Professional Documents

Culture Documents

Finace

Uploaded by

AHMED MOHAMMED SADAQAT PGP 2018-20 BatchCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finace

Uploaded by

AHMED MOHAMMED SADAQAT PGP 2018-20 BatchCopyright:

Available Formats

ORAL CARE INDUSTRY ANALYSIS

TRENDS IN THE INDUSTRY

Oral care market size projection

Market size (2017) Market size forecast (2022)

123,3 billion INR 181.2 billion INR Demand for Natural products due to rising health

consciousness, projected CAGR - 20%

Niche demand for Mouthwash and Dental Floss to

continue with double digit CAGR, market leader - Coral

(50% share)

Consumers awareness set to drive revenues through

events & promotions - especially in non-urban areas

Innovative value-added products being introduced due to

increasing disposible income of people

Key reasons for slowdown since last few quarters

Reduction in market share of Coral since Decrease in share of voice of coral

Siddha captured its market share indicating lower frequency, reach and ad

ratings

Reduction in trade spends by 0.79% in

Apr-Jun quarter as compared to same Price cutting by Siddha in all products

quarter in previous year even though the by almost 10%

sales have increased

Short term actions to turnaround current year Long term actions to fix portfolio issues

growth

Bundling of current products Leverage leader opportunities in mouthwash

Bundle Cavity Protection along with Expert Sensitive and dental floss category

to improve sales of latter Since Coral has a market share of 50% in this category,

leverage this to improve sales in metros to increase

adoption by consumers and grow the category as a

Use lower price SKUs to neutralize price competition

whole

Launch smaller size SKU for Cavity Protection at a

lower price to tackle price competition from Siddha Expansion into Tier 2 & 3 cities

and gain adoption by lower income groups Expand into new market opportunities through

awareness programs and set up of dental camps in

Collaborate with dentists for Expert Sensitive & these cities

Whitening variant

Credibility of dentists can be leveraged to improve Launch innovative products in natural category

sales by marketing the product as approved by Natural variants for plaque removal, gum diseases,

dentists & by providing sample packs to dentists to sensitive tooth, flavored toothpastes for kids in order

provide to their patients to tap the segment that is inclined towards natural

Find an optimum balance between trade and products

marketing spends Divide portfolio into affordable & premium

The balance will ensure there is enough marketing category products

activities to create awareness of product and Affordable range will be priced at market average &

optimum trade spends to push the product at the will be targeted at lower income groups with premium

sales point category for the richer customers who visit dentists

regularly

ENTERING A NEW SEGMENT

WHITE SPACE OPPORTUNITIES

1. Natural category for toothpastes We suggest foraying into natural

2. Flavoured toothpastes for children category, chewing gum & toothbrush

3. Chewing gum with teeth whitening characteristics segment in the long term with

4. Normal and electric toothbrushes priority on natural category

5. Activated charcoal toothpastes

Why expand into a new segment? New brand or new variant?

Launch variants in existing brand

• Coral currently has strong cash flows for expansion • By building a portfolio of variants like Herbal,

• Oral care of Coral India is not growing at the same Active Salt, Total, Activated Charcoal will allow to

pace as market, a need for newer products in cater to all customer needs

portfolio • New brand will result in confusion for customer as

• Cutting price would be a short-term solution & in choosing between brands becomes difficult

the long run it will be difficult to compete with the • Resources required to launch a new brand is costly

growing natural segment and time-consuming

• Competition has been innovating & providing • Variants will allow capturing of sales from

products with newer features competition

BRAND ARCHITECTURE OF CORAL

CORAL

For every

dental need

Health variants Natural Cosmetic

- Cavity variants - variants -

Protection, Herbal, Active Whitening,

Sensitive Salt, Charcoal Freshness

PRICING STRATEGY

Pricing for Natural Variants

• Price Cavity protection at a lower price to

capture the market (current price is over and Cost-plus pricing

above cost & hence this can be done) Price

Index – 93, Maintain pricing of Sensitive

variant Current Making Costs 38.8

• Cosmetic variants can be priced premium as

Markup 35%

the customer base needs the product for Price of product 52.38

aesthetic purposes and will be willing to

spend more Price Index – 128

Price of product to be set at 53 INR rupees that will be

equivalent to a price index of 97-99

• Natural Variants priced in the affordable

(Current mark-up assumed to be 40% from P&L Statement)

segment, Price Index – 97-99

MAKE VS BUY?

