Professional Documents

Culture Documents

Erfdv

Uploaded by

wahidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Erfdv

Uploaded by

wahidCopyright:

Available Formats

Stock On Radar

By: Investment Information April 1, 2019

ANTM IJ

Aneka Tambang Penjualan emas melonjak, Laba

IDR 940 antam melesat 541 persen

*as of 2.31pm

(Kompas.com)

Industry view:

-Inventory level is at a low point

Key earning Driver:

Company Description -Strong growth both in nickel ore and gold sales

volume

PT. Aneka Tambang Tbk (ANTM) is a mining

company with natural deposits also Market cap (IDRtr) : 22.108T

manufacturing, trading, transportation and Market cap rank in sector : #2

other related services. The company is Market cap in all companies : #53

licensed commercial operations on July 5, P/E : 25.8x

1968. PBV : 1.1x

Transaction Activity:

The transaction volume is currently 131.02% from

Deskripsi Perusahaan yesterday.

Transaction value of IDR 88.44bn.

Foreign net buy 1.9bn.

PT. Aneka Tambang Tbk (ANTM) adalah

perusahaan pertambangan dengan deposit alami

juga manufaktur, perdagangan, transportasi dan

layanan terkait lainnya. Perusahaan ini memiliki

izin operasi komersial pada 5 Juli 1968.

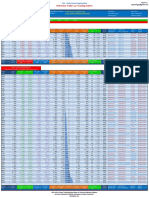

Financial Summary

ANTM Last Quarter

Income Statement 9M17 12M17 3M18 6M18 9M18 12M18 QoQ% YoY%

Sales(Idrbn) 3951 5691 5731 6084 8136 5290 -34.98% 99.49%

Gross Profit(Idrbn) 735 774 727 875 1353 521 -61.49% 111.56%

Ebit(Idrbn) 462 368 478 561 898 -85 -109.47% 208.67%

Net Income(Idrbn) 165 467 245 99 287 243 -15.33% 542.65%

NPM 4% 8% 4% 2% 4% 5%

Company Related Report by Mirae Asset: Broker Recommendation:

-https://bit.ly/2W0wUSs 2019/03/21 BCA Sekuritas buy 1250

Mirae Asset Recommendation: 2019/03/15 Ciptadana Sekuritas buy 1350

-2019/03/13 trading buy 1115 2019/03/13 Mirae asset trading buy 1115

Disclaimer:

This report is published by PT Mirae Asset Sekuritas Indonesia (“Mirae”), a broker-dealer registered in the Republic of Indonesia and

a member of the Indonesia Exchange. Information and opinions contained herein have been compiled from sources believed to be

reliable and in good faith, but such information has not been independently verified and Mirae makes no guarantee, representation

or warranty, express or implied, as to the fairness, accuracy, completeness or correctness of the information and opinions contained

herein or of any translation into English from the Bahasa Indonesia. If this report is an English translation of a report prepared in the

Indonesian language, the original Indonesian language report may have been made available to investors in advance of this report.

Mirae, its affiliates and their directors, officers, employees and agents do not accept any liability for any loss arising from the use

hereof. This report is for general information purposes only and it is not and should not be construed as an offer or a solicitation of

an offer to effect transactions in any securities or other financial instruments. The intended recipients of this report are sophisticated

institutional investors who have substantial knowledge of the local business environment, its common practices, laws and

accounting principles and no person whose receipt or use of this report would violate any laws and regulations or subject Mirae and

its affiliates to registration or licensing requirements in any jurisdiction should receive or make any use hereof. Information and

opinions contained herein are subject to change without notice and no part of this document may be copied or reproduced in any

manner or form or redistributed or published, in whole or in part, without the prior written consent of Mirae. Mirae, its affiliates and

their directors, officers, employees and agents may have long or short positions in any of the subject securities at any time and may

make a purchase or sale, or offer to make a purchase or sale, of any such securities or other financial instruments from time to time

in the open market or otherwise, in each case either as principals or agents. Mirae and its affiliates may have had, or may be

expecting to enter into, business relationships with the subject companies to provide investment banking, market-making or other

financial services as are permitted under applicable laws and regulations. The price and value of the investments referred to in this

report and the income from them may go down as well as up, and investors may realize losses on any investments. Past

performance is not a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Invisible Hands The Businessmen's Crusade Against The New Deal by Kim Phillips-FeinDocument349 pagesInvisible Hands The Businessmen's Crusade Against The New Deal by Kim Phillips-Feinfr33bookspleaseNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- BS 6093: 1993 - Design of Joints and Jointing in Building ConstructionDocument49 pagesBS 6093: 1993 - Design of Joints and Jointing in Building Constructionsathiyan83% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Date Account & Explanation F Debit CreditDocument7 pagesDate Account & Explanation F Debit CreditCindy Claire Pilapil88% (8)

- Scheduled Maintenance Manual: Yak-50 Aircraft With M-14P EngineDocument50 pagesScheduled Maintenance Manual: Yak-50 Aircraft With M-14P Enginebarsalona4569No ratings yet

