Professional Documents

Culture Documents

Economics PDF

Economics PDF

Uploaded by

Arnab MallickOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economics PDF

Economics PDF

Uploaded by

Arnab MallickCopyright:

Available Formats

I

~ Indian Institute of Technology Kharagpur

Date: FN/AN Time 3 hrs Full Marks 50 No of Students: 392 (Approx)

Autumn End-Sem. Exam, 20II Subject: Economics Subject No: HS 2000I

Instruction: Answer any five questions

I. a) What do you mean by production? Define the law of Diminishing Marginal Returns.

What are the basic features of the three stages of production with one variable input?

Elaborate in which stage do you produce and why? 1+2+2

b) Explain the laws of returns to scale with the help of Cobb-Douglas production

function. Prove that the exponents a and pin a Cobb-Douglas Production represents the

elasticity of output with respect to respective inputs. 3+2

2. a) Discuss the relationship between Short-rup Average Cost (SAC) and Short-run

Marginal Cost (SMC) curves. If the cost function of a cement factory is

TC = 200 + SQ- 0.04Q2 + 0.001Q3 , where TC is Total Cost and Q is output, measure

the critical value of output with respect to Average Variable Cost (AVC). 1 + 1.5

b) Write short notes (any three) on: 2.5 X 3

1. Isoquant and economic region of production

11. Variable input and fixed input

iii. Private cost and Social cost

iv. Economic analysis through Linear Programming

3. a) Describe the processes involved in capital budgeting. If two projects are mutually

exclusive, which method should be preferred between NPV and 1RR and why? 4

b) Jindal Steel plans to undertake a new project in West Bengal. The company has

estimated that the capital required for the installation of the plant is Rs 300 Cr. In

addition, the company will have to undertake an additional capital investment of Rs

200 Cr towards reorganization of activities including land acquisition, working capital

etc. The project is expected to last for 4 years. The incremental sales revenue is

estimated to be Rs 400 Cr in the first year which will rise by 20% in next two years

and then by I 0% in the final year. The company will incur variable cost which is 30%

of the sales revenues and its fixed cost is estimated to be Rs 25 Cr annually. The

government levies a tax rate of20% on the company's profit. The company applies flat

depreciation rate to consider wear and tear. Assume that the salvage value is Rs 10 Cr

n ___ ... _r,...

I

and the company would recover Rs 20 Cr as working capital. Derive net cash flows

over the life of the project. If the rate of interest is 8%, derive NPV of the project and

suggest whether the project should be undertaken. 6

4. a) Distinguish between perfect competition and monopoly according to their basic

characteristics and profit maximizing situations. What are the factors responsible for

the existence of monopoly? 5

b) The White Company is a member of the lamp industry, which is perfectly competitive.

The price of a lamp is Rs 50. The firm's total cost function is

2

C = 1000 + 20Q + 5Q

Where C is total cost in rupees and Q is hourly output.

1. What output maximizes profit?

u. What is the firm's economic profit at this output?

m. What is the firm's average cost at this output?

tv. If other firms in the lamp industry have the same cost functions as this firm, is the

industry in equilibrium? Why or why not. 5

5. a) Is it true that National Income can measure growth, welfare and sustainability of a

country? Give suitable examples to prove your answer. 5

b) Describe the trend in the growth of National Income. m India, and discuss the

difficulties and limitations in its estimation. 5

6. Write notes on any two: 5x2

i. Methods of estimation of National Income

ii. Distinguish between the following in the context ofNational Income accounts:

1. Gross and Net

2. Domestic and National

3. Money and Real

4. Personal and Per capita

5. Transfer earnings and Transfer payment

iii. Trade, Technology and Foreign Investment policy in India.

Page 2 of2

You might also like

- Uhu081 PDFDocument2 pagesUhu081 PDFsahibjotNo ratings yet

- 7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)Document11 pages7ACCN018W - Exam July 2020 (MODIFIED 19 MAY 2020)hazyhazy9977No ratings yet

- Refugee LoanDocument1 pageRefugee LoanKSTPTV100% (1)

- FIN444 (Case Mexico)Document6 pagesFIN444 (Case Mexico)Rahat Ali KhanNo ratings yet

- Indian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)Document2 pagesIndian Institute of Technology Kharagpur: (Treat Multiplier As The Reciprocal of Marginal Demand Propensities)maimslapNo ratings yet

- OL L K: Indian Institute of Technology KharagpurDocument2 pagesOL L K: Indian Institute of Technology KharagpurmaimslapNo ratings yet

- Q and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Document95 pagesQ and As-Advanced Management Accounting - June 2010 Dec 2010 and June 2011Samuel Dwumfour100% (1)

- Mco 07Document4 pagesMco 07rammar147No ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- P1 Question June 2019Document6 pagesP1 Question June 2019S.M.A AwalNo ratings yet

- Assignment 2 Dac 314 2024Document10 pagesAssignment 2 Dac 314 2024rachaelmercNo ratings yet

