Professional Documents

Culture Documents

5 6156738380756418780

Uploaded by

Kalpesh ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 6156738380756418780

Uploaded by

Kalpesh ShahCopyright:

Available Formats

VISIT NOTE

SHEELA FOAM

Navigating the current scenario

India Equity Research| Miscellaneous

In our conversations, Mr. Rahul Gautam, CMD, Sheela Foam (SFL) EDELWEISS RATINGS

highlighted: 1) the recently launched budget brand Starlite’s Absolute Rating BUY

performance remains robust. Going forward, SFL is planning to shift this Investment Characteristics Growth

brand’s distribution away from Sleepwell’s EBOs & primarily focus on

MBOs; 2) premium Sleepwell brand, akin to other discretionary

categories, has been impacted by the general slowdown; and 3) MARKET DATA (R: NA , B: SFL IN)

management perceives huge growth potential for Interplasp as its CMP : INR 1,250

current share is mere ~1% of the European Union—world’s largest Target Price : INR 1,489

polyurethane foam (PU) market. Factoring in management’s cautious 52-week range (INR) : 1,660 / 1,073

outlook, we revise down FY20E revenue/EBITDA 3/6%. However, the Share in issue (mn) : 48.8

lower tax rate leads to 3% YoY upwards revision in PAT. Maintain ‘BUY’ M cap (INR bn/USD mn) : 61 / 0

with revised TP of INR1,489 (INR1,456 earlier). Avg. Daily Vol. BSE/NSE (‘000) : 16.0

Starlite gaining heft; Slowdown pangs in Sleepwell SHARE HOLDING PATTERN (%)

Akin to other discretionary categories, SFL has also been impacted by the recent Current Q1FY20 Q4FY19

Promoters * 44.0 44.0 44.0

slowdown. The company’s premium Sleepwell brand has been especially impacted,

MF's, FI's & BKs 6.0 5.7 5.8

which management attributes to the product being an ultra discretionary item.

FII's 11.5 11.4 11.5

However, SFL has continued with its strategy of raising prices and recently hiked it 3%

Others 38.5 38.8 38.7

as it believes such a marginal hike is unlikely to dent demand further. On the positive

* Promoters pledged shares : NIL

side, Starlite continues to remain strong, possibly due to down trending underway in (% of share in issue)

the current scenario. Going forward, management is planning to not stock Starlite in

Sleepwell stores and distribute it separately, mainly via MBO’s. PRICE PERFORMANCE (%)

BSE Midcap Stock over

Stock

Huge growth potential for Interplasp in EU market Index Index

Joyce Foam, SFL’s Australian foam subsidiary, commands ~30-35% of the Australian 1 month 2.1 16.4 14.3

market and has become a mature business. However, management perceives huge 3 months (4.4) 17.5 21.9

growth potential for Interplasp as it currently has mere ~1% market share in the 12 months (4.2) 89.6 93.8

European Union—world’s largest polyurethane foam market. SFL believes

management focus can help drive growth in Interplasp. In addition, Morocco and

North Africa also remain potential growth drivers.

Outlook and valuation: Tax benefit mitigates impact; maintain ‘BUY’

Though margin levers exist, adjusting for the muted outlook in the mattress business

we revise down FY20E revenue/EBITDA 3/6%%. However, adjusting for the lower tax

rate, we revise PAT up by 3%. We value the standalone business at 40x September

2020E EPS and subsidiaries at 13x September 2020E EPS with revised TP of INR1,489.

Financials

Year to March FY18 FY19 FY20E FY21E

Net revenues (INR mn) 19,653 21,414 23,623 27,490

Revenue growth (%) 13.4 9.0 10.3 16.4 Nihal Mahesh Jham

EBITDA (INR mn) 2,163 2,095 2,890 3,430 +91 22 6623 3352

Adj. profit (INR mn) 1,337 1,337 1,933 2,218 nihal.jham@edelweissfin.com

RoACE (%) 34.6 28.3 29.7 26.9

Diluted P/E (x) 44.7 44.7 30.9 26.9 October 18, 2019

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset. Edelweiss Securities Limited

Miscellaneous

Chart 1: Revenue growth has moderated since Q2FY19

30.0

Standalone revenue growth

24.0

18.0

(%)

12.0

6.0

0.0

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Q4FY19

Q1FY20

Q4FY17

Q2FY19

Q3FY19

Source: Company, Edelweiss research

Starlite launch unleashes massive new market

While organised players are targeting the mid (INR8,000–30,000) to premium (INR30,000–

75,000) categories, a huge market lies in economy and unorganised segments (<INR8,000).

