Professional Documents

Culture Documents

TRAIN Handout No. 1

TRAIN Handout No. 1

Uploaded by

SophiaFrancescaEspinosaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TRAIN Handout No. 1

TRAIN Handout No. 1

Uploaded by

SophiaFrancescaEspinosaCopyright:

Available Formats

Tax Law 1 – Handout on TRAIN

Republic Act No. 10963: Tax Reform for Acceleration and Inclusion (TRAIN)

Amends the Tax Code of 1997

Signed into law on December 19, 2017

Effective January 1, 2018 (but there are different dates of effectivity for specific provisions of

the law

President vetoed 5 items

Key amendments:

o Lowers personal income tax rates

o Simplifies estate and donor’s tax rates

o Expands value-added tax base

o Increases excise tax for petroleum products

o Adjusts excise tax for automobiles

o Introduces excise tax on sweetened beverages and non-essential services

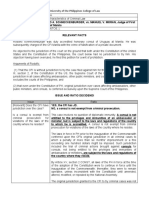

ANNUAL INCOME TAX TABLE - Individual Citizens and Resident Aliens

OLD RULE

Annual Income Bracket Tax Rate

0-10,000 5%

Over 10,000- 30,000 500 +10% of the excess over 10,000

Over 30,000- 70,000 2,500 +15% of the excess over 30,000

Over 70,000 – 140,000 8,500 +20% of the excess over 70,000

Over 140,000 – 250,000 22,500 + 25% of the excess over 140,000

Over 250,000 – 500,000 50,000 +30% of the excess over 250,000

Over 500,000 125,000 +32% of the excess over 500,000

RA No. 10963

Annual Income Bracket Tax Rate (2018-2022) Tax Rate (2023 onwards)

Lower Limit Upper Limit Tax on lower Tax on excess Tax on lower Tax on excess

limit over lower limit over lower

limit limit

0 250,000 - 0% - 0%

250,000 400,000 - 20% - 15%

400,000 800,000 30,000 25% 22,500 20%

800,000 2,000,000 130,000 30% 102,500 25%

2,000,000 8,000,000 490,000 32% 402,500 30%

8,000,000 2,410,000 35% 2,202,500 35%

EXEMPTION/DEDUCTION FROM GROSS INCOME

RA 10963 removed the following:

1. Personal and additional exemptions

2. Premium payments on health and/or hospitalization insurance amounting to P2,400 per family

NON-TAXABLE 13th MONTH PAY AND OTHER BENEFITS

RA 10963 increased non-taxable 13th month pay and other benefits from P82,000 to P90,000.

SAMPLE COMPUTATION

Particulars Old Rule TRAIN

Annual Gross Income xxx xxx

Less: Non-taxable 13th month (82,000) (90,000)

pay and other benefits

Basic Personal Exemption (50,000) -

Additional Personal Exemption (100,000) -

Total Income xxx xxx

Less: Tax-exempt income - (250,000)

Taxable income xxx Xxx

SELF-EMPLOYED INDIVIDUALS/PROFESSIONAL INCOME OF NOT MORE THAN P3 MILLION

8% income tax on gross

sales/receipt in excess of P250,000

Gross Sales/receipts less

than or equal to P3M

(Optional)

Graduated income tax rates (0%- 3% percentage

35%) tax

Note: The following cannot avail of the 8% Income Tax Rate

1. Taxpayers who failed to signify in the 1st Quarter Return the intention to elect the 8% income tax

2. Taxpayer whose Gross Sales/Receipts exceeded the P3M VAT Threshold

3. A VAT-registered taxpayer, regardless of the Gross Sales/Receipts

4. Taxpayers who are subject to Other Percentage Taxes

5. Partners by virtue of their distributive share from GPP which is already net of cost and expenses

The aforementioned taxpayers shall be subject to the graduated rates (0%-35%).

