Professional Documents

Culture Documents

Fundamentals in Customs Tariff

Fundamentals in Customs Tariff

Uploaded by

JoannaMarieLlanteReynoso0 ratings0% found this document useful (0 votes)

18 views7 pagesOriginal Title

Fundamentals-in-Customs-Tariff.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views7 pagesFundamentals in Customs Tariff

Fundamentals in Customs Tariff

Uploaded by

JoannaMarieLlanteReynosoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

Sec. 102. Definition of Terms.

- As used in this Act: (h) Bill of Lading (B/L) refers to a transport

document issued by shipping lines, carriers and

(a) Abatement refers to the reduction or diminution

international freight forwarders or non-vessel

in whole or in part, or duties and taxes where

operating common carrier for water-borne freight.

payment has not been made;

The holder or consignee of the bill has the right to

(b) Actual or Outright Exportation refers to the claim delivery of the goods at the port of

customs procedure applicable to goods which, being destination. It is a contract of carriage that includes

in free circulation, leave the Philippine territory and carrier conditions, such as limits of liability and

are intended to remain permanently outside it; claims procedures. In addition, it contains transport

instruction to shipping lines and carriers, a

(c) Admission refers to the act of bringing imported

description of the goods, and applicable

goods directly or through transit into a free zone;

transportation chargers;

(d) Airway Bill (AWB) refers to a transport

(i) Bureau refers to the Bureau of Customs

document for airfreight used by airlines and

international freight forwarders which specify the (j) Carrier refers to the person actually transporting

holder or consignee of the bill who has the right to goods or in charge of or responsible for the

claim delivery of the goods when they arrive at the operation of the means of transport such as airlines,

port of destination. It is a contract of carriage that shipping lines, freight forwarders, cargo

includes carrier conditions, such as limits of liability consolidators, non-vessel operating common

and claims procedures. In addition, it contains carriers and other international transport operators;

transport instructions to airlines and carriers, a

(k) Clearance refers to the completion of customs

description of the goods, and applicable

and other government formalities necessary to

transportation charges;

allow goods to enter for consumption, warehousing,

(e) Appeal refers to the remedy by which a person transit or transshipment, or to be exported or

who is aggrieved or adversely affected by any placed under another customs procedure;

action, decision, order, or omission of the Bureau,

(l) Commission refers to the Tariff Commission

seeks redress before the Bureau, the Secretary of

Finance, or competent court, as the case may be; (m) Conditional Importation refers to the customs

procedure known under the RKC as temporary

(f) Assessment refers to the process of determining

admission in which certain goods can be brought

the amount of duties and taxes and other charges

into a customs territory conditionally relieved,

due on imported and exported goods;

totally or partially, from payment of import duties

(g) Authorized Economic Operator (AEO) refers to and taxes; such goods must be imported for a

the importer, exporter, customs broker, forwarder, specific purpose and must be intended for re-

freight forwarder, transport provider, and any other exportation within a specified period and without

entity duly accredited by the Bureau based on the having undergone any substantial change except

World Customs Organization (WCO) Framework of due to normal depreciation;

Standards to Secure and Facilitate Global Trade, the

(n) Customs Broker refers to any person who is a

Revised Kyoto Convention (RKC), the WCO Supply

bona fide holder of a valid Certificate of

Chain Management Guidelines and the various

Registration/Professional Identification Card issued

national best practices to promote trade facilitation

by the Professional Regulatory Board and

and to provide a seamless movement of goods

Professional Regulation Commission pursuant to

across borders through secure international trade

Republic Act No. 9280, as ammended, otherwise

supply chains with the use of risk management and

known as the “Customs Brokers Act of 2004”;

modern technology;

(o) Customs Office refers to any customs of the product to the Philippines regardless of the

administrative unit that is competent and manufacturer’s name in the invoive;

authorized to perform all or any of the functions

(w) Free Zone refers to special economic zones

enumerated under customs and tariff laws;

registered with the Philippine Economic Zone

(p) Customs Officer, as distinguished from a clerk or Authority (PEZA) under Republic Act No. 7916, as

employee, refers to a person whose duty, not being amended, duly chartered or legislated special

clerical or manual in nature, involves the exercise of economic zones and freeports such as Clark

discretion in performing the function of the Bureau. Freeport Zone; Poro Point Freeport Zone; Joh Hay