This market has not been explored hitherto because of lack of required distribution reach

and, more importantly, the challenge of rolling out a profitable product given the low price

range. However, since the introduction of GST, bulk of the price differential issue has been

addressed as the unorganised category is now expected to start paying taxes. As per our

analysis, this will open up a market more than double the size of the current market served

by these players.

Fig. 1: Market size by category

2 Edelweiss Securities Limited

Sheela Foam

SFL has rolled out a budget series brand Starlite with an eye on tapping the unrogansied

mattress market (~INR60bn), including a cotton mattress, which is estimated to be more

than INR120bn—the biggest category. Initial response to the budget brand has been

encouraging. While the Sleepwell range starts from INR7,500 a pair, Starlite is priced within

INR4,800–5,200. In fact, INR5,000 a pair is one of the cheapest mattresses in this category.

In the unorganised segment, a pair sells for INR3,500–4,000, which has risen to INR4,000–

4,500 post GST.

Interplasp: Targeting expansion into Europe and economies in raw material sourcing

SFL has paid EUR42mn – ~1.4x CY18 sales–higher than global foam peers. Key reasons for

the acquisition are: 1) Geographical expansion: The acquisition will give SFL a presence in

Europe—the world's largest polyurethane foam market. Interplasp also markets some of its

foam in Morocco, which gives it an opportunity to grow in Morocco and a few other North

African markets; and 2) Economies of scale in sourcing raw materials: SFL also expects to

benefit from cross-fertilization of technologies and product portfolios in India, Australia and

Europe. SFL will set up a 100% subsidiary in Spain, which will acquire 93.7% stake in

Interplasp; balance will be held by three key managers of Interplasp with SFL having the

right of first refusal.

Set up in 1987, Interplasp manufactures and markets slab-stock polyurethane foam for

bedding, furniture and other applications, primarily in Spain. It also markets foam to

mattress manufacturers in Portugal and foam converters in Morocco. The company has a

single plant with capacity to produce 22,000MT; it currently produces 11,000MT. Interplasp

reported a turnover of EUR31.6mn in CY18 (41% CAGR over CY16–18).

SFL had cash of INR2.9bn (as of Mar-19), which is sufficient to fund the acquisition worth

about INR3.2bn (EUR42mn). Being a foam manufacturing business, Interplasp’s current

returns profile is close to SFL’s Australian subsidiary Joyce, but lower than the branded

business.

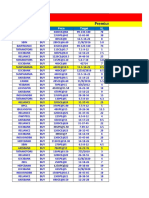

Table 1: Change in Estimates

FY20E FY21E

New Old % change New Old % change Comments

Net Revenue 23,623 24,454 (3.4) 27,490 28,470 (3.4) Lower growth in Mattress segment

EBITDA 2,890 3,081 (6.2) 3,430 3,658 (6.2) Lower growth in Mattress segment

EBITDA Margin 12.2 12.6 12.5 12.8

Adjusted PAT 1,933 1,886 2.5 2,218 2,184 1.6 Lower tax rate of 25%

Net Profit Margin 8.2 7.7 8.1 7.7

Capex 5,820 5,820 0.0 950 950 0.0

3 Edelweiss Securities Limited

Miscellaneous

Company Description

Incorporated in 1971, Sheela Foam is a leading manufacturer of mattresses in India marketed

under its flagship brand Sleepwell. In addition, the company manufactures other foam-based

home comfort products targeted primarily at Indian retail consumers and technical grades of

polyurethane foam (PU foam) for end use in a wide range of industries. As part of its

international footprint, Sheela manufactures PU foam in Australia through its wholly owned

subsidiary Joyce Foam (Joyce).

The company commenced manufacturing PU foam in 1972. Installed capacity for foam

production in India is currently 123,000 tonnes per annum (TPA). In addition to its domestic

facilities, Joyce operates five plants in Australia that exclusively manufacture PU foam

primarily through the variable pressure foaming technology.

Investment Theme

Superior brand with strong distribution and pricing power

Over the past two decades, Sheela has cornered about 20-23% of the organised mattress

market largely due to investments in the Sleepwell brand, clearly visible in its advertising

spend that is comparable to leading FMCG brands. Another key differentiator is its exclusive

brand outlet (EBO) network, which accounts for ~80% of revenue, much higher than any

industry player. This along with launch of the ‘My Mattress’ concept (customized

mattresses) has reinforced Sleepwell’s pricing power—evident from the cumulative 25%

hike effected over the last two years.

