Professional Documents

Culture Documents

Emerging Challenges of Indian Banking Sector: Dr. Savita Sindhu

Uploaded by

prashantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emerging Challenges of Indian Banking Sector: Dr. Savita Sindhu

Uploaded by

prashantCopyright:

Available Formats

International Journal of Engineering Technology Science and Research

IJETSR

www.ijetsr.com

ISSN 2394 – 3386

Volume 5, Issue 3

March 2018

Emerging Challenges of Indian Banking Sector

Dr. Savita Sindhu1

G.G.D.S.D. College, Dept. of Commerce and Management, Chandigarh

Abstract

The banking industry in a country is the lifelines of the economy and plays aninfluential role in initiating and supporting

economic growth, especially, in developing countries like India.Banking in India has been operating for a relatively

longer period has resulted in acontraryeffect on the capital adequacy, asset quality and growth of our banks. With the

changing times, new heights have been achieved by banking industry. Technology use has fetched a revolution in banks

operational activities. Over the period, the industry has faced many issues and scams. But still majority of banks are still

doing a wonderful job as they have succeeded in maintaining the people’s trust and confidence. However, with changing

dynamic forces in this industry, it brings many risks to its stakeholders.

In this paper an attempt has been made to identify the emerging issues in banking sector. Present paper is divided into

three parts. First part deals with the brief introduction of banking sector, which includes the introduction and general

issues of Indian banking sector. The second part discusses the contemporary issues faced by Indian banking sector. And

the last part concludes with the suggestions in order to make this sector a great contributor towards the sustainable

economic growth.

Key words: Indian Banking Industry, Risk Management, Financial Inclusion, Employee Retention and Use of

technology.

Introduction

Increasing emphasis on globalisation of the Indian economy has opened up new avenues and challenges for

Indian banks. Financial sector reforms and liberalisation of prudential regulations have thrown in a lot of

opportunities for Indian bank to grow and diversify their areas of business operations. Moreover, globalisation

has ushered in restructuring of the banking and financial sector through a series of mergers and

amalgamations and eventually brought in convergence of different activities and businesses in the banking

sector (Deshpandey, 2001).The Indian banking system has seen a complete transformation during the last

two decades, in sync with the progress made by the real economy. The period saw banks moving beyond

brick and mortar branches to adopt innovative delivery channels including internet banking, ATMs, call

centres, kiosks, Business Correspondents (BCs), etc. New products such as retail banking gained

prominence.

To cater the needs of customers in a better way, various customised products were introduced in the sector in

a useful manner. In today’s competitive world, banks have to be proactive in their approach rather than a

crisis-driven sector. In reality, after every scam our policy makers come with the new guidelines or

regulations.

Every year banks are confronting the issues which are at once familiar and evolving. Both the internal and

external concerns are faced by the banks. It includes the third party relationships, workforce management,

day-to-day operations etc. All these are somewhere interconnected. As we know that banking sector has the

pivotal position in economy and various stakeholders have many expectations from this sector. They

deposit their savings and hard earned money with these banks. Therefore, banks play a critical role when it

comes to the economy sustainable growth.

1

Assistant Professor, G.G.D.S.D. College, Dept. of Commerce and Management, Chandigarh.

1052 Dr. Savita Sindhu

International Journal of Engineering Technology Science and Research

IJETSR

www.ijetsr.com

ISSN 2394 – 3386

Volume 5, Issue 3

March 2018

The Indian banking sector is faced with multiple and concurrent challenges such as increased competition,

rising customer expectations, and diminishing customer loyalty. The banking industry is also changing at a

phenomenal speed. While at the one end, we have millions of savers and investors who still do not use a bank,

another segment continues to bank with a physical branch and at the other end of the spectrum, the customers

are becoming familiar with ATMs, e-banking, and cashless economy.

Risk management and Financial Consumer Protection:

The emerging area globally is the protection of the customers. During the scams and financial crisis, the

customer class is affected the most and worst hit in the crisis. There are many discriminatory information

issues, lack of transparency in transactions and extra charges with hidden information Product innovations

have not focused on customer requirements and have, instead, aimed at serving the interests of the service

provider.

