Professional Documents

Culture Documents

I C

Uploaded by

Marimuthu0 ratings0% found this document useful (0 votes)

8 views9 pagesPART C economics question and answers unit I

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPART C economics question and answers unit I

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views9 pagesI C

Uploaded by

MarimuthuPART C economics question and answers unit I

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 9

PART C

1. Discuss the important concepts of economics. (APRIL 2012)

Wants : Simply the desires of citizens. Wants are different from needs as we will see below.

Wants are a means of expressing a perceived need. Wants are broader than needs.

Needs: These are basic requirements for survival like food and water and shelter. In recent

years we have seen a perceived shift of certain items from wants to needs. Telephone service,

to many, is a need. I would argue, however, that they are wrong.

Scarcity : The fundamental economic problem facing ALL societies. Essentially it is how to

satisfy unlimited wants with limited resources. This is the issue that plagues all government

and peoples.

Factors of Production/Resources : these are those elements that a nations has at its disposal

to deal with the issue of scarcity. How efficiently these are used determines the measure of

success a nation has. They are

Land - natural resources, etc.

Capital - investment monies.

Labor - the work force; size, education, quality, work ethic.

Entrepreneurs - inventive and risk taking spirit.

The "Three Basic Economic Questions" - these are the questions all nations must ask when

dealing with scarcity and effcientlly allocating their resources.

What to produce?

How to produce?

For whom to produce?

Economics - Economics is the study the production and distribution of goods and services, it

is the study of human efforts to satisfy unlimited wants with limited resources.

Opportunity Cost - the cost of an economic decision. The classic example is "guns or butter."

What should a nation produce; butter, a need, or guns, a want? What is the cost of either

decision? If we choose the guns the cost is the butter. If we choose butter, the cost is the guns.

nations bust always deal with the questions faced by opportunity cost. It is a matter of

choices. Resources are limted thus we cannot meet every need or want.

Free Products: Air, sunshine are and other items so plentiful no one could own them.

Economists are interested in "economic products" - goods and services that are useful,

relatively scarce and transferable.

Good: tangible commodity. These are bought, sold, traded and produced.

Consumer Goods: Goods that are intended for final use by the consumer.

Capital Goods: Items used in the creation of other goods. factory machinery, trucks, Durable

Goods: Any good that lasts more than three years when used on a regular basis.

Non Durable Goods: Any item that lasts less than 3 years when used on a regular basis.

Services: Work that is performed for someone. Service cannot be touched or felt.

Consumers: people who use these goods and services.

Conspicuous Consumption: Use of a good or service to impress others.

Value: An assignment of worth. The assignment is usually based upon the utility (usefulness)

or scarcity of the item (supply and demand).

Utility: capacity to be useful.

Paradox of value: assignment of the highest value to those things we need the least, like

water and the highest things we often don't need at all like diamonds. Why do we do this?

Good question. I do not have an answer.

Wealth: the sum collection of those economic products that are tangible, scarce and useful.

Productivity - the ability to produce vast amounts of goods (economic products) in an

efficient manner. The American capilist economy is productive because:

We use our resource efficiently.

We specialize to increase efficiency and productivity.

We invest in Human Capital (our labor pool)

2. An efficient business manager should have a thorough knowledge of business

environment- Explain. (APRIL 2013)

Business environment is the sum total of all external and internal factors that influence

a business. The manager should keep in mind that external factors and internal factors can

influence each other and work together to affect a business.

A health and safety regulation is an external factor that influences the internal environment of

business operations. Additionally, some external factors are beyond your control. These

factors are often called external constraints.

External Factors

Political factors are governmental activities and political conditions are known by business

manager. Examples include laws, regulations, tariffs and other trade barriers, war, and social

unrest.

Macroeconomic factors are factors that affect the entire economy. Examples include things

like interest rates, unemployment rates, currency exchange rates, consumer confidence,

consumer discretionary income, consumer savings rates, recessions, and depressions.

