Professional Documents

Culture Documents

ARKA - Arkha Jayanti Persada TBK.: RTI Analytics

Uploaded by

farialOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ARKA - Arkha Jayanti Persada TBK.: RTI Analytics

Uploaded by

farialCopyright:

Available Formats

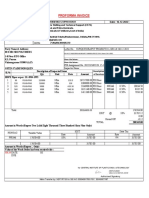

Stock Overview

× Net Foreign Buy

Code ARKA Go ARKA - Arkha Jayanti Persada Tbk. 1700 -20 (-1.16%)

Code Last

RTI Chg (%)

Analytics

Summary Last updated: 25/10/2019 18:09 Jakarta Time

LVol BVol Bid Offer OVol Freq Volume Turnover Prev Open High Low Avg EPS PER DPS Div. Yield Market Cap. BBRI 4230 -70 -1.63

4 7 1650 1700 23 78 1789 305.67 M 1720 1730 1730 1655 1708.6 4 425.0(x) - -% 3.4 T Financial Valuation

TLKM 4280 -70 -1.61

Technical Analysis

Company History Earnings Per Share (EPS)

TBIG 6425 0 0.0

Listing Date : 10 Jul 2019 2016 2017 2018 2019

Period Chart

Effective Date : 28 Jun 2019 (Rp) (Rp) (Rp) (Rp)

GGRM 54650 100 0.18

Nominal : 100 Overview

Q2(Jun) 2 BBCA 31000 -500 -1.59

IPO Price : 236

IPO Shares : 500.0 M Q4(Dec) -15 -15 1 Analytics

MKPI 0 0 0.0

IPO Amount : 118.0 B EPS -15 -15 1 4 Performance

Underwriter :

EXCL 3390 -60 -1.74

Share Registrar : PT Adimitra Jasa Korpora DPS Company News

DPR SIDO 1225 40 3.38

Key Statistics

Shareholders Composition (Per 30 Sep 2019)

INKP 7025 -175 -2.43

Financial

Name of Shareholder Number of Shares Dividend

PT Arkha Tanto Prima 1,046,250,000 (52.31%) INDF 7550

Profiles -100 -1.31

Year Cash Cum Date Ex. Date Recording Payment

PT JAF Asia Investment 452,500,000 (22.63%) Date Date

Dwi Hartanto 1,250,000 (0.06%)

ITMG 13475 Actions

Corporate -25 -0.19

NA

Public (<5%) 500,000,000 (25.%)

INTP

ROI20150

Calculator 0 0.0

Most Recent Quarter (MRQ) : 30 June 2019

Board of Commissioners (Per 10 Jul 2019) DMAS 302 2 0.67

Key Statistics

Komisaris Utama : Devon Widodo Prawiroyudo Fundamental Data PTBA 2350 -60 -2.49

Komisaris : Tatit Jatmiko Financial Stmt Date : 30 June 2019 Sales : 50.8 B

ACES 1810 15 0.84

Financial Year End : December Equity : 10.48 B

Komisaris Independen : Jeremia Kaban Issued Shares : 2.0 B Asset : 364.12 B

Market Cap : 3.4 T Liability : 353.63 B

Direktur Utama : Dwi Hartanto

Stock Index (Base=100) : 720.3 Cash Flow : 3.22 B

Direktur : Baharaja Sianipar

Operating Profit : 824.51 M

Direktur Independen : Aditya Surya Tjahjanaputra

Net Profit : 4.2 B

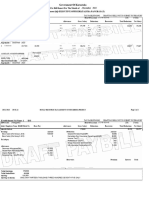

Earnings Valuation

Dividend Per Share (DPS) : na Dividend Yield : na

Earnings Per Share (EPS)* :4 Price Earnings Ratio (PER)* : 425.0x

Revenue Per Share (RPS)* : 51 Price Sales Ratio (PSR)* : 33.47x

Book Value Per Share (BVPS) :5 Price Book Value Rt. (PBVR) : 340.0x

Cash Flow Per Share (CFPS)* :3 Price Cash Flow Rt. (PCFR)* : 528.26x

Cash Eqvl Per Share (CEPS) :1

Net Asset Value Per Sh. (NAVS) :5

Profitability Liquidity

Gross Profit Margin (GPM) : 15.39% Return On Equity (ROE)* : 80.19%

Operating Profit Margin (OPM) : 1.62% Return On Assets (ROA)* : 2.3%

Net Profit Margin (NPM) : 8.27% Debt Equity Ratio (DER) : 3373.22%

Earnings-Int&Tax Margin(EBITM) : -3.37% Cash Ratio (CR) : 0.88%

Dividend Payout Ratio (DPR) : na Quick Ratio (QR) : 60.9%

Current Ratio (CRR) : 81.42%

* Annualized

You might also like

- ARKA - Arkha Jayanti Persada TBK.: RTI AnalyticsDocument1 pageARKA - Arkha Jayanti Persada TBK.: RTI AnalyticsfarialNo ratings yet

