Professional Documents

Culture Documents

Profit and Loss Accounting

Uploaded by

Sujon M Jahid Hasan0 ratings0% found this document useful (0 votes)

115 views8 pagesprofit and loss accounting

Original Title

profit and loss accounting

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentprofit and loss accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

115 views8 pagesProfit and Loss Accounting

Uploaded by

Sujon M Jahid Hasanprofit and loss accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

Problem-1:

From the following balances of the Arab Bangladesh Bank Ltd. as on 31 December 2012,

prepare the Balance sheet as on 31% December, 2012 and Profit and Loss account for the year

ended:

Tk Tk.

Paid up capital 15,00,000 | Salaries 32,150

Profit & Loss A/e 40,333 | Buildings (coat Tk. 3

Jaks) 2,05,000

| Current Accounts 34,12,829 | Law charges 1,650

| Fixed deposits 38,95,554 | Cash in hand and

| with banks 8,16,324

Savings Bank A/c 20,68,000 | Cash with other

banks 12,05,125

Directors Fee 2,980 | Investment at cost 8,78,126

| Auditors Fee 3,000 | Loans, cash credit

| and overdraft 70,20,000

Fumiture (cost Tk. 50,000) 37,280 | Bills discounted 14,00,520

Interest & Discount 2,00,223 | Unexpired insurance 625

Commission & Exchange 1,12,000 | Statutory Reserve

fund 60,000

Investment Reserve Fund 35,000 | Reserve fund 2,05,000

Branch Adj. Cr.) 66,894 | Rent, Rates and 8,507

taxes

Postage 2,156 | Provident fund

contribution 15,000

Printing & Stationery 2,390 | ContingencyReserve | 55,000

i) The bank has accepted Tk. 2,00,000 Bill on behalf of customers, the securities lodged against

them amounted to Tk. 3,00,000. ii) Provide Tk. 7,000 on Buildings and Tk. 4,500 on furniture for

depreciation. iii) The market value of investments on 31“ December, 2012 amounted Tk.

850,000. iv) Rebate on bills discounted on 31" December, 2012, Tk. 5,900.

Problem-2:

From the above particulars for Liverpool Bank Itd. prepare Profit and Loss Statement for the

year ended 31" December 2012 and a Statement of Financial Position on that date as per the 1*

Schedule of Banking Companies Act-1991:

Particulars Debit (Tk) Particulars Credit(Tk)

Cash in hand 3,20,000 | Capital 25,00,000

Cash with Bangladesh bank 8,50,000 | Reserve fund 10,00,000

Interest paid 3,96,000 | Interest & discount 6,55,000

Salaries é& allowances 1,22,000 [Tneome from dividend

PF. Contribution 8,500 | Exchange & commission

Directors fees 12,500 | Brokerages

Management expenses 50,000 | Share transfer fees

Bills discounted £8,00,000 | Investment fluctuation fund,

Premises '5,00,000 | Contingency reserve

Fumiture 166,000 | Deposits & other accounts

Investment 25,00,000 | Provident fund

P-F. Investment 75,000

Loans & Cash

Creditors 40,06,000

Overdrat 23,00,000,

1.20,06,000

Others information:

Rebate on bills discounted Tk. 12,500.

Management expenses outstanding Tk. 9,600.

Interest accrued but not received Tk. 17,500.

Depreciation on premises Tk. 25,000 and Furniture Tk. 6,000.

Investment is to be shown in market price which is Tk. 24, 50,000.

vi. The bank has accepted bills on behalf of customers Tk. 2, 20,000.

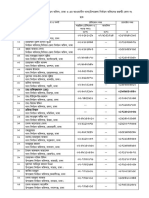

Problem-3:

From the following balances of the Loyads Bank Ltd. prepare Profit and Loss Statement for the

year ended 31 December 2011 and a Statement of Financial Position as on that date:

Particulars Taka

Share capital (6,000 shares of Tk. 100 each, Tk. 50 paid-up) | _3,00,000

Interest and discount received 8,50,000,

Share Premium account 1,00,000

Balances with Bangladesh bank 14,50,000

‘Commission, brokerages etc. received 2,80,000

Balance with other bank 5,50,000

Interest paid on deposits 3,50,000

Money at call and short notice 2,50,000

Savings bank deposits 20,10,000

Rents, rates and insurance premium paid 25,000

Current account, contingency account ete. 45,00,000

Law charges paid 10,000

Shares and debentures purchased (investment) 3,65,000

Miscellaneous receipts from constituents 20,000

Cash in hand 82,000

General reserve fund 1,90,000

Rent received from tenants 50,000

Fixed Deposits 60,00,000

Salaries allowances etc. 2,75,000

Bills discounted and purchased-loans and advances

Postages, telegrams, and stamps

Bills payable

Government securities purchased

Director’s fees and allowances

Auditors fees

Bank premises

Unclaimed dividend

Depreciation

Rebate on bills discounted

Miscellaneous expenses

Repairs to bank premises

Stationery, printing and advertising

Profit and loss account (Cr.)