Microeconomic factors are factors such as market size, demand, supply, relationships with

suppliers and our distribution chain, such as retail stores that sell our products, and the

number and strength of your competition.

Social factors are basically sociological factors related to general society and social relations

that affect your business. Social factors include social movements, such as environmental

movements, as well as changes in fashion and consumer preferences. For example, clothing

fashions change with the season, and there is a current trend towards green construction and

organic foods.

Technological factors are technological innovations that can either benefit or hurt your

business. Some technological innovations can increase your productivity and profit margins,

such as computer software and automated production. On the other hand, some technological

innovations pose an existential threat to a business, such as Internet streaming challenging the

DVD rental business.

Internal factors:

Value System:

The value system of an organisation means the ethical beliefs that guide the organisation in

achieving its mission and objective. The value system of a business organisation also

determines its behaviour towards its employees, customers and society at large.

Mission and Objectives:

The objective of all firms is assumed to be maximization of long-run profits. But mission is

different from this narrow objective of profit maximization.

Organisation Structure:

The nature of organisational structure has a significant influence over decision making

process in an organisation. An efficient working of a business organisation requires that its

organisation structure should be conducive to quick decision making.

Corporate Culture and Style of Functioning of Top Management:

Corporate culture is generally considered as either closed and threatening or open and

participatory.

Quality of Human Resources:

The success of a business organisation depends to a great extent on the skills, capabilities,

attitudes and commitment of its employees.

Labour Unions:

Labour unions are other factor determining internal environment of a firm. Unions

collectively bargain with top managers regarding wages, working conditions of different

categories of employees. Smooth working of a business organisation requires that there

should be good relations between management and labour union.

Physical Resources and Technological Capabilities:

Physical resources such as plant and equipment, and technological capabilities of a firm

determine its competitive strength which is an important factor determining its efficiency and

unit cost of production.

3. Elaborate the role of cost in managerial decision making. (APRIL 2014)

The costs which should be used for decision making are often referred to as "relevant costs".

CIMA defines relevant costs as 'costs appropriate to aiding the making of specific

management decisions'.

To affect a decision a cost must be:

a) Future: Past costs are irrelevant, as we cannot affect them by current decisions and they are

common to all alternatives that we may choose.

b) Incremental: ' Meaning, expenditure which will be incurred or avoided as a result of

making a decision. Any costs which would be incurred whether or not the decision is made

are not said to be incremental to the decision.

c) Cash flow: Expenses such as depreciation are not cash flows and are therefore not relevant.

Similarly, the book value of existing equipment is irrelevant, but the disposal value is

relevant.

Other terms:

d) Common costs: Costs which will be identical for all alternatives are irrelevant, e.g. rent or

rates on a factory would be incurred whatever products are produced.

e) Sunk costs: Another name for past costs, which are always irrelevant, e.g. dedicated fixed

assets, development costs already incurred.

f) Committed costs: A future cash outflow that will be incurred anyway, whatever decision is

taken now, e.g. contracts already entered into which cannot be altered.

Opportunity cost

Relevant costs may also be expressed as opportunity costs. An opportunity cost is the benefit

foregone by choosing one opportunity instead of the next best alternative.

Example

A company is considering publishing a limited edition book bound in a special leather. It has

in stock the leather bought some years ago for $1,000. To buy an equivalent quantity now

would cost $2,000. The company has no plans to use the leather for other purposes, although

it has considered the possibilities:

a) of using it to cover desk furnishings, in replacement for other material which could cost

$900

b) of selling it if a buyer could be found (the proceeds are unlikely to exceed $800).

In calculating the likely profit from the proposed book before deciding to go ahead with the

project, the leather would not be costed at $1,000. The cost was incurred in the past for some

reason which is no longer relevant. The leather exists and could be used on the book without

incurring any specific cost in doing so. In using the leather on the book, however, the

company will lose the opportunities of either disposing of it for $800 or of using it to save an

outlay of $900 on desk furnishings.

The better of these alternatives, from the point of view of benefiting from the leather, is the

latter. "Lost opportunity" cost of $900 will therefore be included in the cost of the book for

decision making purposes.