Without investment in additional capacities

Freight costs have been excluded for comparison purposes Capacity utilization Cost per unit

Cost per unit (Rs) 86% 35.94

Direct material 15.2 88% 35.47

Direct labour 7.8 90% 35.02

Variable overheads 4.6 92% 34.59

Depreciation 3.4 94% 34.17

Fixed cost 4.7 96% 33.78

98% 33.40

Total cost per unit 35.7

100% 33.04

Traditional Costing

TOC based Costing

• Direct material, direct labour, variable overheads, • Fixed cost, direct labour, overheads, depreciation

depreciation per unit remains the same per unit decreases with increase in capacity

• Direct material per unit remains the same

With investment in additional capacities

Cost per unit (Rs) Capacity utilization Per unit price

Direct material 15.2 86% 36.76

Direct labour 7.8 88% 36.27

Variable overheads 4.6 90% 35.80

Depreciation 3.7 92% 35.35

Fixed cost 4.5 94% 34.92

96% 34.51

Total cost per unit 35.8 98% 34.12

100% 33.74

Traditional Costing

TOC based Costing

Even though making in-house costs more than outsourcing the manufacturing, we suggest

manufacturing in-house as costs decrease with increase in capacity & current manufacturing also costs

the same. In addition, in-house manufacturing will allow them to alter the processes for innovative

products, alter production plans as per the demand and ensure quality of product

MARKETING STRATEGY FOR THE NATURAL VARIANTS

2-pronged strategy:

1. Improving the brand health

2. Focusing on Trade Marketing & Distribution

Leverage strong distribution network

Incentives to salesmen:

1. Per outlet addition – Rs. 10 per outlet

2. Repeat billing incentive – Rs. 40 per quarter per

outlet

3. Top Outlet Bonus – top 5% outlets

Incentives to retailers:

1. Stocking Bonus – 12% of total stores

2. Visibility Payout – 2% to top 15% outlets

Collaborate with dentists to push the

Rope in Disha Patani as product to the patient and also advertise

brand ambassador for the product as recommended by dentists

Tier 1 and 2 cities as

she is trendy and a

Target Tier 2 & 3 cities through BTL promotional

fitness freak

activities – dental camps, sampling, awareness

drives, collaboration with schools

You might also like

- Conversational Banking: Edition ViiiDocument10 pagesConversational Banking: Edition ViiiAHMED MOHAMMED SADAQAT PGP 2018-20 BatchNo ratings yet

- Bayer-Monsanto Deal AnalysisDocument4 pagesBayer-Monsanto Deal AnalysisAHMED MOHAMMED SADAQAT PGP 2018-20 BatchNo ratings yet

- Bayer-Monsanto Deal AnalysisDocument4 pagesBayer-Monsanto Deal AnalysisAHMED MOHAMMED SADAQAT PGP 2018-20 Batch0% (1)

- Z. A. Asif: Dowty Fuel System UKDocument1 pageZ. A. Asif: Dowty Fuel System UKAHMED MOHAMMED SADAQAT PGP 2018-20 BatchNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Inventory Management at Hero MotocorpDocument59 pagesInventory Management at Hero Motocorppujanswetal67% (3)

- Cartel & Price LeadershipDocument10 pagesCartel & Price LeadershippinakindpatelNo ratings yet

- What Happened To KmartDocument6 pagesWhat Happened To Kmartnadirerut100% (1)

- Service Department and Joint Cost Allocation: True / False QuestionsDocument246 pagesService Department and Joint Cost Allocation: True / False QuestionsElaine GimarinoNo ratings yet

