Professional Documents

Culture Documents

9 - Sam Savage - San Jose Mercury News - Flaw of Averages PDF

Uploaded by

prismsmiles0 ratings0% found this document useful (0 votes)

14 views1 pageOriginal Title

9 - Sam Savage - San Jose Mercury News - Flaw of averages.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 page9 - Sam Savage - San Jose Mercury News - Flaw of Averages PDF

Uploaded by

prismsmilesCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

PUBLISHED SUNDAY, OCTOBER 8, 2000, IN THE SAN JOSE MERCURY NEWS ©2000 DR.

SAM SAVAGE

The Flaw of Averages

IF YOU COUNT ON THE STOCK MARKET'S AVERAGE RETURN

TO SUPPORT YOU IN RETIREMENT, YOU COULD WIND UP PENNILESS

The Flaw of Averages distorts

By Sam Savage everyday decisions in many other

“The only certainty is that nothing is certain.” Wrong! Given typical areas. Consider the hypothetical

So said the Roman scholar Pliny the Elder. And levels of stock market case of a Silicon Valley product

some 2000 years later, it’s a safe bet he would still volatility there are only

be right. The Information Age, despite its promise, slim odds that the fund

manager who has just been asked

also delivers a dizzying array of technological, will survive the full time. by his boss to forecast demand for

economic and political uncertainties. This often re- The following charts a new-generation microchip.

sults in an error I call the Flaw of Averages, a fallacy simulate this retirement

as fundamental as the belief that the earth is flat. strategy with actual S&P

The Flaw of Averages states that: Plans based on the 500 returns starting in

assumption that average conditions will occur are usu- various years. thousands of scenarios covering all conceivable real world

ally wrong. Notice that the level of contingencies in proportion to their likelihood.

A humorous example involves the statistician who average returns over any par- In the 1950s, Harry Markowitz, a brash young gradu-

drowned while fording a river that was, on average, only ticular 20-year period is no ate student at the University of Chicago, dealt another blow

three feet deep. guarantee of success. The real to the flaw. “I was reading the contemporary investment

But in real life, the flaw continually gums up invest- key is to get off to a good start, theory, which was strictly based on averages,” recalls

ment management, production planning and other seem- which is what separates 1974 from Markowitz. “I said to myself: ‘this can't be right.’” His

ingly well-laid plans. The Flaw of Averages is one of the its neighbors. resulting portfolio theory, which was based on both risk

cornerstones of Murphy’s Law (What can go wrong does For this example the Flaw of Averages states that: If you and average outcomes, revolutionized Wall Street and won

go wrong). assume each year’s growth at least equals the average of him a Nobel Prize. Markowitz also devoted much of his

Fortunately, superfast computers can overcome this 14 percent, there is no chance of running out of money. career to designing simulation systems.

problem by bombarding our plans with a whole range But if the growth fluctuates each year but averages 14 Simulation-based acquisition is now used routinely in

of inputs instead of single average values. Today, this percent, you are likely to run out of money. the military. Its instigator was William J. Perry, who in spite

technique, known as simulation, is at the center of such The results above are not the result of a rigorous of a bachelor's degree, master's degree and doctorate in

diverse activities as Wall Street investing and military scientific study, and should not be used for making math, has had a remarkably well-rounded career as a

defense planning. investment decisions, but they should at least have you Silicon Valley entrepreneur, U.S. Secretary of Defense and

But back to the flaw, and an area that’s important to all asking yourself: Why isn’t someone doing something about Stanford professor.

of us: investing for the future. this? People are. One of the first was William F. Sharpe, a In 1996, while at the Pentagon, Perry issued a direc-

Suppose you want your $200,000 retirement fund Nobel laureate in Economics, who recently left Stanford tive stating that models and simulations must be used to

invested in the Standard & Poor’s 500 index to last 20 to spend full time simulating retirement benefits. “I ex- reduce the time, resources and risks of the acquisition

years. How much can you withdraw per year? The return pected people to question the specifics of our simulation process. Perry says in retrospect: “With tens of thousands

of the S&P has varied over the years but has averaged about algorithms,” reflects Sharpe about the launch of Palo of uncertainties, it was just a perfect application for

