Professional Documents

Culture Documents

ATP Digest - Gatchalian Vs CIR

Uploaded by

Lawrence RiodequeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ATP Digest - Gatchalian Vs CIR

Uploaded by

Lawrence RiodequeCopyright:

Available Formats

JOSE GATCHALIAN ET AL. vs.

THE COLLECTOR OF INTERNAL REVENUE There is no doubt that if the plaintiffs merely formed a community of property the

Imperial J. latter is exempt from the payment of income tax under the law. But according to the

stipulated facts the plaintiffs organized a partnership of a civil nature because each of

DOCTRINE: Having organized and constituted a partnership of a civil nature, the said them put up money to buy asweepstakes ticket for the sole purpose of dividing equally

entity is the one bound to pay the income tax which the defendant collected under the prize which they may win, as they did in fact in the amount of P50,000 (article

the aforesaid section 10 (a) of Act No. 2833, as amended by section 2 of Act No. 3761. 1665, Civil Code). The partnership was not only formed, but upon the organization

thereof and the winning of the prize, Jose Gatchalian personally appeared in the office

FACTS: of the Philippine Charity Sweepstakes, in his capacity as copartner, as such collected

Pplaintiffs, in order to enable them to purchase one sweepstakes ticket, they all the prize, the office issued the check for P50,000 in favor of Jose Gatchalian and

contributed to complete P2.00. Ticket was registered in the name of Gatchalian and company, and the said partner, in the same capacity, collected the said check. All these

Company. circumstances repel the idea that the plaintiffs organized and formed a community of

property only.

Their ticket won the 3rd prize of P50,000.00 paid via check and subsequently encashed

by petitioners. Having organized and constituted a partnership of a civil nature, the 'said entity is the

one bound to pay the income tax which the defendant collected under the aforesaid

Jose Gatchalian was required by income tax examiner Alfredo David to file the section 10 (a) of Act No. 2833, as amended by section 2 of Act No. 3761. There is no

corresponding income tax return covering the prize won by Jose Gatchalian & merit in plaintiffs' contention that the tax should be prorated among them and paid

Company. individually, resulting in their exemption from the tax.

The defendant made an assessment against Jose Gatchalian & Company requesting

the payment of the sum of P1,499.94 to the deputy provincial treasurer.

The plaintiffs, through their attorney, sent to defendant a reply, a copy of which

marked Exhibit C is attached and made a part hereof, requesting- exemption from the

payment of the income tax to which reply there were enclosed fifteen (15) separate

individual income tax returns filed separately by each one of the plaintiffs.

Petitioners failed to pay the tax demanded so the defendant issued a warrant of

distraint and levy against the properties of plaintiff. They were forced to pay but not

the full amount and requested not to pay the balance anymore. Defendant agreed

with the condition petitioner must file usual bond.

Later, the warrant was executed. So petitioners were forced to pay the remaining

balance. They demanded now the full refund of the payment they made.

ISSUE: Whether the petitioners formed a partneship which should be subjected to

partnership tax.

HELD:

Yes. There was a partnership in this case.

You might also like

- Partnership DigestDocument9 pagesPartnership DigestNelia Mae S. VillenaNo ratings yet

- Sps. Mercado v. Landbank (Digest)Document2 pagesSps. Mercado v. Landbank (Digest)rocelimNo ratings yet

- Uy v. Court of Appeals, 314 SCRA 69, 78. G.R. No. 120465. September 9, 1999Document2 pagesUy v. Court of Appeals, 314 SCRA 69, 78. G.R. No. 120465. September 9, 1999Mark Alvin DelizoNo ratings yet

- 479 PP V Sandiganbayan (Failure of Accountable Officer To Render Account)Document1 page479 PP V Sandiganbayan (Failure of Accountable Officer To Render Account)Myrna B RoqueNo ratings yet

- Frivaldo Citizenship Ruling Disqualifies Him as GovernorDocument3 pagesFrivaldo Citizenship Ruling Disqualifies Him as GovernorPaulo Miguel GernaleNo ratings yet

