Professional Documents

Culture Documents

PAR COR ACCOUNTING CUP_AVERAGE QUESTIONS SOLVED

Uploaded by

Shin Yae0 ratings0% found this document useful (0 votes)

358 views6 pagesOriginal Title

PAR COR ACCOUNTING CUP_AVERAGE ROUND QUESTIONS

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

358 views6 pagesPAR COR ACCOUNTING CUP_AVERAGE QUESTIONS SOLVED

Uploaded by

Shin YaeCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 6

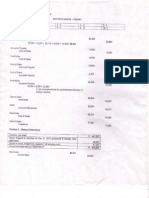

PAR COR ACCOUNTING CUP_AVERAGE QUESTIONS

Multiple Choice

Identify the choice that best completes the statement or answers the question.

1. Which of the following is not a characteristic of a corporation?

a. Corporations are organized as a separate legal taxable entity

b. Ownership is divided into shares of stock.

c. Corporations experience an ease in obtaining large amounts of resources

by issuing stock.

d. A corporation’s resources are limited to their individual owners’ resources.

e. Corporations make up 20% of all businesses.

2. The assets and liabilities of the company are P155,000 and P60,000 respectfully.

Stockholders’ equity should equal

a. P215,000

b. P155,000

c. P60,000

d. P95,000

3. Stockholders' Equity is increased by which of the following accounts?

a. cash

b. revenue

c. accounts receivable

d. all are correct

4. Rivers Computer Makeover Company has received P3,500 in cash for services rendered. What

affect does this transaction have on the accounting equation?

a. Increase Assets (Cash) and decrease Stockholders’ Equity (Expenses)

b. Increase Assets (Cash) and decrease Assets (Accounts Receivable)

c. Increase Assets (Accounts Receivable) and increase Stockholders’ Equity

(Fees Earned)

d. Increase Assets (Cash) and increase Stockholders’ Equity (Fees Earned)

5. Revenue should be recognized when

a. cash is received

b. the service is performed

c. the customer places an order

d. the customer charges an order

6. A chart of accounts is

a. the same as a balance sheet

b. usually a listing of accounts in alphabetical order

c. usually a listing of accounts in financial statement order

d. used in place of a ledger

7. Which statement(s) concerning cash is (are) true?

a. cash will always have more debits than credits

b. cash will never have a credit balance

c. cash is increased by debiting

d. all of the above

8. A debit may signify a(n)

a. decrease in asset accounts

b. decrease in liability accounts

c. increase in the capital stock account

d. decrease in the dividend account

9. In which of the following types of accounts are increases recorded by credits?

a. revenues, liabilities

b. dividends, assets

c. liabilities, dividends

d. expenses, liabilities

10. Which of the following entries records the billing of patients for services performed?

a. Accounts Receivable, debit; Fees Earned, credit

b. Accounts Payable, debit; Cash, credit

c. Fees Earned, debit; Accounts Receivable, credit

d. Fees Earned, debit; Cash, credit

11. Which of the following situations increase stockholders’ equity?

a. Supplies are purchased on account.

b. Services are provided on account.

c. Cash is received from customers.

d. Utility bill will be paid next month.

12. An overpayment error was discovered in computing and paying the wages of a Bartson Repair

Shop employee. When Bartson receives cash from the employee for the amount of the

overpayment, which of the following entries will Bartson make?

a. Cash, debit; Wages Expense, credit

b. Wages Payable, debit; Wages Expense, credit

c. Wages Expense, debit, Cash, credit

d. Cash, debit; Wages Payable, credit

13. The trial balance is out of balance and the accountant suspects that a transposition or slide

error has occurred. What will the accountant do to find the error?

a. Determine the amount of the error and look for that amount on the trial

balance.

b. Determine the amount of the error and divide by two, then look for that

amount on the trial balance.

c. Determine the amount of the error and refer to the journal entries for that

amount

d. Determine the amount of the error and divide by nine. If the result is

evenly divided, then this type of error is likely.

