Professional Documents

Culture Documents

Walt Disney Yen Financing

Uploaded by

AndyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Walt Disney Yen Financing

Uploaded by

AndyCopyright:

Available Formats

Case study in Derivatives

The Walt Disney Company’s

Yen Financing

GROUP SIX

Liang Zhang

Xiao Cao

Xiang Wang

Le Lu

1 / 10

All rights reserved. www.lelu.tk.

Contents & Structure

Part I. Overview -----------------------------------------------------------------------------------------3

Part II. The problem facing Disney ----------------------------------------------------------------- 3

Status quo 1 - JPY royalties grows fast -------------------------------------------------- 3

Status quo 2 – JPY/USD rate fluctuation -------------------------------------------------3

Problem Summary --------------------------------------------------------------------------- 4

Part III. Various ways of hedging the exposure-------------------------------------------------- 5

Unsatisfied ways of Hedging ---------------------------------------------------------------5

Two Viable Alternatives --------------------------------------------------------------------- 5

(IRR analysis – compare the cost of each alternative)

Alternative 1 --- JPY Term Loan --------------------------------------------------5

Alternative 2 --- ECU Eurobond + ECU/YEN SWAP--------------------------- 6

ECU Eurobond ---------------------------------------------------------- 6

ECU/YEN SWAP -------------------------------------------------------- 7

Part IV. Conclusion ------------------------------------------------------------------------------------- 9

2 / 10

All rights reserved. www.lelu.tk.

Harvard Business School

The Walt Disney Company’s Yen Financing

Part I. Overview

- the Walt Disney Company

The Walt Disney Company, a diversified international company headquartered in Burbank,

California, operated entertainment and recreational complexes, produced motion picture and

television features, developed community real estate projects, and sold consumer products. The

company was founded in 1938 as successor to the animated motion picture business established

by Walt and Roy Disney in 1923.

The company operated the Disneyland amusement theme park in Anaheim, California, and the

Walt Disney World destination resort in Orlando, Florida. In addition to the domestic

entertainment and recreation revenues from Disneyland and Walt Disney World, the company

received royalties, paid in yen, on certain revenues generated by Tokyo Disneyland. Owned and

operated by an unrelated Japanese corporation, Tokyo Disneyland was opened to the public on

April 15, 1983.

Consolidated revenues for The Walt Disney Company and its subsidiaries increased by almost 27%

in 1984 to $1.7 billion. Total entertainment and recreation revenues, including royalties from

Tokyo Disneyland, increased 6% to $1.1 billion in the fiscal year ended September 30,1984. Net

income totaled $97.8 million in 1984, an increase of 5% from 1983. Total assets grew 15% to $2.7

billion at the end of fiscal 1984.1

Part II. The problem facing Disney

- The possible exposure of Disney to future fluctuations in the yen/dollar spot rate

Status quo 1 - JPY royalties grows fast.

The JPY royalties from Tokyo Disneyland had increased significantly2 during the last year, and

Disney foresaw further growth (10%-20%) in the years ahead.

Status quo 2 – JPY/USD rate fluctuation

The current spot rate of 248 yen/dollar represented almost an 8% depreciation in the value of

the yen from 229.70 just over a year ago.

1

Excerpted from the “Walt Disney Company’s Yen Financing” case, the Walt Disney company.

2

The receipts has just over ¥8 billion

3 / 10

All rights reserved. www.lelu.tk.

But it has appreciated in the quarter since then. From the chart below, we can see that the U.S.

inflation has exceeded Japanese inflation for the past 5 years, which indicates the future

depreciation of dollar against Yen. Further more, the forward rate (Exhibit 5) also indicates the

same depreciation of dollar.

