Professional Documents

Culture Documents

1

Uploaded by

LalalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

LalalaCopyright:

Available Formats

Ex.

225

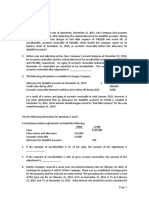

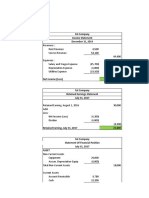

Coffeldt Sign Company uses the allowance method in accounting for uncollectible

accounts. Past experience indicates that 1% of net credit sales will eventually be

uncollectible. Selected account balances at December 31, 2013, and December 31,

2014, appear below:

12/31/13 12/31/14

Net Credit Sales $400,000 $450,000

Accounts Receivable 75,000 100,000

Allowance for Doubtful Accounts 5,000 ?

Instructions

(a) Record the following events in 2014.

Aug. 10 Determined that the account of Sue Lang for $1,000 is

uncollectible.

Sept. 12 Determined that the account of Tom Woods for $4,000 is

uncollectible.

Oct. 10 Received a check for $550 as payment on account from Sue

Lang, whose account had previously been written off as

uncollectible. She indicated the remainder of her account would be

paid in November.

Nov. 1 Loaned $30,000 cash to Linda Waters on a 1-year, 8% note.

Nov. 15 Received a check for $450 from Sue Lang as payment on her

account.

(b) Prepare the adjusting journal entry for the year ended December 31, 2014.

(c) What is the balance of Allowance for Doubtful Accounts at December 31, 2014?

(d) Prepare the journal entry to record the receiving of Linda Loan on Nov. 1, 2015?

You might also like

- Problems Chapter 7 PDFDocument9 pagesProblems Chapter 7 PDFCa AdaNo ratings yet

- Building Wealth on a Dime: Finding your Financial FreedomFrom EverandBuilding Wealth on a Dime: Finding your Financial FreedomNo ratings yet

- 0254J TP5 P8 R2Document3 pages0254J TP5 P8 R2meyulia100% (1)

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Universitas Advent Indonesia: N Final Exam: Intermediate Accounting 1Document2 pagesUniversitas Advent Indonesia: N Final Exam: Intermediate Accounting 1Nicolas ErnestoNo ratings yet

- Review CH 08Document7 pagesReview CH 08Martin Putra100% (1)

- Review CH 08Document7 pagesReview CH 08Lalala100% (1)

- (Ap) 07 - ReceivablesDocument4 pages(Ap) 07 - ReceivablesCykee Hanna Quizo LumongsodNo ratings yet

- Sullivan Equipment Sales Showed The Following 2014 Jan 15 Sold 25 000 ofDocument1 pageSullivan Equipment Sales Showed The Following 2014 Jan 15 Sold 25 000 ofTaimur TechnologistNo ratings yet

- Easy Round-APDocument69 pagesEasy Round-APDaneen GastarNo ratings yet

- Accounting For ReceivablesDocument4 pagesAccounting For ReceivablesMega Pop Locker50% (2)

- 3int - 2005 - Dec - QUS CAT T3Document10 pages3int - 2005 - Dec - QUS CAT T3asad19No ratings yet

- BA 114.1 - Module2 - Receivables - Exercise 1 PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Exercise 1 PDFKurt Orfanel0% (1)

- On December 1 2015 Fullerton Company Had The Account BalancesDocument2 pagesOn December 1 2015 Fullerton Company Had The Account BalancesAmit PandeyNo ratings yet

- Self-Test 1Document8 pagesSelf-Test 1Dymphna Ann CalumpianoNo ratings yet

- Week 2 Team AssignmentDocument10 pagesWeek 2 Team AssignmentMichelle J UrbodaNo ratings yet

- 8.2 Valuing Accounts ReceivableDocument3 pages8.2 Valuing Accounts ReceivableDaniel RhetNo ratings yet

- Chapter 9 Exercises Acc101Document7 pagesChapter 9 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- Recitation #8Document3 pagesRecitation #8wtfNo ratings yet

- Cash, Receivables, Inventory Remedial QuizDocument8 pagesCash, Receivables, Inventory Remedial QuizHaydz AntonioNo ratings yet

- Ar Ada NR - 223Document4 pagesAr Ada NR - 223Maliha KansiNo ratings yet

- Audit of ReceivableDocument4 pagesAudit of ReceivableMark Lord Morales Bumagat100% (2)

- AssignmentDocument8 pagesAssignmentNitesh AgrawalNo ratings yet

- 19 - Account Receivables and Bad DebtDocument47 pages19 - Account Receivables and Bad DebtMarissaCanadyNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2004 1 HourDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2004 1 HourSerenaNo ratings yet

- Bad Debts & Provision For Doubtful DebtsDocument37 pagesBad Debts & Provision For Doubtful DebtsSteven RaintungNo ratings yet

- ACCT 201: Reporting and Analyzing ReceivablesDocument23 pagesACCT 201: Reporting and Analyzing ReceivablesDuygu YılmazNo ratings yet

