Professional Documents

Culture Documents

Adjusted Income Rohani

Uploaded by

Irfan izhamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusted Income Rohani

Uploaded by

Irfan izhamCopyright:

Available Formats

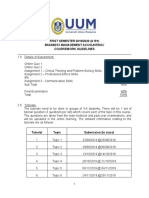

B.4.

Adjusted Income

B.4. Page 1 of 7

Rohani Binti Hashim

Year Assessment : 2018 File No : 123

Reference No : OG 11222475081 IC : 801230-01-5124

Business Source :Rohani Restaurant Reg No : 23789-B

Name of Business Entity :12345-1 56101 Restoran dan restoran yang juga kelab malam

+ -

A. Balance in Profit and Loss Account 43,000 0

Less: Segregation of Income Based on Classes of Income

Dividend Income 0

Rental Income 0

Royalty Income 0

Interest Income 0

Others 0

B. Total Non - Business Income 0

B.1 Less: Other Business Source Income 0

B.2 Less: Other Business Income 0

C. Total Business Income 43,000 0

D. Adjustment for Business Income

Add :

1. Non-allowable loss 0

Others 0

2. Surplus Recovered Mining Expenditure 0

3. Taxable Income gain not taken up in P/L 0

4. Total 0

Less :

5. Non-taxable income/gain taken up in Profit and Loss Account 0

Others 0

6. Total 0 0

E. Business Income 43,000 0

F. Adjustment for Business Expenditure

Add :

1. Non-allowable Expenditure and Charges 29,800

(Refer to Attached Schedule)

Description Source Ded ? Amount

Depreciation 12345-1 No 26,800

Donation 12345-1 No 3,000

B.4. Adjusted Income

B.4. Page 2 of 7

Rohani Binti Hashim

Year Assessment : 2018 File No : 123

Reference No : OG 11222475081 IC : 801230-01-5124

Business Source :Rohani Restaurant Reg No : 23789-B

Name of Business Entity :12345-1 56101 Restoran dan restoran yang juga kelab malam

1.1 Other Adjustment 0

Less :

2. Mining Allowance 0

3. Surplus Mining Expenses 0

4. Further Deductions 0

5. Total 0

6. Total Adjustment of Expenditure 29,800 0

G. ADJUSTED INCOME 72,800

or

H. ADJUSTED LOSS 0

B.4. Adjusted Income

B.4. Page 3 of 7

Rohani Binti Hashim

Year Assessment : 2018 File No : 123

Reference No : OG 11222475081 IC : 801230-01-5124

Business Source :Rohani Restaurant Reg No : 23789-B

Name of Business Entity :12345-1 56101 Restoran dan restoran yang juga kelab malam

Attached Schedule

F.1. Non-allowable Expenditure and Charges

Description / Note Deductable

Depreciation

Source 12345-1

1) depreciation No 26,800

26,800

Total of Depreciation 26,800

Donation

Source 12345-1

1) donation to school No 3,000

3,000

Total of Donation 3,000

Total of Non-allowable Expenditure and Charges Account 29,800

B.4. Adjusted Income

B.4. Page 4 of 7

Brahim Bin Jusoh

Year Assessment : 2018 File No : 85475618

Reference No : OG 11222476070 IC : 640211-01-5113

Business Source :Restoran Brahim Reg No :

Name of Business Entity :123-2 56101 Restoran dan restoran yang juga kelab malam

+ -

A. Balance in Profit and Loss Account 67,840 0

Less: Segregation of Income Based on Classes of Income

Dividend Income 0

Rental Income 0

Royalty Income 0

Interest Income 0

Others 0

B. Total Non - Business Income 0

B.1 Less: Other Business Source Income 0

B.2 Less: Other Business Income 0

C. Total Business Income 67,840 0

D. Adjustment for Business Income

Add :

1. Non-allowable loss 64,040

(Refer to Attached Schedule)

Description Amount

Loss on Disposal of Fixed Assets 64,040

Others 0

2. Surplus Recovered Mining Expenditure 0

3. Taxable Income gain not taken up in P/L 0

4. Total 64,040

Less :

5. Non-taxable income/gain taken up in Profit and Loss Account 0

Others 0

6. Total 64,040 0

E. Business Income 131,880 0

F. Adjustment for Business Expenditure

Add :

1. Non-allowable Expenditure and Charges 132,700

B.4. Adjusted Income

B.4. Page 5 of 7

Brahim Bin Jusoh

Year Assessment : 2018 File No : 85475618

Reference No : OG 11222476070 IC : 640211-01-5113

Business Source :Restoran Brahim Reg No :

