Professional Documents

Culture Documents

VERIFY INDIAN INCOME TAX RETURN

Uploaded by

Rajesh KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VERIFY INDIAN INCOME TAX RETURN

Uploaded by

Rajesh KumarCopyright:

Available Formats

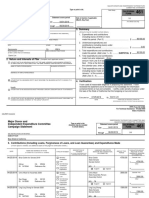

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2019-20

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

RAM SWAROOP MISTRY

PERSONAL INFORMATION AND THE

APDPM9532M

Flat/Door/Block No Name Of Premises/Building/Village

ACKNOWLEDGEMENT

Form Number ITR-1

FLAT NO C 3 ANAMIKA HOMES

NUMBER

Road/Street/Post Office Area/Locality

KISTAPUR ROAD NEAR KLR VENTURES

Status Individual

Town/City/District State Pin/ZipCode Filed u/s

MEDCHAL

TELANGANA 501401 139(1)-On or before due date

Assessing Officer Details (Ward/Circle) ITO WARD 5(1), PATNA

e-Filing Acknowledgement Number 902030640270819

1 Gross Total Income 1 124136

2 Total Deductions under Chapter-VI-A 2 4136

3 Total Income 3 120000

COMPUTATION OF INCOME

3a Deemed Total Income under AMT/MAT 3a 0

3b Current Year loss, if any 3b

AND TAX THEREON

0

4 Net Tax Payable 4 0

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 0

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

Agriculture 0

10 Exempt Income 10 0

Others 0

VERIFICATION

I, RAM SWAROOP MISTRY son/ daughter of INDRA DEO MISTRY , solemnly declare that to the best of my knowledge and

belief, the information given in the return which has been submitted by me vide acknowledgement number 902030640270819 is

correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this return in my capacity

as Self and I am also competent to make this return and verify it. I am holding permanent account number APDPM9532M .

Sign here

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Date of submission 27-08-2019 07:46:22

Source IP address 103.68.9.126

Seal and signature of APDPM9532M0190203064027081906A26DB1FC5929D7DBD8CE630895515A0382F974

receiving official

Please send the duly signed (preferably in blue ink) Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru

560500”, by ORDINARY POST OR SPEED POST ONLY, so as to reach within 120 days from date of submission of ITR. Form ITR-V shall not

be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC

will be sent to the e-mail Id rsmcbi.13@gmail.com .

On successful verification, the acknowledgement can be downloaded from e-Filing portal as a proof of filing the return.

THIS IS NOT A PROOF FOR HAVING FILED THE RETURN

You might also like

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rupalNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Analisis Banco SantanderDocument6 pagesAnalisis Banco Santanderperro_mx0% (1)

- Member Statement 68600048552Document3 pagesMember Statement 68600048552Johnny Warhawk ONeillNo ratings yet

- Retail Invoice Bill for Asus Zenfone 4Document2 pagesRetail Invoice Bill for Asus Zenfone 4Vasanth SreeNo ratings yet

- Seven Generations Energy LTD.: Canada ResearchDocument27 pagesSeven Generations Energy LTD.: Canada ResearchAnonymous m3c6M1No ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaBala SundarNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Blue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementDocument6 pagesBlue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementWAKESHEEP Marie RNNo ratings yet

- DHBVN Electricity Bill DetailsDocument1 pageDHBVN Electricity Bill DetailsPankaj MunjalNo ratings yet

- Dusty YearEnd 2022 FEC RepotDocument140 pagesDusty YearEnd 2022 FEC RepotPat PowersNo ratings yet

- GSTR1 1Document73 pagesGSTR1 1Hridya PrasadNo ratings yet

- Receipt 1-35N3UNZ PDFDocument1 pageReceipt 1-35N3UNZ PDFPrasadNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- Arupr6491f 2019 PDFDocument4 pagesArupr6491f 2019 PDFVeda PrakashNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Label ATT MICrocellDocument1 pageLabel ATT MICrocelljonjow22No ratings yet

- PDFDocument2 pagesPDFpatluNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Tata Mutual Fund: Account StatementDocument11 pagesTata Mutual Fund: Account Statementmetraj1No ratings yet

- Tax Invoice for Sony HeadphonesDocument1 pageTax Invoice for Sony HeadphonesShyam SundarNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)muhammad kamranNo ratings yet

- Customer Details: GST NO.:24AAFCA3788D1ZSDocument2 pagesCustomer Details: GST NO.:24AAFCA3788D1ZSMojilo GujjuNo ratings yet

- Ibs Mib Kuala Terengganu 1 CBS160630163064161024Document3 pagesIbs Mib Kuala Terengganu 1 CBS160630163064161024Ahmad ZubirNo ratings yet

- Account StatementDocument12 pagesAccount StatementRadhi PatelNo ratings yet

- ULAPSADocument2 pagesULAPSANew GlobalNo ratings yet

- Appointment Reciept PassportDocument3 pagesAppointment Reciept PassportKirru KiranNo ratings yet

