Professional Documents

Culture Documents

F5 HKCA 2013 Mock Ques

Uploaded by

Glennizze Galvez0 ratings0% found this document useful (0 votes)

10 views11 pagesfrctbu

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfrctbu

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views11 pagesF5 HKCA 2013 Mock Ques

Uploaded by

Glennizze Galvezfrctbu

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

erry

aes

SE) 2013acca.taobaoGera

LEARNINGMEDIA

ACCA - F5 Performance Management

‘Suggested Mock Exam Answers 2013

Answer 4

(a) Decision Tree

3.

5 marks

Maximum marks 5

(b) Expected value of total profit

‘Annual Machine: Size 1 Machine: Size 2 ‘Machine: Size 3

output

(m’)

Profit | Prob | EV | Profit | Prob | EV | Profit | Prob | EV

T milion 35[ 056] 19.60 5| 016[ 080 - ~ ~

1 milion 25] 024| 6.00 (©)| 0.24} (1.20) e i ze

5 million 175| 008! 1400) 125] 0.12] 1500] 50) 0.18] 900

S million 75| 0.06) 450 75| 009) 675} 25} 030] 750

5 milion 25] 006] 1.50 25] 009) 225] (25)| 0.12] (3.00)

8 milion - - -| 200] 015} 30.00 0.24| 48.00

8 million - - - 40) 0.15| 6.00 0.16| 640

50 58.60 67.90

Note: the profits shown in the above table are before charging lease payments. ae

Probability of breaking even

Machine: Size 1

Probability of breaking even =100%

EV of profit = $45.60 - $20 = $25.60 milion

All for you to... aass/

§G38708370

LEARNINGMEDIA

Machine: Size 2

Probability of breaking even = 51%

EV of profit = $59.60 - $30

Machine: Size 3

Probability of breaking even E = 58%

EV of profit = $67.90 - $40 = $27.90 million

3 marks

Maximum marks 8

{c) Report

From:

‘The Management Accountant

Date: XXIKXIXX

To:

‘The Management of Strong Foundation

‘Subject: Recommendation of action

Based on the decision tree, size 2 machine is the preferred option.

However, there are certain issues to be considered:

> The expected values of the profits from all three machines are close to the current profit of $24 milion.

‘Strong Foundation is a well-known establishment and produces traditional materials (and thus, takes very

litle risk). Thus, the following question would arise:

“Do the extra profits offer sufficient reward for the risks involved in undertaking the new venture?”

> Machine size 2 has the highest expected value, but the lowest probability of breaking even. In order to

decide whether accepting machine size 2 is viable or not, the management needs to revisit the risk appetite

of the company.

» Machine size 1 has the smallest expected value. But based on the outcomes presented, it will always retum

a profit.

» Machine size 3 has an expected value close to that of machine size 1, but offers the potential for the largest

‘output (that is 5 million or 8 million). However, machine size 3 also presents the possibility of the largest

loss,

> The choice between the machines is very sensitive to the forecasts of outputs and costs and their

associated probabilities. For example if for Machine size 3, the profit per metre square for the production of

8 millon square metres was certain to be $25, then the expected value would rise to $53.50 milion. This is

far higher than the other machines and much higher than the profit currently being eamed ($24 milion).

> Expected value is an averaging technique based on probability estimates and therefore its use for a “one-

off decision is questionable. Moreover, the use of a small number of point probabilities also weakens the

technique.

» Expected value does not provide a measure for the spread of results that could occur. A simulation

(modelling) technique may be a better methodology to appraise such projects.

Signed: Management accountant

‘1 mark for report structure

‘1 mark for each valid point

Maximum marks 7

MD) >. 57

2013acca.taobaoGora

LEARNINGMEDIA

Answer 2

(a) Variances should be analysed between planning and operating causes, so that management can focus on

controllable costs and revenues

‘A planning variance represents the difference between an original standard - which is no longer considered to

bbe a relevant or achievable target - and a revised standard. Such variances, therefore, represent uncontrollable

differences between the actual and target performance.

‘Operating variances arise by comparing actual performance against achievable targets. Such variances are

thus considered to be controllable through management decisions and actions.

