Professional Documents

Culture Documents

Contoh CV

Uploaded by

Yolla MirandaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contoh CV

Uploaded by

Yolla MirandaCopyright:

Available Formats

Awesome! Inc.

We are the brains behind utility infrastructure risk management.

Problem

Company Profile

Founded: Dec 2015 Describe the problem that you are addressing. Be precise, empiric and use actual data

Location: Berkeley CA if it supports your cause of proving the existence and importance of the problem.

Employees: 5

Industry: utility risk management Solution

Technology: artificial intelligence

Status: pre-revenue start-up Explain your product or service in an easy to understand way. Focus on how you are

going to solve the problem. Strictly avoid self praises here.

Team

Exma China, Co-Founder, CEO

Pioneer in AI, doctorate in computer

science, Stanford University

Rob Otto, Co-Founder, CTO

Ten years' robotics expert, doctorate in

mechanical engineering, MIT

MODEL DOG1.1 MODEL CAT0.5

Advisors

Alan Turing, Victoria University Market

Allen Newell, RAND Corporation

Give a short overview of the market, describing:1) your target customer – be as precise

as possible by using demographics and motivators and try to draw a detailed profile of

Partners

your typical users; 2) market size of your target market – a measurement of the total

SkyNet, WestWorld Entertainment volume of a given market in $; 3) market growth of your target market – has the market

been growing in the past years? Can further growth be expected? If yes, include this

Financial Information information as well.

Non-Dilutive: $1,000,000

Investments: $1,000,000 (Seed) Competitors

Monthly Burn: $75,000

Cash Balance: $250,000 (Dec 2016) No matter what business you are in, you certainly have a few competitors. Don’t try to

Seeking: $5,000,000 (Series A) cheat yourself or investors by denying your competition. Be transparent; list 3-5 main

competitors, including their strengths and weaknesses. A matrix is a decent way to

Financial Support display your competition by comparing your startup with your main competitors over

relevant variables.

Cyclotron Road

National Science Foundation

Company A Company B Company C Awesome!

ARPA-E

U.S. Department of Energy Metric A

RichGuy, LLC

Metric B

Additional Information Metric C

Lawyers: Jones Day

Accountants: Jameson Competitive Advantage

Contact What is your unique selling proposition? What makes your startup unique and

defensible? What is your secret sauce that makes you better than anyone else?

Dr. Ma China

Examples: Patents, One of a kind technology, Market leader status, Strong brand

iamachine@awesome.com

recognition, Huge community.

m: (666) 666-6666

© Awesome! Inc. December 2016 www.awesome.com

Contact

Business Model

Dr. Ma China

State how you are going to earn money: subscription fees, commission on sales, etc. iamachine@awesome.com

What are your channels of distribution, how big is your gross margin? If you are pre- m: (666) 666-6666

revenue and unsure about monetization, state likely sources, price ranges and data

from market surveys or customer interviews. Depending on the business model,

include important key performance indicators (KPIs) to better understand your business

model and enable the investor to benchmark your case with other comparable startups.

Examples for KPIs to include in this section can be: gross margins, account sizes,

sales cycles, repurchase rate, and customer lifetime value.

Customer Traction

Engagements with potential customers. What potential customers say about your

product--quotation. Note any joint development agreements, material transfer

agreements, purchase orders, etc.

Key Milestones

Past and future proof that you can deliver. Examples: Secure government grant,

Launch lab prototype, Close seed round, Close deal with company X.

2015 2016 2017 2018

Technology

Milestone 1

Funding

Team Milestone 2

Business

Funding

Complete this section is only if you are raising money. Address the following: How

much money are you trying to raise and how are you planning to use it? Try to be as

explicit as possible to show the investor that you have a well-elaborated plan on how

you are actually going to use the money. It has proven to better use numbers rounded

to the thousand (e.g. $ 123,000) than numbers rounded to the hundred thousands (e.g.

$ 100,000). Although a lot of startups do, we don’t recommend to mention the valuation

in the one-pager as this number is likely going to change during the fundraising

process and can also vary among different investors. You don’t want to change this

section all the time and leave the investor curious to come back at you when he is

interested and wants to know your “price”.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- TJ No.101Document1 pageTJ No.101Yolla MirandaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Price List Template 3 ColumnsDocument3 pagesPrice List Template 3 ColumnsYolla MirandaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Quotation - Yolla For PieceDocument6 pagesQuotation - Yolla For PieceYolla MirandaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- YnihDocument1 pageYnihYolla MirandaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Report Subtitle: Name - Course Title - DateDocument2 pagesReport Subtitle: Name - Course Title - DateYolla MirandaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- DesainDocument1 pageDesainYolla MirandaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Creative REsume by MomoDocument1 pageCreative REsume by Momoluis.miguel.medidaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Pymetrics-All Traits ScreeningDocument4 pagesPymetrics-All Traits ScreeningYolla MirandaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Xiaopan OS: DescriptionDocument1 pageXiaopan OS: DescriptionMan SavliNo ratings yet