- CLAY - Citra Putra Realty TBK.: Quarter (YTD)Document1 pageCLAY - Citra Putra Realty TBK.: Quarter (YTD)farialNo ratings yet

- CCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Document29 pagesCCL Products - Initiating Coverage - 09092019 - 11!09!2019 - 08Amit PatelNo ratings yet

- Grasim Industries Limited: Quarterly Result UpdateDocument3 pagesGrasim Industries Limited: Quarterly Result UpdatehiteshaNo ratings yet

- The First Half of 2008 Results (Unaudited) : Financial HighlightsDocument18 pagesThe First Half of 2008 Results (Unaudited) : Financial Highlightsramzy.07No ratings yet

- Automotive Axles LTDDocument25 pagesAutomotive Axles LTDLK CoolgirlNo ratings yet

- Top Story:: MON 14 JUN 2021Document4 pagesTop Story:: MON 14 JUN 2021JajahinaNo ratings yet

- Irq 302 2022Document1 pageIrq 302 2022Gumisiriza ChristopherNo ratings yet

- CB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Document3 pagesCB Industrial Product Berhad: Look To Better FY10 - 01/03/2010Rhb InvestNo ratings yet

- AAPL.O Apple Inc. Profile - ReutersDocument7 pagesAAPL.O Apple Inc. Profile - ReutersSheryl PajaNo ratings yet

- IGPetrochemicals ReportDocument18 pagesIGPetrochemicals ReportP3 AppNo ratings yet

- Stock Decoder - Skipper Ltd-202402261647087215913Document1 pageStock Decoder - Skipper Ltd-202402261647087215913patelankurrhpmNo ratings yet

- MISC Berhad: 1QFY03/11 Net Profit Jumps 83% YoY On Reduced Container Liner Losses - 20/08/2010Document3 pagesMISC Berhad: 1QFY03/11 Net Profit Jumps 83% YoY On Reduced Container Liner Losses - 20/08/2010Rhb InvestNo ratings yet

- Ga55 Jagweer SinghDocument2 pagesGa55 Jagweer SinghPrince ChoudharyNo ratings yet

- Hiap Teck Venture Berhad :2QFY07/10 Net Profit Dips QoQ - 31/03/2010Document3 pagesHiap Teck Venture Berhad :2QFY07/10 Net Profit Dips QoQ - 31/03/2010Rhb InvestNo ratings yet

- Upl SMCDocument3 pagesUpl SMCpranab.gupta.kwicNo ratings yet

- Assistant Engineer (A.I.) - Ghatal (A.I.) Sub Division Pay Slip Government of West BengalDocument1 pageAssistant Engineer (A.I.) - Ghatal (A.I.) Sub Division Pay Slip Government of West BengalRabindranath DindaNo ratings yet

- Info Memo Telkom Fy2008Document18 pagesInfo Memo Telkom Fy2008prakososantosoNo ratings yet

- PSPCL bill detailsDocument2 pagesPSPCL bill detailsGurvinder SinghNo ratings yet

- Top Glove Corporation Berhad: 2Q10 Results Within Expectations-18/03/2010Document3 pagesTop Glove Corporation Berhad: 2Q10 Results Within Expectations-18/03/2010Rhb InvestNo ratings yet

- LTTS IPO Note Analyzes Engineering Firm's FinancialsDocument18 pagesLTTS IPO Note Analyzes Engineering Firm's FinancialsdurgasainathNo ratings yet

- GA55Document7 pagesGA55Tarun Gulshan Dave ShrimaliNo ratings yet

- PSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Document1 pagePSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Jatt SaabNo ratings yet

- SapuraCrest Petroleum Berhad: Looking Forward To FY11 - 25/03/2010Document3 pagesSapuraCrest Petroleum Berhad: Looking Forward To FY11 - 25/03/2010Rhb InvestNo ratings yet

- Affin Holdings Berhad: Low Allowance For Impairment of Loans Helps Beat Estimates - 23/08/2010Document6 pagesAffin Holdings Berhad: Low Allowance For Impairment of Loans Helps Beat Estimates - 23/08/2010Rhb InvestNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument2 pagesGoods & Service Tax (GST) - User Dashboardkasim shekNo ratings yet

- Proforma Invoice for PDI Services of HDPE PipesDocument1 pageProforma Invoice for PDI Services of HDPE PipesGNANA CHARAN GNo ratings yet