The relevant costs for decision purposes will be the sum of:

i) 'avoidable outlay costs', i.e. those costs which will be incurred only if the book project is

approved, and will be avoided if it is not

ii) the opportunity cost of the leather (not represented by any outlay cost in connection to the

project).

This total is a true representation of 'economic cost'.

4. Discuss the difference between 'Economics' and 'Managerial Economics'.

(APRIL 2015) (NOV 2016)

Both managerial economics and traditional economics involve the production, distribution,

and consumption of goods and services, and are both reflected from the basic economic

principle of using the factors of production in an efficient manner for the production of output

of goods and services.

The main difference between the branches of economics is that traditional economics is

primitive and is used in underdeveloped and less technologically advanced economies,

whereas managerial economics is a result of globalization and evolution of economics to

include managerial decision making. Managerial economics makes the use of sophisticated

modelling systems and statistical data in decision making regarding production volumes,

pricing and distribution channels, whereas traditional economics involves the use of farming,

hunting, and pastoral activities by individuals to meet their daily consumption needs.

Economics vs. Managerial Economics

• Traditional economics is employed by less developed nations with no sophisticated

management systems, whereas managerial economics is used by modern day high-tech

economies.

• Managerial economics is concerned with modelling systems and complex managerial

decision making, whereas traditional economics is concerned with the production of food and

other necessities to meet daily requirements of individuals.

• Managerial economics represents the development that a traditional economy has been

through with globalization, development in technology and modernization of economic

theories to suit managerial decision making.

5. Discuss the role of Managerial Economist. (APRIL 2016)

1. Study of the Business Environment:

Every firm has to take into consideration such external factors as the growth of national

income, volume of trade and the general price trends, for its policy decision.

A firm works within a business environment. The basic elements of business environment for

a firm are the trend of growth of national economy and world economy and phase of the

business cycle in which the economy is moving.

At what rate and where is population getting concentrated? Where are the demand prospects

for established and new products? Where are the prospective markets? These questions lead

the economists into purposeful studies of the economic environment.

The international economic outlook is a very important environmental factor for exporting

firms. The nature and degree of competition within the industry in which a firm is placed are

also a part of the business environment. The kind of economic policies pursued by the

government constitute a powerful dement of the business environment of a firm.

What are the priorities of the new five-year plan? In which sectors of the economy have the

outlays been increased? What are the budgetary trends? What about changes in expenditure,

tax rates tariffs and import restrictions? What export incentives are being given? For all

purposes, the economists play a significant role.

2. Business Plan and Forecasting:

The business economists can help the management in the formulation of their business plan

by forecasting and economic environment. The management can easily decide the timing and

locating of their specific action. The managerial economist has to interpret the national

economic trends and industrial outlook for their relevance to the firm in which he is working.

He advises top management by means of short, business like practical notes. In a partially

controlled economy like India, the business economist translates the government’s intentions

in business jargon and also transmits the reaction of the industry to propose changes in

government policy.

3. Study of Business Operations:

The business economist can also help the management in decision making relating to the

internal operations of a firm, i.e., in deciding about price, rate of operations, investment and

growth of the firm for offering this advice: the economist has specific analytical and

forecasting techniques which yield meaningful conclusions.

What will be the reasonable sales and profit budget for the next year? What are the suitable

production schedules and inventory policies? What changes in wage and price policies are

imperative now? What would be the sources of finance? Thus, he is trained to answer such

questions posed by the top management.

4. Economic Intelligence:

The business economist also provides general intelligence services by supplying the

management with economic information of general interest so that they can talk intelligently

in conferences and seminars. They are also supplied the facts and figures for preparing the

annual reports of the firm. Those facts and figures are collected by the business economist as

he understands the literature available on business activities.

5. Specific Functions:

Business economists are now performing specific functions as consultants also. Their specific

functions are demand forecasting, industrial market research, pricing problems of industry,

production programmes, investment analysis and forecasts. They also offer advice on trade

and public relations, primary commodities and capital projects in agriculture, industry,

transport and tourism and also of the export environment.

