Professional Documents

Culture Documents

Abdul Ghaffar 14-10-19 PDF

Uploaded by

Ayan BOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abdul Ghaffar 14-10-19 PDF

Uploaded by

Ayan BCopyright:

Available Formats

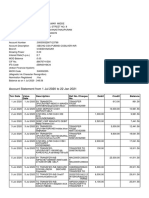

INCOME TAX PAYMENT CHALLAN

PSID # : 35220076

RTO-II LAHORE 6 5 2020

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year 10 19

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 236K Purchase / Transfer of Immovable Property Payment Section Code 64151101

u/s 236K (ATL @ 1% / Non-ATL @ 2%)

(Section) (Description of Payment Section) Account Head (NAM) B01131

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

NTN CNIC/Reg./Inc. No.

Taxpayer's Name Status

Business Name

Address

FOR WITHHOLDING TAXES ONLY

NTN/FTN of Withholding agent 9023700-5 CNIC/Reg./Inc. No.

Name of withholding agent REVENUE, PUNJAB - REVENUE, PUNJAB

Total no. of Taxpayers 1 Total Tax Deducted 15,800

Amount of tax in words: Fifteen Thousand Eight Hundred Rupees And No Paisas Only Rs. 15,800

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 Cash 15,800

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor

Name of Depositor REVENUE, PUNJAB

Date

Stamp & Signature

PSID-IT-000087207656-102020

Prepared By : guest_user - Guest_User Date: 14-Oct-2019 03:45 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Income Tax Payment Challan: PSID #: 35235957Document1 pageIncome Tax Payment Challan: PSID #: 35235957Ayan BNo ratings yet

- Umair + Shahid PDFDocument1 pageUmair + Shahid PDFAyan BNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- Income Tax Payment Challan: PSID #: 42751407Document1 pageIncome Tax Payment Challan: PSID #: 42751407Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 42730325Document1 pageIncome Tax Payment Challan: PSID #: 42730325Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 42125287Document1 pageIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 42719670Document1 pageIncome Tax Payment Challan: PSID #: 42719670Muhammad Qaisar LatifNo ratings yet

- Income Tax Payment Challan: PSID #: 48978159Document1 pageIncome Tax Payment Challan: PSID #: 48978159Abdul SattarNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 43320237Document1 pageIncome Tax Payment Challan: PSID #: 43320237gandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 172780977Document1 pageIncome Tax Payment Challan: PSID #: 172780977fast fbrNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 48979834Document1 pageIncome Tax Payment Challan: PSID #: 48979834Abdul SattarNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- It 000144418085 2024 10Document1 pageIt 000144418085 2024 10Sheeraz AhmedNo ratings yet

- Income Tax Payment Challan: PSID #: 150493633Document1 pageIncome Tax Payment Challan: PSID #: 150493633Shehla FarooqNo ratings yet

- It 000145640626 2023 11Document1 pageIt 000145640626 2023 11pleasemakemefilerNo ratings yet

- Income Tax Payment Challan: PSID #: 143186538Document1 pageIncome Tax Payment Challan: PSID #: 143186538talhaNo ratings yet

- Income Tax Payment Challan: PSID #: 165120097Document1 pageIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNo ratings yet

- Income Tax Payment Challan: PSID #: 146916470Document1 pageIncome Tax Payment Challan: PSID #: 146916470Madiah abcNo ratings yet

- Income Tax Payment Challan: PSID #: 172247415Document1 pageIncome Tax Payment Challan: PSID #: 172247415fast fbrNo ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsAsif JavidNo ratings yet

- Income Tax Payment Challan: PSID #: 141441493Document1 pageIncome Tax Payment Challan: PSID #: 141441493Syed Mudassar GillaniNo ratings yet

- INCOME TAX PAYMENTDocument1 pageINCOME TAX PAYMENTSkjhkjhkjhNo ratings yet

- It 000144041855 2024 10Document1 pageIt 000144041855 2024 10MUHAMMAD TABRAIZNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- IT-000132223866-2023-01Document1 pageIT-000132223866-2023-01mazharehsan08No ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- It 000142262613 2024 09Document1 pageIt 000142262613 2024 09MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 148643587Document1 pageIncome Tax Payment Challan: PSID #: 148643587Ehtsham AliNo ratings yet

- Goga 2.5Document1 pageGoga 2.5advocateyaqootNo ratings yet

- Income Tax Payment Challan: PSID #: 171709428Document1 pageIncome Tax Payment Challan: PSID #: 171709428fast fbrNo ratings yet

- It 000147370616 2024 12Document1 pageIt 000147370616 2024 12Revenue sectionNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- Income Tax Payment Challan: PSID #: 173203210Document1 pageIncome Tax Payment Challan: PSID #: 173203210Muhammad QayyumNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- It 000144914729 2024 11Document1 pageIt 000144914729 2024 11MUHAMMAD TABRAIZNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- It 000147370507 2024 12Document1 pageIt 000147370507 2024 12Revenue sectionNo ratings yet

- Income Tax Payment Challan: PSID #: 139758233Document1 pageIncome Tax Payment Challan: PSID #: 139758233umaar99No ratings yet

- Income Tax Payment Challan: PSID #: 30308134Document1 pageIncome Tax Payment Challan: PSID #: 30308134Azam mughalNo ratings yet

- Income Tax Payment Challan: PSID #: 48977809Document1 pageIncome Tax Payment Challan: PSID #: 48977809Abdul SattarNo ratings yet

- Income Tax Payment Challan: PSID #: 34336315Document1 pageIncome Tax Payment Challan: PSID #: 34336315kashif shahzadNo ratings yet