- B2B marketing-MRFDocument46 pagesB2B marketing-MRFAshok Kumar100% (1)

- PwonDocument2 pagesPwonwahidNo ratings yet

- Technical Chart View: Saham AALIDocument1 pageTechnical Chart View: Saham AALIwahidNo ratings yet

- BMTR 1Document2 pagesBMTR 1wahidNo ratings yet

- MNCN IDR 805 (+5.92%) : Investment Information Team Stock On Radar (Jan 14, 2019)Document2 pagesMNCN IDR 805 (+5.92%) : Investment Information Team Stock On Radar (Jan 14, 2019)wahidNo ratings yet

- Jan 14 Essa PDFDocument1 pageJan 14 Essa PDFwahidNo ratings yet

- PNLF IDR 290 (+7.41%) : Investment Information Team Stock On Radar (Jan 14, 2019)Document1 pagePNLF IDR 290 (+7.41%) : Investment Information Team Stock On Radar (Jan 14, 2019)wahidNo ratings yet

- ATS - Daily Trading Plan 27agustus2018Document1 pageATS - Daily Trading Plan 27agustus2018wahidNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsiteDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM Channel: WebsitewahidNo ratings yet

- ATS - Daily Trading Plan 20agustus2018Document1 pageATS - Daily Trading Plan 20agustus2018wahidNo ratings yet

- ATS - Daily Trading Plan 14agustus2018Document1 pageATS - Daily Trading Plan 14agustus2018wahidNo ratings yet

- TF 00000007Document2 pagesTF 00000007wahidNo ratings yet

- Experiment4 DoxDocument9 pagesExperiment4 Doxsajith100% (1)

- Kanatol 400 (M)Document2 pagesKanatol 400 (M)buildguard7No ratings yet

- Custom Car Care: Case Analysis OnDocument4 pagesCustom Car Care: Case Analysis OnSatyabrataNayakNo ratings yet

- Shangai Houton ParkDocument15 pagesShangai Houton ParkHari HaranNo ratings yet

- Labor Law Bar Exam 2012 ResearchDocument9 pagesLabor Law Bar Exam 2012 ResearchMalaybalaycity TiktokchallengeNo ratings yet

- Amir Adnan Retain StoreDocument25 pagesAmir Adnan Retain StoreWaqas Mazhar100% (1)

- Price Comparison TemplateDocument1 pagePrice Comparison TemplateAqeel RashNo ratings yet

- Arabic-English Legal GlossaryDocument13 pagesArabic-English Legal GlossaryAnas EbrahimNo ratings yet

- Eton Mess Recipe - EatOutDocument1 pageEton Mess Recipe - EatOutAhmedsabri SabriNo ratings yet

- Earl Bryan M. Apale: Personal Portfolio)Document7 pagesEarl Bryan M. Apale: Personal Portfolio)Kilk SueNo ratings yet

- Sampling ProceduresDocument14 pagesSampling ProceduresNaina SinghNo ratings yet

- Earth Magnetometer ProjectDocument17 pagesEarth Magnetometer ProjectMario Ariel VesconiNo ratings yet

- CSE-SS Unit 3 QBDocument43 pagesCSE-SS Unit 3 QBJKNo ratings yet

- Chapter 4 Descriptive Data MiningDocument6 pagesChapter 4 Descriptive Data MiningAngela PonceNo ratings yet

- Aquino vs. Heirs of Raymunda CalayagDocument7 pagesAquino vs. Heirs of Raymunda CalayagJenny ButacanNo ratings yet

- Gujarat Technological University: Project EmpathyDocument7 pagesGujarat Technological University: Project EmpathyKaval PatelNo ratings yet

- TracebackDocument2 pagesTracebackTim HinderkottNo ratings yet

- Upstream RF TroubleshootingDocument66 pagesUpstream RF TroubleshootingDjnsilva Silva100% (1)

- International Standard 2671: Environmental Tests For Aircraft Equipment - Part 3.4: Acoustic VibrationDocument12 pagesInternational Standard 2671: Environmental Tests For Aircraft Equipment - Part 3.4: Acoustic VibrationfgnestorNo ratings yet

- BRM Unit-2Document17 pagesBRM Unit-2PunithNo ratings yet

- Special Power of Attorney: Full Name and Full Residential and Office Address of NRI Borrower(s)Document5 pagesSpecial Power of Attorney: Full Name and Full Residential and Office Address of NRI Borrower(s)Rushikesh BhongadeNo ratings yet

- AKG CS3 Discussion SystemDocument6 pagesAKG CS3 Discussion SystemSound Technology LtdNo ratings yet

- Project Report On Tata NanoDocument62 pagesProject Report On Tata NanoDrew Gordon100% (1)

- mt4 GuideDocument24 pagesmt4 GuideGeorge PruteanuNo ratings yet

- Schematic Diagram of QuadrilateralsDocument1 pageSchematic Diagram of QuadrilateralsNavi Buere0% (1)