Figure 1:

Historical Summary of Average Yen/Dollar Exchange Rates and Price

Indexes

275

250

225

200

175

150

YEN/Dollar

125

U.S. CPI

100

Japan CPI

75

50

25

0

1980 1981 1982 1983 1984 1984 1984 1984 1985 1985

I II III IV I II

Source: compiled from Exhibit 4 of ‘The Walt Disney Company's Yen Financing’ case

Problem Summary

Disney needs USD for construction and expansion but not that much YEN cash flow. So, Disney

needs to transfer YEN to USD. Cause the JPY receipts are an huge amounts of money, a

depreciation of the JPY could deeply disrupt Disney’s financial plans. Given the fluctuation of

YEN/USD rate, this is a big exposure needs to be hedged. Considering the long term trend, maybe

it does not need to concern the depreciation of the JPY, but if the appreciation of JPY is lower

than expectation will also hurt Disney’s plan. Therefore, it can’t be more precise to arrange

comprehensively.

Our goal: hedging the exposure of Disney to future fluctuations in the yen/dollar spot rate!

4 / 10

All rights reserved. www.lelu.tk.

Part III. Various ways of hedging the exposure

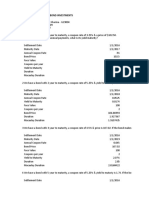

Table 1: Unsatisfied ways of Hedging:

Reasons for ruling out

Liquid markets for options and futures contracts Existed only for maturities of two years or less

long-dated FX forward Considered as a part of their total exposure to

Disney, thus tying up valuable credit lines.

Foreign-currency swap(JPY/USD) Also be short-term since Disney’s Eurodollar

note issues matured in one to four years.

Attractive yen swap rates for maturities less

than four years were hard to find.

Longer maturity Eurodollar debt Disney’s recent Eurodollar note issue and the

company’s temporarily high debt ratio

Euroyen bonds Disney was ineligible to issue Euroyen bonds

under the current Japanese Ministry of Finance

guidelines

Source: compiled from case

Two Viable Alternatives:

1) Create a YEN liability - 15 billion ten-year bullet loan

2) SWAP solution offered by Goldman Sachs

Two steps: 1. Issue a ECU Eurobond

2. ECU/yen swap

In the following section, we will consider the two alternatives, 1) JPY Term Loan and 2) ECU

Eurobond + ECU/YEN SWAP.

Alternative 1 --- JPY Term Loan

One of the viable choices was to create a yen liability through a term loan from a Japanese bank

at the Japanese long-term prime rate. It could hedge the JPY royalties, and the proceeds could be

used to pay off some of the short-term debt and diversify the maturity structure of Disney’s debt.

We tried to figure out the cost (interest rate) of this Eurobond by using the info below:

Table 2: Summary of loan terms:

JPY 15 billion principle

10-year term

7.50% annual percentage rate, paid semiannually

0.75% front-end fees

Bullet loan - semiannual interest payments and principle paid at maturity.

Source: Based on assumption stated in case.

5 / 10

All rights reserved. www.lelu.tk.

All-in cost of this JPY Term loan:

0.5625 0.5625 0.5625 0.5625 15.5625

14.8875 − − − − ⋯− − =0

(1 + r) (1 + r) (1 + r) (1 + r) (1 + r)

IRR3 =3.80423% (Semiannually)

Annual all-in cost of the JPY Term Loan=(1+3.80423%)2-1=7.75319%

Alternative 2 --- ECU Eurobond + ECU/YEN SWAP

Another choice, suggested by Goldman Sachs, is that Disney issue ten-year ECU Eurobonds that

would be swapped into a yen liability at a potentially more attractive all-in yen cost than a yen

term loan.

ECU Eurobond

Goldman was prepared to underwrite ECU80 million ten-year Eurobonds with sinking fund. If the

ECU Eurobonds were launched, Disney would be only the second U.S. corporation to access this

market and be the first ECU bond incorporating an amortization schedule to repay the bond’s

principal.

Table 3: Summary of ECU Eurobond:

10-Year ECU Eurobond with Sinking Fund (in millions)

Par ECU 80 million

Price 100.250%

Coupon 9.125%

Fees 2.000%

Expenses $75,000

Dollar/ECU 0.7420

ECU 16 million/year sinking fund from year 6 to10

Source: Based on assumption stated in case. (Exhibit 6)

Table 4: Cash Flows of 10-Year ECU Eurobond

Cash Flow

Year Cash flow (Million in ECU)

1 78.4994

2 (7.300)

3 (7.300)

4 (7.300)

5 (7.300)

6 (23.300)

7 (21.840)

8 (20.380)

9 (18.920)

10 (17.460)

Source: Based on assumption stated in case. (Exhibit 6)

3

internal rate of return (IRR) –here, it can be regarded as the all-in cost of the debt.