A non-VAT registered taxpayer who initially opted to avail of the 8% option but has exceeded

the P3M VAT Threshold during the taxable year shall be subject to:

3% Percentage Tax on the first P3M

The excess of the threshold shall be subject to VAT

The 8% Income Tax previously paid shall be credited to the income Tax Due under

graduated rates

MIXED INCOME EARNERS

Compensation Income Income from Business or Practice of Profession

Graduated income tax rates (0%-35%) Same as above diagram

SELF-EMPLOYED INDIVIDUALS/PROFESSIONAL INCOME OF MORE THAN P3MILLION

Gross Sales/receipts greater

than P3M

Graduated income tax rates (0%-

12% VAT

35%)

FRINGE BENEFITS TAX (FBT)

Increase in FBT Rate - From 32% (1997 Tax Code) to 35% (RA No. 10963)

Note: FBT rate for non-resident alien not engaged in trade or business shall still be at 25% gross

FBT – SAMPLE COMPUTATION

Particulars Old Rule TRAIN

Monetary Value P 65,000 P 65,000

Divided by: 68% 65%

Grossed-up Monetary Value P 95,588 P100,000

Multiplied by: FBT Rate 32% 35%

FBT Payable P 30,588 P 35,000

INCOME TAX OF ALIEN EMPLOYEES OF RHQS, ROHQs, OBUs, PSCs/SCs

Particulars Old Rule TRAIN

Alien Employees and Filipino 15% Preferential Rate Regular Income Tax Rates

Employees occupying the same (without prejudice to

position of: application of preferential tax

rates under existing

Regional Headquarters international tax treaties)

(RHQs)

Regional Operating

Headquarters (ROHQs)

Offshore Banking Units

(OBUs)

Petroleum Service

Contractors and

Subcontractors

(PSCs/SCs)

OPTIONAL STANDARD DEDUCTION (OSD)

Deductions Old Rule TRAIN

OSD for General Professional Not provided May be availed only once

Partnerships (GPPs) EITHER by the GPP or the

partners comprising the

partnership

PASSIVE INCOME TAX RATES

Type of Income Old Rule TRAIN

Philippine Charity Sweepstakes EXEMPT (full amount) Sweepstakes and Lotto

and lotto winnings winnings – exempt up to

P10,000; 20% final tax in

excess

Interest income from 7.5% final tax 15% -

Expanded Foreign Currency Resident individual and

Deposit Units domestic corporation

Note: Rate did not change for

resident foreign corporation

Sale of shares NOT traded in First P100,000 - 5% capital 15% - Resident individuals and

the stock exchange gains tax (CGT) domestic corporations

In excess of P100,000 – 10% Note: No change in CGT rate

CGT applicable to resident foreign

corporations and nonresident

foreign corporations (5%/10%)

Sale of listed shares ½ of 1% of the gross selling 6/10 of 1% of the gross selling

price or the gross value in price or the gross value in

money of the shares sold money of the shares sold

INCOME TAX EXEMPTION OF PCSO

Entity Old Rule TRAIN

Philippine Charity Sweepstakes Exempt from income tax Removed exemption

Office (PCSO)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Florentina L. Baclayon, vs. Judge Mutia: Relevant FactsDocument2 pagesFlorentina L. Baclayon, vs. Judge Mutia: Relevant FactsSophiaFrancescaEspinosaNo ratings yet

- People V TolentinoDocument2 pagesPeople V TolentinoSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument2 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: RelevantDocument3 pagesUniversity of The Philippines College of Law: RelevantSophiaFrancescaEspinosaNo ratings yet

- People v. SanidadDocument3 pagesPeople v. SanidadSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of LawDocument2 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: Us, V. Catalino ApostolDocument2 pagesUniversity of The Philippines College of Law: Us, V. Catalino ApostolSophiaFrancescaEspinosa100% (1)

- University of The Philippines College of LawDocument3 pagesUniversity of The Philippines College of LawSophiaFrancescaEspinosaNo ratings yet

- University of The Philippines College of Law: Melencio Gigantoni Y Javier, vs. People and IacDocument2 pagesUniversity of The Philippines College of Law: Melencio Gigantoni Y Javier, vs. People and IacSophiaFrancescaEspinosaNo ratings yet

- Clemente v. CADocument2 pagesClemente v. CASophiaFrancescaEspinosaNo ratings yet

- Pan v. PenaDocument2 pagesPan v. PenaSophiaFrancescaEspinosaNo ratings yet

- Associated Bank, vs. Ca and Lorenzo Sarmiento JRDocument4 pagesAssociated Bank, vs. Ca and Lorenzo Sarmiento JRSophiaFrancescaEspinosaNo ratings yet

- 14 Lecaroz V SandiganbayanDocument3 pages14 Lecaroz V SandiganbayanSophiaFrancescaEspinosaNo ratings yet

- Dee Ping Wee v. Lee Hiong WeeDocument3 pagesDee Ping Wee v. Lee Hiong WeeSophiaFrancescaEspinosa100% (1)

