Professional Documents

Culture Documents

Note For Teachers and Students: Answers

Note For Teachers and Students: Answers

Uploaded by

Richa Sharma0 ratings0% found this document useful (0 votes)

8 views1 pageThis document contains questions and answers related to partnership accounts. It provides examples of calculating interest payable on partners' capital for different scenarios. It also presents several challenge cases involving the distribution of profits and losses to partners where interest is or isn't paid on capital. The document concludes by providing contact information for teachers or students who have additional questions.

Original Description:

acgg

Original Title

avff

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains questions and answers related to partnership accounts. It provides examples of calculating interest payable on partners' capital for different scenarios. It also presents several challenge cases involving the distribution of profits and losses to partners where interest is or isn't paid on capital. The document concludes by providing contact information for teachers or students who have additional questions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageNote For Teachers and Students: Answers

Note For Teachers and Students: Answers

Uploaded by

Richa SharmaThis document contains questions and answers related to partnership accounts. It provides examples of calculating interest payable on partners' capital for different scenarios. It also presents several challenge cases involving the distribution of profits and losses to partners where interest is or isn't paid on capital. The document concludes by providing contact information for teachers or students who have additional questions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

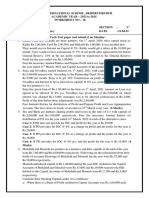

ANSWERS

1. Interest payable A Rs.7,250 and B Rs.4,000.

2. Interest on capital will be recorded in partners’ current account when capitals are fixed.

3. X is correct because in the absence of partnership deed profits are to be shared equally and no

interest on capital in the absence of partnership deed to any partner.

4. Y is correct because in the absence of partnership deed as per the Section 12(a) of Indian

Partnership Act, 1932 is applicable according to which every partner is entitled to participate in

the conduct of the firm’s business but not interest on capital will be allowed to any partner

because there is not partnership deed.

5. Interest on X’s Capital Rs.13,000 and Y Rs.8,000

6. Interest on Kumar’s Capital Rs.12,000 + 16,000 = 28,000

7. Interest on A’s Capital 12,812.50

8. Interest on X’s Capital Rs.11,500 and Y’s Capital Rs.8,150

Challenge-1 : Case 1: Profit to Vinod Rs.18,000 and Kumar Rs.12,000

Case 2: No interest on capital to partners; Loss to Vinod Rs.12,000; Kumar 8,000.

Case 3: Interest on capital to Vinod Rs.10,000; Kumar Rs.5,000; Profit to Vinod

Rs.3,000 and Kumar Rs.2,000.

Case 4: Distribute in the ratio of Appropriation Vinod Rs.6,000; Kumar Rs.3,000.

Case 5: Interest on capital to Vinod Rs.10,000; Kumar Rs.5,000; Loss to Vinod Rs.3,600

and Kumar Rs.2,400.

Case 6: Interest on capital to Vinod Rs.10,000; Kumar Rs.5,000; Loss to Vinod

Rs.12,000 and Kumar Rs.8,000.

Note for teachers and students

In case you have any doubt or any inquiry please go through the

Ultimate Book of Accountancy CBSE class 12th

OR

Contact the respected author: authorcbse@gmail.com

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

You might also like

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Conversion of Partnership Firm Into CompanyDocument8 pagesConversion of Partnership Firm Into CompanyAthulya MDNo ratings yet

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustFrom EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustNo ratings yet

- Grade Xi HOLIDAY HOMEWORK-2016-17 Commerce Stream AccountancyDocument36 pagesGrade Xi HOLIDAY HOMEWORK-2016-17 Commerce Stream AccountancysanjeevaniNo ratings yet

- Accountancy Xi Online Exam (2) - 274Document6 pagesAccountancy Xi Online Exam (2) - 274Swami NarangNo ratings yet

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokNo ratings yet

- Partnership Fundamental 12 (2023)Document3 pagesPartnership Fundamental 12 (2023)Hansika SahuNo ratings yet

- Answers NCERT Solutions For Class 12 Accountancy Freehomedelivery NetDocument149 pagesAnswers NCERT Solutions For Class 12 Accountancy Freehomedelivery NetAnkur MishraNo ratings yet