Broad-based growth, easing raw material prices and improving mix

Sleepwell is likely to be a key beneficiary of high growth in the mattress industry driven by

its aggressive branding, deepening reach and product innovation. The company is eying a

market much larger than the cumulative size of other segments via its budget category

brand Starlite. Besides, TDI (key raw material; ~20% of revenue) prices, which have been

rising over the past two years, are finally beginning to ease. This given Sheela’s track record

of limited rollback along with improving product mix (higher mattress share) should bolster

EBITDA margin.

Key Risks

Launch of organised home décor outlets and increasing online share

Launch of any organised home décor outlets such as IKEA (which has already opened its first

store in India) could disrupt the sales channel and impact the brand Sheela has built via

Sleepwell. Moreover, increasing online share would reduce barriers to entry for new brands

looking for a foothold.

Size of planned acquisition

Sheela Foam has been clear in its intent of acquiring a company in the mattress or bedding-

related category. The planned acquisition is expected to be in a range of INR1.5-4.5bn.

While we believe Sheela Foam will make a prudent acquisition, it does create uncertainty.

4 Edelweiss Securities Limited

Sheela Foam

Financial Statements

Key Assumptions Income statement (INR mn)

Year to March FY18 FY19 FY20E FY21E Year to March FY18 FY19 FY20E FY21E

Macro Net revenue 19,653 21,414 23,623 27,490

GDP(Y-o-Y %) 7.2 6.8 6.8 7.1 Materials costs 10,945 11,732 12,373 14,295

Inflation (Avg) 3.6 3.4 4.0 4.5 Employee costs 1,627 1,773 2,039 2,241

Repo rate (exit rate) 6.0 6.3 5.3 5.0 Other Expenses 4,919 5,814 6,320 7,524

USD/INR (Avg) 64.5 70.0 72.0 72.0 Total operating expenses 17,490 19,320 20,733 24,061

Company EBITDA 2,163 2,095 2,890 3,430

Mattress rev. growth (Y-o-Y %) 6 3 1 8 Depreciation 352 395 532 702

Tech. foam rev. growth (Y-o-Y %) 31 10 - 10 EBIT 1,811 1,700 2,359 2,728

Starlite revenues (INR mn) 70 700 1,100 1,320 Less: Interest Expense 87 96 136 165

Furniture cushioning (Y-o-Y %) 18 1 5 10 Add: Other income 210.64 290.49 371.44 420.91

Standalone gross margin (%) 43 44 47 47 Profit Before Tax 1,935 1,894 2,594 2,984

Subsidiary gross margin (%) 53 53 50 50 Less: Provision for Tax 598 557 661 766

Subsidiary rev. growth (Y-o-Y %) 2 6 49 46 Reported Profit 1,337 1,337 1,933 2,218

Adjusted Profit 1,337 1,337 1,933 2,218

Shares o /s (mn) 49 49 49 49

Adjusted Basic EPS 27.4 27.4 39.6 45.5

Diluted shares o/s (mn) 49 49 49 49

Adjusted Diluted EPS 27.4 27.4 39.6 45.5

Adjusted Cash EPS 34.6 35.5 50.5 59.9

Dividend per share (DPS) - - 4.0 4.5

Dividend Payout Ratio(%) - - 11.7 11.7

Common size metrics

Year to March FY18 FY19 FY20E FY21E

Materials costs 44.3 45.2 47.6 48.0

Staff costs 8.3 8.3 8.6 8.2

S G & A expenses 25.0 27.2 26.8 27.4

Depreciation 1.8 1.8 2.3 2.6

Interest Expense 0.4 0.4 0.6 0.6

EBITDA margins 11.0 9.8 12.2 12.5

Net Profit margins 6.8 6.2 8.2 8.1

Growth ratios (%)

Year to March FY18 FY19 FY20E FY21E

Revenues 13.4 9.0 10.3 16.4

EBITDA 10.3 (3.2) 38.0 18.7

PBT 8.8 (2.1) 36.9 15.1

Adj. net profit 6.5 - 44.6 14.8

EPS 6.5 - 44.6 14.8

5 Edelweiss Securities Limited

Miscellaneous

Balance sheet (INR mn) Cash flow metrics

As on 31st March FY18 FY19 FY20E FY21E Year to March FY18 FY19 FY20E FY21E

Share capital 244 244 244 244 Cash flow from ops 1,337 1,377 2,249 2,639

Reserves & Surplus 5,729 7,057 8,764 10,723 Financing cash flow (201) (270) 1,083 (446)

Shareholders' funds 5,973 7,301 9,008 10,966 Investing cash flow (801) (2,457) (5,449) (529)

