Professional Documents

Culture Documents

Class Example 2 - Budgets: Current Assets

Uploaded by

Yadhir0 ratings0% found this document useful (0 votes)

4 views2 pagesCell A's budgeted financial statements for January, February and March showed:

1) Credit sales were budgeted at R4 million, R6 million, and R5 million respectively.

2) Cost of sales were budgeted at R2.4 million, R3.6 million, and R3 million respectively.

3) Depreciation was budgeted at R200,000 per month.

Original Description:

Budgets

Original Title

Budgets

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCell A's budgeted financial statements for January, February and March showed:

1) Credit sales were budgeted at R4 million, R6 million, and R5 million respectively.

2) Cost of sales were budgeted at R2.4 million, R3.6 million, and R3 million respectively.

3) Depreciation was budgeted at R200,000 per month.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesClass Example 2 - Budgets: Current Assets

Uploaded by

YadhirCell A's budgeted financial statements for January, February and March showed:

1) Credit sales were budgeted at R4 million, R6 million, and R5 million respectively.

2) Cost of sales were budgeted at R2.4 million, R3.6 million, and R3 million respectively.

3) Depreciation was budgeted at R200,000 per month.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Class example 2 – budgets

The following budget information relates to Cell A for the three months to 31

March:

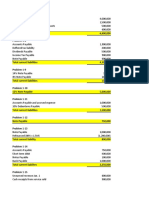

Budgeted statement of comprehensive incomes:

Month ending 31 Jan. 28 Feb. 31 Mar.

R(000) R(000) R(000)

Credit sales 4 000 6 000 5 000

Cost of sales 2 400 3 600 3 000

Gross profit 1 600 2 400 2 000

Depreciation 200 200 200

Other expenses 900 1 000 1 200

(1 100) (1 200) (1 400)

Net profit 500 1 200 600

Extracts from budgeted Statement of Financial Positions:

Balances at: 31 Dec. 31 Jan. 28 Feb. 31 Mar.

R(000) R(000) R(000) R(000)

Current assets

Inventories 200 240 300 300

Accounts receivable 400 600 700 800

Short-term investments 120 120 120 120

Current liabilities

Accounts payable 220 360 320 300

Accruals 100 100 100 100

Taxation 300 ? ? ?

Dividends 400 400 400 400

The bank balance on 1 January was expected to be R30 000.

You are required to:

1. Prepare the expected cash outflows for January, February and March.

Ignore Taxation.

2. Calculate the tax paid if the tax liability was:

a) R200 000 on 31 January,

b) And then increased to R400 000 on 28 February.

You might also like

- Use The Following Information For The Next Two (2) QuestionsDocument37 pagesUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas50% (4)

- Practical Accounting of Cash Flow From Operating ActivitiesDocument13 pagesPractical Accounting of Cash Flow From Operating ActivitiesDJ Nicart63% (8)

- Previous Year Question Paper (FSA)Document16 pagesPrevious Year Question Paper (FSA)Alisha ShawNo ratings yet

- Sol. Man. Chapter 4 Partnership Liquidation 2020 EditionDocument30 pagesSol. Man. Chapter 4 Partnership Liquidation 2020 EditionJennifer RelosoNo ratings yet

- HW On Receivables B PDFDocument12 pagesHW On Receivables B PDFJessica Mikah Lim AgbayaniNo ratings yet

- Master BudgetDocument8 pagesMaster BudgetNicole Baste100% (1)

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Profe03 Activity Chapter 7Document5 pagesProfe03 Activity Chapter 7eloisa celisNo ratings yet

- Discontinued OperationsDocument2 pagesDiscontinued OperationsBwwwiiiiiNo ratings yet

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- CashflowDocument8 pagesCashflowShubhankar GuptaNo ratings yet

- Installment Sales MethodDocument25 pagesInstallment Sales MethodAngerica BongalingNo ratings yet

- FIN 408 MT 01 Fall 2020Document2 pagesFIN 408 MT 01 Fall 2020Tamim RahmanNo ratings yet

- Test 1 - 2022 08 17Document3 pagesTest 1 - 2022 08 17MiclczeeNo ratings yet

- Solution: Opening CapitalDocument19 pagesSolution: Opening CapitalBOHEMIAN GAMINGNo ratings yet

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Singapore Institute of Management: University of London Preliminary Exam 2015Document8 pagesSingapore Institute of Management: University of London Preliminary Exam 2015MahmozNo ratings yet