- Philo - So vs. CADocument4 pagesPhilo - So vs. CAMia Dee-AbdNo ratings yet

- Global Transformations - David HeldDocument3 pagesGlobal Transformations - David HeldAngelaCălmucNo ratings yet

- Legrama V Sandiganbayan GR 178626 CrimDocument3 pagesLegrama V Sandiganbayan GR 178626 CrimKayee KatNo ratings yet

- People vs. Nazareno GR 196434 October 24, 2017 Case DigestDocument2 pagesPeople vs. Nazareno GR 196434 October 24, 2017 Case Digestbeingme2No ratings yet

- Leung Ben v. O'BrienDocument2 pagesLeung Ben v. O'BrienWendell MirabelNo ratings yet

- Expertravel and Tours V CADocument3 pagesExpertravel and Tours V CAmxviNo ratings yet

- Case Digest Miriam Santiago v. SandiganbayanDocument4 pagesCase Digest Miriam Santiago v. SandiganbayanAvel ObligadoNo ratings yet

- Murder conviction upheld for stabbing attackDocument6 pagesMurder conviction upheld for stabbing attackClarence ProtacioNo ratings yet

- People Vs de Guzman GR No 77368Document1 pagePeople Vs de Guzman GR No 77368Norway AlaroNo ratings yet

- 4 C C - Daging-v-DavisDocument2 pages4 C C - Daging-v-DavisesfsfsNo ratings yet

- Kidnapping Case Against Clinic OwnersDocument6 pagesKidnapping Case Against Clinic OwnersNash LedesmaNo ratings yet

- Crim AggravatingDocument10 pagesCrim AggravatingArlan De LeonNo ratings yet

- Bank Robbery Accomplices ConvictedDocument3 pagesBank Robbery Accomplices ConvictedGia DimayugaNo ratings yet

- Batch 2 Crim DigestsDocument9 pagesBatch 2 Crim DigestsSHIMRI JANE TENORIONo ratings yet

- Sistoza v. DesiertoDocument8 pagesSistoza v. DesiertodoookaNo ratings yet

- Ladjaalam and Celino - PD 1866 CasesDocument3 pagesLadjaalam and Celino - PD 1866 CasesDanilo LauritoNo ratings yet

- Alonzo Vs IacDocument1 pageAlonzo Vs Iacjimart10No ratings yet

- Hermojina Estores Vs Spouses Arturo and Laura Supangan GR 175139Document17 pagesHermojina Estores Vs Spouses Arturo and Laura Supangan GR 175139chingdelrosarioNo ratings yet

- Torben Overgaard Vs Godwin Valdez PDFDocument2 pagesTorben Overgaard Vs Godwin Valdez PDFqwertyNo ratings yet

- 1 - Sagrada Orden de Predicadores Del Santismo Rosario de Filipinas v. Natl Coconut CorpDocument2 pages1 - Sagrada Orden de Predicadores Del Santismo Rosario de Filipinas v. Natl Coconut CorpRashell AndasanNo ratings yet

- Case Digest Ethics 6Document1 pageCase Digest Ethics 6Salvador III V. SantosNo ratings yet

- Business Mathematics - Module 17 - Presentation and Analysis of Business DataDocument16 pagesBusiness Mathematics - Module 17 - Presentation and Analysis of Business Dataluxtineury2310No ratings yet

- Second Division: Willy G. Sia, Appellee, vs. People of The Philippines, AppellantDocument12 pagesSecond Division: Willy G. Sia, Appellee, vs. People of The Philippines, AppellantLianne Rose ParajenoNo ratings yet

- 85 Filipino Pipe v. NAWASADocument1 page85 Filipino Pipe v. NAWASAFrancesca Isabel MontenegroNo ratings yet

- Petroleum Shipping Limited v. NLRC (2006)Document5 pagesPetroleum Shipping Limited v. NLRC (2006)Zan BillonesNo ratings yet

