Professional Documents

Culture Documents

Treasury Share Transactions

Uploaded by

Faith FernandezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Treasury Share Transactions

Uploaded by

Faith FernandezCopyright:

Available Formats

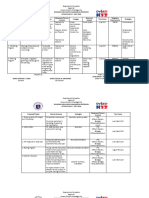

Treasury share transactions

Repurchase. To record a repurchase, simply record the entire amount of the purchase in

the treasury stock account.

Treasury shares (at cost) xx

Cash in bank xx

Resale. If the treasury stock is resold at a later date, offset the sale price against

the treasury stock account, and credit any sales exceeding the repurchase cost

to the additional paid-in capital account. If the sale price is less than the

repurchase cost, charge the differential to any additional paid-in capital

remaining from prior treasury stock transactions, and any residual amount to

retained earnings if there is no remaining balance in the additional paid-in

capital account.

a) Reissuance of treasury shares at above cost

Cash in bank xx

Treasury shares (at cost) xx

Share premium – TS xx

b) Reissuance of treasury shares below cost

Cash in bank xx

(1) Share Premium – TS xx

(2) Retained Earnings xx

Treasury shares (at cost) xx

Retirement. If management decides to permanently retire stock that it has

already accounted for under the cost method, it reverses the par value and

additional paid-in capital associated with the original stock sale, with any

remaining amount being charged to retained earnings.

a) Retirement at below original issuance price

Share Capital(at par or stated value) xx

Share Premium – original issuance xx

Treasury shares (at cost)/CIB xx

Share premium – retirement xx

b) Retirement at above original issuance price

Share Capital(at par or stated value) xx

Share Premium – original issuance xx

(1) Share Premium –TS xx

(2) Retained earnings xx

Treasury shares (at cost)/CIB xx

You might also like

- Program of WorksDocument3 pagesProgram of WorksFaith FernandezNo ratings yet

- TaskDocument3 pagesTaskFaith Fernandez100% (1)

- SynthesisDocument1 pageSynthesisFaith FernandezNo ratings yet

- Alone TogetherDocument5 pagesAlone TogetherFaith FernandezNo ratings yet

- Revised Corp CodeDocument30 pagesRevised Corp CodeFaith Fernandez100% (1)

- BE Form 5 - RECORD OF DONATIONS RECEIVEDDocument3 pagesBE Form 5 - RECORD OF DONATIONS RECEIVEDFaith FernandezNo ratings yet

- Abstract and Learning ObjectivesDocument1 pageAbstract and Learning ObjectivesFaith FernandezNo ratings yet

- Action Plan-Brigada EskwelaDocument3 pagesAction Plan-Brigada EskwelaFaith FernandezNo ratings yet

- TRAIN Income TaxDocument49 pagesTRAIN Income TaxFaith FernandezNo ratings yet

- Debut ScriptDocument4 pagesDebut ScriptToto Canong86% (14)

- TRAIN Value Added TaxDocument32 pagesTRAIN Value Added TaxMickey MouseyNo ratings yet

- Medical CertificateDocument1 pageMedical CertificateFaith FernandezNo ratings yet

- TRAIN - VisionDocument20 pagesTRAIN - VisionFaith FernandezNo ratings yet

- First FruitDocument14 pagesFirst FruitFaith FernandezNo ratings yet

- Request LetterDocument1 pageRequest LetterFaith FernandezNo ratings yet

- 2017 Christmas Raffle BonanzaDocument1 page2017 Christmas Raffle BonanzaFaith Fernandez100% (1)

- SUMMARYDocument1 pageSUMMARYFaith FernandezNo ratings yet

- Brigada 2018 DailyDocument11 pagesBrigada 2018 DailyFaith FernandezNo ratings yet

- Letter RequestDocument1 pageLetter RequestFaith FernandezNo ratings yet

- Teknik at Estratehiya MemoDocument1 pageTeknik at Estratehiya MemoFaith FernandezNo ratings yet

- Innovation ReportDocument4 pagesInnovation ReportFaith FernandezNo ratings yet

- Cavraa 2019 PicsDocument1 pageCavraa 2019 PicsFaith FernandezNo ratings yet

- Brigada Eskwela Working Committee 2019Document1 pageBrigada Eskwela Working Committee 2019Faith FernandezNo ratings yet

- PoliteDocument2 pagesPoliteFaith FernandezNo ratings yet

- Badminton Test 2017-2018Document2 pagesBadminton Test 2017-2018Faith FernandezNo ratings yet

- Gad ReportDocument3 pagesGad ReportFaith FernandezNo ratings yet

- Dar Letter of RequestDocument1 pageDar Letter of RequestFaith FernandezNo ratings yet

- Affidavit of LossDocument1 pageAffidavit of LossFaith FernandezNo ratings yet

- Bisikleta 2019Document4 pagesBisikleta 2019Faith FernandezNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)