Professional Documents

Culture Documents

APY Brochure PDF

Uploaded by

Hariragavaraj SadasivamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APY Brochure PDF

Uploaded by

Hariragavaraj SadasivamCopyright:

Available Formats

BRIEF OF ATAL PENSION YOJANA

BROCHURE

• The Government of India is concerned about the old age

income security of the working poor and is focused on

encouraging and enabling them to save for their retirement.

To address the longevity risks among the workers in

unorganized sector and to encourage the workers in

unorganized sector to voluntarily save for their retirement

Logo of

• The GoI has therefore announced a new scheme called Atal

Product

Pension Yojana (APY)1 in 2015-16 budget. The APY is

focussed on all citizens in the unorganized sector.

• The scheme is administered by the Pension Fund

ATAL PENSION YOJANA

Regulatory and Development Authority (PFRDA) through

JAN DHAN TO JAN SURAKHSHA NPS architecture.

HIGHLIGHTS OF ATAL PENSION YOJANA

Guaranteed Pension by

• Under the APY, there is guaranteed minimum monthly

Govt. of India pension for the subscribers ranging between Rs. 1000

and Rs. 5000 per month.

• The benefit of minimum pension would be guaranteed

by the GoI.

• GoI will also co-contribute 50% of the subscriber’s

contribution or Rs. 1000 per annum, whichever is lower.

Government co-contribution is available for those who

are not covered by any Statutory Social Security

Schemes and is not income tax payer.

• GoI will co-contribute to each eligible subscriber, for

(a landmark move by GoI towards pensioned society from a period of 5 years who joins the scheme between the

pension less society) period 1st June, 2015 to 31st December, 2015. The

benefit of five years of government Co-contribution

under APY would not exceed 5 years for all subscribers

including migrated Swavalamban beneficiaries.

• All bank account holders may join APY.

Eligibility

• APY is applicable to all citizen of India aged between

18-40 years.

• Aadhaar will be the primary KYC. Aadhar and mobile

1

The Scheme is subject to the approval of the Government. number are recommended to be obtained from

subscribers for the ease of operation of the scheme. If

not available at the time of registration, Aadhar details

may also be submitted later stage.

BROCHURE

Charges for default

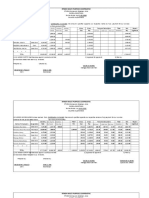

Indicative Monthly Contribution Chart

Banks are required to collect additional amount for delayed

payments, such amount will vary from minimum Re 1 per month

to Rs 10/- per month as shown below:

• Re. 1 per month for contribution upto Rs. 100 per

month. Age Monthly Monthly Monthly Monthly Monthly

of pension of pension of pension of pension of pension of

• Re. 2 per month for contribution upto Rs. 101 to 500/- Entry Rs 1000. Rs2000 Rs3000 Rs4000 Rs5000 .

18 42 84 126 168 210

per month.

• Re 5 per month for contribution between Rs 501/- to 20 50 100 150 198 248

1000/- per month.

25 76 151 226 301 376

• Rs 10 per month for contribution beyond Rs 1001/- per

month.

30 116 231 347 462 577

The fixed amount of interest/penalty will remain as part of the

pension corpus of the subscriber.

35 181 362 543 722 902

Important information for subscriber:

40 291 582 873 1164 1454

Discontinuation of payments of contribution amount shall lead to

following:

• After 6 months account will be frozen.

• After 12 months account will be deactivated.

• After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded

enough for auto debit of contribution amount.

Exit :

On attaining the age of 60 years:

The exit from APY is permitted at the age with 100%

annuitisation of pension wealth. On exit, pension would be

available to the subscriber.

In case of death of the Subscriber due to any cause:

In case of death of subscriber pension would be available to the

spouse and on the death of both of them (subscriber and spouse),

the pension corpus would be returned to his nominee.

Exit Before the age of 60 Years:

Exit before 60 years of age is not permitted however it is

permitted only in exceptional circumstances, i.e., in the event of

the death of beneficiary or terminal disease.

