Professional Documents

Culture Documents

31st December, 2018

Uploaded by

bissilaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

31st December, 2018

Uploaded by

bissilaCopyright:

Available Formats

PINIl

..

CLE ~~ .~

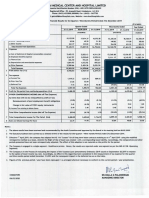

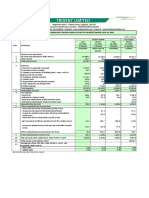

STATEMENT OF STANDALONE FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED 31ST DECEMBER 2018

fRs. In Lakhs

S" Partic u lars STANDALONE

9 Months 9 Months

Corresponding fjgure for the figure for the

3 Months 3 Months Year

Ended Ended

3 Months current previous

Ended

Ended period period

31/1212018 30(0912018 3110312018

3111212017 ended ended

31 /1212018 31 /1212017

Unaudited Unaudited Unaudited Unaudited Unaudited Audited

I Revenue from Operations 1249.29 1373.42 204063 3 526.65 4920 .14 653 5.30

II Other Income 2.35 26.38 16.61 54.53 128.19 153.29

III Total Income (1+11) 1251.64 1399.80 2057. 24 3581. 18 504833 668859

IV Expenses

(a) Cost of materi als consumed 640.47 973.45 1017.20 2208.73 2557.69 335743

(b) Purchases of Stock-in-trade 117.95 - - 117.95 -

(c) Change in inventones of finished goods, (74.46) (258.27) 5525 (45329) (6539) -39.68

Work-in-progress and Stock-in-trade

(d) Employees Benefits Expenses 300.56 270.40 264.17 826 .40 756.61 1041 .69

(e) Finance Costs 29.57 40.10 39 .61 100.75 114.06 145.02

(f) Depreciation and Amortisation Expenses 60.61 60.33 64.27 179.38 190. 31 25378

(g) Other Expenses 394.28 277.54 395.00 934.68 988.23 1428.89

Total Expenses (IV) 1468.98 1363.55 1835.50 3914.60 4541 .51 6187.13

V Profit before tax (III - IV) (217.34) 36.25 221 .74 (333.42) 506. 82 50146

VI Tax Expense

(a) Current Tax - 54.99 103. 74 106.56

(b) Deferred Tax - - (2.78) - (12.85)

Total Tax Expense (VI) 54 .99 (2.78) 103.74 93.71

VII Profit for the period (V-Vt) (217.34) 36.25 166.75 (330.64 ) 403.08 407.75

VIII Other Comprehensive Income, net of income tax

a) i) Items that will not be reclassified to Profit or Loss 0.76 0.76 (2.04) 2. 28 (6. 12) 3.05

ii) Income tax relating to Items that will not be reclassified to Profit or loss -0.20 (0.20) 0.63 (0.60) 1.89 (0.92)

b) i) Items that will be reclassified to Profit or loss - - -

ii) Income tax relating to Items that will be reclassified to Profit Of Loss . . . .

Total Other Comprehensive Income, net of income tax (VII I) 0.56 0.56 (1 .41) 1.68 (4.23) 2. 14

IX Total Comprehensive Income for the Period(VII+VIIII) -216.78 36.81 165.34 (328 .96) 398.85 409 .88

X Paid-up equity share capital : face value Rs.l01- each) 950.14 950.14 950.14 950.14 950.14 950.14

XI Earnings per share

(a) Basic (2.29) 0.38 1.76 (3.48) 4.24 4.29

(b) Diluted (2.29) 0.38 1.76 (3.48 4.24 4 29

The above Financial Result of The Company have been reviewed by the Audit Committee and approved by the Board of Directors at their respective meetings held

on 31st January, 2019.

2 Segment wise Reporting as per Ind AS 108 is not applicable as the Company operates only in one segments i.e. Plastic Thermoware Products

3 Aftr applicability of Goods and SeNice Tax (GST) with effect from July 01,2017, sales are required to be disclosed net of GST. Accordingly the figures of revenew from

opereations for nine months ended 31.12.2018 are not comparable with corresponding nine months ended 31 .12.2017 presented in the result.

4 Previous Year's figures have been regrouped/rearranged where ever required _

By Order of the Board

Velji l, Shah

Place: Mumbai Chairman & MD

Dated: 31st J an uary, 2019 DIN: 00007239

1"fC.Y' r>LASl" .g~!J!td.

ADMIN. OFFICE Vyom Alcade, 5th Floor, Tejpal Scheme Road No.5, Above United Bank of India, Vile Palle (East), Mumbai· 400 057, India.

Tel.: 9t·22·6 t 45330016695 230t - Fax: 91-22·669t 4499 - E·mail: info@tokyoplast.com-Webslte www.tokyoplast.com

REGD. OFFICE Plot No. 3631t , (1,2,3) Shree Ganesh Industrial Estate, Kachigaum Road, Daman - 396 2tO (U.T.). India.

