Professional Documents

Culture Documents

Pineland PID FY 2019 Budget

Uploaded by

Seth RobbinsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pineland PID FY 2019 Budget

Uploaded by

Seth RobbinsCopyright:

Available Formats

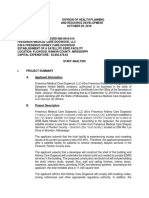

Pinelands Public Improvement District

FY 09/30/19 Budget Worksheet FY 2018

FY 2019 Actual through Additional Expected

REVENUES Budget 8/13/2018 * Expected FY 2018

Special Assessment Revenues Lots Amount

Residential 841 $ 465 $ 391,065

Acreage 360.68 $ 967.58 $ 348,987

740,052 604,704 198,804 803,508

Interest Income - Hancock 7,500 12,839 104 12,943

Penalties & interest - on delinquent collections - - 25,592 25,592

Total Revenues 747,552 617,543 842,043

EXPENDITURES

Debt Service

Bond Principal Payment (due 02/01/19) 315,000 295,000 - 295,000

Interest Payment (due 02/01/19) 141,750 149,563 - 149,563

Interest Payment (due 08/01/19) 132,300 - 141,750 141,750

Total Debt Service 589,050 444,563 586,313

Operating

Tax Collection & Tax Assessor Fees (payable to Rankin County) 7,500 7,500 - 7,500

Board Attorney Fees 2,500 - 2,500 2,500

Board Member Fees 4,800 ??? - -

Trustee Fees 7,000 6,735 - 6,735

Audit Fees 7,500 - 6,250 6,250

Insurance Expense 7,500 5,389 - 5,389

Bookkeeping Fees 10,000 8,005 1,500 9,505

Landscaping 100,000 58,624 5,296 63,919

Bank charges 200 112 - 112

Water 3,000 331 35 366

Electricity 7,000 377 60 437

Repairs and maintenance 1,000 200 - 200

Other supplies 500 120 - 120

Total operating 158,500 87,392 103,033

Total Expenditures 747,550 531,955 689,346

Revenues Over (Under) Expenditures 2 85,588 $ 152,697

You might also like

- Media Release - 06042020 Cancellation of Independence Celebration 2020Document1 pageMedia Release - 06042020 Cancellation of Independence Celebration 2020Seth RobbinsNo ratings yet

- ABC Complaint Against Wine Express Et AlDocument18 pagesABC Complaint Against Wine Express Et AlSeth RobbinsNo ratings yet

- Mississippi Supreme Court Opinion - Wine ExpressDocument17 pagesMississippi Supreme Court Opinion - Wine ExpressSeth RobbinsNo ratings yet

- Sample Ballot 3.10.2020 Primary RacesDocument2 pagesSample Ballot 3.10.2020 Primary RacesSeth RobbinsNo ratings yet

- PRVWSD Media Release - 02112020 High Water EventDocument1 pagePRVWSD Media Release - 02112020 High Water EventSeth RobbinsNo ratings yet

- PRV Lease To Expedition Point Development, LLCDocument24 pagesPRV Lease To Expedition Point Development, LLCSeth RobbinsNo ratings yet

- PRVWSD Media Release - 01152020 Reservoir To Mitigate High Water PDFDocument2 pagesPRVWSD Media Release - 01152020 Reservoir To Mitigate High Water PDFSeth RobbinsNo ratings yet

- MM2020 Fact Sheet SOS Issues Official VerificationDocument1 pageMM2020 Fact Sheet SOS Issues Official VerificationSeth RobbinsNo ratings yet

- PRVWSD Media Release - 01152020 Reservoir To Mitigate High Water PDFDocument2 pagesPRVWSD Media Release - 01152020 Reservoir To Mitigate High Water PDFSeth RobbinsNo ratings yet

- MBOH ResolutionDocument2 pagesMBOH ResolutionWLBT News100% (2)

- Ranking GIS Map - Northshore Landing, LLCDocument1 pageRanking GIS Map - Northshore Landing, LLCSeth RobbinsNo ratings yet

- Yakiniku LogoDocument1 pageYakiniku LogoSeth RobbinsNo ratings yet

- Northshore Landing, Part 1 - Subdivision PlatDocument3 pagesNorthshore Landing, Part 1 - Subdivision PlatSeth RobbinsNo ratings yet