- 2015 AC3091 Prelim Eqp and CommentaryDocument21 pages2015 AC3091 Prelim Eqp and Commentaryduong duongNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- Sunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeDocument2 pagesSunil Panda Commerce Classes (SPCC) Accounts Term 2 Day 1 Home Work For PracticeHarsh MishraNo ratings yet

- Receivable FinancingDocument4 pagesReceivable FinancingLorence Patrick LapidezNo ratings yet

- UntitledDocument4 pagesUntitledAppleNo ratings yet

- Practice Problems For Comprehensive Exam 1573294973795Document8 pagesPractice Problems For Comprehensive Exam 1573294973795Christeena MichaelNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- Chapter 5 Installment Liq Comprehensive IllustrationDocument12 pagesChapter 5 Installment Liq Comprehensive IllustrationChris Jobert AlmacenNo ratings yet

- Master BudgetDocument4 pagesMaster BudgetJERALDINE BOTOHANNo ratings yet

- Financial Reporting and AnalysisDocument10 pagesFinancial Reporting and AnalysisSagarPirtheeNo ratings yet

- Case Study 2022 FallDocument3 pagesCase Study 2022 FallAppleDugarNo ratings yet

- Financial Reporting in Hyperinflationary Economies: AssetsDocument4 pagesFinancial Reporting in Hyperinflationary Economies: AssetsKian GaboroNo ratings yet

- Xii AccDocument3 pagesXii Accantonytreesa8No ratings yet

- Advanced Financial AccountingDocument17 pagesAdvanced Financial Accountingtassnimemad12No ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Partnership Inst LiqDocument51 pagesPartnership Inst LiqRica Ella RestauroNo ratings yet

- Financial Reporting and Analysis (OUpm001111)Document10 pagesFinancial Reporting and Analysis (OUpm001111)SagarPirtheeNo ratings yet

- Account 1Document6 pagesAccount 1jean rousselinNo ratings yet

- Arias, Kyla Kim B. - Midterm Project October 8,2021Document6 pagesArias, Kyla Kim B. - Midterm Project October 8,2021Kyla Kim AriasNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- Comprehensive IllustrationDocument12 pagesComprehensive IllustrationNucke Febriana Putri RZNo ratings yet

- Exercise 7.3 (2023)Document1 pageExercise 7.3 (2023)Clarisha fritzNo ratings yet

- Practice Numericals FSADocument15 pagesPractice Numericals FSAHaripriyaNo ratings yet

- Notes Part 1 & 2 QuizDocument2 pagesNotes Part 1 & 2 QuizElla Mae LayarNo ratings yet

- PFA (1st) Dec2017Document3 pagesPFA (1st) Dec2017A RY ANNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersDocument6 pages9706 Accounting: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of Teachersaryan mahmoodNo ratings yet

- Answer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsDocument2 pagesAnswer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsmaryamambakhutwalaNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- 2021-11 ICMAB FL 001 PAC Year Question CMA Special Examination November 2021Document4 pages2021-11 ICMAB FL 001 PAC Year Question CMA Special Examination November 2021Mohammad ShahidNo ratings yet

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument6 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- You Have Been Provided With The Following Summarised Accounts of Golden Times LTDDocument4 pagesYou Have Been Provided With The Following Summarised Accounts of Golden Times LTDNelsonMoseM100% (1)

- 2Document4 pages2Dan Shadrach DapegNo ratings yet

- H.B Commerce ClassesDocument3 pagesH.B Commerce ClassesPavan BachaniNo ratings yet

- FfsDocument9 pagesFfsDivya PoornamNo ratings yet

- Fi Concession April 2023 Application of Financial Management TechniquesDocument12 pagesFi Concession April 2023 Application of Financial Management TechniquesBenineNo ratings yet

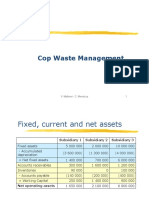

- Cop Waste Management SolutionDocument5 pagesCop Waste Management SolutionPaul GhanimehNo ratings yet

- 5Document11 pages5shayn delapenaNo ratings yet

- Siddharth Education Services LTDDocument5 pagesSiddharth Education Services LTDBasanta K SahuNo ratings yet

- Cash Flow ProbDocument3 pagesCash Flow Probbimbee 13No ratings yet