Long term borrowings 83 56 1,596 1,596 Net cash Flow 336 (1,350) (2,117) 1,663

Short term borrowings 397 250 155 133 Capex (911) (528) (5,820) (950)

Total Borrowings 479 305 1,751 1,729 Dividend paid - - (226) (260)

Long Term Liabilities 701 776 860 995

Deferred tax (net) 20 65 65 65 Profitability and efficiency ratios

Sources of funds 7,173 8,448 11,683 13,755 Year to March FY18 FY19 FY20E FY21E

Net Block 3,402 4,035 7,743 7,992 ROAE (%) 25.2 20.1 23.7 22.2

Capital work in progress 522 7 7 7 ROACE (%) 34.6 28.3 29.7 26.9

Intangible Assets 82 82 1,662 1,662 Inventory Days 53 56 57 54

Total Fixed Assets 4,006 4,124 9,413 9,661 Debtors Days 27 26 25 24

Non current investments 375 492 492 492 Payable Days 51 45 43 42

Cash and Equivalents 2,188 2,887 770 2,434 Cash Conversion Cycle 29 36 38 37

Inventories 1,726 1,871 1,974 2,280 Current Ratio 1.9 2.2 1.5 1.9

Sundry Debtors 1,473 1,522 1,678 1,953 Gross Debt/EBITDA 0.2 0.1 0.6 0.5

Loans & Advances 284 333 367 427 Gross Debt/Equity 0.1 - 0.2 0.2

Other Current Assets 375 388 426 494 Adjusted Debt/Equity 0.1 0.1 0.2 0.2

Current Assets (ex cash) 3,858 4,113 4,445 5,155 Net Debt/Equity (0.3) (0.4) 0.1 (0.1)

Trade payable 1,468 1,432 1,510 1,745 Interest Coverage Ratio 20.9 17.7 17.3 16.5

Other Current Liab 1,786 1,738 1,928 2,243

Total Current Liab 3,254 3,170 3,438 3,988 Operating ratios

Net Curr Assets-ex cash 604 943 1,007 1,167 Year to March FY18 FY19 FY20E FY21E

Uses of funds 7,173 8,448 11,683 13,755 Total Asset Turnover 3.0 2.7 2.3 2.2

BVPS (INR) 122.4 149.7 184.7 224.8 Fixed Asset Turnover 5.9 5.6 3.5 2.9

Equity Turnover 3.7 3.2 2.9 2.8

Free cash flow (INR mn)

Year to March FY18 FY19 FY20E FY21E Valuation parameters

Reported Profit 1,337 1,337 1,933 2,218 Year to March FY18 FY19 FY20E FY21E

Add: Depreciation 352 395 532 702 Adj. Diluted EPS (INR) 27.4 27.4 39.6 45.5

Interest (Net of Tax) 60 68 102 123 Y-o-Y growth (%) 6.5 - 44.6 14.8

Others (17) (205) (337) (379) Adjusted Cash EPS (INR) 34.6 35.5 50.5 59.9

Less: Changes in WC 395 219 (20) 25 Diluted P/E (x) 45.6 45.6 31.5 27.5

Operating cash flow 1,337 1,377 2,249 2,639 P/B (x) 10.2 8.4 6.8 5.6

Less: Capex 911 528 5,820 950 EV / Sales (x) 2.9 2.6 2.5 2.1

Free Cash Flow 426 849 (3,571) 1,689 EV / EBITDA (x) 27.4 27.9 21.4 17.6

Dividend Yield (%) - - 0.3 0.4

6 Edelweiss Securities Limited

Sheela Foam

Additional Data

Directors Data

Rahul Gautam Executive Director V K Chopra Independent Director

Namita Gautam Executive Director Som Mittal Independent Director

Rakesh Chahar Executive Director Ravindra Dhariwal Independent Director

Tushaar Gautam Executive Director Anil Tandon Independent Director

Lt Gen (Dr.) VK Ahluwalia Independent Director

Auditors - S.P. Chopra & Co

*as per last available data

Holding – Top10

Perc. Holding Perc. Holding

SBI Funds Management 9.71 DSP 3.19

UTI Asset Management Co Ltd 2.96 Kotak Mahindra Asset Management 1.68

Goldman Sachs Group Inc/The 1.01 Reliance Capital Trustee Co Ltd 0.88

Reliance Capital 0.88 ICICI Prulife 0.24

MDO Management 0.09 ICICI Pru AMC 0.08

*as per last available data

Bulk Deals

Data Acquired / Seller B/S Qty Traded Price

No Data Available

*as per last available data

Insider Trades

Reporting Data Acquired / Seller B/S Qty Traded

05 Jul 2019 Tushaar Gautam Buy 17561880.00

01 Apr 2019 Rahul Gautam Sell 3745934.00

01 Apr 2019 Tushaar Gautam Sell 1463486.00

*as per last available data

7 Edelweiss Securities Limited

Miscellaneous

Edelweiss Securities Limited, Edelweiss House, off C.S.T. Road, Kalina, Mumbai – 400 098.

