Professional Documents

Culture Documents

BNK 601

Uploaded by

Háłīmà TáríqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BNK 601

Uploaded by

Háłīmà TáríqCopyright:

Available Formats

1 bnk601 final

43) Define consortium finance. 3 marks

Consortium Financing, two or more individuals, companies, organizations or

governments or any combination of these entities pool their resources for financing a

large project through a common appraisal, common documentation and joint supervision.

For example Airbus Industries was formed in 1970 as a consortium of aerospace

manufacturers.

44) Define hypothecation. 3 marks

“Hypothecation is a legal transaction, whereby goods may be made available as security

for a debt without transferring possession to the lender”.

45) Define money market. 3 marks

Money Market is a financial market which deals in short term debt instruments

The short maturity of money market assets doesn't allow much time for their returns to

vary. Therefore these instruments are safe investments for short-term surplus funds of

households and firms.

46) Differentiate b/w blank and full endorsement. 5 marks

If the endorser signs his name only, the endorsement is said to be "in blank", and if he

adds a direction to pay the amount mentioned in the instrument to, or to the order of, a

specified person, the endorsement is said to be 'in full", and the person so specified is

called the "endorsee" of the instrument.

47) Briefly explain R14 auto loans. 5 marks

REGULATION R-14

The auto loans shall be classified and provided for in the following manner:

CLASSIFI DETERMINANT TREATMENT OF INCOME PROVISION TO

CATION BE MADE

(1) (2) (3) (4)

1. Where mark-up/Unrealized markup/ interest to beProvision of 25% of the

Substandar interest or principalkept in Memorandum Account anddifference resulting from the

d. is overdue by 90not to be credited to Incomeoutstanding balance of

days or more fromAccount except when realized inprincipal less the amount of

the due date. cash. Unrealized mark up/interestliquid assets.

already taken to income account to

be reversed and kept in

Memorandum Account.

2. Where mark-up/As above. Provision of 50% of the

Doubtful. interest or principal difference resulting from the

is overdue by 180 outstanding balance of

days or more from principal less the amount of

the due date. liquid assets.

3. Loss. Where mark-up/ As above. Provision of 100% of the

interest or difference resulting from the

2 bnk601 final

principal is outstanding balance of

overdue by one principal less the amount of

year or more from liquid assets.

the due date

48) Write note on

Regulation R-8 (Classification AND Provision)

The credit card advances shall be classified and provided for in the following manner:

CLASSIFICATION DETERMINANT TREATMENT OFPROVISION TO

INCOME BE MADE

(1) (2) (3) (4)

Loss. Where mark-up /Put in SuspenseProvision of 100% of the

interest or Principal isAccount and not todifference Resulting from the

overdue by 180 days orbe credited tooutstanding balance of

more from the due date. Income Accountprincipal less the amount of

except when realizedliquid securities with the

in cash. bank / DFI.

It is clarified that the lenders are allowed to follow more conservative policies. Further,

provisioning may be created and maintained by the bank/DFI on a portfolio basis

provided that the provision maintained by the bank/DFI shall not be less than the level

required under this Regulation.

Regulation R-6 Margin Requirement..5Marks

Banks / DFIs are free to determine the margin requirements on consumer facilities

provided by them to their clients taking into account the risk profile of the borrower(s) in

order to secure their interests. However, this relaxation shall not apply in case of items,

import of which is banned by the Government

45) Define endorsement. 3 marks

“When the maker or holder of a negotiable instrument signs the same, otherwise than as

such maker, for the purpose of negotiation, on the back or face thereof or on a slip of

paper annexed thereto, or so signs for the same purpose a stamped paper intended to be

completed as a negotiable instrument, he is said to indorse the same, and is called

endorser

46) Differentiate b/w liquidity risk & operational risk. 5 marks

Liquidity risk is the current and potential risk to earnings and the market value of

stockholders’ equity that results from a bank’s inability to meet payment or clearing

obligations in a timely and cost-effective manner. Liquidity risk is greatest when a bank

cannot anticipate new loan demand or deposit withdrawals, and does not have access to

new sources of cash

. Operational risk: Refers to the possibility that operating expenses might vary

significantly from what is expected, producing a decline in net income and firm value.