- IT-000151392010-2023-00Document1 pageIT-000151392010-2023-00aminabutt4524No ratings yet

- It 000147370701 2024 12Document1 pageIt 000147370701 2024 12Revenue sectionNo ratings yet

- MUMTAZ KHAN 236 K 6000Document1 pageMUMTAZ KHAN 236 K 6000mazharehsan08No ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsHaseeb RazaNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanzeshanNo ratings yet

- It 000095921212 2020 05Document1 pageIt 000095921212 2020 05Haroon ButtNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Income Tax Payment Challan: PSID #: 141518891Document1 pageIncome Tax Payment Challan: PSID #: 141518891IkramNo ratings yet

- It 000147370452 2024 12Document1 pageIt 000147370452 2024 12Revenue sectionNo ratings yet

- It 000095921232 2020 06Document1 pageIt 000095921232 2020 06Haroon ButtNo ratings yet

- Income Tax Payment Challan: PSID #: 165866486Document1 pageIncome Tax Payment Challan: PSID #: 165866486Ashok KumarNo ratings yet

- It 000147370561 2024 12Document1 pageIt 000147370561 2024 12Revenue sectionNo ratings yet

- Sales (Special Contracts) Case DigestsDocument42 pagesSales (Special Contracts) Case DigestsSee Gee50% (2)

- PPDM Data Model Overview 3.8Document116 pagesPPDM Data Model Overview 3.8Izzul QudsiNo ratings yet

- Philippine Airlines Vs CADocument1 pagePhilippine Airlines Vs CAGeorge Almeda100% (1)

- LAW545 5 Bil of CostsDocument24 pagesLAW545 5 Bil of Costssyahmi7No ratings yet

- Tablas por modulos en SAP HANADocument11 pagesTablas por modulos en SAP HANAVicente ArellanoNo ratings yet

- MicroSoft Office Packages: Practical QuestionsDocument112 pagesMicroSoft Office Packages: Practical QuestionsMakaha Rutendo84% (69)

- En 05 10073Document8 pagesEn 05 10073OneNationNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Reyes, AnelynDocument9 pagesCertificate of Creditable Tax Withheld at Source: Reyes, AnelynJacqueline PamalinNo ratings yet

- Ndjy UZEqv MEn DoxkDocument14 pagesNdjy UZEqv MEn DoxkKiran KumarNo ratings yet

- 1231 1267Document22 pages1231 1267Thea BacsaNo ratings yet

- Tabish AssignmentDocument10 pagesTabish AssignmenttabishalizahidNo ratings yet

- Appendix 11 - Instructions - ORSDocument1 pageAppendix 11 - Instructions - ORSthessa_starNo ratings yet

- EBF PSD2 Guidance Final December 2019Document92 pagesEBF PSD2 Guidance Final December 2019aldykurniawanNo ratings yet

- Internal Audit Report - Education - Secondary SchoolsDocument16 pagesInternal Audit Report - Education - Secondary SchoolsDanishNo ratings yet

- Pramadom Grama Panchayat Property Tax ReceiptDocument1 pagePramadom Grama Panchayat Property Tax ReceiptvishnuNo ratings yet

- Opera User Manual 2.5Document279 pagesOpera User Manual 2.5Luca BasilicoNo ratings yet

- CA Intermediate Accounting Chapter 3 QuestionsDocument15 pagesCA Intermediate Accounting Chapter 3 QuestionsKabiir RathodNo ratings yet

- NB! This Price List Applies To Service Agreements, That Are Concluded With Nordea Bank AB Latvia BranchDocument34 pagesNB! This Price List Applies To Service Agreements, That Are Concluded With Nordea Bank AB Latvia Branchwaraxe23No ratings yet

- Income Tax Divyastra CH 12 Set Off Carry Forward of Losses RDocument17 pagesIncome Tax Divyastra CH 12 Set Off Carry Forward of Losses R655priya THAPANo ratings yet

- Digitisation of Nepalese Banking Systems and Its Prospects and ChallengesDocument21 pagesDigitisation of Nepalese Banking Systems and Its Prospects and ChallengesNepal BholaNo ratings yet

- How To Get Started in Domain NamesDocument32 pagesHow To Get Started in Domain NamesMiraNo ratings yet

- Memorandum of Agreement EIUDocument4 pagesMemorandum of Agreement EIUanshul sharmaNo ratings yet

- Banking Ombudsman SchemeDocument27 pagesBanking Ombudsman SchemeRajiv AnanthamurthyNo ratings yet

- Legal Framework of CompensationDocument18 pagesLegal Framework of CompensationSujataNo ratings yet

- Manual Casa de Marcat Sapel Seria HTDocument77 pagesManual Casa de Marcat Sapel Seria HTHendea TeodoraNo ratings yet

- Fusion Apps - ReceivablesDocument70 pagesFusion Apps - Receivablessrak478502No ratings yet

- Perfiles y FormasDocument113 pagesPerfiles y FormasYuranni Paola GilNo ratings yet

- Airtel - Prepaid - Postpaid - Broadband - 4G - DTH Services in IndiaDocument1 pageAirtel - Prepaid - Postpaid - Broadband - 4G - DTH Services in IndiaBebin SamuvalNo ratings yet

- Request personal student recordsDocument2 pagesRequest personal student recordsHannah AguilarNo ratings yet

- The Recovery of Debts Inherent in Cheques Without Cover in Cameroon Via The OHADA Simplified Recovery Procedure and Enforcement MeasuresDocument11 pagesThe Recovery of Debts Inherent in Cheques Without Cover in Cameroon Via The OHADA Simplified Recovery Procedure and Enforcement MeasuresEditor IJTSRDNo ratings yet