitation, paints, plywood,

hardware and building materials. Its product range includes a broad range

ICICI Securities Ltd | Retail Equity Research Page 15

of chemical products including epoxy, silicones, cyanoacrylate, solvent

cements, PU sealants, anaerobic, UV care, MS polymers, acrylic, etc. The

company has three manufacturing capacity (two in UP and one in Gujarat)

in India. Resinova sells its products with around 50 brands and 600 SKUs.

Some of the key brands of the company are Bondtite, Resibond, Bondset,

Solvobond, Vetra, Brushbond, Zesta, etc.

Seal It manufactures a range of sealants and adhesives

UK based Seal It manufactures a range of sealants and adhesives under the

under the brand name “Bond-it” as well as a

brand name Bond-it, as well as a comprehensive range of silicones,

comprehensive range of silicones, sealants, cleaning

sealants, cleaning agents, tile adhesives, waterproofing chemicals bitumen,

agents, tile adhesives, waterproofing chemicals bitumen,

polyurethane foams, building & construction chemicals, and silicon tape

polyurethane foams, building & construction chemicals

business. The plant is operating with a capacity of 20895 metric tonnes. Its

primary markets include the UK, Europe and Middle East. Further, APTL

also plans to launch new products and leverage dealer networks (in India

and abroad) for cross-selling higher margin products.

Exhibit 38: Product range of Resinova

Source: Company, ICICIdirect.com Research

Exhibit 39: Seal-IT product range

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 16

Adhesive: India exhibits high growth potential

The Indian adhesive, sealants and building chemical industry is pegged at

| 10,000 crore and is growing at a CAGR of 15%. Adhesives can be

classified into four major segments, including water-based adhesives,

solvent-based adhesives, hot-melt adhesives and reactive adhesives.

Among these, water-based adhesives dominated the Indian adhesives

The Indian adhesive, sealants and building chemical

market with about 38% share in volume terms in 2013. Water-based

industry is pegged at | 10,000 crore growing at a CAGR of

adhesives in India are largely dependent on wood and paper for packaging

15%. Adhesives can be classified into four major

and furniture. As water-based adhesives provide maximum adhesion on

segments, including water-based adhesives, solvent-based

porous substances made up of wood, they find major application in the

adhesives, hot-melt adhesives and reactive adhesives

retail market for non-industrial applications. Solvent-based adhesives are

also being widely used in the country despite their high volatile organic

compound (VOC) emissions. The reason can be the absence of stringent

regulations. However, with growing awareness, manufacturers are

switching to less costly and environment-friendly water-based adhesives.

Another advantage is that the same machinery can be used for water-based

adhesives manufacturing, which was initially used for solvent-based

adhesives production. As a result, the share of the solvent based adhesives

market is forecast to grow at a moderate rate and account for around 20%

share in the Indian adhesives market by FY19. Hot-melt and reactive

adhesives technologies are generally the high-priced adhesives available in

the Indian market. The market share of these technologies is expected to be

driven by their use in emerging applications and research efforts in various

fields like automotive, construction, product assembly, etc.

Exhibit 40: India adhesive market share by technology 2013 Exhibit 41: India adhesive market share by technology 2019E

Hot-melt Hot-melt

19% 20%

Reactive

Reactive

16%

18%

water based

water based

38%

42%

Solvent based Solvent based

27% 20%

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research

Low per capita consumption: depicts promising future of industry

The per capita consumption of adhesives is 9.4 kg in Germany and 9.1 kg in

US compared to 1.5 kg in China and just 0.20 kg in India. Similarly, while

the value of per capita consumption of adhesives is | 750 for developed

countries it is just | 50 for India. This shows that India offers good potential

for growth in consumption of adhesives, which is a positive feature of this

Per capita consumption of adhesives is 9.4 kg in Germany,

industry. As adhesives offer strength and versatility for bonding two or

9.1 kg in US compared to 1.5 kg in China and just 0.20 kg

more components, the product has developed a unique position in the

in India

Indian market in both the retail and industrial segment. The adhesive market

in India is diverse in terms of end-use applications, as almost every

manufacturing sector requires some sort of adhesive.

Major end use industries that utilise adhesives are furniture and

woodworking, paperboard & packaging and building & construction.