2marks

Maximum marks 2

Planning price variance (ingredient A)

Revised standard cost (1,650 x 0.5 kg x $0.55) $453.75

Original standard cost (1,650 x 0.5 kg x $0.50) $412.50

$41.25 (A)

3 marks

Operating price variance (ingredient A)

1,072 kg cost $510.0

1,072 kg should have cost (1,072 x $0.50) $589.60

$79.60 _(F)

3 marks

Maximum marks 5

(b) Material mix and yield variances

Material mix variance

Revised average standard price per kg of input

$

0.5 kg of A @ $0.55 per kg | 0.275

0.5kg of B @ $1.20 per kg | 0.360

0.5kg of C @ $0.80 per kg | 0.200

0.835

‘$0.835/1.05 kg = $0.795 per kg of input

For the month of October:

Ingredients | Actual quantity in ] Actual quantity in | Difference

actual mix (kg) | standard mix (kg) | (kg)

A 4,072 895, 7

8 412 537 (125)

c 396, 448 (62)

7,880 7,880 Nil

Material mix variances:

A= 177 x ($0.55- 0.795) = 43 (F)

B = (125) x ($1.20 - 0.795) = 51 (F)

C= (62) x (0.80 ~ 0.795) = Nil

Total material mix variance = 43 (F) + 51 (F) + Nil

$94 (F)

Note: the weighted average method of valuation has been used.

3 marks

All for you to... azss/

§G38708370 mon

LEARNINGMEDIA

Material yield variance

Kg

1,880 kg input should yield (1,880/ 1.05) | 1,790.48

‘Actual yield (1,650.00)

Difference (shortfall) 140.48

‘Thus, material yield variance = 140.48 kg x $0.835 = $117 (A)

3marks

‘Maximum marks 6

{c) For the month of October:

Variance % Adverse / Favourable

Ingredient A (1777 895) 19.8% (A)

Ingredient B (125 / 537) 23.3% (F)

Ingredient C (52/448) 11.6% (F)

Yield (140.48 / 1,790.48) 7.8% (A)

3marks

This form of analysis is useful because it shows the trend of product mix without distortion from the effect of the

standard price being very similar to the weighted average standard price.

1 mark

This information is very important, and the use of percentages relative to the standard values for the actual

inputs and output avoids the distortions caused to the variance values by fluctuating actual activity levels. Some

‘managers may also find it easier to understand non-financial measures. It should be remembered that mixing is

done by weight, not based on financial values.

1 mark

In this question, it can be seen that there is a continuing, increasing trend of using more of ingredient A and less

of ingredient B. The use of ingredient C is fluctuating around the standard and is of less significance. However,

the monetary mix variance for ingredient C, which is nil, could be misleading.

1 mark

‘There is a mix variance, but the nil valuation is a function of its small size in kg, and the similarity between the

‘standard input value of material C and the weighted average standard input cost per kg,

1 mark

‘Maximum marks 7

Answer 3

{a) Total savings achieved by implementing JIT

Current situation

‘$000 [$000

Direct costs

Mi 273,000

m2 316,200

M3 445,500

Total direct cost 1,034,700

Overheads

Set-ups 45,500

Materials handling | 58,400

Inspection 63,000

Machining 182,400

Warehousing 43,800 | 303,100

Fixed overheads 342,870

Total cost 4,770,670

3marks

MEO 6-257

Implementing the JIT system

‘$000 [$000

Direct costs

M1 289,800

m2 335,580

M3 475,200

Total direct cost 1,100,580

Overheads

Setups 31,850

Materials handling | 40,880

Inspection 44,100

Machining 155,040 | 271,870

Fixed overheads

Setups 29,862

Materials handling | 37,023,

Inspection 41,916

Machining 122,859 |_231,660

Total cost 1,604,110

‘$000

Current cost 1,770,670

Cost under JIT system | 1,604,110

Cost savings 166,560

(b) Variable cost per machine under JIT

‘Comparison of current system and the proposed system of JIT

mi (8) [M2(8) [M3 (8)

Total direct cost 3,864.00 | 4,474.40 | 6,336.00

Variable overheads (W1) | _ 928.26 | 1,292.00 | 1,404.67

Total variable cost 4,792.26 | 5,766.40 | 7,740.67

Determination of optimum selling price and output level

2013acca.taobaoGora

LEARNINGMEDIA

3 marks

‘Therefore, Haydon Pic should implement the JIT system, as there are substantial savings in costs.