- Tourism ManagementDocument20 pagesTourism ManagementPARTH SaxenaNo ratings yet

- Investigating The Impact of Social Media Marketing On Millennial's Purchase Intention of Sports Brands in ChinaDocument7 pagesInvestigating The Impact of Social Media Marketing On Millennial's Purchase Intention of Sports Brands in ChinaJoshua heavenNo ratings yet

- Business Level Strategy RevisedDocument5 pagesBusiness Level Strategy Revisedmiss_elephantNo ratings yet

- Significance of Amazing Selling Machine (ASM12)Document3 pagesSignificance of Amazing Selling Machine (ASM12)Tariqul Islam AyanNo ratings yet

- Sem - VI FR 0 FSA (Ratio 0 Intro.) Sample TestDocument1 pageSem - VI FR 0 FSA (Ratio 0 Intro.) Sample TestAmit SinghNo ratings yet

- Push-Pull Strategy: Supply-Chain ManagementDocument4 pagesPush-Pull Strategy: Supply-Chain ManagementbhnodarNo ratings yet

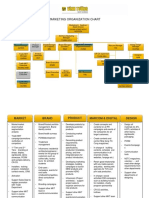

- Organization Chart - Marketing 2017 (Rev 5)Document2 pagesOrganization Chart - Marketing 2017 (Rev 5)Nam CHNo ratings yet

- Quiz 2 KeysDocument15 pagesQuiz 2 KeysLeslieCastro100% (1)

- Mystic SportsDocument6 pagesMystic SportsBatista Firangi100% (2)

- Integrating OSH Into The Business StrategyDocument5 pagesIntegrating OSH Into The Business StrategyAlifudin HanifNo ratings yet

- Chapter 4 OTDocument7 pagesChapter 4 OTHika DebelaNo ratings yet

- B2B Buying JourneyDocument1 pageB2B Buying JourneyRMNo ratings yet

- Industry Analysis Lecture NotesDocument15 pagesIndustry Analysis Lecture NotesChaitanya Reddy KondaNo ratings yet

- IKT105U 17V1S1 8 0 1 SV1 EbookDocument222 pagesIKT105U 17V1S1 8 0 1 SV1 EbookPapelNo ratings yet

- Tutorial Chapter 6 - Sol.Document6 pagesTutorial Chapter 6 - Sol.Madina SuleimenovaNo ratings yet

- Managerial Economics (Compatibility Mode)Document8 pagesManagerial Economics (Compatibility Mode)abhik1979No ratings yet

- Hw3 AKDocument5 pagesHw3 AKrjhav1025No ratings yet

- CAMEL Rating Toolkit 7.4Document34 pagesCAMEL Rating Toolkit 7.4Setiawan GunadiNo ratings yet

- 2020 FA L4 To L10 StudentsDocument40 pages2020 FA L4 To L10 Students徐恺民No ratings yet

- Practice Set - Cost BehaviorDocument2 pagesPractice Set - Cost BehaviorPotie RhymeszNo ratings yet

- Chapter 05 - The Production Process and CostsDocument34 pagesChapter 05 - The Production Process and CostsAli Mubarok ApandiNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesAeris StrongNo ratings yet

- Chapter 01 - A Modern Financial System An OverviewDocument49 pagesChapter 01 - A Modern Financial System An OverviewEdden CloudNo ratings yet

- Synopsis - Packaging & LabellingDocument5 pagesSynopsis - Packaging & LabellingBandi DamodarNo ratings yet

- MEZAN MASHHOOD (Repaired)Document18 pagesMEZAN MASHHOOD (Repaired)Mashhood AliNo ratings yet

- A. Contrution Margin 45 B. Contribution Margin Ratio 0.25 C. Break-Even Point in Unit 12.5 D. Break-Even Point in Dollar 2250Document36 pagesA. Contrution Margin 45 B. Contribution Margin Ratio 0.25 C. Break-Even Point in Unit 12.5 D. Break-Even Point in Dollar 2250Bành Đức HảiNo ratings yet