Impaired Assets: Another issue is the rising portfolio of non-performing assets (NPAs) which is generating

considerable concern.At nearly Rs. 10 lakh crore, India’s pile of bad loans is better than the gross

domestic products of at least 137 countries. But so far, the RBI’s attempts to reduce Non-Performing Assets

(NPAs) in the banking sector have yielded little result. Banks should focus on their risk management

practices during boom time as they are not able to anticipate future declines. Currently, the worst-hit are the

state-owned banks, which dominate the Indian banking system. In March 2017, the average bad loans of PSBs

stood at 75% of their net worth. These bad loans are squeezing banks’ profitability and capital positions,

threatening the health of some of India’s biggest banks. The risk of more and more impaired assets is now a

“Governance” issue for banks as they hesitate in saying ‘no’, except, may be, to small borrowers. Banks

are now required to significantly improve their risk assessment capability and their ability to price risks, so

that they take on only those risks that they understand and can effectively manage.

The transaction cost of carrying NPA’s is also a major concern for the Indian banking sector. The operational

efficiency of banks has also decreased and it further causes the addition of non- performing assets in their loan

portfolios.

Financial Inclusion:The extent of financial inclusion in the Indian financial system continues to be low

despite several steps having been taken by the Government and the Reserve Bank of India. Financial

inclusion has become a necessity in today’s business environment. In financial inclusion there is no “one-size-

fits-all” approach. But the banks must recognize three important prerequisites for maximising the benefits of

financial inclusion efforts. One is the holistic approach to provision of financial services, not just credit or

deposit alone. Next is Meeting the needs of small firms and to focus on segments of population excluded by

gender or geographical remoteness. The unbanked masses constitute a unique but important stakeholder

group for banks, even though they may not be bank customers. This is a huge business opportunity for

banks to meet the expectations of this group through financial inclusion efforts. Financial institutions have

to keep a check of various perspectives like environmental concerns, corporate governance, social and ethical

issues while introducing any product. Poor people in the country should be given proper attention to improve

their economic condition. Several initiatives have been done by RBI to achieve greater financial inclusion

over a period of time.

Revolution of Information Technology:Banks must focus on leveraging technology to build new business

models and delivery channels that are tailored to the needs of the targeted population. With the help of

technology it is possible to increase the financial inclusion efforts, provided it is implemented in a planned

manner. But the increasing complexity, flexibility, and difficulty of product and servicing offerings makes the

effective use of technology critical for handling the risks linked with the business. Managing technology is,

therefore, a key challenge for the Indian banking sector. Developing or acquiring the right technology,

deploying it optimally, and then leveraging it to the maximum extent is essential to achieve and maintain high

service and efficiency standards while remaining cost-effective and delivering sustainable returns to

shareholders.Banks may have to go for mobile banking services for a cluster of villages. Alternatively,

technological institutions have to come out with low-cost, self-service solutions/ ATMs. The government and

1053 Dr. Savita Sindhu

International Journal of Engineering Technology Science and Research

IJETSR

www.ijetsr.com

ISSN 2394 – 3386

Volume 5, Issue 3

March 2018

the RBI should actively support such research efforts. To face competition it is necessary for banks to absorb

the technology and upgrade their services.

Rigorous Competition:Globalization effect resulted in the forceful competition for the domestic banks. As the

foreign banks opened their branches or subsidiaries in India, it becomes a major challenge for Indian banks to

survive with international standards. RBI regulations have kept the banking industry open for foreign and

private banks over a period of time. Due to lower entry barriers by the authorities, many players like private

banks, foreign banks and non-banking finance companies etc. entered the banking sector. Entry of foreign

banks and new private sector banks hasstarted the high technology revolution. Therefore, banks have to follow

the prompt and efficient customer service for survival and growth in highly competitive environment, which

calls for suitable customer centric policies and customer friendly processes.

Employees’ Retention:Due to high competition in banking industry, revenue is on top priority for

banks.Banking industry has transformed from transactional and customer service-oriented to an increasingly

aggressive environment. But banking employees are often resistant to perform up to new expectations.

Customer centric banking industry fails to retain valuable employees can mean the loss of valuable customer

relationships. Employees are becoming disappointed because of frequent changes in the system. Their

diminishing morale results in less revenue. Banking industry is anxious about employee retention from all

levels, tellers to executives to customer service representatives because competition is always moving in to

hire them away.