It may also refer to an employee authorized to Special Economic Zone and Subic Bay Freeport Zone

perform a specific function of the Bureau as under Republic Act No. 7227, as amended by

provided in this Act; Republic Act No. 9400; the Aurora Special Economic

Zone and Freeport under Republic Act No. 9490, as

(q) Customs Territory refers to areas in the

amended; the Cagayan Special Economic Zone and

Philippines where customs and tariff laws may be

Freeport under Republic Act No. 7922; the

enforced;

Zamboanga City Special Economic Zone under

(r) Entry refers to the act, documentation and Republic Act No. 7903; the Freeport Area of Bataan

process of bringing imported goods into the under Republic Act No. 9728; and such other

customs territory, including goods coming from free freeports as established or maybe created by law;

zones;

(x) Goods refers to articles, wares, merchandise and

(s) Exportation refers to the act, documentation, any other items which are subject of importation or

and process of bringing goods out of the Philippine exportation;

territory;

(y) Goods declaration refers to a statement made in

(t) Export Declaration refers to a statement made in the manner prescribed by the Bureau and other

the manner prescribed by the Bureau and other appropriate agencies, by which the persons

appropriate agencies, by which the persons concerned indicate the procedure to be observed in

concerned indicate the procedure to be observed the application for the entry ir admission of

for taking out or causing to be taken out any imported goods and the particulars of which the

exported goods and the particulars of which the customs administration shall require;

customs administration shall require;

(z) Importation refers to the act of bringing in of

(u) Flexible Clause refers to the power of the goods from a foreign territory into Philippine

President upon recommendation of the National territory, whether for consumption, warehousing,

Economic and Development Authority (NEDA): (1) or admission as defined in this Act;

to increase, reduce or remove existing protective

(aa) Freight Forwarder refers to a local entity that

tariff rates of import duty, but in no case shall be

acts as a cargo intermediary and facilities transport

higher than one hundred percent (100%) ad

of goods on behalf of its client without assuming the

valorem; (2) to establish import quota or to ban

role of a carrier, which can also perform other

importation of any commodity as maybe necessary;

forwarding services, such as booking cargo space,

(3) to impose additional duty on all import not

negotiating freight rates, preparing documents,

exceeding ten percent (10%) ad valorem, whenever

advancing freight payments, providing packing/

necessary;

crating, trucking and warehousing, engaging as an

(v) Foreign Exporter refers to one whose name agent/representative of a foreign non-vessel

appears on documentation attesting to the export operating as a common carrier/cargo consolidator

named in a master bill of lading as consignee of a

consolidated shipment, and other related port. Subports of entry are under the administrative

undertakings; jurisdiction of the District Collector of the principal

port of entry of the Customs District. Port of entry

(bb) International freight forwarder refers to

as used in this Act shall include airport of entry;

persons responsible for the assembly and

consolidation of shipments into single lot, and (ii) Port of Discharge, also called Port of Unloading,

assuming , in most cases, the full responsibility for refers to a place where a vessel, ship, aircarft or train

the international transport of such shipment from unloads it shipments, from where they will be

point of receipt to the point of destination; dispatched to their respective consignees;

(cc) Jurisdictional Control refers to the power and (jj) Reexportation means exportation of goods

rights of the Bureau in exercising supervision and which have been imported;

police authority over all seas within the jurisdiction

(kk) Release of Goods refers to the action by the

of the Philippine territory and over all coasts, ports,

Bureau to permit goods undergoing clearance to be

airports, harbors, bays, rivers and inland waters

placed at the disposal of the party concerned;

whether navigable or not from the sea;

(ll) Refund refers to the return, in whole or in part,

(dd) Lodgement refers to the registration of a goods

of duties and taxes paid on goods;

declaration with the Bureau;

(mm) Security refers to any form of guaranty, such

(ee) Non-Vessel Operating Common Carrier

as a surety bond, cash bond, standby letter of credit

(NVOCC) refers to an entity, which may or may not

or irrevocable letter of credit, which ensures the

own or operate a vessel that provides a point-to-

satisfaction of an obligation to the Bureau;

point service which may include several modes of

transport and/or undertakes group age of less (nn) Smuggling refers to the fraudulent act of

container load (LCL) shipments and issues the importing any goods into the Philippines, or the act

corresponding transport document; of assissting in receiving, concealing, buying, selling,

disposing or transporting such goods, with full

(ff) Outright Smuggling refers to an act of importing

knowledge that the same has been fraudulently

goods into the country without complete customs

imported, or the fraudulent exportation of goods.

