Professional Documents

Culture Documents

Advisory To UIN Entities Claiming GST Refunds

Uploaded by

Rashmi KumariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advisory To UIN Entities Claiming GST Refunds

Uploaded by

Rashmi KumariCopyright:

Available Formats

Ministry of Finance

Advisory to UIN Entities claiming GST Refunds

Posted On: 09 NOV 2018 4:17PM by PIB Delhi

The GST Act provides for allotting a Unique Identification Number (UIN) to Consulates, Embassies and other

UN Organizations to enable such entities to claim refund of GST paid. One of the conditions for claiming this

refund is to file Invoice Level Data in their FORM GSTR-11 on the common portal. There are common

discrepancies which have been noticed by GST Authorities while processing refund applications.

FORM GSTR-11 under Rule 82 of the CGST Rules, 2017 mandates reporting “Place of Supply” for every

invoice on which refund is applied for. Many UIN entities while filling invoice data have been reporting their

place of supply as the State where they are registered instead of the place of supply as reflected in the invoice.

For example, it was observed that Embassies registered in Delhi have been consistently declaring their place of

supply as “New Delhi” even on hotel service consumed in the State of Maharashtra for which the place of supply

is Maharashtra.

It may be noted that under the GST law, place of supply determines the chargeability of CGST / SGST or IGST

tax on an invoice. Generally, except few exceptions, if the location of the supplier and the place of supply are in

the same State then CGST + SGST is charged on an invoice and if the location of the supplier and the place of

supply are in separate States then IGST is charged.

Therefore, it is advised that while reporting the “place of supply” and charging of CGST / SGST or IGST on an

invoice, the details shall be exactly as per the details mentioned in the invoice issued by the supplier of goods or

services. Wrong reporting of invoice level data in FORM GSTR-11 or in the statement of invoice submitted may

lead to delay in processing / rejection of refund claims.

********************

DSM/RM

(Release ID: 1552302) Visitor Counter : 977

Read this release in: Tamil

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 101 Powerful Ways To Use The Law of AttractionDocument128 pages101 Powerful Ways To Use The Law of Attractionaashay shroff96% (25)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Free Magazine For UPSC/IAS/PCS Exams - UPSC IQDocument111 pagesFree Magazine For UPSC/IAS/PCS Exams - UPSC IQUPSC IQ100% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sound and The ChakrasDocument4 pagesSound and The ChakrasRashmi KumariNo ratings yet

- Calendar PDFDocument2 pagesCalendar PDFRashmi KumariNo ratings yet

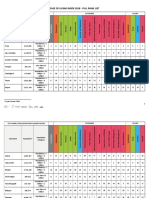

- Ease of Living Index 2018 Full Rank List PDFDocument13 pagesEase of Living Index 2018 Full Rank List PDFpraveench1888No ratings yet

- Caspian Sea DealDocument11 pagesCaspian Sea DealRashmi KumariNo ratings yet

- GzoDocument2 pagesGzoRashmi KumariNo ratings yet

- Arunchal Dam ProjectDocument16 pagesArunchal Dam ProjectRashmi KumariNo ratings yet

- Asi-Bharat Ratna JRD Tata Award To Aai ProfessionalDocument1 pageAsi-Bharat Ratna JRD Tata Award To Aai ProfessionalRashmi KumariNo ratings yet

- Delegation of Saints From Bochasanvasi Akshar Purushottam Sanstha Calls On PMDocument1 pageDelegation of Saints From Bochasanvasi Akshar Purushottam Sanstha Calls On PMRashmi KumariNo ratings yet

- AnnualReport2013 PDFDocument88 pagesAnnualReport2013 PDFRashmi KumariNo ratings yet

- First Copy of "QS BRICS 2014 University Rankings" Presented To PM PDFDocument1 pageFirst Copy of "QS BRICS 2014 University Rankings" Presented To PM PDFRashmi KumariNo ratings yet

- Amendment To Rule 6 of The Companies ActDocument1 pageAmendment To Rule 6 of The Companies ActRashmi KumariNo ratings yet

- Vibrational Numbers (FAQ) PDFDocument4 pagesVibrational Numbers (FAQ) PDFRashmi KumariNo ratings yet

- In A Major Achievement, India Becomes Permanent Signatory To Washington AccordDocument1 pageIn A Major Achievement, India Becomes Permanent Signatory To Washington AccordRashmi KumariNo ratings yet

- Inscription of The Great Himalayan National Park Conservation Area As A World Heritage SiteDocument2 pagesInscription of The Great Himalayan National Park Conservation Area As A World Heritage SiteRashmi KumariNo ratings yet

- Dedication Ceremony On 09 Nov 18Document1 pageDedication Ceremony On 09 Nov 18Rashmi KumariNo ratings yet

- Shri Vishwesh Chaube Appointed As New Member (Engineering), Railway BoardDocument1 pageShri Vishwesh Chaube Appointed As New Member (Engineering), Railway BoardRashmi KumariNo ratings yet

- Press Information BureauDocument2 pagesPress Information BureauRashmi KumariNo ratings yet

- 25 Nursing Students Pass Out From The College of Nursing, Army Hospital (R&R) PDFDocument1 page25 Nursing Students Pass Out From The College of Nursing, Army Hospital (R&R) PDFRashmi KumariNo ratings yet

- PM To Launch Major Support and Outreach Initiative For MSME Sector On November 02, 2018Document1 pagePM To Launch Major Support and Outreach Initiative For MSME Sector On November 02, 2018Rashmi KumariNo ratings yet

- PM To Launch Major Support and Outreach Initiative For MSME Sector On November 02, 2018Document1 pagePM To Launch Major Support and Outreach Initiative For MSME Sector On November 02, 2018Rashmi KumariNo ratings yet

- Sujas MegazineDocument64 pagesSujas MegazineRashmi KumariNo ratings yet

- SIMBEX-18 Kicks Off at Port Blair PDFDocument2 pagesSIMBEX-18 Kicks Off at Port Blair PDFRashmi KumariNo ratings yet

- Epson ManualDocument144 pagesEpson ManualRashmi KumariNo ratings yet