BROCHURE

Administered by:

Pension Fund Regulatory and Development Authority

1st Floor, ICADR Building, Plot No. 6, Vasant Kunj

Institutional Area, Phase-II, New Delhi-110070

You might also like

- How to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanFrom EverandHow to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanNo ratings yet

- Atal Pension Yojana: Page 1 of 4Document4 pagesAtal Pension Yojana: Page 1 of 4Bhanu Satya SaiNo ratings yet

- Name of The Organisation Le - Dhanadhan LE Means Fast Services DHANADHAN Means Money ProviderDocument7 pagesName of The Organisation Le - Dhanadhan LE Means Fast Services DHANADHAN Means Money ProviderAnkita SandhuNo ratings yet

- Atal Pension Yojana-SchemeDocument9 pagesAtal Pension Yojana-SchemeSaurabhNo ratings yet

- Atal Pension Yojana (APY) - Details of The Scheme 1.: Annexure IIIDocument9 pagesAtal Pension Yojana (APY) - Details of The Scheme 1.: Annexure IIIvenkateshNo ratings yet

- APY Scheme DetailsDocument9 pagesAPY Scheme DetailsGARUAV RAHINo ratings yet

- Here's Everything You Want To Know About Atal Pension YojanaDocument5 pagesHere's Everything You Want To Know About Atal Pension YojanavgpraveenkumarNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima Yojana - Features, Benefits and EligibilityDocument6 pagesPradhan Mantri Jeevan Jyoti Bima Yojana - Features, Benefits and EligibilityAshirbad NayakNo ratings yet

- Atal Pension SchemeDocument19 pagesAtal Pension SchemeKirti ChotwaniNo ratings yet

- Atal - Pension - Yojana RuleDocument1 pageAtal - Pension - Yojana RulePulkit SinghNo ratings yet

- APY FAQs PDFDocument8 pagesAPY FAQs PDFKishan VarshneyNo ratings yet

- All Schemes and YojanaDocument11 pagesAll Schemes and YojanaAnonymous c3ZtybuHqsNo ratings yet

- Various Non Statutory Schemes: Cheena Lalwani 04414901821 Aditya Gupta 00314901821 Reet Pandey 03514901821Document25 pagesVarious Non Statutory Schemes: Cheena Lalwani 04414901821 Aditya Gupta 00314901821 Reet Pandey 03514901821vipin sharmaNo ratings yet

- Final Published PaperDocument3 pagesFinal Published PaperbhagatsupriyaNo ratings yet

- Kisan Samman Pension To Traders and FAQ On NPSDocument16 pagesKisan Samman Pension To Traders and FAQ On NPSg h raoNo ratings yet

- Atal Pension Yojana (APY)Document75 pagesAtal Pension Yojana (APY)prasenjit_gayen100% (2)

- Ministry of FinanceDocument12 pagesMinistry of FinanceNikhil DhokeNo ratings yet

- Government Schemes For Senior CitizensDocument12 pagesGovernment Schemes For Senior CitizenstadilakshmikiranNo ratings yet

- Flyer: Administration of TheDocument3 pagesFlyer: Administration of TheChandraSekharNo ratings yet

- Press Information Bureau Government of India Ministry of FinanceDocument4 pagesPress Information Bureau Government of India Ministry of FinanceSaiChaitanyaNo ratings yet

- Personal FinanceDocument10 pagesPersonal Financehariom gargNo ratings yet

- Frequently Asked Questions-Atal Pension Yojana: 1. What Is Pension? Why Do I Need It ?Document5 pagesFrequently Asked Questions-Atal Pension Yojana: 1. What Is Pension? Why Do I Need It ?Harshal harshalchaudhari211No ratings yet

- Unit-1 Social Security Schemes NotesDocument12 pagesUnit-1 Social Security Schemes NotesAnupriyaNo ratings yet

- Government Sponsored Schemes in IndiaDocument4 pagesGovernment Sponsored Schemes in IndiaRajalaxmi BarathNo ratings yet

- EPFO Social Security NotesDocument7 pagesEPFO Social Security Notes570Akash Pawarjan22No ratings yet

- List of Government Insurance SchemesDocument7 pagesList of Government Insurance SchemesMURALIKRISHNA790No ratings yet

- Frequently Asked Questions - Atal Pension YojanaDocument13 pagesFrequently Asked Questions - Atal Pension YojanaanuNo ratings yet

- Atal Pension Yojana (APY) - Scheme DetailsDocument7 pagesAtal Pension Yojana (APY) - Scheme DetailsguruprasadNo ratings yet

- Pension System of IndiaDocument5 pagesPension System of IndiaPriyam MhashilkarNo ratings yet

- Apy FaqDocument14 pagesApy Faqakgupta.bti.2019No ratings yet

- Over View of TPP-1Document9 pagesOver View of TPP-1UtkarshMalikNo ratings yet

- What Is The Retirement Benefit?Document3 pagesWhat Is The Retirement Benefit?Victor MacalintalNo ratings yet