4

80M*100.25&-80M*2%-75,000/0.742

6 / 10

All rights reserved. www.lelu.tk.

Based on the info above, we can get the All-in Cost of the ECU Eurobond:

7.300 7.300 7.300 23.300 21.840 20.380 18.920 17.460

78.499 − − − ⋯− − + + + + =0

(1 + r) (1 + r) (1 + r) (1 + r) (1 + r) (1 + r) (1 + r) (1 + r)

IRR=All-in Cost of the ECU Eurobond=9.47267%

ECU/YEN SWAP

After issuing the Eurobond, Disney needed to SWAP the ECU liability into YEN liability to achieve

the goal to hedge the excepted future YEN receipts.

In finance, a swap is a derivative in which two counterparties agree to exchange one stream of

cash flows against another stream. Swaps can be used to hedge certain risks such as interest rate

risk, or to speculate on changes in the underlying prices.5

In this case, Disney tried to use SWAP to transfer the ECU liability to YEN liability with French

Utility.

SWAPs are popular and attractive, because they can benefit both counterparts of the contract.

For example, if firms in separate countries have comparative advantages on interest rates, then a

swap could benefit both firms. For example, one firm may have a lower fixed interest rate, while

another has access to a lower floating interest rate. These firms could swap to take advantage of

the lower rates.6

Table 5: Loan rates for comparative-advantage:

JPY Loan EUR Loan

Walt Disney (rated A) 7.75319% 9.47267%

0.92% 0.10%

French Utility (rated AAA) 6.83%7 9.37%8

Source: compiled from previous calculation and assumption in the case.

From the table above, we notice that the French Utility has an advantage in both currencies’ debt,

but Disney has a Comparative-Advantage in ECU. If Disney borrows in ECU and the French Utility

borrows in JPY, they pay less combined interest than if Disney borrows in JPY and the French

Utility borrows in ECU. Therefore, it seems to be a good idea that Walt Disney and French Utility

should involve in a SWAP to exchange their liability.

SWAP between Disney and French Utility

JPY JPY

ECU Walt French JPY

IBJ

Disney Utility

ECU ECU

5

Wikipedia, SWAP(Finance), http://en.wikipedia.org/wiki/Swap_(finance)

6

http://www.investopedia.com/terms/s/swap.asp

7

Exhibit 8, the yield-to-maturity of its 1/95 JPN yen bonds (the JPN bonds with a comparable remaining life)

8

Exhibit 8, the yield-to-maturity of its 1/95 Euro ECU bonds (the EUR bonds with a comparable remaining life)

7 / 10

All rights reserved. www.lelu.tk.

Table 6: ECU/Yen Swap Flows, in Millions (assuming $/ECU of .7420 and yen/dollar of 248)

Note: The initial proceeds can be used to reduce short term debt as Mr. Anderson want.

Source: based on the assumption in the case (Exhibit 7).

Disney’s JPY Debt as a result of this SWAP: IRR = All-in Cost =7.00% (< 7.75319%)

Through this SWAP, Disney could reduce 75 basis points on the cost compared with JPY loan.

French Utility’s ECU Debt as a result of this SWAP: IRR = All-in Cost =9.19% (<9.37%)

For French Utility, It could reduce 18 basis points on the cost compared with JPY loan.

(Note: The IRR we calculated here can be regarded as the cost of the debt (All-In cost) resulted by

the SWAP. The lower the IRR is, the better result the issuer of the debt gets.)

8 / 10

All rights reserved. www.lelu.tk.

Part IV. Conclusion

From the analysis above, we can reach our conclusion that the solution suggested by Goldman

Sachs is better than the direct JPY term loan in terms of their cost. We recommend Disney to

ACCEPT the Goldman’s SWAP solution.

But there is still something we should think carefully before making final decision, For example,

the market reception of the ECU Eurobond issued by Disney (it would be only the second U.S.

corporation to access the ECU Eurobond market. ), and the default risk of the counterpart of the

SWAP.