Social and Ethical Aspects:Banking industry undertakes the responsibility of social and ethical aspects. But in

practical this is a biggest challenge for banks to consider these aspects in their working. Along with profit

maximization, banks have to support the organizations which have social and ethical concerns.

Security/ Cyber threats: In our new digital India, with the growing penetration of computers and smartphones,

and increasing access to the internet, Indians are taking to digital channels for their banking needs. Due to

which, cybercrime is becoming a greater threat. The RBI classifies frauds as transactions involving any

cheating, negligence, misappropriation of funds, or forged documents. “Not only simple attacks using

phishing, vishing and social engineering, but also increasingly audacious attacks by organised gangs with or

without backing by state players have come to light,” the RBI said. Authorities recommended that banking

industry should invest in defensive software and regularlymeasure the risks at hand, not just for

internalprocesses but also for the outside vendors that the lenders employ.

Bank Fraud:Banking regulators are also concerned with the increased number of fraudulent transactions in

banks. And banks are often seen unwilling to report these cases. All corporate loan-related fraud cases get

seasoned for two to three years as NPAs before they are reported as fraud,” the RBI said in the report. In the

last five years, the volume of bank fraud has increased by 19.6% to 5,064 cases.

New payment and finance banks:More and more new payments banks and small finance banks are launching

their operations. Specific segment is being catered by these banks. In future these banks will increase their

share. And when we talk about banks return on investments, they are not making enough profits. Their

shareholders expectations are not met when it comes to return on investment or return on equity.

Due to increasing competition, now banks are concentrating more on customer satisfaction. Nowadays,

customer experience plays an important role. Banks are able to provide the services as demanded by the

customers, especially in regards to technology. Regulatory pressure is increasing continuously and banks are

now required to spend more of the discretionary budget on upgrading their systems and processes to provide

the services to customers. Nowadays, financial technology companies are providing financial services with the

help of software. It has created an enormous challenge for the banks as they are not able to adjust quickly to

the changes like in technology, working operations etc. These types of challenges are certain in future also,

banks need to constantly improve their operations in order to keep up with the fast pace of change in the

banking and financial industry today.

1054 Dr. Savita Sindhu

International Journal of Engineering Technology Science and Research

IJETSR

www.ijetsr.com

ISSN 2394 – 3386

Volume 5, Issue 3

March 2018

Mobile Banking: Another contemporary issue faced by banks is “Mobile Banking”. It is definitely trending

upward. More than 55% of adults now use mobile banking, and 81% of mobile deposit users say they are

“extremely” or “very” satisfied with their bank, comparedto 72% for non-mobile deposit users.But when we

talk of remote deposits, usage rates are very low. Banks need to be proactive in marketing and remarketing

the mobile capabilities. And encourage the accountholders to try bank mobile app and use it frequently for

their routine transactions. Most of the young consumers consider the mobile banking a “must have” or “nice

to have” feature. In fact, accountholders who use mobile deposit are less likely to change banking

relationships than those who do not utilize the remote deposit capabilities.

Banks need to start conversations about their mobile app at account opening start. They must help the new

accountholders to download the app and give them proper instructions regarding its safe usage.

In this digital age, creating personal connections is next to impossible for banks. Lesser face to face

interactions made it difficult for banks to maintain good customer relationship. According to data from

Nielsen, accountholders complaint that they face difficulty in resolving their problems as while using online

resolving mechanism, they don’t find the answers that they seek online. If they have not been able to resolve

the queries online, they regularly pick up the phone to do so.

Conclusion:

In the digital age, banks need to be careful while handing the contemporary issues. Banks should go for

transparent and non-discriminatory pricing of assets. It must be ensured that poor do not subsidize the

provision of banking services to the rich. The risk-return trade-off involved in various operations must be

analysed. We usually say that higher the risk more is the return you will get. But banks must study the

systematic and unsystematic risk so that they can take only that risk which is under their control and are in

alignment with the banks and customer long term gains. And while maintaining relationship with

customers and resolving their problems banks can use technology like interactive video ATMs for

distributing costs among branches. And providing access to specialists via video conferencing is another

way to bring specific skill sets into branches.