According to the company, the Indian adhesive, sealant and building

material chemical industry is likely to grow at a CAGR of 15%, going ahead,

supported by dynamic economic development with expanding middle class

population, urbanisation and strengthening of industries like construction

and transpiration (including metro rail and railways).

ICICI Securities Ltd | Retail Equity Research Page 17

Exhibit 42: Per capita consumption lowest in India among other developing countries

10 9.4 9.1

9

8

7 6.4

(kg per capita)

6

5

4

2.9

3

2 1.5

1

1 0.2

0

Germany US Japan Russia China Brazil India

Source: Company, ICICIdirect.com Research

APTL has continuously focused on improving the Modernisation, doubling adhesive capacity for scalability

performance and launching new products under the

The recent acquisition of the adhesive and sealant business would

adhesive & sealant division. It has doubled the

synergise APTL in terms of deepening and widening its product offerings.

manufacturing capacity of this division and also

We believe the combined brand development, product innovation skills and

modernised the old capacity at UP

distribution reach of Astral, Seal IT and Resinova will enable building a

robust and valuable adhesive business. Post acquisition, APTL has

continuously focused on improving the performance and launch of new

products under the adhesive & sealant division. APTL has doubled the

manufacturing capacity of adhesive and sealant in India to 31739 metric

tonnes by opening a new manufacturing plant at Ahmedabad (Gujarat). It

has also modernised its Kanpur facility (UP) to increase the production with

saving in cost. Commencement of the new plant in Ahmedabad will not

only help the company scale up the adhesive business, it will also help the

company to capture newer markets with lower logistic cost.

Initial focus on niche categories to strengthen present

The Indian adhesive industry is pegged at | 6000 crore. It is largely

dominated by organised players with a market share of ~60%. Pidilite

Industries, being the largest adhesive player in India, dominates the

APTL is focusing towards niche products categories of industry with ~70% market share followed by Henkel and Sika India. Other

Epoxy adhesive (used in laminates, glass, tiles, etc) solvent major players operating in the market include Atul, 3M, HB Fuller, Bostik,

cement (for joining pipes) and silicon (used in glass to Huntsman India, etc. APTL has largely focused on the Industrial segment

glass and glass to metal bond with product categories including acrylic, epoxy adhesives/sealant and

solvent cements. APTL is focusing on niche product categories of epoxy

adhesive (used in laminates, glass, tiles, etc), solvent cement (for joining

pipes) and silicon (used in glass to glass and glass to metal bond) unlike

Pidilite, which is a market leader in retail like poly vinyl acetate, rubber

adhesive, acrylics and construction chemicals (includes Fevicol, Fevibond,

Fevikwik, M-Seal).

Despite mere 26% contribution to topline, APTL is now focusing on

improving the performance of the adhesive and sealant business. The effort

has been yielding good results. This is evident from the strong performance

of the business wherein business recorded sales CAGR of 14% during

FY12-17, with EBITDA margin improving from 6.5% to ~13% during the

same period. We believe that currently APTL is a small player in this

category and would leverage its strong brand image (of pipe business) to

push up the sales of adhesive and sealant business. Doubling the capacity

and strong brand image would help the company achieve segment sales

CAGR of 22% in FY17-19E. We also believe, at initial level, APTL has to

compromise at lower EBITDA margin of ~12-13% (unlike ~22% EBITDA

margin of Pidilite Industries) mainly due to higher sales & promotion activity

and discount to new dealers. However, APTL has guided that it will increase

ICICI Securities Ltd | Retail Equity Research Page 18

We believe, at initial level APTL has to compromise at

EBITDA margin (by 100 bps every year) with the launch of premium

lower EBITDA margin of ~12%-13% (unlike ~22% EBITDA

products and lowering the discounts of dealers, going forwards.

margin of Pidilite Industries) mainly due to higher sales and

promotion activity and discount to new dealers

Exhibit 43: Strong revenue growth for APTL due to capacity expansion Exhibit 44: Scope of margin expansion …

8000.0 25.0 23.2

6967.1

7000.0

20.0 16.9

6000.0

4706.5

5000.0 15.0

(| crore)

4000.0 10.2

(%)

3000.0 10.0 6.5

2000.0

410.3 674.8 5.0

1000.0

0.0 0.0

FY16 FY19E FY12 FY16

Pidilite Ind Astral Pidilite Ind Astral

Source: Company, ICICIdirect.com, Research, Pidilite (standalone revenue) Source: Company, ICICIdirect.com, Research, Pidilite (standalone margin)