3 bnk601 final

The Basel Committee defines operational risk as: “The risk of loss resulting from

inadequate or failed internal processes, people, and systems, or from external events.

44) Diffrentiate b/w sight and Usance letter of credit. 3 marks

A 'sight' LC means that payment is made immediately to the beneficiary/seller/exporter

upon presentation of the correct documents in the required time frame.

Usance Letter of Credit A letter of credit payable at a determined future date after

presentation of conforming documents.

47) Write down advantage of letter of credit risk. 5 marks

Advantages of Letter of Credit:

1. General global acceptability by the interacting parties

2. The beneficiary is assured of payment as long as it complies with the terms and

conditions of the letter of credit.

3. The beneficiary can enjoy the advantage of mitigating the issuing bank’s country risk

by requiring that a bank in its own country confirm the letter of credit.

4. The beneficiary minimizes collection time as the letter of credit accelerates payment of

the receivables.

5. The beneficiary’s foreign exchange risk is eliminated with a letter of credit issued in

the currency of the beneficiary’s country.

Risks involved in Letter of Credit.

1. Since all the parties involved in Letter of Credit deal with the documents and not with

the goods, the risk of Beneficiary not shipping goods as mentioned in the LC is still

persists.

2. The Letter of Credit as a payment method is costlier than other methods of payment

such as Open Account or Collection

3. The Beneficiary’s documents must comply with the terms and conditions of the Letter

of Credit for Issuing Bank to make the payment.

4. The Beneficiary is exposed to the Commercial risk on Issuing Bank, Political risk on

the Issuing Bank’s country and Foreign Exchange Risk in case of Usance Letter of

Credits.

48) Draw the specimen of a bearer cheque Rs.10,000 on 1st January 2009. 5 marks

Cheque #...... Date:

01/07/2013

Account#:1204556569

Pay: Mr. Ahmed or bearer

Rupees: Fifty thousand only Rs.50, 000

ABC, Bank Limited,

Mall Road, Lahore Signature

4 bnk601 final

1) Why preferred stock is referred as hybrid security? (03)

Preferred stock is many times referred to as a hybrid security. This is because

preferred stock has many characteristics of both common stock and bonds.

2) Describe how bank endorsement can be converted into Full Endorsement? (

If the endorser signs his name only, the endorsement is said to be "in blank", and if he

adds a direction to pay the amount mentioned in the instrument to, or to the order of, a

specified person, the endorsement is said to be 'in full",

4) What do you mean by substandard loans? (03)

A loan where full repayment is questionable and uncertain. Degree of repayment of

loans in question range from a complete loss to uncertain loss unless corrective

actions are taken. substandard loans are usually non-performing loans on which

interest is overdue and full collection of principal is uncertain.

5) Write down any five provision of section 21 of corporate and industrial

restructuring corporation ordinance 2000 regarding inspection and investing.

(05)

Inspection and investigation: Sec 21

(1) The State Bank may, at any time, inspect books of accounts and records of any

microfinance institution to evaluate its financial viability and may, of its own or on

receipt of complaint investigate the affairs of such institution.

(2) The inspection or investigation shall be carried out by such officer of the State

Bank or by such other person as the State Bank may authorize.

(3) It shall be the duty of every officer and employee of a microfinance institution or

any other person dealing with or connected with the operations of the microfinance

institution to produce to any officer, making an inspection or investigation under this

section

(4) The inspecting officer may examine on oath any officer or employee of the

microfinance institution in relation to its business and may administer an oath

accordingly.

(5) The State Bank shall supply to the microfinance institution a copy of its report on

the inspection made under this section.

