Professional Documents

Culture Documents

PN PDF

Uploaded by

YvetteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PN PDF

Uploaded by

YvetteCopyright:

Available Formats

REV.

11/2017

WHAT DOES FIRST PREMIER BANK

FACTS DO WITH YOUR PERSONAL

INFORMATION?

Why? Financial companies choose how they share your personal information. Federal

law gives consumers the right to limit some but not all sharing. Federal law also

requires us to tell you how we collect, share, and protect your personal information.

Please read this notice carefully to understand what we do.

What? The types of personal information we collect and share depend on the product or

service you have with us. This information can include:

Social Security number and income

account balances and payment history

credit history and credit scores

How? All financial companies need to share customers’ personal information to run their

everyday business. In the section below, we list the reasons financial companies

can share their customers’ personal information; the reasons First PREMIER Bank

chooses to share; and whether you can limit this sharing.

Does First PREMIER Can you limit this

Reasons we can share your personal information

Bank share? sharing?

For our everyday business purposes -

such as to process your transactions, maintain

Yes No

your account(s), respond to court orders and legal

investigations, or report to credit bureaus

For our marketing purposes -

Yes No

to offer our products and services to you

For joint marketing with other financial companies Yes No

For our affiliates’ everyday business purposes -

Yes No

information about your transactions and experiences

For our affiliates’ everyday business purposes -

Yes Yes

information about your creditworthiness

For our affiliates to market to you Yes Yes

For nonaffiliates to market to you Yes Yes

To limit our Call 1-877-635-2568

Please note:

sharing

If you are a new customer, we can begin sharing your information 30 days from

the date we sent this notice. When you are no longer our customer, we continue to

share your information as described in this notice.

However, you can contact us at any time to limit our sharing.

Questions? Call 1-800-987-5521

Page 2

Who we are

Who is providing this notice? First PREMIER Bank

PREMIER Bankcard, LLC

PREMIER NEVADA, LLC

What we do

How does First PREMIER To protect your personal information from unauthorized access and use,

Bank protect my personal we use security measures that comply with federal law. These measures

information? include computer safeguards and secured files and buildings.

How does First PREMIER We collect your personal information, for example, when you

Bank collect my personal open an account or give us your income information

information? give us your contact information or provide account information

use your credit or debit card

We also collect your personal information from others, such as credit

bureaus, affiliates, or other companies.

Why can’t I limit all sharing? Federal law gives you the right to limit only

sharing for affiliates’ everyday business purposes- information about

your creditworthiness

affiliates from using your information to market to you

sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights to

limit sharing. See below for more on your rights under state law.

What happens when I limit Your choices will apply to everyone on your account.

sharing for an account I hold

jointly with someone else?

Definitions

Affiliates Companies related by common ownership or control. They can be

financial and nonfinancial companies.

Our affiliates include financial companies such as First PREMIER

Bank, PREMIER BANKCARD, LLC, PREMIER NEVADA, LLC,

Rushmore Service Center, LLC, and United National Corporation.

Nonaffiliates Companies not related by common ownership or control. They can be

financial and nonfinancial companies.

Nonaffiliates we share with can include insurance companies, credit

monitoring companies, membership clubs, and other retailers.

Joint marketing A formal agreement between nonaffiliated financial companies that

together market financial products or services to you.

Our joint marketing partners include various types of financial

companies such as insurance companies and other credit providers.

Other important information

CA Residents: We will not share information we collect about you with nonaffiliates, except as permitted

by law. For example, we may share information with your consent, to service your

account, or under joint marketing agreements with other financial companies. We will limit

sharing among our affiliates to the extent required by California law.

VT Residents: We will not share information we collect about Vermont residents with nonaffiliates,

unless the law allows. For example, we may share information with your consent, to

service your account, or under joint marketing agreements with other financial companies.

We will not share information about your creditworthiness with our affiliates except with

your consent, but we may share information about our transactions or experiences with

you among our affiliates without your consent.