- Pradhan Mantri Karam Yogi Maandhan (PM-KYM) Scheme: Central GovtDocument7 pagesPradhan Mantri Karam Yogi Maandhan (PM-KYM) Scheme: Central GovtARAVINDAAN NATARAJANNo ratings yet

- LEARNING CAPSULE On Financial InclusionDocument7 pagesLEARNING CAPSULE On Financial Inclusionதனேஷ் உNo ratings yet

- Social Welfare Schemes 61Document17 pagesSocial Welfare Schemes 61SeemaNo ratings yet

- Government Sponsored Socially Oriented Insurance SchemesDocument8 pagesGovernment Sponsored Socially Oriented Insurance SchemesTushar SrivastavNo ratings yet

- Source: HTTPS://WWW - Sss.gov - Ph/sss/printversion - Jsp?id 73&file Ben5000.html What Is The Retirement Benefit?Document2 pagesSource: HTTPS://WWW - Sss.gov - Ph/sss/printversion - Jsp?id 73&file Ben5000.html What Is The Retirement Benefit?palmpoeyNo ratings yet

- Pradhan Mantri Jan Dhan Yojna (Pmjdy) : Poshan AbhiyaanDocument4 pagesPradhan Mantri Jan Dhan Yojna (Pmjdy) : Poshan AbhiyaanSouradeepBhattacharyaNo ratings yet

- Atal Pension YojanaDocument2 pagesAtal Pension YojanakrithikNo ratings yet

- Ssl1-Apy StudyDocument15 pagesSsl1-Apy StudyRK Mallya KasaragodNo ratings yet

- Social Security Schemes Notes by CivilstapDocument31 pagesSocial Security Schemes Notes by CivilstapPrashantNo ratings yet

- Important Schemes - Department of Financial Services - Ministry of Finance - Government of IndiaDocument4 pagesImportant Schemes - Department of Financial Services - Ministry of Finance - Government of IndiaritulNo ratings yet

- GSISDocument53 pagesGSISBen GNo ratings yet

- Frequently Asked Questions - Atal Pension YojanaDocument11 pagesFrequently Asked Questions - Atal Pension YojanaBp PbNo ratings yet

- Rural DevelopmentDocument4 pagesRural DevelopmentWilliam VaughnNo ratings yet

- 6458d946e4b05abca48595c1 OriginalDocument5 pages6458d946e4b05abca48595c1 OriginalSuprit JainNo ratings yet

- Social Security in IndiaDocument15 pagesSocial Security in IndiaUpsc AnalysisNo ratings yet

- 9a.investment Adviser Level 1 Retirement Planning Ppt4 1 AutosavedDocument114 pages9a.investment Adviser Level 1 Retirement Planning Ppt4 1 AutosavedIshaNo ratings yet

- PM Social Security Schemes From ICICIDocument2 pagesPM Social Security Schemes From ICICIMishtiNo ratings yet

- Final Rules PMJJBYDocument3 pagesFinal Rules PMJJBYsdawdwsqNo ratings yet

- UNIT-4: Objectives of Financial InstitutionsDocument21 pagesUNIT-4: Objectives of Financial InstitutionspraveenaNo ratings yet

- Pradhan Mantri Jeevan Jyoti Bima YojanaDocument1 pagePradhan Mantri Jeevan Jyoti Bima YojanaSandeep WaydandeNo ratings yet

- Govt SchemesDocument49 pagesGovt Schemestrends videosNo ratings yet

- SBI National Pension SchemeDocument26 pagesSBI National Pension SchemeSaurav ChakravartyNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and Conditionsvikalpsharma96No ratings yet

- Atal Pension YojnaDocument1 pageAtal Pension Yojnaalankar2050No ratings yet

- Notes On EPF Latest News Fin533Document3 pagesNotes On EPF Latest News Fin533SITI BAIZURA ABDUL RAHIMNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- RaghuvanshiDocument18 pagesRaghuvanshids468No ratings yet

- S.No Medicine Name List S.No Medicine Name List S.No Medicine Name ListDocument3 pagesS.No Medicine Name List S.No Medicine Name List S.No Medicine Name Listds468No ratings yet

- Da82dc36b54b1033.mspx: Verify If This Is The Current Check Master atDocument4 pagesDa82dc36b54b1033.mspx: Verify If This Is The Current Check Master atds468100% (1)

- Andra Pradesh: Circle Festival Name Day DateDocument4 pagesAndra Pradesh: Circle Festival Name Day Dateds468No ratings yet

- PMEGP GuidelinesDocument72 pagesPMEGP Guidelinesds468100% (5)