The business operations of banks should be customer-centric in nature. This should be reflected in all

aspects of banking operations including creation of customized products and services, pricing of services,

delivery channels, etc. Banks should, inherently, be flexible in their operations so that they have the ability

to meet the evolving stakeholder expectations.The culture of efficient risk management needs to be

imbibed in the organization’s ethos so that everyone from the top management to frontline managers in the

field shares a common vision of risk management.Banks are the lifeline of any economy and it is the

collective responsibility of all of us to ensure that we have a strong, resilient and inclusive banking system

geared up to face all domestic and global challenges.In this complex and fast changing environment, the

only sustainable competitive advantage is to give the customer an optimum blend of technology and

traditional service.

References:

Bartel, A. P. (2004), “Human Resource Management and Organizational Performance: Evidence from Retail

Banking”, Industrial and Labor Relations Review, Vol. 57(2), pp. 181-203.

Clark, M. (1997), “Modelling the Impact of Customer-Employee Relationships on Customer Retention Rates in a

Major UK Retail Bank”, Management Decision, Vol. 35(4), pp. 293-301.

Chakrabarty,K.C. (2012), “Contemporary issues in banking – reflections on viewpoints of a bank economist”, BIS

central bankers’ speeches, pp. 1-5.

Dev, S. M. (2006), “Financial Inclusion: Issues and Challenges”, Economic & Political Weekly, Vol. 41.

George, B (2015), “Recent trends in banking sector- challenges and opportunities”, International Journal of Current

Research, Vol. 7, Issue 10, pp. 21913-21915.

Goyal, K.A. and V. Joshi (2011), “Mergers in banking industry of India: some emerging issues”, Asian journal of

Business and Management Sciences, pp. 157-165.

1055 Dr. Savita Sindhu

International Journal of Engineering Technology Science and Research

IJETSR

www.ijetsr.com

ISSN 2394 – 3386

Volume 5, Issue 3

March 2018

Goyal, K. A. and V. Joshi (2011), “A Study of Social and Ethical Issues in Banking Industry”. International Journal

of Economics & Research, Vol. 2(5), pp. 49-57.

Grima, S and F. Bezzina (2016), “Contemporary Issues in Bank Financial Management”, Contemporary

Studies in Economic and Financial Analysis, Vol. 97, Emerald Group Publishing Limited.

Sekaran, U. (1989), “Paths to the job satisfaction of bank employees”, Journal of Organizational Behavior, Vol.

10(4), pp. 347-359.

Sensarma, R. and Jayadev (2009), “Are bank stocks sensitive to risk management?” Journal of Risk Finance, Vol.

10(1), pp. 7-22.

Zhao, T, B. Casu and A. Ferrari (2008), “Deregulation and Productivity Growth: A study of the Indian commercial

banking industry”, International journal of Business Performance Management, pp. 318-343.

https://www.indiatoday.com

https://www.moneyindia.com

https://www.indiainfoline.com

1056 Dr. Savita Sindhu

You might also like

- Bank of America StatementDocument12 pagesBank of America StatementAmin Sahil0% (1)

- Kaleidoscopic View of BankingDocument89 pagesKaleidoscopic View of BankingRahul D'abreoNo ratings yet

- Final Project Neft Rtgs PDFDocument82 pagesFinal Project Neft Rtgs PDFMehul Patel58% (12)

- Emerging Role of Technology in Indian Banking Sector: A Phase of Digitalization in The SectorDocument18 pagesEmerging Role of Technology in Indian Banking Sector: A Phase of Digitalization in The Sectorsamriddhi sinhaNo ratings yet

- Rural SatisfactionDocument8 pagesRural SatisfactionVDC CommerceNo ratings yet

- Impact of Income and Expenditure On Technology PDFDocument11 pagesImpact of Income and Expenditure On Technology PDFrujutaNo ratings yet

- Impact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanDocument5 pagesImpact of Retail Banking in Indian Economy: Research Article Parmanand Barodiya and Anita Singh ChauhanthNo ratings yet

- Neo Banks A Paradigm Shift in BankingDocument15 pagesNeo Banks A Paradigm Shift in Bankingdosah93991No ratings yet

- ArticleText 37965 1 10 20200617Document11 pagesArticleText 37965 1 10 20200617ngu mahNo ratings yet

