Professional Documents

Culture Documents

Option Strategies 24 06 2019

Uploaded by

Arunangshu BhattacharjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Option Strategies 24 06 2019

Uploaded by

Arunangshu BhattacharjeeCopyright:

Available Formats

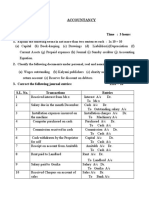

Option Strategies and Payoff Diagrams

The purpose of this spreadsheet is to allow you to

Input Table simulate the payoff of various option strategies by

combing the positions in underlying stocks and call and

Current Unit # of Units Traded put options/ The Payoff table lets you see the resulting

Option Strike Price of (1 option covers profit/loss situation at expiry. The resulting profit is

Instrument Initial Position Price Instrument 1 share) Investment charted on the "Payoff Diagram sheet".

Stock Shares Buy 100.00 1 (100.00)

Call Option 1 Sell 105.00 3.00 1 3.00 Inputs cells are light yellow background with blue text.

Call Option 2 n/a 120.00 2.00 1 - After inputting the data click the "Refresh Payoff Table"

Call Option 3 n/a 100.00 3.00 1 - button. This must be done everytime inputs are changed.

Put Option 1 n/a 97.00 3.00 1 -

Put Option 2 n/a 100.00 2.00 1 -

Put Option 3 n/a 100.00 2.00 1 -

Net Investment: (97.00)

Stock Price at Option Expiry Scenario Range

High Low Increment

110.00 90.00 1.00

Payoff Table

Instrument Stock Shares Call Option 1 Call Option 2 Call Option 3 Put Option 1 Put Option 2 Put Option 3 Prepared by

Initial Position Buy Sell n/a n/a n/a n/a n/a

Initial Stock Finance Train:

Price or Option http://financetrain.com

Strike 100.00 105.00 120.00 100.00 97.00 100.00 100.00

Units Traded 1.00 1.00 1.00 1.00 1.00 1.00 1.00

Stock Price at Cash Flow at Cash Flow at Cash Flow at Cash Flow at Cash Flow at Cash Flow at Cash Flow at Total Cash Flow at Position Profit /

Option Expiry Expiry Expiry Expiry Expiry Expiry Expiry Expiry Expiry (Loss) at Expiry

90.00 90.00 - - - - - - 90.00 (7.00)

91.00 91.00 - - - - - - 91.00 (6.00)

92.00 92.00 - - - - - - 92.00 (5.00)

93.00 93.00 - - - - - - 93.00 (4.00)

94.00 94.00 - - - - - - 94.00 (3.00)

95.00 95.00 - - - - - - 95.00 (2.00)

96.00 96.00 - - - - - - 96.00 (1.00)

97.00 97.00 - - - - - - 97.00 -

98.00 98.00 - - - - - - 98.00 1.00

99.00 99.00 - - - - - - 99.00 2.00

100.00 100.00 - - - - - - 100.00 3.00

101.00 101.00 - - - - - - 101.00 4.00

102.00 102.00 - - - - - - 102.00 5.00

103.00 103.00 - - - - - - 103.00 6.00

104.00 104.00 - - - - - - 104.00 7.00

105.00 105.00 - - - - - - 105.00 8.00

106.00 106.00 (1.00) - - - - - 105.00 8.00

107.00 107.00 (2.00) - - - - - 105.00 8.00

108.00 108.00 (3.00) - - - - - 105.00 8.00

109.00 109.00 (4.00) - - - - - 105.00 8.00

110.00 110.00 (5.00) - - - - - 105.00 8.00

451927700.xls: Strategy inputs Page 1 of 3 12/13/2019

1

The purpose of this spreadsheet is to allow you to

simulate the payoff of various option strategies by

combing the positions in underlying stocks and call and

put options/ The Payoff table lets you see the resulting

profit/loss situation at expiry. The resulting profit is

charted on the "Payoff Diagram sheet".

Inputs cells are light yellow background with blue text.

After inputting the data click the "Refresh Payoff Table"

button. This must be done everytime inputs are changed.