2 marks

‘Maximum marks 8

2 marks

Machine M1

Demand (units) | Selling Price (8) | Variable cost (S)

Contribution ($)

Total contribution ($000)

75,000

65,000

50,000

35,000

5,000 4,792.26

5,750 4,792.26

6,000 4,792.26

6,500 4,192.26

207.74

987.74

1,207.74

4,707.74

15,581

62,253

60,387

59,771

Therefore, the optimum level of sales and the corresponding selling price is: 65,000 machines @ $5,750

‘3 marks

All fon you te, aass/

§G38708370 mon

LEARNINGMEDIA

Machine M2

Demand (units) | Selling Price (S) | Variable cost (S) | Contribution (8) | Total contribution (S000)

75,000 5,750 5,766.40 (16.40) (1,230)

60,000 6,250 5,766.40 483.60 29,016

50,000 6,500 5,766.40 733.60 33,012

45,000 7,500 5,766.40 1,733.60 60,676

Therefore, the optimum level of sales and the corresponding selling price is: 35,000 machines @ $7,500

3 marks

Machine M3

Demand (units) | Selling Price ($) | Variable cost ($) | Contribution ($) | Total contribution ($000)

75,000 6,500 7,740.87 (1,240.67) (63,050)

60,000 6,750 7,740.67 (990.67) (69,440)

45,000 7,750 7,740.87 9:33 420

30,000 8,000 7,740.87 259.33, 7,780

Therefore, the optimum level of sales and the corresponding selling price is: 30,000 machines @ $8,000,

3 marks

Working

Wt: Variable overheads

Set-up costs: $13,000 x 70% = $9,100 per production run

M1: $9,100 x (1,000/75,000)

M2: $9,100 x (1,000/75,000)

M3: $9,100 x (1,500/75,000)

Material handling costs: $4,000 x 70% = $2,800 per order executed

M1: $2,800 x (4,000/75,000)

M2: $2,800 x (5,000/75,000)

(M3: $2800 x (5,600/75,000) = $209.07

Inspection costs: $18,000 x 70% = $12,600 per production run

M1 = $12,600 x (1,000/75,000)

M2 = $12,600 x (1,000/75,000)

M3 = $12,600 x (1,500/75,000)

Machining costs: $40 x 85% = 434 per machine hour

M1: $34 x (1,080,000/75,000) = $489.60

M2: $34 x (1,800,000/75,000) = $816

M3: $34 x (1,680,000/75,000) = $761.60

Variable overheads per machine

M1: $121.33 + $149.33 + $168 + $489.60 = $928.26

M2: $121.33 + $186.67 + $168 + $816 = $1,292

M3: 4182 + $209.07 + $252 + $761.60 = $1,404.67

2marks

Maximum marks 12

BEd e257

2013acca.taobaoGora

LEARNINGMEDIA

Answer 4

(a) Throughput accounting ratio = Retum per factory hour/Cost per factory hour

Return per factory hour

Retumn per factory hour =

hroughput per uni/Usage of bottleneck resource

Rotary Tillers | Pruners | Marks

Selling price per unit sioo[ $160

Material cost per unit $40 $50

Throughput per unit seo[si0| 1

Bottleneck resource (hours required) | __0.25 hours | 0.4 hours | 1

Return per factory hour ‘s240 [$275

Cost per factory hour

Cost per factory hour = Total factory costs/Bottleneck hours available

Fixed production overheads ‘$2,025,000 | Marks

Labour and other variable production overheads | _ $2,400,000

Total factory costs $4,426,000 | 1

Bottleneck resource hours available 30,000 hours.

Cost per factory hour $147.50 | 1

‘Throughput accounting ratio

Rotary Tillers | Pruners | Marks

Retum per factory hour ‘s240 | $275

Cost per factory hour 147.50 | $147.50

‘Throughput accounting ratio 163[ 1.86] 2

In situations where throughput accounting principles are applied, a product will be worth producing provided that

the throughput per factory hour is greater than the cost per factory hour. This may be measured by the

throughput accounting ratio. If throughput return outweighs the cost per factory hour, the ratio will be greater

than 1.00.

‘Management attention should focus upon increasing the throughput ratio. if they can do this then higher levels

Of profit will be achieved

1 mark

‘Maximum marks 8

{b) Since the pruner has a higher return per bottleneck hour than the rotary tiller, Garden Companion should

‘manufacture the pruner until it has satisfied the total demand of 48,000 units.