- ADA - TVS - Raider - Commercial - Sep 2022-Feb 2023 OldDocument2 pagesADA - TVS - Raider - Commercial - Sep 2022-Feb 2023 Oldmustafiz.tvs011022No ratings yet

- Ipo Note Oimex Electrode LimitedDocument7 pagesIpo Note Oimex Electrode LimitedSajjadul MawlaNo ratings yet

- Ito Fuel HCT Mill - ErgonoditsDocument5 pagesIto Fuel HCT Mill - Ergonoditsbintang_arifNo ratings yet

- Government Employee Salary DetailsDocument2 pagesGovernment Employee Salary DetailsPmNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- Options Strategy for Nifty Index with Potential Profit of ₹2,035Document4 pagesOptions Strategy for Nifty Index with Potential Profit of ₹2,035radesh.reddyNo ratings yet

- L&T India Value Fund Performance ReportDocument1 pageL&T India Value Fund Performance Reportjaspreet AnandNo ratings yet

- Hunza Properties Berhad: Above Expectations Again - 18/08/2010Document3 pagesHunza Properties Berhad: Above Expectations Again - 18/08/2010Rhb InvestNo ratings yet

- Axiata Group Berhad: Mixed Outlook For Regional Cellcos-22/04/2010Document4 pagesAxiata Group Berhad: Mixed Outlook For Regional Cellcos-22/04/2010Rhb InvestNo ratings yet

- TCS maintains strong growth but margins weakenDocument11 pagesTCS maintains strong growth but margins weakenuefqyaufdQNo ratings yet

- Petronas Gas Berhad: Off To A Good Start - 30/08/2010Document3 pagesPetronas Gas Berhad: Off To A Good Start - 30/08/2010Rhb InvestNo ratings yet

- Carlsberg Brewery Berhad: Strong Contribution From Singapore - 31/5/2010Document3 pagesCarlsberg Brewery Berhad: Strong Contribution From Singapore - 31/5/2010Rhb InvestNo ratings yet

- PSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Document1 pagePSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Jatt SaabNo ratings yet

- Kuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Document4 pagesKuala Lumpur Kepong Berhad: Impressive Turnaround For Retail Division - 19/08/2010Rhb InvestNo ratings yet

- BP Plastics Berhad: Within Expectations-25/05/2010Document3 pagesBP Plastics Berhad: Within Expectations-25/05/2010Rhb InvestNo ratings yet

- Draft Bill DDO 1400QQ0002 Est1Req 1400QQ000228122023DPB01831Document2 pagesDraft Bill DDO 1400QQ0002 Est1Req 1400QQ000228122023DPB01831eo.shimogaNo ratings yet

- PSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Document2 pagesPSPCL: (Pgbillpay - Aspx) (Pgbillpay - Aspx)Rahul BatraNo ratings yet

- ValueResearchFundcard HDFCSmallCapFund DirectPlan 2019mar04Document4 pagesValueResearchFundcard HDFCSmallCapFund DirectPlan 2019mar04ChittaNo ratings yet

- Telekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Document5 pagesTelekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Rhb InvestNo ratings yet

- Berjaya Sports Toto Berhad: BCorp Aborts Sports Betting Deal - 28/06/2010Document2 pagesBerjaya Sports Toto Berhad: BCorp Aborts Sports Betting Deal - 28/06/2010Rhb InvestNo ratings yet

- MEG and EMP lead top stories on office, commercial projects and whisky expansionDocument3 pagesMEG and EMP lead top stories on office, commercial projects and whisky expansionJajahinaNo ratings yet

- Sanjoy 2018 Pay SlipDocument1 pageSanjoy 2018 Pay Slipwater wing civil defenceNo ratings yet

- Nadia Highway Division No-II Pay Slip Government of West BengalDocument1 pageNadia Highway Division No-II Pay Slip Government of West BengalChandana SarkarNo ratings yet

- Kencana Petroleum Berhad: Follow Up - 23/6/2010Document2 pagesKencana Petroleum Berhad: Follow Up - 23/6/2010Rhb InvestNo ratings yet

- Alliance Financial Group Berhad: Boosted by Low Impairment Allowance For Loans - 23/08/2010Document5 pagesAlliance Financial Group Berhad: Boosted by Low Impairment Allowance For Loans - 23/08/2010Rhb InvestNo ratings yet

- HITECH 27052023181123 Investor PresentationDocument33 pagesHITECH 27052023181123 Investor Presentationdev_dip_donNo ratings yet

- 1675564388bharti InfratelDocument2 pages1675564388bharti Infratelkishore13No ratings yet

- Puncak Niaga Berhad: Eyeing Hogenakkal Water Project in India - 21/10/2010Document2 pagesPuncak Niaga Berhad: Eyeing Hogenakkal Water Project in India - 21/10/2010Rhb InvestNo ratings yet