Board: (91-22) 4009 4400, Email: research@edelweissfin.com

ADITYA

Digitally signed by ADITYA NARAIN

Aditya Narain DN: c=IN, o=EDELWEISS SECURITIES LIMITED,

ou=SERVICE,

2.5.4.20=3dc92af943d52d778c99d69c48a8e0c89

Head of Research e548e5001b4f8141cf423fd58c07b02,

NARAIN

postalCode=400011, st=MAHARASHTRA,

serialNumber=e0576796072ad1a3266c27990f20

bf0213f69235fc3f1bcd0fa1c30092792c20,

aditya.narain@edelweissfin.com cn=ADITYA NARAIN

Date: 2019.10.18 13:43:43 +05'30'

Coverage group(s) of stocks by primary analyst(s): Miscellaneous

AIA Engineering, Apar Industries Ltd, Balkrishna Industries, CCL Products India, Essel Propack, Orient Refractories, Polyplex Corporation Ltd., Sheela Foam

Ltd, Uflex Ltd., Vesuvius India, VIP Industries

`

Recent Research

Date Company Title Price (INR) Recos

07-Aug-19 Sheela Mattress stable, but spurt 1,192 Buy

Foam awaited; Result Update

26-Jul-19 Sheela Acquires foam manufacturer 1,275 Buy

Foam in Europe; Edel Flash

08-May-19 Essel Stable quarter; upside limited; 133 Hold

Propack Result Update

Distribution of Ratings / Market Cap

Edelweiss Research Coverage Universe Rating Interpretation

Buy Hold Reduce Total Rating Expected to

Rating Distribution* 161 67 11 240 Buy appreciate more than 15% over a 12-month period

* 1stocks under review

Hold appreciate up to 15% over a 12-month period

> 50bn Between 10bn and 50 bn < 10bn

Reduce depreciate more than 5% over a 12-month period

Market Cap (INR) 156 62 11

One year price chart

1,700

1,580

1,460

(INR)

1,340

1,220

1,100

Dec-18

Aug-19

Oct-18

Oct-19

Apr-19

Nov-18

May-19

Feb-19

Sep-19

Jan-19

Mar-19

Jun-19

Jul-19

Sheela Foam

8 Edelweiss Securities Limited

Sheela Foam

DISCLAIMER

Edelweiss Securities Limited (“ESL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is

licensed to carry on the business of broking, depository services and related activities. The business of ESL and its Associates (list

available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing and SME

Finance, Commodities, Financial Markets, Asset Management and Life Insurance.

This Report has been prepared by Edelweiss Securities Limited in the capacity of a Research Analyst having SEBI Registration

No.INH200000121 and distributed as per SEBI (Research Analysts) Regulations 2014. This report does not constitute an offer or

solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Securities as

defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 includes Financial Instruments and Currency

Derivatives. The information contained herein is from publicly available data or other sources believed to be reliable. This report is

provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The

user assumes the entire risk of any use made of this information. Each recipient of this report should make such investigation as it

deems necessary to arrive at an independent evaluation of an investment in Securities referred to in this document (including the

merits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. The

investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This information should not be

reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in

part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or

resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use

would be contrary to law, regulation or which would subject ESL and associates / group companies to any registration or licensing

requirements within such jurisdiction. The distribution of this report in certain jurisdictions may be restricted by law, and persons

in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date

of this report and there can be no assurance that future results or events will be consistent with this information. This information

is subject to change without any prior notice. ESL reserves the right to make modifications and alterations to this statement as

may be required from time to time. ESL or any of its associates / group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. ESL is committed

to providing independent and transparent recommendation to its clients. Neither ESL nor any of its associates, group companies,

directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential

including loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietary

trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed

herein. Past performance is not necessarily a guide to future performance .The disclosures of interest statements incorporated in

this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in

the report. The information provided in these reports remains, unless otherwise stated, the copyright of ESL. All layout, design,

original artwork, concepts and other Intellectual Properties, remains the property and copyright of ESL and may not be used in

any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

ESL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including

network (Internet) reasons or snags in the system, break down of the system or any other equipment, server breakdown,

maintenance shutdown, breakdown of communication services or inability of the ESL to present the data. In no event shall ESL be

liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or

expenses arising in connection with the data presented by the ESL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. We will not treat recipients as customers by virtue of

their receiving this report.

