Professional Documents

Culture Documents

The Eight Steps of The Accounting Cycle

Uploaded by

Gerard Ivan EscotonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Eight Steps of The Accounting Cycle

Uploaded by

Gerard Ivan EscotonCopyright:

Available Formats

THE EIGHT STEPS OF THE ACCOUNTING

CYCLE Unfortunately, many times your first calculation

of the trial balance shows that the books aren’t

As a bookkeeper, you complete your work by in balance. If that’s the case, you look for errors

completing the tasks of the accounting cycle. It’s and make corrections called adjustments, which

are tracked on a worksheet.

called a cycle because the accounting workflow

Adjustments are also made to account for the

is circular: entering transactions, manipulating

depreciation of assets and to adjust for one-time

the transactions through the accounting cycle, payments (such as insurance) that should be

closing the books at the end of the accounting allocated on a monthly basis to more accurately

match monthly expenses with monthly revenues.

period, and then starting the entire cycle again

After you make and record adjustments, you

for the next accounting period.

take another trial balance to be sure the

accounts are in balance.

The accounting cycle has eight basic steps,

6. Adjusting journal entries

which you can see in the following illustration.

You post any corrections needed to the affected

These steps are described in the list below.

accounts once your trial balance shows the

1. Transactions accounts will be balanced once the adjustments

Financial transactions start the process. needed are made to the accounts. You don’t

Transactions can include the sale or return of a need to make adjusting entries until the trial

product, the purchase of supplies for business balance process is completed and all needed

activities, or any other financial activity that corrections and adjustments have been

involves the exchange of the company’s assets, identified.

the establishment or payoff of a debt, or the 7. Financial statements

deposit from or payout of money to the

You prepare the balance sheet and income

company’s owners.

statement using the corrected account balances.

2. Journal entries

8. Closing the books

The transaction is listed in the appropriate

You close the books for the revenue and

journal, maintaining the journal’s chronological

expense accounts and begin the entire cycle

order of transactions. The journal is also known

again with zero balances in those accounts.

as the “book of original entry” and is the first

place a transaction is listed.

3. Posting

As a businessperson, you want to be able to

The transactions are posted to the account that

it impacts. These accounts are part of the gauge your profit or loss on month by month,

General Ledger, where you can find a summary quarter by quarter, and year by year bases. To

of all the business’s accounts.

do that, Revenue and Expense accounts must

4. Trial balance

start with a zero balance at the beginning of

At the end of the accounting period (which may

each accounting period. In contrast, you carry

be a month, quarter, or year depending on a

business’s practices), you calculate a trial over Asset, Liability, and Equity account

balance. balances from cycle to cycle.

5. Worksheet

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- IndiGo Economic Analysis ReportDocument10 pagesIndiGo Economic Analysis ReportChandra Kiran100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Test Bank For Financial Accounting Tools For Business Decision Making 6th Canadian Edition by KimmelDocument45 pagesTest Bank For Financial Accounting Tools For Business Decision Making 6th Canadian Edition by Kimmela228871108No ratings yet

- CH 14Document2 pagesCH 14tigger5191100% (1)

- Solutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210Document36 pagesSolutions Manual For Comprehensive Assurance Systems Tool 3e by Ingraham 0133099210detachedcoped.f863i3100% (44)

- Understanding You Pay Guide 2018Document28 pagesUnderstanding You Pay Guide 2018Rodríguez CésarNo ratings yet

- Amazon Case Study-Strategic ManagementDocument7 pagesAmazon Case Study-Strategic ManagementMihaela Medina100% (1)

- Retailer Preference Towards Sunfeast BiscuitsDocument45 pagesRetailer Preference Towards Sunfeast Biscuitssachinsachi55573% (11)

- The Theory of Interest - Solutions ManualDocument11 pagesThe Theory of Interest - Solutions ManualwidyasNo ratings yet

- Tcs IntroDocument12 pagesTcs IntroRomi.Roy1820 MBANo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- Contracts 2Document27 pagesContracts 2ANJALI KAPOORNo ratings yet

- Real Estate Developer Revenue RecognitionDocument2 pagesReal Estate Developer Revenue RecognitionEster SabatiniNo ratings yet

- Econews: Puerto RicoDocument7 pagesEconews: Puerto RicomramininiNo ratings yet

- JPM Brazil 2013Document140 pagesJPM Brazil 2013César León QuillasNo ratings yet

- COURSE PACK - ACCTG 1&2 Lesson 5.1Document10 pagesCOURSE PACK - ACCTG 1&2 Lesson 5.1Victoria Quebral CarumbaNo ratings yet

- Jurisprudence On Stock DividendDocument4 pagesJurisprudence On Stock Dividendfrancis_asd2003No ratings yet

- Chapter 1 BAC 100 PDFDocument32 pagesChapter 1 BAC 100 PDFacademianotes75% (4)

- Financial Statement Analysis LectureDocument16 pagesFinancial Statement Analysis LectureSaeed UllahNo ratings yet

- Philippine Housing Framework Highlights UDHA 1992Document13 pagesPhilippine Housing Framework Highlights UDHA 1992Gen Lamsis AlmoraNo ratings yet

- Republic V KerDocument3 pagesRepublic V KerCinNo ratings yet

- Topic 19 IAS 41 PDFDocument4 pagesTopic 19 IAS 41 PDFAnonymous HumanNo ratings yet

- Pay Slip Details for Siddharth in September 2022Document1 pagePay Slip Details for Siddharth in September 2022SiddharthNo ratings yet

- Appointment Letter-New DraftDocument3 pagesAppointment Letter-New DraftNikita JaiswalNo ratings yet

- HBP Request For Funds PDFDocument1 pageHBP Request For Funds PDFMortgage ResourcesNo ratings yet

- Letter of Atty Arevalo B.M. No. 1370Document1 pageLetter of Atty Arevalo B.M. No. 1370Ceresjudicata100% (1)

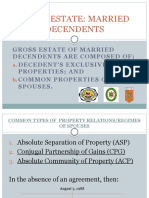

- GROSS ESTATE OF MARRIED DECENDENTSDocument35 pagesGROSS ESTATE OF MARRIED DECENDENTSbetariceNo ratings yet

- IRAS E-Tax Guide: Deductibility of "Keyman" Insurance PremiumsDocument8 pagesIRAS E-Tax Guide: Deductibility of "Keyman" Insurance PremiumsSampath VimalaNo ratings yet

- Air Asia Presentation, Strategic ManagementDocument22 pagesAir Asia Presentation, Strategic ManagementNitin RajotiaNo ratings yet

- Exercise Sheet 2 With SolutionsDocument8 pagesExercise Sheet 2 With SolutionsFlaminiaNo ratings yet

- Financial Accounting Analysis P&LDocument11 pagesFinancial Accounting Analysis P&LJerrin JoseNo ratings yet