- Vavdiya Mahesh ChanneiDocument1 pageVavdiya Mahesh ChanneiANISH SHAIKHNo ratings yet

- Vehicle History WDC2511232A162800Document5 pagesVehicle History WDC2511232A162800vikas sharmaNo ratings yet

- Private & Confidential: Re: Your Medical Card ApplicationDocument7 pagesPrivate & Confidential: Re: Your Medical Card ApplicationjulieannagormanNo ratings yet

- True ValueDocument1 pageTrue ValueTonya SmithNo ratings yet

- Invoice 1150873662Document1 pageInvoice 1150873662Rahul SethiNo ratings yet

- Malik Allah Ditta S-O Muhammad Shafi Kot Sher Baz Khan KasurDocument1 pageMalik Allah Ditta S-O Muhammad Shafi Kot Sher Baz Khan KasurAli RockkNo ratings yet

- Blue Shield CA Employee Enrollment Template v20160101Document8 pagesBlue Shield CA Employee Enrollment Template v20160101Anonymous RLktVcNo ratings yet

- Nursys e Notify Report: NINA M WALSH (NCSBN ID: 20526130)Document2 pagesNursys e Notify Report: NINA M WALSH (NCSBN ID: 20526130)Nina Michelle WalshNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Anup KumarNo ratings yet

- Icici Bank Gstinvoice May 2021 Xxxxxxxx2165Document1 pageIcici Bank Gstinvoice May 2021 Xxxxxxxx2165Solomon PasulaNo ratings yet

- Get affordable fixedline and broadband servicesDocument5 pagesGet affordable fixedline and broadband servicesAzhar SkNo ratings yet

- Motor Vehicle Inspection Appointment 15052018165442Document1 pageMotor Vehicle Inspection Appointment 15052018165442Gilbert KamanziNo ratings yet

- Disconnect Notice Explains Delinquent Electric Bill and Risk of Service TerminationDocument3 pagesDisconnect Notice Explains Delinquent Electric Bill and Risk of Service TerminationDaniel GonzalesNo ratings yet

- ITR-1 Form PDFDocument3 pagesITR-1 Form PDFAravind S NarayanNo ratings yet

- Statement Apr 20 XXXXXXXX0674 PDFDocument12 pagesStatement Apr 20 XXXXXXXX0674 PDFmarikumar289No ratings yet

- APSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDocument2 pagesAPSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDominic ChalmersNo ratings yet

- Chetan GehlotDocument1 pageChetan GehlotSamaNo ratings yet

- Jon Brown Evolve 0122Document2 pagesJon Brown Evolve 0122Mark DeweyNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Invoice 141Document1 pageInvoice 141franshadiNo ratings yet

- ACFrOgBwQvRHVNt3wkSr-iydMTJjUhN0otU2QiaOeFXKNgOBS1ualGRA - Kc8UvsaB0f7Ives8JzHU3-QYGpyrFZ-czYWYeJHxN6jogwOK3wzaxX7skgOVRzszt-ovdE PDFDocument3 pagesACFrOgBwQvRHVNt3wkSr-iydMTJjUhN0otU2QiaOeFXKNgOBS1ualGRA - Kc8UvsaB0f7Ives8JzHU3-QYGpyrFZ-czYWYeJHxN6jogwOK3wzaxX7skgOVRzszt-ovdE PDFJade JonesNo ratings yet

- Engineers Australia Tax Invoice ReceiptDocument1 pageEngineers Australia Tax Invoice ReceiptElie OtayekNo ratings yet

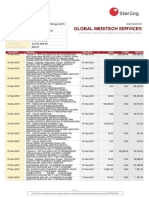

- MEDITECH - MEDITECH Statement 20191128 PDFDocument49 pagesMEDITECH - MEDITECH Statement 20191128 PDFLion Micheal OtitolaiyeNo ratings yet

- Application Form Account Opening20112016031008Document4 pagesApplication Form Account Opening20112016031008Jim AlanNo ratings yet

- Loan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Document12 pagesLoan Account Detail As On 15/07/2021: Issue Date: 15/07/2021 Page 1 of 12Omprakash KatreNo ratings yet

- Capital IQ Transaction Screening Report: Announced Mergers & AcquisitionsDocument12 pagesCapital IQ Transaction Screening Report: Announced Mergers & AcquisitionsaspiringstudentNo ratings yet

- Https WWW - Irctc.co - in Eticketing Printticket PDFDocument1 pageHttps WWW - Irctc.co - in Eticketing Printticket PDFAnkita ShrivastavaNo ratings yet

- Indian Bank statement summaryDocument1 pageIndian Bank statement summaryEmmanuel melvinNo ratings yet

- Obtain PA Antique, Classic or Collectible PlateDocument2 pagesObtain PA Antique, Classic or Collectible PlateNick RosatiNo ratings yet