ESL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to

time, have long or short positions in, and buy or sell the Securities, mentioned herein or (b) be engaged in any other transaction

involving such Securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other

potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of

publication of research report or at the time of public appearance. ESL may have proprietary long/short position in the above

mentioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do not

consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional

advice before investing. This should not be construed as invitation or solicitation to do business with ESL.

9 Edelweiss Securities Limited

Miscellaneous

ESL or its associates may have received compensation from the subject company in the past 12 months. ESL or its associates may

have managed or co-managed public offering of securities for the subject company in the past 12 months. ESL or its associates

may have received compensation for investment banking or merchant banking or brokerage services from the subject company in

the past 12 months. ESL or its associates may have received any compensation for products or services other than investment

banking or merchant banking or brokerage services from the subject company in the past 12 months. ESL or its associates have

not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

Research analyst or his/her relative or ESL’s associates may have financial interest in the subject company. ESL and/or its Group

Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise in the

Securities/Currencies and other investment products mentioned in this report. ESL, its associates, research analyst and his/her

relative may have other potential/material conflict of interest with respect to any recommendation and related information and

opinions at the time of publication of research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange

rates can be volatile and are subject to large fluctuations; ( ii) the value of currencies may be affected by numerous market

factors, including world and national economic, political and regulatory events, events in equity and debt markets and changes in

interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the

value of the currency. Investors in securities such as ADRs and Currency Derivatives, whose values are affected by the currency of

an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

ESL has financial interest in the subject companies: No

ESL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month

immediately preceding the date of publication of research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of

the month immediately preceding the date of publication of research report: No

ESL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately

preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by ESL on any matter related to the capital markets, resulting in significant and

material disciplinary action during the last three years except that ESL had submitted an offer of settlement with Securities and

Exchange commission, USA (SEC) and the same has been accepted by SEC without admitting or denying the findings in relation to

their charges of non registration as a broker dealer.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about

the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or

indirectly related to specific recommendations or views expressed in this report.

Additional Disclaimers

Disclaimer for U.S. Persons

This research report is a product of Edelweiss Securities Limited, which is the employer of the research analyst(s) who has

prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States

(U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to

supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required

to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public

appearances and trading securities held by a research analyst account.

This report is intended for distribution by Edelweiss Securities Limited only to "Major Institutional Investors" as defined by Rule

15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and

Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as

specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied,

duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

10 Edelweiss Securities Limited

Sheela Foam

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC

in order to conduct certain business with Major Institutional Investors, Edelweiss Securities Limited has entered into an

agreement with a U.S. registered broker-dealer, Edelweiss Financial Services Inc. ("EFSI"). Transactions in securities discussed in

this research report should be effected through Edelweiss Financial Services Inc.

Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial

Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional

experience in matters relating to investments falling within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the

“Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and unincorporated

associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being

referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment

activity to which this research report relates is available only to relevant persons and will be engaged in only with relevant

persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents. This

research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other

person.

Disclaimer for Canadian Persons

This research report is a product of Edelweiss Securities Limited ("ESL"), which is the employer of the research analysts who have

prepared the research report. The research analysts preparing the research report are resident outside the Canada and are not

associated persons of any Canadian registered adviser and/or dealer and, therefore, the analysts are not subject to supervision by

a Canadian registered adviser and/or dealer, and are not required to satisfy the regulatory licensing requirements of the Ontario

Securities Commission, other Canadian provincial securities regulators, the Investment Industry Regulatory Organization of

Canada and are not required to otherwise comply with Canadian rules or regulations regarding, among other things, the research

analysts' business or relationship with a subject company or trading of securities by a research analyst.

This report is intended for distribution by ESL only to "Permitted Clients" (as defined in National Instrument 31-103 ("NI 31-103"))

who are resident in the Province of Ontario, Canada (an "Ontario Permitted Client"). If the recipient of this report is not an

Ontario Permitted Client, as specified above, then the recipient should not act upon this report and should return the report to

the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any Canadian person.

ESL is relying on an exemption from the adviser and/or dealer registration requirements under NI 31-103 available to certain

international advisers and/or dealers. Please be advised that (i) ESL is not registered in the Province of Ontario to trade in

securities nor is it registered in the Province of Ontario to provide advice with respect to securities; (ii) ESL's head office or

principal place of business is located in India; (iii) all or substantially all of ESL's assets may be situated outside of Canada; (iv)

there may be difficulty enforcing legal rights against ESL because of the above; and (v) the name and address of the ESL's agent for

service of process in the Province of Ontario is: Bamac Services Inc., 181 Bay Street, Suite 2100, Toronto, Ontario M5J 2T3 Canada.