14. If the effect of the credit portion of an adjusting entry is to increase the balance of a liability

account, which of the following describes the effect of the debit portion of the entry?

a. increases the balance of a contra asset account

b. increases the balance of an asset account

c. decreases the balance of an stockholders’ equity account

d. increases the balance of an expense account

15. The cash basis of accounting records revenues and expenses when the cash is exchanged

while the accrual basis of accounting

a. records revenues when they are earned and expenses when they are paid

b. records revenues and expenses when they are incurred.

c. records revenues when cash is received and expenses when they are

incurred.

d. records revenues and expenses when the company needs to apply for a

loan.

16. Which of the following is considered to be unearned revenue?

a. Concert tickets sold for tonight’s performance.

b. Concert tickets sold yesterday on credit.

c. Concert tickets that were not sold for the current performance.

d. Concert tickets sold for next month’s performance.

17. Prepaid advertising, representing payment for the next quarter, would be reported on the

balance sheet as a(n)

a. asset

b. liability

c. contra asset

d. expense

18. The adjusting entry for rent earned that is currently recorded in the unearned rent account is

a. Unearned Rent, debit; Rent Revenue, credit

b. Rent Revenue, debit; Unearned Rent, credit

c. Unearned Rent, debit; Prepaid Rent, credit

d. Rent Expense, debit; Unearned Rent, credit

19. Which of the following accounts will be closed to the retained earnings account at the end of

the fiscal year?

a. Rent Expense

b. Fees Earned

c. Income Summary

d. Depreciation Expense

20. The difference between the totals of the debit and credit columns of the Adjusted Trial

Balance columns on a work sheet

a. is the amount of net income or loss

b. indicates there is an error on the work sheet

c. is not unusual when preparing the work sheet

d. is the net difference between revenue, expenses, and dividends

21. A net loss appears on the work sheet in the

a. debit column of the Balance Sheet columns

b. credit column of the Balance Sheet columns

c. debit column of the Income Statement columns

d. credit column of the Adjustments columns

22. The inventory system employing accounting records that continuously disclose the amount of

inventory is called

a. retail

b. periodic

c. physical

d. perpetual

23. Apple Co sells merchandise on credit to Zea Co in the amount of P8,000. The invoice is dated

on September 15 with terms of 1/15, net 45. If Zea Co. chooses not to take the discount, by

when should the payment be made?

a. September 30

b. October 30

c. October 15

d. September 25

24. One of the main disadvantages of the corporate form is the

a. professional management

b. double taxation of dividends

c. charter

d. corporation must issue stock

25. The SEC allows a corporation to issue only a certain number of shares of each class of stock.

This amount of stock is called

a. treasury stock

b. issued stock

c. outstanding stock

d. authorized stock

26. The charter of a corporation provides for the issuance of 100,000 shares of common stock.

Assume that 40,000 shares were originally issued and 5,000 were subsequently reacquired.

What is the number of shares outstanding?

a. 5,000

b. 35,000

c. 45,000

d. 55,000

27. The par value per share of common stock represents

a. the minimum selling price of the stock established by the articles of

incorporation.

b. the minimum amount the stockholder will receive when the corporation is

liquidated

c. an arbitrary amount established in the articles of incorporation

d. the amount of dividends per share to be received each year

28. The Rand Corporation began the current year with a retained earnings balance of P25,000.

During the year, the company corrected an error made in the prior year, which was a failure

to record depreciation expense of P3,000 on equipment. Also, during the current year, the

company earned net income of P12,000 and declared cash dividends of P5,000. Compute the

year end retained earnings balance.