- Rcvbls ProblemsDocument6 pagesRcvbls ProblemsJerric CristobalNo ratings yet

- On November 1 2015 The Account Balances of Schilling EquipmentDocument1 pageOn November 1 2015 The Account Balances of Schilling EquipmentAmit PandeyNo ratings yet

- Chapter 7 - Accounting For ReceivablesDocument53 pagesChapter 7 - Accounting For ReceivablesJes ReelNo ratings yet

- Accounts Receivable - Quiz FTFDocument8 pagesAccounts Receivable - Quiz FTFAcads PurpsNo ratings yet

- Lecture 4 & 5Document2 pagesLecture 4 & 5Marwan DawoodNo ratings yet

- Handout 7.studentDocument6 pagesHandout 7.studentVikrant KapoorNo ratings yet

- Chapters 4 and 5 The LedgerDocument14 pagesChapters 4 and 5 The LedgerSneha DasNo ratings yet

- Ose Pa1Document17 pagesOse Pa1gladys manaliliNo ratings yet

- AccountingPrinciples Group08Document12 pagesAccountingPrinciples Group08Truong Ngoc Tho B2206548No ratings yet

- TUTORIAL CHAPTER 5 - Bad and Doubtful DebtsDocument3 pagesTUTORIAL CHAPTER 5 - Bad and Doubtful DebtsShowenah ThiruNo ratings yet

- ACC 2103 Practise QuestionsDocument7 pagesACC 2103 Practise Questionsfalnuaimi001No ratings yet

- At December 31 2014 The Trial Balance of Sloane Company: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt December 31 2014 The Trial Balance of Sloane Company: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Lesson 7.6 - AJE Bad DebtsDocument31 pagesLesson 7.6 - AJE Bad DebtsYra Dominique ChuaNo ratings yet

- Receivables Study Guide Solutions Fill-in-the-Blank EquationsDocument19 pagesReceivables Study Guide Solutions Fill-in-the-Blank EquationsPelin CanikliNo ratings yet

- Irrecoverable Debts and Provision For Doubtful Debts QuestionsDocument5 pagesIrrecoverable Debts and Provision For Doubtful Debts Questions1932godfreyNo ratings yet

- Accounts Receivable q2Document4 pagesAccounts Receivable q2Omnia Hassan100% (1)

- Unit 2 - Cash and Cash EquivalentsDocument8 pagesUnit 2 - Cash and Cash EquivalentsJeremy Jess ArizabalNo ratings yet

- Chapter 9 ExercisesDocument4 pagesChapter 9 ExercisesChu Thị ThủyNo ratings yet

- 110 WarmupDay1Document25 pages110 WarmupDay1shiieeNo ratings yet

- BA3 Mock Exam 01 - PILOT PAPER Nov 2020Document8 pagesBA3 Mock Exam 01 - PILOT PAPER Nov 2020Sanjeev JayaratnaNo ratings yet

- 123Document18 pages123Andrin LlemosNo ratings yet

- Financial Accounting Online Course - Final Exam 1 - Answer KeyDocument5 pagesFinancial Accounting Online Course - Final Exam 1 - Answer Keyvarun02208438% (8)

- Audit Problems CashDocument18 pagesAudit Problems CashLuis David Manipol50% (4)

- QuizletDocument4 pagesQuizletKizzea Bianca GadotNo ratings yet

- Survey of Accounting 4Th Edition Edmonds Test Bank Full Chapter PDFDocument77 pagesSurvey of Accounting 4Th Edition Edmonds Test Bank Full Chapter PDFzanewilliamhzkbr100% (9)

- Account Receivable Notes Receivable Revenue: Magister Akuntansi Stie SwadayaDocument13 pagesAccount Receivable Notes Receivable Revenue: Magister Akuntansi Stie SwadayabraiNo ratings yet

- 0452 s20 QP 11 PDFDocument12 pages0452 s20 QP 11 PDFHan Thi Win KoNo ratings yet

- At December 31 2014 The Trial Balance of Valcik Company: Unlock Answers Here Solutiondone - OnlineDocument1 pageAt December 31 2014 The Trial Balance of Valcik Company: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Cpa Review School - Prac 1Document12 pagesCpa Review School - Prac 1jikee1150% (2)

- FINACC-Homework Exercise 2Document3 pagesFINACC-Homework Exercise 2Jomel BaptistaNo ratings yet

- Akuntansi DesiDocument2 pagesAkuntansi DesiLalalaNo ratings yet

- Chapter 17Document42 pagesChapter 17hussam100% (2)

- Review CH 08Document7 pagesReview CH 08Lalala100% (1)

- 1Document1 page1LalalaNo ratings yet

- Final ReviewDocument53 pagesFinal ReviewLalalaNo ratings yet

- Chapter 17Document42 pagesChapter 17hussam100% (2)

- I Need You BooDocument1 pageI Need You BooLalalaNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)