6. Participation in Public Debates:

The business economists participate in public debates organized by different agencies. Both

governments and society seek their advice. Their practical experience in business and

industry gives value to their observation. In nut shell a business economist can play a multi-

faceted role. He is not only an analyst of current trends and policies for his employers but

also a bridge between the businessmen in the specific industry and the government. He acts

as a spokesman of his firm and interpreter of the Government.

6. “Managerial Economics is prescriptive rather than descriptive” (ARIL 2017)

Yes, it is prescriptive. The various reasons are:

Managerial economics is micro-economic in character. This is because the unit of

study is a firm and its problems. Managerial economics does not deal with the entire

economy as a unit of study.

Managerial economics largely uses that body of economic concepts and principles,

which is known as Theory of the Firm or Economics of the Firm. In addition, it also seeks to

apply profit theory, which forms part of distribution theories in economics.

Managerial economics is concrete and realistic. I avoids difficult abstract issues of

economic theory. But it also involves complications ignored in economic theory in order to

face the overall situation in which decisions are made. Economic theory ignores the variety of

backgrounds and training found in individual firms. Conversely, managerial economics is

concerned more with the particular environment that influences decision-making.

Managerial economics belongs to normative economics rather than positive

economics. Normative economy is the branch of economics in which judgments about the

desirability of various policies are made. Positive economics describes how the economy

behaves and predicts how it might change. In other words, managerial economics is

prescriptive rather than descriptive. It remains confined to descriptive hypothesis.

Managerial economics also simplifies the relations among different variables without

judging what is desirable or undesirable. For instance, the law of demand states that as price

increases, demand goes down or vice-versa but this statement does not imply if the result is

desirable or not. Managerial economics, however, is concerned with what decisions ought to

be made and hence involves value judgments. This further has two aspects: first, it tells what

aims and objectives a firm should pursue; and secondly, how best to achieve these aims in

particular situations. Managerial economics, therefore, has been described as normative

microeconomics of the firm.

Macroeconomics is also useful to managerial economics since it provides an

intelligent understanding of the business environment. This understanding enables a business

executive to adjust with the external forces that are beyond the management’s control but

which play a crucial role in the well being of the firm. The important forces are: business

cycles, national income accounting, and economic policies of the government like those

relating to taxation foreign trade, anti-monopoly measures and labour relations.

7. Explain the various objective of a modern firm. (NOV 2012)

The main objectives of firms are:

1. Profit maximisation

2. Sales maximisation

3. Increased market share/market dominance

4. Social/environmental concerns

5. Profit satisficing

6. Co-operatives/

Sometimes there is an overlap of objectives. For example, seeking to increase market share,

may lead to lower profits in the short-term, but enable profit maximisation in the long run.

Profit maximisation

Usually, in economics, we assume firms are concerned with maximising profit. Higher profit

means:

Higher dividends for shareholders.

More profit can be used to finance research and development.

Higher profit makes the firm less vulnerable to takeover.

Higher profit enables higher salaries for workers

Alternative aims of firms

However, in the real world, firms may pursue other objectives apart from profit

maximisation.

1. Profit Satisficing

In many firms, there is a separation of ownership and control. Those who own the

company (shareholders) often do not get involved in the day to day running of the company.

This is a problem because although the owners may want to maximise profits, the

managers have much less incentive to maximise profits because they do not get the same

rewards, (share dividends)

Therefore managers may create a minimum level of profit to keep the shareholders

happy, but then maximise other objectives, such as enjoying work, getting on with other

workers. (e.g. not sacking them) This is the problem of separation between owners and

managers.

This ‘principal-agent‘ problem can be overcome, to some extent, by giving managers

share options and performance related pay although in some industries it is difficult to

measure performance.

2. Sales maximisation

Firms often seek to increase their market share – even if it means less profit. This could occur

for various reasons:

Increased market share increases monopoly power and may enable the firm to put up

prices and make more profit in the long run.