prescribed importation documents, or without

Goods referred to under this definition shall be

being cleared by customs or other regulatory

known as smuggled goods;

government agencies, for the purpose of evading

payment of prescribed taxes, duties and other (oo) Taxes refers to all taxes, fees and charges

government charges; imposed under this Act and the National Internal

Revenue Code (NIRC) of 1997, as amended, and

(gg) Perishable Good refers to goods liable to perish

collected by the Bureau;

or goods that depreciate greatly in value while

stored or which cannot be kept without great (pp) Technical Smuggling refers to the act of

disproportionate expense, which may be proceeded importing goods into the country by means of

to, advertised and sold at auction upon notice if fradulent, falsified or erroneous declaration of the

deemed reasonable; goods to its nature, kind, quality, quantity or weight,

for the purpose of reducing or avoiding payment of

(hh) Ports of Entry refers to a domestic port open to

prescribed taxes, duties and other charges;

both domestic and international trade, including

principal ports of entry and subports of entry. A (qq) Tentative Release refers to a case where the

principal port of entry is the chief port of entry of assessment is disputed and pending review, an

the Customs District wherein it is situated and is the importer may put up a cash bond equivalent to the

permanent station of the District Collector of such

duties and taxes due on goods before the importer Barter System between China and

can obtain release of said goods; Philippines

Philippines pay their tribute to the rajah or

(rr) Transit refers to the customs procedure under

datu

which goods, in its original form, are transported

The silk serves as their customs duty

under customs control from one customs office to

Tariffa: Julia Traducta – city in Spain

another, or to a free zone;

Tax is also an obligation to the Lord, not only

(ss) Transshipment refers to the customs procedure to God.

under which goods are transferred under customs Ceuz Canal

control from the importing means of transport to

CUSTOMS DUTY

the exporting means of transport within the area of

one customs office, which is the office of both Tariff

importation and exportation;

Is the list or schedule of importable

(tt) Travelers refers to any person who temporarily articles to the Philippines with

enters the territory of a country in which he or she corresponding rate of duty.

does not normally resides (non-resident), or who

Customs

leaves that territory, and any person who leaves the

territory of a country in which he or she normally Habitual practice: traditions and norms

resides (departing resident) or who returns to that Rules and regulations imposed

territory (returning resident); and

Customs Duty

(uu) Third Party refers to any person who deals

are taxes paid/levied/imposed on

directly with the Bureau, for and on behalf of

imported goods and computed based on

another person, relating to the importation,

the list of the tariff.

exportation, movement or storage of goods.

SECTION 104. Customs Duty

HISTORY OF CUSTOMS

Except as otherwise, provided for in this

Habitual practice of paying duties

act or in other laws, all goods when

310 BC – 21 miles from the Strait of Gibraltar

imported to the Philippines, shall be

is Julia Traducta which is a Muslim town in

subject to duty upon importation,

Spain

including all goods previously exported

Strait of Gibraltar was the only passage way

from the Philippines.

to the Mediterranean Sea

Even if it’s made in the Philippines, when

Strait is a body of water surrounded by land,

it is previously exported, there is a need

connecting one body of water to another.

to pay for duty.

Berber: Tarik Ibn Malik (sinakop yung Julia

Unless it is part of Section 800, the list of

Traducta)

exempted goods for duty.

Hinarang ng mga tauhan niya yung vessels ng

nag eenter sa Julia Traducta to ask for tribute TYPES OF IMPORTATION

They pay their tribute as a duty to be able to

Sec. 115. Treatment of Importation. – Imported

pass the Strait of Gibraltar, that’s why there

goods shall be deemed “entered” in the Philippines

are customs duty.

for consumption when the goods declaration is

Then it became a habitual practice

electronically lodged, together with any required

Was done also in England and China

supporting documents, with the pertinent customs

office.