Disclaimer for Singapore Persons

In Singapore, this report is being distributed by Edelweiss Investment Advisors Private Limited ("EIAPL") (Co. Reg. No.

201016306H) which is a holder of a capital markets services license and an exempt financial adviser in Singapore and (ii) solely to

persons who qualify as "institutional investors" or "accredited investors" as defined in section 4A(1) of the Securities and Futures

Act, Chapter 289 of Singapore ("the SFA"). Pursuant to regulations 33, 34, 35 and 36 of the Financial Advisers Regulations ("FAR"),

sections 25, 27 and 36 of the Financial Advisers Act, Chapter 110 of Singapore shall not apply to EIAPL when providing any

financial advisory services to an accredited investor (as defined in regulation 36 of the FAR. Persons in Singapore should contact

EIAPL in respect of any matter arising from, or in connection with this publication/communication. This report is not suitable for

private investors.

Copyright 2009 Edelweiss Research (Edelweiss Securities Ltd). All rights reserved

Access the entire repository of Edelweiss Research on www.edelresearch.com

11 Edelweiss Securities Limited

You might also like

- Summary of W.DDocument6 pagesSummary of W.Dapi-3749193No ratings yet

- 5 6093898 709953675529Document2 pages5 6093898 709953675529Kalpesh ShahNo ratings yet

- 5 60600099 01864779880Document4 pages5 60600099 01864779880Kalpesh ShahNo ratings yet

- 5 6154726356081967287 PDFDocument9 pages5 6154726356081967287 PDFKalpesh ShahNo ratings yet

- 5 609116 0913115611237Document7 pages5 609116 0913115611237Kalpesh ShahNo ratings yet

- Trading Vs Making MoneyDocument26 pagesTrading Vs Making MoneyHarsh Dixit100% (1)

- 5 6120581817050333308 PDFDocument9 pages5 6120581817050333308 PDFKalpesh ShahNo ratings yet

- 5 61029 36313281904816Document15 pages5 61029 36313281904816Kalpesh ShahNo ratings yet

- Candlestick Charting BasicsDocument27 pagesCandlestick Charting BasicsJayakumar Mundayodummal100% (2)

- 5 614332 3235090956423Document6 pages5 614332 3235090956423Kalpesh ShahNo ratings yet

- 7 Steps To Success Trading Options OnlineDocument146 pages7 Steps To Success Trading Options OnlineRaju.Konduru100% (1)

- Stock Books 012-Economics - How The Stock Market WorksDocument30 pagesStock Books 012-Economics - How The Stock Market WorksdiglemarNo ratings yet

- 5 6100630289506107520Document1 page5 6100630289506107520Kalpesh ShahNo ratings yet

- Van Tharp Worrying While TradingDocument5 pagesVan Tharp Worrying While TradingLokator100% (1)

- 5 6062405870845689872 PDFDocument7 pages5 6062405870845689872 PDFKalpesh ShahNo ratings yet

- 5 6120581817050333308 PDFDocument9 pages5 6120581817050333308 PDFKalpesh ShahNo ratings yet

- 5 60735 3125Document86 pages5 60735 3125Kalpesh ShahNo ratings yet

- Futures Magazine - The Art of Day-TradingDocument35 pagesFutures Magazine - The Art of Day-Tradingapi-370474480% (5)

- 5 6183748012741754986Document5 pages5 6183748012741754986Kalpesh ShahNo ratings yet

- 5 6118376536027431105Document17 pages5 6118376536027431105Kalpesh ShahNo ratings yet

- 5 6088872756403765337Document3 pages5 6088872756403765337Kalpesh ShahNo ratings yet

- 5 6086860637240033391Document41 pages5 6086860637240033391Kalpesh ShahNo ratings yet

- 5 6062405870845689865 PDFDocument11 pages5 6062405870845689865 PDFKalpesh ShahNo ratings yet

- 5 6132197805210468370Document2 pages5 6132197805210468370Kalpesh ShahNo ratings yet

- 5 6109166326553510010Document2 pages5 6109166326553510010Kalpesh ShahNo ratings yet

- 5 6086860637240033391Document41 pages5 6086860637240033391Kalpesh ShahNo ratings yet

- YearCompass Booklet en Us A4 FillableDocument20 pagesYearCompass Booklet en Us A4 FillablePaul LeeNo ratings yet

- 5 6086860637240033389Document6 pages5 6086860637240033389Kalpesh ShahNo ratings yet