(6) The State Bank shall systematically monitor and evaluate the performance of a

microfinance institution to ensure that it is complying with the applicable criteria and

prudential rules and regulations:

7) Briefly explain various parties involves in the transaction of a cheque? (05)

Parties to a Cheque:

These are discussed below:

Drawer

The person who draws/ writes a cheque is called the drawer

Drawee

The person who is directed through a cheque to pay the specified amount is called the

drawee, however in case of a cheque, drawee must always be a bank.

5 bnk601 final

Payee

The person to whom or to whose order the amount stated in cheque is to be paid.

Holder

Holder is the person who is entitled to the possession of the instrument in his own name

and also entitled to receive the amount due under cheque.

Endorser

The person who by endorsement transfers the cheque to another person.

Endorsee

The person to whom the cheque is transferred by endorsement.

Holder:

The "holder" of a cheque means the payee or endorsee that is inpossession of it or the

bearer thereof but does not include a beneficial owner claiming through a benamidar.

8) Write short note. (05)

(i) Limits on exposure against total customers’ financing. (RI)

Banks / DFIs shall ensure that the aggregate exposure under all consumer financing

facilities at the end of first year and second year of the start of their consumer financing

does not exceed 2 times and 4 times of their equity respectively. For subsequent years,

following limits are placed on the total consumer financing facilities:

(ii) General reserves against customer financing (R4)

The banks / DFIs shall maintain a general reserve at least equivalent to 1.5% of the

consumer portfolio which is fully secured and 5% of the consumer portfolio which is

unsecured, to protect them from the risks associated with the economic cyclical nature of

this business.

6) Suppose you are an account opening officer in a bank. A customer comes to

your bank for purpose of opening his account. What step you will take for

opening the account (05)

Generally the following steps are taken by an account opening officer in this regard.

Completion of Account Opening Form ( AOF)

Introduction of the prospective customer and preliminary investigations

(know your customer KYC)

Obtaining specimen Signatures

Mandate regarding operation of Account (document required will vary

according to the type of customers.

You might also like

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- ACC125 BankingDocument10 pagesACC125 BankingLenar Dean EdquibanNo ratings yet

- CAR For Non-BankDocument16 pagesCAR For Non-Bankco samNo ratings yet

- Captive Insurance Collateral OptionsDocument15 pagesCaptive Insurance Collateral OptionsMuhammad SaleemNo ratings yet

- Analyzing Financing Activities: ReviewDocument64 pagesAnalyzing Financing Activities: ReviewNisaNo ratings yet

- CH 03Document67 pagesCH 03Khoirunnisa Dwiastuti100% (2)

- B Iii: A G R F M R B B S: Common Shares Issued by The BankDocument6 pagesB Iii: A G R F M R B B S: Common Shares Issued by The BankArun PrakashNo ratings yet

- Students Manuals Iqs Law c08Document26 pagesStudents Manuals Iqs Law c08haninadiaNo ratings yet

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaNo ratings yet

- Chapter 03 - Analyzing Financing ActivitiDocument72 pagesChapter 03 - Analyzing Financing ActivitiMuhammad HamzaNo ratings yet

- Ifrs For SMEsDocument104 pagesIfrs For SMEsApril AcboNo ratings yet

- BNK601 Short NotesDocument7 pagesBNK601 Short NotesNasir MuhammadNo ratings yet

- BNK601 Short Notes: Consortium FinanceDocument7 pagesBNK601 Short Notes: Consortium FinanceRimsha TariqNo ratings yet

- Reporting and Analyzing Receivables Answers To QuestionsDocument57 pagesReporting and Analyzing Receivables Answers To Questionsislandguy19100% (3)

- ALTUM CREDO Annexures With IndexingDocument40 pagesALTUM CREDO Annexures With IndexingSwarna SinghNo ratings yet

- Write Off Policy FINALDocument5 pagesWrite Off Policy FINALHoward UntalanNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsnaboumilikaNo ratings yet