a. P29,000

b. P35,000

c. P39,000

d. P45,000

29. To organize a corporation require at least _____, but not more than ____ incorporators.

a. 2, 5 c. 5, 15,

b. 5, 10 d. 7, 20

30. To form a partnership, one of the requirements is that

a. all partners must be CPAs c. objective is charitable pursuits

b. all partners must invest funds d. purpose must be lawful

PAR COR ACCOUNTING CUP_AVERAGE QUESTIONS

Answer Section

MULTIPLE CHOICE

1. D

2. A

3. B

4. D

5. B

6. C

7. C

8. B

9. A

10. A

11. B

12. A

13. D

14. D

15. B

16. D

17. A

18. A

19. C

20. B

21. A

22. D

23. B

24. B

25. D

26. B

27. C

28. A

29. C

30. D

You might also like

- Polytechnic University Midterm Exam Adjusting EntriesDocument7 pagesPolytechnic University Midterm Exam Adjusting EntriesEdison San JuanNo ratings yet

- Seeds of The Nations Review-MidtermsDocument9 pagesSeeds of The Nations Review-MidtermsMikaela JeanNo ratings yet

- Financial Reporting I: Key Accounting ConceptsDocument5 pagesFinancial Reporting I: Key Accounting ConceptsKim Cristian Maaño50% (2)

- Far Reviewer 1Document4 pagesFar Reviewer 1MARK JAYSON MANABATNo ratings yet

- Far FPBDocument16 pagesFar FPBMae Marcos SaguipedNo ratings yet

- Optical Clinic Financial RecordsDocument3 pagesOptical Clinic Financial RecordsJadon MejiaNo ratings yet

- CCDC First Grading Examination MCQDocument9 pagesCCDC First Grading Examination MCQRoldan ManganipNo ratings yet

- Job Costing Finished Goods InventoryDocument46 pagesJob Costing Finished Goods InventoryNavindra JaggernauthNo ratings yet

- Accounting ReviewerDocument5 pagesAccounting ReviewerNoelyn PaghubasanNo ratings yet

- Actg 216 Reviwer Part 2 Without AnswerDocument5 pagesActg 216 Reviwer Part 2 Without Answercute meNo ratings yet

- Three Methods of Estimating Doubtful AccountsDocument8 pagesThree Methods of Estimating Doubtful AccountsJay Lou PayotNo ratings yet

- CASH FLOW STATEMENTS - Quiz 3Document2 pagesCASH FLOW STATEMENTS - Quiz 3JyNo ratings yet

- AFST Short Quiz 01 Partnership FormationDocument3 pagesAFST Short Quiz 01 Partnership Formationsad gurlNo ratings yet

- Quiz JournalizingDocument13 pagesQuiz JournalizingEron Roi Centina-gacutanNo ratings yet

- CFAS FinalsDocument7 pagesCFAS FinalsMarriel Fate CullanoNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Quiz No. 3 - Working Capital Management PDFDocument5 pagesQuiz No. 3 - Working Capital Management PDFNerissa PasambaNo ratings yet

- Practice Quiz NonFinlLiabDocument15 pagesPractice Quiz NonFinlLiabIsabelle GuillenaNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple Choicetough mamaNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- Final Exam AC 1 2 Answer KeyDocument7 pagesFinal Exam AC 1 2 Answer KeyBill VilladolidNo ratings yet

- Single Entry SystemDocument2 pagesSingle Entry SystemQuestionscastle FriendNo ratings yet

- Accounting ExercisesDocument41 pagesAccounting ExercisesKayla MirandaNo ratings yet

- HO 2 Receivables PDFDocument4 pagesHO 2 Receivables PDFIzzy BNo ratings yet

- ACC1003 Practice QuestionsDocument6 pagesACC1003 Practice Questionsmeera abdullahNo ratings yet

- PFRS 12 Disclosures of Interest in Other EntitiesDocument32 pagesPFRS 12 Disclosures of Interest in Other EntitiesRenge TañaNo ratings yet

- Chap 008Document100 pagesChap 008avivdechner83% (6)

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- CFASDocument4 pagesCFASBruce Devin Pabayos SolanoNo ratings yet

- ICare First Preboard Examination-MSDocument14 pagesICare First Preboard Examination-MSLeo M. SalibioNo ratings yet

- Diagnostic Examination For Capital BudgetingDocument16 pagesDiagnostic Examination For Capital BudgetingJames ScoldNo ratings yet