Name of Business Entity :123-2 56101 Restoran dan restoran yang juga kelab malam

(Refer to Attached Schedule)

Description Source Ded ? Amount

Production Cost - Depreciation 123-2 No 7,000

Production Cost - Other Non Allowable Expenses 123-2 No 7,000

Input tax not claimable from JKDM 123-2 No 7,200

Depreciation 123-2 No 110,520

Donation 123-2 No 480

Subscription (not related to Business) 123-2 No 500

1.1 Other Adjustment 0

Less :

2. Mining Allowance 0

3. Surplus Mining Expenses 0

4. Further Deductions 0

5. Total 0

6. Total Adjustment of Expenditure 132,700 0

G. ADJUSTED INCOME 264,580

or

H. ADJUSTED LOSS 0

B.4. Adjusted Income

B.4. Page 6 of 7

Brahim Bin Jusoh

Year Assessment : 2018 File No : 85475618

Reference No : OG 11222476070 IC : 640211-01-5113

Business Source :Restoran Brahim Reg No :

Name of Business Entity :123-2 56101 Restoran dan restoran yang juga kelab malam

Attached Schedule

D.1. Non Allowable Loss

Description / Note Deductable

Loss on Disposal of Fixed Assets

Source 123-2

1) loss on disposal of fixed asset No 64,040

64,040

Subtotal of Loss on Disposal of Fixed Assets 64,040

Total of Non Allowable Loss 64,040

F.1. Non-allowable Expenditure and Charges

Description / Note Deductable

Production Cost - Depreciation

Source 123-2

1) depreciation No 7,000

7,000

Total of Production Cost - Depreciation 7,000

Production Cost - Other Non Allowable Expenses

Source 123-2

1) qq No 7,000

7,000

Total of Production Cost - Other Non Allowable Expenses 7,000

Input tax not claimable from JKDM

Source 123-2

1) rax instalment No 7,200

7,200

Total of Input tax not claimable from JKDM 7,200

B.4. Adjusted Income

B.4. Page 7 of 7

Brahim Bin Jusoh

Year Assessment : 2018 File No : 85475618

Reference No : OG 11222476070 IC : 640211-01-5113

Business Source :Restoran Brahim Reg No :

Name of Business Entity :123-2 56101 Restoran dan restoran yang juga kelab malam

Depreciation

Source 123-2

1) depreciation No 110,520

110,520

Total of Depreciation 110,520

Donation

Source 123-2

1) donation No 480

480

Total of Donation 480

Subscription (not related to Business)

Source 123-2

1) subsription No 500

500

Total of Subscription (not related to Business) 500

Total of Non-allowable Expenditure and Charges Account 132,700

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 4Document1 page4Irfan izhamNo ratings yet

- 1Document1 page1Irfan izhamNo ratings yet

- 5Document1 page5Irfan izhamNo ratings yet

- 2Document1 page2Irfan izhamNo ratings yet

- 3Document1 page3Irfan izhamNo ratings yet

- Service Learning: A Small Business Project: Bkam3023 Management Accounting Ii A192 Second Semester February 2019/2020Document4 pagesService Learning: A Small Business Project: Bkam3023 Management Accounting Ii A192 Second Semester February 2019/2020Irfan izhamNo ratings yet

- Test 1: Chapter 1-3 QuestionsDocument38 pagesTest 1: Chapter 1-3 QuestionsIrfan izhamNo ratings yet

- FIRST SEMESTER 2019/2020 (A191) Bkam2013 Management Accounting I Coursework GuidelinesDocument4 pagesFIRST SEMESTER 2019/2020 (A191) Bkam2013 Management Accounting I Coursework GuidelinesIrfan izhamNo ratings yet

- Eco CHPT 2Document96 pagesEco CHPT 2Irfan izhamNo ratings yet

- A Confidential Financial and Retirem Ent Planning Fact Finder ForDocument17 pagesA Confidential Financial and Retirem Ent Planning Fact Finder ForIrfan izhamNo ratings yet

- Overseas Development Institute : 10-11 Percy Street London W1POJBDocument4 pagesOverseas Development Institute : 10-11 Percy Street London W1POJBIrfan izhamNo ratings yet

- Programmazione e Controllo Esercizi Capi PDFDocument43 pagesProgrammazione e Controllo Esercizi Capi PDFHeap Ke XinNo ratings yet

- Balance Shit!!Document3 pagesBalance Shit!!Irfan izhamNo ratings yet

- Reportonlaunchingofnewproduct 121018112409 Phpapp01Document38 pagesReportonlaunchingofnewproduct 121018112409 Phpapp01Atiq ur RahmanNo ratings yet