- Info Tech in Banking SectorDocument8 pagesInfo Tech in Banking SectorMadhan Padma ShaliNo ratings yet

- IJCRT2301008Document17 pagesIJCRT2301008hifeztobgglNo ratings yet

- Knowledge Management in Commercial BanksDocument17 pagesKnowledge Management in Commercial BanksShasanka KarmakarNo ratings yet

- A Study On Contemporary Challenges and Opportunities of Retail Banking in IndiaDocument12 pagesA Study On Contemporary Challenges and Opportunities of Retail Banking in IndiakokoNo ratings yet

- A Study On Impact of Technological Up Gradation and Innovation in Indian Banking Sector With Special Reference To SBI-2019-02!12!11-44Document8 pagesA Study On Impact of Technological Up Gradation and Innovation in Indian Banking Sector With Special Reference To SBI-2019-02!12!11-44Impact JournalsNo ratings yet

- Evaluation of Effectiveness of Customer Services in Banking SectorDocument14 pagesEvaluation of Effectiveness of Customer Services in Banking SectorMehrab Jami Aumit 1812818630No ratings yet

- 10 Nishith Devraj Paper For Jbfsir 1 PDFDocument10 pages10 Nishith Devraj Paper For Jbfsir 1 PDFpareek gopalNo ratings yet

- Revolution of Digital Finance in India - Trends &challengesDocument10 pagesRevolution of Digital Finance in India - Trends &challengesIAEME PublicationNo ratings yet

- IjarcommerceDocument5 pagesIjarcommerceManisharan JuluriNo ratings yet

- Summer Internships 2011 MBA 2010-12: Role of IT in The Banking IndustryDocument71 pagesSummer Internships 2011 MBA 2010-12: Role of IT in The Banking IndustrySakshi DuaNo ratings yet

- Industrial Research Analysis (IAR) Research Paper SummariesDocument6 pagesIndustrial Research Analysis (IAR) Research Paper SummariesAyush SatyamNo ratings yet

- Ankitha - Ret BankDocument25 pagesAnkitha - Ret BankMOHAMMED KHAYYUMNo ratings yet

- Ngu N 1Document13 pagesNgu N 1Min MaxNo ratings yet

- Impact of Bancassurance Product On Banking Business & Customer Satisfaction PDFDocument6 pagesImpact of Bancassurance Product On Banking Business & Customer Satisfaction PDFcrescidaNo ratings yet

- Digital Banking An Indian Perspective: Dr. (SMT.) Rajeshwari M. ShettarDocument5 pagesDigital Banking An Indian Perspective: Dr. (SMT.) Rajeshwari M. ShettarNikhil RajNo ratings yet

- Research Paper On Banking Sector in IndiaDocument5 pagesResearch Paper On Banking Sector in Indiafzhw508n100% (1)

- New Technological Changes in Indian Banking SectorDocument8 pagesNew Technological Changes in Indian Banking SectorSiddhant SinghNo ratings yet

- New Technological Changes in Indian Banking SectorDocument8 pagesNew Technological Changes in Indian Banking Sectormanish sharmaNo ratings yet

- Operational Competiveness of Retail Industries: A Case Study in OdishaDocument6 pagesOperational Competiveness of Retail Industries: A Case Study in OdishaSIBASISH PATANAIKNo ratings yet

- Zijmr3jan21 13817Document13 pagesZijmr3jan21 13817Rajni KumariNo ratings yet

- New Technological Changes in Indian Banking Sector: September 2017Document8 pagesNew Technological Changes in Indian Banking Sector: September 2017vinay tejNo ratings yet

- New Technological Changes in Indian Banking Sector: September 2017Document8 pagesNew Technological Changes in Indian Banking Sector: September 2017vinay tejNo ratings yet

- Jagriti CUSTOMER ATTITUDE TOWARDS HDFC CREDIT CARDSDocument103 pagesJagriti CUSTOMER ATTITUDE TOWARDS HDFC CREDIT CARDSAkash SinghNo ratings yet

- Analytical Study of Customer Satisfaction Towards IT Enabled Services of ICICI BankDocument10 pagesAnalytical Study of Customer Satisfaction Towards IT Enabled Services of ICICI BankAshish MOHARENo ratings yet