You might also like

- Bank of Missouri Privacy PolicyDocument2 pagesBank of Missouri Privacy PolicykirstieNo ratings yet

- Facts: What Does Bofi Federal Bank Do With Your Personal Information?Document2 pagesFacts: What Does Bofi Federal Bank Do With Your Personal Information?Dan MacRaeNo ratings yet

- Privacy Policy & Online Privacy StatementDocument7 pagesPrivacy Policy & Online Privacy StatementRobert RooseNo ratings yet

- 2022 Privacy NoticeDocument2 pages2022 Privacy NoticejamesNo ratings yet

- Costco Privacy TermsDocument2 pagesCostco Privacy TermsGK SKNo ratings yet

- QA AttachedDocument2 pagesQA Attachedcbsurya1996No ratings yet

- USAA Privacy PromiseDocument2 pagesUSAA Privacy PromiseEnter KenethNo ratings yet

- Evolve Privacy Policy 20230105Document6 pagesEvolve Privacy Policy 20230105tormentapesadeloNo ratings yet

- Privacy NoticeDocument2 pagesPrivacy Noticejohn.v.ella.1972No ratings yet

- Privacy NoticeDocument2 pagesPrivacy Noticekekzismith1994No ratings yet

- 12282023024100.768 85350134 NewBusinessDocument58 pages12282023024100.768 85350134 NewBusinessWilfredo AmayaNo ratings yet

- Electronic Privacy Disclosure 2017 PDFDocument2 pagesElectronic Privacy Disclosure 2017 PDFRaynell RanjelNo ratings yet

- What Does Bank of America Do With Your Personal Information?Document3 pagesWhat Does Bank of America Do With Your Personal Information?docster12No ratings yet

- D 547 CBKC Privacy Policy V 1.1 Approved 12.4.2018Document2 pagesD 547 CBKC Privacy Policy V 1.1 Approved 12.4.2018Conoon 633No ratings yet

- Facts: What Does Citizens Bank Do With Your Personal Information?Document2 pagesFacts: What Does Citizens Bank Do With Your Personal Information?Deltaflyer47No ratings yet

- Getfile (2) FDocument3 pagesGetfile (2) FIvan MilosavljevicNo ratings yet

- CapOnePolicy PDFDocument1 pageCapOnePolicy PDFDevin DavisNo ratings yet

- Glba Privacy Notice November 2018 Updated For Legal Name ChangeDocument2 pagesGlba Privacy Notice November 2018 Updated For Legal Name ChangeBrad SoomNo ratings yet

- BAS PrivacyNotice NoAffil NoOptOut 01-02-15Document2 pagesBAS PrivacyNotice NoAffil NoOptOut 01-02-15Anonymous jwwkzIatANo ratings yet

- Republic Privacy PolicyDocument2 pagesRepublic Privacy PolicylourisawinstonNo ratings yet

- USBank Dealer Financial Service PledgeDocument3 pagesUSBank Dealer Financial Service Pledgeromonperez97No ratings yet

- Facts: Reasons We Can Share Your Personal Information Does NBKC Bank Share? Can You Limit This Sharing?Document3 pagesFacts: Reasons We Can Share Your Personal Information Does NBKC Bank Share? Can You Limit This Sharing?DmitryNo ratings yet

- Privacy Notice Oct 2021Document2 pagesPrivacy Notice Oct 2021frankNo ratings yet

- Facts: What Does Do With Your Personal Information?Document2 pagesFacts: What Does Do With Your Personal Information?Dominick BryantNo ratings yet

- Rcs Privacy PolicyDocument2 pagesRcs Privacy PolicyAng MattaNo ratings yet

- Privacy PolicyDocument4 pagesPrivacy PolicySucreNo ratings yet

- Facts: What Does Navy Federal Do With Your Personal Information?Document2 pagesFacts: What Does Navy Federal Do With Your Personal Information?Ravanna BeyNo ratings yet

- Upgrade Privacy Notice AgreementDocument8 pagesUpgrade Privacy Notice AgreementEvangelista Josue CruzNo ratings yet

- PrivacyDocument2 pagesPrivacyAdam MotzNo ratings yet

- Privacy Policy: FactsDocument2 pagesPrivacy Policy: FactsKundan VanamaNo ratings yet