- Test Bank 1 - Ia 3Document23 pagesTest Bank 1 - Ia 3Xiena100% (3)

- Audit of Financial Cycle Chapter 10Document19 pagesAudit of Financial Cycle Chapter 10jeric rotasNo ratings yet

- ReceivablesDocument16 pagesReceivablesJanela Venice SantosNo ratings yet

- Bank ManagementDocument50 pagesBank ManagementApoorva GuptaNo ratings yet

- Presented By: 1. Pravin Gavali 2. Vickram Singh MIT-MBA (Finance)Document24 pagesPresented By: 1. Pravin Gavali 2. Vickram Singh MIT-MBA (Finance)shrikant_gaikwad100No ratings yet

- Prudential Regulations 2004 Amended Up To October 9 2020 PDFDocument34 pagesPrudential Regulations 2004 Amended Up To October 9 2020 PDFwasim ul haq osmaniNo ratings yet

- Chapter 18: Audit of Long-Term Liabilities: Review QuestionsDocument11 pagesChapter 18: Audit of Long-Term Liabilities: Review Questionstrixia nuylesNo ratings yet

- Insurance AuditDocument7 pagesInsurance AuditArpit jainNo ratings yet

- 2020 6 StatementDocument7 pages2020 6 StatementChad Schell100% (1)

- Intermediate Accounting 3 - Week 1 - Module 2Document6 pagesIntermediate Accounting 3 - Week 1 - Module 2LuisitoNo ratings yet

- Off-Balance Sheet Activities: Section 3.8Document7 pagesOff-Balance Sheet Activities: Section 3.8Hell LuciNo ratings yet

- (2 Marks) Any Five Advantages To Originator of Securitization Reduces Funding CostsDocument5 pages(2 Marks) Any Five Advantages To Originator of Securitization Reduces Funding CostsAnil MishraNo ratings yet

- Chapter 3 RISK IN FINANCIAL SERVICES CISI Notes 3Document32 pagesChapter 3 RISK IN FINANCIAL SERVICES CISI Notes 3Maher G. BazakliNo ratings yet

- 11-2-24... 4110-Inter Rev Both... Int-2008... Law... AnsDocument7 pages11-2-24... 4110-Inter Rev Both... Int-2008... Law... Ansnikulgauswami9033No ratings yet

- Presented byDocument48 pagesPresented byAli KhanNo ratings yet

- Revenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeDocument5 pagesRevenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeelmersgluethebombNo ratings yet

- Chapter 15 CPWD ACCOUNTS CODEDocument7 pagesChapter 15 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- Shopping For The Right Bank AccountDocument2 pagesShopping For The Right Bank AccountSam ONiNo ratings yet

- Company A:c-Banking CompaniesDocument30 pagesCompany A:c-Banking CompaniessarahhussainNo ratings yet

- Factoring: Presented ByDocument24 pagesFactoring: Presented ByswatigouravNo ratings yet

- Notes of Consumer FinanceDocument8 pagesNotes of Consumer Financemuneebmateen01No ratings yet

- Securitisation of Debt (Loan Assets)Document7 pagesSecuritisation of Debt (Loan Assets)Sanskar YadavNo ratings yet

- Symbiosis Law School, Pune: Subject: Company Law I (SEM V) Batch 2017-22 B.A.LL.B (Hons)Document8 pagesSymbiosis Law School, Pune: Subject: Company Law I (SEM V) Batch 2017-22 B.A.LL.B (Hons)vipin gautamNo ratings yet

- Intermediate Accounting Stice 18th Edition Solutions ManualDocument45 pagesIntermediate Accounting Stice 18th Edition Solutions ManualJames CarsonNo ratings yet

- Financial Instruments FINALDocument40 pagesFinancial Instruments FINALShaina DwightNo ratings yet