- Issues and Challenges in Indian Banking SectorDocument7 pagesIssues and Challenges in Indian Banking Sectorbhattcomputer3015No ratings yet

- JE 02 1 045 11 023 Singh S TTDocument12 pagesJE 02 1 045 11 023 Singh S TTVinod ThadhaniNo ratings yet

- Impact of Digital Disruption On Human Capital of Banking SectorDocument9 pagesImpact of Digital Disruption On Human Capital of Banking SectorKhushi BhartiNo ratings yet

- Impact of Technology On Banking Sector in India: International Journal of Scientific Research June 2012Document5 pagesImpact of Technology On Banking Sector in India: International Journal of Scientific Research June 2012Shubham RajNo ratings yet

- Customer Perception On E-Banking Services of Public and Private Sector Banks in Hyderabad RegionDocument13 pagesCustomer Perception On E-Banking Services of Public and Private Sector Banks in Hyderabad RegionIJRASETPublicationsNo ratings yet

- 30-07-2022-1659161461-7-IJBGM-2. Reviewed - IJBGM - An Overview - Impact of FinTech in Indian Banking SectorDocument4 pages30-07-2022-1659161461-7-IJBGM-2. Reviewed - IJBGM - An Overview - Impact of FinTech in Indian Banking Sectoriaset123No ratings yet

- Impact of Digitalisation On Bank Performance: A Study of Indian BanksDocument15 pagesImpact of Digitalisation On Bank Performance: A Study of Indian BanksHardik MistryNo ratings yet

- A Study of Impact of Information Technology in Indian Bnaking IndustryDocument8 pagesA Study of Impact of Information Technology in Indian Bnaking IndustryShivansh ChauhanNo ratings yet

- Fintech in India-Opportunities and ChallengesDocument14 pagesFintech in India-Opportunities and Challengescaalokpandey2007No ratings yet

- 2.10 Retail BankingDocument14 pages2.10 Retail BankingSrinivas RaoNo ratings yet

- Banking Industry-Final Report Group 18Document14 pagesBanking Industry-Final Report Group 18Pranav KumarNo ratings yet

- New Age of Banking-1 PDFDocument9 pagesNew Age of Banking-1 PDFsomprakash giriNo ratings yet

- Customers' Satisfaction On E Banking Services in Indian Banking SectorsDocument7 pagesCustomers' Satisfaction On E Banking Services in Indian Banking SectorsEditor IJTSRDNo ratings yet

- Retail and Wholesale Banking in IndiaDocument12 pagesRetail and Wholesale Banking in Indiau2indiaNo ratings yet

- PS34Document14 pagesPS34abdsmd1249No ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewNaman MittalNo ratings yet

- Electronic Banking in India Innovations Challenges and Opportunities IJERTCONV5IS11011Document8 pagesElectronic Banking in India Innovations Challenges and Opportunities IJERTCONV5IS11011Pavan PaviNo ratings yet

- Fundamental Analysis of Companies in Banking and IT SectorDocument70 pagesFundamental Analysis of Companies in Banking and IT SectorShreyas PatilNo ratings yet

- Customer Satisfaction On Services of Private Sector Banks in Erode District of TamilnaduDocument5 pagesCustomer Satisfaction On Services of Private Sector Banks in Erode District of TamilnaduJithinNo ratings yet

- Bazil. 22381027 (Smart Banking)Document8 pagesBazil. 22381027 (Smart Banking)BazilNo ratings yet

- Retail Banking - A Real Growing Concept in The Present Scenario Dr.A.SelvarajDocument8 pagesRetail Banking - A Real Growing Concept in The Present Scenario Dr.A.Selvarajrajeshraj0112No ratings yet

- Growth and Development of Retail Banking in India: Drivers of Retail BankingDocument17 pagesGrowth and Development of Retail Banking in India: Drivers of Retail BankingDR.B.REVATHYNo ratings yet

- Mini Project On Emerging Phase of Banking IndustryDocument9 pagesMini Project On Emerging Phase of Banking IndustryPrince PanwarNo ratings yet

- Growth and Development of ATM in IndiaDocument9 pagesGrowth and Development of ATM in IndiatraderescortNo ratings yet