Managers prefer to work for bigger companies as it leads to greater prestige and

higher salaries.

Increasing market share may force rivals out of business. E.g. the growth of

supermarkets have lead to the demise of many local shops. Some firms may actually engage

in predatory pricing which involves making a loss to force a rival out of business.

3. Growth maximisation

This is similar to sales maximisation and may involve mergers and takeovers. With this

objective, the firm may be willing to make lower levels of profit in order to increase in size

and gain more market share. More market share increases their monopoly power and ability

to be a price setter.

4. Long run profit maximisation

In some cases, firms may sacrifice profits in the short term to increase profits in the long run.

For example, by investing heavily in new capacity, firms may make a loss in the short run but

enable higher profits in the future.

5. Social/environmental concerns

A firm may incur extra expense to choose products which don’t harm the environment or

products not tested on animals. Alternatively, firms may be concerned about local community

/ charitable concerns.

Some firms may adopt social/environmental concerns into part of its branding. This

can ultimately help profitability as the brand becomes more attractive to consumers.

Some firms may adopt social/environmental concerns on principal alone – even if it

does little to improve sales/brand image.

6. Co-operatives

Co-operatives may have completely different objectives to a typical PLC. A co-operative is

run to maximise the welfare of all stakeholders – especially workers. Any profit the co-

operative makes will be shared amongst all members.

Diagram showing different objectives of firms

Q1 = Profit maximisation (MR=MC)

Q2 = Revenue Maximisation (MR=0)

Q3 = Marginal cost pricing (P=MC) – allocative efficiency

Q4 = Sales maximisation – maximum sales while still making normal profit

(AR=ATC)

8. Describe the fundamental concepts of Managerial Economics. (NOV 2015)

Managerial Economics can be defined as amalgamation of economic theory with business

practices so as to ease decision-making and future planning by management. Managerial

Economics assists the managers of a firm in a rational solution of obstacles faced in the

firm’s activities. It makes use of economic theory and concepts. It helps in formulating

logical managerial decisions. The key of Managerial Economics is the micro-economic

theory of the firm. It lessens the gap between economics in theory and economics in

practice. Managerial Economics is a science dealing with effective use of scarce resources.

It guides the managers in taking decisions relating to the firm’s customers, competitors,

suppliers as well as relating to the internal functioning of a firm. It makes use of statistical

and analytical tools to assess economic theories in solving practical business problems.

Study of Managerial Economics helps in enhancement of analytical skills, assists in

rational configuration as well as solution of problems. While microeconomics is the study

of decisions made regarding the allocation of resources and prices of goods and services,

macroeconomics is the field of economics that studies the behavior of the economy as a

whole (i.e. entire industries and economies). Managerial Economics applies micro-

economic tools to make business decisions. It deals with a firm.

The use of Managerial Economics is not limited to profit-making firms and organizations.

But it can also be used to help in decision-making process of non-profit organizations

(hospitals, educational institutions, etc). It enables optimum utilization of scarce resources in

such organizations as well as helps in achieving the goals in most efficient manner.

Managerial Economics is of great help in price analysis, production analysis, capital

budgeting, risk analysis and determination of demand.Managerial economics uses

both Economic theory as well as Econometrics for rational managerial decision making.

Econometrics is defined as use of statistical tools for assessing economic theories by

empirically measuring relationship between economic variables. It uses factual data for

solution of economic problems. Managerial Economics is associated with the economic

theory which constitutes “Theory of Firm”. Theory of firm states that the primary aim of the

firm is to maximize wealth. Decision making in managerial economics generally involves

establishment of firm’s objectives, identification of problems involved in achievement of

those objectives, development of various alternative solutions, selection of best alternative

and finally implementation of the decision. The following figure tells the primary ways in

which Managerial Economics correlates to managerial decision-making.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Marriot CaseDocument15 pagesMarriot CaseArsh00100% (7)

