Professional Documents

Culture Documents

Finance Effects 1

Finance Effects 1

Uploaded by

ethernalx0 ratings0% found this document useful (0 votes)

5 views1 pageThe document discusses when and how a company should recognize revenue. A company recognizes revenue when it is earned, not when payment is received. There are three options for handling the timing difference between revenue recognition and cash receipt: 1) receiving payment in advance and initially recording it as unearned revenue, 2) receiving payment at sale to directly increase cash, or 3) receiving payment after sale to initially record a receivable instead of cash.

Original Description:

Effects page 1

Original Title

Finance effects 1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses when and how a company should recognize revenue. A company recognizes revenue when it is earned, not when payment is received. There are three options for handling the timing difference between revenue recognition and cash receipt: 1) receiving payment in advance and initially recording it as unearned revenue, 2) receiving payment at sale to directly increase cash, or 3) receiving payment after sale to initially record a receivable instead of cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageFinance Effects 1

Finance Effects 1

Uploaded by

ethernalxThe document discusses when and how a company should recognize revenue. A company recognizes revenue when it is earned, not when payment is received. There are three options for handling the timing difference between revenue recognition and cash receipt: 1) receiving payment in advance and initially recording it as unearned revenue, 2) receiving payment at sale to directly increase cash, or 3) receiving payment after sale to initially record a receivable instead of cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

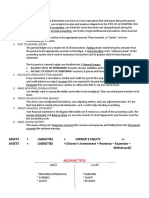

A company recognizes revenue when it is realized, when it is earned, no matter when the firm receives the actual payment.

Given that the payment for the product could have a

different timing, we can easily end up with a difference between revenues and cash at hand. There are three possible options.

Cash before the sale

• If we receive 10,000 in advance, we’ll use a T-account called

“Prepaid Revenue”. This is a liability and we’ll credit it for 10, 000

• When the goods have been delivered, we will credit the revenue

account for 10,000 and will debit the prepaid revenue for 10,000.

Cash at the sale

• If we receive 10,000 in cash at the sale, we’ll have to credit

Revenues for 10,000 and debit Cash for the same amount.

03

• This option creates no difference between revenues and cash

at hand, while the other two do.

Cash after the sale

• We register 10,000 of revenue on the day when we deliver

the goods.

02

• Instead of increasing our cash balance, we would have to

increase its trade receivables account.

• We debit Trade Receivables for 10,000.

• Later, when the payment is received, we debit cash and

credit trade receivables for 10,000. 01

You might also like

- Chapter 7 ReceivablesDocument87 pagesChapter 7 ReceivablesLEE WEI LONGNo ratings yet

- Tally NotesDocument32 pagesTally NotesenuNo ratings yet

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Topic 1.1.1 Additional NotesDocument6 pagesTopic 1.1.1 Additional NotesMei Yi YeoNo ratings yet

- NIOS Bakery and Confectionery L8 Accounting ProceduresDocument23 pagesNIOS Bakery and Confectionery L8 Accounting ProceduresEdNo ratings yet

- Sample ProblemDocument5 pagesSample ProblemNath BongalonNo ratings yet

- BUSN7008 Week 5 Receivables and PayablesDocument33 pagesBUSN7008 Week 5 Receivables and PayablesberfamenNo ratings yet

- Class 11 Accountancy Chapter-3 Revision NotesDocument11 pagesClass 11 Accountancy Chapter-3 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Accounts ReceivableDocument92 pagesAccounts Receivableco230154No ratings yet

- Lect 04Document17 pagesLect 04Aamir MansoorNo ratings yet

- Debit and Credit Rules of AccountingDocument6 pagesDebit and Credit Rules of AccountingsbcluincNo ratings yet

- ReconciliationsDocument8 pagesReconciliationsPrachi PalreshaNo ratings yet

- NWB Business Account Terms srv01 00Document24 pagesNWB Business Account Terms srv01 00tinashe.faroNo ratings yet

- Financial AccountingDocument12 pagesFinancial AccountingHardik JainNo ratings yet

- Module 1 - Credit Bad DebtsDocument21 pagesModule 1 - Credit Bad Debtsiacpa.aialmeNo ratings yet

- Identify Transactions: Accounting CycleDocument6 pagesIdentify Transactions: Accounting CycleNezhreen MaruhomNo ratings yet

- Merchandising Organized As A Partnership BusinessDocument23 pagesMerchandising Organized As A Partnership BusinessIzza WrapNo ratings yet

- Accounting LedgerDocument5 pagesAccounting LedgerlekalonzoNo ratings yet

- Additional Questions On Financial Statements and Cash BookDocument5 pagesAdditional Questions On Financial Statements and Cash BookBoi NonoNo ratings yet

- Unit 3 - Trial BalanceDocument11 pagesUnit 3 - Trial Balancegogo chanNo ratings yet