APTL to leverage strong dealer network of acquired companies

Over the last few years, the company has ventured into other segments

such as PVC and adhesive segment, which reduced its dependence on the

core CPVC business. Acquisitions of Resinova and Seal It have not only

added a new product portfolio to its kitty but have given APTL access to a

strong dealer network across India and UK, respectively. Under the piping

segment, APTL has access to over 750 distributors and 25000 dealers

across India. For the adhesive segment, the company has 2500 distributors

and over 4,50,000 dealers in India. Seal-It has an over 1800 customer base

(dealing with Seal IT products) in the UK. We believe the company will

utilise the extensive dealer network for cross-selling international products

(higher margin products like silicon tape) to Indian markets. APTL’s

relentless focus on building a strong consumer brand through various ad

Under the piping segment, APTL has access to over 750

campaigns (Introduction of Salman Khan as brand ambassador) makes it

distributors and 25000 dealers across India, while for

different from other piping players. We believe APTL has established a

adhesive segment company has 2500 distributors and over

strong brand name in the building materials industry in India over the last

4,50,000 dealers in India

15 years, particularly for CPVC and PVC piping and plumbing systems and

allied products (last four year average of discounts and promotion

expenses as percentage of sales remained at 3.5%).

Exhibit 45: Higher advertisement and discounts expenses due to diversification

4.7

5.0 4.4

4.2

4.5 3.9 4.0

4.1 3.6

4.0

3.7

3.6 3.8

3.5 3.5

3.4

3.0 2.9

2.5

(%)

2.0 2.1 2.1 2.2

1.9 2.0

1.5 1.4

1.0 1.1

0.7 0.6 0.7 0.8

0.5

0.0

FY11 FY12 FY13 FY14 FY15 FY16

Pidilite Astral Poly Supreme Ind Finolex ind

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 19

Exhibit 46: Strong branding activity with introduction of Bollywood celebrity

Source: Company, ICICIdirect.com Research

Continuous investment in increasing capacity, a strengthening dealer

network and maintaining high product quality helped APTL maintain its

leadership position in the CPVC pipe industries. We believe continuous

capacity expansion along with regular addition to the dealer network would

result in overall volume CAGR of ~17% for FY17-19E vs. ~32% during

FY09-16 (capacity addition recorded a CAGR of 26% in FY09-16 while the

company is likely to record a CAGR of 12% in FY17-19E).

Exhibit 47: Leveraging dealer network to help company to increase turnover

Company Distribution Networks

Supreme Industries 2469

Astral Poly technik Ltd 1700

Ashirvad Pipes 1800

Jain Irrigation 3071

Finolex Industries 600

Source: Company, ICICIdirect.com Research

Collaboration with global players to support new product launch

APTL has a proven record of launching new products in the market backed

by strong R&D and tie-ups with global players. Being a market leader, APTL

APTL has a proven record of launching new products in the is concerned about the relevance and quality of the products. The company

the market backed by strong R&D and tie-ups with global has entered into technical tie-ups with various multinational companies

players across the world. The technical collaboration has helped APTL improve the

quality (by adopting new technology) thereby producing international

standard products at minimal operating costs. This has also helped APTL

create strong brand value for its products and helped increase the

contribution of value added products in sales.

Exhibit 48: Global partners to build competent products for global market under piping and adhesive segment

Commencing business in 1947, Sekisui group is one of the largest chemical groups based in Japan. As on March 31, 2016 Sekisui group has a

turnover of over US$ 10 billion with global presence in Europe, Asia and America. Astral Poly joined hands with Sekisui to source Cholinated Poly

Vinyl Chloride (CPVC) resin for hot and cold water plumbing system

US based 'Spears’ product line inlcudes selection of 1/8” through 12” injection molded fittings and fabricated fittings through 48”, specialty

products, and manual and mechanically actuated thermoplastic valves in a variety of types, sizes and configurations

Established in 1954 as the original inventor of solvent cement for PVC pipe applications, IPS® Corporation has operations throughout the US,

Europe, and Asia. Astral Poly entered into a JV with IPS® Corporation to manufacture solvent cement, which is used as glue in PVC/CPVC pipes in