- The Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmDocument3 pagesThe Teaching Hub Class Xii Accountancy Chapter 2: The Fundamental of Partnership FirmAthArvA .TNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- 12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationDocument3 pages12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationHari SharmaNo ratings yet

- 12 Accountancy Ch01 Test Paper 04 Past AdjustmentsDocument2 pages12 Accountancy Ch01 Test Paper 04 Past AdjustmentsSACHIN YADAV100% (1)

- Accounting For Partnership FirmDocument11 pagesAccounting For Partnership FirmNeha AhilaniNo ratings yet

- Revision Fundamentals 1Document7 pagesRevision Fundamentals 1LexNo ratings yet

- Unit 2 Partmership Firms FundamentsDocument10 pagesUnit 2 Partmership Firms FundamentsSunlight SirSundeepNo ratings yet

- AccountsDocument59 pagesAccountsrajat0% (1)

- Part - A Partnership, Share Capital and Debentures: General InstructionsDocument7 pagesPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNo ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- Sample Paper - 4: Book Recommended - Ultimate Book of Accountancy Class 12Document23 pagesSample Paper - 4: Book Recommended - Ultimate Book of Accountancy Class 12Titiksha Joshi100% (1)

- 12 Acc PMT QP, Set A-2023-24-Answer KeyDocument9 pages12 Acc PMT QP, Set A-2023-24-Answer KeyMOHAMMED IZAAN IQBAL IQBAL MOHAMMED MANGALORENo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- SAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Document16 pagesSAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Shreya PalejkarNo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3No ratings yet

- Assignment 18 Partnerhsip Firm PDFDocument2 pagesAssignment 18 Partnerhsip Firm PDFThanushree JNo ratings yet

- CLASS 12 ACCOUNTS WORKSHEET ON FUNDAMENTALS OF PARTNERSHIP Mr. Md. MurtujaDocument1 pageCLASS 12 ACCOUNTS WORKSHEET ON FUNDAMENTALS OF PARTNERSHIP Mr. Md. MurtujaSahyogNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Term One Accountancy 12 QP & MSDocument13 pagesTerm One Accountancy 12 QP & MSVarun HurriaNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Accounting Equation Practice QuestionsDocument6 pagesAccounting Equation Practice QuestionsJahanzaib ButtNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question BankDocument17 pagesCBSE Class 11 Accountancy Worksheet - Question BankUmesh JaiswalNo ratings yet

- Assignment 1Document4 pagesAssignment 1Eshaal FatimaNo ratings yet

- Journalize Following TransactionsDocument13 pagesJournalize Following TransactionsMD SAHIRNo ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- Financial Management NotesDocument37 pagesFinancial Management NotesNavdeeshSharmaNo ratings yet

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- Class 12 Accounts Pre-Board CorrectDocument7 pagesClass 12 Accounts Pre-Board CorrectHarini NarayananNo ratings yet

- 7 HOTS Questions PDFDocument33 pages7 HOTS Questions PDFNishant ShyaraNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- Jairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)Document6 pagesJairam Higher Secondary School, Salem-8 Quarterly Examination-2020-2021 Class: Xii Accountancy MARKS: 90 DATE: 16.10.2020 TIME: 2 Hrs I. Choose The Correct Answer: (20 X 1 20)ShruthikaNo ratings yet

- 1 TEST, 2020-21 Class: Xii AccountancyDocument1 page1 TEST, 2020-21 Class: Xii AccountancyKul DeepNo ratings yet

- Group Worksheet and AssignmentDocument10 pagesGroup Worksheet and AssignmentmohammedNo ratings yet

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- Last 5 Year Accounting For Partnership FirmDocument13 pagesLast 5 Year Accounting For Partnership FirmTCPS UNFILTEREDNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question BankDocument17 pagesCBSE Class 11 Accountancy Worksheet - Question Bankganesh pathakNo ratings yet

- Practical (TSG 2020-21)Document24 pagesPractical (TSG 2020-21)Gaming With AkshatNo ratings yet