- 5 6107037530308214954Document13 pages5 6107037530308214954Kalpesh ShahNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Greece, Derivates, and FX? What Went Wrong?Document4 pagesGreece, Derivates, and FX? What Went Wrong?Zerina BalićNo ratings yet

- Estimating, Costing and Building Specifications - AR L2330Document19 pagesEstimating, Costing and Building Specifications - AR L2330Sakshi RawatNo ratings yet

- Comparative Study of of Uber and OlaDocument40 pagesComparative Study of of Uber and OlaDeep Choudhary100% (5)

- Video Vocab 002: Economy 1: The Business English Podcast For Professionals On The MoveDocument5 pagesVideo Vocab 002: Economy 1: The Business English Podcast For Professionals On The MoveashwinNo ratings yet

- Why Marketers Need A New Concept of CultureDocument10 pagesWhy Marketers Need A New Concept of CultureOrkid Dahlia JamalNo ratings yet

- Argumentative EssayDocument1 pageArgumentative EssayAshiqur Rahman AshikNo ratings yet

- The Impact of Shareholder Activism - Cover Story - The Edge MalaysiaDocument3 pagesThe Impact of Shareholder Activism - Cover Story - The Edge Malaysiaqpmoerzh100% (1)

- Part I Introduction To Financial SystemsDocument57 pagesPart I Introduction To Financial SystemsfisehaNo ratings yet

- Daali Case Marketing Strategy Ms TaniaDocument3 pagesDaali Case Marketing Strategy Ms TaniaFaizan Khalid SiddiquiNo ratings yet

- Short Term Trading - ASX Power SetupsDocument5 pagesShort Term Trading - ASX Power SetupsNick Radge0% (1)

- Ava TradeDocument3 pagesAva TradeAmit RajoriaNo ratings yet

- If 3Document4 pagesIf 3Abdul Aziz WadiwalaNo ratings yet

- 16 DecDocument38 pages16 Decmahmoudfahmytotti1No ratings yet

- Marketing Audit of Emirates AirlinesDocument22 pagesMarketing Audit of Emirates AirlinesMarta Shymonyak100% (2)

- Literature Review On Credit Default SwapDocument5 pagesLiterature Review On Credit Default Swapea3d6w9v100% (1)

- Business Finance Nov Dec 2018Document13 pagesBusiness Finance Nov Dec 2018bimalNo ratings yet

- Sheela Devi Institute of Management & TechnologyDocument83 pagesSheela Devi Institute of Management & TechnologyVishal Pahuja0% (1)

- Consumer Choice and Demand: Chapter ChecklistDocument18 pagesConsumer Choice and Demand: Chapter ChecklistNaman VanshuNo ratings yet

- Group3 pr2Document23 pagesGroup3 pr2Johnlloyd BarretoNo ratings yet

- Is Concerned With Forecasting Markets in Total. This Is About Determining TheDocument6 pagesIs Concerned With Forecasting Markets in Total. This Is About Determining TheHarshPanugantiNo ratings yet

- Advanced financial accounting intercompany inventory transactionsDocument19 pagesAdvanced financial accounting intercompany inventory transactionseferem100% (1)

- Fractal Formation and Trend Trading Strategy in Futures MarketDocument5 pagesFractal Formation and Trend Trading Strategy in Futures MarketPinky BhagwatNo ratings yet

- Basic Microeconomics: (The Importance of Economic Choice in Economics)Document25 pagesBasic Microeconomics: (The Importance of Economic Choice in Economics)namiNo ratings yet

- Foreign Exchange Risk Management Commercial Banks in KenyaDocument2 pagesForeign Exchange Risk Management Commercial Banks in KenyaMahnoor SaleemNo ratings yet

- Junior Account Manager XTB RomaniaDocument1 pageJunior Account Manager XTB RomaniaRobert NacuNo ratings yet

- GOODWILLDocument2 pagesGOODWILLFRANK IMHANFORTORNo ratings yet

- Professional Disappointments and Electrical Engineering QuestionsDocument17 pagesProfessional Disappointments and Electrical Engineering QuestionsAshu MeanNo ratings yet

- Material Downloaded From - 1 / 4Document4 pagesMaterial Downloaded From - 1 / 4Gamer ChannelNo ratings yet

- Portifolio Theory & Asset Pricing ModelsDocument39 pagesPortifolio Theory & Asset Pricing ModelszivainyaudeNo ratings yet

- ES 312b - Engineering Economy Cost ConceptsDocument8 pagesES 312b - Engineering Economy Cost ConceptsJerard BalalaNo ratings yet