14 percent per year since its inception in 1952. You use Alto-based Financial Engines Inc., “but to my surprise, simulation.”

an annuity workbook in your spreadsheet that requires everyone else out there was just plugging in averages.” A dramatic example of the savings that resulted from

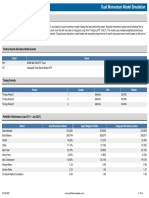

an initial amount ($200,000) (As in Figure A) Perry’s directive is related by John D. Illgen of Santa

and a growth rate for the The Flaw of Averages distorts everyday decisions in many Barbara-based Illgen Simulation Technologies Inc., who

fund. “I need a number,” you other areas. Consider the hypothetical case of a Silicon says: “In response to improvements in foreign weapon

say to yourself, so you plug Valley product manager who has just been asked by his systems, the Navy was preparing to spend tens of millions

in 14 percent. Now you can boss to forecast demand for a new-generation microchip. of dollars to upgrade its shipboard defensive systems. With

play with the annual with- “That's difficult for a new product,” responds the a $250,000 simulation we were able to show that the

drawal amount until your product manager, “but I’m confident annual demand will present defensive system was adequate to meet the

Figure A. Funds remaining with

money lasts exactly 20 years. be between 50,000 and 150,000 units.” increased threat.”

annual withdrawal of $32,000 ,

assuming 14% return every year. If you do this you will be “Give me a number to take to my production people,” While many of today’s managers still cling tenaciously

pleased to find that you can barks the boss. “I can't tell them to build a facility with a to “flat earth” ideals, the innovators are abandoning aver-

withdraw $32,000 per year. (see Figure A). capacity of between 50,000 and 150,000 units!” ages and facing up to uncertainty. Those who dare

Even if the return fluctuates in the future, as long as it So the product manager dutifully replies: “If you need discover a New World of managerial tools including simu-

averages 14 percent per year, the fund should last 20 years, a single number, the average is 100,000.” lation, decision trees, portfolio theory and real options.

right? The boss plugs the average demand and the cost of a And what happens when one of these innovators is

100k capacity fab into a spreadsheet. The bottom line is a confronted by someone cloaking themselves behind a

Start: 1973 Avg. Return Start: 1974 Avg Return healthy $10 million, which he reports to his board as the single number? The story of the emperor's new clothes

14% Tanks in 8 years. 15.4% Goes the distance. average profit to expect. Assuming that demand is the only says it all.

uncertainty, and that 100,000 is the correct average, then Sam Savage is senior research associate at Stanford

$10 million must be the best guess for profit. Right? Wrong! University, where he directs the Industrial Affiliates

The Flaw of Averages ensures that average profit will be Program for the Management Science & Engineering

less than the profit associated with the average demand. Department. See www.stanford.edu/~savage/flaw for

Why? Lower-than-average demand clearly leads to profit animations and downloadable simulations of the

of less than $10 million. That's the downside. But greater examples in this article.

demand exceeds the capacity of the plant, leading to a Jeff Danziger is a widely syndicated cartoonist. See

Start: 1975 Avg. Return Start: 1976 Avg. Return maximum of $10 million. There is no upside to balance www.danzigercartoons.com for more of his work.

15.4% Tanks in 13 yrs. 15.3% Tanks in 10 yrs the downside.

This leads to a problem of Dilbertian proportion: The Sam Savage, senior research

product manager’s correct forecast of average demand associate at Stanford University,

says innovators who abandon

leads to an incorrect forecast of average profit, so he gets

averages and face up to

blamed for giving the correct answer. uncertainty are free to discover a

A computerized cure for the Flaw of Averages is Monte New World of managerial tools

Carlo Simulation, first used for modeling uncertainty including simulation, decision

during development of the atomic bomb. It generates trees, portfolio theory and real

Figure B. Simulated Fund performance if started in various years. options.

