Professional Documents

Culture Documents

Quiz p2

Uploaded by

ace zero0 ratings0% found this document useful (0 votes)

112 views6 pagesp2

Original Title

quiz p2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentp2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

112 views6 pagesQuiz p2

Uploaded by

ace zerop2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

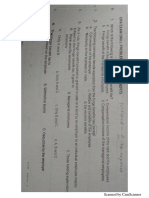

pia ea ae

BISTRUCTIONS: shoe — ae

ser UR STL Tions«

SRLY.NO SOLUTIONS NO RONSON THe op

score.

‘ACE PROVIDE ABEL YOu

balan and Seed sch ner pany

Aba SS Profe-sharing percent worse Toone MP © May 2, 2008, on {his date, hair eapitay

= Behe a

pace, Income tram ey, 2%

Fae 20 NP |Ca8h and haves’ {May 31, 2000 ee Ala

ort romnrhaatere tne aala faee RSENS. No Ny 9) an

heparan se he Penoaranp how ich mtb esis in ce

* * Bodine, A aK oer, pale wep

“Ray Nemes BR ter ne

ire Aus Shee onte, "EB Geren) C105

ithed hen ee Th eRE e ae aims ae

2. On May 1, 206: us % jhe oe (a xe’

7208 eons EMER ae ee)

ane 11.000 pan Se : i

‘Accounts Receivable 234,536 ~29n 56 7'390-T6R > AAsHe sate

inventones '20,035-r6 2e0\t02-c1m= mes Sap

, 603,000 2

Building = 428,267

Furniture and fixtures %

ther assets face s

° 000m 3 600-340 «>

0,916 27,P'1,317,002 i

Accounts pa-ahie PITA 049 ong

D810 pnss.ecn ke os

Notes payeti' 200,000, 341,004 meh ances

Oliver, Capital 641,976-2m0 % amare we, AIEEE gy ey

Twist, Capital e 728,352 - acwo =

Total Pinta 6 re

E1020.915 — P1.317.002

Oliver and Twist agreed to form a Partnership contributing their respective as

to the following adjustments:

3) Accounts receivable of P20,000 in Oliver's books and 35,000 in Twist/books are uncollectibie

2) Inventories of P5,500 and PE,700 are worthiose Oliver's and Ty 00k

3) Other assets of P2,000 and 3,600 in the respective bec of Olivdr and Twist are to be written

off

id equities subject Sez }

Peter offered to join for a 20% interest in the firm. How much cash sh id be contributed?

3. Tom, a pariner in TJ Partnership, has 30%: share in the partnership's mr Ss,

account had a net decrease of P60,000 I year 2012. In year 2012 30

Partnership against his capital and invested property. vahied at P2S,600. in th perth

income of the partnership in year 2012 is

Tom Cap thare gp oe a

P81

Beg Gams =

Vornatmend 2500 | 1, poy withirnel ae

Pe NA oe

Gress) ‘

4. Mark and Michelle are partners with capitals of 200,000 and P100,000 and sharing profits and

i ic jth a 50% interest in the

: i decided to admit Michael asa new parner with a 80% terest the

fiat ches pee pea Pe esa DDD and Mark and Michele transferred portions of canitals as &

bonus to MMM. After Michael's admission, Michelle capital would be -

ee Fee Bonds

Are 27 Tar, mow 4 Sas ca

ee 7 jt 240.

pachelle er j Sh yoo 4 ly 8

chee Be asm agg aw

4s00" } Tae

5. Sunlight Co, Started operations on January 1. 2008, seling home appliances on instalment basie. For =

2008 anc! 2609, the folowing information are avatatic, "” "°™e °F : bas

‘2008 2009

Installment Sales 1,200,000 1,500,000

Cost of instalment sales "720,000 * 1!080,000

Collections:

For 2008 sales 620,000 450,000

For 2009 sales ‘300,000

2010, an instalment

#8 account balance of 2008 was defaulted and the

‘of P15,000, was repossessed. The account balance

unrealized gross proft account 38a the end of 2008 wae

with current market’ val

defaulted was P24,000. The balance of the

de pian

forthe fst three months:

instalment Rsveivable, Dec. 31 800,000 $n

Deferred gross profi, Dec. St unadjusted" 1'050.000

Gross profiton Sales 25%

‘The realized gross profit on instalment sales during the first three months amounted to

Ber —soreree Ins. ree -l2/21 seus

Cer baft

Pon EE, EP on sete x Ot oe Cree

315, Coma |

cota |

8. Santos Co. Sells heavy duty batteries, which cost P7,000 at a total instalment price of 12,000. A-

regular customer buys a unit and trades in his old unit for an allowancerof P2500 5Sa