- Hedge Fund Performance FeesDocument5 pagesHedge Fund Performance Feesfreebanker777741No ratings yet

- Ch11 SCC Longterm LiabilitiesDocument49 pagesCh11 SCC Longterm Liabilitiesfathiah nur afifiNo ratings yet

- Modern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions ManualDocument107 pagesModern Advanced Accounting in Canada Canadian 8th Edition Hilton Solutions ManualLoriStricklandrdycf100% (16)

- Unit-4 Study MaterialDocument19 pagesUnit-4 Study MaterialSETHUMADHAVAN BNo ratings yet

- Exam 1 - Key AnswersDocument23 pagesExam 1 - Key Answersarlynajero.ckcNo ratings yet

- Regulation TDocument13 pagesRegulation TAbhi RajendraprasadNo ratings yet

- 01 GL Classification of Impaired LoansDocument11 pages01 GL Classification of Impaired LoansTrang LoeNo ratings yet

- 3relation Between Banker and CastomerDocument12 pages3relation Between Banker and Castomertanjimalomturjo1No ratings yet

- M.C 2020 18 Regulatory Relief For Coops - Staggered Booking of Allowance For Loan LossesDocument10 pagesM.C 2020 18 Regulatory Relief For Coops - Staggered Booking of Allowance For Loan Lossesasdfjkl asddfNo ratings yet

- Intermediate Accounting Test Bank With SolManDocument40 pagesIntermediate Accounting Test Bank With SolManbpadz04No ratings yet

- Client On-Boarding and CIF Creation Manual - Fixed (1) - With SF CommentsDocument39 pagesClient On-Boarding and CIF Creation Manual - Fixed (1) - With SF CommentsJan Paolo CruzNo ratings yet

- AYM Shafa - Indicative Offer May 2019 (9649)Document4 pagesAYM Shafa - Indicative Offer May 2019 (9649)Chioma EzeNo ratings yet

- Credit ManagementDocument13 pagesCredit ManagementAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Triple Jump OfficialsDocument6 pagesTriple Jump OfficialsHáłīmà TáríqNo ratings yet

- Track and Field Pre-Meet Notes: OfficialsDocument20 pagesTrack and Field Pre-Meet Notes: OfficialsHáłīmà TáríqNo ratings yet

- Fin624 Curren Solved PaperDocument8 pagesFin624 Curren Solved PaperHáłīmà TáríqNo ratings yet

- Long Jump Officials Long Jump Officials Long Jump Officials Long Jump OfficialsDocument6 pagesLong Jump Officials Long Jump Officials Long Jump Officials Long Jump OfficialsHáłīmà Táríq100% (1)

- Organizational Behaviour - MGT502 Spring 2008 Quiz 03 SolutionDocument2 pagesOrganizational Behaviour - MGT502 Spring 2008 Quiz 03 SolutionHáłīmà TáríqNo ratings yet

- Organizational Behaviour - MGT502 Spring 2006 Quiz 03 SolutionDocument2 pagesOrganizational Behaviour - MGT502 Spring 2006 Quiz 03 SolutionHáłīmà TáríqNo ratings yet

- Human Resource Management - MGT501 Spring 2006 Quiz 03 SolutionDocument1 pageHuman Resource Management - MGT501 Spring 2006 Quiz 03 SolutionHáłīmà TáríqNo ratings yet

- Prepaid Payment Instruments A Discussion On Draft Guidelines by RBIDocument11 pagesPrepaid Payment Instruments A Discussion On Draft Guidelines by RBIAshutoshNo ratings yet

- Article Loan & Investment by CompanyDocument7 pagesArticle Loan & Investment by CompanyDivesh GoyalNo ratings yet

- Exchange Rates in Baku For Today - AZN - Day.azDocument1 pageExchange Rates in Baku For Today - AZN - Day.aznizam0879No ratings yet

- Profit MGT & InflationDocument21 pagesProfit MGT & InflationParkhi AgarwalNo ratings yet

