Professional Documents

Culture Documents

New Microsoft Word Document

Uploaded by

NishantCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Microsoft Word Document

Uploaded by

NishantCopyright:

Available Formats

If unit 1 requires 200 hours to produce and the labor records for an Air Force contract of 50 units

indicates an average labor content of 63.1 hours per unit. What was the learning rate? What total

additional number of labor-hours would be required for a follow-on Air Force contract of 50 units?

What would be the average labor content of this second contract? Of both contracts combined? If

labor costs the vendor $10/hour on this second contract and the price to the Air Force is fixed at

$550 each, what can you say about the profitability of the first and second contracts, and hence

the bidding process in general?

3. Your firm designs PowerPoint slides for computer training classes, and you have just received a request

to bid on a contract to produce the slides for an 8-session class. From previous experience, you know that

your firm follows an 85% learning rate. For this contract it appears the effort will be substantial, running

50 hours for the first session. Your firm bills at the rate of $100/hour and the overhead is expected to run a

fixed $600 per session. The customer will pay you a flat fixed rate per session. If your nominal

profitmargin is 20 percent, what will be the total bid price, the per session price, and at what

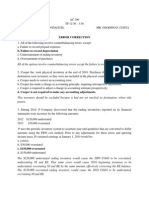

A manufacturing firm has set up a project for developing a new machine for one of its production lines. The

most likely estimated cost of the project itself is $1 million, but the most optimistic estimate is $900,000

while the pessimists predict a project cost of $1,200,000. The real problem is that even if the project costs

are within those limits, if the project itself plus its implementation cost exceed 1,425,000, the project will

not meet the firm’s NPV hurdle. There are four cost categories involved in adding the prospective new

machine to the production line: (1) engineering labor cost, (2) non-engineering labor cost, (3) assorted

materials cost, and (4) production line down-time cost.The engineering labor requirement has been

estimated to be 600 hours, plus or minus 15% at a cost of $80 per hour. The non-engineering labor

requirement is estimated to be 1500 hrs., but could be as low as 1200 hrs. or as high as 2200 hrs. at a cost

of $35 per hour. Assorted material may run as high as $155,000 or as low as $100,000 but is most likely

to be about $135,000. The best guess of time lost on the production line is 110 hours, possibly as low as

105 hours and as high as 120 hours. The line contributes about $500 per hour to the firms profit and

overhead. What is the probability that the new machine project will meet the firm’s NPV hurdle?

You might also like

- Tutorial Q1Document2 pagesTutorial Q1Von JinNo ratings yet

- GNB+13 e+Kelvin+Aerospace,+IncDocument2 pagesGNB+13 e+Kelvin+Aerospace,+InconedaytodayNo ratings yet

- Friendly Assisted Living Facility UpdateDocument5 pagesFriendly Assisted Living Facility UpdateCream FamilyNo ratings yet

- F5 - LCT-1Document6 pagesF5 - LCT-1Amna HussainNo ratings yet

- BusinessDocument5 pagesBusinessNikhil AroraNo ratings yet

- Problem SetDocument10 pagesProblem SetDaksh AnejaNo ratings yet

- Short Term Decisions F5 NotesDocument9 pagesShort Term Decisions F5 NotesSiddiqua KashifNo ratings yet

- Tutorial Questions: Pricing DecisionDocument5 pagesTutorial Questions: Pricing Decisionmarlina rahmatNo ratings yet

- Pcu Topic Number 4 ActivityDocument1 pagePcu Topic Number 4 ActivityAilyn S. BulataoNo ratings yet

- Learning Curve - AnswersDocument8 pagesLearning Curve - Answerszoyashaikh20No ratings yet

- Job and Batch Costing NotesDocument5 pagesJob and Batch Costing NotesFarrukhsg100% (1)

- F5 PM Quantitative AnalysisDocument14 pagesF5 PM Quantitative AnalysisMazni HanisahNo ratings yet

- P2 - Performance ManagementDocument16 pagesP2 - Performance ManagementjoelvalentinorNo ratings yet

- CH 2 - Job Costing SystemDocument19 pagesCH 2 - Job Costing SystemDeeb. DeebNo ratings yet

- Variance Analysis 5.16Document3 pagesVariance Analysis 5.16George BulikiNo ratings yet

- Case 1.4 - Kelcin Aerospace - 3-34 GarrisonDocument2 pagesCase 1.4 - Kelcin Aerospace - 3-34 GarrisonAsmaNo ratings yet

- PM Sect B Test 4Document6 pagesPM Sect B Test 4FarahAin FainNo ratings yet

- Relevant Costing ConceptsDocument7 pagesRelevant Costing ConceptsAngel Lilly100% (1)