Loans and advances:

Unclassified

Substandard

Doubtful

Bad

Branch adjustment (Dr.)

Interest accrued on investment

8,50,000

65,000

7,00,000

23,00,000

28,000

12,000

16,50,000

15,000

50,000

35,000

25,000

74,000

46,000

50,000

30,00,000

20,00,000

8,00,000

2,23,000

5,95,000

25,000

Additional information:

i.

Provide for taxation Tk. 20,000;

Dividend declared @ 10 for the year;

‘The management has decided to create a specified provision for Tk. 50,000 and general

provision for unclassified advances Tk. 30,000;

Transfer to general reserve Tk. 20,000;

Transfer to investment fluctuation fund Tk. 20,000;

Bills for collection Tk. 5,00,000; acceptance endorsement Tk. 10,00,000;

Outstanding salaries Tk. 10,000;

Prepaid law charges Tk. 2,000.

Problem-4:

The following are the balances of Bengal Bank Ltd. at December, 2006.

Debit | Credit

(te) | ky

‘Share capital (88,750 shares of TK-10 each) 887,500

Reserve | _5,00,000

Current accounts 25,81,343

Deposit accounts 6,85,135

Acceptance and endorsement for customers 340,216

Reserve for final dividend 56,005

Profit & Loss account (01.01.85) 128,139

Interest received TAio10

Discount charges 38,41

‘Commission charges 1,54,859

Dividend received less tax 86,251

Cash in hand 341,644

Cash with Bangladesh bank 621,858

Money at call and short notice 2,79,416

Bills discounted 8,33,483,

Advances to customers 13,42,120

Liability of customers for

acceptance & endorsement 3,40,216

Bank premises 2,60,000

Investment in shares of

Joint stock companies (at cost) 2,48,000

Investments in national defence bonds (at cost) 1,68,000

Balances with other banks 24,220

Government securities (at cost) 618,358

Interest paid 42,048

General expenses 91,363

Salaries & allowances 100,000,

Interim dividend 32,188

Final dividend 56,005

35,98,919 | 55,98.919

You are required to prepare a profit and loss account for the year ended 31% December, 2006

and the Balance sheet as at that date after taking into account the following adjustments:

i ‘Unexpired discounts amounted to Tk. 4,200, while interest and dividends accrued

and outstanding were Tk. 1, 23,395.

Salaries include Tk. 10,000 paid to general expenses.

Provide Tk. 17, 500 for depreciation on Bank premises.

v. Provide for bad debts to the extent of Tk. 5,500.

Problem-5:

‘The market value of shares of Joint Stock Companies was Tk. 2, 55,000.

From the following trial balance of National Bank Ltd,, prepare the balance sheet as on 31%

December, 2009 and profit and loss account for the year ended 31% December, 2009:

Tk

Share Capital: Authorized and Issued 10,000 shares of tk. 100 each, Tk. 90paid | _5,00,000

Reserve fund 3,50,000

Fixed deposit accounts 9,50,000

Savings bank deposits 30,00,000

Current accounts 80,00,000

Money at call & short notice 3,00,000

‘Acceptance and endorsement on behalf of customers 2,00,000

Investment (at cost) 30,00,000

Interest accrued and paid 2,00,000

Salary (including salary to general manager Tk. 24000 and directors fees tk. 5000 80,000 |

‘Non banking assets acquired in satisfaction of claims 50,000 |

Rent paid 720,000

| General expenses 15,000

Stationery a 8,000

‘Auditors fees 2,000

Profit and loss account (credit) on I“ January, 2006 2,10,000

Dividend paid for 2005 ae [50,000

Premises (Less accumulated depreciation up to December, 2005 Tk. 100000) 12,00,000

Cash in hand 60,000

Cash with Bangladesh Bank 15,00,000

Cash with other banks 13,00,000

Borrowed from banks 7,00,000

Interest and discounts 650,000

Commission, exchange, brokerage etc. 15,000

Branch adjustment (credit) 50,000

Bills discounted and purchased 5,00,000

Bills payable 8,00,000

Loans, cash credits and overdrafts 770,00,000

Unclaimed dividends 30,000

Sundry creditors 30,000

Bills for collection 7,40,000

Additional Information:

a. Rebate on bills discounted and purchased for unexpired terms amounted to Tk. 5,000.

b.A provision for doubtful debts amounting to Tk. 25,000 is required.

c. The market value of investments amounted to Tk. 34, 50,100.