FY12

Italy based 'First Plast' is skilled in manufacturing building plastics and produces drainage systems such as drainage channels, ground accessories,

rainwater gutter and solvent cement fittings made of PVC

AlcaPlast is one of the largest manufacturers of sanitary ware in Central and Eastern Europe. Besides its traditional product range of fill and flush

valves, it also produces concealed WC installation systems, plastic cisterns, bath siphons and shower-basin siphons

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 20

Key Financials

Consolidated sales CAGR of 21% in FY17-19E

APTL has recorded sales CAGR of ~37% during FY09-16, driven by the

company’s core business i.e. piping division, which recorded a sales CAGR

of 32% during the same period. Piping division sales were entirely led by

volume growth whereas realisation was muted due to a change in the

The topline is expected to grow at a CAGR of ~21%

product mix (rising proportion of PVC products in the topline). Volume

during FY17-19E to | 2786 crore in FY19E from | 1889

growth of the piping segment came on the back of replacement demand

crore during FY17E led by strong volume growth of 17% in

from the housing segment in both rural and urban India (translated into

the piping segment

regular capacity addition). We have modelled consolidated revenue CAGR

of 21% in FY17-19E to | 2786 crore led by capacity expansion and strong

demand in the piping segment. We believe the piping and drainage

segments will record a strong revenue CAGR of 21% in FY17-19E led by

volume CAGR of 17% supported by continuous demand from various

government schemes and replacement demand (share of metal piping in

the housing segment to reduce gradually). On the other hand, doubling the

capacity coupled with strong branding of adhesive & sealant segment

would lead strong segment revenue CAGR of 22% in FY17-19E.

Exhibit 49: Capacity expansion on the cards …. Exhibit 50: … to drive future volume growth

200000 140000

CAGR 12%

120000 CAGR 17%

123054

CAGR 26%

172708

150000 100000 CAGR 32%

155208

102049

137708

80000

(tonnes)

(tonnes)

89992

127762

100000

77909

60000

40000

25968

50000

11164

20000

0 0

FY09 FY16 FY17 FY18E FY19E FY09 FY16 FY17 FY18E FY19E

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

Exhibit 51: Revenue growth backed by strong volume growth Exhibit 52: Doubling capacity to drive adhesive & sealant revenue

2500 800

CAGR 21% 700 CAGR 22%

2205

2000

675

600

587

1786

1500 CAGR 32% 500

(| crore)

(| crore)

1506

400

451

1318

410

1000 300

200

500

223

193

100

0 0

FY09 FY16 FY17 FY18E FY19E FY15 FY16 FY17 FY18E FY19E

Source: Company, ICICIdirect.com, Research Source: Company, ICICIdirect.com, Research

ICICI Securities Ltd | Retail Equity Research Page 21

Backward integration coupled with stabilisation of new units to drive margin

The major raw material for piping and adhesive & sealant are derivatives of

crude oil and APTL had CPVC compound outsourcing tie-up with Lubrizol

We believe raw material (largely derivative of crude oil Corp. Despite a decline in raw material prices (PVC prices declined ~6%

like PVC) prices will remain subdued in the near term. The YoY and ~11% YoY in FY15 and FY16, respectively) APTL suffered a loss in

commencement of its own CPVC compounding unit in gross margin to the tune of ~300 bps and ~200 bps YoY in FY15 and FY16

Gujarat would translate into a margin improvement to the respectively. This was mainly due to inventory loss on account of no benefit

tune of ~100 bps being passed on by Lubrizol Corp. However, the company has discontinued

its tie up with Lubrizol and commenced its own CPVC compounding plant at

Santej (Gujarat) in FY17. It entered into a joint agreement with Japan’s

Sekesui for outsourcing CPVC resins.

This move resulted in expansion in gross margin by 260 bps YoY during

FY17. Further, addition of new capacity in newer geographies (near selling

markets) would help save freight cost (~50 bps). Further, though we believe

raw material prices (CPVC/PVC resins) will remain benign in the near future,

Astral being a strong brand in the piping business is in a strong position to

pass on adverse price movements of raw material to end customers. In

addition, a gradual improvement in profitability of adhesive and sealant

segment due to better product mix (launch of new products like silicon tape

in the domestic market that has ~40% of EBITDA margin), rising proportion

of retail segments, continuous addition to dealer network would help drive

profitability of the business, going forward. As a result, we believe the

EBITDA margin will increase 100 bps in FY17-19E to ~15%. However,

higher branding and promotional expenses of new products under the

adhesive and sealant categories would keep margins under check.