250 to recondition each unit traded in and then sells them at P3,250 each, 7

from the sale of used batteries, What

customer?

ntos spends

PFOM of 20% resul

was the trade-in over(under) allowance granted to the

: 807. -207,7 0H)

Trde clone, 2res J

FIBY ag ged

podteree (32¢0K07.)-2q4 2350

Our callmance. 1s6

9. MOTOYAMA Motors, a dealer of motorcycles, sells exclusively on instalment basis. One of its -

Customers, Mr. Sikat, purchased a motorcycle for P45,375. The cost to MOTOYAMA was P25,410.

After_making an initial payment of P6,875. MR. Sikat defaulted on subsequent payments

MOT lost no time in reposséssi jotorcycle which by this time, was a ata value

zs MOTOVAa had to incyradditional cost of repair/remodelling before the

motorcycle was subsequently resold fér.P27,400 te Mr. Laos who made an initial payment of P6875.

How much gross profit was realized on the sale to Mr. Laos?

rest weles 2740

CoS (Roses tere), fase

ber The

calles dion Gvis

err C18 /2 74a) ”

Rap BSR. Sor

10. 1n October 2013, bits

ot 5000 08

Below! >

: ro soma

ear Cost ine atimated py

be st incurred Cost acai Sten

dors "3.980.000 3,480,000 py Bagi

et 900, 4180,000 "2 s00,008

Tho grace pllers uses iho costto-cost percentage of 22.2

STOR prot recognized in Sone eh PRFCSMAGS oF compton method of revenue recogeton

Det een nara

Lento avars) Sy tt oN Content: ew 20%

Ea Eres ied a 2a GS .

eal ee fee cat To tang a HEH og

Lirwas” 3h go> x7 Gente) ie ton

1 oe Co. ones The Beitontage of cana 7 2018, he company bosah ores —

roject hat Price of 5,000,000. At the end of 2016, a summary ef the copays oct

2015 2016

Cost incurred to date 1,128,000 9,828,000

Estimated cost to complete 31375000 "1'27s000 J

| Total estimated cost 4,800,009 5,100,000

In ts mcome statement for the year 2016, the company would recognize a gross proft (loss) of

REPT “at lute hee vey —zefade- fer yrenzens

REP YEU W205 ja5uo Corimeh Proce Coos Cee teammate Inve — ator WEB

e toa See ried Oi ci ie ode

ter: ee, Fokranen 2, ORs

12 NTC entered into a franchising agreement with Cfo ord , 2016 for a fran °

7500.00, payable P100,000 on. the agreement dalé_grd the balance in four equal annual

instalments, Per agreement, the down payments refundabiedn the event that the franchisor Is unable

to render certain stpulated ‘services and, co fasts have been rendee) in Nice we wo Bee

Financia stareme-ts, the franchise feo ravenuc tsi operate

x BO HO Seve nedtred

13. On September 1, 2008, Ace Enterprise, a franchisor, entered into a franchising agreement with Base *

Co. charging Base_a-tranchise fee of P1,000.000 Upon signing the contract, a_non-refundable

oumpaymentaf P50 000 aid with the balance payable in three equal annual instalments Starting

2009. Ace had already performed 95% of the services as of February 1, 2009 at a total cost of

P300,000. Ace was able to collect the first instalment in 2009 but the collectability of the remaining

balance is still doubtful. In its 2009 income statement, Ace should recognize a revenue of

ge

ha hae

14, Ruby Co. Bills its branch for-arerchandise shipments at25% gbove cost. The brancti in turn sells -

merchandise af-33-1/3% Above the billing price. On May 31, 2006, a fire destroved all of the

merchandise si i@ branch, The branch records show the following:

January 4 inventory, at billing price ) daa

Lepr pom te Gaur/ize) aon

a Pm bam bac) (yasy00)

Sle

ees Caran fhtets fae) jm

cst ast of merch. burned ee

un Branch

& Balun Branch recorded a deta

& Baten Gran 1. debt note on inventory transfers for Home Ofom of P75 060 twin

Barnette ca els Fo he Bann rah a crn Wen te

© Bakun Branch raversod a previous dobit me Alok Br

no rom Atok Bran amounting to P¥0.500, when

5 home office decided is appropriately Buguias Branch’s cost na

Bakun Branch recorded n debit meme from soma Ciice of P4.060 as PASEO — <7#

15:Betore the above discrepancies were given 16+The adjusted. balance of the reciprocal

effect the balance in the Home Office books Sone :

of the akin Branch Curent Account was

165.920" The unadjusted balance in Barun

Branch’s books of ts Home Office’ Current

‘Account must be ®

6) Be ocant

‘ Pekan

reo) markaing OP

5d) Cenk bmnirte

O15, the branch currant account had a

17, APC Marketi {es a branch in Makati. On October

balance of the process of reconciling current acrcunts, the following ttems that follow

were noted pene acta

x * Thefiome cltice-had billed the branch P75,000 for merchandise shipment still in transit as of

Octover ST.