- FAR QTR2 Part1.notesDocument27 pagesFAR QTR2 Part1.notestygurNo ratings yet

- 8.2 Valuing Accounts ReceivableDocument3 pages8.2 Valuing Accounts ReceivableDaniel RhetNo ratings yet

- ReceivablesDocument45 pagesReceivablesjerickolian.delrosarioNo ratings yet

- CH 10Document52 pagesCH 10jannatfatima2875No ratings yet

- Bad Debts and Provision For Doubtful DebDocument3 pagesBad Debts and Provision For Doubtful DebLaghari ShafquatNo ratings yet

- Accrued-And-Derrered-Income - CPADocument1 pageAccrued-And-Derrered-Income - CPAGodfrey MakurumureNo ratings yet

- Processing Transactions NewDocument34 pagesProcessing Transactions NewAkanksha Gupta100% (1)

- Chapter 7 - Accounting For ReceivablesDocument53 pagesChapter 7 - Accounting For ReceivablesJes ReelNo ratings yet

- Books of Prime Entry and LedgersDocument10 pagesBooks of Prime Entry and LedgersLOW YAN QINNo ratings yet

- Module4 AccountsReceivablePartIDocument6 pagesModule4 AccountsReceivablePartIGab OdonioNo ratings yet

- Accounting For ReceivablesDocument19 pagesAccounting For ReceivablesMrinal Kanti DasNo ratings yet

- 3 Golden Rules of AccountingDocument5 pages3 Golden Rules of AccountingBilal SiddiqueNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- Recording of TransactionDocument20 pagesRecording of TransactionNikita SharmaNo ratings yet

- ACC 124 HO 6 Accounts ReceivableDocument3 pagesACC 124 HO 6 Accounts ReceivableJames Cañada GatoNo ratings yet

- Intermediate Accounting: Seventeenth EditionDocument97 pagesIntermediate Accounting: Seventeenth EditionheyyyukizxNo ratings yet

- 3 Accounting MechanicsDocument50 pages3 Accounting MechanicsVasu Narang100% (1)

- ACC406 - Chapter 6Document44 pagesACC406 - Chapter 6Carol LeslyNo ratings yet

- ACT2111 Fall 2019 Ch5 - Lecture 7&8 - StudentDocument73 pagesACT2111 Fall 2019 Ch5 - Lecture 7&8 - StudentKevinNo ratings yet

- Chapter 7Document39 pagesChapter 7juls100% (1)

- Adjusting Process5Document28 pagesAdjusting Process5mouhammad mouhammadNo ratings yet

- Financial Reporting and Analysis 7th Edition by Revsine Collins Mittelstaedt and Soffer ISBN Solution ManualDocument108 pagesFinancial Reporting and Analysis 7th Edition by Revsine Collins Mittelstaedt and Soffer ISBN Solution Manualphyllis100% (21)

- Seance 3Document16 pagesSeance 3Mohamed ElyaâkoubiNo ratings yet

- Journalizing Transactions: Transaction #1Document3 pagesJournalizing Transactions: Transaction #1Kazu YoshinagaNo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 02Document15 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 02Advance KnowledgeNo ratings yet

- CH 5Document35 pagesCH 5Mohamed DiabNo ratings yet

- Merch 1Document3 pagesMerch 1Angelica EcliseNo ratings yet

- Chapter 5 (3) - Bad Debts, Allowance For Doubtful Debts and Discount AllowableDocument43 pagesChapter 5 (3) - Bad Debts, Allowance For Doubtful Debts and Discount AllowableIrsamNo ratings yet

- Slides Receivables NOTES RECEIVABLEDocument26 pagesSlides Receivables NOTES RECEIVABLElocomotingkenya.co.keNo ratings yet

- Accounting Equation & Financial ReportingDocument36 pagesAccounting Equation & Financial ReportingAnelisa IvyNo ratings yet

- CH 5 - Returns, Discounts and Sales Tax - UpdatedDocument31 pagesCH 5 - Returns, Discounts and Sales Tax - Updatedgolooz43No ratings yet

- TransactionDocument4 pagesTransactionapi-351243280No ratings yet

- Session 2 Revenue Recognition AR InventoryDocument41 pagesSession 2 Revenue Recognition AR InventoryNANo ratings yet

- Cashflow StatementDocument40 pagesCashflow StatementJUAN ANTONIO CERON CRUZNo ratings yet

- Accounting Non-Accountants Part 2Document37 pagesAccounting Non-Accountants Part 2Vanessa Gapas0% (1)

- CA2 - Group 4 - PresentationDocument19 pagesCA2 - Group 4 - PresentationS1626No ratings yet

- CH 08Document71 pagesCH 08ANGELLINA SADRA SOETANDYNo ratings yet

- Kimmel Acct 7e Ch10 Reporting and Analyzing LiabilitiesDocument97 pagesKimmel Acct 7e Ch10 Reporting and Analyzing LiabilitiesElectronNo ratings yet

- Answer Key Chapter 3Document60 pagesAnswer Key Chapter 3HectorNo ratings yet