- Top Stories:: TUE 17 AUG 2021Document14 pagesTop Stories:: TUE 17 AUG 2021Elcano MirandaNo ratings yet

- Puncak Niaga Holdings Berhad: FY12/09 Net Profit Underpinned by GovernmentCompensation Yet To Be Received - 01/03/2010Document3 pagesPuncak Niaga Holdings Berhad: FY12/09 Net Profit Underpinned by GovernmentCompensation Yet To Be Received - 01/03/2010Rhb InvestNo ratings yet

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Connectors World Summary: Market Values & Financials by CountryFrom EverandConnectors World Summary: Market Values & Financials by CountryNo ratings yet

- Disclosure Requirements of AsDocument75 pagesDisclosure Requirements of AsVelayudham ThiyagarajanNo ratings yet

- Buffettology Sustainable GrowthDocument12 pagesBuffettology Sustainable GrowthLisa KrissNo ratings yet

- Relative ValuationDocument96 pagesRelative ValuationParvesh AghiNo ratings yet

- Business Transfer TaxDocument5 pagesBusiness Transfer TaxFrincess Go Porazo100% (3)

- Hailu Worku - LuluDocument112 pagesHailu Worku - Luluhailu123No ratings yet

- SME Valuation Standards 2016 01192016Document20 pagesSME Valuation Standards 2016 01192016alfri121No ratings yet

- Finance L5Document40 pagesFinance L5Rida RehmanNo ratings yet

- FAR MaterialDocument25 pagesFAR MaterialJerecko Ace ManlangatanNo ratings yet

- Fsav 6e Test Bank Mod13 TF MC 101520Document9 pagesFsav 6e Test Bank Mod13 TF MC 101520pauline leNo ratings yet

- PDFDocument507 pagesPDFAmol MandhaneNo ratings yet

- Fundamentals of Advanced Accounting 6th Edition Hoyle Solutions ManualDocument25 pagesFundamentals of Advanced Accounting 6th Edition Hoyle Solutions ManualBrianDaviswxfd100% (63)

- Vol-4 Introduction To Technical Analysis (1) BDocument28 pagesVol-4 Introduction To Technical Analysis (1) BJuliana PinheiroNo ratings yet

- Perfect Business Plan: Company SummaryDocument21 pagesPerfect Business Plan: Company SummaryNirav TalsaniaNo ratings yet

- PERS LawsuitDocument120 pagesPERS LawsuitStatesman JournalNo ratings yet

- 9a Capital BudgetingDocument29 pages9a Capital BudgetingRonny AsmaraNo ratings yet

- Chapter - I Introduction To Auditing: Meaning of AuditDocument28 pagesChapter - I Introduction To Auditing: Meaning of AuditJeeva JeevaNo ratings yet

- Sino-Forest 2006 Annual ReportDocument67 pagesSino-Forest 2006 Annual ReportQinhai XiaNo ratings yet

- CA ProspectusDocument132 pagesCA Prospectusudhay19867872No ratings yet

- 1321612987financial AnalysisDocument15 pages1321612987financial AnalysisMuhammad Arslan UsmanNo ratings yet

- Nike Inc - Case Solution (Syndicate Group 4) - FadhilaDocument13 pagesNike Inc - Case Solution (Syndicate Group 4) - FadhilaFadhila HanifNo ratings yet

- Test Bank: Theory of AccountsDocument241 pagesTest Bank: Theory of Accountsdeeznuts100% (1)

- CircularsDocument81 pagesCircularsahtshamahmedNo ratings yet

- Financial StatementDocument16 pagesFinancial StatementCuracho100% (1)

- IFRS Edition-2nd: Conceptual Framework For Financial ReportingDocument30 pagesIFRS Edition-2nd: Conceptual Framework For Financial ReportingAhmed SroorNo ratings yet

- Ebook PDF Financial Accounting Theory 8th EditionDocument41 pagesEbook PDF Financial Accounting Theory 8th Editionbrad.harper906No ratings yet

- EY Portfolio Management in Oil and GasDocument24 pagesEY Portfolio Management in Oil and GaswegrNo ratings yet

- BW Energy Feb 2021 NoteDocument9 pagesBW Energy Feb 2021 NoteMessina04No ratings yet

- Forensics - Manager July 09Document2 pagesForensics - Manager July 09nash666No ratings yet

- 19P044 - PGPM - Sarvagya Jha - Risk and Financial AdvisoryDocument3 pages19P044 - PGPM - Sarvagya Jha - Risk and Financial AdvisorySarvagya JhaNo ratings yet

- Generative Ai and Firm Values SchubertDocument69 pagesGenerative Ai and Firm Values SchubertRaquel CadenasNo ratings yet