- Assignment Drive WINTER 2013 Program Mbads/ Mbaflex/ Mbahcsn3/ Mban2/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credit 4 Marks 60Document2 pagesAssignment Drive WINTER 2013 Program Mbads/ Mbaflex/ Mbahcsn3/ Mban2/ Pgdban2 Semester II Subject Code & Name MB0045 Financial Management BK Id B1628 Credit 4 Marks 60Dhruvik PatelNo ratings yet

- Managerial Acc QnaireDocument5 pagesManagerial Acc QnaireMutai JoseahNo ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Assessment 1 October 2021 POCFDocument2 pagesAssessment 1 October 2021 POCFAakanksha ChughNo ratings yet

- BEC 3253 Production EconomicsDocument4 pagesBEC 3253 Production EconomicsKelvin MagiriNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Cost Accounting (781) Sample Question Paper Class XII 2018-19Document5 pagesCost Accounting (781) Sample Question Paper Class XII 2018-19Saif HasanNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- MA-II Sec C & D PGDM MT QPDocument3 pagesMA-II Sec C & D PGDM MT QPAyush DevraNo ratings yet

- Cse Commerce Accountancy 2005Document4 pagesCse Commerce Accountancy 2005anon-479548No ratings yet

- Sree Vidyanikethan Engineering College: CODE No.:10BT60301Document2 pagesSree Vidyanikethan Engineering College: CODE No.:10BT60301Soumya BsoumyaNo ratings yet

- Afin317 FPD 1 2020 1Document8 pagesAfin317 FPD 1 2020 1Daniel Daka100% (1)

- P1 Q December 2020Document6 pagesP1 Q December 2020S.M.A AwalNo ratings yet

- B.sc. Engineering 2nd Year 2nd Term Regular Examination, 2015Document15 pagesB.sc. Engineering 2nd Year 2nd Term Regular Examination, 2015MD SHAKIL AHMEDNo ratings yet

- Production Planning and ControlDocument8 pagesProduction Planning and ControlKamal ChaitanyaNo ratings yet

- ACCT 321-Magerial AccountingDocument6 pagesACCT 321-Magerial AccountingNodeh Deh SpartaNo ratings yet

- Uhu081 PDFDocument2 pagesUhu081 PDFsahibjotNo ratings yet

- BMS College of Engineering, Bangalore-560019: January 2015 Semester End Make Up ExaminationsDocument2 pagesBMS College of Engineering, Bangalore-560019: January 2015 Semester End Make Up Examinationshemavathi jayNo ratings yet

- ECON F411 - MidTerm Paper - 2019-20Document2 pagesECON F411 - MidTerm Paper - 2019-20AdityaNo ratings yet

- Siddharth Education Services LTD: Tel:2443455 TelDocument3 pagesSiddharth Education Services LTD: Tel:2443455 TelBasanta K SahuNo ratings yet

- Exam2505 2012Document8 pagesExam2505 2012Gemeda GirmaNo ratings yet

- Mbac 2001Document6 pagesMbac 2001sujithNo ratings yet

- Assignment For First Sem CMDocument4 pagesAssignment For First Sem CMnishant khadkaNo ratings yet

- BMS College of Engineering, Bangalore-560019: December 2016 Semester End Main ExaminationsDocument3 pagesBMS College of Engineering, Bangalore-560019: December 2016 Semester End Main Examinationshemavathi jayNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- ACCT 321 - Managerial AccountingDocument5 pagesACCT 321 - Managerial AccountingNodeh Deh SpartaNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementgundapola100% (2)

- PGP 2019 CM Exam Question Paper SharedDocument19 pagesPGP 2019 CM Exam Question Paper SharedAMARJEET KUMARNo ratings yet

- SA Syl12 Jun2014 P10 PDFDocument21 pagesSA Syl12 Jun2014 P10 PDFpatil_viny1760No ratings yet

- Complete Set Tutorial Sheets 1-10Document17 pagesComplete Set Tutorial Sheets 1-10APOORV AGARWALNo ratings yet

- Project Financing: DPM 202: RequiredDocument3 pagesProject Financing: DPM 202: RequiredBobb KetterNo ratings yet

- Main Exam - 2019Document16 pagesMain Exam - 2019Musah LindyNo ratings yet

- Birla Institute of Technology & Science, Pilani Distance Learning Programmes Division First Semester 2007-2008 Comprehensive Examination (EC-2 Regular)Document3 pagesBirla Institute of Technology & Science, Pilani Distance Learning Programmes Division First Semester 2007-2008 Comprehensive Examination (EC-2 Regular)rajpd28No ratings yet

- Assignment 1Document2 pagesAssignment 1ilyas muhammadNo ratings yet

- AssigmentDocument8 pagesAssigmentnonolashari0% (1)

- Government Arts and Science College, Idappadi: Parta - (15 X 1 15 Marks) Answer All QuestionsDocument3 pagesGovernment Arts and Science College, Idappadi: Parta - (15 X 1 15 Marks) Answer All QuestionsMukesh kannan MahiNo ratings yet

- BMS College of Engineering, Bangalore-560019: I I I I I I I IiiiDocument3 pagesBMS College of Engineering, Bangalore-560019: I I I I I I I Iiiihemavathi jayNo ratings yet