Sec. 116. Free Importation and Exportation. – misbranded drug in violation of relevant laws and

Unless otherwise provided by laws and regulation, regulations;

all goods may be freeky imported into and exported

(f) Infringing goods as defined under the Intellectual

from the Philippines without need for import and

Property Code and related laws; and

export permits, clearances or licenses.

(g) All goods or parts thereof, which importation and

Sec. 117. Regulated Importation and Exportation. –

exportation are explicitly prohibited by law or rules

Goods which are subject to regulation shall be

and regulations issued by the competent authority.

imported or exported only after securing the

necessary goods declaration or export declaration, Sec. 119. Restricted Importation and Exportation. –

clearances, licenses, and any other requirements, Except when authorized by law or regulation, the

prior to importation or exportation. In case of importation and exportation of the following

importation, submission of requirements after restricted goods are prohibited:

arrival of the goods but prior to release from

(a) Dynamite, gunpowder, ammunitions and other

customs custody shall be allowed, but only in cases

explosives, firearms and weapons of war, or parts

provided for by governing laws or regulations.

thereof;

Sec. 118. Prohibited Importation and Exportation.

(b) Roulette wheels, gambling outfits, loaded dice,

– The importation and exportation of the following

marked cards, machines, apparatus or mechanical

goods are prohibited:

devices used in gambling or the distribution of

(a) Written or printed goods in any form containing money, cigars, cigarettes or other goods when such

any matter advocating or inciting treason, rebelion, distribution is dependent on chance, including

insurrection, sedition against the government of the jackpot and pinball machines or similar

Philippines, or forcible resistance to any law of the contrivances, or parts thereof;

Philippines, or written or printed goods containing

(c) Lottery and sweepstakes tickers, except

any threat to take the life of, or inflict bodily harm

advertisements thereof and lists of drawings

upon any person in the Philippines;

therein;

(b) Goods, instruments, drugs and substances

(d) Marijuana, opium, poppies, coca leaves, heroin

designed, intended or adapted for producing

or other narcotics or synthetic drugs which are or

unlawful abortion, or any printed matter which

may hereafter be declared habit forming by the

advertises, describes or gives direct or indirect

President of the Philippines, or any compound ,

information where, how or by whom unlawful

manufactured salt, derivative, or preparation

abortion is committed;

thereof, except when imported by the government

(c) Written or printed goods, negatives or of the Philippines or any person duly authorized by

cinematographic films, photographs, engravings, the Dangerous Drugs Board, for medical purposes;

lithographs, objects, paintings, drawings or other

(e) Opium pipes or parts thereof, of whatever

representation of an obscene or immoral character;

matrial; and

(d) Any goods manufactured in whole or in part of

(f) Any other goods whose importation and

gold, silver or other precious metals or alloys and

exportation are restricted.

the stamp, brand or mark does not indicate the

actual fineness of quality of the metals or alloys; The restriction to import or export the above stated

goods shall include the restriction on their transit

(e) Any adulterated or misbranded food or goods

for human consumption or any adulterated or

DOCTRINES APPLICABLE TO CUSTOMS AND TARIFF Doctrine of the Hot Pursuit

Life Blood Doctrine The right of a police officer to cross

jurisdictional lines (boundaries of other

The nation cannot live without tax because

countries, with no hindrance and questions)

taxes are the lifeblood of the nation.

in order to arrest a vessel (a person who

Taxation- lifeblood doctrine, brought about

committed crime)

the power of taxation

Called “hot” because the crime they did is

In order for the government to have funds

still hot with BOC

for our rights and benefits, they need

For high seas: no country can claim that area

resources which are the taxes

May continue to pursuit

Taxes: income, product, property, real

More on the vessel or aircraft who

estate, residences, etc.

committed a crime in CMTA.

Inherent Powers of the Government

Doctrine of Primary Jurisdiction

Power of Eminent Domain

Kung sinong government agency yung mag

• It is the right of the government to acquire a hahandle ng case.

private property for compensation for publics use The court cannot and will not question

especially when the controversy is under

• The owner gets paid by the government

administrative tribunal

• The owner can reject, but if the government insist No one can hinder BOC to litigate cases

on their power, he/she have no choice. connected to imported goods.

Section 203 (e) BOC has exclusive original

Police Power

jurisdictional over forfeiture cases.