4d. Provide for taxation Tk. 1,00,000.

e. The directors recommended 15% dividend for the year 2006.

£ Allow 5% depreciation on premises on original cost.

Problem-06:

From the following balances of the Arab Bangladesh Bank Ltd. as at 31" December 2009,

prepare a profit and loss account and a balance sheet.

‘The authorized capital consists of 20,000 shares of Tk. 100 each, Tk. 50 per share called up and

paid. Provide Tk. 8,000 for depreciation on buildings, Tk. 3,500 on furniture, Tk. 25,000 for

investment reserve fund, Tk. 20,000 further by way of bad debts reserve. The rebate on bills not

due amounted to Tk. 15,000. An-ad-interim dividend at the rate of 7% per annum was paid for

half year ended 30" June 2009.

Tk.

Paid up capital 10,00,000

Buildings (cost Tk. 300000) [__2,05,000

Profit & loss appropriation account (1% January 2006) 40,000

‘Advertising 1,700

Investment reserve fund 35,000

Bils discounted sams 9,00,000

Lomstocustomers = 45,00,000

Liability for expenses 46,000

Cash credit & overdrafis 30,00,000

Current account 34,153,000

‘Cash with other banks 16,05,000

Directors & auditors fees 5,900

Cash at head office & branches 416,000

Fumiture & fixtures (cost Tk. 50000) 37,000

Fixed deposits 38,99,000

Interest 3,50,000

Discount received 67,000

Investment cost 2,78,000

Postage & telegrams 2,000

‘Unexpired insurance 500

Printing & stationery 3,000

‘Stamps on hand 200

Rent, taxes & insurance 8,700

Reserve fund 2,65,000

Salaries 357,000

Reserve for bad debis 40,000

Interest on deposits 100,000

Out of the total debts for Tk. 5, 18,000 were considered doubtful, and the balance was

considered good, of which debts amounting to Tk. 43, 50,000 were fully secured, and amounting

to Tk. 6,99,000 the bank held guarantees for one or more persons over and above the personal

secutities of debtors. Debts due by directors jointly with other persons amounted to Tk.

2,00,000. For the balance the bank held no other security except the personal security of the

debtor.

Problem-07:

The following trial balances of Habib Bank Ltd. as on 31% December, 2009:

Particulars Debit (Tic) _| Credit (Tk)

Share capital account (authorized and paid-up) 3,00,000

10000 shares of Tk. 100 each, Tk. 50 paid-up

Reserve fund 8,00,000,

Fixed deposit account 30,00,000

Savings bank deposits 20,00,000

Current accounts and unadjusted contingencies 1,10,00,000

Money at call and short notice-in Bangladesh 1,00,000

Money at call and short notice-outside 50,000

Bills discounted and purchased-in Bangladesh —____ | 4,50,000 |

Bills discounted and purchased- outside 1,00,000

Investment at cost 7

Government securities 50,00,000

Ordinary share-fully paid 5,00,000

Preference share-fully paid 1,00,000

Preference share-partly paid (calls to be made 20000) 50,000

Debentures 200,000

Gold 12,00,000

Pakistan Government Securities 5,00,000

Reserve for Building 3,00,000

Interest and discount 650,000

Commission brokerage and exchange 50,000

Rents 20,000

Interest on deposits, current accounts etc, 2,00,000,

Salaries (Tk. 30000 to General Manager) 2,15,000

Postage and Telegrams 3,000

Rent, rates, insurance ete, 11,000

Legal charges 500

Director’s fees 2,500

‘Auditor's fees 1,500

Miscellaneous receipts 61000

Premises at cost 30,00,000

‘Additions to premises 10,00,000

Depreciation fund on premises 40,00,000

Repair to premises 60,000

Stationery, printing and advertisement 72,000

Stamps on hand 3,000

Other expenses of the business 15,000

Cash in hand 62,000

Cash with Bangladesh Bank 12,00,000,

Cash with Pakistan State Bank 3,00,000

Cash with other Banks in Bangladesh [6,00,000

Unclaimed Dividends 12,000

Unexpired Discounts 25,000

Loans, advances, overdrafts and cash credits:

InBangladesh 50,00,000

In Pakistan 8,00,000

Branch Adjustment 9,00,000

Silver 1,00,000

‘Advance payment of tax 60,500

Interest accrued on investments 125,000

Interim dividend on share capital 25,000

‘Non-banking assets acquired in satisfaction of claims 10,000

Borrowed from Banks in Bangladesh 1,25,000

Borrowed from Banks in Pakistan 15,000

Bills payable 10,00,000,

Profit and Loss Account

~1,50,000 ]

Dividend equalization fund 3,00,000

2.42,18,000 | 2,42,18,000

The bank had bills for collection Tk. 150000 including Tk. 10000 in Pakistan and acceptance and

endorsements Tk. 200000 on December 31, 2005 for its constituents. The directors decided to

reserve Tk. 1000 more for unexplored discounts. Bonus to staff to be provided Tk. 42000

including Tk. 5000 to general manager. The directors decided to transfer reserve for building to

depreciation fund account as new premises have been collected. Out of loans to clients in

Pakistan, a loan to the extent of Tk. 5000 is considered bad and the directors have passed a

resolution to write it off. All otherLoans and Debts are considered good.

You are required to prepare profit and loss account and balance sheet as at 31" December,

2009.

Problem-08:

From the following particulars of Dhaka City Bank Ltd. prepare the balance sheet as on 31"

December, 2009 and profit and loss account for the year ended December 31, 2009:

T

Particulars Tk

Borrowing from other banks 12,00,000

Bils receivable for collection 12,00,000

Customer’s liability for acceptances 21,06,800

Rebate on bills discounted 4,000

Branch adjustment (credit) 45,000

Reserve Fund 13,00,000

Capital: 20000 shares of tk. 100 each 20,00,000

Interest and discount received cSt 6,50,000

Exchange and commission (credit) 180,000

Profit and Loss Account balance on 1.1.2006 1,90,000

Cash in hand 6,62,050

Money at call and short notice 250,000

Investments (cost) “30,00,000

Interest acerued on investment 47,050

Cash credit and Joans 30,41,000

Bills purchased and discounted 24,00,900

Furniture, fixture and equipment 50,000

Repairs 40,000

Interest paid 140,000

Exchange and commission paid 30,000

Salaries 7,30,000

Directors’ fees and remuneration a 5,000

Stationery and advertisements i 720,000

Miscellaneous expenses 50,000

Land and buildings 3,60,000

Current deposits 35,00,000

Savings bank accounts 24,50,000

Fixed and time deposits 37,67,000

Sundry creditors account 50,000

Other Information:

() Provide for depreciation on building Tk. 10,000. Depreciation up to the last year is Tk. 90,000.

i Provide Tk. 10,000 for doubtful debts.

(ii) Transfer Tk. 50,000 to reserve fund and provide Tk. 10,000 for income tax

(iv) A dividend of 5% was declared for the year 2006 and

(v) The market value of investment is Tk. 49,50,000.

You might also like

- Bank Digest (Bangla)Document130 pagesBank Digest (Bangla)StudioX100% (2)

- Sample Questions: Basic BiologyDocument4 pagesSample Questions: Basic BiologySujon M Jahid HasanNo ratings yet

- 15 Thana EO Dhaka NewDocument2 pages15 Thana EO Dhaka NewSujon M Jahid HasanNo ratings yet

- Finance and AccountingDocument2 pagesFinance and AccountingSujon M Jahid HasanNo ratings yet

- Systems Design: Job-Order Costing: Solutions To QuestionsDocument69 pagesSystems Design: Job-Order Costing: Solutions To QuestionsALizeyNo ratings yet

- The Managerial Process of Excecuting StrategyDocument8 pagesThe Managerial Process of Excecuting StrategySujon M Jahid HasanNo ratings yet

- Hasan Internship Report-2Document94 pagesHasan Internship Report-2Sujon M Jahid HasanNo ratings yet

- Final Internship Report HasanDocument72 pagesFinal Internship Report HasanSujon M Jahid HasanNo ratings yet

- MbaDocument3 pagesMbaSujon M Jahid Hasan0% (1)

- Mba PDFDocument53 pagesMba PDFSujon M Jahid HasanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)