You might also like

- Crown SP 3500 Stock Picker Lift Truck Operator's Manual PDFDocument22 pagesCrown SP 3500 Stock Picker Lift Truck Operator's Manual PDFVüsal 1No ratings yet

- Dynamic Road Traffic ManagementDocument5 pagesDynamic Road Traffic ManagementBhargava GantiNo ratings yet

- Common Sense On Mutual Funds New Imperatives For TDocument3 pagesCommon Sense On Mutual Funds New Imperatives For Tau nishNo ratings yet

- Adaptive Markets - Andrew LoDocument22 pagesAdaptive Markets - Andrew LoQuickie Sanders100% (4)

- Barclays Shiller White PaperDocument36 pagesBarclays Shiller White PaperRyan LeggioNo ratings yet

- John Maynard Keynes As An Investor Timeless Lessons and PrinciplesDocument5 pagesJohn Maynard Keynes As An Investor Timeless Lessons and PrincipleskwongNo ratings yet

- Commodity Trading Goes Back To The FutureDocument10 pagesCommodity Trading Goes Back To The FutureIshan SaneNo ratings yet

- Espen Gaarder Haug: Space-Time FinanceDocument14 pagesEspen Gaarder Haug: Space-Time Financedeenutz93No ratings yet

- Problems With EconomicsDocument16 pagesProblems With Economicscosmin_k19No ratings yet

- Around The World With Kennedy WilsonDocument48 pagesAround The World With Kennedy WilsonBroyhill Asset ManagementNo ratings yet

- 7th Motilal Oswal Wealth Creation StudyDocument28 pages7th Motilal Oswal Wealth Creation StudyarjbakNo ratings yet

- Accelerating Dual Momentum Is Better Than Classic Dual MomentumDocument26 pagesAccelerating Dual Momentum Is Better Than Classic Dual MomentumAyhanNo ratings yet

- Corey Hoffstein - Two Centuries of Momentum (2018)Document27 pagesCorey Hoffstein - Two Centuries of Momentum (2018)Kenneth AndersonNo ratings yet

- It Pays To Be Contrary (Draft)Document24 pagesIt Pays To Be Contrary (Draft)Cornel Miron100% (1)

- Bridgewater Seeks Competitive Advantage Through Lateral ThinkingDocument2 pagesBridgewater Seeks Competitive Advantage Through Lateral ThinkingOasux100% (1)

- 88 Bloomberg 102019Document76 pages88 Bloomberg 102019Armando Mahatma Rodriguez Rivera100% (1)

- Understanding DrawdownsDocument12 pagesUnderstanding DrawdownsRodolpho Cammarosano de LimaNo ratings yet

- September 2019 American ConsequencesDocument78 pagesSeptember 2019 American Consequencesgalt67No ratings yet

- 15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia FeaturesDocument2 pages15.020 How Does The Earnings Power Valuation Technique (EPV) Work - Stockopedia Featureskuruvillaj2217No ratings yet

- Fat Tails and (Anti) Fragility: Nassim Nicholas TalebDocument33 pagesFat Tails and (Anti) Fragility: Nassim Nicholas TalebDom DeSiciliaNo ratings yet

- Money and EducationDocument4 pagesMoney and EducationtamirisaarNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- Value Investing Program Info Session 2021Document13 pagesValue Investing Program Info Session 2021Keren CherskyNo ratings yet

- Kase Fund LTR To Investors-Q2 14Document4 pagesKase Fund LTR To Investors-Q2 14CanadianValueNo ratings yet

- Paper On Mcap To GDPDocument20 pagesPaper On Mcap To GDPgreyistariNo ratings yet

- Data Mining With RattleDocument161 pagesData Mining With Rattleelz0rr0No ratings yet

- The "Dogs of The Dow" MythDocument16 pagesThe "Dogs of The Dow" Mythompomp13No ratings yet

- Who Is On The Other Side?: Antti IlmanenDocument65 pagesWho Is On The Other Side?: Antti IlmanenaptenodyteNo ratings yet

- Markets Move FirstDocument385 pagesMarkets Move FirstBharat Sahni100% (1)

- DKAM ROE Reporter January 2016 PDFDocument9 pagesDKAM ROE Reporter January 2016 PDFJohn Hadriano Mellon FundNo ratings yet

- Econometrics of Financial MarketsDocument627 pagesEconometrics of Financial MarketsGiacomo BoschetiNo ratings yet

- Day Trading PEG Red To Green SetupsDocument5 pagesDay Trading PEG Red To Green Setupsarenaman0528No ratings yet

- Dollar Cost AveragingDocument2 pagesDollar Cost AveragingLawrence LaneNo ratings yet