• It is the power of the government to enforce,

Doctrine of Exhaustion of Administrative Remedies

promote safety and health of the citizens

Exhaust all remedies available in the

• It is also their power to apprehend citizens who

organization before seeking help of the

violated laws.

judicial court.

Power of Taxation

Sec. 103. When Importation Begins and Deemed

• In order to build projects and infrastructures, they Terminated. – Importation begins when the

need to get taxes. carrying vessel or aircraft enters the Philippine

territory with the intention to unload therein.

• Connected to the lifeblood doctrine.

Importation is deemed terminated when:

Doctrine of the Fresh Pursuit

(a) The duties, taxes and other charges due upon the

The right of a police officer to cross goods have been paid or secured to be paid at the

jurisdictional lines (boundaries of other port of entry unless the goods are free from duties,

countries, with no hindrance and questions) taxes and other charges and legal permit for

in order to arrest a felon (a person who withdrawal has been granted; or

committed crime)

(b) In case the goods are deemed free of duties,

In order to cross jurisdictional lines,

taxes and other charges, the goods have legally left

countries have to be in harmony with the

the jurisdiction of the Bureau.

doctrine.

It is called “fresh” because the crime is just Sec. 1600. Chief Officials of the Tariff Commission

committed. and Qualification. – The officials of the Tariff

Commission shall consist of a Chairperson and two shall be expected to cooperate fully with the

(2) Commissioners to be appointed by the President Commission.

of the Philippines. The Chairperson and the

Sec. 1606. Sworn and Verified Statements. – The

Commissioners shall be natural-born citizens of the

Commission may order the taking of sworn

Philippines, of good moral character and proven

statements at any stage of any proceeding or

integrity, and who, by experience and academic

investigation before it. The sworn statements must

training possess the necessary qualifications

be made before a person authorized to administer

requisite for developing expert knowledge of tariff

oaths.

and trade related matters. During their terms of

office, the Chairperson and the Commissioners shall The Commission is authorized to require any

not engage in the practice of any profession, or importer, grower, producer, manufacturer or seller

intervene directly or indirectly in the management to file with the Commission a statement, under

or control of any private enterprise which may, in oath, giving the selling prices in the Philippines of

any way, be affected by the functions of their office. goods imported, grown, produced, fabricated or

They shall not be, directly or indirectly, financially manufactured by such person.

interested in any contract with the government, or

Sec. 105. Effective Date of Rate of Import Duty. –

any subdivision or instrumentality thereof.

Imported goods shall be subject to the import duty

Sec. 1604. Reports of the Commission. – The rates under the applicable tariff heading that are

Commission shall place at the disposal of the effective at the date of importation or upon

President and any member of the Congress of the withdrawal from the warehouse for consumption. In

Philippines all information at its command. It shall case of withdrawal from free zones for introduction

conduct such investigation and submit reports as to the customs territory, the duty rate at the time of

may be required by the President and the Congress withdrawal shall be applicable on the goods

of the Philippines. It shall likewise report to the originally admitted, whether withdrawn in its

President and Congress on the first Monday of original or advanced form.

December of each year and hereafter, a statement

of methods adopted and a summary of all reports

made during the year.

Sec. 1605. Access to Documents and Assistance to

the Commission. – The Commission or its duly

authorized representative shall have access to any

document, paper or record, pertinent to the subject

matter under investigation, in the possession of any

person, firm, co-partnership, corporation, or

association engaged in the production, importation,

or distribution of goods under investigation, and

shall have power to summon witnesses, take

testimony, administer oaths, and to issue subpoena

duces tecum requiring the production of books,

papers, or documents relating to the matter under

investigation. The Commission may also request the

views, recommendations, and assistance of any

government office, agency, or instrumentality who

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Handling Units Configuration and TestDocument25 pagesHandling Units Configuration and Testreddyap67% (3)

- 5500 5300合同(浙江宁波港)Document14 pages5500 5300合同(浙江宁波港)Febyo AhmadNo ratings yet

- Restore ManualDocument50 pagesRestore Manualdemo1967No ratings yet

- Summer Internship Project in CONCOR at ICD Tughlakabad ON ANALYSIS & PROMOTION OF LCL CARGODocument17 pagesSummer Internship Project in CONCOR at ICD Tughlakabad ON ANALYSIS & PROMOTION OF LCL CARGOhaidersyed06100% (1)

