Professional Documents

Culture Documents

Problem No

Problem No

Uploaded by

Kiel SorrosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem No

Problem No

Uploaded by

Kiel SorrosaCopyright:

Available Formats

PROBLEM NO.

1A t i m on a n C o r p o r a t i o n i s s e l l i n g a u d i o a n d v i d e o

a p p l i a nc e s . Thecompany’ s fiscal year ends on March 31. The

following informationrelates to the obligations of the company as of March 31,

2006:Notes payableAtimonan has signed several long-term notes with

financial institutions.The maturities of these notes are given below. The

total unpaid interestfor all of these notes amounts to P408,000 on March 31,

2006.Due dateAmountApril 31, 2006P 720,000July 31,

20061,080,000September 1, 2006540,000February 1, 2007540,000April 1,

2007 – March 31, 20083,240,000P 6,120,000Estimated warrantiesAtimonan

has a one-year product warranty on some selected items. Theestimated

warranty liability on sales made during the 2004 – 2005 fiscalyear and still

outstanding as of March 31, 2005, amounted to P302,400.The warranty

costs on sales made from April 1, 2005 to March 31, 2006,are estimated at

P756,000. The actual warranty costs incurred during2005 – 2006 fiscal

year are as follows:Warranty claims honored on 2004 – 2005 salesP

302,400Warranty claims honored on 2005 – 2006 sales342,000TotalP

644,400Trade payablesAccounts payable for supplies, goods, and services

purchases on openaccount amount to P672,000 as of March 31,

2006.DividendsOn Ma rc h 1 0 , 2 0 0 6 , A t i mona n’ s b oard o f d i re c t ors

d e c l a re d a c a sh dividend of P0.30 per common share and a 10% common

stock dividend.B oth d i vi d e nd s w e re t o b e d i st ri b ut e d o n A p ri l 5 ,

2 0 0 6 t o c ommon stockholders on record at the close of business on March

31, 2006. As ofMarch 31, 2006, Atimonan has 6 million, P2 par value,

common sharesissued and outstanding.191

Bonds payableAtimonan issued P6,000,000, 12% bonds, on October 1, 2000

at 96. Thebonds will mature on October 1, 2010. Interest is paid semi-

annually onO c t o b e r 1 a n d A p r i l 1 . Atimonan uses the straight line

method toamortize bond discount.QUESTIONS:Based on the foregoing

information, determine the adjusted balances ofthe following as of March 31,

2006:1.Estimated warranty payablea. P414,000c. P 302,400b. P756,000d.

P1,058,4002.Unamortized bond discount3.Bond interest payablea. P360,000c.

P180,000b. P300,000d. P 04.Total current liabilities5.Total noncurrent liabilitiesa.

P9,240,000c. P9,108,000b. P9,132,000d. P9,000,000Suggested

Solution:Question No. 1Warranty payable, 3/31/05P302,400Add warranty

expense accrued during 2005-2006756,000Total1,058,400Less payments

during 2005-2006644,400Warranty payable, 3/31/06P 414,000192

Question No. 2Bond discount, 10/1/00 (P6,000,000 x .04)P240,000Discount

amortization, 10/1/00 to 3/31/06 (P240,000 x 5.5/10)132,000Bond discount,

3/31/06P 108,000Question No. 3Bond interest payable, 10/1/05 to 3/31/06

(P6,000,000 x 12% x 6/12)P 360,000Question No. 4Notes payable - current

(maturing up to 3/31/07)P2,880,000Accrued interest payable – Notes

payable408,000Estimated warranty payable (see no. 1) 414,000Accounts

payable672,000Cash dividends payable (6 million shares x

P0.30)1,800,000Accrued interest payable – Bonds payable360,000Total current

liabilitiesP6,534,000Question No. 5Notes payable –

noncurrentP3,240,000Bonds payable, net of discount of

P108,0005,892,000Total noncurrent liabilitiesP 9,132,000Answers: 1) A; 2) B; 3)

A; 4) C, 5) B

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

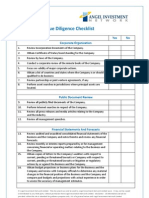

- Due Diligence ChecklistDocument10 pagesDue Diligence ChecklistVikasdeep SharmaNo ratings yet

- Assignment Network and SecurityDocument4 pagesAssignment Network and SecurityTryson SikanyikaNo ratings yet