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Chua v. CADocument2 pagesChua v. CASophiaFrancescaEspinosaNo ratings yet

- BLTB v. BitangaDocument2 pagesBLTB v. BitangaSophiaFrancescaEspinosaNo ratings yet

- Agilent v. IntegratedDocument2 pagesAgilent v. IntegratedSophiaFrancescaEspinosaNo ratings yet

- SDocument3 pagesSSophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Foreign Tax CreditDocument2 pagesForeign Tax CreditSophiaFrancescaEspinosaNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- January 2016Document2 pagesJanuary 2016bhavaniNo ratings yet

- F 8288 ADocument5 pagesF 8288 AIRSNo ratings yet

- Practice Test Chapter 3 With AnswersDocument8 pagesPractice Test Chapter 3 With AnswersDimpZ Patel100% (1)

- Tax Review Syllabus A.Y. 2019-2020Document6 pagesTax Review Syllabus A.Y. 2019-2020Kelvin Culajará100% (1)

- Schedules For Form 1040 and Form 1040Document2 pagesSchedules For Form 1040 and Form 1040Eloy GonzalezNo ratings yet

- R2207005 (Flex) CEJA Siegele Track A Opening TestimonyDocument37 pagesR2207005 (Flex) CEJA Siegele Track A Opening TestimonyRob NikolewskiNo ratings yet

- Literature Review On Value Added Tax in NigeriaDocument7 pagesLiterature Review On Value Added Tax in Nigeriaea84k86s100% (1)

- RPH FinalsDocument2 pagesRPH FinalsHagia CanapiNo ratings yet

- Chapter 6vat On SalesDocument24 pagesChapter 6vat On SalesNoriel Justine QueridoNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- Scholarship Income DeclarationDocument4 pagesScholarship Income DeclarationLawyer Chandresh TiwariNo ratings yet

- TNTC Form 75CDocument2 pagesTNTC Form 75Cjaiinfo84No ratings yet

- Taxation - Agricultural IncomeDocument5 pagesTaxation - Agricultural IncomeAmogha GadkarNo ratings yet

- Realization of IncomeDocument3 pagesRealization of IncomeHanselNo ratings yet

- 1040 ArmstrongDocument2 pages1040 Armstrongapi-458373647No ratings yet

- Tax Sybba FinanceDocument9 pagesTax Sybba FinancemayurNo ratings yet

- Paper F6 Taxation: Revision Mock Examination September 2016 Question PaperDocument22 pagesPaper F6 Taxation: Revision Mock Examination September 2016 Question PaperAhmed SabryNo ratings yet

- Intro To Consumption TaxesDocument50 pagesIntro To Consumption TaxesHerlyn QuintoNo ratings yet

- Payslip SEP 2017Document1 pagePayslip SEP 2017Kurakula RamaNo ratings yet

- PTP - Professional ChefDocument1 pagePTP - Professional ChefjohnNo ratings yet

- The Effects of Train Law To The Saving and Spending Behavior of The Teaching and NonDocument15 pagesThe Effects of Train Law To The Saving and Spending Behavior of The Teaching and NonPrincess Angela GelliaparangNo ratings yet

- Ebook Economics Today The Macro View 18Th Edition Miller Solutions Manual Full Chapter PDFDocument36 pagesEbook Economics Today The Macro View 18Th Edition Miller Solutions Manual Full Chapter PDFgebbiasadaik100% (9)

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Salary Slip (30065613 July, 2019)Document1 pageSalary Slip (30065613 July, 2019)sanaNo ratings yet

- Foreign Tax Credit: Taxable Income or Loss From Sources Outside The United States (For Category Checked Above)Document2 pagesForeign Tax Credit: Taxable Income or Loss From Sources Outside The United States (For Category Checked Above)Linda GardnerNo ratings yet

- Advance Payment of TaxDocument11 pagesAdvance Payment of TaxParul Bhardwaj VaidyaNo ratings yet

- CourseheroDocument3 pagesCourseheronumber oneNo ratings yet

- Cir Vs Algue, Inc. GR No. L-28896 February 7, 1996Document2 pagesCir Vs Algue, Inc. GR No. L-28896 February 7, 1996ian ballartaNo ratings yet

- Solution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108Document36 pagesSolution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108stephanievargasogimkdbxwn100% (26)

- Role of EntrepreneurDocument3 pagesRole of EntrepreneurMekdes SamsonNo ratings yet