- Privacy AgreementDocument4 pagesPrivacy Agreementxopaget458No ratings yet

- Lender (Sgs Finance, Inc.) Privacy Policy: Facts Why?Document28 pagesLender (Sgs Finance, Inc.) Privacy Policy: Facts Why?bootybethathangNo ratings yet

- DipoleDocument7 pagesDipoleabbycanNo ratings yet

- MetaBank Privacy PolicyDocument2 pagesMetaBank Privacy PolicyAmy KitikaNo ratings yet

- Privacy PolicyDocument1 pagePrivacy PolicyStephen VogelNo ratings yet

- 2021 RapidPay CIT BIN Migration Privacy PolicyDocument2 pages2021 RapidPay CIT BIN Migration Privacy PolicyValeria M.SNo ratings yet

- PrivacypolicyinformationDocument6 pagesPrivacypolicyinformationapi-287876235No ratings yet

- Privacy NoticeDocument8 pagesPrivacy NoticeLaurenNo ratings yet

- Facts: What Does Do With Your Personal Information?Document9 pagesFacts: What Does Do With Your Personal Information?Betzaida MansillaNo ratings yet

- Facts: What Does Do With Your Personal Information?Document2 pagesFacts: What Does Do With Your Personal Information?batambintanNo ratings yet

- Facts: Reasons We Can Share Your Personal Information Does Webbank Share? Can You Limit This Sharing?Document2 pagesFacts: Reasons We Can Share Your Personal Information Does Webbank Share? Can You Limit This Sharing?Rodrigo SantosNo ratings yet

- Facts: What Does Metabank Do With Your Personal Information?Document6 pagesFacts: What Does Metabank Do With Your Personal Information?Daniel SantizoNo ratings yet

- Privacy NoticeDocument2 pagesPrivacy NoticeBen DoeNo ratings yet

- Scottrade BA PIPCDocument2 pagesScottrade BA PIPCGlenn LaGasseNo ratings yet

- Statements March 2021 2Document5 pagesStatements March 2021 2Pam RiceNo ratings yet

- Nomad Privacy Notice 20231016Document7 pagesNomad Privacy Notice 20231016ferditavaresNo ratings yet

- 5915 DHDocument13 pages5915 DHLauren D DanielleNo ratings yet

- Facts: What Does TD Ameritrade Do With Your Personal Information?Document2 pagesFacts: What Does TD Ameritrade Do With Your Personal Information?jesusNo ratings yet

- FNBP 26096 ImportAcctInfo FINAL ReducedDocument76 pagesFNBP 26096 ImportAcctInfo FINAL ReducedenjelNo ratings yet

- Facts: Cambridge Savings Bank & Cambridge Appleton Trust, N.A. ("CAMBRIDGE")Document2 pagesFacts: Cambridge Savings Bank & Cambridge Appleton Trust, N.A. ("CAMBRIDGE")boston4534No ratings yet

- HPF Wirtten Privacy NoticeDocument3 pagesHPF Wirtten Privacy NoticeCooper McGoodwinNo ratings yet

- 2016 Citizens Annual Privacy NoticeDocument2 pages2016 Citizens Annual Privacy Noticemike6850No ratings yet

- SafariDocument8 pagesSafarisamhaljmlNo ratings yet

- Financial Privacy Policy Feb 2022Document2 pagesFinancial Privacy Policy Feb 2022mazeo.2024No ratings yet

- P.O. Box 6764 Sioux Falls, SD 57117: Home Depot Credit ServicesDocument4 pagesP.O. Box 6764 Sioux Falls, SD 57117: Home Depot Credit Servicesmoe mNo ratings yet

- Amerant - Acuerdo de ConfidencialidadDocument2 pagesAmerant - Acuerdo de Confidencialidadscribd01No ratings yet

- PrivacyPolicy PDFDocument3 pagesPrivacyPolicy PDFTeff MurchioNo ratings yet

- 3rd Party Privacy InfoDocument2 pages3rd Party Privacy InfoJon McFarlaneNo ratings yet

- Terms and ConditionsDocument19 pagesTerms and Conditionsdromac shogsNo ratings yet

- Comparative Study of HDFC Bank SBI Bank MBA ProjectDocument9 pagesComparative Study of HDFC Bank SBI Bank MBA ProjectAsif shaikhNo ratings yet