- BE Post-Work Session 6Document4 pagesBE Post-Work Session 6vjpopinesNo ratings yet

- Product and Service Costing: Job-Order System: Questions For Writing and DiscussionDocument22 pagesProduct and Service Costing: Job-Order System: Questions For Writing and Discussionsetiani putriNo ratings yet

- 2) - Target CostingDocument2 pages2) - Target CostingBisma AsifNo ratings yet

- Chapter 03Document74 pagesChapter 03Kent Raysil PamaongNo ratings yet

- Diskusi Job CosrtingDocument8 pagesDiskusi Job CosrtingArsad AufarNo ratings yet

- Sup Questions 4Document17 pagesSup Questions 4Anonymous bTh744z7E6No ratings yet

- ARS Webinar Handout 10292023Document3 pagesARS Webinar Handout 10292023johnafar998No ratings yet

- Capital BudgetingDocument4 pagesCapital Budgetingrachmmm0% (3)

- TOS Cost AssessmentDocument41 pagesTOS Cost AssessmentHNo ratings yet

- 5 Fun ConceptDocument6 pages5 Fun ConceptBhavuk SharmaNo ratings yet

- Exercise 5 - Topic 4 (Chapter 3)Document2 pagesExercise 5 - Topic 4 (Chapter 3)sameerhaNo ratings yet

- Jamie KincadeDocument5 pagesJamie KincadeChristine HermawanNo ratings yet

- Systems Design: Job-Order Costing and Process Costing: MANAGEMENT ACCOUNTING - Solutions ManualDocument16 pagesSystems Design: Job-Order Costing and Process Costing: MANAGEMENT ACCOUNTING - Solutions ManualBianca LizardoNo ratings yet

- MS-44N (Various Topics in MS)Document6 pagesMS-44N (Various Topics in MS)juleslovefenNo ratings yet

- Case Chapter 03Document3 pagesCase Chapter 03Pandit PurnajuaraNo ratings yet

- Relevant CostDocument16 pagesRelevant CostAli ArshadNo ratings yet

- L5 Job CostingDocument57 pagesL5 Job CostingBenoit NouguierNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6jasperkennedy094% (17)

- Day 4 Chap 1 Rev. FI5 Ex PR PDFDocument7 pagesDay 4 Chap 1 Rev. FI5 Ex PR PDFJoannaNo ratings yet

- Quizz C3Document10 pagesQuizz C3Thanh NgânNo ratings yet

- Present EconomyDocument21 pagesPresent EconomyKhryz Anne AvilaNo ratings yet

- Accounting For Overhead CostsDocument2 pagesAccounting For Overhead CostsLijobethNo ratings yet

- Absorption Costing - OverviewDocument24 pagesAbsorption Costing - OverviewEdwin LawNo ratings yet

- Morroow Question SolutionDocument4 pagesMorroow Question SolutionDilsa JainNo ratings yet

- Throughput AccountingDocument5 pagesThroughput AccountingMohammad Faizan Farooq Qadri AttariNo ratings yet

- 1 TutorDocument7 pages1 TutorHero StrikesNo ratings yet

- Chap 004Document50 pagesChap 004Mohamed ElmahgoubNo ratings yet

- SESSION 6 - Chapter 14Document8 pagesSESSION 6 - Chapter 14Malefa TsoeneNo ratings yet

- 14 Various Topics in Management ServicesDocument6 pages14 Various Topics in Management Servicesrandomlungs121223No ratings yet

- Case 1 Prod HartDocument5 pagesCase 1 Prod Harteldo0% (1)

- Microeconomics Hubbard CH 11 AnswersDocument10 pagesMicroeconomics Hubbard CH 11 AnswersLeah LeeNo ratings yet

- Learning Curve Assgnm. Case StudyDocument4 pagesLearning Curve Assgnm. Case StudymaryamfarqNo ratings yet

- Lession 2Document44 pagesLession 2Yi WeiNo ratings yet

- Learning CurveDocument7 pagesLearning CurveSyed FaizanNo ratings yet

- Problem SolvingDocument2 pagesProblem SolvingGileah ZuasolaNo ratings yet

- Operation Caselet - 7 Auburn Machine CoDocument11 pagesOperation Caselet - 7 Auburn Machine CoArchana DaveNo ratings yet

- Final Case Analysis - CostconDocument7 pagesFinal Case Analysis - CostconDheine Maderazo100% (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Schedule for Sale: Workface Planning for Construction ProjectsFrom EverandSchedule for Sale: Workface Planning for Construction ProjectsRating: 4.5 out of 5 stars4.5/5 (2)