Group Six (Liang Zhang; Xiao Cao; Xiang Wang; Le Lu), Instructor: Wendy Jeffus

Master of Science in Finance 10’, Cohort 2, GSOM, Clark University

Feb, 2009

9 / 10

All rights reserved. www.lelu.tk.

Pitch Book

Experts of Group Six:

Liang Zhang

Ÿ Master of Science in Finance, Clark University

Ÿ One-year Internship experience in the Consumer Banking

department of Standard Chartered Bank China Main Branch

Ÿ Specialized in Corporate Finance & Stock analysis

Ÿ Great leadership capability

Ÿ Very interested in Walt Disney

Xiao Cao

Ÿ Master of Science in Finance, Clark University

Ÿ Good at asset pricing model, trend analysis & bond

Ÿ Excellent presentation skill

Ÿ Great spirit of team work

Ÿ A Real Disney fan, knows almost every thing about Disney

Xiang Wang

Ÿ Master of Science in Finance, Clark University (GPA 3.9)

Ÿ Proven team spirit and strong leadership skills

Ÿ Talented in Portfolio Management, Financial Derivative

Analysis, and Trade Strategy Creation

Ÿ Highly organized and efficient

Ÿ Willing to take pressure and challenge at anytime

Le Lu

Ÿ Master of Science in Finance, Clark University (GPA 4.0)

Ÿ Specialized in Hedging, Trade strategy, Bond(TIPS), & SWAP

Ÿ Excellent analytical skill

Ÿ Champion of the 1st Stimulated Stock Competition held by

Financial Association, GSOM, Clark University (More than 60%

total return in 2 months period (Oct,2008-Dec, 2008))

Ÿ Finance & Marketing Internship experience in China & Japan

10 / 10

All rights reserved. www.lelu.tk.

You might also like

- Case Study: Tiffany & Company 1993 Analysis : Assignment of Financial Risk Analysis (FRA)Document5 pagesCase Study: Tiffany & Company 1993 Analysis : Assignment of Financial Risk Analysis (FRA)Kamran Shabbir100% (2)

- Knoll Furniture CaseDocument5 pagesKnoll Furniture CaseIni EjideleNo ratings yet

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Document25 pagesIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420No ratings yet

- Burton SensorsDocument4 pagesBurton SensorsAbhishek BaratamNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- Case StudyDocument4 pagesCase StudylifeisyoungNo ratings yet

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- Blank 3e ISM Ch01Document24 pagesBlank 3e ISM Ch01Sarmad KayaniNo ratings yet

- BUS 5110 - Written Assignment - Unit 6Document5 pagesBUS 5110 - Written Assignment - Unit 6Aliyazahra KamilaNo ratings yet

- Burton Ch.1 Case Summaries Book ContractsDocument30 pagesBurton Ch.1 Case Summaries Book ContractsMissy MeyerNo ratings yet

- Financial ManagementDocument48 pagesFinancial Managementalokthakur100% (1)

- Week 6 - The Flinder Valves and Controls Inc - AnswersDocument3 pagesWeek 6 - The Flinder Valves and Controls Inc - AnswersLucasNo ratings yet

- Disney Hedging Yen Royalty Cash Flow RiskDocument6 pagesDisney Hedging Yen Royalty Cash Flow RiskSonal Choudhary100% (1)

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- Corporate Finance - PresentationDocument14 pagesCorporate Finance - Presentationguruprasadkudva83% (6)

- UK Gilts CalculationsDocument10 pagesUK Gilts CalculationsAditee100% (1)

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDocument27 pagesForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- M&M PizzaDocument3 pagesM&M PizzaAnonymous 2LqTzfUHY0% (3)

- Kota Fibres IncDocument20 pagesKota Fibres IncMuhamad FudolahNo ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Foreign Exchange Hedging Strategies at General MotorsDocument6 pagesForeign Exchange Hedging Strategies at General MotorsMelania PenzaNo ratings yet

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- Jet fuel price trends 1990-2011Document123 pagesJet fuel price trends 1990-2011jk kumar100% (1)

