Professional Documents

Culture Documents

Financial Root Analysis For Ts

Financial Root Analysis For Ts

Uploaded by

anuja0 ratings0% found this document useful (0 votes)

8 views5 pagesOriginal Title

financial root analysis for ts.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views5 pagesFinancial Root Analysis For Ts

Financial Root Analysis For Ts

Uploaded by

anujaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

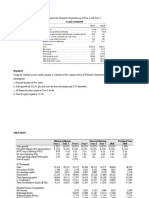

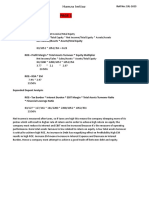

Balance sheet of Tata Steel and calculation of financial ratios

(in Rs. Crore)

Profit and Loss statement of Tata Steel

Ratio Analysis for 2019

s. ratios Particulars (Rs in value remarks

no crores)

1 Net working capital = Current assets = -14339.63 Liquidity available is

current assets – current 21,073.33 less.

liabilities Current

liabilities =

35,412.96

2. 𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑟𝑎𝑡𝑖𝑜 As for 1 0.595 Not safe

𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠

=

𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

3. Quick ratio = Quick assets = 0.38 Not safe

quick assets 13336.49

𝑐𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

4 𝑑𝑒𝑏𝑡 − 𝑡𝑜 − 𝑒𝑞𝑢𝑖𝑡𝑦 Total debt = 0.41 Not good

𝑙𝑜𝑛𝑔 𝑡𝑒𝑟𝑚 𝑑𝑒𝑏𝑡 28934.28

=

𝑠ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦

Shareholders’

equity =

70454.71

5 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑐𝑜𝑣𝑒𝑟𝑎𝑔𝑒 Operating profit 7.28 Not safe

𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 = 20562.94

=

𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡

Interest =

2823.58

6 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 Sales = 29.12% It is good.

𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 ∗ 100 70610.71

=

𝑠𝑎𝑙𝑒𝑠

7 𝑔𝑟𝑜𝑠𝑠 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 Gross profit = 25.12% It is average.

𝑔𝑟𝑜𝑠𝑠 𝑝𝑟𝑜𝑓𝑖𝑡 ∗ 100 17739.36

=

𝑠𝑎𝑙𝑒𝑠

8 𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 Net profit = 14.92% Not good

𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 ∗ 100 10533.19

=

𝑠𝑎𝑙𝑒𝑠

9 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑎𝑠𝑠𝑒𝑡𝑠 Operating profit 21.83% Not good

𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 ∗ 100 = 20562.94

=

𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑎𝑠𝑠𝑒𝑡𝑠

Average assets =

94208.83

10 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 Profit before tax 23.04% Not satisfactory

𝑝𝑟𝑜𝑓𝑖𝑡 𝑏𝑒𝑓𝑜𝑟𝑒 𝑡𝑎𝑥 ∗ 100 = 16231.13

=

𝑛𝑒𝑡 𝑤𝑜𝑟𝑡ℎ

Net worth =

70454.71

11 𝑟𝑒𝑡𝑢𝑟𝑛 𝑜𝑛 𝑛𝑒𝑡 𝑤𝑜𝑟𝑡ℎ Net profit = 15.96% Not good

𝑛𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 ∗ 100 10533.19

=

𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑒𝑡 𝑤𝑜𝑟𝑡ℎ

Average net

worth =

65984.78

12 Return on capital employed Operating profit 34.38% satisfactory

(ROCE) = 20562.94

𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 ∗ 100

= Average capital

𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑎𝑝𝑖𝑡𝑎𝑙

𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑑 employed =

59807.76

13 Cost of goods sold ratio = Cost of goods 0.36 Not satisfactory

Cost of Goods sold sold = 25688.42

Sales

Sales =

70610.71

14 Operating ratio = Other expenses 0.72 Not good

Cost of Goods sold+other = 24913.68

expenses

Sales

15 Fixed assets turnover = Sales = 0.82 good

sales 70610.71

fixed assets

Fixed assets =

86110.62

You might also like

- Corporate FinanceDocument4 pagesCorporate FinanceMogul Dodger Kevin100% (1)