- Rankin County Sample Ballot - November 5, 2019 - General ElectionDocument5 pagesRankin County Sample Ballot - November 5, 2019 - General ElectionSeth RobbinsNo ratings yet

- Mississippi Division of Health Planning - 10.29.2018Document13 pagesMississippi Division of Health Planning - 10.29.2018Seth RobbinsNo ratings yet

- Ordinance Establishing Pinelands Public Improvement DistrictDocument31 pagesOrdinance Establishing Pinelands Public Improvement DistrictSeth RobbinsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Invty EstimationDocument6 pagesInvty EstimationdmiahalNo ratings yet

- Fundamentals of Auditing and Assurance Services OverviewDocument8 pagesFundamentals of Auditing and Assurance Services OverviewSkye LeeNo ratings yet

- PIC Q As As of 6.30.20 PDFDocument749 pagesPIC Q As As of 6.30.20 PDFKatherine Cabading InocandoNo ratings yet

- Notes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The NotesDocument5 pagesNotes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The Notesjake doinogNo ratings yet

- Fundamentals Dec 2014Document40 pagesFundamentals Dec 2014Yew Toh TatNo ratings yet

- Ernst & Young Islamic Funds & Investments Report 2011Document50 pagesErnst & Young Islamic Funds & Investments Report 2011The_Banker100% (1)

- IC38 Janamghutti v1 10052019 PDFDocument67 pagesIC38 Janamghutti v1 10052019 PDFMahesh S Gour75% (4)

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- Novi Letter To The OCCDocument1 pageNovi Letter To The OCCJason BrettNo ratings yet

- Functions of Treasury MGTDocument5 pagesFunctions of Treasury MGTk-911No ratings yet

- SEC 204 Status ReportDocument17 pagesSEC 204 Status Reportthe kingfishNo ratings yet

- 122 1004Document32 pages122 1004api-275486640% (1)

- BSP M-2020-016 PDFDocument9 pagesBSP M-2020-016 PDFRaine Buenaventura-EleazarNo ratings yet

- COGM5 Final RequirementDocument24 pagesCOGM5 Final RequirementLadignon IvyNo ratings yet

- Mutual Funds - IntroductionDocument9 pagesMutual Funds - IntroductionMd Zainuddin IbrahimNo ratings yet

- 3 - Valuation of Equity Shares - Assignment (26-04-19)Document4 pages3 - Valuation of Equity Shares - Assignment (26-04-19)AakashNo ratings yet

- Pension - RR 01-83 Amend - 211118 - 115738Document4 pagesPension - RR 01-83 Amend - 211118 - 115738HADTUGINo ratings yet

- G.5 Allied Bank Vs MateoDocument1 pageG.5 Allied Bank Vs MateoBryan NavarroNo ratings yet

- Sample Financial Reports For Livelihood AssociationDocument7 pagesSample Financial Reports For Livelihood AssociationOslec AtenallNo ratings yet

- Arvog Finance Corporate Presentation 2022Document9 pagesArvog Finance Corporate Presentation 2022Dinesh KandpalNo ratings yet

- Goa University International Economics Sem V SyllabusDocument3 pagesGoa University International Economics Sem V SyllabusMyron VazNo ratings yet

- BSBCRT611 BriefDocument2 pagesBSBCRT611 BriefJohnNo ratings yet

- DrewDocument2 pagesDrewmusunna galibNo ratings yet

- BUS 330 Exam 1 - Fall 2012 (B) - SolutionDocument14 pagesBUS 330 Exam 1 - Fall 2012 (B) - SolutionTao Chun LiuNo ratings yet

- The 7 Steps To Freedom - by David MacGregorDocument24 pagesThe 7 Steps To Freedom - by David MacGregorTamás DunavölgyiNo ratings yet

- Financing Options in The Oil and Gas IndustryDocument31 pagesFinancing Options in The Oil and Gas IndustrymultieniyanNo ratings yet

- DigiKhata PDFDocument2 pagesDigiKhata PDFtufailnazir Muhammad tufailNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Personal Loan Application Form Borang Permohonan Pinjaman PeribadiDocument6 pagesPersonal Loan Application Form Borang Permohonan Pinjaman PeribadiMohd AzhariNo ratings yet

- GenMath FormulasDocument2 pagesGenMath FormulasWendy Mae Lapuz100% (1)