(7+ The home office customer's account for P21,000 collected by the branch on October 26 ha€not )

been reported to the home office. ee

* © The branch failed to recognize ifs 5,000 share of advertising expense paid for by the home office

_2_ The branch reported a net income of P43,500 during the fiscal period then ended: this was

erroneously taken up as P45,500 by the home office ~ #rF-u --7sFew = Pam

‘Assuming that all other transactions related to the home office and its branch are correctly recorded,

the adjusted balance ofthe reciprocal current accounts as of October 31, 2015 was

eth rare

lOmin Aa. uo

tnionce

ellafin — zyme

Gy buh i

Aaaggtel bef

18.iokia Vehtures fanch in Cebu City. Selected accounts taken from the May 31, 2016

statements of Bokia and its branch follow:

202 error Gnis - 45 50

Head Office Branch

Sales P380,000 353,000

‘Shipments to branch 150,000 -

Branch merchandise mark-up 39,500 -

Inventory, June 1, 2015 24,000 16,000

Purchases 300,000 60,000

Shipments from home office : (87,500,

inventory, May 31, Z0Te 28,000 Ter, oh >

The branch ending inventory included items costing P8,700 that were acquired {rom outsi

suppliers. The realized mark-up on branch merchandise that would be recognized by the home off

Marke x H7sw = [$0 Stroh prom Ho (187500 /f.35)k-26 3160

77 {foo wvenkiry Gil fie rm

£26), Pl (zor 900) /Lee (4w

= F6% ~/2um) 37 /@

72

stares comming =

Sebi co pr branch on May | 2017 wth 9 anomant of mrerchanene bie at

deca Soproerte avg. ceo we ted a PATS OD. Ten beach eta

“Bivens Merchendiee mort inter often stvemacts are ihe Oraey 4 {oes cast Cn

May 31, 2017, the branch reportet 8 net tone oF PES SO ana an reventony pee EDGR SHUT he

ranch met income foes) retcad ihthr commend one tatemeane ha Wak SOOT

Apron t oar 4 trae Ray 4, otha

fd. ~~ oe

. Bigot // We 2 SIDA Am

120,0n April 7. 2014, Steve Co. Part 620,000 for all common sock of Joby

‘property accounted under purchase method The recorded avsets and llahiliies of John Corp

Ape? P01 are

‘Cann 60.000

Inveetony 180.000

Property, plant_and equipment

(nat of pocumulated deprecsation P220.000) 320.000

Goodwill _100.000__

Liabiines —fiz0.000,

Net Assets: Psa 000

‘on Apri 1. 2011, John’s inventory had a fair valve of P'50,000 and the property and equipment (nat

had @ fair value of P380,000” What i the amount of goodwill resulting from the business

comin? atm tnby teh feb I rhk G20 00

BO: Leah - sebadiey (Are

cane

fy @ Fr (tino where Fae

_ | er, BSE Co: Ascede sb Cpa)

Hl wot Fea ew Bree

2t¢Justin Inc. Has forced into bankruptcy and has begun to ‘iq wil be pad a

the rate of 40 cents on the peso. Kylie Co. Holds a non-interest Dearing note receivable {rom Justin in

the amount of P100,000, collateralized by equipment with a licuidation value of 25,000, The total '

amount to be realized by Kylie Co. on this note receivable is

Mle fecerasle ae

bese;

AE! et Coesm

X PAA Goth mpg PE

14 bbon age So

Bim © rr aw

22.DKY company filed a voluntary bankruptcy petition on September 30, 2009 and the statement of

affairs reflects the following amounts:

Estimated

Book Value Current Value

Assets

Assets pledged with fully secured creditors P910,000 1,080,625

Assets pledged with partially secured creditor 511,875 wis

Free Assets 1,137,500 250

Liabilities

Liabilities with priority 113,750

Fully secured creditors

Partially secured creditors 8,750 Jal eres 22 78oe

Unsecured creditors 0 7 are

Assume that the assole are converted into cash at the estimated current values and Ne bite

liquidated, What total amount of cash should partially secured creditors receive?