- Notice: Constable (Driver) - Male in Delhi Police Examination, 2022Document50 pagesNotice: Constable (Driver) - Male in Delhi Police Examination, 2022intzar aliNo ratings yet

- Reflection On An American ElegyDocument2 pagesReflection On An American ElegyacmyslNo ratings yet

- Lifelong Learning: Undergraduate Programs YouDocument8 pagesLifelong Learning: Undergraduate Programs YouJavier Pereira StraubeNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummarySofia ArissaNo ratings yet

- Reflecting Our Emotions Through Art: Exaggeration or RealityDocument2 pagesReflecting Our Emotions Through Art: Exaggeration or Realityhz202301297No ratings yet

- ICTSAS601 Student Assessment Tasks 2020Document30 pagesICTSAS601 Student Assessment Tasks 2020Lok SewaNo ratings yet

- Improving Downstream Processes To Recover Tartaric AcidDocument10 pagesImproving Downstream Processes To Recover Tartaric AcidFabio CastellanosNo ratings yet

- ch-1 NewDocument11 pagesch-1 NewSAKIB MD SHAFIUDDINNo ratings yet

- Journal Entry EnrepDocument37 pagesJournal Entry Enreptherese lamelaNo ratings yet

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDocument4 pagesKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojNo ratings yet

- Eradication, Control and Monitoring Programmes To Contain Animal DiseasesDocument52 pagesEradication, Control and Monitoring Programmes To Contain Animal DiseasesMegersaNo ratings yet

- Science Technology and SocietyDocument46 pagesScience Technology and SocietyCharles Elquime GalaponNo ratings yet

- PSIG EscalatorDocument31 pagesPSIG EscalatorNaseer KhanNo ratings yet

- Java Magazine JanuaryFebruary 2013Document93 pagesJava Magazine JanuaryFebruary 2013rubensaNo ratings yet

- Lifeline® Specialty: Fire Resistant QFCI Cable: Fire Resistant, Flame Retardant Halogen-Free Loose Tube - QFCI/O/RM-JMDocument2 pagesLifeline® Specialty: Fire Resistant QFCI Cable: Fire Resistant, Flame Retardant Halogen-Free Loose Tube - QFCI/O/RM-JMkevinwz1989No ratings yet

- Quiz 07Document15 pagesQuiz 07Ije Love100% (1)

- Responsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3Document172 pagesResponsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3CREWNo ratings yet

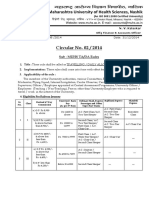

- Circular No 02 2014 TA DA 010115 PDFDocument10 pagesCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- Health and Hatha Yoga by Swami Sivananda CompressDocument356 pagesHealth and Hatha Yoga by Swami Sivananda CompressLama Fera with Yachna JainNo ratings yet

- Positive Accounting TheoryDocument47 pagesPositive Accounting TheoryAshraf Uz ZamanNo ratings yet

- Product Training OutlineDocument3 pagesProduct Training OutlineDindin KamaludinNo ratings yet

- Intro To Law CasesDocument23 pagesIntro To Law Casesharuhime08No ratings yet

- Ra 7877Document16 pagesRa 7877Anonymous FExJPnCNo ratings yet

- 4-Page 7 Ways TM 20Document4 pages4-Page 7 Ways TM 20Jose EstradaNo ratings yet

- Applications of Tensor Functions in Solid MechanicsDocument303 pagesApplications of Tensor Functions in Solid Mechanicsking sunNo ratings yet

- Fix List For IBM WebSphere Application Server V8Document8 pagesFix List For IBM WebSphere Application Server V8animesh sutradharNo ratings yet

- Type of MorphologyDocument22 pagesType of MorphologyIntan DwiNo ratings yet

- Brahm Dutt v. UoiDocument3 pagesBrahm Dutt v. Uoiswati mohapatraNo ratings yet

- The Eaglet - Vol. 31, No. 3 - September 2019Document8 pagesThe Eaglet - Vol. 31, No. 3 - September 2019Rebecca LovettNo ratings yet