- Thapar Institute of Engineering and Technology (Deemed To Be University)Document2 pagesThapar Institute of Engineering and Technology (Deemed To Be University)AdityaNo ratings yet

- Management Accountant Paper 2.2 Dec 2023Document19 pagesManagement Accountant Paper 2.2 Dec 2023MEYVIELYKERNo ratings yet

- OM - I-III Chaptetrs Question BankDocument5 pagesOM - I-III Chaptetrs Question Bankchandrarao chNo ratings yet

- 4336Document4 pages4336Sumon DharaNo ratings yet

- MCO-05 ENG IgnouDocument51 pagesMCO-05 ENG Ignousanthi0% (1)

- 11CH8DHSS2Document4 pages11CH8DHSS2Pranit SonthaliaNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)gulzar ahmadNo ratings yet

- 401 Epm QP NDDocument2 pages401 Epm QP NDvipul rathodNo ratings yet

- Question Paper of FMDocument3 pagesQuestion Paper of FMsrijana pathakNo ratings yet

- P1 Question June 2021Document6 pagesP1 Question June 2021S.M.A AwalNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Formation of PartnershipDocument18 pagesFormation of PartnershipschafieqahNo ratings yet

- Capital Gain Exemption U/s 54, 54B, 54D, 54EC, 54F, 54G, 54GA TableDocument4 pagesCapital Gain Exemption U/s 54, 54B, 54D, 54EC, 54F, 54G, 54GA Tableಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- The Status of Zambia Domestic Debt and External DebtDocument11 pagesThe Status of Zambia Domestic Debt and External DebtChola MukangaNo ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentRemNo ratings yet

- Chapter 17 - Short-Term Credit For Financiang Current AssetsDocument12 pagesChapter 17 - Short-Term Credit For Financiang Current Assetslou-92450% (4)

- UNIT I - The Realm of MacroeconomicsDocument7 pagesUNIT I - The Realm of MacroeconomicsAkeem TaylorNo ratings yet

- Third World CountryDocument3 pagesThird World Countryapi-285429731No ratings yet

- Cfa Level III 4 Months Study PlanDocument21 pagesCfa Level III 4 Months Study Planzev zNo ratings yet

- Sale of Goods Act 1930Document15 pagesSale of Goods Act 1930Nitin GroverNo ratings yet

- 06-03 Great Asian Sales Center Vs CADocument2 pages06-03 Great Asian Sales Center Vs CABernz Velo TumaruNo ratings yet

- Factoring - BangladeshDocument58 pagesFactoring - Bangladeshrajin_rammstein100% (1)

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyNo ratings yet

- 0452 s06 QP 1 PDFDocument12 pages0452 s06 QP 1 PDFAbirHuda100% (1)

- Promissory Note Due On A Specific DateDocument2 pagesPromissory Note Due On A Specific DateRocketLawyer100% (3)

- Book Review: White Man's BurdenDocument3 pagesBook Review: White Man's BurdenRuby GarciaNo ratings yet

- Consolidations - Subsequent To The Date of AcquisitionDocument42 pagesConsolidations - Subsequent To The Date of AcquisitionAla'aEQahwajiʚîɞNo ratings yet

- Are You Aware of Your Mortgage Reinstatement Letter?Document2 pagesAre You Aware of Your Mortgage Reinstatement Letter?PersonalStatementWri100% (1)

- Money CreationDocument3 pagesMoney CreationKarl_23No ratings yet

- Ratio Analysis Classification of Ratios: The Above Classification Further Grouped IntoDocument5 pagesRatio Analysis Classification of Ratios: The Above Classification Further Grouped IntoWaqar AmjadNo ratings yet

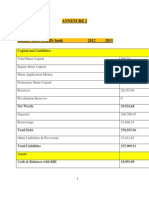

- Annexure 2Document13 pagesAnnexure 2Shalini SrivastavNo ratings yet

- How Bank Creates MoneyDocument1 pageHow Bank Creates Moneyrazz_22No ratings yet

- MCQ QuestionsDocument8 pagesMCQ Questionsvarma pranjalNo ratings yet

- Financial Accounting: Reference Books: Accountancy by D. K. Goel Rajesh Goel OR Double Entry Book Keeping by T. S. GrewalDocument27 pagesFinancial Accounting: Reference Books: Accountancy by D. K. Goel Rajesh Goel OR Double Entry Book Keeping by T. S. GrewalBhawna SinghNo ratings yet

- Higher Secondary Accounts Syllabus NewDocument10 pagesHigher Secondary Accounts Syllabus NewBIKASH166No ratings yet

- st3 FormDocument12 pagesst3 FormAvijit BanerjeeNo ratings yet

- Concept of RiskDocument21 pagesConcept of RiskAbhilash BekalNo ratings yet

- Macroeconomics: Money Supply and Money DemandDocument7 pagesMacroeconomics: Money Supply and Money DemandSharhie RahmaNo ratings yet

- A: What Would It Have Been If The Bonds Were Priced at 100% (Price at Par), 99% and 101% of Face Value?Document47 pagesA: What Would It Have Been If The Bonds Were Priced at 100% (Price at Par), 99% and 101% of Face Value?juan planas rivarolaNo ratings yet