- Sample Paper: Toles Advanced ExaminationDocument20 pagesSample Paper: Toles Advanced ExaminationFLORETA100% (1)

- Summer Internship Project Report Axis Bank For MBA StudentDocument79 pagesSummer Internship Project Report Axis Bank For MBA StudentTrailer takNo ratings yet

- Luca PacioliDocument14 pagesLuca PaciolialexileaNo ratings yet

- 340 S02 FinalDocument6 pages340 S02 Final2376271No ratings yet

- 15 BibliographyDocument14 pages15 Bibliographyakkisantosh7444No ratings yet

- Liquidity Analysis of Nepal Investment Bank LTDDocument39 pagesLiquidity Analysis of Nepal Investment Bank LTDsuraj banNo ratings yet

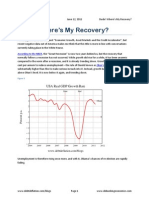

- Dude Wheres My RecoveryDocument19 pagesDude Wheres My RecoveryOccupyEconomics100% (1)

- SAP MX Eletronic Accounting CustomizingDocument12 pagesSAP MX Eletronic Accounting CustomizingFernando Zank Correa Evangelista0% (1)

- BRM ProjectDocument58 pagesBRM ProjectKirti BafnaNo ratings yet

- StatementOfAccount 7157238650 22092022 182727Document4 pagesStatementOfAccount 7157238650 22092022 182727JANE 20COHE016No ratings yet

- MERS As Nominee For MFC - Mary Kist and Donald ClarkDocument2 pagesMERS As Nominee For MFC - Mary Kist and Donald ClarkLoanClosingAuditorsNo ratings yet

- Preview 4Document4 pagesPreview 4Harry TiwanaNo ratings yet

- MBA INTERNATIONAL BUSINESS PROJECT REPORT SAMPLE - Project Helpline PDFDocument81 pagesMBA INTERNATIONAL BUSINESS PROJECT REPORT SAMPLE - Project Helpline PDFAniket MankarNo ratings yet

- What Are The Determinants of Cash ManagementDocument15 pagesWhat Are The Determinants of Cash Managementislam elnassagNo ratings yet

- HSBC - KYC Remediation Junior AnalystDocument1 pageHSBC - KYC Remediation Junior Analystro_splinterNo ratings yet

- User Manual Oracle FLEXCUBE Direct Banking Retail InquiriesDocument39 pagesUser Manual Oracle FLEXCUBE Direct Banking Retail Inquiriesasafoabe4065No ratings yet

- IRCTC Sample Train TicketDocument3 pagesIRCTC Sample Train TicketPawan KumarNo ratings yet

- Modul 10Document9 pagesModul 10Herdian KusumahNo ratings yet

- Sample Credit Control PolicyDocument21 pagesSample Credit Control PolicyMozitomNo ratings yet

- Menu DetailsDocument18 pagesMenu Detailssiddhmax21No ratings yet

- ING-Vysya Summer Training ReportDocument112 pagesING-Vysya Summer Training Reportmukhargoel9096No ratings yet

- British Gas Acquisition Verbal Script 06-01-2014Document3 pagesBritish Gas Acquisition Verbal Script 06-01-2014asdasdsadNo ratings yet

- General Bank and Trust V Central BankDocument3 pagesGeneral Bank and Trust V Central Bankdino de guzmanNo ratings yet

- Ramzan Ali PP ApoDocument1 pageRamzan Ali PP ApoAshok RauniarNo ratings yet

- Krunal ResumeDocument5 pagesKrunal ResumeJai KhushalaniNo ratings yet

- Syla F552Document7 pagesSyla F552Aiman Maimunatullail RahimiNo ratings yet

- Sample MemorandumDocument3 pagesSample MemorandumchrisNo ratings yet

- Dissertation Topics in Accounting and Finance Related To AuditingDocument6 pagesDissertation Topics in Accounting and Finance Related To AuditingPaySomeoneToWriteMyPaperGilbertNo ratings yet

- Instructions For Form CT-1: Department of The TreasuryDocument4 pagesInstructions For Form CT-1: Department of The TreasuryIRSNo ratings yet