- Profitability RatiosDocument3 pagesProfitability RatiosJohn Muema100% (1)

- Nero's Pasta Case Study AnalysisDocument8 pagesNero's Pasta Case Study AnalysisAbhinav RajNo ratings yet

- Faculty of Business and Management FIN430 Introduction To Corporate FinanceDocument8 pagesFaculty of Business and Management FIN430 Introduction To Corporate FinanceNur Shazleen AfinaNo ratings yet

- RequiredDocument3 pagesRequiredKplm StevenNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Stock ValuationDocument4 pagesStock ValuationAMIN BUHARI ABDUL KHADERNo ratings yet

- Balance Sheet of Tata Steel and Calculation of Financial RatiosDocument4 pagesBalance Sheet of Tata Steel and Calculation of Financial RatiosanujaNo ratings yet

- Practice Numericals Solutions-1Document7 pagesPractice Numericals Solutions-1Daniyal ZafarNo ratings yet

- Analysis and InterpretationDocument13 pagesAnalysis and InterpretationSukanya SarmaNo ratings yet

- Accounts ProjectDocument5 pagesAccounts ProjectMuhammad AwaisNo ratings yet

- Project Work FinanceDocument18 pagesProject Work Financeaqsarana ranaNo ratings yet

- Attock Cement Ratio Analysis 2019 by RizwanDocument8 pagesAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNo ratings yet

- Apple Management Ratio Analysis 2Document2 pagesApple Management Ratio Analysis 2PhucNo ratings yet

- Case StudyDocument6 pagesCase StudyHozefa SodagarNo ratings yet

- CF Project - GP 13Document8 pagesCF Project - GP 13hjiyoNo ratings yet

- Ratio Analysis Unitech LimitedDocument4 pagesRatio Analysis Unitech Limitedraj8882No ratings yet

- Computation For The Year 2015Document3 pagesComputation For The Year 2015joshuaNo ratings yet

- Company Background - Jollibee1Document5 pagesCompany Background - Jollibee1Ray marNo ratings yet

- FM Second AssignmemntDocument3 pagesFM Second Assignmemntwbmba23057chahatNo ratings yet

- Financial Analysis Ratios For The Year Ended 31 DecDocument6 pagesFinancial Analysis Ratios For The Year Ended 31 DecAmirah MaisarahNo ratings yet

- Introduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsDocument23 pagesIntroduction To Business Finance Final Project Ratio Analysis of Al Abbas Sugar MillsUmer Ali SangiNo ratings yet

- AIBL Financial Satement in 2015: Net Income Total AssetsDocument4 pagesAIBL Financial Satement in 2015: Net Income Total Assetsjisanus5salehinNo ratings yet

- Couche-Tards Ratio Analysis 2019Document2 pagesCouche-Tards Ratio Analysis 2019/jncjdncjdnNo ratings yet

- Financial JadualDocument6 pagesFinancial JadualJoe VenNo ratings yet

- RP - CF1 - Financial Analysis and PlanningDocument22 pagesRP - CF1 - Financial Analysis and PlanningSamyu KNo ratings yet

- Sistia Presentation: For The Year Ended June 30, 2017Document3 pagesSistia Presentation: For The Year Ended June 30, 2017FahimNo ratings yet

- AlnoorDocument4 pagesAlnoorZain KhalidNo ratings yet

- Roe Net Income 7,009 Average Stockholders Equity 7,819Document30 pagesRoe Net Income 7,009 Average Stockholders Equity 7,819sum pradhanNo ratings yet

- Profitability Ratios With AnalysisDocument4 pagesProfitability Ratios With AnalysisElla JoyceNo ratings yet