- Business Project Investment: Risk Assessment & Decision MakingFrom EverandBusiness Project Investment: Risk Assessment & Decision MakingNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Ray Dalio Consistently Deliver ReturnsDocument2 pagesRay Dalio Consistently Deliver ReturnsnabsNo ratings yet

- TERM PAPER On PRANDocument21 pagesTERM PAPER On PRANSmookers Heaven0% (1)

- Impossible TrinityDocument43 pagesImpossible TrinityArnab Kumar SahaNo ratings yet

- ECO724 Nigerian Financial SystemDocument187 pagesECO724 Nigerian Financial SystemTimi MarquisNo ratings yet

- Funding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionDocument10 pagesFunding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionBoboy AzanilNo ratings yet

- Error CorrectionDocument8 pagesError CorrectionCharlie Magne G. SantiaguelNo ratings yet

- IG Bloomberg CryptoebookDocument12 pagesIG Bloomberg CryptoebookTHAN HAN100% (1)

- Meero MCC 3.0: Team Winterfell Batch - MBA 2021-23Document5 pagesMeero MCC 3.0: Team Winterfell Batch - MBA 2021-23Raaqib KhanNo ratings yet

- Chapte R: Dividend TheoryDocument19 pagesChapte R: Dividend TheoryArunim MehrotraNo ratings yet

- Functional FibreDocument10 pagesFunctional Fibresofia NunesNo ratings yet

- Bill 2Document1 pageBill 2Naveen SelvaraajuNo ratings yet

- Thailand's Cosmetics and Beauty Products Industry: Opportunities For International BusinessDocument32 pagesThailand's Cosmetics and Beauty Products Industry: Opportunities For International BusinessBridge EstateNo ratings yet

- Supply Chain NetworkDocument41 pagesSupply Chain NetworkJanmejai BhargavaNo ratings yet

- Franco Modigliani and Merton Miller ThoeryDocument11 pagesFranco Modigliani and Merton Miller ThoeryS GNo ratings yet

- Designing and Managing Services: Learning ObjectivesDocument10 pagesDesigning and Managing Services: Learning Objectivestsega-alemNo ratings yet

- Problem Set 9Document2 pagesProblem Set 9nikhil gangwarNo ratings yet

- Presentation 5 - Valuation of Bonds and Shares (Final)Document21 pagesPresentation 5 - Valuation of Bonds and Shares (Final)sanjuladasanNo ratings yet

- The Cost of Capital: Chema C. PacionesDocument13 pagesThe Cost of Capital: Chema C. PacionesChema PacionesNo ratings yet

- Marketing Strategies of RAK Ceramics LimitedDocument20 pagesMarketing Strategies of RAK Ceramics LimitedMonsur Habib50% (2)

- Module 5 TaxationDocument22 pagesModule 5 TaxationEcinaj LeddaNo ratings yet

- CMS Level II - Monetary Transaction ProcessingDocument41 pagesCMS Level II - Monetary Transaction ProcessingvaradhanrgNo ratings yet

- SoftwareAG 2010 Annual Report Tcm16-84432Document162 pagesSoftwareAG 2010 Annual Report Tcm16-84432Rodrigo LuisNo ratings yet

- Fast Fasion Brand-Uniqlo: H&M vs. ZaraDocument4 pagesFast Fasion Brand-Uniqlo: H&M vs. ZaraHappyninjaytNo ratings yet

- Acfrogaavn1gx Bzyc E3dofd6mzeugia1eu61zhuyszmyu542nybwqnouwobj3nb6vvdmezdwpb9tnotax2bv Fr6pm6aukubjy6btn Njbe Wgv0wsf7f6jxcdldb3tsyochffx5gymgnna4Document10 pagesAcfrogaavn1gx Bzyc E3dofd6mzeugia1eu61zhuyszmyu542nybwqnouwobj3nb6vvdmezdwpb9tnotax2bv Fr6pm6aukubjy6btn Njbe Wgv0wsf7f6jxcdldb3tsyochffx5gymgnna4Alyssa Jane G. AlvarezNo ratings yet

- NSDLDocument11 pagesNSDLmanish7827No ratings yet

- FINS3666 Outline 2019Document6 pagesFINS3666 Outline 2019jake chudnowNo ratings yet

- GE105 - The Contemporary WorldDocument1 pageGE105 - The Contemporary WorldLynneth L. MaijinNo ratings yet

- Unit I SDMDocument76 pagesUnit I SDMChirag JainNo ratings yet

- Consulting Internship ProjectDocument7 pagesConsulting Internship ProjectEwaoluwaNo ratings yet

- Digital Marketing Plan For Real Estate BusinessDocument3 pagesDigital Marketing Plan For Real Estate BusinessSynergy Real Estate100% (2)