‘The production mix of the equipment will therefore be as follows:

Equipment Units Units perhour of | Totalhours of | Marks

manufactured bottleneck bottleneck

resource resource required

Pruners, 48,000 a 12,000 | 1.5

Rotary Tillers 48,000 2.50 18,000 | 1.5

"30,000

All for you to... aass/

§G38708370

LEARNINGMEDIA

Projected profit of Garden Companion for the coming period:

$ 3 | Marks

‘Throughput return

Pruners (48,000 units x $110) 5,280,000

Rotary Tillers (45,000 units x $60) 2,700,000 | 7,980,000 | 1

Less: Costs

Fixed production overheads $2,025,000

Labour and other variable production overheads | $2,400,000 | (4,425,000) | 1

Net profit 3,556,000

‘Maximum marks 6

{) Environmental accounting is the identification, priorisation, quantification or qualification and incorporation

Of environmental costs into business decisions. it would be beneficial for Garden Companion to implement

environmental accounting as part of its accounting system as it would help the organisation in the folowing

assessment of annual environmental costs

product pricing

budgeting

investment appraisal, calculating investment options

designing, calculating costs, savings and benefits of environmental projects

{design and implementation of environmental management systems

‘environmental performance evaluation, indicators and benchmarking

‘external reporting / disclosure of environmental expenditures, investments and liabilities

reporting of environmental data to statistical agencies and local authorities

vvvvvvyyy

3 marks

Environmental costs of Garden Companion

Environmental costs are a general classification for several types of costs relating to use, release and regulation

of materials in facility operations,

Environmental costs include disposal costs, investment costs and extemal costs incurred because poor

environmental quality exists or may exist.

‘The following costs can be identified with respect to Garden Companion:

> Environmental preventive costs: these costs are basically incurred to prevent the production of

contaminants or wastes that could cause damage to the environment.

Garden Companion’s efforts to minimise the effects of its activities on the environment, conducting

environment oriented research and development activities and planting trees in the neighbourhood can be

classified as the organisation's environmental preventive costs.

The costs that may be incurred by Garden Companion in complying with the various environmental

regulations and obtaining environmental certificates would also fall under the category of preventive cost.

mark

> Environmental detection costs: these costs relate to the activities undertaken to determine if products,

processes and other activities within the firm are in compliance with environmental standards. Costs that

‘may be incurred by Garden Companion in testing the “environmental compatibility’ of its products (garden

equipment), machining and other processes, and the processes involved in the treatment of residues can be

Classified as environmental detection costs.

1 mark

> Environmental failure costs: these costs relate to the activities performed in order to deal with the

pollutants that result from the activities of the organisation. Such costs of Garden Companion would include

costs related to the treatment of various gaseous and solid wastes, noise levels, etc. that are generated by

the firm's processes.

1 mark

‘Maximum marks 6

BED 6-257

2013acca.taobaoGora

Answer 5

(a) Financial performance of Smart Shoes

(i) Sales Growth

It can be observed that Smart Shoes has had an excellent start to its business. It has made $550,000 of sales in

the first quarter and then increased that figure by nearly 41% to $775,000 (working notes) in the next quarter.

This is impressive, particularly given that the footwear industry is very competitive. Although it is often that new

businesses make slow starts, this does not look to be the case here.

2marks

(ii) Gross Profit

‘The gross profit of Smart Shoes is 55% for the first quarter and 52% (working notes) for the second quarter. We

have no comparable industry data provided so no absolute comment can be made. However, we can see the

{gross profit has reduced by three points in one quarter. This can be taken to be potentially serious and should

not continue in future.

However, the cause of this fall is not clear. Price pressure from competitors is possible, who may be responding

to the good start made by the business. If Smart Shoes is reducing its prices, this would reflect on the gross

profit margin produced,

It could also be that the costs of sales figures are rising disproportionately. As the business has grown so

quickly, Smart Shoes may have had to resort to sourcing extra new supplies at short notice incurring higher

Purchase or shipping costs. These could all reduce the gross profits achieved,

2marks

(iii) Website design and operation cost

‘Website design and operation costs are being written off as incurred to the management accounting profit and

loss account. They should be seen as an investment for the future and not likely to be incurred in the long term.