- Military Out of State Vehicle Registration Forms For FloridaDocument17 pagesMilitary Out of State Vehicle Registration Forms For Floridapnguin1979No ratings yet

- 1 Svcinv Hocs565001 012918 1 PDFDocument2 pages1 Svcinv Hocs565001 012918 1 PDFangela alcarazNo ratings yet

- Eric Luedtke Campaign Finance ReportDocument20 pagesEric Luedtke Campaign Finance ReportbriancgriffithsNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ruloans VaishaliNo ratings yet

- Central Sales TaxDocument17 pagesCentral Sales TaxJyoti ShahNo ratings yet

- The Doctrine of Operative FactDocument3 pagesThe Doctrine of Operative FactTrem GallenteNo ratings yet

- SITXGLC001 Student Assessment Tasks MTDocument38 pagesSITXGLC001 Student Assessment Tasks MTRohan ShresthaNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- ROBIN Hood ExamDocument5 pagesROBIN Hood Examjoke_jansen_dulkNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 759201740040819 Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 759201740040819 Assessment Year: 2019-20mukesh singhNo ratings yet

- Ey Presentation For UniversitiesDocument13 pagesEy Presentation For UniversitiesRehan FarhatNo ratings yet

- Frederick C. Fisher V. Wenceslao Trinidad, GR No. 17518, 1922-10-30Document84 pagesFrederick C. Fisher V. Wenceslao Trinidad, GR No. 17518, 1922-10-30Reia RuecoNo ratings yet

- Direct Tax II Loss Set OffDocument30 pagesDirect Tax II Loss Set Off5561 ROSHAN K PATELNo ratings yet

- Colonial Mining & LabourDocument4 pagesColonial Mining & LabourCherisse Musokwa100% (1)

- Quiz TaxDocument4 pagesQuiz TaxrocketamberNo ratings yet

- Prj57392171draft of Agreement For Sale Cum Allotment LetterDocument28 pagesPrj57392171draft of Agreement For Sale Cum Allotment LetterPKCL027 Rishabh JainNo ratings yet

- Chapter OneDocument16 pagesChapter OneHaile GirmaNo ratings yet

- Jumia Affiliate Program Terms & ConditionsDocument8 pagesJumia Affiliate Program Terms & ConditionsdfsfNo ratings yet

- Unique Questions on PGBP for IPCC StudentsDocument5 pagesUnique Questions on PGBP for IPCC StudentsRohit GargNo ratings yet

- The Circular Flow of Economic ActivityDocument8 pagesThe Circular Flow of Economic ActivityShrahi Singh KaranwalNo ratings yet

- How To Deal With Demand Notice For Late TDS Returns Under Section 234E - Moneycontrol PDFDocument4 pagesHow To Deal With Demand Notice For Late TDS Returns Under Section 234E - Moneycontrol PDFAnonymous dx25f5tZKNo ratings yet

- Payhawk Ebook How To Manage Month End Close Like A ProDocument11 pagesPayhawk Ebook How To Manage Month End Close Like A ProCorneliu Bajenaru - Talisman Consult SRLNo ratings yet

- Cbleecpl 04Document8 pagesCbleecpl 04AdityaNo ratings yet

- Reading Comprehensions WorkbookDocument93 pagesReading Comprehensions WorkbookAlex McIntyreNo ratings yet

- Module 1 BALOBCOX Introduction To Obligations and ContractsDocument35 pagesModule 1 BALOBCOX Introduction To Obligations and ContractsLiza SadiwaNo ratings yet

- Sharad J Taank ITR 2021-2022Document3 pagesSharad J Taank ITR 2021-2022sharad.taankNo ratings yet

- Diplomatic and Consular ImmunityDocument4 pagesDiplomatic and Consular ImmunityRuth Lumibao100% (1)

- Workshop E-Filing of TaxDocument2 pagesWorkshop E-Filing of TaxFaisal MemonNo ratings yet

- Barangay San Vicente Garbage Fee OrdinanceDocument3 pagesBarangay San Vicente Garbage Fee OrdinanceLerio Cabanizas Adaro100% (1)

- Sir Josiah Stamp, Some Economic Factors in Modern LifeDocument291 pagesSir Josiah Stamp, Some Economic Factors in Modern Lifemaivin2No ratings yet

- Morpheus Proposal PoLL 2Document12 pagesMorpheus Proposal PoLL 2Papers of the Libertarian LeftNo ratings yet

- Appendix 7 - Instructions - RROR-SDocument1 pageAppendix 7 - Instructions - RROR-SPayie PerezNo ratings yet

- SPVG Quote SI-95692 Revision 0 PDFDocument4 pagesSPVG Quote SI-95692 Revision 0 PDFherrerafaridcrNo ratings yet

- Mandatory vs Directory StatutesDocument7 pagesMandatory vs Directory StatutesMydz Salang LndygNo ratings yet