- FA Assignment 6Document2 pagesFA Assignment 6Sidhant ThakurNo ratings yet

- Cara Menghitung Eva: Summary of Financial Statement 31 December 2006 (Million Rupiah)Document4 pagesCara Menghitung Eva: Summary of Financial Statement 31 December 2006 (Million Rupiah)Kusma WennyNo ratings yet

- DuPont AnalysisDocument5 pagesDuPont AnalysisHoàng TrầnNo ratings yet

- Lupin LimitedDocument12 pagesLupin LimitedDJ Razz OfficialNo ratings yet

- 8.1: Introduction and Objective of Finance DepartmentDocument10 pages8.1: Introduction and Objective of Finance DepartmentHarsh SiddhapuraNo ratings yet

- 2011 of Cimb BankDocument9 pages2011 of Cimb BankjagethiswariNo ratings yet

- Analysing Financial StatementDocument9 pagesAnalysing Financial StatementHieu NguyenNo ratings yet

- Tata Steel 1Document12 pagesTata Steel 1Dhwani ShahNo ratings yet

- 3.1 Analisis Rasio Keuangan PT Holcim TBK Periode Tahun 2007 Dan 2006Document3 pages3.1 Analisis Rasio Keuangan PT Holcim TBK Periode Tahun 2007 Dan 2006Mulia PutriNo ratings yet

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDocument27 pagesComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNo ratings yet

- Financial AnalysisDocument14 pagesFinancial AnalysisNavneet MayankNo ratings yet

- Amount of Cash Flow From Operating ActivityDocument2 pagesAmount of Cash Flow From Operating ActivityAfreenAfrinNo ratings yet

- L&T Financial Health AssessmentDocument12 pagesL&T Financial Health AssessmentSudhir SalunkeNo ratings yet

- Case Study 1 Supplementary Material (Needs To Be Updated)Document4 pagesCase Study 1 Supplementary Material (Needs To Be Updated)voves44055No ratings yet

- FA2 AssignmentDocument69 pagesFA2 AssignmentWilliam Lee j. jNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Ratio Analysis of National FoodsDocument9 pagesRatio Analysis of National FoodsMujtaba NaqviNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Section: C Hamza ImtiazDocument6 pagesSection: C Hamza ImtiazCrazy FootballNo ratings yet

- Revision - Income Stat and BS - V3Document4 pagesRevision - Income Stat and BS - V3betyibtihal03No ratings yet

- Liquidity Ratios: Current RatioDocument12 pagesLiquidity Ratios: Current RatioArimuthukumarNambiNo ratings yet

- Halaman 57 Khotari 2Document7 pagesHalaman 57 Khotari 2Kori NofiantiNo ratings yet

- RatioDocument1 pageRatiolaila sofeaNo ratings yet

- Ratios Analysis of Rafhan Maize PVTDocument6 pagesRatios Analysis of Rafhan Maize PVTImtiaz AhmadNo ratings yet

- Financial Statement AnalysisDocument13 pagesFinancial Statement AnalysisJojo DiazNo ratings yet

- Activity in Discounted Cash Flows MethodDocument2 pagesActivity in Discounted Cash Flows MethodPanda ErarNo ratings yet

- Data Section: Ratio Analysis Chisholm Company 2015 & 2016Document19 pagesData Section: Ratio Analysis Chisholm Company 2015 & 2016Hằngg ĐỗNo ratings yet

- Computation:: Liquidity Ratio CRDocument7 pagesComputation:: Liquidity Ratio CRAngelAsistolNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosNguyễn Như NgọcNo ratings yet

- MA Income StatementDocument3 pagesMA Income StatementSaiyam ShahNo ratings yet

- Bata India Limited: Statement of Profit and Loss For The Fifteen Month Period Ended 31St March, 2015Document1 pageBata India Limited: Statement of Profit and Loss For The Fifteen Month Period Ended 31St March, 2015Viswateja KrottapalliNo ratings yet