‘Website development has been made with the future in mind as research done by Smart Shoes revealed that

‘such footwear can be best sold through intemet marketing,

Itcan be assumed that future website costs will be lower than at present. Taking this into consideration the loss

made by the business does not look as serious as it initially appears.

2marks

(iv) Initial Promotional Expenses

The initial promotional expenses would not continue at this level in the future. Once the market share is

established, this cost will be replaced by more general marketing of the website. Initial promotion proves to be

‘more expensive than general marketing and so the profits of the business will improve over time. This is another

‘good sign that the results of the first two quarters are not as bad as they seem.

1 mark

(v) Selling and Distribution Expenses

This is a relatively minor cost and appears under control. The proportion of this cost to sales is 6% in quarter 1

‘and 5.8% in quarter 2.

mark

(vl) Admin Expenses

The admin expenses are 25% of sales in quarter 1 and reduce to 23% of sales in quarter 2. This indicates good

cost control by Smart Shoes. This is an example of a business gaining critical mass. The bigger it gets the more

itis able to absorb costs. Smart Shoes may have some way to go in this regard, gaining a much greater size

than at present

mark

(vil)Other Variable Operating Expenses

‘These costs of Smart Shoes also appear under control in that it seems to have just varied with volume.

Ye marks

All for you to... aass/

LEARNINGMEDIA

§G38708370

LEARNINGMEDIA

Comment on Loss

‘Smart Shoes has lost $181,500 in the first quarter and $83,700 in the second quarter. But the situation is not as

bad as it appears to be due to the following reasons:

> New businesses take a while to break even after their launch,

> The loss figures have been computed after considering website design and development costs which may

not be incurred in the future.

> Also responsible for the losses are the initial promotion expenses which would subsequently reduce in the

future.

The major concem of Smart Shoes would be the increase in the cost of sales as a percentage of sales. Steps

should be taken to correct this.

2'/s marks:

‘Maximum Marks 12

(b) Non - financial performance of Smart Shoes

(i) Number of footwear sold

The number of footwear sold by Smart Shoes increased by nearly 41% in the second quarter, which suggests

an impressive start.

The data can also be used to calculate the selling price per footwear.

Quarter 1: $550,000 / 11,000 = $50

Quarter 2: $775,000 / 15,500 = $50

The above suggests that the fall in gross profit has litle to do with the sales price for the shoes. The problem of

the falling gross profit must lie elsewhere.

2marks

(il) Number of website visitors

This is a very impressive start. A new business can often find it dificult to make an impression in the market.

Growth in website hits is 24% in the two quarters. If this continued over a year, Smart Shoes’ footwear would

become very well known. The internet enables new businesses to impact the market quickly.

2 marks

(iii) Unproductive system time

Unproductive system time is to be avoided by internet based sellers as much as possible. If the system is down,

then customers (and potential customers) cannot access the site. This could easily lead to lost sales at that time

and even discourage customers from trying again at later dates,

‘The unproductive time percentage has risen alarmingly and this is a matter of concem. Ideally, we would need

figures for the average percentage of unproductive time achieved by comparable systems to be able to

‘comment further. The owners are likely to be disappointed given the level of initial investment they have already

made. A discussion with the website developers may well be warranted

2marks

(iv) Delivery Efficiency

The efficiency of delivery has reduced between the first and the second quarters. This could affect the future

sales of Smart Shoes and thus has to be taken care of.

2marks

‘Maximum marks 8

EO 6-257

2013acca.taobaoGora

LEARNINGMEDIA

Workings

Profit and Loss Statement of Smart Shoes for the two Quarters.

First Quarter ($)__| Second Quarter ($)

Sales 550,000 775,000

Less: Cost of Sales (247,500) (372,000)

Gross Profit (a) 302,500 “403,000

Less: Operating Expenses:

‘Admin Expenses 137,500 178,250

Selling and Distribution Cost 33,000 44,950

‘Website Design and Operation 165,000 116,250

Initial Promotion Expenses. 82,500 54,250

ther Operating Expenses 66,000 93,000

Total Operating Expenses (b) 484,000 486,700

Profit (a) ~ (b) (181,500) (83,700)