- Wesleyan University PH v. WUP AssocDocument1 pageWesleyan University PH v. WUP AssocVon Lee De LunaNo ratings yet

- MichiganState GlMe Aff 1 - Northwestern Round 5Document74 pagesMichiganState GlMe Aff 1 - Northwestern Round 5saodifjoijNo ratings yet

- Return Service AgreementDocument1 pageReturn Service Agreementkay tunaNo ratings yet

- Assignment 2 S 10Document4 pagesAssignment 2 S 10Misbah KarimNo ratings yet

- Anatomy of Budget and Budgetary ControlDocument90 pagesAnatomy of Budget and Budgetary Controlenbassey100% (5)

- Difference Between Workman and Contract LabourDocument4 pagesDifference Between Workman and Contract LabourGaurav mishraNo ratings yet

- Night Shift DifferentialDocument20 pagesNight Shift DifferentialJica GulaNo ratings yet

- Working in Ireland May 09Document10 pagesWorking in Ireland May 09Deepak NaraharisettyNo ratings yet

- Labor Case DigestDocument4 pagesLabor Case DigestEarleen Del RosarioNo ratings yet

- BELENDocument22 pagesBELENLuzbe BelenNo ratings yet

- Institutions Related To Compensation-Shubham HasijaDocument34 pagesInstitutions Related To Compensation-Shubham HasijaÑàdààñ ShubhàmNo ratings yet

- Negotiating On Thin IceDocument4 pagesNegotiating On Thin IceKomalAslamNo ratings yet

- Skilled Worker Overseas FAQs - Manitoba Immigration and Economic OpportunitiesDocument2 pagesSkilled Worker Overseas FAQs - Manitoba Immigration and Economic OpportunitieswesamNo ratings yet

- MBA 820 Employee Relations - Topic 5Document19 pagesMBA 820 Employee Relations - Topic 5elinzola100% (16)

- Labor New DigestDocument6 pagesLabor New DigestRon AceroNo ratings yet

- HK 12 SolutionsDocument3 pagesHK 12 SolutionsNatasha VaniaNo ratings yet

- DOL Field Handbook (Teacher Exemptions Etc) PDFDocument96 pagesDOL Field Handbook (Teacher Exemptions Etc) PDFHéctor J. QuiñonesNo ratings yet

- Star Paper vs. SimbolDocument2 pagesStar Paper vs. SimbolNivra Lyn EmpialesNo ratings yet

- ConstructionjDocument6 pagesConstructionjHimal Nilanka RathnayakaNo ratings yet

- Assignmnet 3 - Case StudeyDocument10 pagesAssignmnet 3 - Case StudeyJaveria KhanNo ratings yet

- Princess Talent Center Production, Inc. vs. Masagca, 860 SCRA 602, G.R. No. 191310 April 11, 2018Document62 pagesPrincess Talent Center Production, Inc. vs. Masagca, 860 SCRA 602, G.R. No. 191310 April 11, 2018Jm SantosNo ratings yet

- Intermediate Macroeconomics (Ecn 2215) : Unemployment by Charles M. Banda Notes Extracted From MankiwDocument9 pagesIntermediate Macroeconomics (Ecn 2215) : Unemployment by Charles M. Banda Notes Extracted From MankiwYande ZuluNo ratings yet

- F2 Pre-Exam QuestionsDocument7 pagesF2 Pre-Exam Questionsaddi420100% (1)

- Labor Relations Case DigestDocument4 pagesLabor Relations Case DigestRochelle GablinesNo ratings yet

- Chapter 13 US History Notes Mr. BoardmanDocument6 pagesChapter 13 US History Notes Mr. BoardmanMichael ReigNo ratings yet

- DOLE Advisory On RA 7641Document2 pagesDOLE Advisory On RA 7641Hannah AdduruNo ratings yet

- NFL Retirement Board 2013 Filing Form 5500Document252 pagesNFL Retirement Board 2013 Filing Form 5500Jeff NixonNo ratings yet

- 117 Apines V Elburg ShipmanagementDocument35 pages117 Apines V Elburg ShipmanagementGeorginaNo ratings yet

- Gm591 FinalDocument9 pagesGm591 FinalMehmet Can CevherNo ratings yet

- RTMDH Multi Purpose Cooperative: Amt. Due For Overtime Holiday The Period Trans. Exp. 100% DeductionDocument10 pagesRTMDH Multi Purpose Cooperative: Amt. Due For Overtime Holiday The Period Trans. Exp. 100% DeductionREMA PALCORINNo ratings yet