fr, seu» eds 544.780

Lees’, Anse. PPSE 541350

u 22s

X Bee. fake i"

CaA\20 fost) er.

i 36500

Ads: APPS ba oe

yO

C4112 )

a

700 VSS corp. tam

the branch at a aintaining @ branch

cf ae hm Mata. um

ranger P5000 Th eet tg eyo, ne nme ages

» forthe narod wndoa besa outage otic Ene

Sates (20% on

Expenses (50% of wiih ~

Rragnees (8 of eh i anpaiy Mages een Ie em rye pep

Shipments from home ot :

/entory, 1/1/2008 (30% fo

Inventor. 1/1/2008 (30% from outsiders)

ntory, 2 000 4-8 = 40 -wiey > 24

Remittance to home office "2 Home Office) 80.000 ee

60,000

‘The branch Cost of Sales and Net income/Loss in as far a some office ie iconcemed are:

‘

pee cel eaten ere ae

og he See

Ti agcmenynn a, CE Tam

nae oe ore eppern (O

Se Gee

24,61, B2 and

oa Be Taio Gecided to form a partnership. BI is to Invest cash of P15

190,000 57.000 but has a market value of P48,000. B2 is to invest cash amounting to

units with a regular price of family is, gaged Jy computer dealership, is to invest three computer

P30,000-Sach But Which cost their family’s business P20,000 for each

fis according to their capital contribution. The capital balances of 81,

unit. Partners agree to share pr

2 and B3 respectively upon formation are:

$1 pseu beqmer =CIAS iad

B2 seyQ0 EO - wef,

43 Yous 43 Goren

as follows’

2 — (96

:- The partnership agreement of A, B and C provides for the division of net income

¢ B, who manages the partnership is to receive a salary of P16,500 monthiy _/#.

= Each parineristo-be-aliowed interestat 15% on hiding capilat”

Balance is to be divided 25:30:45 y= =e

During 2009, A invested an additional P96,000 in the partnership. B made an additional investment of

P60,000 and withdrew P90,000 and C withdrew P72,000. No other investments or withdrawals were

made during 2009. On January 1, 2009, the capital balances were A P280,000, B, P300,000 and ©,

>170,000. Total capital at year-end was 975,000. What are the capital balances of A, B and C

£

8B e Tots|

espectively at year-end? x

sal a 40? Op

an oe 4102 Kew 26

ol (oe) in) easy)

Tov? BSD Dey Pad = AT oo ~ 2B.

, 5

Bie ee Tio-yee dad

xd ATES

a ie

oo EF can, v0

Lechon Inc., anctisons tre GAPE cance Saree id ‘Sison, franchisee, on

ber 30, 2003. The total franchise fee is P500,000 of which P100,000 is payable upon signing and

nce in four equal annual installments. The down payment is refundable in the event franc’

i ices and none thus far had been rendered. ,

Ce teoaes its financial statements on September 30, 2003, the franchise revenue to

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Q19 - Audit Procedures, Evidence and DocumentationDocument7 pagesQ19 - Audit Procedures, Evidence and Documentationace zero0% (1)

- MAS MidtermDocument6 pagesMAS Midtermace zeroNo ratings yet

- Int AssetDocument21 pagesInt Assetace zeroNo ratings yet

- Standard CostingDocument11 pagesStandard Costingace zeroNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularace zeroNo ratings yet

- Franchise p3Document4 pagesFranchise p3ace zeroNo ratings yet

- p2 Home OfficeDocument9 pagesp2 Home Officeace zeroNo ratings yet

- Statements 3Document69 pagesStatements 3ace zeroNo ratings yet

- Intermediate Examination: Suggested Answers To QuestionsDocument21 pagesIntermediate Examination: Suggested Answers To Questionsace zeroNo ratings yet

- Developing Our Future Professionals - Cross-Cultural Dialogues in The Workplace - LCC and HCC Characteristics EHall PDFDocument1 pageDeveloping Our Future Professionals - Cross-Cultural Dialogues in The Workplace - LCC and HCC Characteristics EHall PDFace zeroNo ratings yet

- PromoDocument1 pagePromoace zeroNo ratings yet

- Rit ExclusionDocument21 pagesRit Exclusionace zeroNo ratings yet

- Inc Tax CGTDocument15 pagesInc Tax CGTace zero80% (5)

- Scanned by CamscannerDocument4 pagesScanned by Camscannerace zeroNo ratings yet

- Scanned by CamscannerDocument9 pagesScanned by Camscannerace zeroNo ratings yet