Professional Documents

Culture Documents

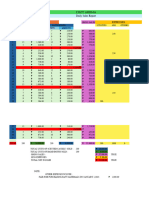

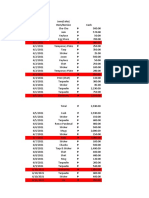

Formula For April 2019

Uploaded by

Ulysses Empleo DansecoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formula For April 2019

Uploaded by

Ulysses Empleo DansecoCopyright:

Available Formats

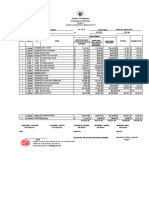

Damaso Rabi

Name

Mabanban

Barangay

015-16-044-02-002-A

PIN

No. of Assessed

BRACKET Tax Due Penalty/Discount Total

Years Value *10%

1957-1966 (10) ₱ - ₱ - ₱ -

1967-1973 (7) ₱ - ₱ - ₱ -

1974-1979 (6) ₱ - ₱ - ₱ -

1980-1984 (5) ₱ - ₱ - ₱ -

1985-1991 (7) ₱ - ₱ - ₱ -

1992-1993 (2) ₱ - ₱ - ₱ -

1994-1996 (3) 3 ₱ - ₱ - ₱ -

1997-2002 (6) 6 ₱ - ₱ - ₱ -

2003-2015 (13) 13 ₱ 487.20 ₱ 6,333.60 ₱ 4,560.19 ₱ 10,893.79

2016 1 ₱ 487.20 ₱ 487.20 ₱ 350.78 ₱ 837.98

2017 1 ₱ 487.20 ₱ 487.20 ₱ 272.83 ₱ 760.03

2018 1 ₱ 487.20 ₱ 487.20 ₱ 155.90 ₱ 643.10

2019 0.25 ₱ 487.20 ₱ 121.80 ₱ 9.74 ₱ 131.54

0.75 ₱ 487.20 ₱ 365.40 ₱ 36.54 ₱ 328.86

Sub-Total ₱ 8,282.40 ₱ 5,349.46 ₱ 13,595.32

Total Amount Due as of April 2019 ₱ 27,190.63

Prepared by:

ULYSSES E. DANSECO Date: November 15, 2019

MTO Staf

You might also like

- Notas (Compras 2020)Document14 pagesNotas (Compras 2020)lanna oliveiraNo ratings yet

- Quilo Met Rage MDocument9 pagesQuilo Met Rage MAndre OliveiraNo ratings yet

- Income Statement FINALDocument53 pagesIncome Statement FINALCaile Peñora CajuraoNo ratings yet

- September 4, 2020 Weekly SummaryDocument12 pagesSeptember 4, 2020 Weekly SummaryJune Karl CepidaNo ratings yet

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- AULA 2 - 3H - IntrodDocument47 pagesAULA 2 - 3H - IntrodgrasieleNo ratings yet

- Tabela Evolucao Valor AçoDocument1 pageTabela Evolucao Valor AçoHarrison PauloNo ratings yet

- Date Item Qty Price TotalDocument9 pagesDate Item Qty Price TotalJefNo ratings yet

- Week 1 - June 5-11, 2020Document8 pagesWeek 1 - June 5-11, 2020June Karl CepidaNo ratings yet

- GESTÃODocument3 pagesGESTÃONICOLE SARAIVANo ratings yet

- Daily Monthly Sales 2018Document30 pagesDaily Monthly Sales 2018Rex ResNo ratings yet

- Balones Voleibol: España, Calle Cornejo #50 TEL 787 567 8909Document6 pagesBalones Voleibol: España, Calle Cornejo #50 TEL 787 567 8909AdrianNo ratings yet

- Vendas: Paulo Lindomar R$ 350.00Document5 pagesVendas: Paulo Lindomar R$ 350.00Paulo PavlakNo ratings yet

- Basic Education Department Senior High School Cagayan de Oro CityDocument16 pagesBasic Education Department Senior High School Cagayan de Oro CityGabriel Nyl Madronero CasiñoNo ratings yet

- DepreciationDocument2 pagesDepreciationjoveNo ratings yet

- Island Properties Sold - Comparison 2020 IIDocument1 pageIsland Properties Sold - Comparison 2020 IILouis CutajarNo ratings yet

- October 2, 2020 Weekly SummaryDocument13 pagesOctober 2, 2020 Weekly SummaryJune Karl CepidaNo ratings yet

- Rafael EstopasDocument1 pageRafael EstopasLuiz HabkostNo ratings yet

- Equipe Noite - Maio 2023 AtualizadoDocument7 pagesEquipe Noite - Maio 2023 AtualizadoAnderson Clayton FreitasNo ratings yet

- Public Prosecutor V Phua Keng TongDocument2 pagesPublic Prosecutor V Phua Keng TongPhilip TanNo ratings yet

- CONTABILDocument26 pagesCONTABILAndressa FoltzNo ratings yet

- BMW Motorrad Service Packages Warranty Extension Price List August 2021Document1 pageBMW Motorrad Service Packages Warranty Extension Price List August 2021WAN AHMAD HANISNo ratings yet

- September 18, 2020 Weekly SummaryDocument11 pagesSeptember 18, 2020 Weekly SummaryJune Karl CepidaNo ratings yet