- CF Report Emi Group PLC (Final)Document11 pagesCF Report Emi Group PLC (Final)CaterpillarNo ratings yet

- Deluxe Corporation's Debt Policy AssessmentDocument7 pagesDeluxe Corporation's Debt Policy Assessmentankur.mastNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- New Heritage DollDocument26 pagesNew Heritage DollJITESH GUPTANo ratings yet

- Case 35 Deluxe CorporationDocument6 pagesCase 35 Deluxe CorporationCarmelita EsclandaNo ratings yet

- Econophysics and Capital Asset Pricing: James Ming ChenDocument293 pagesEconophysics and Capital Asset Pricing: James Ming ChenJetzayn CasasNo ratings yet

- FX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargDocument9 pagesFX Risk Hedging at EADS: Group 1-Prachi Gupta Pranav Gupta Sarvagya Jha Harshvardhan Singh Puneet GargSarvagya JhaNo ratings yet

- MGT431 - Apple, Einhorn, iPrefs Group ReportDocument13 pagesMGT431 - Apple, Einhorn, iPrefs Group ReportMokshNo ratings yet

- Adelphia Scandal - 3322 FinalDocument10 pagesAdelphia Scandal - 3322 Finalapi-320643467No ratings yet

- Case 16 Group 56 FinalDocument54 pagesCase 16 Group 56 FinalSayeedMdAzaharulIslamNo ratings yet

- Paper 2 Accountancy 2 2pb QP Set 2Document9 pagesPaper 2 Accountancy 2 2pb QP Set 2Harini NarayananNo ratings yet

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Business Finance WorksheetsDocument11 pagesBusiness Finance WorksheetsShiny NatividadNo ratings yet

- METALLGESELLSCHAFTDocument8 pagesMETALLGESELLSCHAFTShreyash SuryavanshiNo ratings yet

- WilliamsDocument20 pagesWilliamsUmesh GuptaNo ratings yet

- Soluz 7Document9 pagesSoluz 7Angates1100% (1)

- Diageo PLCDocument13 pagesDiageo PLCRitika BasuNo ratings yet

- Prada CaseDocument12 pagesPrada CaseNam Pham100% (1)

- The Walt Disney Company's Yen FinancingDocument25 pagesThe Walt Disney Company's Yen FinancingAbhishek Prasad100% (2)

- Arundel Case SolDocument14 pagesArundel Case SolRohan RustagiNo ratings yet

- Porsche's FX Hedging and VW Acquisition StrategyDocument2 pagesPorsche's FX Hedging and VW Acquisition StrategyRavi Patel100% (1)

- Group Ariel CaseDocument3 pagesGroup Ariel Casemibebradford33% (9)

- Disney CaseDocument25 pagesDisney Casejustinbui85No ratings yet

- Walt DisneyDocument10 pagesWalt DisneystarzgazerNo ratings yet

- Tiffany and CoDocument2 pagesTiffany and Comitesh_ojha0% (2)

- Nintendo Case StudyDocument3 pagesNintendo Case StudyAnne-Laure La Mongis100% (2)

- Decko Co Is A U S Firm With A Chinese Subsidiary ThatDocument1 pageDecko Co Is A U S Firm With A Chinese Subsidiary ThatM Bilal SaleemNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Nike Inc Cost of Capital - Syndicate 1 (Financial Management)Document26 pagesNike Inc Cost of Capital - Syndicate 1 (Financial Management)natya lakshitaNo ratings yet

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- Metallgesellschafts Hedging Debacle - DRM Group 4Document2 pagesMetallgesellschafts Hedging Debacle - DRM Group 4vineet kabra100% (1)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- If ProjectDocument16 pagesIf ProjectShashank ShrivastavaNo ratings yet

- The Walt Disney CompanyDocument11 pagesThe Walt Disney CompanyNarinderNo ratings yet

- THE WALT DISNEY COMPANY - EditedDocument11 pagesTHE WALT DISNEY COMPANY - EditedNarinderNo ratings yet

- Walt Disney Yen Financing-Kelompok 1Document25 pagesWalt Disney Yen Financing-Kelompok 1michelleruthnNo ratings yet