Tel.: (0260) 2242977 12244471- Fax: (0260) 224327 t - CIN -L25209DDt992PLC009784

You might also like

- Regd - Office: 114, Greams Road, Chennai - 600 006: Income From OperationsDocument4 pagesRegd - Office: 114, Greams Road, Chennai - 600 006: Income From OperationsSagar BhardwajNo ratings yet

- March 2019Document4 pagesMarch 2019Pranay TapariaNo ratings yet

- Q2 18 19Document4 pagesQ2 18 19Surya SudheerNo ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- In CroresDocument5 pagesIn CroresKartikNo ratings yet

- Tata Steel LimitedDocument7 pagesTata Steel LimitedmomNo ratings yet

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalNo ratings yet

- ITC Financial Result Q4 FY2023 CfsDocument6 pagesITC Financial Result Q4 FY2023 Cfsnishi25wadhwaniNo ratings yet

- Afm Shree 2Document8 pagesAfm Shree 2Niraj JhajhariaNo ratings yet

- (Lacs) Particulars Consolidated Statement of Standalone/ Consolidated Audited Results For The Quarter and Year Ended March 31, 2015 StandaloneDocument5 pages(Lacs) Particulars Consolidated Statement of Standalone/ Consolidated Audited Results For The Quarter and Year Ended March 31, 2015 StandaloneRavi AgarwalNo ratings yet

- ResultsDocument5 pagesResultssanjayvichare2020No ratings yet

- Enduring ValueDocument6 pagesEnduring ValueMandeep BatraNo ratings yet

- Standalone Result Sep, 17Document4 pagesStandalone Result Sep, 17Varun SidanaNo ratings yet

- Sebi ReleaseDocument10 pagesSebi Releaseabhinashgiri2023No ratings yet

- Thermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014Document1 pageThermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014kartiknamburiNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Avantel LimitedDocument17 pagesAvantel LimitedContra Value BetsNo ratings yet

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyNo ratings yet

- Ambuja Cement Financial Results Q4 2019Document16 pagesAmbuja Cement Financial Results Q4 2019Varinder SainiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q3FY22Document7 pagesQ3FY22Pratik PatilNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- To, ToDocument12 pagesTo, Torkumar_81No ratings yet

- Trident Financial ResultsDocument11 pagesTrident Financial ResultsPabloNo ratings yet

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Document21 pagesAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahNo ratings yet

- 91invuf 2Document1 page91invuf 2Mahamadali DesaiNo ratings yet

- Regulation 33 Unaudited Financial Results For The Half Year Ended On 30.09.2019Document5 pagesRegulation 33 Unaudited Financial Results For The Half Year Ended On 30.09.2019Neetu JainNo ratings yet

- TCL Standalone Sebi Results March 2020Document6 pagesTCL Standalone Sebi Results March 2020Adesh ChauhanNo ratings yet

- Regd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001Document6 pagesRegd - Office: Bombay House, 24, Homi Mody Street, Mumbai 400 001HolaNo ratings yet

- Bafna Pharmaceuticals Limited: Height (321 MM) Length (152mm)Document1 pageBafna Pharmaceuticals Limited: Height (321 MM) Length (152mm)BoschoorNo ratings yet

- Investor Download DataDocument9 pagesInvestor Download Dataindradanush2608No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- TCL Consolidated Sebi Results 31 December 2022Document3 pagesTCL Consolidated Sebi Results 31 December 2022Ravi Kumar KodiyalaNo ratings yet

- ITC Financial Result Q4 FY2021 CfsDocument8 pagesITC Financial Result Q4 FY2021 CfsKaushik ViswanathanNo ratings yet

- DILQ4 April 9Document1 pageDILQ4 April 9sachin976No ratings yet

- Time ScheduleDocument1 pageTime ScheduleMuhamad FajarNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- Asl Marine Holdings Ltd.Document30 pagesAsl Marine Holdings Ltd.citybizlist11No ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- Sebi ReleaseDocument8 pagesSebi ReleaseKingNo ratings yet

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchNo ratings yet

- Results Trident16446Document6 pagesResults Trident16446mohitNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Revised Segment Results For December 31, 2016 (Company Update)Document4 pagesRevised Segment Results For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- 2017TAtA Steel Annual ReportDocument8 pages2017TAtA Steel Annual ReportHeadshot's GameNo ratings yet

- Mq-18-Results-In-Excel - tcm1255-522302 - enDocument5 pagesMq-18-Results-In-Excel - tcm1255-522302 - enbhavanaNo ratings yet

- Final F.M.Document12 pagesFinal F.M.avismlNo ratings yet

- Reg30LODR QFR LRReport 31dec2020 WebsiteDocument15 pagesReg30LODR QFR LRReport 31dec2020 WebsiteAnveshNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Results Final - CastedDocument4 pagesResults Final - CastedMan Mohan KalitaNo ratings yet

- Unaudited Financial Results For The Quarter Ended 30th September-2017Document2 pagesUnaudited Financial Results For The Quarter Ended 30th September-2017RajNo ratings yet

- Monte Carlo Fashions Ltd. Forecast - UPDATEDDocument26 pagesMonte Carlo Fashions Ltd. Forecast - UPDATEDsanket patilNo ratings yet