- CE - Advanced Financial Accounting and ReportingDocument27 pagesCE - Advanced Financial Accounting and ReportingCristinaNo ratings yet

- Receivable ManagementDocument2 pagesReceivable ManagementR100% (1)

- ACTG21c MIDTERM EXAM REVIEWDocument6 pagesACTG21c MIDTERM EXAM REVIEWJuanito TanamorNo ratings yet

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDocument5 pagesCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSVDocument14 pagesACCT 1A&B: Fundamentals of Accounting BCSVDanicaZhayneValdezNo ratings yet

- MAS Midterm Review: Products, Budgets, ROI & Variance AnalysisDocument12 pagesMAS Midterm Review: Products, Budgets, ROI & Variance AnalysisZyrelle DelgadoNo ratings yet

- Course Outline - Intermediate Accounting 1Document3 pagesCourse Outline - Intermediate Accounting 1acctg20120% (1)

- Semi Final Exam (Accounting)Document4 pagesSemi Final Exam (Accounting)MyyMyy JerezNo ratings yet

- Mergers and acquisitions multiple choice questionsDocument2 pagesMergers and acquisitions multiple choice questionsKristel SumabatNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- Not For Profit Organization and Government Accounting HandoutDocument6 pagesNot For Profit Organization and Government Accounting HandoutNicoleNo ratings yet

- Accounting ReviewerDocument15 pagesAccounting ReviewerDeryll MacanasNo ratings yet

- BLT 2008 First Pre-Board August 2Document15 pagesBLT 2008 First Pre-Board August 2Lester AguinaldoNo ratings yet

- Quiz 1 P2 FinmanDocument3 pagesQuiz 1 P2 FinmanRochelle Joyce CosmeNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- Chapter 6 Exercise QuestionsDocument2 pagesChapter 6 Exercise QuestionsMunkh-Erdene OtgonboldNo ratings yet

- RFBT 04 03 Law On Obligation For Discussion Part TwoDocument15 pagesRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieNo ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- Accounting For Partnership DissolutionDocument19 pagesAccounting For Partnership DissolutionMelanie kaye ApostolNo ratings yet

- Bank of The Philippine Islands Balanced Scorecard Group 2Document5 pagesBank of The Philippine Islands Balanced Scorecard Group 2Jasper TabernillaNo ratings yet

- MAC Material 2Document33 pagesMAC Material 2Blessy Zedlav LacbainNo ratings yet

- Tax DrillsDocument21 pagesTax DrillsJewelle CantosNo ratings yet

- Chapter 15 - Test BankDocument19 pagesChapter 15 - Test BankBAur100% (1)

- Principles of AccountingDocument6 pagesPrinciples of AccountingGian Karlo PagariganNo ratings yet

- Chapter 6 TBDocument26 pagesChapter 6 TBSophia UnaNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamMikaela SalvadorNo ratings yet

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. Biligan0% (1)

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. BiliganNo ratings yet

- Chapter 5 - Inventories and Related ExpensesDocument13 pagesChapter 5 - Inventories and Related ExpensesJoshua HinesNo ratings yet

- Prism Region 4a-Pnc Cup Far QuestionsDocument16 pagesPrism Region 4a-Pnc Cup Far QuestionsShin YaeNo ratings yet

- Cost of CapitalDocument7 pagesCost of CapitalShin YaeNo ratings yet

- 4th PNC Goodwill Cup (Nov 2016)Document5 pages4th PNC Goodwill Cup (Nov 2016)Shin YaeNo ratings yet

- Junior Finex CommitteeDocument4 pagesJunior Finex CommitteeShin YaeNo ratings yet

- Fraud ExaminationDocument1 pageFraud ExaminationShin YaeNo ratings yet

- Cost of Credit Formula ExplainedDocument3 pagesCost of Credit Formula ExplainedShin YaeNo ratings yet

- ScheduleDocument1 pageScheduleShin YaeNo ratings yet

- ScheduleDocument1 pageScheduleShin YaeNo ratings yet

- ScheduleDocument1 pageScheduleShin YaeNo ratings yet

- Cash and Internal ControlDocument47 pagesCash and Internal ControlHEM CHEA100% (2)