Exhibit 53: PVC prices Exhibit 54: Saving from lower material cost to drive EBITDA margin

33.1

32.4

31.7

31.1

31.0

90,000 35.0

29.5

29.4

28.4

28.4

28.3

26.6

80,000 30.0

70,000 25.0

20.0

14.9

60,000

14.4

14.4

14.2

14.2

14.0

14.0

13.4

12.4

11.8

(%)

11.3

(|/tonne)

50,000 15.0

40,000 10.0

30,000 5.0

20,000 0.0

FY18E

FY19E

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

10,000

0

FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17

Gross Margin EBITDA margin

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 22

Strong sales growth to drive PAT at CAGR 28% in FY17-19E

APTL has recorded strong PAT CAGR of ~33% during FY09-16 led by

piping & drainage systems and disciplined approach towards capital

The company recorded a net profit CAGR of 33% during expenditure (debt to equity ratio declined from 0.7x in FY09 to 0.2x in

FY09-16 led by an increase in sales and EBITDA margin. FY16). We believe a reduction in debt level by 18% would lead to a

We believe the company would continue to record strong significant reduction in interest outgo by ~48% (by FY19E). Despite rising

sales growth (backed by capacity addition) with increase non-cash expenditure (higher depreciation charges due to recent capex),

in EBITDA margin that would drive PAT at 28% CAGR in the company is expected to record strong PAT CAGR of 28% in FY17-19E

FY17-19E led by sales growth and expansion in EBITDA margin.

Exhibit 55: Net profit to grow at ~27% CAGR in FY17-19E

250 235

CAGR 28%

200

173

145

150

CAGR 33%

102

100 79 76

61

33 39

50 28

14

0

FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Source: Company, ICICIdirect.com Research

Exhibit 56: Asset turnover to improve gradually with stabilisation of new plants

3.5

3.0 2.9 3.0

2.9 2.9 2.9

2.8 2.7 2.7

Fixed assets turnover of APTL has been strong barring 2.5 2.5 2.6

FY15-16 wherein the company have done significant capex

for both addition of new business and capacity. We believe 2.0 2.0

(x)

the turnover will increase gradually with the stabilisation of 1.5

new units, going forward

1.0

0.5

0.0

FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 23

Better earnings growth to lead to expansion in return ratios

APTL has maintained a disciplined approach for capital expenditure to add

We believe stabilisation of new capacity, improvement in

new capacity or new business by using internal accrual. This has translated

margin and lower working capital requirement would

into decline in debt/equity mix 0.4x in FY12 to 0.2x in FY16. However, the

translate into strong operating cash flow and bring back

company’s cash conversion cycle was stretched due to significant cut in

the return ratios to elevated levels

credit days by Lubrizol Corp (from 120 days to 60 days after starting new

capacity in Gujarat). After joining hands with Sekesui, APTL was assured of

getting extended credit days (of 120 days), which would translate to lower

working capital requirement, going forward. Historically, the company has

recorded strong RoCE, RoE led by a strong performance. We believe

stabilisation of new capacity, improvement in margin and lower working

capital requirement would bring back return ratios to elevated levels.

Exhibit 57: Debt/equity mix at comfort zone despite regular capex Exhibit 58: Return ratios to improve with increase in profitability

31.4 31.8

0.8 35.0 28.7

0.7 0.7 30.0 23.9 23.7 23.8

21.3 21.7

0.6 25.0 19.2

17.0

0.5 20.0 13.6 23.6 25.1 25.0

22.2 21.4

(%)

0.4 15.0

17.2 16.0 18.0

(x)

0.4 0.4

0.3 0.3 10.0 15.1 14.5

0.3 0.3 12.3

0.2 5.0

0.2 0.2 0.2

0.1 0.0

0.1 0.1

FY18E

FY19E

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

0.0

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18E

FY19E

RoCE RoE

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

Exhibit 59: Higher credit days to translate into lower cash conversion cycle

80

69 69

70

59 61

60 52

50

41

(Days)

40

30

20

10

0

FY13 FY14 FY15 FY16 FY17E FY18E

Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 24

Risk & concerns

Volatility in raw material prices

Major raw materials consumed by APTL are poly vinyl chloride (PVC)

resins, Chlorinated polyvinyl chloride (CPVC) resins, which are linked to