- 40 Molino v. Security Diners International, 363 SCRA 358 (2001)Document6 pages40 Molino v. Security Diners International, 363 SCRA 358 (2001)Aicing Namingit-VelascoNo ratings yet

- 1 - Eurotech Industrial TechnologiesDocument4 pages1 - Eurotech Industrial TechnologiesGraceNo ratings yet

- Cabigas Reynes v. People, 152 SCRA 18Document5 pagesCabigas Reynes v. People, 152 SCRA 18PRINCESS MAGPATOCNo ratings yet

- Ascencion DigestDocument25 pagesAscencion Digestjohn vidadNo ratings yet

- Taer v. CA 186 Scra 598Document4 pagesTaer v. CA 186 Scra 598Peter RojasNo ratings yet

- ObliCon Case Digest 7Document15 pagesObliCon Case Digest 7Charlene Mae Delos SantosNo ratings yet

- REPUBLIC OF THE PHILIPPINES Vs EvangelistaDocument2 pagesREPUBLIC OF THE PHILIPPINES Vs Evangelistafermo ii ramosNo ratings yet

- Si Boco V YapDocument1 pageSi Boco V YapNic NalpenNo ratings yet

- #30 Mactan Workers Union v. Aboitiz, 45 SCRA 577Document3 pages#30 Mactan Workers Union v. Aboitiz, 45 SCRA 577ROCELLE TANGINo ratings yet

- AZNAR DigestDocument3 pagesAZNAR DigestkarlonovNo ratings yet

- People Vs PagalanasDocument2 pagesPeople Vs PagalanasLyka Bucalen DalanaoNo ratings yet

- G.R. No. 70481 December 11, 1992Document5 pagesG.R. No. 70481 December 11, 1992Rache BaodNo ratings yet

- Spouses Aldaba Vs Leonora RimandoDocument5 pagesSpouses Aldaba Vs Leonora RimandoRuel FernandezNo ratings yet

- Land Sale DisputesDocument5 pagesLand Sale DisputesMartinNo ratings yet

- MARPHILDocument13 pagesMARPHILGem SilvaNo ratings yet

- Santos vs Reyes: Partnership profits accounting requiredDocument2 pagesSantos vs Reyes: Partnership profits accounting requiredyaneedeeNo ratings yet

- 57 Urbano v. IACDocument1 page57 Urbano v. IACNN DDLNo ratings yet

- People V AlfecheDocument4 pagesPeople V Alfechemark kenneth cataquizNo ratings yet

- NAGA TELCO V CADocument2 pagesNAGA TELCO V CADan Marco GriarteNo ratings yet

- Philippine National Bank Vs CADocument6 pagesPhilippine National Bank Vs CAHamitaf LatipNo ratings yet

- Bentir and Sps. Pormida v. Hon. Mateo LeandaDocument1 pageBentir and Sps. Pormida v. Hon. Mateo LeandaMac SorianoNo ratings yet

- 19 Casino JR V CaDocument11 pages19 Casino JR V CaPeachChioNo ratings yet

- Mutuality of ContractsDocument19 pagesMutuality of ContractsChris InocencioNo ratings yet

- Legal Research PEOPLE Vs ERNESTO FRAGANTE Y AYUDA GR No. 182521 CASE DIGEST 2011Document25 pagesLegal Research PEOPLE Vs ERNESTO FRAGANTE Y AYUDA GR No. 182521 CASE DIGEST 2011Brenda de la Gente100% (1)

- Jose V Herrera Vs L P Leviste Co Inc PDFDocument9 pagesJose V Herrera Vs L P Leviste Co Inc PDFElla ThoNo ratings yet

- Gatchalian vs. CIRDocument1 pageGatchalian vs. CIRSusie SotoNo ratings yet

- 04 Gatchalian v. CIRDocument2 pages04 Gatchalian v. CIRNichole LanuzaNo ratings yet

