Professional Documents

Culture Documents

Slab Rates

Uploaded by

jayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Slab Rates

Uploaded by

jayCopyright:

Available Formats

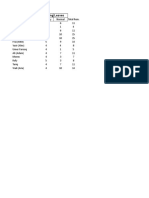

New Income Tax Slabs for FY 2019-20

S.

Taxable Income Rate of Tax

No

(1) (2) (3)

1. Where the taxable income does not exceed Rs. 600,000 0%

Where the taxable income exceeds Rs. 600,000 but does not

2. 5% of the amount exceeding Rs. 600,000

exceed Rs. 1,200,000

Where taxable income exceeds Rs. 1,200,000 but does not Rs. 30,000 plus 10% of the amount exceeding

3.

exceed Rs. 1,800,000 Rs. 1,200,000

Where taxable income exceeds Rs. 1,800,000 but does not Rs. 90,000 plus 15% of the amount exceeding

4.

exceed Rs. 2,500,000 Rs. 1,800,000

Where taxable income exceeds Rs. 2,500,000 but does not Rs. 195,000 plus 17.5% of the amount

5.

exceed Rs. 3,500,000 exceeding Rs. 2,500,000

Where the taxable income exceeds Rs. 3,500,000 but does Rs. 370,000 plus 20% of the amount

6.

not exceed Rs. 5,000,000 exceeding Rs. 3,500,000

Where the taxable income exceeds Rs. 5,000,000 but does Rs. 670,000 plus 22.5% of the amount

7.

not exceed Rs. 8,000,000 exceeding Rs. 5,000,000

Where the taxable income exceeds Rs. 8,000,000 but does Rs. 1,345,000 plus 25% of the amount

8.

not exceed Rs. 12,000,000 exceeding Rs. 8,000,000

Where taxable income exceeds Rs. 12,000,000 but does not Rs. 2,345,000 plus 27.5% of the amount

9.

exceed Rs.30,000,000 exceeding Rs. 12,000,000

Where the taxable income exceeds Rs. 30,000,000 but does Rs. 7,295,000 plus 30% of the amount

10.

not exceed Rs.50,000,000 exceeding Rs. 30,000,000

Where taxable income exceeds Rs. 50,000,000 but does not Rs.13,295,000 plus 32.5% of the amount

11.

exceed Rs.75,000,000 exceeding Rs. 50,000,000

Rs. 21,420,000 plus 35% of the amount

12. Where taxable income exceeds Rs.75,000,000

exceeding Rs. 75,000,000

You might also like

- Review ReplyDocument2 pagesReview ReplyjayNo ratings yet

- Best Regards,: Accounts & Finance ExecutiveDocument1 pageBest Regards,: Accounts & Finance ExecutivejayNo ratings yet

- Job Description: Job Roles and ResponsibilitiesDocument2 pagesJob Description: Job Roles and ResponsibilitiesjayNo ratings yet

- Mr. Colonel Javed,: Ref: 25hr102019/a2Document1 pageMr. Colonel Javed,: Ref: 25hr102019/a2jayNo ratings yet

- Lost Item Value: Deal Well Technology (HK) Company LimitedDocument1 pageLost Item Value: Deal Well Technology (HK) Company LimitedjayNo ratings yet

- Seller / OverviewDocument2 pagesSeller / OverviewjayNo ratings yet

- Fini 619 Allied Bank Internship ReportDocument47 pagesFini 619 Allied Bank Internship ReportJaved IqbalNo ratings yet

- PTCL DecDocument1 pagePTCL DecjayNo ratings yet

- Slab RatesDocument1 pageSlab RatesjayNo ratings yet

- TermDocument2 pagesTermjayNo ratings yet

- Slab RatesDocument1 pageSlab RatesjayNo ratings yet

- Financial Highlights 2018Document2 pagesFinancial Highlights 2018jayNo ratings yet

- LeavesDocument1 pageLeavesjayNo ratings yet

- Spell NoDocument3 pagesSpell NodeyprasenNo ratings yet

- Financial Highlights 2018Document2 pagesFinancial Highlights 2018jayNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSubhendu NathNo ratings yet

- 100 % Stamp Duty Exemption GRDocument3 pages100 % Stamp Duty Exemption GRRadheShyamNo ratings yet

- EAG 036 Financial Managment Cash Vs Accrual AccountingDocument4 pagesEAG 036 Financial Managment Cash Vs Accrual AccountingMICHAEL USTARENo ratings yet