- Power-Laws in Economy and Finance: Some Ideas From Physics: Jean-Philippe BouchaudDocument16 pagesPower-Laws in Economy and Finance: Some Ideas From Physics: Jean-Philippe BouchaudJohann Alexandria HughNo ratings yet

- Brian Arthur - Increasing Returns and The New World of BusinessDocument11 pagesBrian Arthur - Increasing Returns and The New World of BusinessLuis Gonzalo Trigo SotoNo ratings yet

- SSRN Id593584Document28 pagesSSRN Id593584Loulou DePanamNo ratings yet

- The Art of Stock PickingDocument13 pagesThe Art of Stock PickingRonald MirandaNo ratings yet

- 2020 in One GraphDocument1 page2020 in One GraphShirley LaiNo ratings yet

- Benjamin Graham S NCAV Approach PDFDocument6 pagesBenjamin Graham S NCAV Approach PDFJames WarrenNo ratings yet

- Speculation: The Art of Speculation Mutual FundsDocument2 pagesSpeculation: The Art of Speculation Mutual Fundssan291076No ratings yet

- Securities in An Insecure World - Benjamin GrahamDocument14 pagesSecurities in An Insecure World - Benjamin Grahamneo269100% (3)

- Adaptive Asset AllocationDocument14 pagesAdaptive Asset AllocationQuasiNo ratings yet

- Volatility Arbitrage ReferencesDocument11 pagesVolatility Arbitrage ReferencesSrinivasaNo ratings yet

- Net Net USDocument70 pagesNet Net USFloris OliemansNo ratings yet

- Network To Net Worth - Exploring Network DynamicsDocument32 pagesNetwork To Net Worth - Exploring Network Dynamicspjs15No ratings yet

- Prof Robert Shiller Irrational ExuberancDocument32 pagesProf Robert Shiller Irrational ExuberancTrung NguyenNo ratings yet

- How To Live in A World We Donot UnderstandDocument20 pagesHow To Live in A World We Donot UnderstandPrashant Nalluri100% (1)

- First Four Chapters of How To Value InvestDocument23 pagesFirst Four Chapters of How To Value InvestJason RiveraNo ratings yet

- SSRN Id4336419Document26 pagesSSRN Id4336419brineshrimpNo ratings yet

- Understanding Probability in Everyday Life PDFDocument3 pagesUnderstanding Probability in Everyday Life PDFKhim ChiNo ratings yet

- Kelly CriterionDocument14 pagesKelly Criterionmustafa-ahmedNo ratings yet

- Marcato Capital 4Q14 Letter To InvestorsDocument38 pagesMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- A Century of EvidenceDocument16 pagesA Century of EvidenceSultan Fehaid0% (1)

- Forecasting The Term Structure of Government Bond Yields: Article in PressDocument28 pagesForecasting The Term Structure of Government Bond Yields: Article in Pressstan32lem32No ratings yet

- Return On Equity:: A Compelling Case For InvestorsDocument15 pagesReturn On Equity:: A Compelling Case For InvestorsPutri LucyanaNo ratings yet

- Words From The Wise Charles Ellis On Confronting Investing ChallengesDocument23 pagesWords From The Wise Charles Ellis On Confronting Investing ChallengesFrederico DimarzioNo ratings yet

- The Paradox of Svalbard: Climate Change and Globalisation in the ArcticFrom EverandThe Paradox of Svalbard: Climate Change and Globalisation in the ArcticNo ratings yet

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningFrom EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo ratings yet

- Strategic and Tactical Asset Allocation: An Integrated ApproachFrom EverandStrategic and Tactical Asset Allocation: An Integrated ApproachNo ratings yet

- Yellow Belt FrontlineDocument6 pagesYellow Belt FrontlineMohamed Salah-EldinNo ratings yet

- Crossed Roller Paper WebDocument5 pagesCrossed Roller Paper WebMohamed Salah-EldinNo ratings yet

- Basic Instrumentation: by Eng. Mohamed Salah-EldinDocument97 pagesBasic Instrumentation: by Eng. Mohamed Salah-EldinMohamed Salah-EldinNo ratings yet

- Amezcua Arabic May09Document24 pagesAmezcua Arabic May09Mohamed Salah-EldinNo ratings yet