- Gatchalian v. Collector: Partnership Tax Liability UpheldDocument1 pageGatchalian v. Collector: Partnership Tax Liability Uphelddivina gracia hinloNo ratings yet

- Gatchalian Vs CirDocument2 pagesGatchalian Vs Cirmitsudayo_100% (2)

- GATCHALIAN v. COLLECTOR OF INTERNAL REVENUEDocument1 pageGATCHALIAN v. COLLECTOR OF INTERNAL REVENUEAna AdolfoNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyLawrence RiodequeNo ratings yet

- Law Student Practice Rule Amendments AdoptedDocument17 pagesLaw Student Practice Rule Amendments AdoptedGJ LaderaNo ratings yet

- FPIC Exempt from Batangas Business TaxDocument10 pagesFPIC Exempt from Batangas Business TaxLawrence RiodequeNo ratings yet

- British Airways, Inc. Vs CADocument8 pagesBritish Airways, Inc. Vs CALawrence RiodequeNo ratings yet

- RIODEQUE Lawrence PDFDocument9 pagesRIODEQUE Lawrence PDFLawrence RiodequeNo ratings yet

- Riodeque - Extrajudicial Settlement of EstateDocument3 pagesRiodeque - Extrajudicial Settlement of EstateLawrence RiodequeNo ratings yet

- ATP Digest - Penalber Vs RamosDocument2 pagesATP Digest - Penalber Vs RamosLawrence Riodeque100% (3)

- Naguiat vs Court of Appeals agency disputeDocument1 pageNaguiat vs Court of Appeals agency disputeLawrence RiodequeNo ratings yet

- Riodeque - Board ResolutionDocument2 pagesRiodeque - Board ResolutionLawrence RiodequeNo ratings yet

- Affidavit of Loss - Riodeque, Lawrence CuiDocument1 pageAffidavit of Loss - Riodeque, Lawrence CuiLawrence RiodequeNo ratings yet

- ATP Digest - Acenas Vs SisonDocument1 pageATP Digest - Acenas Vs SisonLawrence RiodequeNo ratings yet

- RIODEQUE - Contract To SellDocument3 pagesRIODEQUE - Contract To SellLawrence RiodequeNo ratings yet

- 4 Prudential Bank Vs AlviarDocument11 pages4 Prudential Bank Vs AlviarLawrence RiodequeNo ratings yet

- Star Two (SPV-AMC), Inc. vs. Paper City Corporation of The PhilippinesDocument13 pagesStar Two (SPV-AMC), Inc. vs. Paper City Corporation of The PhilippinesLawrence RiodequeNo ratings yet

- 4 Prudential Bank Vs AlviarDocument11 pages4 Prudential Bank Vs AlviarLawrence RiodequeNo ratings yet

- CHARLES L. ONG, Petitioner, vs. REPUBLIC OF THE PHILIPPINES, RespondentDocument6 pagesCHARLES L. ONG, Petitioner, vs. REPUBLIC OF THE PHILIPPINES, RespondentLawrence RiodequeNo ratings yet

- Carlos vs Republic Judicial Confirmation RequirementsDocument6 pagesCarlos vs Republic Judicial Confirmation RequirementsLawrence RiodequeNo ratings yet

- 2 Paradigm Development Corp Vs BPIDocument22 pages2 Paradigm Development Corp Vs BPILawrence RiodequeNo ratings yet

- 8 Villarico V SarmientoDocument5 pages8 Villarico V SarmientoLawrence RiodequeNo ratings yet

- 7 Bogo-Medellin Milling Co. V CADocument11 pages7 Bogo-Medellin Milling Co. V CALawrence RiodequeNo ratings yet

- Asset Privatization Trust Breach of Contract CaseDocument7 pagesAsset Privatization Trust Breach of Contract CaseLawrence RiodequeNo ratings yet

- Republic vs. Imperial Credit CorporationDocument10 pagesRepublic vs. Imperial Credit CorporationLawrence RiodequeNo ratings yet