- Selling AIESEC To Your TargetsDocument7 pagesSelling AIESEC To Your TargetspijoowiseNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Utah Vaccine AdministrationDocument1 pageUtah Vaccine AdministrationOffice of Utah Gov. Spencer J. CoxNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

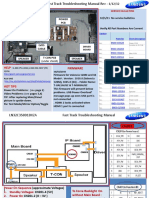

- Samsung LN55C610N1FXZA Fast Track Guide (SM)Document4 pagesSamsung LN55C610N1FXZA Fast Track Guide (SM)Carlos OdilonNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CV - en - Hamdaoui Mohamed AmineDocument2 pagesCV - en - Hamdaoui Mohamed AmineHAMDAOUI Mohamed Amine100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Glorious Mysteries 1Document5 pagesGlorious Mysteries 1Vincent safariNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Project Report - Performance Anaylysis of Mutual Funds in IndiaDocument52 pagesProject Report - Performance Anaylysis of Mutual Funds in Indiapankaj100% (1)

- Shaira Narrative Report (Final)Document7 pagesShaira Narrative Report (Final)Sheryll TamangNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Irjet V3i7146 PDFDocument6 pagesIrjet V3i7146 PDFatulnarkhede2002No ratings yet

- CH 6 Answers (All) PDFDocument29 pagesCH 6 Answers (All) PDFAhmed SideegNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Entropy (Information Theory)Document17 pagesEntropy (Information Theory)joseph676No ratings yet

- 2010 DOE FEMP Exterior Lighting GuideDocument38 pages2010 DOE FEMP Exterior Lighting GuideMoideen Thashreef100% (1)

- 1.4 BG00381946 - ADocument1 page1.4 BG00381946 - AAnand KesarkarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- E650E650M-17 Guía Estándar para El Montaje de Sensores Piezoeléctricos de Emisión Acústica1Document4 pagesE650E650M-17 Guía Estándar para El Montaje de Sensores Piezoeléctricos de Emisión Acústica1fredy lopezNo ratings yet

- Working With Hierarchies External V08Document9 pagesWorking With Hierarchies External V08Devesh ChangoiwalaNo ratings yet

- Organization of Production: Test IiDocument7 pagesOrganization of Production: Test IiKamarul NizamNo ratings yet

- THE FIELD SURVEY PARTY ReportDocument3 pagesTHE FIELD SURVEY PARTY ReportMacario estarjerasNo ratings yet

- Sheiko 13week Beginner ProgramDocument16 pagesSheiko 13week Beginner ProgramAnders DahlNo ratings yet

- Application List: Required Items: A: Cpu-95 Ignition ModuleDocument12 pagesApplication List: Required Items: A: Cpu-95 Ignition ModuleShubra DebNo ratings yet

- 实用多元统计分析Document611 pages实用多元统计分析foo-hoat LimNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Register A Custom Table in Apps SchemaDocument5 pagesRegister A Custom Table in Apps SchemaIapps ErpSolutionsNo ratings yet

- Unit 2: TransducerDocument24 pagesUnit 2: TransducerROYAL GAMER YTNo ratings yet

- Rapid History Taking: 1. Patient ProfileDocument3 pagesRapid History Taking: 1. Patient ProfileTunio UsamaNo ratings yet

- Q4L6 Properties of KiteDocument8 pagesQ4L6 Properties of KiteAltheus Miguel Dela CruzNo ratings yet

- Nur Syamimi - Noor Nasruddin - Presentation - 1002 - 1010 - 1024Document14 pagesNur Syamimi - Noor Nasruddin - Presentation - 1002 - 1010 - 1024abdulhasnalNo ratings yet

- Accomplishment Report Filipino Values MonthDocument4 pagesAccomplishment Report Filipino Values MonthIan Santos B. Salinas100% (10)

- Education and Its LegitimacyDocument4 pagesEducation and Its LegitimacySheila G. Dolipas100% (6)

- BasicCalculus12 Q3 Ver4 Mod3 The Derivatives V4Document34 pagesBasicCalculus12 Q3 Ver4 Mod3 The Derivatives V4karren100% (1)

- Method For Determination of Iron Folic Acid & Vitamin B12 in FRK - 07.11.2023Document17 pagesMethod For Determination of Iron Folic Acid & Vitamin B12 in FRK - 07.11.2023jonesbennetteNo ratings yet

- Nail Malformation Grade 8Document30 pagesNail Malformation Grade 8marbong coytopNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)