- 14% de (Soldo + Gratificaçoes) (Aliquota% - Redução) (PREV. + IR)Document1 page14% de (Soldo + Gratificaçoes) (Aliquota% - Redução) (PREV. + IR)ariNo ratings yet

- Summary of Current Regional Daily Minimum Wage Rates Non-Agriculture, Agriculture (As of July 2017)Document4 pagesSummary of Current Regional Daily Minimum Wage Rates Non-Agriculture, Agriculture (As of July 2017)Cel DelabahanNo ratings yet

- Praktikum PenganggaranDocument3 pagesPraktikum PenganggaranMuhammad FajrunNo ratings yet

- Bhimboi Grains Corner Weekly Net Income: Date Description Amount Out Balay 25kg RedDocument12 pagesBhimboi Grains Corner Weekly Net Income: Date Description Amount Out Balay 25kg RedJune Karl CepidaNo ratings yet

- Investimento SDocument35 pagesInvestimento Snelsonbraga1107No ratings yet

- Monthly Summary of JuneDocument2 pagesMonthly Summary of JuneJune Karl CepidaNo ratings yet

- October 2, 2020 Weekly SummaryDocument11 pagesOctober 2, 2020 Weekly SummaryJune Karl CepidaNo ratings yet

- Activity 1 - PAYROLL SYSTEMDocument2 pagesActivity 1 - PAYROLL SYSTEMEmilyn olidNo ratings yet

- Elected Officials Compensation - 1975 - 2022 - Attachment BDocument2 pagesElected Officials Compensation - 1975 - 2022 - Attachment BWXYZ-TV Channel 7 DetroitNo ratings yet

- 1er PERÍODO 2019 (Autoguardado)Document12 pages1er PERÍODO 2019 (Autoguardado)Yessiik GarzónNo ratings yet

- Hutang NewDocument5 pagesHutang Newrumahsakit danausalakNo ratings yet

- Gerenciamento MensalDocument18 pagesGerenciamento MensalclailtonNo ratings yet

- Caed103 PrefexamDocument17 pagesCaed103 PrefexamShaneen AdorableNo ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Shreyam Enterprises: Tax InvoiceDocument57 pagesShreyam Enterprises: Tax Invoicemui12042006No ratings yet

- CPD-61 400Document4 pagesCPD-61 400efrancocaNo ratings yet

- Costing For Civil WorksDocument3 pagesCosting For Civil WorksRhuss SalazarNo ratings yet

- 2º Semana DezembroDocument1 page2º Semana Dezembroalan alvesNo ratings yet

- Bhimboi Grains Corner Weekly Net Income: Previous Inventory 22,795.00Document8 pagesBhimboi Grains Corner Weekly Net Income: Previous Inventory 22,795.00June Karl CepidaNo ratings yet

- Bhimboi Grains Corner Weekly Net Income: Previous Inventory 21,752.00Document7 pagesBhimboi Grains Corner Weekly Net Income: Previous Inventory 21,752.00June Karl CepidaNo ratings yet

- Andin CellDocument79 pagesAndin Cellsemarang advanveNo ratings yet

- June July Income and ExpensesDocument1 pageJune July Income and ExpensesRani VermaNo ratings yet

- M44 Strategy: Equity Price SR NO. BUY Price SL PriceDocument8 pagesM44 Strategy: Equity Price SR NO. BUY Price SL PriceburhanNo ratings yet

- Banca Bet365Document1,056 pagesBanca Bet365Elias OliveiraNo ratings yet

- Accounts Payable Ledger 2021Document10 pagesAccounts Payable Ledger 2021skbuayahon2024No ratings yet

- Calculo CTS Noviembre 2018-Abril 2019Document1 pageCalculo CTS Noviembre 2018-Abril 2019sandra kelly corzo arandaNo ratings yet

- 5.-Abstract-of-Canvass ADMIN SUPPLIESDocument3 pages5.-Abstract-of-Canvass ADMIN SUPPLIESAřčhäńgël Käśtïel100% (1)

- June - SalesDocument5 pagesJune - SalesPatrickNo ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Bhimboi Grains Corner Weekly Net Income: Previous Inventory 32,340.00Document6 pagesBhimboi Grains Corner Weekly Net Income: Previous Inventory 32,340.00June Karl CepidaNo ratings yet

- Island Properties Sold - ComparisonDocument1 pageIsland Properties Sold - Comparisoncutty54No ratings yet

- Rincian Penerimaan Dan Pengeluaran Dana Kapitasi JKN Puskesmas Tahun 2020Document6 pagesRincian Penerimaan Dan Pengeluaran Dana Kapitasi JKN Puskesmas Tahun 2020Incheng AssaNo ratings yet

- Profit Loss Statement - TemplateDocument3 pagesProfit Loss Statement - TemplateJohn Rey Bantay RodriguezNo ratings yet

- Gerenciamento de RiscoDocument3 pagesGerenciamento de RiscoRafael SantosNo ratings yet

- Finacre Ass3 M1Document12 pagesFinacre Ass3 M1Rosette SANTOSNo ratings yet

- Profitability of simple fixed strategies in sport betting: Soccer, Portugal Liga I, 2009-2019From EverandProfitability of simple fixed strategies in sport betting: Soccer, Portugal Liga I, 2009-2019No ratings yet