- 3 Heirs of Cabal V Cabal PDFDocument12 pages3 Heirs of Cabal V Cabal PDFLawrence RiodequeNo ratings yet

- Income Tax in Myanmar LawDocument2 pagesIncome Tax in Myanmar LawICT MyanmarNo ratings yet

- Philam Asset Management, Inc V CirDocument2 pagesPhilam Asset Management, Inc V CirNeph MendozaNo ratings yet

- GHJDocument6 pagesGHJJilyan SiobalNo ratings yet

- Gross Taxable Income Tax DueDocument19 pagesGross Taxable Income Tax DueEdcelyn SamaniegoNo ratings yet

- CORPORATE TAX CALCULATORDocument11 pagesCORPORATE TAX CALCULATORmohanraokp2279No ratings yet

- 9 Cir vs. Baier-Nickel DGSTDocument2 pages9 Cir vs. Baier-Nickel DGSTMiguelNo ratings yet

- Air Canada v. CIR - Taxation Law - DebtDocument3 pagesAir Canada v. CIR - Taxation Law - DebtMichael VillalonNo ratings yet

- DIFFICULTDocument3 pagesDIFFICULTClyde RamosNo ratings yet

- Direct Tax CodeDocument22 pagesDirect Tax Codespchheda4996No ratings yet

- Passive Income ActivityDocument2 pagesPassive Income ActivityMarielle Dela Torre LubatNo ratings yet

- AY2022-23 REACHMEE PRIVATE LIMITED-AALCR1757K-ComputationDocument3 pagesAY2022-23 REACHMEE PRIVATE LIMITED-AALCR1757K-ComputationGST BACANo ratings yet

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Vincent AmomonponNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDuttaNo ratings yet

- First Summative Test-Tle He6Document6 pagesFirst Summative Test-Tle He6Jassim Magallanes100% (1)

- Section 194C: TDS On ContractDocument5 pagesSection 194C: TDS On ContractwaghuleNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Detailed Analysis of Section 115BAA & Section 115BABDocument3 pagesDetailed Analysis of Section 115BAA & Section 115BABdamanoberoiNo ratings yet

- Set Off and Carry Forward Losses ExplainedDocument3 pagesSet Off and Carry Forward Losses ExplainedBilal AwanNo ratings yet

- Notice of Assessment 2021 04 01 17 31 56 853329Document4 pagesNotice of Assessment 2021 04 01 17 31 56 85332969j8mpp2scNo ratings yet

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineDocument2 pagesFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoNo ratings yet

- Tax Accounting Acc 3400 Chapter ExamsDocument188 pagesTax Accounting Acc 3400 Chapter Examshmgheidi100% (2)

- IND 14 CHP 04 2A Textbook Problems 2012 SolutionsDocument20 pagesIND 14 CHP 04 2A Textbook Problems 2012 SolutionsrakutenmeeshoNo ratings yet

- Foreign Tax CreditDocument2 pagesForeign Tax CreditSophiaFrancescaEspinosaNo ratings yet

- Shraddha Tax ProjectDocument19 pagesShraddha Tax ProjectDeepak Maheshwari67% (3)

- CIR v. Consuelo Vda. De Prieto (ViDocument2 pagesCIR v. Consuelo Vda. De Prieto (VivictoriaNo ratings yet

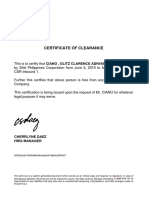

- Certificate of Clearance for Ciano Glitz Clarence AdiwangDocument2 pagesCertificate of Clearance for Ciano Glitz Clarence Adiwangkorean languageNo ratings yet

- Inbound 2168611759498459938Document2 pagesInbound 2168611759498459938MarielleNo ratings yet

- Fiscal Federalism and Decentralization. A Review of Some Efficiency and - TanziDocument22 pagesFiscal Federalism and Decentralization. A Review of Some Efficiency and - TanziGustavo RodríguezNo ratings yet

- 08 Actvity 1Document3 pages08 Actvity 1Angelo MorenoNo ratings yet