- Building A Steam Powered Boat: Edison Challenge 2007Document4 pagesBuilding A Steam Powered Boat: Edison Challenge 2007endoparasiteNo ratings yet

- 808 #16 Camera Manual R2 PDFDocument6 pages808 #16 Camera Manual R2 PDFmr_vdgreefNo ratings yet

- Zeus Maior User Manual GBDocument30 pagesZeus Maior User Manual GBsebax123No ratings yet

- Job ExpDocument4 pagesJob Expกลุ่มงานรังสีวิทยา โรงพยาบาลลําปางNo ratings yet

- Ardudroid: A Simple 2-Way Bluetooth-Based Android Controller ForDocument16 pagesArdudroid: A Simple 2-Way Bluetooth-Based Android Controller ForRiza PNo ratings yet

- Wire Rope ConstructionDocument3 pagesWire Rope ConstructionLutfi IsmailNo ratings yet

- Electric Motor RegreasingDocument6 pagesElectric Motor Regreasinghamidkarimi_zpcNo ratings yet

- BR Quickie Freestyle Flyer v2 m56577569830549148Document2 pagesBR Quickie Freestyle Flyer v2 m56577569830549148beedoesNo ratings yet

- Alerta Vermelho. Como Me Tornei o Inimigo Número Um de PutinDocument1 pageAlerta Vermelho. Como Me Tornei o Inimigo Número Um de PutinJosé EduardoNo ratings yet

- Sub Machine GunsDocument10 pagesSub Machine Gunsprinando260408No ratings yet

- TriangDocument73 pagesTriangNikhil SinglaNo ratings yet

- Aboitiz EyesDocument64 pagesAboitiz EyesGerald Joseph MalitNo ratings yet

- Dead Weight TesterDocument5 pagesDead Weight Testersanjaysingh2013100% (3)

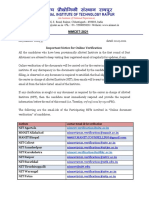

- Important Notice For Online VerificationDocument3 pagesImportant Notice For Online VerificationMithun GoudaNo ratings yet

- Review Assembly Language: Example: Insulin Pump For Diabetics (Cruise Control For Constant Speed Driving)Document2 pagesReview Assembly Language: Example: Insulin Pump For Diabetics (Cruise Control For Constant Speed Driving)Alan BensonNo ratings yet

- Community Health Worker RoadmapDocument4 pagesCommunity Health Worker RoadmapDEA ANDINI PUTRINo ratings yet

- Solenoid Valve (Proportional Reducing) - Power Shift SystemDocument4 pagesSolenoid Valve (Proportional Reducing) - Power Shift SystemMoncefNo ratings yet

- Brosure Sheet Pile Ok PDFDocument37 pagesBrosure Sheet Pile Ok PDFMuhammad Alfanny SetiawanNo ratings yet

- Introducción A EESDocument97 pagesIntroducción A EESlaura villarroelNo ratings yet

- Technical Note: DDR3 ZQ CalibrationDocument5 pagesTechnical Note: DDR3 ZQ CalibrationsantydNo ratings yet

- Py 40 L - 25-09-16Document2 pagesPy 40 L - 25-09-16sultanprince0% (1)

- STE02 Product Sheet 1Document1 pageSTE02 Product Sheet 1AZMAN ZHNo ratings yet

- Chapter 5.1 - Install Fedora 9Document14 pagesChapter 5.1 - Install Fedora 9Wendell BarbosaNo ratings yet

- Week 8.Final-GHTF RegulationDocument27 pagesWeek 8.Final-GHTF Regulationmustafe810No ratings yet

- Boq For Badminton Bleachers 2Document1 pageBoq For Badminton Bleachers 2Rose Ann RodriguezNo ratings yet

- 2 PDFDocument1 page2 PDFGodOfPC 611No ratings yet

- Facebook Agency Pitch DeckDocument17 pagesFacebook Agency Pitch DeckChris KhouryNo ratings yet

- ADAPT-Builder Concrete Design Suite PDFDocument1 pageADAPT-Builder Concrete Design Suite PDFSuranjan BhanjaNo ratings yet

- Supplier Development StrategiesDocument31 pagesSupplier Development StrategiesJayNo ratings yet