Professional Documents

Culture Documents

ROI Valuation of Firm Worksheet

ROI Valuation of Firm Worksheet

Uploaded by

Jatin KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ROI Valuation of Firm Worksheet

ROI Valuation of Firm Worksheet

Uploaded by

Jatin KumarCopyright:

Available Formats

Share value estimate computation: (E/S times P/E = P/S where E=Earnings, S=Share and P=Price) Earnings/share

times Earnings multiple = Share value estimate

ROI computation: ROI = ( Share value estimate in the last quarter minus Share price paid by Venture Capitalists)

divided by Share price paid by Venture Capitalists

Note: when you report back to the investor at the end of the exercise, be sure to use the actual Price per share in

the last quarter. You may then compare your actual ROI to the one you had projected during the Business Plan

presentation.

COMPUTATION OF SHARE PRICE AND ROI FOR THE VENTURE CAPITALISTS

ENTER VALUE IN

Column 1 EMPTY, HIGHLIGHTED Explanation

CELLS

When you run your pro forma statements, enter the Earnings

EPS (Earnings per

Share) 631 per Share number in the last quarter (this number can be found

in the Income Statement)

It is recommended to use a Earnings multiple of 10 (but you may

pick another value as long as you can justify it). A Price Earnings

Earnings multiple (also

known as Price Earnings 10 ratio of 10 means an investor is willing to pay $10 for each $1 of

earnings or wait 10 years to earn back the original investment

Ratio) (assuming no inflation). You can decide what makes sense for

this early stage of the industry.

This number is automatically computed. You should regard this

Share value estimate 6310 number as a reflection of the value of one share of the company

for the last quarter in the last quarter of play, not as a stock market transaction.

(Expected Price per share minus Price paid in Business Plan

ROI formula: intentionally blank Quarter) divided by Price paid in business plan quarter times

100

Enter the price you are requesting (when you have the offers

Share price paid by VC 120 from the investors, you may update this price with the actual

offer) in the cell to the left.

5158% This number is automatically computed and is based on the

ROI Expected Price per share and the Price paid by the investors.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 19 Chart Patterns PDF Guide - ForexBeeDocument40 pages19 Chart Patterns PDF Guide - ForexBeeThemba Hope Tshabalala100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- J. Peter Steidlmayer:: in Step With The MarketsDocument6 pagesJ. Peter Steidlmayer:: in Step With The Marketsdoron1100% (5)

- BondsDocument3 pagesBondsMaketh.Man75% (4)

- Pooling, Netting, Credit Substitution & Delegation: Fi-IiiDocument13 pagesPooling, Netting, Credit Substitution & Delegation: Fi-IiiasifanisNo ratings yet

- Heiken Ashi ExplanationDocument6 pagesHeiken Ashi ExplanationExpresID100% (2)

- Historical Development of The Banking SystemDocument8 pagesHistorical Development of The Banking SystemHustice FreedNo ratings yet

- How To Master The Art of Intraday ScalpingDocument3 pagesHow To Master The Art of Intraday ScalpingVenkata100% (1)

- PBM - Marketing Activities and IMCDocument12 pagesPBM - Marketing Activities and IMCRishika MadhukarNo ratings yet

- Commodity MarketDocument61 pagesCommodity Marketrocklife_sagarNo ratings yet

- Syllabus 6th Sem BBA-BI PUDocument10 pagesSyllabus 6th Sem BBA-BI PUashish tiwari0% (1)

- CFA Level I - Fixed Income: Fundamentals of Credit AnalysisDocument24 pagesCFA Level I - Fixed Income: Fundamentals of Credit AnalysisAbhishek GuptaNo ratings yet

- Fundamental Analysis 3rd SemDocument23 pagesFundamental Analysis 3rd SemSagar PatilNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosVenz LacreNo ratings yet

- Tata Corus Tata Teltly Final PresentationDocument27 pagesTata Corus Tata Teltly Final PresentationAbhishek GarodiaNo ratings yet

- Horizon Report & AccountsDocument252 pagesHorizon Report & AccountsCyrill Joyce Santelices EgualNo ratings yet

- Analysis To Financial Statement: FLEX Course MaterialDocument29 pagesAnalysis To Financial Statement: FLEX Course MaterialElla Marie LopezNo ratings yet

- Solutions Chapter 16Document7 pagesSolutions Chapter 16Kakin WanNo ratings yet

- United Capital Partners Sources $12MM Approval For High Growth Beverage CustomerDocument2 pagesUnited Capital Partners Sources $12MM Approval For High Growth Beverage CustomerPR.comNo ratings yet

- Barron's - 05.04.2021Document117 pagesBarron's - 05.04.2021marcelo moNo ratings yet

- AI Global Opportunities Xs0342664413Document8 pagesAI Global Opportunities Xs0342664413Southey CapitalNo ratings yet

- Unit 3: 4. The Management of IT Limited, A Debt Free Company Desires To Determine The Economic ValueDocument2 pagesUnit 3: 4. The Management of IT Limited, A Debt Free Company Desires To Determine The Economic Valuedharshana.segaranNo ratings yet

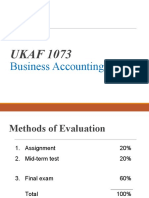

- UKAF 1073: Business Accounting IIDocument61 pagesUKAF 1073: Business Accounting IIalibabaNo ratings yet

- Advanced Accounting Global 12th Edition Beams Test Bank Full Chapter PDFDocument48 pagesAdvanced Accounting Global 12th Edition Beams Test Bank Full Chapter PDFpucelleheliozoa40wo100% (13)

- Asset Liability Management Banking Book - Tom Haczynski PDFDocument57 pagesAsset Liability Management Banking Book - Tom Haczynski PDFvinaykansal1No ratings yet

- Note On Angel InvestingDocument18 pagesNote On Angel InvestingSidakachuntuNo ratings yet

- Chetan Parikh Utpal SethDocument1 pageChetan Parikh Utpal Sethkaya nathNo ratings yet

- Avoiding Option Trading TrapDocument81 pagesAvoiding Option Trading TrapSudhakar Reddy100% (1)

- SRPM Economy Analysis - Group-7Document58 pagesSRPM Economy Analysis - Group-7hiitsds12bNo ratings yet

- Barron 39 S 29 June 2020 PDFDocument88 pagesBarron 39 S 29 June 2020 PDFAD StrategoNo ratings yet

- Stock ExchangeDocument21 pagesStock ExchangemanyasinghNo ratings yet