- XII AccountancyDocument156 pagesXII AccountancyRiddhi SharmaNo ratings yet

- 12 Accountancy ch01 Test Paper 04 Past Adjestments PDFDocument3 pages12 Accountancy ch01 Test Paper 04 Past Adjestments PDFRicha SharmaNo ratings yet

- CBSE 12th Accountancy 2012 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2012 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Ch1 AssignmentDocument3 pagesCh1 AssignmentRachit JainNo ratings yet

- Xii CommerceDocument7 pagesXii CommerceJatinNo ratings yet

- Accounting For Partnership Firms Fundamental PDFDocument10 pagesAccounting For Partnership Firms Fundamental PDFMarivisiasNo ratings yet

- Rbse Class 12 Accountancy Question Paper 2020Document10 pagesRbse Class 12 Accountancy Question Paper 2020rajwanikajal24No ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument11 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsSikha KaushikNo ratings yet

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Accountancy Practice Worksheet Ch-2Document2 pagesAccountancy Practice Worksheet Ch-2Pujan SachaparaNo ratings yet

- Basic Concept (Test)Document4 pagesBasic Concept (Test)Midhun PerozhiNo ratings yet

- Accounts Test No. 5Document2 pagesAccounts Test No. 5AMIN BUHARI ABDUL KHADERNo ratings yet

- XII ACC Holiday HomeworkDocument3 pagesXII ACC Holiday HomeworkGaurav SainNo ratings yet

- Revised Final Result Punjab Haryana High Court PCS JB 2019Document30 pagesRevised Final Result Punjab Haryana High Court PCS JB 2019Richa SharmaNo ratings yet

- 68 Ujala BookDocument104 pages68 Ujala BookRicha SharmaNo ratings yet

- Hindi All Competitive Exams: (31 JANUARY 2018)Document1 pageHindi All Competitive Exams: (31 JANUARY 2018)Richa SharmaNo ratings yet

- Q.P. Suitability Test - 2017 First Q.PDocument34 pagesQ.P. Suitability Test - 2017 First Q.PRicha SharmaNo ratings yet

- P-947 Interns Report Conference Sentencing Brief by Vaibhav Kumar 15-10-15Document16 pagesP-947 Interns Report Conference Sentencing Brief by Vaibhav Kumar 15-10-15Richa SharmaNo ratings yet

- Criminal Law LLM 2nd SemDocument2 pagesCriminal Law LLM 2nd SemRicha SharmaNo ratings yet

- WelcomeLetterSeptember2020 693448463Document2 pagesWelcomeLetterSeptember2020 693448463Richa SharmaNo ratings yet

- 2.bail For Children in Conflict With The LawDocument7 pages2.bail For Children in Conflict With The LawRicha SharmaNo ratings yet

- Introduction: The Term "Execution" Has Not Been Defined in The Code. in Its WidestDocument25 pagesIntroduction: The Term "Execution" Has Not Been Defined in The Code. in Its WidestRicha SharmaNo ratings yet

- PGGC-11 Subject Change List Sr. No Form No. Name Roll No. Old Comb New Comb Left Sub Taken SubDocument3 pagesPGGC-11 Subject Change List Sr. No Form No. Name Roll No. Old Comb New Comb Left Sub Taken SubRicha SharmaNo ratings yet

- List of The Chairman/Member & Staff of Haryana Public Service Commission, PanchkulaDocument3 pagesList of The Chairman/Member & Staff of Haryana Public Service Commission, PanchkulaRicha SharmaNo ratings yet

- The Legal Profession Is Governed by A Moral Code That Is The Key To Maintaining Independence and Accountability and Instilling Trust Among Clients by Ritu GuptaDocument4 pagesThe Legal Profession Is Governed by A Moral Code That Is The Key To Maintaining Independence and Accountability and Instilling Trust Among Clients by Ritu GuptaRicha SharmaNo ratings yet

- Order") That Is The Subject of This Analysis. The Final Order Found That The Respondent Had ViolatedDocument2 pagesOrder") That Is The Subject of This Analysis. The Final Order Found That The Respondent Had ViolatedRicha SharmaNo ratings yet