- Vault LogDocument1 pageVault LogIrfan izhamNo ratings yet

- Wcms 190112 PDFDocument305 pagesWcms 190112 PDFTeboho QholoshaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Transcript For ValuationDocument2 pagesTranscript For ValuationRichik DadhichNo ratings yet

- Boakye Yiadom 2012Document107 pagesBoakye Yiadom 2012chicky_chikNo ratings yet

- Statement 05-APR-23 AC 20312789 07043628 PDFDocument4 pagesStatement 05-APR-23 AC 20312789 07043628 PDFBakhter Jabarkhil0% (1)

- Estimating Earnings and Cash FlowDocument38 pagesEstimating Earnings and Cash FlowashuuuNo ratings yet

- D31PS-Unit 6 - Tutorial - VisionDocument1 pageD31PS-Unit 6 - Tutorial - VisionAmir_Jamal_QureshiNo ratings yet

- Al Azim Transport PVT LTDDocument10 pagesAl Azim Transport PVT LTDAl Azim TransportNo ratings yet

- Air Traffic Controller Staffing ReportDocument22 pagesAir Traffic Controller Staffing ReportBill RuminskiNo ratings yet

- Investment and Competition Law NotesDocument25 pagesInvestment and Competition Law NotesRishabh Malhotra100% (1)

- International Business The Challenges of Globalization Canadian 1st Edition Wild Test BankDocument32 pagesInternational Business The Challenges of Globalization Canadian 1st Edition Wild Test BankLucasDavisxjpqs100% (17)

- AASB 3 Is Relevant When Accounting For A Business Combination ThatDocument6 pagesAASB 3 Is Relevant When Accounting For A Business Combination ThatBiruk GultaNo ratings yet

- Power and Water - Final BrochureDocument7 pagesPower and Water - Final BrochureEngr Muhammad HussainNo ratings yet

- Week 4 ALK Kelompok CDocument82 pagesWeek 4 ALK Kelompok COldiano TitoNo ratings yet

- RBI Guidelines Mapping With COBIT 5 Res Eng 1013Document194 pagesRBI Guidelines Mapping With COBIT 5 Res Eng 1013KenChenNo ratings yet

- Nestle's Case StudyDocument7 pagesNestle's Case StudyRaj Kiran100% (1)

- Procurement Management Processes: Lecture #3 16 February, 2014Document20 pagesProcurement Management Processes: Lecture #3 16 February, 2014TauseefKhanNo ratings yet

- Payroll Accounting & Other Selected TransactionDocument29 pagesPayroll Accounting & Other Selected TransactionParamorfsNo ratings yet

- Leadership Managing Change Globalization Innovation Cost Reduction New Economy and KnowledgeDocument8 pagesLeadership Managing Change Globalization Innovation Cost Reduction New Economy and KnowledgeAllison Nadine MarchandNo ratings yet

- Record Retention GuidelinesDocument7 pagesRecord Retention GuidelinesricciporchcoNo ratings yet

- Proposal For InternDocument4 pagesProposal For InternshuvofinduNo ratings yet

- Assignment 4Document30 pagesAssignment 4azimlitamellaNo ratings yet

- BSPDocument2 pagesBSPapi-236234542No ratings yet

- Marketing Research NotesDocument8 pagesMarketing Research NotesEmily100% (1)

- Module 2 Work Study Approach LatestDocument33 pagesModule 2 Work Study Approach LatestSangam KadoleNo ratings yet

- 15 Quick Reference GuideDocument2 pages15 Quick Reference Guidecontactscorpion4427No ratings yet

- ASR Quizzer 6 - Planning and Risk AssessmenttDocument18 pagesASR Quizzer 6 - Planning and Risk AssessmenttInsatiable LifeNo ratings yet

- Internship Report On Merchandising Activities ofDocument56 pagesInternship Report On Merchandising Activities ofNoshaba MaqsoodNo ratings yet

- 02-18-005 BIM Revit Modeling RFP FinalDocument12 pages02-18-005 BIM Revit Modeling RFP FinalSantosh NathanNo ratings yet

- Eskom 2019 Integrated Report PDFDocument95 pagesEskom 2019 Integrated Report PDFNatalie WaThaboNo ratings yet

- Assignment 3 ICSDocument8 pagesAssignment 3 ICSauni fildzahNo ratings yet

- The Site of Paid Watching Ads Gtmoney - Icuhome 2Document1 pageThe Site of Paid Watching Ads Gtmoney - Icuhome 2Hammed AkintundeNo ratings yet