451927700.xls: Strategy inputs Page 2 of 3 12/13/2019

Option Strategy

Profit / (Loss) Diagram

12

Profit / (Loss)

10

Stock Price at Expiration

451927700.xls: Payoff Diagram Page 3 of 3 12/13/2019

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2019 Mock Exam B - Morning SessionDocument22 pages2019 Mock Exam B - Morning SessionLU GenNo ratings yet

- Lecture Notes Definition of TermsDocument14 pagesLecture Notes Definition of Termsrachel banana hammockNo ratings yet

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocument5 pagesToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNo ratings yet

- DPE Guidelines 2019Document253 pagesDPE Guidelines 2019Neetika MittalNo ratings yet

- Intro To Accounting Lecture NotesDocument15 pagesIntro To Accounting Lecture NotesSaffa IbrahimNo ratings yet

- MSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Document3 pagesMSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Leophil RascoNo ratings yet

- Corporation LiquidationDocument1 pageCorporation LiquidationMelisa DomingoNo ratings yet

- Quiz 2 - Prof 3Document5 pagesQuiz 2 - Prof 3Tifanny MallariNo ratings yet

- Chap 1-5Document49 pagesChap 1-5Angel RubiosNo ratings yet

- TB 350 Owner ManualDocument13 pagesTB 350 Owner ManualabhilashrkNo ratings yet

- Reading 23 Income TaxesDocument26 pagesReading 23 Income TaxessalmaNo ratings yet

- Schools Division of Tarlac ProvinceDocument40 pagesSchools Division of Tarlac ProvinceMarc Aaron GarciaNo ratings yet

- UntitledDocument404 pagesUntitledAmity National Moot Court CompetitionNo ratings yet

- Corporate Governance in Indian Banking SectorDocument11 pagesCorporate Governance in Indian Banking SectorFàrhàt HossainNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Expert Systems With Applications: Bruce Vanstone, Gavin FinnieDocument13 pagesExpert Systems With Applications: Bruce Vanstone, Gavin FinnieCarlosNo ratings yet

- Final Audit Report Consolidated On Letter HeadDocument4 pagesFinal Audit Report Consolidated On Letter HeadCA Nagendranadh TadikondaNo ratings yet

- Reading 27 Applications of Financial Statement AnalysisDocument11 pagesReading 27 Applications of Financial Statement AnalysisARPIT ARYANo ratings yet

- Bu 260820Document205 pagesBu 260820Geeta BhattNo ratings yet

- SummaryDocument16 pagesSummaryapi-529669983No ratings yet

- Setting Up A Company in GreeceDocument11 pagesSetting Up A Company in GreeceSvetlana DonchevaNo ratings yet

- Revised Corporation CODE ("RCC") : Title Iv - Powers of The Corporation Title V - BylawsDocument55 pagesRevised Corporation CODE ("RCC") : Title Iv - Powers of The Corporation Title V - BylawsRose Diane CabiscuelasNo ratings yet

- Preference SharesDocument1 pagePreference SharesRishab MehtaNo ratings yet

- Maybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)Document4 pagesMaybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)azjNo ratings yet

- Kcse 2010 Business Studies p2Document3 pagesKcse 2010 Business Studies p2Urex ZNo ratings yet

- GICB - Annual Report 2017 PDFDocument40 pagesGICB - Annual Report 2017 PDFÛbř ÖňNo ratings yet

- 5f388b962f84e - BANK RECONCILIATION STATEMENT PDFDocument4 pages5f388b962f84e - BANK RECONCILIATION STATEMENT PDFYogesh ChaulagaiNo ratings yet

- Accounting For Management Question PaperDocument3 pagesAccounting For Management Question PaperVINOD KUMARNo ratings yet

- CA AOF For Other Than Sole ProprietorshipDocument16 pagesCA AOF For Other Than Sole ProprietorshipnewattelectricNo ratings yet

- Session6.Bond ValuationDocument21 pagesSession6.Bond Valuationsincere sincereNo ratings yet