- Tange Awbrey ResumeDocument2 pagesTange Awbrey Resumeapi-264168595No ratings yet

- 2023 Nigeria Census Field Officer's ManualDocument261 pages2023 Nigeria Census Field Officer's Manuallohyi danielNo ratings yet

- Assignment On Green Business ManagementDocument5 pagesAssignment On Green Business Managementsai5charan5bavanasiNo ratings yet

- South Padre FlyerDocument2 pagesSouth Padre FlyerConrado Gonzalo Garcia JaminNo ratings yet

- Internet Bill For Aug-2022Document2 pagesInternet Bill For Aug-2022rased ahkcNo ratings yet

- Logan ProblemsDocument2 pagesLogan Problemspriyajit1977No ratings yet

- Netflix Case AnalysisDocument2 pagesNetflix Case AnalysisShubham SoganiNo ratings yet

- Sap SD InnerDocument132 pagesSap SD InnerRakesh KumarNo ratings yet

- Oracle Fusion Middleware Developer GuideDocument1,422 pagesOracle Fusion Middleware Developer GuideahsunNo ratings yet

- Lal Mohammad and Ors Vs Indian Railway Construction Co. ... On 4 December, 1998Document19 pagesLal Mohammad and Ors Vs Indian Railway Construction Co. ... On 4 December, 1998SatyaRaoNo ratings yet

- Discussion Questions #1Document2 pagesDiscussion Questions #1Denise NgNo ratings yet

- AS 1 PPT The Consultancy Process Teacher Workshop#1Document9 pagesAS 1 PPT The Consultancy Process Teacher Workshop#1Oaga GutierrezNo ratings yet

- Resume (Inderpreet Singh)Document4 pagesResume (Inderpreet Singh)cool_aman_luthraNo ratings yet

- Joint Ventures ChecklistDocument2 pagesJoint Ventures ChecklistcityrenNo ratings yet

- NExitDocument164 pagesNExitdanuckyNo ratings yet

- Präsentation Leadership & Intercultural ManagementDocument18 pagesPräsentation Leadership & Intercultural ManagementbellaNo ratings yet

- Tender Evaluation Template GuideDocument15 pagesTender Evaluation Template Guidedarshantas67% (3)

- Past Gala Honorees 052214 PDFDocument3 pagesPast Gala Honorees 052214 PDFrika rahimNo ratings yet

- Feasibility Study Guide USDA1Document24 pagesFeasibility Study Guide USDA1Jessica Ddw FianzaNo ratings yet

- MBA-622 - Financial ManagementDocument11 pagesMBA-622 - Financial Managementovina peirisNo ratings yet

- Edu Datasheet Srmicm V6 1Document3 pagesEdu Datasheet Srmicm V6 1vcp vcloudxpertsNo ratings yet

- Total Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred OnlyDocument1 pageTotal Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred Only Total Amount (In Word) : Rupees Four Hundred Onlysaurabhdabas7No ratings yet

- Mm/dd/yyyy 01/07/2023Document1 pageMm/dd/yyyy 01/07/2023Eustache luckens yadleyNo ratings yet

- Corporate Taxation LLC ClassificationDocument186 pagesCorporate Taxation LLC Classificationkatie_deluca_2100% (7)

- FSRE Easily Understood (DipFA Revision Guide) 2015/16 Preview by RuksonsDocument6 pagesFSRE Easily Understood (DipFA Revision Guide) 2015/16 Preview by Ruksonsadetomiruksons100% (2)

- Us GaapDocument3 pagesUs GaapHaneen Abdulla100% (1)

- Chapter 1Document4 pagesChapter 1Lyn AmbrayNo ratings yet

- Ethical Dillema in BusinessDocument2 pagesEthical Dillema in BusinesscharlesNo ratings yet

- To RctiDocument4 pagesTo RctiSis Joko NugrohoNo ratings yet