- Disney's Yen Hedging TechniquesDocument6 pagesDisney's Yen Hedging TechniquesFlavia Angelina WitarsahNo ratings yet

- Gfmi ArticlesDocument70 pagesGfmi ArticlesBijay AgrawalNo ratings yet

- Chapter 7 Global Bond Investing HW SolutionsDocument36 pagesChapter 7 Global Bond Investing HW SolutionsNicky Supakorn100% (1)

- Investment Portfolio RevisedDocument22 pagesInvestment Portfolio RevisedAngelika Bragais OlarteNo ratings yet

- IFM-assignmentDocument21 pagesIFM-assignmentmehtamahir07No ratings yet

- 2 Trilioane Euro Cheltuite PTR Impiedicare Prabusire Zona Euro Pina in Iunie2012Document4 pages2 Trilioane Euro Cheltuite PTR Impiedicare Prabusire Zona Euro Pina in Iunie2012abelardbonaventuraNo ratings yet

- Group Reporting II: Application of The Acquisition Method Under IFRS 3Document77 pagesGroup Reporting II: Application of The Acquisition Method Under IFRS 3Hà PhươngNo ratings yet

- Chapter 8Document8 pagesChapter 8bumbum12354No ratings yet

- Technical AnalysisDocument85 pagesTechnical AnalysismeerziyafathaliNo ratings yet

- Chapter Thirteen: Managing Nondeposit LiabilitiesDocument22 pagesChapter Thirteen: Managing Nondeposit Liabilitiessridevi gopalakrishnanNo ratings yet

- International Finance: Chapter 6: Government Influence On Exchange RatesDocument31 pagesInternational Finance: Chapter 6: Government Influence On Exchange RatesAizaz AliNo ratings yet

- UntitledDocument22 pagesUntitledAayush TareNo ratings yet

- Project of Abhishek SinghDocument25 pagesProject of Abhishek SinghIshaan JaiswalNo ratings yet

- Real Time Data Get From Stock Exchange Using PHPDocument6 pagesReal Time Data Get From Stock Exchange Using PHPAsad Ullah KhanNo ratings yet

- Ch.3-Depositories & CustodiansDocument57 pagesCh.3-Depositories & Custodiansjaludax100% (1)

- MCA Imposes Penalty On Auditors For Failure To Comment On Shareholding in Excess of 5% - Taxguru - inDocument6 pagesMCA Imposes Penalty On Auditors For Failure To Comment On Shareholding in Excess of 5% - Taxguru - inVaibhawNo ratings yet

- Nike Cost of Capital CaseDocument18 pagesNike Cost of Capital CasePatricia VidalNo ratings yet

- Role of Intermediaries in Primary MarketDocument24 pagesRole of Intermediaries in Primary MarketAmit Kumar (B.Sc. LLB 15)No ratings yet

- Cash ManagementDocument18 pagesCash ManagementbhargaviNo ratings yet

- Book Building ProcessDocument3 pagesBook Building ProcessgiteshNo ratings yet

- Lupin CaseDocument15 pagesLupin CaseSanjit Sinha0% (1)

- HKICPA QP Exam (Module A) May2007 Question PaperDocument7 pagesHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiNo ratings yet

- Corporate Finance Asia Edition (Solution Manual)Document3 pagesCorporate Finance Asia Edition (Solution Manual)Kinglam Tse20% (15)

- BTVN Chap 4Document4 pagesBTVN Chap 4Hà LêNo ratings yet

- Financial Analysis GuideDocument5 pagesFinancial Analysis GuideApril BoreresNo ratings yet

- Finance AssignmentDocument2 pagesFinance AssignmentYEOH SENG WEI NICKLAUSNo ratings yet

- CB SimexDocument14 pagesCB SimexRob De CastroNo ratings yet

- Section 4Document3 pagesSection 4MariamHatemNo ratings yet

- Afar 01 - Partnership Formation and LiquidationDocument6 pagesAfar 01 - Partnership Formation and LiquidationMarie GonzalesNo ratings yet

- Strategic Management Text and Cases 7th Edition Dess Test BankDocument94 pagesStrategic Management Text and Cases 7th Edition Dess Test Bankunknitbreedingbazmn100% (28)