- Emergence of Bancassurance in India - P4Document7 pagesEmergence of Bancassurance in India - P4Rajeev SenguptaNo ratings yet

- Literature Review (Retail Banking)Document3 pagesLiterature Review (Retail Banking)Hemalatha Aroor100% (2)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Inclusive Growth Strategy (Special Case Study in India)Document15 pagesInclusive Growth Strategy (Special Case Study in India)Chandan ParidaNo ratings yet

- Electronic Funds Transfer Application: WWW - Rakbank.aeDocument2 pagesElectronic Funds Transfer Application: WWW - Rakbank.aeMehran KhanNo ratings yet

- SA's Best Value For You and Your FamilyDocument38 pagesSA's Best Value For You and Your FamilyKosie SmithNo ratings yet

- The Great Depression - Assignment # 1Document16 pagesThe Great Depression - Assignment # 1Syed OvaisNo ratings yet

- Monetary, Fiscal, and International Trade Policy With Taxation and Agrarian Reform Monetary PolicyDocument38 pagesMonetary, Fiscal, and International Trade Policy With Taxation and Agrarian Reform Monetary PolicycarendleonNo ratings yet

- Treasury Inspection Manual 20200602154643Document80 pagesTreasury Inspection Manual 20200602154643NickNo ratings yet

- Eco ProjectDocument33 pagesEco ProjectNeel NarsinghaniNo ratings yet

- Book Reviews: The Whole Brain Leader - 8 Dimensional ApproachDocument7 pagesBook Reviews: The Whole Brain Leader - 8 Dimensional ApproachneodvxNo ratings yet

- 11th & 12 TH Q&ADocument28 pages11th & 12 TH Q&Aankitmohanty01No ratings yet

- Ap2904 Cash and Cash EquivalentsDocument8 pagesAp2904 Cash and Cash EquivalentsMa Yra YmataNo ratings yet

- Idioms BookDocument110 pagesIdioms BookCorneliu Meciu100% (1)

- On Submission of SFT in Form 61A PDFDocument36 pagesOn Submission of SFT in Form 61A PDFajinkya ghevadeNo ratings yet

- StressDocument61 pagesStressToufique Kazi100% (1)

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Banking R & B InfraDocument29 pagesBanking R & B InfraGaurav IngleNo ratings yet

- Dec - 21Document17 pagesDec - 21Amit KumarNo ratings yet

- Account StatementDocument3 pagesAccount StatementJobz ForuNo ratings yet

- Vivas Vs Monetary BoardDocument9 pagesVivas Vs Monetary BoardSur ReyNo ratings yet

- Le Discours de Ramesh Basant Roi À L'occasion Du Dîner Annuel de La BOMDocument22 pagesLe Discours de Ramesh Basant Roi À L'occasion Du Dîner Annuel de La BOML'express MauriceNo ratings yet

- Project Financial AppraisalDocument79 pagesProject Financial AppraisalAmy MengistuNo ratings yet

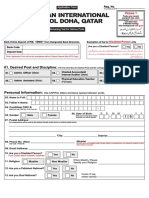

- Do Ha Qatar FormDocument4 pagesDo Ha Qatar FormsajidNo ratings yet

- House Construction GuidelinesDocument7 pagesHouse Construction GuidelinesBinu KaaniNo ratings yet

- 2 Administrative Systems and Instruments (Nota)Document32 pages2 Administrative Systems and Instruments (Nota)cik bungaNo ratings yet

- Unit - 20 - Banking Operations - NestoDocument4 pagesUnit - 20 - Banking Operations - NestoBarun Kumar SinghNo ratings yet

- STMDocument72 pagesSTMKiran ReddyNo ratings yet

- 250 MCQs - September 2019 - August 2019Document254 pages250 MCQs - September 2019 - August 2019mdi mNo ratings yet

- Monthly BeePedia December 2019 - Statutory Bodies Exams PDFDocument144 pagesMonthly BeePedia December 2019 - Statutory Bodies Exams PDFSahil AdhikariNo ratings yet

- SSP Application GuideDocument10 pagesSSP Application GuideAnirudh IndanaNo ratings yet

- SIP Black BookDocument37 pagesSIP Black BookAmanNo ratings yet