Gross Profit Percentage

‘Quarter 1: $302,500 / $550,000 = 55%

‘Quarter 2: $403,000 / $775,000 = 52%

End of Answers

All for you to... axss/

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

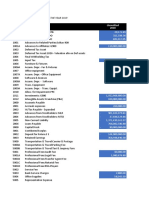

- Unaudited Trial Balance For The Year 2019: Sultan 900 Capital, IncDocument18 pagesUnaudited Trial Balance For The Year 2019: Sultan 900 Capital, IncGlennizze GalvezNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Accountancy Student: Froilan Arlando BandulaDocument5 pagesAccountancy Student: Froilan Arlando BandulaGlennizze GalvezNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- HsyshDocument1 pageHsyshGlennizze GalvezNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Entrep 4 Week: What I KnowDocument9 pagesEntrep 4 Week: What I KnowGlennizze GalvezNo ratings yet

- Assets: Balance Sheet As of September 31, 2020Document91 pagesAssets: Balance Sheet As of September 31, 2020Glennizze GalvezNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chapter 14 - Bus Com Part 1 - Afar Part 2-1Document4 pagesChapter 14 - Bus Com Part 1 - Afar Part 2-1Glennizze GalvezNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Mathematics in Modern World Lecture InsightsDocument2 pagesMathematics in Modern World Lecture InsightsGlennizze GalvezNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- January 2018 - December 2018Document12 pagesJanuary 2018 - December 2018Jussa Leilady AlberbaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Senior High School Department Proposed Tax Amnesty ProgramDocument1 pageSenior High School Department Proposed Tax Amnesty ProgramGlenn GalvezNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- PurposiveDocument1 pagePurposiveGlennizze GalvezNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Financialaccounting 3 Theories Summary ValixDocument10 pagesFinancialaccounting 3 Theories Summary ValixDarwin Competente LagranNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Maxims of CommunicationDocument1 pageMaxims of CommunicationGlennizze GalvezNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Maxims of CommunicationDocument1 pageMaxims of CommunicationGlennizze GalvezNo ratings yet

- Body Composition: BenefitsDocument8 pagesBody Composition: BenefitsGlennizze GalvezNo ratings yet

- Cpa Review Questions - Batch 7Document44 pagesCpa Review Questions - Batch 7MJ YaconNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- January 2019: Sun Mon Tue Wed Thu Fri SatDocument12 pagesJanuary 2019: Sun Mon Tue Wed Thu Fri SatGlennizze GalvezNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- TestbankDocument93 pagesTestbankMack Ray O. Paredes100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chapter 16 - Bus Com Part 3 - Afar Part 2-1Document5 pagesChapter 16 - Bus Com Part 3 - Afar Part 2-1Glennizze GalvezNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Accountants National Capital Region (NFJPIA-NCR) Is A Duly: Ngarap Tungo SA Kilang LaDocument4 pagesAccountants National Capital Region (NFJPIA-NCR) Is A Duly: Ngarap Tungo SA Kilang LaGlennizze GalvezNo ratings yet

- 3.2.9 Process FlowchartDocument4 pages3.2.9 Process FlowchartGlennizze GalvezNo ratings yet

- Accountancy Student: Froilan Arlando BandulaDocument5 pagesAccountancy Student: Froilan Arlando BandulaGlennizze GalvezNo ratings yet

- Systems Analysis and Design 2014 Course OverviewDocument3 pagesSystems Analysis and Design 2014 Course OverviewGlennizze GalvezNo ratings yet

- Determining the Feasibility of Manufacturing and Marketing LaingDocument65 pagesDetermining the Feasibility of Manufacturing and Marketing LaingGlennizze Galvez100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Analytic-Geometry:: You Should Be Using A RulerDocument8 pagesAnalytic-Geometry:: You Should Be Using A RulerGlennizze GalvezNo ratings yet

- 3.1.4-3.1.5 Marketing PlanDocument4 pages3.1.4-3.1.5 Marketing PlanGlennizze GalvezNo ratings yet

- Umar SulemanDocument7 pagesUmar SulemanUmar SulemanNo ratings yet

- Perpetual Dalta Fun Booth U-Week 2018Document2 pagesPerpetual Dalta Fun Booth U-Week 2018Glennizze GalvezNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Senior High School Department Proposed Tax Amnesty ProgramDocument1 pageSenior High School Department Proposed Tax Amnesty ProgramGlenn GalvezNo ratings yet

- Whole UniverseDocument2 pagesWhole UniverseGlenn GalvezNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)