- CEO CompensationDocument27 pagesCEO CompensationmummimNo ratings yet

- General Information About-ExportDocument52 pagesGeneral Information About-Exportcarlos.vinklerNo ratings yet

- 2021 RAILBOTIC SYSTEMS, InC Form 1120 Corporations Tax Return - FilingDocument29 pages2021 RAILBOTIC SYSTEMS, InC Form 1120 Corporations Tax Return - FilingMoises DiazNo ratings yet

- Introduction To Accounting: StructureDocument418 pagesIntroduction To Accounting: StructureRashadNo ratings yet

- Clearing CS-EXECUTIVE Exams - Strategies and Plots - CAclubindiaDocument3 pagesClearing CS-EXECUTIVE Exams - Strategies and Plots - CAclubindiagoodygood1No ratings yet

- Philex Mining V CIRDocument7 pagesPhilex Mining V CIRJeunaj LardizabalNo ratings yet

- Company ProfileDocument19 pagesCompany ProfileDiana CitraNo ratings yet

- Start and Run A Successful Beauty Salon - A Comprehensive Guide To Managing or Acquiring Your Own SalonDocument273 pagesStart and Run A Successful Beauty Salon - A Comprehensive Guide To Managing or Acquiring Your Own Salondeepankar100% (4)

- Recent Public Financial Management Publications and Other ResourcesDocument16 pagesRecent Public Financial Management Publications and Other ResourcesInternational Consortium on Governmental Financial ManagementNo ratings yet

- Tally Accounting Book by Ca MD ImranDocument6 pagesTally Accounting Book by Ca MD ImranMd ImranNo ratings yet

- Test 1 Tax 667 - Mac 2019Document4 pagesTest 1 Tax 667 - Mac 2019Fakhrul Haziq Md FarisNo ratings yet

- Profit and Gain of Business ProfessionDocument21 pagesProfit and Gain of Business ProfessionSamar GautamNo ratings yet

- Topic 2Document51 pagesTopic 2rahulkushwahacnbNo ratings yet

- Yes We Can, But WHV We Cannot ?" & How We Can ? Written by Nanubhai NaikDocument151 pagesYes We Can, But WHV We Cannot ?" & How We Can ? Written by Nanubhai NaikNanubhaiNaikNo ratings yet

- Internal Generated Revenue and Economic Development: A Study of Akwa Ibom StateDocument85 pagesInternal Generated Revenue and Economic Development: A Study of Akwa Ibom Statevictor wizvikNo ratings yet

- Allahabad University B.com SyllabusDocument45 pagesAllahabad University B.com SyllabusRowdy RahulNo ratings yet

- A1402754455 - 24966 - 24 - 2021 - ECO113 CA 2 TopicsDocument11 pagesA1402754455 - 24966 - 24 - 2021 - ECO113 CA 2 TopicsKathuria AmanNo ratings yet

- Marcia Brady Tucker and Estate of Carll Tucker, Deceased, Marcia Brady Tucker, Carll Tucker, JR., and Luther Tucker, Executors v. Commissioner of Internal Revenue, 322 F.2d 86, 2d Cir. (1963)Document5 pagesMarcia Brady Tucker and Estate of Carll Tucker, Deceased, Marcia Brady Tucker, Carll Tucker, JR., and Luther Tucker, Executors v. Commissioner of Internal Revenue, 322 F.2d 86, 2d Cir. (1963)Scribd Government DocsNo ratings yet

- 200 SAP SD Interview Questions and AnswersDocument16 pages200 SAP SD Interview Questions and Answersestivali10No ratings yet

- 1 CT Unit 1 CSSDocument96 pages1 CT Unit 1 CSSKiran AnvattiNo ratings yet

- General Education 7.4Document6 pagesGeneral Education 7.4Zhtem CruzadaNo ratings yet

- Cir Vs Boac DigestDocument1 pageCir Vs Boac DigestkarlonovNo ratings yet

- Fullpaper-Dr Jason NG Wei JianDocument16 pagesFullpaper-Dr Jason NG Wei JianfarishasbiNo ratings yet

- Ambani Organics Limited Annual Report 2017-2018Document83 pagesAmbani Organics Limited Annual Report 2017-2018shark123No ratings yet

- Construction Linked Payment PlansDocument2 pagesConstruction Linked Payment PlansSushil AroraNo ratings yet

- Hotel Master Critical PathDocument14 pagesHotel Master Critical Pathtaola80% (25)

- Declaratory Relief On The Validity of BIR RMC No. 65-2012Document25 pagesDeclaratory Relief On The Validity of BIR RMC No. 65-2012CJNo ratings yet