- Data For Financial AnalysisDocument8 pagesData For Financial AnalysisPriyanshu SinghNo ratings yet

- KhartiDocument1 pageKhartibissilaNo ratings yet

- Vaccine Importance For The WorldDocument1 pageVaccine Importance For The WorldbissilaNo ratings yet

- DKJGKDG F GFDocument1 pageDKJGKDG F GFbissilaNo ratings yet

- Quoting The SopahfgfDocument1 pageQuoting The SopahfgfbissilaNo ratings yet

- THGHJGJDocument1 pageTHGHJGJbissilaNo ratings yet

- FJKSDL 645 MKFJLMDDocument2 pagesFJKSDL 645 MKFJLMDbissilaNo ratings yet

- FJKSDLMKFJLMDDocument2 pagesFJKSDLMKFJLMDbissilaNo ratings yet

- NojkfkDocument3 pagesNojkfkbissilaNo ratings yet

- Page16Heritage PDFDocument1 pagePage16Heritage PDFAnonymous ciEaCjovUJNo ratings yet

- Sify 20F Dec 09Document265 pagesSify 20F Dec 09Pradeep YadavNo ratings yet

- CASE 2.1 Hector Gaming CompanyDocument2 pagesCASE 2.1 Hector Gaming CompanyGopal MahajanNo ratings yet

- The Zomato IPO: A Bet On Big Markets and Platforms!Document16 pagesThe Zomato IPO: A Bet On Big Markets and Platforms!Hoàng Kiều Anh100% (1)

- Feasibility 11 13Document17 pagesFeasibility 11 13Eniam SotnasNo ratings yet

- LGU Guidebook For Local Housing ProgramDocument89 pagesLGU Guidebook For Local Housing ProgramAura Garcia-Gabriel100% (1)

- 2016 Global Vs SchedularDocument1 page2016 Global Vs SchedularClarissa de VeraNo ratings yet

- 2017 Infrastructure Report CardDocument112 pages2017 Infrastructure Report CardAngel J. AliceaNo ratings yet

- Greenply Annual Report 2014Document91 pagesGreenply Annual Report 2014prathameshspNo ratings yet

- Soal Cause & EffectDocument8 pagesSoal Cause & Effecteca indira83% (29)

- Enterpreneurship Chapter-7 GrowthDocument12 pagesEnterpreneurship Chapter-7 GrowthBantamkak FikaduNo ratings yet

- Garanti Bank - Leveraging Technology To Advance in BusinessDocument20 pagesGaranti Bank - Leveraging Technology To Advance in BusinessKorhan CoskunNo ratings yet

- SWOT Analysis Focus PointDocument3 pagesSWOT Analysis Focus PointJaeEun Siwon100% (3)

- Introduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualDocument42 pagesIntroduction To Financial Accounting 11th Edition Horngren Sundem Elliott Philbrick Solution ManualberthaNo ratings yet

- Capital Structure TheoriesDocument17 pagesCapital Structure Theoriesvijayjeo100% (1)

- International Corporate Finance 11 Edition: by Jeff MaduraDocument40 pagesInternational Corporate Finance 11 Edition: by Jeff MaduraMahmoud SamyNo ratings yet

- ESG Sectorial Analysis: For Metals & Mining SectorDocument16 pagesESG Sectorial Analysis: For Metals & Mining SectorSahil Gupta100% (1)

- Analysis of Non Performing Assets in Public Sector Banks of IndiaDocument9 pagesAnalysis of Non Performing Assets in Public Sector Banks of IndiaPruthviraj RathoreNo ratings yet

- INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFDocument4 pagesINVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFVidushi ThapliyalNo ratings yet

- Tokenizing Real-World Assets: - Towards A Regulated and Stable Token-Driven EconomyDocument31 pagesTokenizing Real-World Assets: - Towards A Regulated and Stable Token-Driven EconomyAlexandre MasudaNo ratings yet

- Fin4002 MCDocument10 pagesFin4002 MCYMC SOEHKNo ratings yet

- Part - A Chapter - 1: Industry ProfileDocument85 pagesPart - A Chapter - 1: Industry ProfileShahbaz Khan100% (1)

- ICC Publication List1103Document3 pagesICC Publication List1103Hitendra Nath BarmmaNo ratings yet

- The Global Central Banks Want To Keep Interest Rates atDocument3 pagesThe Global Central Banks Want To Keep Interest Rates atIrina StoicaNo ratings yet

- Users of Accounting InformationDocument6 pagesUsers of Accounting InformationMylene Santiago100% (1)

- USA Eco ProjectDocument18 pagesUSA Eco ProjectAnubhav GaurNo ratings yet

- Summer Training Project Report ParthDocument74 pagesSummer Training Project Report Parthparthbhavsar756179No ratings yet

- Issue of SharesDocument20 pagesIssue of SharesKhalid AzizNo ratings yet

- History of OngcDocument3 pagesHistory of OngcNidhi RanaNo ratings yet

- Annual Report Analysis On ACCDocument42 pagesAnnual Report Analysis On ACCShiVâ SãiNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)