- TechREG INAUGURAL EDITION DECEMBER 2021 REGULATING DIGITAL ECONOMYDocument74 pagesTechREG INAUGURAL EDITION DECEMBER 2021 REGULATING DIGITAL ECONOMYtmunozeNo ratings yet

- Posting General Journal Entries (J58)Document6 pagesPosting General Journal Entries (J58)waqar anwarNo ratings yet

- ACN3112 T1 The Conceptual Framework For Financial ReportingDocument30 pagesACN3112 T1 The Conceptual Framework For Financial ReportingNURIN SOFIYA BT ZAKARIA / UPMNo ratings yet

- Individual Taxation ExercisesDocument3 pagesIndividual Taxation ExercisesMargaux CornetaNo ratings yet

- RbiDocument12 pagesRbiIvy RainaNo ratings yet

- Chapter 4 Why Do Interest Rates ChangeDocument13 pagesChapter 4 Why Do Interest Rates ChangeJay Ann DomeNo ratings yet

- Machi Koro: Millionaire's Row RULES DigitalDocument2 pagesMachi Koro: Millionaire's Row RULES DigitalfuminariNo ratings yet

- Chapter 6 WorksheetDocument46 pagesChapter 6 WorksheetHardeep SinghNo ratings yet

- AIC Zawya ProfileDocument3 pagesAIC Zawya ProfilezammanjiNo ratings yet

- Core Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalDocument8 pagesCore Banking Solutions: Andhra Pradesh Grameena Vikas Bank Head Office, WarangalleenardniNo ratings yet

- International BankingDocument19 pagesInternational BankingAshishBhardwajNo ratings yet

- Final Exam ReviewDocument47 pagesFinal Exam ReviewMelissa NagyNo ratings yet

- Reading Test Book AEUKDocument51 pagesReading Test Book AEUKIrina KazakovaNo ratings yet

- Balance of PaymentDocument4 pagesBalance of PaymentAMALA ANo ratings yet

- Mortgage Foreclosure RecoupmentDocument28 pagesMortgage Foreclosure Recoupmentjvo197077% (13)

- Tax Bill FormatDocument2 pagesTax Bill FormatAnil MishraNo ratings yet

- Portfolio Details AMC Name: Scheme Name: Scheme Features Investment DetailsDocument4 pagesPortfolio Details AMC Name: Scheme Name: Scheme Features Investment DetailsRobert AyalaNo ratings yet

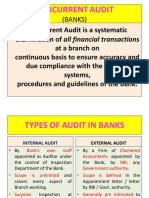

- Concurrent-Audit GuideDocument71 pagesConcurrent-Audit GuideFenil RamaniNo ratings yet

- Benitez, Allan Christian C. Doctrine: Bill of Exchange (Definition & Concept)Document5 pagesBenitez, Allan Christian C. Doctrine: Bill of Exchange (Definition & Concept)Arrianne ObiasNo ratings yet

- A Beginners Guide To Algorithmic Trading 2017Document49 pagesA Beginners Guide To Algorithmic Trading 2017Anonymous KeU4gphVL5100% (4)

- Online BankingDocument38 pagesOnline BankingROSHNI AZAMNo ratings yet

- Prospectus For Zambia's $750 Million 10 Year Euro-Bond Maturing in 2022Document119 pagesProspectus For Zambia's $750 Million 10 Year Euro-Bond Maturing in 2022Zambia Buzz100% (1)

- Financial Education Workbook-VII - ComprDocument44 pagesFinancial Education Workbook-VII - ComprShubh JainNo ratings yet

- Sales Function of UBLDocument18 pagesSales Function of UBLNayyar MasoodNo ratings yet

- CfroiDocument2 pagesCfroiPro Resources100% (1)

- Jana Bank General Terms and Conditions For AccountsDocument18 pagesJana Bank General Terms and Conditions For AccountsArc En CielNo ratings yet