- Mock Exam 2Document12 pagesMock Exam 2Lupao Nueva EcijaNo ratings yet

- BFC 5175 Management Accounting NotesDocument94 pagesBFC 5175 Management Accounting NotescyrusNo ratings yet

- MA REV 2 - Midterm Exam Wit Ans KeyDocument14 pagesMA REV 2 - Midterm Exam Wit Ans Keylouise carinoNo ratings yet

- Ten Top IELTS Writing Tips-DC IELTSDocument15 pagesTen Top IELTS Writing Tips-DC IELTSzacrias100% (4)

- Travel BlogsDocument14 pagesTravel BlogsEliasNo ratings yet

- US Botanical Gardens Greenhouse Manual PDFDocument76 pagesUS Botanical Gardens Greenhouse Manual PDFLinda Mirelez-Huca100% (1)

- HIIT - Google SearchDocument1 pageHIIT - Google Searchpj villadolidNo ratings yet

- Shape Poems - ReadWriteThinkDocument3 pagesShape Poems - ReadWriteThinkJeanie Rogers-StreetNo ratings yet

- Registration Certificate of Real Estate Agent Form HDocument2 pagesRegistration Certificate of Real Estate Agent Form HPratiiek MorNo ratings yet

- SDL Trados Studio 2009 - Keyboard Shortcuts Editor MenuDocument2 pagesSDL Trados Studio 2009 - Keyboard Shortcuts Editor MenuEugenio Andres HolmesNo ratings yet

- Gravity Type Davit Shiptest Program 重力式吊艇架系泊试验大纲Document3 pagesGravity Type Davit Shiptest Program 重力式吊艇架系泊试验大纲Ivan MaltsevNo ratings yet

- Kat2eng PDFDocument84 pagesKat2eng PDFABELWALIDNo ratings yet

- Reflex Sympathetic Dystrophy, CRPS-1Document47 pagesReflex Sympathetic Dystrophy, CRPS-1Sayantika Dhar100% (1)

- Fabrication of Hydraulic Scissor Lift: February 2020Document10 pagesFabrication of Hydraulic Scissor Lift: February 2020atashi baran mohantyNo ratings yet

- Electronics Q4 Module2Document21 pagesElectronics Q4 Module2Herbert RodriguezNo ratings yet

- Trade Test Prep PlumbingDocument2 pagesTrade Test Prep PlumbingChikondi KanamaNo ratings yet

- Concrete Mix Design As Per Indian Standard CodeDocument4 pagesConcrete Mix Design As Per Indian Standard CodesemakambaNo ratings yet

- Histology - Nerve Tissue and The Nervous SystemDocument21 pagesHistology - Nerve Tissue and The Nervous SystemDan UvarovNo ratings yet

- SCHX1014 - Chemical Engineering Thermodynamics - Unit 3Document17 pagesSCHX1014 - Chemical Engineering Thermodynamics - Unit 3Shanmuga PriyaNo ratings yet

- Offering Letter Aston BNR Bogor Hotel 2024Document3 pagesOffering Letter Aston BNR Bogor Hotel 2024rc.simbaraNo ratings yet

- Long Test 5Document14 pagesLong Test 5MudassiraNo ratings yet

- Eligibility CriteriaDocument13 pagesEligibility CriteriaArnab SahaNo ratings yet

- Economics - BECC 131 EnglishDocument5 pagesEconomics - BECC 131 Englishtusarpanda666No ratings yet

- 9 M Carrying Out Animal Husbandry Practice and Farm ManagementDocument127 pages9 M Carrying Out Animal Husbandry Practice and Farm ManagementEndash HaileNo ratings yet

- Security Dowans High Court LondonDocument3 pagesSecurity Dowans High Court LondonSarah HermitageNo ratings yet

- (Aptitude) Percentage - Percentage To Fraction & Fraction To Percentage Conversion - RAVI MOHAN MISHRADocument1 page(Aptitude) Percentage - Percentage To Fraction & Fraction To Percentage Conversion - RAVI MOHAN MISHRAPeterGomesNo ratings yet

- Spaces One Liners in The BodyDocument16 pagesSpaces One Liners in The BodyRatan YadavNo ratings yet

- Audit of Chicago FAA SecurityDocument2 pagesAudit of Chicago FAA SecuritycraignewmanNo ratings yet