- Bauto Ratio AnalysisDocument4 pagesBauto Ratio Analysisfatimahsalleh96No ratings yet

- Home Work 2Document5 pagesHome Work 2Shoaib MahmoodNo ratings yet

- EserciziDocument3 pagesEserciziAnnagrazia ArgentieriNo ratings yet

- Indian Financial System (Bba433) - 1516281679413Document8 pagesIndian Financial System (Bba433) - 1516281679413ISHDEV SINGH DHEER 1620217No ratings yet

- Financial Accounting: Formation 2 Examination - April 2008Document11 pagesFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNo ratings yet

- Credit Guarantee Trust For Micro - Small Enterprises (CGTMSE)Document12 pagesCredit Guarantee Trust For Micro - Small Enterprises (CGTMSE)Manoj Kumar MannepalliNo ratings yet

- Actual Costing Material Ledger PDF Sap Standard Cost Production VariancesDocument16 pagesActual Costing Material Ledger PDF Sap Standard Cost Production VariancesBhaskar Biswas100% (3)

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- ACC 221 SHE EditedDocument90 pagesACC 221 SHE EditedHazel PachecoNo ratings yet

- Chap002 PPTDocument25 pagesChap002 PPTUmaid FaisalNo ratings yet

- Adrian Shin Liquidity and LeverageDocument39 pagesAdrian Shin Liquidity and LeverageecrcauNo ratings yet

- 2023 CFA LIII MockExamA-Answer KeyDocument46 pages2023 CFA LIII MockExamA-Answer KeyHugo VALERIONo ratings yet

- Dupire Local VolatilityDocument15 pagesDupire Local VolatilityJohn MclaughlinNo ratings yet

- VII Giverny Capital August 2010Document9 pagesVII Giverny Capital August 2010globalaviNo ratings yet

- IFSCA Grade A Officer 2023 Paper 1 Previous Year Paper Shift 2Document62 pagesIFSCA Grade A Officer 2023 Paper 1 Previous Year Paper Shift 2vishvaNo ratings yet

- Chapter 8 - Pas 1 Statement of Financial PositionDocument33 pagesChapter 8 - Pas 1 Statement of Financial PositionMarriel Fate CullanoNo ratings yet

- Prime CostDocument1 pagePrime CostAva DasNo ratings yet

- ManaccDocument2 pagesManaccrhandy oyaoNo ratings yet

- 12.1 Bond Investment & Share Investment TradingDocument19 pages12.1 Bond Investment & Share Investment TradingTIFFANNY SHELIANo ratings yet

- Time Value of MoneyDocument17 pagesTime Value of MoneysgNo ratings yet

- Capital Budgeting Decision Methods (TQ)Document2 pagesCapital Budgeting Decision Methods (TQ)Gabriela GoulartNo ratings yet

- Assignment #3 (S.E.)Document5 pagesAssignment #3 (S.E.)Muhammad ZohaibNo ratings yet

- Exotic Interest-Rate Options: Marco MarchioroDocument66 pagesExotic Interest-Rate Options: Marco MarchioroVishalMehrotraNo ratings yet

- Financial Accounting and Reporting 1Document6 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- MF Classic Value Investor Fact Sheet JhiDocument2 pagesMF Classic Value Investor Fact Sheet JhiJosé JoseNo ratings yet

- Tutorial Solutions Week 11Document3 pagesTutorial Solutions Week 11Jaden EuNo ratings yet

- GBM Round Table Seminars PresentationDocument40 pagesGBM Round Table Seminars PresentationUpendra ChoudharyNo ratings yet

- PancakeSwap Development MobiloitteDocument1 pagePancakeSwap Development MobiloitteMobiloitte TechnologiesNo ratings yet

- BNPP Structured Retail and PB Products 2005 StudyDocument32 pagesBNPP Structured Retail and PB Products 2005 StudyjcsaucaNo ratings yet