- Wg135 Mark HillDocument12 pagesWg135 Mark HillHerum ManaluNo ratings yet

- Consent LetterDocument1 pageConsent LetterJoannaMarieLlanteReynosoNo ratings yet

- BASIC BUSINESS PROCESS Using SAP Business OneDocument56 pagesBASIC BUSINESS PROCESS Using SAP Business OneJoannaMarieLlanteReynosoNo ratings yet

- 31Document68 pages31JoannaMarieLlanteReynosoNo ratings yet

- Theology 2Document7 pagesTheology 2JoannaMarieLlanteReynosoNo ratings yet

- The Royal and Pontifical University of Santo Tomas The Catholic University of The PhilippinesDocument12 pagesThe Royal and Pontifical University of Santo Tomas The Catholic University of The PhilippinesJoannaMarieLlanteReynosoNo ratings yet

- Chapter 4Document4 pagesChapter 4Nguyễn Đan NhiNo ratings yet

- Navy FlagsDocument5 pagesNavy FlagsTricia MaeNo ratings yet

- KSPC Packing Marking Shipping InstructionDocument9 pagesKSPC Packing Marking Shipping InstructionMohammed Ahmed NasherNo ratings yet

- OdooDocument5 pagesOdooNurma YusnitaNo ratings yet

- Illustrated Visit NewoDocument254 pagesIllustrated Visit NewoRaquel LimaNo ratings yet

- PACC/ POSH ProspectusDocument516 pagesPACC/ POSH ProspectusEugene TayNo ratings yet

- Export ManagementDocument79 pagesExport ManagementVikrant Singla100% (2)

- Improvement On FIFODocument17 pagesImprovement On FIFOristian_rehi355No ratings yet

- Norwegian Sales Form 1993Document13 pagesNorwegian Sales Form 1993dingoberry123No ratings yet

- TVS LOGISTICS SERVICE LIMITED SudhaDocument17 pagesTVS LOGISTICS SERVICE LIMITED SudhaSudhakar R Ragu100% (1)

- Fedex IncotermsDocument1 pageFedex IncotermsshadibchNo ratings yet

- FlagshipPosidonia 2012Document2 pagesFlagshipPosidonia 2012Fotini HalouvaNo ratings yet

- The Philippine Shipping Company Et. Al. v. Vergara G.R. No. L-1600, June 1, 1906 FactsDocument40 pagesThe Philippine Shipping Company Et. Al. v. Vergara G.R. No. L-1600, June 1, 1906 FactsHarry Dave Ocampo PagaoaNo ratings yet

- How Long Does My Order Usually Take?Document2 pagesHow Long Does My Order Usually Take?Imran Khan-DMNo ratings yet

- SRO 601 I 2011AfghanTransit RuleDocument43 pagesSRO 601 I 2011AfghanTransit RuleAazam Shahzad CasanovaNo ratings yet

- Group 9 - Section E - HPDocument12 pagesGroup 9 - Section E - HPShubham ShuklaNo ratings yet

- Outline MaritimeCommerce2017Document5 pagesOutline MaritimeCommerce2017gavy cortonNo ratings yet

- IHS McCloskey Coal Report SampleDocument32 pagesIHS McCloskey Coal Report SampleMichel DashNo ratings yet

- Final Exam Questions TMA308MDocument8 pagesFinal Exam Questions TMA308MMinh LêNo ratings yet

- Rahul SinghDocument63 pagesRahul SinghRahul Singh ChouhanNo ratings yet

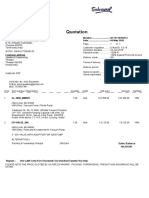

- Quotation: Sales BalanceDocument1 pageQuotation: Sales BalanceSujesh AnNo ratings yet

- Warehouse MGTDocument57 pagesWarehouse MGTnikhilnetra100% (1)

- SAP Logistics Optimization With Handling Unit ManagementDocument17 pagesSAP Logistics Optimization With Handling Unit Managementamitava_bapiNo ratings yet

- Everett Steamship V. Ca (Steph)Document2 pagesEverett Steamship V. Ca (Steph)Blah Blam100% (1)

- Akron Weldon List Price GuideDocument76 pagesAkron Weldon List Price GuideAdvenser GroupNo ratings yet